The global SCSI interface connector market continues to demonstrate resilience amid evolving data storage demands, driven by the need for high-speed data transfer in enterprise-level servers, data centers, and industrial applications. According to a 2023 report by Mordor Intelligence, the global market for SCSI technology and related components is projected to grow at a CAGR of approximately 3.8% from 2023 to 2028. This growth is primarily fueled by legacy system maintenance, ongoing demand in specialized industrial equipment, and niche high-performance computing environments where SCSI’s reliability and throughput remain advantageous. Despite the broader shift toward newer interfaces like NVMe and SATA, SCSI connectors still hold critical relevance in systems requiring robust, daisy-chained peripheral connectivity and low-latency communication. As a result, leading manufacturers continue to innovate within this mature but steady segment, focusing on durability, signal integrity, and backward compatibility. In this landscape, the top 10 SCSI interface connector manufacturers are distinguished by their engineering precision, adherence to industry standards, global supply chain reach, and sustained R&D investment—key factors enabling them to maintain market relevance in a highly specialized domain.

Top 10 Scsi Interface Connector Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 SCSI Connector Suppliers & Manufacturers & Factory

Domain Est. 2018

Website: starte-cable.com

Key Highlights: Starte is leading SCSI connector supplier from China, Starte offers a complete line of standard and custom Small Computer System Interface USB. Shenzhen Starte ……

#2 Connector SCSI

Domain Est. 1991

Website: arrow.com

Key Highlights: Arrow.com is an authorized distributor of Connector SCSI from industry-leading manufacturers. Find datasheets, pricing, and inventory for the available ……

#3 SCSI Connector

Domain Est. 1998

Website: norcomp.net

Key Highlights: SCSI connector types or Small Computer Systems Interface is a technology designed to reliably connect devices to various computer systems with a secure, ……

#4 What is the SCSI connector?

Domain Est. 2018

Website: denentech.com

Key Highlights: A SCSI connector is an interface used to connect a computer system to external devices. SCSI is a Small Computer System Interface…

#5 SCSI Connectors

Domain Est. 1990

Website: avnet.com

Key Highlights: A Small Computer System Interface (SCSI) connector, is used for physically connecting and transferring data between computers and peripheral devices….

#6 SCSI Connectors: SAS and MiniSAS

Domain Est. 1992

Website: te.com

Key Highlights: TE offers a wide range of serial attached SCSI (SAS) and Mini-SAS connectors for enterprise storage, servers, and desktop PC applications….

#7 SCSI FAQ Answers. What is SCSI? SCSI technical information …

Domain Est. 1995

Website: paralan.com

Key Highlights: SCSI provides a high-speed, intelligent interface that allows an easy connection for up to 16 devices (8 devices for Narrow SCSI) on a single bus….

#8 SCSI Adapters: 50–68 Pin Interconnects for SCSI

Domain Est. 1996

Website: meritec.com

Key Highlights: Meritec SCSI Adapters have proven to be the most reliable connection you will ever come across when interfacing between SCSI-1 and SCSI-3 devices….

#9 SCSI & VHDCI Connectors

Domain Est. 1996

Website: connecticc.com

Key Highlights: SCSI (Small Computer System Interface) is a set of standards for connecting and transferring data between computers and peripheral devices….

#10 ECS SCSI Connectors

Domain Est. 1998

Website: ecsconn.com

Key Highlights: ECS offers a complete line of standard and custom Small Computer System Interface (SCSI) connectors. Many products are available that are not listed in the ……

Expert Sourcing Insights for Scsi Interface Connector

2026 Market Trends for SCSI Interface Connectors

The SCSI (Small Computer System Interface) connector market in 2026 is defined by a landscape of legacy support, niche specialization, and gradual technological displacement. While largely supplanted by faster, more cost-effective interfaces like SATA, SAS, and NVMe over PCIe in mainstream applications, SCSI connectors persist in specific industrial, enterprise, and embedded systems. The 2026 trends reflect a mature, declining market with targeted demand drivers and evolving integration methods.

Legacy System Maintenance and Industrial Longevity

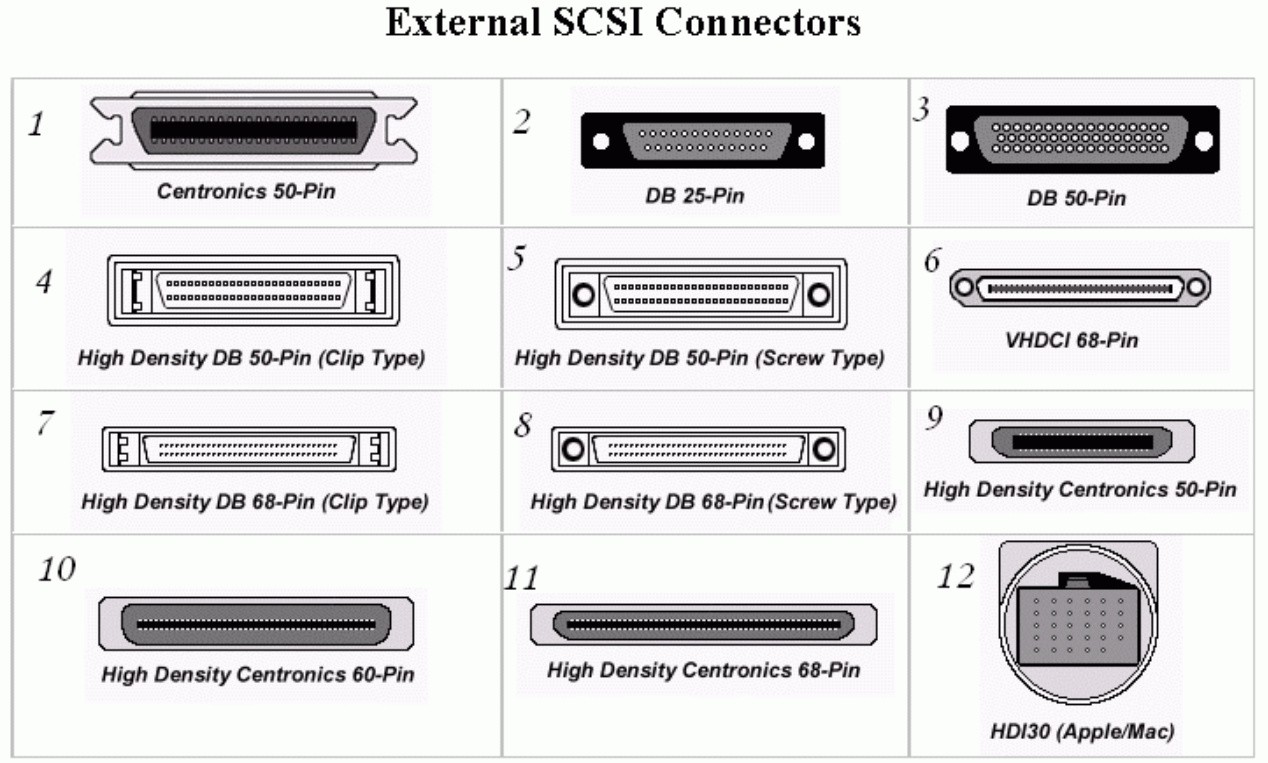

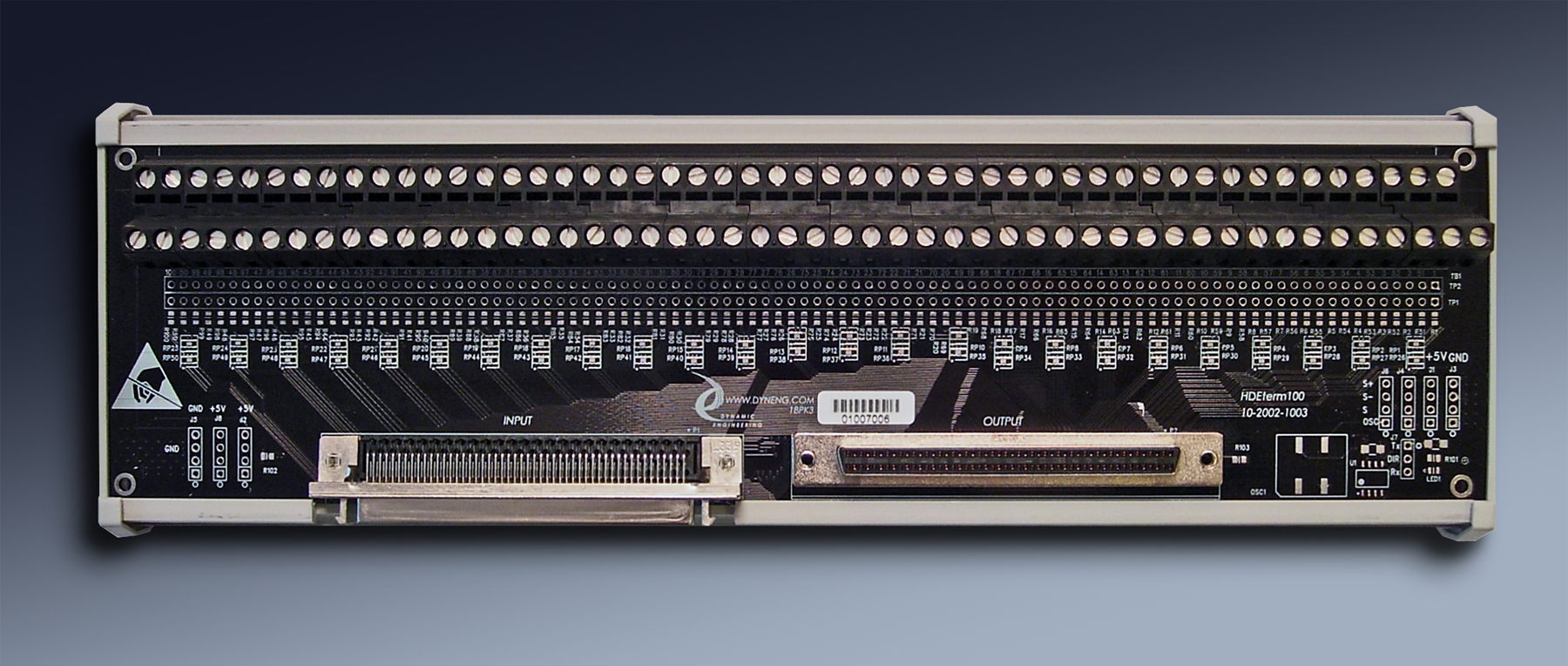

A primary driver for SCSI connector demand in 2026 remains the extensive installed base of legacy industrial equipment, medical devices, telecommunications infrastructure, and specialized test/measurement systems. These systems often have lifespans exceeding 15–20 years, and manufacturers prioritize reliability and compatibility over upgrading entire platforms. Consequently, demand for SCSI connectors (particularly HD68, VHDCI, and DB25 variants) is sustained by replacement parts for repair and maintenance. The market is characterized by low volume but high value, with suppliers focusing on long-term component availability and backward compatibility. This trend ensures a stable, albeit shrinking, revenue stream for connector manufacturers catering to industrial OEMs and service providers.

Transition to SAS and the Niche Role of Parallel SCSI

By 2026, Serial Attached SCSI (SAS) has firmly replaced parallel SCSI in high-performance enterprise storage, utilizing different physical connectors (SFF-8482, SFF-8643). However, the SCSI protocol remains relevant over SAS and even in NVMe environments via SCSI Express or translation layers. This creates a nuanced market: while physical SCSI connectors for parallel buses are in steep decline, the broader SCSI ecosystem influences interface design. For parallel SCSI specifically, demand is now almost exclusively tied to maintaining legacy arrays, tape libraries (LTO drives often used SCSI historically), and proprietary systems. New designs rarely incorporate parallel SCSI connectors, pushing the market toward obsolescence management and aftermarket support.

Supply Chain Consolidation and Obsolescence Management

As demand for traditional SCSI connectors wanes, the supply chain has consolidated significantly. Fewer manufacturers produce these components, leading to potential shortages and longer lead times. In 2026, key market strategies involve obsolescence management, with specialized distributors and manufacturers offering last-time buys, extended lifecycle programs, and counterfeit mitigation. Companies like TE Connectivity, Molex (now part of Koch Industries), and Amphenol continue to support select SCSI connector lines, but often at premium prices due to low production volumes. This environment favors suppliers with strong inventory management and relationships with legacy system integrators.

Impact of Modern Interconnects and Virtualization

The rise of high-speed serial interfaces—USB4, Thunderbolt, PCIe 5.0/6.0, and 100GbE—has further marginalized SCSI connectors in new applications. These modern standards offer superior bandwidth, lower pin counts, and smaller form factors, making traditional SCSI bulky and inefficient by comparison. Additionally, virtualization and cloud computing reduce reliance on direct-attached storage (DAS), a traditional SCSI stronghold. In data centers, NVMe-oF (over Ethernet or InfiniBand) dominates new deployments, utilizing RJ45 or optical connectors instead of SCSI. This technological shift accelerates the decline of physical SCSI connectors in enterprise IT.

Niche Applications and Custom Solutions

Despite overall decline, SCSI connectors maintain relevance in niche applications requiring ruggedness, deterministic timing, or specialized signaling. Examples include military/aerospace systems, scientific instrumentation, and some high-end audio/video equipment where legacy SCSI implementations offered low latency and reliable daisy-chaining. In these areas, demand for custom or modified SCSI connectors persists. Additionally, retro computing and vintage hardware restoration communities create a small but dedicated aftermarket for SCSI connectors, often driving demand for reproduction parts and adapters.

Conclusion

In 2026, the SCSI interface connector market is a shadow of its former self, sustained primarily by legacy support, industrial longevity, and niche applications. The trend is unmistakably downward, with parallel SCSI connectors facing obsolescence. Growth lies not in new SCSI adoption but in managing the end-of-life of existing systems, supporting specialized industrial needs, and adapting to the enduring influence of SCSI protocols over modern physical layers. Suppliers must focus on reliability, long-term availability, and aftermarket services to remain viable in this mature, specialized segment.

Common Pitfalls When Sourcing SCSI Interface Connectors (Quality and IP)

Sourcing SCSI (Small Computer System Interface) connectors—especially for legacy or specialized industrial systems—can present several challenges related to quality and intellectual property (IP). Being aware of these pitfalls helps avoid system failures, compliance issues, and long-term supply problems.

Poor Manufacturing Quality

Many SCSI connectors available in the market, particularly from non-reputable suppliers, suffer from substandard materials and inconsistent manufacturing processes. Low-quality connectors may use inferior plating (e.g., thin or non-uniform gold plating), leading to poor electrical conductivity, increased resistance, and premature wear. Mechanical durability is also compromised, resulting in loose fits, broken latches, or misaligned pins after minimal use. These issues can cause intermittent signal loss or complete interface failure, especially in high-vibration or industrial environments.

Counterfeit or Non-Compliant Components

Counterfeiting is a significant risk when sourcing older or obsolete SCSI connectors. Fake components may visually resemble genuine parts but fail to meet original specifications for impedance, shielding, or pin alignment. These counterfeit connectors often lack proper certifications (e.g., UL, RoHS) and may introduce electromagnetic interference (EMI) or signal integrity issues. Additionally, using non-compliant parts can jeopardize product certifications and expose the end-user to regulatory or safety risks.

Lack of IP and Design Rights Clarity

When sourcing SCSI connectors, especially from third-party or clone manufacturers, there may be ambiguity around intellectual property rights. Some connectors replicate designs protected by patents or trademarks, potentially exposing buyers to legal liability. Even if a connector functions correctly, using a design that infringes on IP—especially from original manufacturers like AMP (now TE Connectivity) or Molex—can result in cease-and-desist orders or supply chain disruption if legal action is taken.

Inadequate Documentation and Traceability

Many suppliers, particularly in grey or secondary markets, fail to provide full technical documentation, test reports, or lot traceability. This lack of transparency makes it difficult to verify performance claims, ensure consistency across batches, or conduct failure analysis when problems arise. Without proper documentation, maintaining compliance with industry standards (e.g., in medical or aerospace applications) becomes nearly impossible.

Obsolescence and Supply Chain Instability

SCSI technology is largely legacy, meaning original manufacturers may have discontinued production. This forces buyers toward aftermarket or replica suppliers, increasing the risk of inconsistent quality and limited long-term availability. Relying on a single obscure supplier without a clear obsolescence management plan can lead to production halts when the connector becomes unavailable.

Insufficient Environmental and Mechanical Specifications

Some sourced connectors do not meet required environmental ratings—such as temperature range, humidity resistance, or vibration tolerance—especially when used in industrial or outdoor applications. Buyers may assume compatibility based on form factor alone, only to discover that the connector fails under operational stress due to inadequate design or materials.

Avoiding these pitfalls requires due diligence: sourcing from authorized distributors, verifying compliance certifications, conducting sample testing, and ensuring legal clarity around design rights. Engaging with reputable suppliers and maintaining alternative sourcing strategies are essential for reliable, long-term deployment.

Logistics & Compliance Guide for SCSI Interface Connector

Product Overview and Classification

The SCSI (Small Computer System Interface) Interface Connector is a hardware component used to establish high-speed data connections between computers and peripheral devices such as hard drives, tape drives, and scanners. For logistics and compliance purposes, proper classification under international and regional regulations is essential. The connector typically falls under HS Code 8536.69 (Electrical Apparatus for Switching or Protecting Electrical Circuits) or 8471.80 (Parts and Accessories for Automatic Data Processing Machines), depending on form and function. Accurate classification ensures correct duty assessment and regulatory handling.

Import/Export Regulations

When shipping SCSI Interface Connectors across borders, adherence to import and export control regulations is mandatory. Exporters must verify if the product contains encryption or dual-use technologies, which may require authorization under regimes such as the Wassenaar Arrangement or the U.S. Export Administration Regulations (EAR). Additionally, ensure compliance with destination country-specific requirements, including labeling, documentation (commercial invoice, packing list, bill of lading), and import permits. Restricted destinations or end-users may require additional screening against denied party lists.

Packaging and Handling Requirements

SCSI Interface Connectors are sensitive electronic components requiring ESD (Electrostatic Discharge) protection during storage and transit. Use anti-static packaging materials such as shielding bags, conductive foam, or static-dissipative containers. Secure packaging must prevent physical damage, moisture exposure, and contamination. Clearly label packages with ESD-safe symbols, handling instructions (e.g., “Fragile,” “Do Not Stack”), and product identifiers. Use tamper-evident seals where appropriate to maintain integrity during shipping.

Transportation and Shipping Standards

Transport SCSI Interface Connectors via air, sea, or ground using carriers compliant with IATA (air), IMDG (sea), or ADR (road) regulations as applicable. While the connectors themselves are generally not classified as hazardous, ensure compliance with general electronics shipping standards. Avoid extreme temperatures and humidity during transport. For air freight, follow IATA Packing Instructions for electronic goods, and declare contents accurately to prevent customs delays. Utilize trackable and insured shipping methods to mitigate loss or damage risks.

Regulatory Compliance and Certifications

Ensure SCSI Interface Connectors meet relevant regulatory standards prior to distribution. Key certifications include:

– RoHS (Restriction of Hazardous Substances): Compliant with EU Directive 2011/65/EU, limiting lead, cadmium, and other hazardous materials.

– REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals): Confirm absence of Substances of Very High Concern (SVHC).

– CE Marking: Required for sale in the European Economic Area, indicating conformity with health, safety, and environmental standards.

– UL/CSA Certification: Recommended for North American markets to demonstrate electrical safety compliance.

Maintain technical documentation and test reports for audit readiness.

Customs Clearance and Documentation

Efficient customs clearance requires accurate and complete documentation. Provide:

– Commercial invoice with detailed product description, value, and HS code

– Packing list specifying quantity, weight, and dimensions

– Certificate of Origin (preferably on a standardized form such as EUR.1 or COO)

– RoHS/REACH compliance declaration

– Any applicable export licenses or conformity certificates

Ensure harmonized data entry across documents to prevent discrepancies and delays at borders.

Environmental and Disposal Considerations

SCSI Interface Connectors are classified as electronic waste (WEEE – Waste Electrical and Electronic Equipment) at end-of-life. Comply with local WEEE regulations by providing take-back options or partnering with certified e-waste recyclers. Avoid landfill disposal and ensure environmentally sound recycling processes. Include WEEE symbols on packaging where required, and communicate proper disposal methods to end users.

Recordkeeping and Audit Preparedness

Maintain comprehensive records for a minimum of five years, including:

– Product compliance certifications

– Supply chain due diligence documentation

– Shipping and customs records

– RoHS/REACH compliance declarations

– Export control screening logs

These records support audits by customs authorities, regulatory bodies, or internal compliance reviews, ensuring traceability and legal defensibility.

Conclusion for Sourcing SCSI Interface Connector:

Sourcing the appropriate SCSI (Small Computer System Interface) connector requires careful consideration of several factors including connector type (e.g., HD50, HD68, VHDCI), compatibility with existing hardware, signal integrity requirements, and the specific application environment (e.g., legacy systems, industrial equipment, high-performance storage). While SCSI technology has largely been superseded by newer interfaces such as SATA, SAS, and NVMe in modern computing, it remains relevant in certain specialized and legacy systems where reliability and device compatibility are critical.

When sourcing SCSI connectors, it is essential to verify electrical specifications, pin configurations, and shielding capabilities to ensure reliable data transmission and system stability. Additionally, selecting connectors from reputable suppliers helps mitigate risks related to counterfeit components and ensures long-term availability and support.

In conclusion, although SCSI interface connectors are niche components in today’s market, they remain vital for maintaining and upgrading specific legacy and industrial systems. A strategic sourcing approach involving technical due diligence, supplier evaluation, and attention to lifecycle management will ensure successful integration and sustained system performance.