The global satin polyester market is experiencing steady expansion, driven by rising demand across apparel, home textiles, and industrial applications. According to a 2023 report by Mordor Intelligence, the global polyester fiber market is projected to grow at a CAGR of approximately 5.2% from 2023 to 2028, fueled by increasing consumer preference for durable, wrinkle-resistant, and cost-effective fabrics. Satin polyester, known for its lustrous finish and versatility, is a key segment within this growth trajectory. Advancements in manufacturing technologies and a shift toward synthetic alternatives in response to cotton price volatility are further accelerating market adoption. As demand surges across fashion, interior design, and technical textiles, a select group of manufacturers are leading innovation, scalability, and sustainability in satin polyester production. Based on production capacity, global reach, product quality, and industry reputation, here are the top 9 satin polyester manufacturers shaping the future of the textile industry.

Top 9 Satin Polyester Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 100% Polyester Satin Fabric Wholesale

Domain Est. 2001

Website: mh-chine.com

Key Highlights: Discover premium polyester satin fabric for dresses, linings, and upholstery. MH offers wholesale supply, OEM service, and global export….

#2 100% Recycled Polyester Satin Fabric

Domain Est. 2017

Website: kmtextilesupplier.com

Key Highlights: Source great deals on kmtextilesupplier.com for 100% recycled polyester satin fabric with K&M Textile which is one of leading manufacturers and suppliers of ……

#3 Polyester Satin Fabric

Domain Est. 2022

Website: visheshfabrics.com

Key Highlights: Vishesh Fabric, located in Surat, India, is a leading manufacturer and supplier of Plain Satin Fabric, offering a vast collection in over 100 beautiful and ……

#4 STARTER

Domain Est. 2001 | Founded: 1971

Website: starter.com

Key Highlights: A premium athletic brand established in 1971, Starter pioneered the fusion of sports clothing with popular culture by forging partnerships….

#5 Polyester Satin Fabrics

Domain Est. 2008

Website: sujatasynthetics.com

Key Highlights: We offer you exclusive collection of Polyester Satin Fabric available in very attractive design comprising with various colors and latest patterns….

#6 Polyester Satin

Domain Est. 2011

Website: kingtextiles.ca

Key Highlights: Polyester Crepe Back Satin – 44” – Lilac. $1.63 – $6.50. Add to Cart. Polyester Crepe Back Satin – 44” – Mauve. Add to Cart ……

#7 Polyester Satin Fabric

Domain Est. 2012

#8 Satin Fabric By The Yard

Domain Est. 2014

Website: fabricwholesaledirect.com

Key Highlights: Free delivery over $99 · 30-day returnsWoven in a satin style weave, satin fabric can be manufactured from any fiber, including silk, cotton, and polyester. The unique weaving str…

#9 Polyester Satin Fabric

Domain Est. 2017

Website: leantex.com

Key Highlights: Lean Textile Co., Limited supplies all kinds of polyester satin fabric, such as polyester dull satin fabric, polyester twisted satin fabric, polyester stretch ……

Expert Sourcing Insights for Satin Polyester

H2: Market Trends for Satin Polyester in 2026

The global satin polyester market is poised for notable transformation by 2026, driven by evolving consumer preferences, technological advancements, and shifting supply chain dynamics. As a lightweight, lustrous, and durable synthetic fabric, satin polyester continues to maintain strong demand across fashion, home textiles, and industrial applications. The following analysis outlines key market trends expected to shape the industry in 2026 under an H2 (second half) outlook:

-

Increased Demand in Sustainable Fashion

By H2 2026, sustainability will be a dominant force in the textile industry. Brands are increasingly adopting recycled satin polyester, made from post-consumer plastic bottles and production waste. Leading fashion houses and fast-fashion retailers are expected to launch new collections featuring eco-certified satin polyester, responding to consumer demand for environmentally responsible materials. Innovations in closed-loop recycling and biodegradable polyester variants are anticipated to gain traction during this period. -

Growth in E-Commerce and Customization

The expansion of online retail platforms will continue to fuel demand for satin polyester, especially in ready-to-wear apparel and wedding fashion. In H2 2026, personalization trends—such as custom-printed satin garments and made-to-order home décor items—are expected to rise, supported by digital textile printing technologies that enhance design flexibility and reduce inventory waste. -

Regional Shifts in Production and Consumption

Asia-Pacific, particularly China and India, will remain central to both production and consumption of satin polyester. However, by H2 2026, there will be a noticeable shift toward nearshoring and regional supply chains in North America and Europe due to geopolitical uncertainties and rising logistics costs. Localized manufacturing using automated looms and energy-efficient processes will support faster turnaround and reduce carbon footprints. -

Innovation in Fabric Performance

Satin polyester is expected to see enhanced functional properties by 2026, including moisture-wicking, UV resistance, and anti-microbial finishes. These performance upgrades will broaden its application beyond fashion into activewear, medical textiles, and technical interiors. Smart textiles integrating satin polyester with conductive fibers may also emerge in niche markets during H2. -

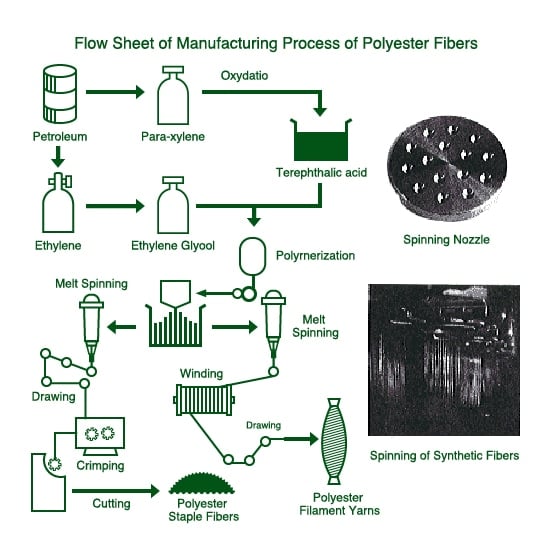

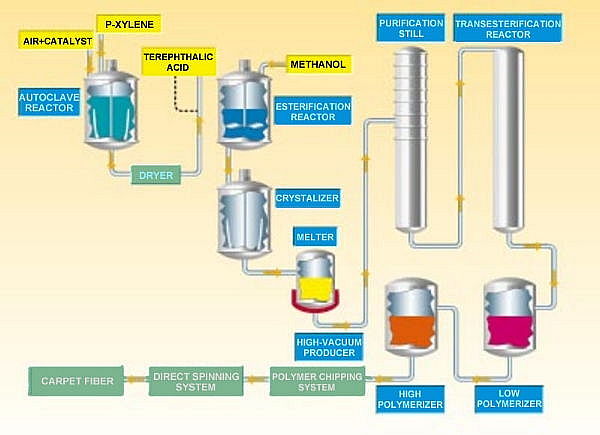

Price Volatility and Raw Material Constraints

Fluctuations in crude oil prices—key to polyester production—may lead to moderate price volatility in H2 2026. However, increased investment in bio-based polyester alternatives (e.g., PTT and partially bio-sourced PET) is expected to stabilize long-term supply chains and reduce dependency on fossil fuels. -

Regulatory Pressures and Compliance

Stricter environmental regulations, especially in the EU (e.g., Ecodesign Directive and Green Claims Regulation), will compel manufacturers to improve transparency in labeling and lifecycle reporting. By H2 2026, compliance with these standards will be critical for market access, pushing companies to adopt digital product passports and third-party certifications.

Conclusion:

By the second half of 2026, the satin polyester market will be characterized by a strong emphasis on sustainability, digital innovation, and regional resilience. While challenges around raw material sourcing and regulatory compliance persist, ongoing advancements in recycling technologies and functional finishes position satin polyester for continued relevance in a rapidly evolving textile landscape. Companies that prioritize circularity, transparency, and agility are likely to lead the market in H2 2026 and beyond.

Common Pitfalls Sourcing Satin Polyester (Quality, IP)

Sourcing satin polyester can be cost-effective, but overlooking key quality and intellectual property (IP) issues can lead to significant problems. Here are common pitfalls to avoid:

Inconsistent Fabric Quality

One of the biggest risks is receiving batches with inconsistent quality. Issues like uneven dyeing, variable sheen, or differences in drape and hand feel can arise due to poor manufacturing controls. Buyers may receive samples in perfect condition, only to discover production runs vary significantly. Always request production batch samples and conduct third-party quality inspections before full shipment.

Substandard Material Composition

Some suppliers may misrepresent the fabric composition, blending in lower-grade polyester or even other fibers to cut costs. This affects durability, wash resistance, and the signature satin luster. Verify material certifications and conduct lab testing (e.g., FTIR analysis) to confirm 100% polyester content if required.

Poor Color Fastness and Durability

Low-quality satin polyester may fade quickly after washing or exposure to sunlight. Suppliers in regions with lax quality standards might use inferior dyes or weak finishing treatments. Request AATCC or ISO test reports for color fastness to washing, light, and rubbing to ensure long-term performance.

Misuse of Brand Names or Trademarked Finishes

Sourcing satin polyester with branded finishes (e.g., “anti-UV,” “moisture-wicking”) can pose IP risks. Some suppliers falsely claim their fabric uses proprietary technologies protected by trademarks or patents. Using such materials without proper licensing exposes buyers to legal action. Always verify IP ownership and obtain documentation of authorized use.

Counterfeit or Grey Market Materials

Suppliers may offer “branded” satin polyester at suspiciously low prices, indicating counterfeit or diverted goods. These materials may lack quality control and violate IP rights. Stick to authorized distributors and request chain-of-custody documentation to avoid legal and reputational damage.

Lack of Compliance Documentation

Many markets require compliance with safety and environmental standards (e.g., REACH, OEKO-TEX®). Suppliers may not provide proper certification, putting importers at risk of customs rejection or consumer lawsuits. Ensure all required compliance documents are provided and up to date.

Avoiding these pitfalls requires due diligence, clear specifications, and verification at every stage of sourcing.

Logistics & Compliance Guide for Satin Polyester

Product Overview

Satin Polyester is a synthetic fabric known for its smooth, glossy surface and lustrous finish. It is widely used in apparel, home textiles, and industrial applications. As a petroleum-based textile, it requires careful handling, documentation, and compliance with international trade and environmental regulations.

Classification & Harmonized System (HS) Code

- HS Code: 5407.42.00 (Woven fabrics of polyester staple fibers, satin weave, unbleached or bleached)

Note: Final HS code may vary by country and specific product composition (e.g., blends with cotton or spandex). Always confirm with local customs authorities. - Textile Category: 600 (as per U.S. import regulations)

Packaging & Handling Requirements

- Packaging: Rolls or bales wrapped in polyethylene film to prevent moisture absorption and physical damage.

- Labeling: Each package must include:

- Product name (Satin Polyester)

- Fiber content (% polyester)

- Weight and dimensions

- Lot number and batch code

- Country of origin

- Care instructions (if applicable)

- Storage: Store in dry, well-ventilated areas away from direct sunlight and heat sources. Avoid contact with sharp objects to prevent snagging.

Transportation Guidelines

- Mode of Transport: Suitable for road, rail, sea, and air freight.

- Container Requirements (Sea Freight):

- Use dry van containers to protect from moisture.

- Ensure proper stowage to prevent shifting during transit.

- Air Freight: Complies with IATA standards; no special restrictions for polyester fabric.

- Temperature & Humidity: Maintain ambient conditions; avoid high humidity to prevent static buildup or mildew.

Import/Export Documentation

Essential documents for international shipping include:

– Commercial Invoice

– Packing List

– Bill of Lading (B/L) or Air Waybill (AWB)

– Certificate of Origin

– Textile Declaration (as required by destination country)

– Import License (if applicable)

Regulatory Compliance

United States (U.S. Customs and Border Protection – CBP)

- FTC Labeling Requirements: Must include fiber content, country of origin, and registered manufacturer/importer identification (RN or CA number).

- Customs Bond: Required for formal entries.

- Duty Rate: Typically ranges from 12% to 16%, depending on end-use and blend. Check the latest HTSUS for updates.

European Union (EU)

- REACH Regulation (EC 1907/2006): Ensure no restricted substances (e.g., phthalates, azo dyes) are present.

- Textile Labeling Regulation (EU) No 1007/2011: Mandatory fiber content labeling in member states.

- Customs Duty: Generally 8–12% depending on composition and processing.

Other Regions

- Canada: Complies with Textile Labelling Act; HS code 5407.42.00; duty-free under USMCA if originating.

- China: Requires CCC certification only for certain end-products; fabric itself typically exempt.

- India: Subject to BIS standards for certain textile products; check import policy under ITC (HS).

Environmental & Safety Considerations

- Non-hazardous Material: Satin Polyester is not classified as dangerous goods under IMDG, IATA, or ADR.

- Waste Disposal: Recyclable; dispose of according to local plastic waste regulations.

- Sustainability: Consider certifications like OEKO-TEX® Standard 100 or Global Recycled Standard (GRS) for eco-friendly branding.

Quality Assurance & Testing

Recommended tests prior to shipment:

– Colorfastness (to rubbing, washing, light)

– Tensile strength

– Dimensional stability

– pH level (to ensure skin safety)

– Composition verification (via FTIR or other methods)

Risk Mitigation

- Counterfeit Prevention: Use batch tracking and tamper-evident packaging.

- Supply Chain Transparency: Maintain records of raw material sources and manufacturing processes.

- Insurance: Cover for loss, damage, or delay during transit.

Conclusion

Satin Polyester is a globally traded textile that requires adherence to logistics best practices and compliance with regional regulations. Proper classification, documentation, and quality control are essential for smooth cross-border movement and market access. Always verify requirements with local authorities and stay updated on trade policy changes.

In conclusion, sourcing satin polyester requires a strategic approach that balances quality, cost, sustainability, and reliability. By identifying reputable suppliers, evaluating material specifications such as thread count, weight, and dyeing methods, and considering factors like minimum order quantities and lead times, businesses can secure a consistent and high-quality supply. Additionally, prioritizing ethical manufacturing practices and environmental certifications can enhance brand reputation and meet growing consumer demand for responsible sourcing. With careful due diligence and strong supplier relationships, satin polyester can be sourced effectively to support product excellence and long-term business success.