The global circular saw blade market, driven by rising demand in metalworking, construction, and aerospace sectors, is projected to grow at a CAGR of 4.8% from 2023 to 2028, according to Mordor Intelligence. A key segment within this growth is saw blades designed specifically for non-ferrous metals, particularly aluminum, where efficient, burr-free cutting is critical to downstream fabrication processes. With aluminum consumption increasing across automotive lightweighting, renewable energy infrastructure, and industrial manufacturing, the demand for high-performance cutting tools has intensified. This surge has prompted innovation among blade manufacturers, focusing on advanced tooth geometries, specialized coatings, and carbide compositions tailored to aluminum’s unique properties. In this data-driven landscape, selecting the right saw blade manufacturer is no longer just a procurement decision—it’s a strategic factor in improving yield, reducing downtime, and optimizing machining efficiency. Here, we analyze the top 7 manufacturers pioneering technological advancements in saw blades for aluminum, combining technical excellence, global reach, and market adaptability.

Top 7 Saw Blade For Aluminum Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

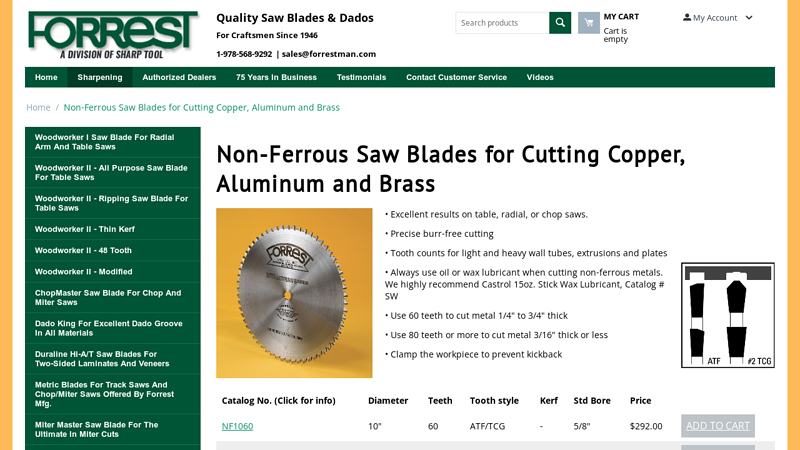

#1 Non

Domain Est. 1997

Website: forrestblades.com

Key Highlights: Non-Ferrous saw blades provide precise burr-free cutting of copper, aluminum and brass tubes, extrusions and plates. For use on table, radial and chop saws….

#2 Aluminum Carbide Blade

Domain Est. 1998

Website: unitedabrasives.com

Key Highlights: Aluminum Carbide Blade Application: Cutting Aluminum, Aluminum, other non-ferrous metals and pipe, Metal-Cutting Circular Saw, Circular Saw, Worm Drive Saw….

#3 Aluminum Cutting Saw Blades Archives

Domain Est. 1998

Website: originalsaw.com

Key Highlights: 1-day delivery 30-day returnsOriginal Saw offers a wide range of aluminum crosscut blades for all of our radial arm saws….

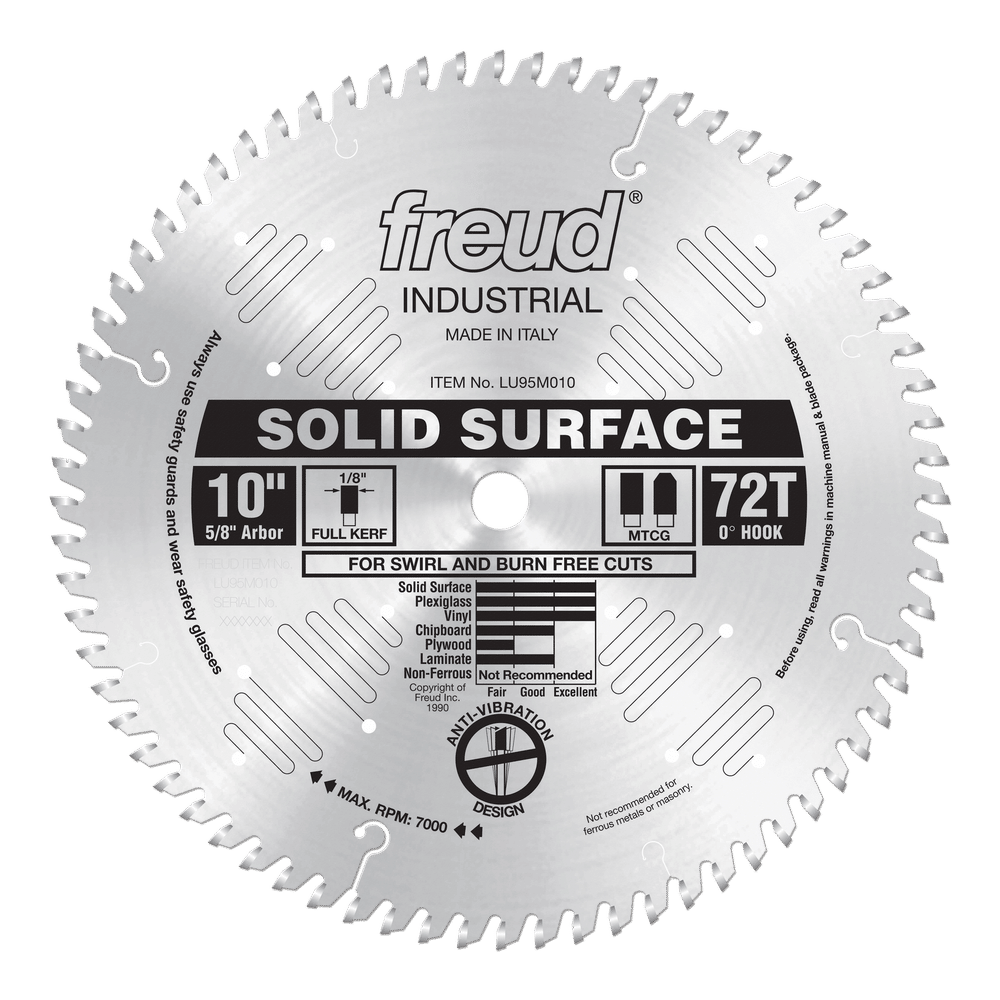

#4 LU95M010

Domain Est. 1999

Website: freudtools.com

Key Highlights: This blade features teeth with a specially designed triple chip grind for leaving swirl-free cuts in solid surface materials….

#5 Evolution Tungsten

Domain Est. 2000

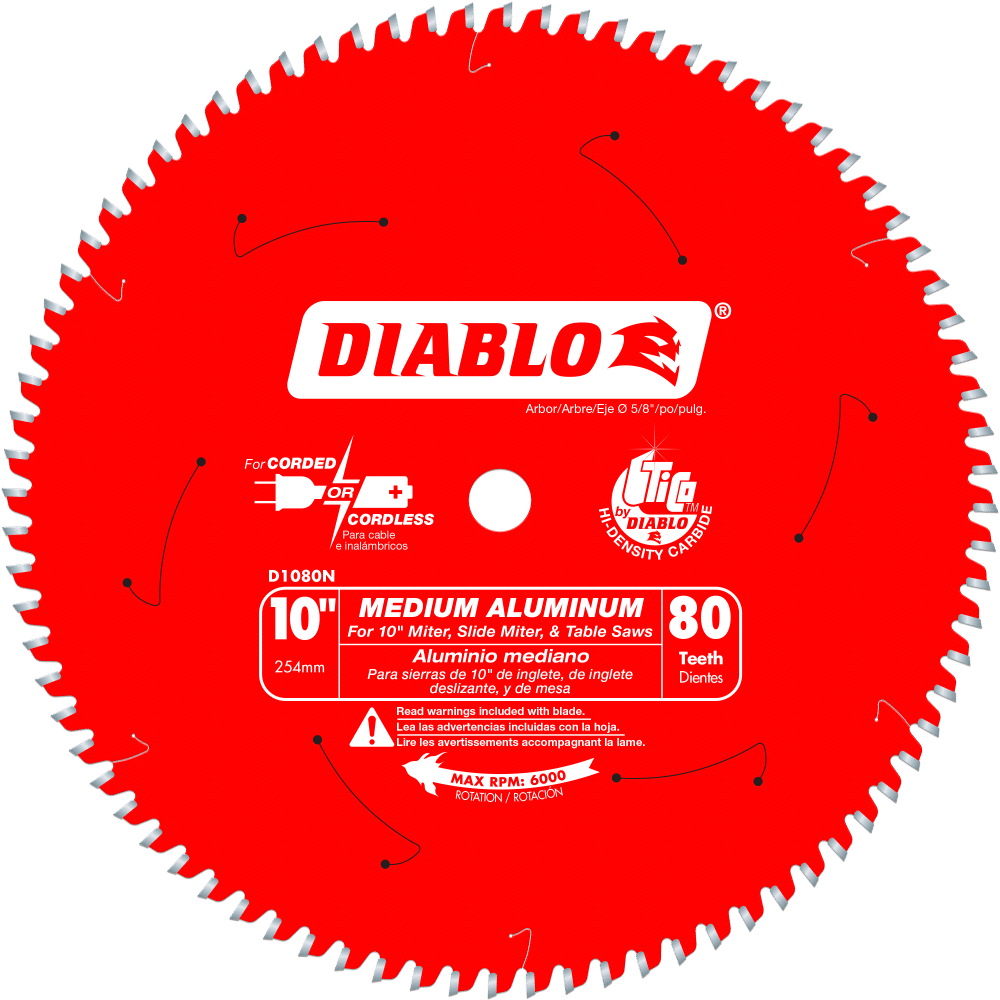

#6 D1080N

Domain Est. 2004

Website: diablotools.com

Key Highlights: Diablo’s next generation Saw Blades for Aluminum are optimized for cutting thin (up to 1/8”), medium (3/32”-1/4”) and thick (3/16”-7/16”) aluminum metals….

#7 Saw Blade for Wood, Saw Blade for Aluminum,Saw Blade for Steel …

Domain Est. 2019

Website: kwssawblade.com

Key Highlights: Our company export Saw Blade for Cutting Wood, Saw Blade for Cutting Aluminum, Saw Blade for Cutting Steel,we have a whole set of quality management system….

Expert Sourcing Insights for Saw Blade For Aluminum

H2: 2026 Market Trends for Saw Blades for Aluminum

The global market for saw blades designed specifically for aluminum is poised for significant evolution by 2026, driven by advancements in materials, manufacturing technologies, and shifting industrial demand. Key trends shaping this market include increased demand from high-growth sectors, technological innovation in blade design, sustainability initiatives, regional market shifts, and the impact of automation.

-

Rising Demand from Key Industries

By 2026, industries such as construction, automotive, aerospace, and renewable energy are expected to drive heightened demand for aluminum cutting tools. The push for lightweight materials in electric vehicles (EVs) and energy-efficient buildings will elevate aluminum usage, necessitating precision saw blades capable of clean, burr-free cuts. Manufacturers of saw blades are adapting their product lines to meet the performance requirements of cutting aluminum alloys with high thermal conductivity and gummy characteristics. -

Advancements in Blade Technology

Innovation in saw blade materials and coatings is a major trend. Carbide-tipped blades with specialized geometries (e.g., high rake angles, variable tooth pitch) and advanced coatings like TiAlN (titanium aluminum nitride) or diamond-like carbon (DLC) are becoming standard by 2026. These enhancements reduce friction, prevent aluminum buildup (gumming), and extend blade life. Additionally, the integration of digital design tools and simulation software enables optimized tooth configurations for specific aluminum grades. -

Growth in Automation and CNC Integration

As manufacturing processes become more automated, saw blades for aluminum are being designed to integrate seamlessly with CNC sawing machines and robotic systems. This trend favors blades with consistent performance, longer tool life, and minimal maintenance needs. Compatibility with Industry 4.0 systems—such as predictive maintenance and real-time performance monitoring—is expected to be a competitive advantage for blade manufacturers. -

Sustainability and Recycling Focus

Environmental regulations and corporate sustainability goals are influencing saw blade production. By 2026, there is a growing emphasis on recyclable blade materials and energy-efficient manufacturing processes. Additionally, the recyclability of aluminum itself supports a circular economy, indirectly increasing the need for durable, reusable cutting tools that minimize waste. -

Regional Market Dynamics

Asia-Pacific, particularly China, India, and Southeast Asia, is projected to be the fastest-growing market for aluminum saw blades due to rapid industrialization and infrastructure development. North America and Europe are seeing steady growth driven by aerospace and high-end automotive production. Localized production and supply chain resilience will become more important, prompting saw blade manufacturers to establish regional manufacturing hubs. -

Competitive Landscape and Market Consolidation

The market is witnessing consolidation, with leading tool manufacturers acquiring niche players specializing in non-ferrous cutting solutions. This trend is expected to continue through 2026, resulting in broader product portfolios and enhanced R&D capabilities. At the same time, smaller innovators are gaining traction by offering customized blades for specialized aluminum applications.

Conclusion

By 2026, the saw blade market for aluminum will be characterized by technological sophistication, sector-specific customization, and alignment with global industrial and environmental trends. Companies that invest in material science, automation compatibility, and sustainable practices are likely to capture a larger share of this evolving market.

Common Pitfalls When Sourcing Saw Blades for Aluminum (Quality & IP)

Logistics & Compliance Guide for Saw Blade For Aluminum

Product Classification and HS Code

The accurate classification of saw blades for aluminum under the Harmonized System (HS) is critical for international shipping and customs compliance. These products typically fall under HS Code 8202.20, which covers circular saw blades, whether or not mounted, including those designed specifically for cutting non-ferrous metals like aluminum. However, classification may vary by country, so verification with the destination country’s customs authority or a licensed customs broker is recommended. Misclassification can result in delays, fines, or shipment rejection.

Import/Export Regulations

Exporting saw blades may be subject to trade controls depending on the destination country and the materials used in blade construction (e.g., tungsten carbide tips). Some countries regulate tools capable of cutting metal due to dual-use concerns. Ensure compliance with export control laws such as the U.S. Export Administration Regulations (EAR) or EU Dual-Use Regulation. A valid export license may be required for certain destinations. Additionally, importers must adhere to local industrial tool regulations and ensure product conformity with national standards.

Packaging and Shipping Requirements

Proper packaging is essential to prevent damage during transit. Saw blades should be individually wrapped in protective materials (e.g., plastic sleeves or foam) and secured in sturdy corrugated boxes with internal dividers. For bulk shipments, palletizing with edge protectors and stretch-wrapping is recommended. Clearly label packages with handling instructions such as “Fragile,” “This Side Up,” and content descriptions. Use UN-certified packaging if shipping via air freight or when hazardous materials (e.g., blades with oil coatings) are present.

Labeling and Documentation

All shipments must include accurate commercial documentation, including a commercial invoice, packing list, and bill of lading or air waybill. The invoice should detail the product description (“Saw Blade for Aluminum”), quantity, unit value, total value, HS code, country of origin, and Incoterms (e.g., FOB, CIF). Safety Data Sheets (SDS) may be required if the blades contain lubricants or coatings. CE marking or equivalent certification should be displayed if applicable, especially when exporting to the EU or markets requiring conformity with safety standards.

Compliance with Safety and Environmental Standards

Saw blades intended for industrial use may need to comply with safety certifications such as CE (Europe), UKCA (United Kingdom), or ANSI B7.1 (United States) for safety of use. Blades containing regulated substances (e.g., cobalt in carbide tips) must comply with environmental directives like REACH (EU) or TSCA (USA). Ensure suppliers provide compliance declarations and that packaging materials are recyclable or meet local environmental regulations.

Customs Clearance and Duties

Prepare for customs clearance by providing complete and accurate documentation. Duties and taxes vary by country and are based on the declared value and HS classification. Use a licensed customs broker in the destination country to facilitate clearance and avoid delays. Be aware of free trade agreements that may reduce or eliminate tariffs—for example, USMCA for shipments between the U.S., Canada, and Mexico.

Transportation Mode Considerations

Choose the appropriate transportation mode based on urgency, volume, and cost. Air freight offers speed but higher costs and stricter regulations for sharp objects. Ocean freight is cost-effective for large volumes but requires longer lead times. Ground transport within regions (e.g., trucking in North America or EU) is ideal for domestic or regional distribution. Ensure carriers are informed about the nature of the cargo to comply with handling policies for metal tools.

Storage and Handling Guidelines

Upon arrival, store saw blades in a dry, temperature-controlled environment to prevent rust or coating degradation. Keep them vertically or on racks to avoid edge damage. Implement inventory practices that follow the first-in, first-out (FIFO) principle, especially for coated or treated blades. Train warehouse staff on proper handling to avoid injuries and maintain product integrity.

End-of-Life and Recycling Compliance

Plan for end-of-life management in accordance with environmental regulations. Used saw blades, especially those with carbide tips, may be classified as industrial waste and must be recycled through approved metal reclamation facilities. Comply with local waste disposal laws and provide customers with take-back or recycling program information where applicable.

Conclusion: Sourcing Saw Blades for Aluminum Cutting

Selecting the right saw blade for aluminum is crucial to ensure clean, efficient, and safe cutting while minimizing material waste and blade wear. Based on evaluation of material compatibility, tooth geometry, coating, and manufacturing standards, carbide-tipped blades with a high tooth count (typically 60–100 teeth), alternating top bevel (ATB) design, and a positive rake angle are most effective for aluminum applications. Anti-stick or non-stick coatings, such as titanium or specialized polymers, help prevent aluminum buildup (galling), which can lead to poor cuts and overheating.

When sourcing saw blades, prioritize reputable manufacturers known for precision and durability in non-ferrous cutting. Consider supplier reliability, lead times, technical support, and availability of custom specifications if needed. Additionally, ensure blades comply with safety and quality standards, such as ANSI or ISO ratings.

Ultimately, investing in high-quality, aluminum-specific saw blades improves cutting performance, extends tool life, and reduces long-term operational costs. A strategic sourcing approach that balances performance, cost, and supplier trust will support consistent production quality and efficiency in aluminum fabrication operations.