The global manhole cover market is experiencing steady growth, driven by increasing urbanization, infrastructure development, and aging sewer systems requiring replacement and upgrades. According to Grand View Research, the global trench drains and channel drains market—closely aligned with sewer infrastructure—was valued at USD 3.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030. Similarly, Mordor Intelligence projects robust growth in infrastructure-related construction materials, with the manhole cover segment benefiting from rising municipal investments and stringent safety standards. As demand surges across developed and emerging economies, selecting reliable manufacturers has become critical for ensuring durability, load-bearing capacity, and compliance with international standards. In this evolving landscape, the following nine manufacturers have emerged as leaders, combining innovation, quality production, and global reach to meet the escalating needs of urban infrastructure.

Top 9 Sewer Hole Cover Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 High Quality Cast Iron Manhole Cove Manufacturers and Factory

Domain Est. 2022

Website: yt-cast.com

Key Highlights: Sealed Drain Cover · Recessed Inspection Cover · Sewage Hole Cover · 600×600 Recessed Drain Cover · Cast Iron Manhole Cover · Inspection Chamber Lid ……

#2 Manhole Covers Direct

Domain Est. 2015

Website: manholecoversdirect.com

Key Highlights: Get custom manhole covers and frames fabricated to your exact specifications. No project is too big or small for Manhole Covers Direct….

#3 Manhole Covers

Domain Est. 1997

Website: fibrelite.com

Key Highlights: Fibrelite manufactures an extensive range of composite manhole covers to fit every access requirement….

#4 Manhole Covers

Domain Est. 1999

Website: jrhoe.com

Key Highlights: JR HOE & Sons manufactures gray iron and ductile iron manhole covers and frames at their Middlesboro, Kentucky facilities….

#5 Neenah Foundry

Domain Est. 2000

Website: neenahfoundry.com

Key Highlights: Neenah Foundry has been a consistent leader in delivering durable and highly engineered, structural, and sustainable casting solutions for customers….

#6 Manhole Covers

Domain Est. 2001

Website: pamline.com

Key Highlights: Our PAM manhole covers have become benchmark products because they satisfy the criteria of location and exposure to traffic, addressing operators’ main concerns ……

#7 Manhole Covers and Frames

Domain Est. 2003

Website: ejco.com

Key Highlights: Innovative Access Solutions, Composite Manhole Covers and Frames, Drainage Grates, Frames and Curb Inlets, Linear Trench Grates, Junction Boxes, Cleanout/ ……

#8 WunderCovers

Domain Est. 2008

Website: wundercovers.com

Key Highlights: WunderCovers provides the highest quality recessed manhole covers, access hatches, and underground utility covers….

#9 Composite Manhole Covers: A Durable Choice

Domain Est. 2015

Website: justcapthat.com

Key Highlights: Explore the advantages of composite manhole covers, designed for durability and excellence in urban infrastructure….

Expert Sourcing Insights for Sewer Hole Cover

H2: 2026 Market Trends for Sewer Hole Covers

The global sewer hole cover market is poised for significant transformation by 2026, driven by urbanization, infrastructure modernization, and technological advancements. Below are key trends shaping the industry:

1. Increased Urban Infrastructure Investment

Governments worldwide are prioritizing smart city development and aging infrastructure upgrades. As cities expand, the demand for durable, efficient sewer systems—including high-quality manhole covers—will rise. Emerging economies in Asia-Pacific and Africa are expected to lead growth due to rapid urban development.

2. Shift Toward Smart and Sensor-Integrated Covers

By 2026, smart sewer systems incorporating IoT-enabled manhole covers are expected to gain traction. These covers can monitor water levels, detect gas leaks, and alert authorities to overflow or blockages. Municipalities are increasingly adopting such solutions to improve public safety and reduce maintenance costs.

3. Growth in Sustainable and Recyclable Materials

Environmental regulations are pushing manufacturers to adopt eco-friendly materials. Ductile iron remains dominant, but composite and recyclable polymer-based covers are gaining popularity due to their corrosion resistance, lighter weight, and lower carbon footprint.

4. Rising Demand for Anti-Theft and Safety-Enhanced Designs

With increased incidents of metal theft and public safety concerns, manufacturers are introducing tamper-proof, locking mechanisms and non-metallic alternatives. These innovations are expected to become standard in high-risk urban zones by 2026.

5. Regional Market Expansion in Asia and Latin America

China, India, and Southeast Asian nations are investing heavily in sewage and drainage infrastructure, positioning the Asia-Pacific region as the fastest-growing market. Latin America follows closely, supported by public-private partnerships in urban sanitation projects.

6. Technological Advancements in Manufacturing

Automation and precision casting technologies are improving production efficiency and product consistency. This enables cost-effective scaling and customization, meeting diverse municipal requirements across climates and load conditions.

Conclusion

By 2026, the sewer hole cover market will evolve beyond basic functionality, integrating intelligence, sustainability, and security. Stakeholders who embrace innovation and align with urban development goals will lead the next phase of growth in this essential infrastructure segment.

Common Pitfalls When Sourcing Sewer Hole Covers (Quality and Intellectual Property)

Sourcing sewer hole covers—also known as manhole covers—may seem straightforward, but it involves several hidden risks related to quality and intellectual property (IP). Avoiding these pitfalls ensures long-term safety, compliance, and cost-efficiency.

Poor Material Quality and Durability

One of the most frequent issues is receiving covers made from substandard materials such as low-grade cast iron or recycled metals that lack the required tensile strength. Inferior materials are prone to cracking, corrosion, and deformation under heavy traffic, posing serious safety hazards. Buyers may only discover the poor quality after installation, leading to premature replacement and liability risks.

Non-Compliance with International Standards

Many suppliers, especially in low-cost manufacturing regions, fail to adhere to regional or international standards like ISO 9001, EN 124, or ASTM A48. Covers that don’t meet load class requirements (e.g., for pedestrian vs. highway use) can collapse under pressure. Always verify test certifications and ensure the product meets the specific application standards for your market.

Inaccurate Load Class Ratings

Suppliers may misrepresent the load-bearing capacity of covers (e.g., claiming Class D400 when the product is only suitable for Class B125). This mislabeling can lead to structural failures in high-traffic zones. Request third-party test reports and conduct spot inspections to confirm compliance.

Lack of Anti-Theft and Anti-Skid Features

In many urban areas, theft of metal covers is a major issue. Sourcing covers without tamper-resistant designs or modern anti-theft mechanisms increases long-term maintenance costs. Similarly, inadequate skid resistance can create slip hazards, especially in wet conditions. Ensure the design includes proper surface texturing and locking mechanisms.

Intellectual Property Infringement

Some manufacturers replicate patented cover designs—such as unique locking systems, ventilation patterns, or decorative city logos—without authorization. Importing or using such products can expose buyers to legal action, shipment seizures, or reputational damage. Always conduct IP due diligence and require suppliers to confirm design rights compliance.

Inconsistent Finishes and Coatings

Poor or uneven protective coatings (e.g., epoxy or galvanization) lead to rapid corrosion, especially in coastal or de-icing salt environments. Inconsistent finishes also affect aesthetics in urban installations. Specify coating thickness and corrosion resistance standards in contracts.

Inadequate Traceability and Documentation

Reputable suppliers provide material test reports (MTRs), certificates of conformance, and batch traceability. Lack of documentation makes it difficult to verify quality or manage recalls. Ensure contracts mandate full documentation for each production batch.

By addressing these common pitfalls proactively—through supplier audits, third-party testing, and IP verification—buyers can ensure they source safe, durable, and legally compliant sewer hole covers.

Logistics & Compliance Guide for Sewer Hole Cover

Product Classification and Regulatory Overview

Sewer hole covers, also known as manhole covers, are categorized as infrastructure or public works products and are subject to various regional, national, and international standards. These covers are primarily used in municipal, industrial, and commercial drainage systems and must comply with load-bearing, safety, and environmental regulations. Proper classification under trade codes (e.g., HS Code 7308.90 for iron or steel structural elements) is essential for customs clearance and import/export compliance.

Material and Safety Standards

Sewer hole covers are typically manufactured from ductile iron, cast iron, or composite materials, each subject to specific performance standards:

– ASTM A48 (Standard Specification for Gray Iron Castings)

– EN 124 (European standard for load classes in vehicular and pedestrian areas)

– ASME A112.4.1 (for certain applications in the U.S.)

– ISO 9001 for quality management in manufacturing

Compliance ensures that the product meets minimum strength, corrosion resistance, and anti-slip surface requirements. Load classifications (e.g., A15, B125, C250, D400 under EN 124) must be clearly marked on the product for traceability and correct application.

Packaging and Handling Requirements

Proper packaging is critical to prevent damage during transit:

– Covers should be stacked on wooden pallets with protective spacers.

– Use moisture-resistant wrapping or shrink film to prevent rust (especially for metal covers).

– Individual labeling must include product specifications, load class, material type, manufacturer details, and batch/lot number.

– Forklift-friendly packaging is required for ease of loading and unloading.

Transportation and Shipping Considerations

- Due to their weight (typically 50–200+ lbs per unit), sewer hole covers require freight shipping via flatbed trucks or containerized load.

- Secure cargo with straps or braces to prevent shifting during transit.

- For international shipments, ensure compliance with IMDG (for sea freight) or ADR (for road transport in Europe) if applicable.

- Declare accurate weight and dimensions to avoid carrier penalties.

Import/Export Documentation

Essential documentation includes:

– Commercial Invoice (with HS code and value)

– Packing List (detailing weight, quantity, and dimensions)

– Certificate of Conformity (to EN 124, ASTM, or other relevant standard)

– Bill of Lading or Air Waybill

– Import permits or municipal certifications (if required by destination country)

– Certificate of Origin (for preferential tariff treatment under trade agreements)

Environmental and Disposal Compliance

- Manufacturing and disposal must comply with environmental regulations such as REACH (EU) and RoHS (where applicable).

- Metal covers are recyclable; suppliers should provide recycling guidelines.

- Avoid coatings or paints containing hazardous substances (e.g., lead-based paints).

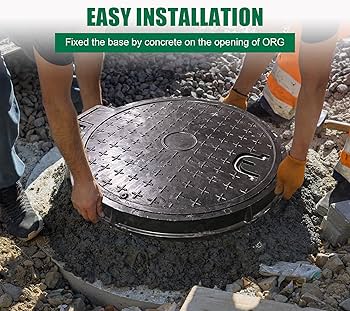

Installation and Municipal Compliance

- Final installation must adhere to local municipal codes and engineering specifications.

- Ensure alignment with underground utility maps to prevent infrastructure damage.

- Some jurisdictions require third-party inspection or certification prior to installation.

Recordkeeping and Traceability

- Maintain records of material test reports, production batches, and compliance certificates for at least five years.

- Serial or batch tracking allows for efficient recall management if non-conformities are identified.

Adherence to this logistics and compliance framework ensures safe, legal, and efficient distribution and use of sewer hole covers globally. Always verify region-specific regulations before shipment or installation.

Conclusion for Sourcing Sewer Hole Covers

In conclusion, sourcing sewer hole covers requires a strategic approach that balances quality, cost, compliance, and durability. Key considerations include material selection—such as cast iron, ductile iron, or composite materials—based on load requirements, environmental conditions, and anti-theft features. It is essential to partner with reliable suppliers who adhere to industry standards (e.g., EN 124, ASTM) and provide certified, traceable products. Additionally, evaluating total cost of ownership, lead times, and logistical support ensures timely project execution and long-term performance. By conducting thorough market research, assessing supplier capabilities, and prioritizing safety and sustainability, organizations can secure optimal solutions that enhance infrastructure resilience and public safety. Effective sourcing of sewer hole covers ultimately contributes to efficient urban drainage systems and sustainable city development.