The global self-adhesive roofing market is experiencing robust growth, driven by rising demand for energy-efficient building solutions and low-maintenance waterproofing systems. According to Grand View Research, the global roofing membranes market, which includes self-adhesive variants, was valued at USD 14.8 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 7.3% from 2024 to 2030. Similarly, Mordor Intelligence reports that increasing infrastructure development in emerging economies, coupled with stringent building regulations promoting sustainable construction, is accelerating the adoption of advanced roofing technologies. Self-adhesive roofing products, known for their ease of installation, durability, and superior weather resistance, are gaining favor among contractors and property developers. As the market expands, a select group of manufacturers are leading innovation, scalability, and product performance—shaping the future of modern roofing systems.

Top 10 Self Adhesive Roofing Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Sika, a Leading Manufacturer of Commercial Roofing Solutions

Domain Est. 1995

Website: usa.sika.com

Key Highlights: Sika is a worldwide leader in manufacturing resilient and sustainable roofing and waterproofing solutions for non-residential construction projects….

#2 GAF Roofing

Domain Est. 1996

Website: gaf.com

Key Highlights: As North America’s largest roofing manufacturer, GAF is an industry leader that produces quality, innovative roofing materials….

#3 Roofing Products Manufacturer

Domain Est. 2001

Website: tarcoroofing.com

Key Highlights: Tarco is one of the largest independently owned manufacturers of residential roofing products and commercial roofing products in North America….

#4 Polyglass

Domain Est. 2002

Website: polyglass.us

Key Highlights: We’re a leading manufacturer of modified bitumen & waterproofing membranes and roof systems & coatings for low & steep-slope applications. Learn more here….

#5 OMG Roofing Products

Domain Est. 2011

Website: omgroofing.com

Key Highlights: OMG Roofing is a leading manufacturer of high performance roof products and systems that improve rooftop productivity and enhance installation quality….

#6 Henry LowSlope™ One

Domain Est. 1994

Website: henry.com

Key Highlights: Henry LowSlope One-Ply Roll Roofing offers reliable, long-lasting protection for low-slope roofs, providing easy installation and superior weather ……

#7 Benefits Self Adhered Modified Bitumen Roof System

Domain Est. 1995

Website: certainteed.com

Key Highlights: Self-adhered SBS (styrene butadiene styrene) modified bitumen (‘mod bit’) roofing systems offer roofers a safe, clean and quick alternative to those installed ……

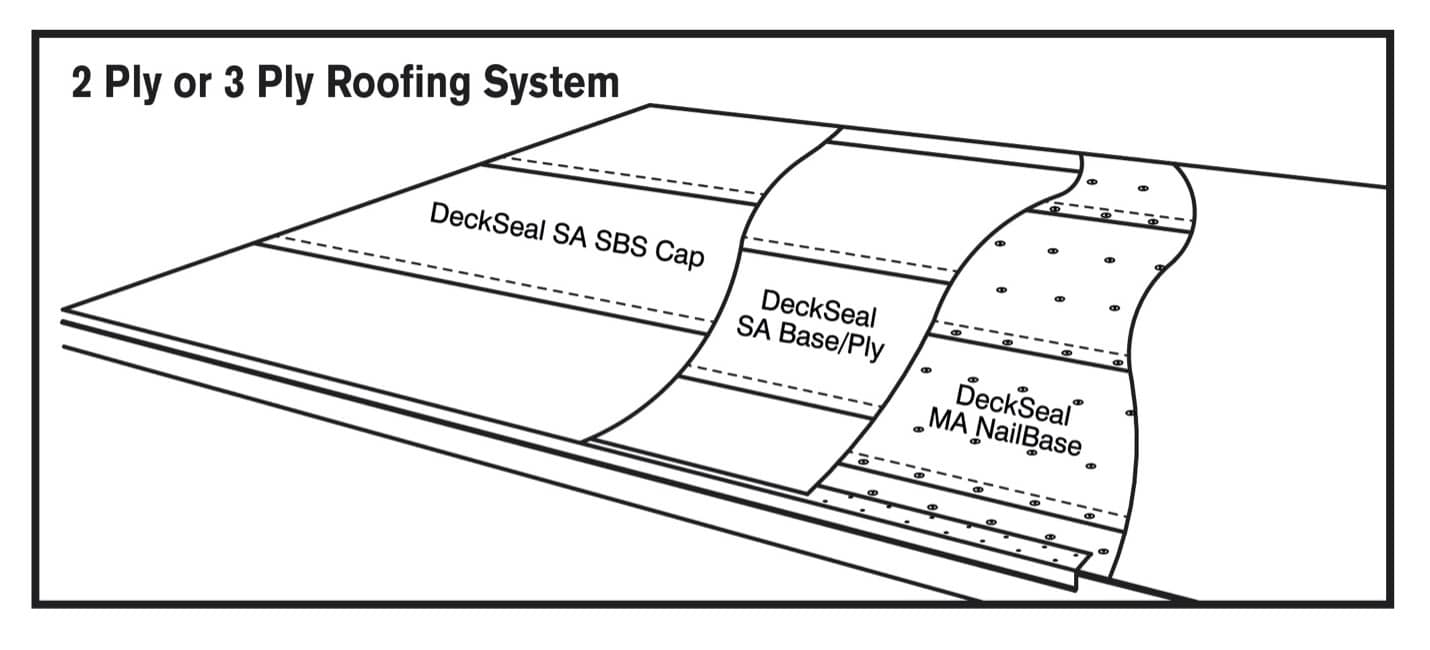

#8 DeckSeal Self

Domain Est. 1996

Website: owenscorning.com

Key Highlights: The DeckSeal Self-Adhered Roofing System is an excellent solution for low slope applications 1/4:12 to 2:12 on residential re-roofing jobs….

#9 to MuleHide

Domain Est. 1996

Website: mulehide.com

Key Highlights: Our premium-quality commercial roofing products promise performance so our roofing contractors can get the job done….

#10 Versico Roofing Systems

Domain Est. 1998

Website: versico.com

Key Highlights: Adhesives, Primers, & Sealants · Coatings · Air and Vapor Barriers · Fasteners · Insulation · Multiple-Ply · Flashings & Accessories · Edge Metal….

Expert Sourcing Insights for Self Adhesive Roofing

H2: 2026 Market Trends for Self-Adhesive Roofing

The self-adhesive roofing market is poised for significant evolution by 2026, driven by technological advancements, sustainability demands, and shifting construction practices. This analysis explores key trends shaping the industry over the next few years.

1. Rising Demand for Energy-Efficient Building Materials

As global energy efficiency standards tighten, self-adhesive roofing membranes are increasingly valued for their seamless installation and superior air tightness. These properties contribute to improved building envelopes, reducing thermal bridging and energy loss. By 2026, demand is expected to grow, especially in residential and low-slope commercial applications across North America and Europe.

2. Expansion in Cold-Adhesive Application Technologies

Traditional hot-mopped roofing methods are being replaced by cold-applied, self-adhesive systems due to safety, environmental, and labor efficiency benefits. Innovations in adhesive chemistry—such as enhanced UV resistance and improved low-temperature flexibility—are broadening the geographic and seasonal usability of these products, accelerating adoption in colder climates.

3. Sustainability and Regulatory Influence

Environmental regulations, including VOC (volatile organic compound) restrictions and green building certifications (e.g., LEED, BREEAM), are pushing manufacturers toward eco-friendly formulations. By 2026, self-adhesive roofing products with recycled content, recyclable backings, and low-emission adhesives are expected to dominate the market. Regulatory pressure in the EU and North America will be a key driver.

4. Growth in Retrofit and Repair Markets

With aging infrastructure and increasing extreme weather events, the need for durable, easy-to-install roofing solutions is rising. Self-adhesive membranes offer quick application over existing roofs, minimizing disruption. The repair and retrofit segment is projected to be one of the fastest-growing areas for self-adhesive roofing by 2026, especially in urban redevelopment and disaster-prone regions.

5. Technological Integration and Smart Roofing

Emerging integration with smart building technologies—such as moisture sensors embedded in self-adhesive membranes—is beginning to enter the market. While still in early stages, these innovations are expected to gain traction by 2026, offering predictive maintenance capabilities and enhanced performance monitoring.

6. Regional Market Dynamics

North America and Europe will remain dominant markets due to strict building codes and high renovation activity. However, Asia-Pacific—particularly China and India—is expected to experience the highest growth rate, fueled by rapid urbanization and infrastructure development. Local manufacturing and distribution expansions will support this growth.

7. Competitive Landscape and Product Differentiation

Major players such as Sika, GAF, Firestone Building Products, and IKO are investing heavily in R&D to differentiate through performance (e.g., higher peel strength, longer lifespan) and ease of installation. By 2026, brand loyalty and technical support services will play a crucial role in market positioning.

Conclusion

By 2026, the self-adhesive roofing market will be characterized by innovation, sustainability, and broader application scope. With increasing emphasis on resilient, energy-efficient construction, self-adhesive solutions are set to become a standard choice across new builds and retrofit projects globally.

Common Pitfalls When Sourcing Self-Adhesive Roofing (Quality and Intellectual Property)

Sourcing self-adhesive roofing materials can present significant challenges, particularly concerning product quality and intellectual property (IP) risks. Being aware of these common pitfalls helps ensure you select reliable, compliant, and high-performing products.

Poor Material Quality and Inconsistent Performance

One of the most frequent issues when sourcing self-adhesive roofing is receiving products that fail to meet performance standards. Low-quality materials may use inferior bitumen, weak adhesive layers, or substandard reinforcement fabrics, leading to premature failure, leaks, or poor bonding. These defects often become apparent only after installation, resulting in costly repairs and reputational damage.

Misrepresentation of Product Specifications

Suppliers—especially those in less-regulated markets—may exaggerate or falsify technical data such as peel strength, temperature resistance, or UV stability. Buyers relying on datasheets without independent verification risk installing products unsuitable for their climate or application, compromising roof longevity.

Lack of Compliance with Regional Building Codes

Self-adhesive roofing products must meet local fire safety, wind uplift, and environmental regulations. Sourcing from international suppliers without verifying compliance can result in non-certified materials being used, leading to failed inspections, liability issues, or voided warranties.

Counterfeit or IP-Infringing Products

A major IP risk involves counterfeit or cloned products that mimic well-known branded materials. These copies often replicate logos, packaging, and product names without authorization, violating trademarks and patents. Using such products exposes buyers to legal liability, warranty voidance, and performance issues due to unlicensed manufacturing processes.

Inadequate or Missing Documentation

Reputable manufacturers provide detailed technical documentation, test reports, and certificates of authenticity. Sourcing from unreliable suppliers often means receiving incomplete or forged documentation, making it difficult to verify quality claims or defend against IP allegations.

Unverified Manufacturing Origins

Some suppliers obscure the actual country of origin or use third-party factories without proper oversight. This lack of transparency increases the risk of inadvertently sourcing products from facilities with poor quality control or those involved in IP violations.

Overreliance on Price Over Performance

Choosing the lowest-cost option often leads to compromised quality and higher long-term costs due to early degradation or failure. Bargain-priced self-adhesive membranes may cut corners on raw materials or skip essential production steps, undermining reliability and voiding any implied warranty.

Failure to Conduct Due Diligence

Skipping supplier audits, sample testing, or IP clearance checks leaves buyers vulnerable. Verifying supplier credentials, requesting product samples for lab testing, and consulting legal experts on IP rights are essential steps to mitigate risks before procurement.

Logistics & Compliance Guide for Self-Adhesive Roofing

Product Handling and Storage

Self-adhesive roofing membranes are sensitive to temperature and environmental conditions. Proper handling and storage are essential to maintain product integrity and ensure optimal performance.

- Temperature Control: Store rolls in a cool, dry environment between 40°F (5°C) and 90°F (32°C). Avoid exposure to extreme heat or freezing conditions, which can compromise the adhesive layer.

- Indoor Storage: Always store materials indoors on pallets, elevated off the ground, to prevent moisture absorption and damage.

- UV Exposure: Limit exposure to direct sunlight. If temporary outdoor storage is unavoidable, cover rolls with opaque, breathable tarps—never plastic, which can trap moisture.

- Roll Positioning: Store rolls upright (on their edges) to prevent deformation. Do not stack more than two layers high unless specified by the manufacturer.

Transportation Requirements

Proper transportation ensures that self-adhesive roofing materials arrive at the job site in optimal condition.

- Weather Protection: Secure loads with waterproof tarps during transit. Avoid leaving materials exposed during rain or snow.

- Temperature During Transit: In extreme climates, use climate-controlled trucks to prevent premature curing or hardening of the adhesive.

- Securing Loads: Fasten rolls to prevent rolling or shifting. Use straps or braces to minimize physical damage during transport.

- Delivery Verification: Inspect deliveries upon arrival for signs of moisture, crushing, or temperature damage. Document and report any issues immediately to the supplier.

Job Site Management

Effective on-site logistics reduce waste and support efficient installation.

- Staging Area: Designate a clean, dry, shaded area for material staging. Keep rolls off the ground and covered when not in use.

- First-In, First-Out (FIFO): Use older stock first to prevent materials from exceeding shelf life.

- Installation Timing: Install self-adhesive membranes only when ambient and substrate temperatures meet manufacturer specifications (typically above 40°F/5°C).

- Substrate Preparation: Ensure roof decks are clean, dry, smooth, and free of debris, frost, or standing water before application.

Regulatory and Safety Compliance

Adherence to safety and building regulations is critical for legal and performance reasons.

- OSHA Guidelines: Follow OSHA safety standards for fall protection, PPE (gloves, safety glasses, non-slip footwear), and handling heavy materials.

- Fire Safety: Comply with local fire codes. Store materials away from ignition sources. Some self-adhesive membranes require flame-retardant underlayments or cover boards.

- Building Codes: Ensure product selection and installation comply with relevant codes, including the International Building Code (IBC) and local amendments.

- Manufacturer Specifications: Always follow the manufacturer’s installation instructions to maintain warranty coverage and ensure performance.

Environmental and Sustainability Considerations

- Waste Management: Collect and dispose of packaging and offcuts according to local recycling and disposal regulations.

- VOC Emissions: Most self-adhesive membranes are low- or zero-VOC. Verify compliance with EPA and CARB (California Air Resources Board) standards if applicable.

- Sustainable Procurement: Choose products with environmental product declarations (EPDs) or third-party sustainability certifications when possible.

Documentation and Traceability

Maintaining proper documentation supports compliance and quality assurance.

- Batch Tracking: Retain batch numbers and delivery receipts for traceability in case of product issues or warranty claims.

- Installation Logs: Record installation dates, conditions, and crew details.

- Warranty Registration: Submit required documentation to the manufacturer to activate product warranties.

By following this guide, contractors and project managers can ensure safe, compliant, and efficient handling, transport, and installation of self-adhesive roofing systems.

Conclusion on Sourcing Self-Adhesive Roofing

Sourcing self-adhesive roofing materials offers a practical, efficient, and cost-effective solution for both residential and commercial roofing projects. The ease of installation, strong waterproofing capabilities, and durability in various weather conditions make self-adhesive membranes a preferred choice for flashings, underlayments, and flat roof applications. When sourcing these products, it is essential to prioritize quality, manufacturer reputation, and compliance with industry standards to ensure long-term performance and building integrity.

Procurement should consider factors such as climate suitability, substrate compatibility, UV resistance, and proper certification (e.g., ASTM, CE marking). Working with reliable suppliers or manufacturers who provide technical support and warranties adds further value and reduces the risk of installation failures. Additionally, comparing pricing, lead times, and sustainability practices—such as recyclability or low VOC emissions—can support environmentally responsible construction goals.

In conclusion, sourcing self-adhesive roofing requires a balanced approach that emphasizes product quality, technical fit, and supplier reliability. With the right selection and installation practices, self-adhesive roofing systems can significantly enhance building envelope performance, reduce maintenance costs, and contribute to energy efficiency and longevity of the roofing system.