The auxiliary power unit (APU) market for semi-trucks is experiencing robust growth, driven by stringent idling regulations, rising fuel costs, and increasing demand for driver comfort during rest periods. According to a report by Mordor Intelligence, the global APU market was valued at USD 1.8 billion in 2023 and is projected to reach USD 2.7 billion by 2029, growing at a CAGR of approximately 6.8% over the forecast period. Similarly, Grand View Research highlights that the North American market remains a key growth region, with regulatory pressures—such as the U.S. Environmental Protection Agency’s anti-idling laws—fueling adoption among long-haul fleets. As carriers seek to reduce fuel consumption and operational costs while complying with environmental standards, electrified and hybrid APUs are gaining traction. This shift has intensified competition among manufacturers, positioning innovation, reliability, and integrated energy efficiency as critical differentiators. The following list highlights the top 9 semi-truck APU manufacturers leading this transformation through advanced technology and strong market presence.

Top 9 Semi Truck Apu Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Auxiliary Power Units (APUs) for Trucks

Domain Est. 1995

Website: carrier.com

Key Highlights: Carrier Transicold auxiliary power units create a comfortable, homelike cab experience for drivers, while providing big advantages for fleets….

#2 3rd Generation TriPac® Diesel APU

Domain Est. 1997

Website: thermoking.com

Key Highlights: Our newest diesel TriPac APU provides the same comfort and performance our auxiliary power units are known for, plus enhancements to reduce emissions, ……

#3 Semi Truck Electric APU for Idle Elimination

Domain Est. 2001

Website: phillipsandtemro.com

Key Highlights: These electric APU units for semi trucks offer the cleanest and most fuel efficient idle free system and maximize driver comfort. Browse electric APUs now….

#4 Dynasys APU

Domain Est. 2008

Website: dynasysapu.com

Key Highlights: Dynasys APUs are intelligently designed to provide dependable, energy-efficient performance with convenient service intervals that match scheduled truck ……

#5 THE HP2000 APU

Domain Est. 2010

Website: hp2000apu.com

Key Highlights: The HP2000 APU is the lightest APU on the market, weighing only 310lbs, which is a minimum of 100lbs less than any of our competitors, who sit at 415+lbs!…

#6 GREEN APU UNITS Auxiliary Power Units

Domain Est. 2012

Website: greenapu.com

Key Highlights: The Diesel APU, Reinvented · An auxiliary power unit designed to give truckers more comfort and flexibility on the road. · See how a Green APU pays you back….

#7 Thermo King

Domain Est. 2022

Website: hoathermoking.com

Key Highlights: Heart of America Thermo King has four convenient locations that carry a large selection of genuine parts, reefer units, diesel and electric-powered APUs, and is ……

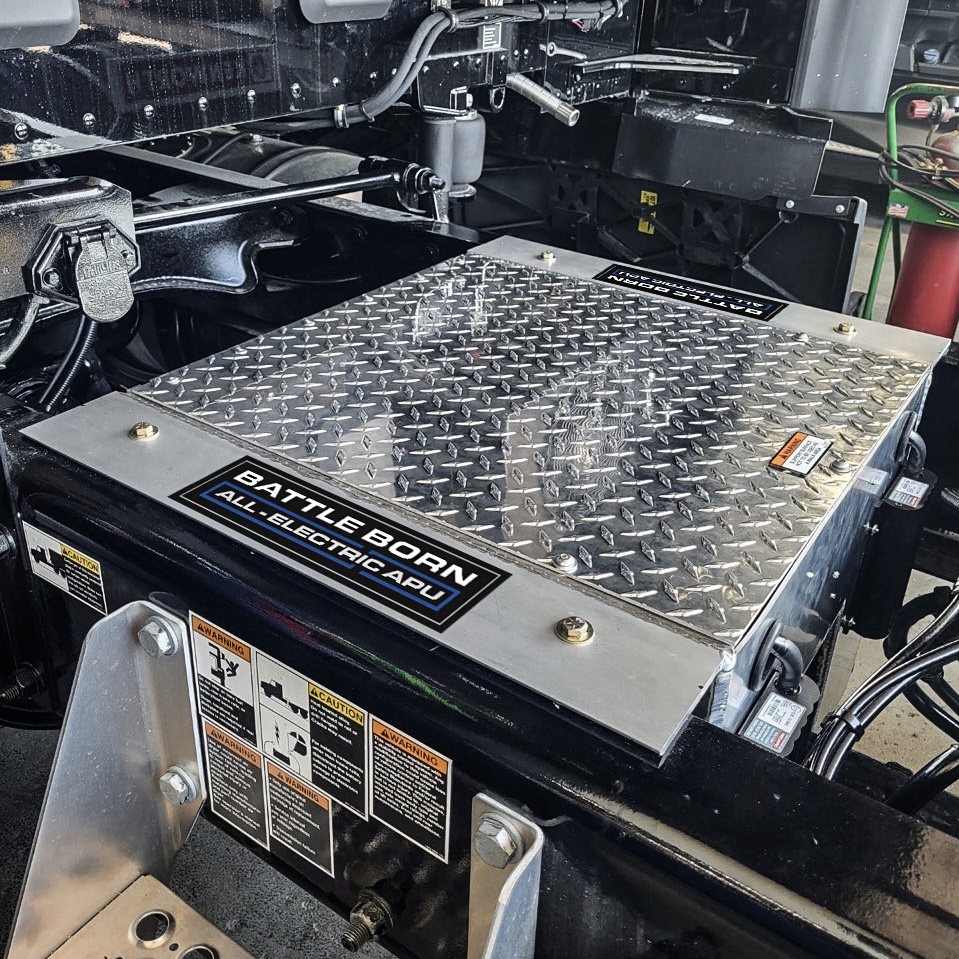

#8 Electric APU

Domain Est. 2022

Website: electricapu.com

Key Highlights: We offer an Electric APU system, developed with the driver in mind. Our Idle-Free system helps to significantly decrease your engine wear and tear….

#9 Best truck APUs: Save fuel & money

Domain Est. 2010

Website: gogreenapu.com

Key Highlights: Durable diesel APUs for semi-trucks. Cut idling costs and extend engine life with our reliable, long-interval units. Get a free quote today!…

Expert Sourcing Insights for Semi Truck Apu

H2: 2026 Market Trends for Semi-Truck APUs (Auxiliary Power Units)

The market for Auxiliary Power Units (APUs) in semi-trucks is undergoing significant transformation as it heads toward 2026, driven by tightening emissions regulations, rising fuel costs, advancements in battery technology, and a growing emphasis on driver comfort and operational efficiency. Below are the key H2-level trends expected to shape the semi-truck APU market in 2026:

1. Shift Toward Electric and Hybrid APUs

By 2026, the demand for electric APUs (eAPUs) is projected to surge, replacing traditional diesel-powered units. Driven by emissions regulations such as the U.S. EPA’s Clean Truck Initiative and California’s Advanced Clean Fleets (ACF) rule, fleets are increasingly adopting zero-emission solutions. eAPUs, powered by lithium-ion or emerging solid-state batteries, offer quiet, emission-free operation during driver rest periods, aligning with sustainability goals and reducing idling penalties.

2. Integration with Truck Electrification and Telematics

APUs are becoming more integrated with broader vehicle electrification systems and telematics platforms. By 2026, many new semi-trucks—especially battery-electric and hydrogen fuel cell models—will feature factory-installed APUs that share power with the main propulsion system. This integration enables smarter energy management, remote monitoring, and predictive maintenance, improving uptime and reducing total cost of ownership.

3. Regulatory Pressure and Idling Restrictions

With over 40 U.S. states and numerous international jurisdictions enforcing anti-idling laws, compliance is a major driver for APU adoption. By 2026, stricter enforcement and expanded geographic coverage of these regulations will make APUs a standard feature rather than an optional add-on. Fleets operating cross-border or in urban delivery zones will especially benefit from APU-equipped trucks to avoid fines and ensure uninterrupted driver rest.

4. Advancements in Battery Technology and Charging Infrastructure

The performance of eAPUs will improve significantly by 2026 due to advances in energy density, faster charging, and longer cycle life in lithium-iron phosphate (LFP) and next-generation batteries. Additionally, expanded charging infrastructure at truck stops and distribution centers will support overnight recharging, making electric APUs more viable for long-haul operations.

5. Growth in Retrofit and Aftermarket Demand

While OEM integration is increasing, the aftermarket for APU retrofits remains strong. Independent owner-operators and mid-sized fleets are expected to drive demand for cost-effective, modular APU kits that can be installed on existing trucks. By 2026, plug-and-play retrofit solutions with simplified certification and installation will dominate this segment.

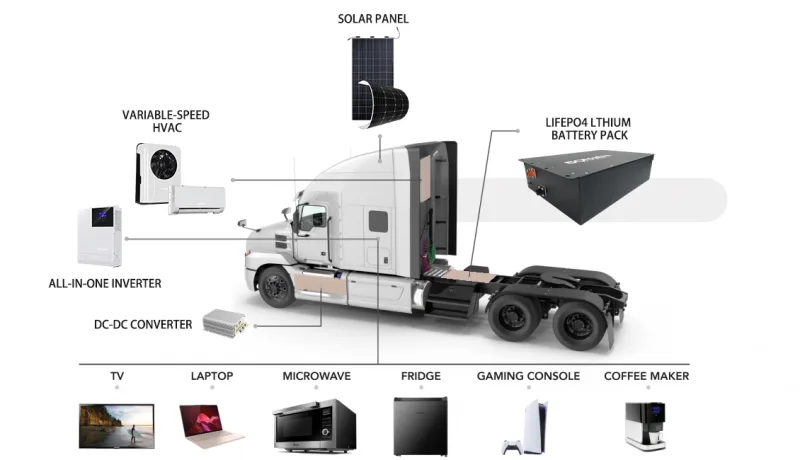

6. Focus on Driver Comfort and Retention

As the trucking industry faces a persistent driver shortage, carriers are investing in amenities that improve quality of life. APUs that power HVAC systems, appliances, and electronics during rest periods enhance driver comfort, directly impacting recruitment and retention. By 2026, APUs with smart climate control, app-based monitoring, and low noise profiles will be preferred by both drivers and fleet managers.

7. Competitive Landscape and Consolidation

The APU market is seeing increased competition from traditional suppliers (e.g., Thermo King, Bergstrom, and Carrier Transicold) and new entrants specializing in electric and hybrid systems (e.g., SmartTruck, Diesel Solutions, and emerging EV tech startups). By 2026, industry consolidation is expected as larger players acquire innovative eAPU developers to expand their clean technology portfolios.

8. Total Cost of Ownership (TCO) Advantage

Fleets are increasingly evaluating APUs based on long-term TCO rather than upfront cost. Electric APUs, despite higher initial prices, offer substantial savings through reduced fuel consumption, lower maintenance, and avoidance of idling fines. By 2026, lifecycle cost analyses will favor eAPUs, accelerating their adoption across all fleet sizes.

Conclusion

By 2026, the semi-truck APU market will be defined by electrification, regulatory compliance, and integration with smart truck systems. Electric and hybrid APUs will dominate new installations, supported by technological innovation and sustainability mandates. Fleets that adopt advanced APUs will gain operational, environmental, and competitive advantages—positioning them for success in an increasingly regulated and efficiency-driven transportation landscape.

Common Pitfalls When Sourcing Semi Truck APUs (Quality, IP)

Sourcing Auxiliary Power Units (APUs) for semi-trucks can significantly reduce fuel costs, emissions, and driver fatigue during rest periods. However, buyers often encounter critical pitfalls related to quality and intellectual property (IP) that can lead to performance issues, legal risks, and long-term costs. Being aware of these challenges is essential for making informed procurement decisions.

Poor Build Quality and Reliability

One of the most frequent issues when sourcing APUs—especially from lesser-known or overseas manufacturers—is substandard build quality. Units may use inferior materials, lack proper sealing against weather, or feature under-engineered components that fail prematurely under heavy-duty conditions. This leads to higher maintenance costs, unplanned downtime, and driver dissatisfaction. Always verify third-party testing certifications (e.g., ISO, SAE standards) and request field performance data before committing to a supplier.

Inadequate Thermal and Noise Performance

Low-quality APUs often fail to deliver consistent heating, cooling, and electrical output, particularly in extreme climates. Poor insulation, undersized compressors, or inefficient generators result in inadequate cabin comfort and reduced driver compliance. Additionally, excessive noise levels can disturb drivers during rest, defeating the purpose of the unit. Evaluate thermal performance metrics and sound decibel ratings under real-world conditions, not just manufacturer claims.

Misrepresentation of Power Output and Efficiency

Some suppliers exaggerate the power output, fuel efficiency, or run-time of their APUs. Units may consume more diesel than advertised or fail to support common in-cab appliances (e.g., refrigerators, TVs, heating systems). This leads to unexpected fuel costs and operational shortfalls. Request independent test results and ensure power ratings are based on sustained, not peak, output.

Lack of Compliance with Emissions and Safety Regulations

Non-compliant APUs may violate EPA, CARB, or DOT regulations, especially regarding emissions and noise. Using such units can result in fines, failed inspections, or fleet-wide operational disruptions. Always confirm that the APU has the necessary certifications (e.g., EPA Tier 4, CARB Executive Order) for the regions in which your fleet operates.

Intellectual Property (IP) Infringement Risks

Sourcing from manufacturers that copy patented designs or use counterfeit components exposes your fleet and company to legal liability. Some low-cost suppliers reverse-engineer leading brands, violating IP rights. If your company deploys such units, you could face lawsuits, product recalls, or reputational damage. Conduct due diligence on the supplier’s IP portfolio and avoid products that appear suspiciously similar to established brands without proper licensing.

Limited Warranty and After-Sales Support

Many budget APU suppliers offer weak or geographically limited warranty coverage and lack a reliable service network. When failures occur, obtaining parts or technical support can be slow or impossible, especially for fleets operating across regions. Ensure the supplier provides comprehensive warranty terms and accessible technical and repair support before making a purchase.

Integration Challenges with OEM Truck Systems

Poorly designed APUs may not integrate smoothly with a truck’s existing electrical, HVAC, or telematics systems. This can lead to dashboard error codes, battery drain, or conflicts with onboard diagnostics. Confirm compatibility with major truck OEMs (e.g., Freightliner, Peterbilt, Volvo) and verify whether the APU requires custom wiring or software updates.

Conclusion

To avoid these pitfalls, prioritize suppliers with a proven track record, transparent technical specifications, full regulatory compliance, and respect for intellectual property. Investing time in vetting APUs upfront can prevent costly downtime, legal exposure, and reduced driver satisfaction in the long run.

Logistics & Compliance Guide for Semi Truck APUs (Auxiliary Power Units)

Understanding APUs and Their Role in Logistics

Auxiliary Power Units (APUs) are compact systems installed on semi-trucks to provide power for climate control, electrical devices, and rest period comfort without idling the main diesel engine. In modern logistics operations, APUs play a critical role in reducing fuel consumption, lowering emissions, and ensuring driver comfort during mandated rest periods. Their adoption supports compliance with anti-idling regulations and contributes to a carrier’s sustainability goals.

Regulatory Compliance: Federal and State Idling Restrictions

The use of APUs must align with federal and state regulations governing engine idling. The Environmental Protection Agency (EPA) promotes idle reduction technologies under its SmartWay program, offering incentives for APU adoption. Additionally, many states and municipalities enforce strict anti-idling laws—often limiting idling to 3–5 minutes—to reduce air pollution and noise. Drivers and fleets using APUs can remain compliant during rest breaks, avoiding fines and enhancing environmental responsibility.

Hours of Service (HOS) and APU Integration

APUs support compliance with the Federal Motor Carrier Safety Administration (FMCSA) Hours of Service (HOS) rules by enabling drivers to rest comfortably without idling. When drivers use an APU during sleeper berth rest periods, they can maintain a habitable cab environment while preserving engine life and fuel. Some APUs integrate with electronic logging devices (ELDs), allowing fleets to monitor usage and demonstrate compliance during audits.

Emissions Standards and Environmental Certifications

APUs must meet emissions standards set by the EPA and the California Air Resources Board (CARB). CARB certification is particularly important for fleets operating in California, where only approved idle reduction technologies are permitted. Selecting CARB-compliant APUs ensures legality in regulated regions and may qualify for state or federal grants and tax incentives aimed at reducing diesel emissions.

Fuel Efficiency and Cost-Benefit Analysis

APUs significantly improve fuel efficiency by replacing engine idling, which can consume up to a gallon of diesel per hour. Most APUs use less than 0.2 gallons per hour, delivering substantial fuel savings over time. Fleets should perform a cost-benefit analysis considering initial investment, fuel savings, maintenance costs, and potential regulatory penalties avoided. ROI is typically achieved within 1–2 years for long-haul operations.

Maintenance and Operational Best Practices

To ensure reliability and compliance, APUs require routine maintenance, including battery checks, filter replacements, and refrigerant level monitoring (for HVAC-based units). Integrate APU maintenance into regular preventive maintenance schedules. Train drivers on proper startup, shutdown, and troubleshooting procedures to maximize lifespan and avoid misuse.

Documentation and Audit Readiness

Maintain detailed records of APU installation, maintenance, compliance certifications (e.g., CARB, SmartWay), and usage logs. In the event of a roadside inspection or compliance audit, these documents prove that your fleet adheres to idle reduction regulations. Digital logs synced with ELDs or fleet management systems enhance transparency and streamline reporting.

Future-Proofing: Transition to Alternative Technologies

As environmental regulations tighten, fleets should consider next-generation alternatives such as battery-electric APUs, shore power connections (e.g., electrified parking spaces), or hybrid systems. Staying informed about emerging technologies and federal initiatives like the Inflation Reduction Act’s clean truck provisions ensures long-term compliance and competitive advantage.

Conclusion

Integrating APUs into semi-truck operations enhances logistical efficiency, supports regulatory compliance, and promotes sustainable freight transport. By understanding applicable laws, maintaining equipment properly, and planning for future advancements, fleets can optimize performance, reduce costs, and demonstrate environmental stewardship in the modern supply chain.

Conclusion for Sourcing a Semi-Truck APU (Auxiliary Power Unit):

Sourcing a semi-truck APU is a strategic decision that offers significant benefits in terms of fuel savings, regulatory compliance, driver comfort, and environmental responsibility. As idling restrictions become more stringent and fuel costs remain volatile, integrating an APU provides a cost-effective and sustainable solution to power climate control, electronics, and other amenities during rest periods without running the main engine.

When sourcing an APU, it is essential to evaluate factors such as power requirements, weight, ease of installation, maintenance needs, warranty, and total cost of ownership. Electric APUs (including battery-powered and shore-power options) are increasingly viable, especially with advancements in lithium-ion technology and growing infrastructure support. Traditional diesel-fired APUs still offer reliability and long runtime but come with higher emissions and fuel use.

Ultimately, the right APU choice depends on fleet size, operational demands, duty cycles, and environmental goals. Partnering with reputable suppliers, considering driver feedback, and staying informed about emerging technologies—such as hybrid systems and smart integration with truck telematics—will ensure a successful implementation. Investing in the right APU not only enhances driver satisfaction and retention but also positions fleets for long-term efficiency and compliance in an evolving transportation landscape.