The global patient lift market is experiencing robust growth, driven by an aging population, rising prevalence of chronic diseases, and increasing demand for safe patient handling solutions in healthcare facilities. According to Mordor Intelligence, the patient lift market was valued at USD 1.45 billion in 2023 and is projected to grow at a CAGR of 7.2% from 2024 to 2029. This expansion reflects heightened awareness of workplace safety for healthcare providers and efforts to reduce musculoskeletal injuries associated with manual patient transfers. Among the various types of patient lifts, SCS (Sit-to-Stand) and scissor lift systems are gaining traction due to their versatility, ease of use, and adaptability in both clinical and home care settings. As demand surges, a number of manufacturers have emerged as leaders, combining innovation, reliability, and compliance with stringent safety standards. Based on market presence, product offerings, and technological advancements, the following is a data-driven overview of the top 10 scissor lift manufacturers shaping the industry’s future.

Top 10 Sciscor Lift Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 32 Scissor Lift Manufacturers: The Complete List

Domain Est. 1996

Website: conger.com

Key Highlights: This is the complete list of scissor lift manufacturers. Learn company histories and what scissor lifts each company offers….

#2 AXCS Equipment

Domain Est. 2001

Website: axcs.com

Key Highlights: Discover Hy-Brid scissor lifts, micro lifts, and telehandlers from AXCS Equipment—durable, compact vertical access solutions for construction and industrial ……

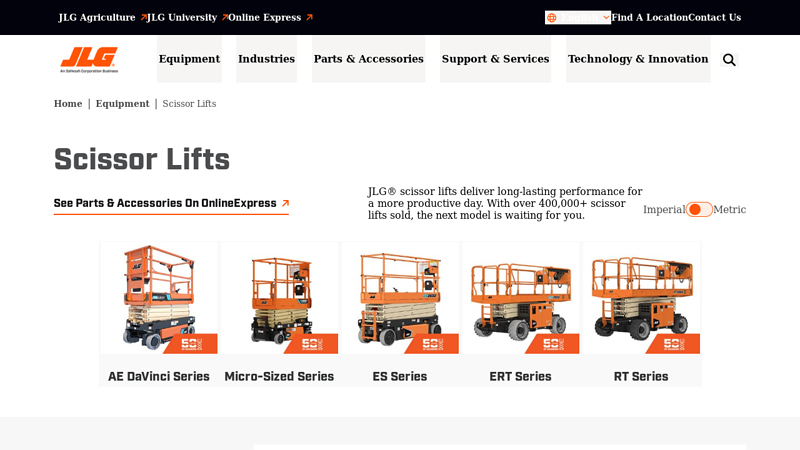

#3 Scissor Lifts

Domain Est. 1995

Website: jlg.com

Key Highlights: JLG® scissor lifts deliver long-lasting performance for a more productive day. With over 400,000+ scissor lifts sold, the next model is waiting for you….

#4

Domain Est. 1995

Website: genielift.com

Key Highlights: Genie® articulated boom lifts, telescopic boom lifts, scissor lifts and telehandler products are used in a wide range of industries around the world….

#5 Scissor Lift Tables

Domain Est. 1997

Website: advancelifts.com

Key Highlights: We offer a wide selection of premium-quality scissor lift tables in various styles: hydraulic, pneumatic, work access, mobile, and more….

#6 Skyjack

Domain Est. 2000

Website: skyjack.com

Key Highlights: RT SCISSOR LIFTS · ARTICULATING BOOMS · TELEHANDLERS. en. fr. es. es-lt. pt-br. ELEVATE. en. fr. es. es-lt. pt-br. en-eu. fr-eu. de. en-au. ACCESSORYZERS™. en….

#7 snorkellifts.com

Domain Est. 2004

Website: snorkellifts.com

Key Highlights: Home · EQUIPMENT · SCISSOR LIFTS · Electric · Rough Terrain · BOOM LIFTS · Articulated · Electric · Telescopic · TELEHANDLERS · SUPPORT · THE PLATFORM · THE ……

#8 MEC Aerial Work Platforms

Domain Est. 2004

Website: mecawp.com

Key Highlights: What We Offer · Vertical Mast Lifts · Slab Scissor Lifts · Rough Terrain Scissor Lifts · Boom Lifts · Specialty Applications ……

#9 Electric and all terrain scissors lifts

Domain Est. 2006

Website: haulotte-usa.com

Key Highlights: Designed for lifting people to carry out work at height in complete safety, Haulotte scissor lifts are used in a number of fields: construction, masonry and ……

#10 Sinoboom.us North America Lift Equipment

Domain Est. 2020

Website: sinoboom.us

Key Highlights: Sinoboom North America sells and supports Sinoboom manufactured mobile elevated work platforms (MEWP). Featuring a large range of quality scissor lifts and ……

Expert Sourcing Insights for Sciscor Lift

H2: Market Trends for Scissor Lifts in 2026

As the construction, warehousing, and industrial sectors continue to evolve, scissor lifts remain a critical component of elevated work platforms (EWPs). By 2026, several key market trends are expected to shape the demand, innovation, and competitive landscape for scissor lifts globally. These trends reflect broader economic, technological, and regulatory shifts influencing equipment adoption and fleet management strategies.

1. Growth in Construction and Infrastructure Spending

Global infrastructure initiatives—particularly in North America, Europe, and parts of Asia-Pacific—are expected to drive demand for scissor lifts in 2026. Government investments in urban renewal, transportation networks, and green building projects will increase the need for efficient, safe access equipment. The U.S. Infrastructure Investment and Jobs Act and similar policies in Europe and India are likely to sustain construction activity, directly benefiting scissor lift rentals and sales.

2. Expansion of the Rental Market

The equipment rental market is projected to dominate scissor lift distribution channels by 2026. Contractors are increasingly favoring rentals over ownership due to cost efficiency, flexibility, and access to newer, technologically advanced models. Rental companies are responding by expanding fleets and offering value-added services such as telematics integration and maintenance support. This trend is particularly strong in North America and Western Europe.

3. Electrification and Emissions Regulations

Environmental regulations are accelerating the shift toward electric-powered scissor lifts. With stricter emissions standards (e.g., EU Stage V, U.S. EPA Tier 4 Final), manufacturers are focusing on zero-emission, battery-electric models. By 2026, electric scissor lifts are expected to account for over 70% of new units sold, especially in indoor applications such as warehousing, retail, and commercial construction. Improvements in lithium-ion battery technology are enhancing runtime, charging speed, and overall performance.

4. Advancements in Smart Technology and Telematics

Digitalization is transforming scissor lift operations. By 2026, most new scissor lifts will come equipped with embedded telematics systems that enable remote monitoring of location, usage, maintenance needs, and operator behavior. These systems improve fleet utilization, reduce downtime, and enhance safety compliance. Integration with fleet management software is becoming a standard offering from major manufacturers like JLG, Genie, and Haulotte.

5. Focus on Safety and Operator Training

Workplace safety regulations are tightening globally, especially in the EU and North America. This is driving demand for scissor lifts with enhanced safety features such as automatic leveling, tilt sensors, emergency stop systems, and collision avoidance. In parallel, there is growing emphasis on operator certification and training, with OEMs and rental companies offering digital training modules and augmented reality (AR)-based simulations.

6. Emerging Markets Driving Growth

While mature markets remain dominant, emerging economies in Southeast Asia, the Middle East, and Latin America are expected to see rising demand for scissor lifts. Urbanization, industrialization, and increasing foreign direct investment (FDI) in manufacturing and logistics are fueling equipment adoption. Local distributors and partnerships with global OEMs will be key to market penetration in these regions.

7. Sustainability and Circular Economy Initiatives

Environmental, social, and governance (ESG) goals are influencing procurement decisions. Equipment manufacturers are adopting sustainable practices such as modular designs for easier repair, use of recycled materials, and end-of-life equipment recycling programs. By 2026, buyers—especially large enterprises and government contractors—will increasingly prioritize suppliers with strong sustainability credentials.

Conclusion

By 2026, the scissor lift market will be characterized by technological innovation, environmental compliance, and a shift toward service-oriented business models. Companies that invest in electric platforms, digital integration, and customer-centric solutions will be best positioned to capture market share. As labor shortages and safety concerns persist, scissor lifts will continue to offer a cost-effective, safe alternative to traditional scaffolding and ladders—solidifying their role in modern worksite productivity.

Common Pitfalls When Sourcing Scissor Lifts (Quality and Intellectual Property)

Sourcing scissor lifts—whether new, used, or from third-party suppliers—comes with significant risks related to product quality and intellectual property (IP) protection. Failing to address these pitfalls can lead to safety hazards, legal liabilities, and financial losses. Below are key challenges to watch for:

Quality-Related Pitfalls

1. Substandard Materials and Construction

Some suppliers may use inferior steel, weak welds, or low-grade hydraulic components to reduce costs. This compromises structural integrity and increases the risk of mechanical failure, especially under heavy loads or frequent use.

2. Lack of Compliance with Safety Standards

Not all scissor lifts meet OSHA, ANSI, or CE safety requirements. Sourcing from non-compliant manufacturers can result in workplace accidents, regulatory fines, and voided insurance coverage.

3. Inadequate Testing and Certification

Reputable manufacturers subject lifts to rigorous load, stability, and emergency system testing. Suppliers skipping these steps may deliver units with undetected flaws, increasing long-term maintenance costs and downtime.

4. Poor After-Sales Support and Spare Parts Availability

Low-cost suppliers often lack service networks or spare parts inventory. This leads to extended downtime when repairs are needed, undermining operational efficiency.

5. Misrepresentation of Specifications

Some sellers exaggerate lifting capacity, platform size, or battery life. Buyers may end up with equipment unsuited for their needs, leading to safety risks and reduced productivity.

Intellectual Property-Related Pitfalls

1. Counterfeit or Knockoff Equipment

Unscrupulous suppliers may replicate branded scissor lifts (e.g., Genie, JLG) without authorization. These counterfeit units often mimic logos and model numbers, infringing on trademarks and patents.

2. Unauthorized Use of Proprietary Technology

Some suppliers reverse-engineer patented safety mechanisms, control systems, or hydraulic designs. Purchasing such equipment could expose buyers to IP infringement claims, especially if used commercially.

3. Gray Market Imports

Equipment imported without the manufacturer’s authorization may violate distribution agreements and lack proper warranties. These units could also be rebranded or modified, raising both quality and IP concerns.

4. Voided Warranties and Legal Exposure

Using non-OEM or IP-infringing lifts can void warranties and expose the end-user to legal action if the original manufacturer pursues infringement claims.

5. Lack of Documentation and Traceability

Illegitimate suppliers often provide incomplete or falsified documentation (e.g., manuals, compliance certificates). This makes it difficult to verify IP legitimacy or ensure regulatory compliance.

Mitigation Strategies

- Verify Supplier Credentials: Work only with authorized dealers or reputable manufacturers.

- Request Compliance Certificates: Ensure lifts meet ANSI/SAIA A92, OSHA, or equivalent standards.

- Conduct Factory Audits: Visit manufacturing sites to assess quality controls and IP practices.

- Review IP Documentation: Confirm trademarks, patents, and licensing agreements are valid.

- Use Legal Contracts: Include warranties, IP indemnification clauses, and quality assurance terms.

By recognizing these pitfalls and implementing due diligence, businesses can avoid costly mistakes and ensure they source safe, compliant, and legally sound scissor lift equipment.

Logistics & Compliance Guide for Sciscor Lift

This guide outlines essential logistics procedures and compliance requirements for the safe and efficient handling, transportation, installation, and maintenance of the Sciscor Lift. Adherence ensures operational safety, regulatory conformity, and product longevity.

Conclusion for Sourcing ScisCor Lift

After thorough evaluation of suppliers, product specifications, pricing, reliability, and after-sales support, sourcing the ScisCor patient lift presents a strategic and cost-effective solution for enhancing patient handling safety and efficiency. The ScisCor lift demonstrates strong performance in terms of durability, ease of use, and compliance with healthcare safety standards. Its ergonomic design reduces caregiver strain and minimizes the risk of injury, supporting safer patient transfers across various care environments.

Furthermore, the availability of service and spare parts, along with positive user feedback from healthcare facilities, reinforces its reputation as a reliable mobility aid. While initial procurement costs may be higher compared to some alternatives, the long-term benefits—including reduced workplace injuries, increased staff satisfaction, and improved patient comfort—justify the investment.

In conclusion, sourcing the ScisCor lift aligns with organizational goals of patient and caregiver safety, operational efficiency, and regulatory compliance. It is recommended for adoption across relevant departments to standardize safe patient handling practices and improve overall care quality.