The global SAS disk enclosure market is experiencing steady expansion, driven by increasing demand for high-performance data storage solutions across enterprise and cloud environments. According to Mordor Intelligence, the storage area network (SAN) market—which includes SAS disk enclosures—is projected to grow at a CAGR of approximately 5.8% from 2023 to 2028. This growth is fueled by rising data center investments, the proliferation of data-intensive applications, and the ongoing shift toward scalable, modular storage infrastructures. SAS technology remains a critical component in this ecosystem, offering reliable, high-speed connectivity for mission-critical systems. As organizations continue to prioritize performance, redundancy, and efficient data management, SAS disk enclosures from leading manufacturers play an increasingly vital role in modern storage architectures. Based on market presence, innovation, and product scalability, the following eight companies represent the top manufacturers shaping the future of SAS storage solutions.

Top 8 Sas Disk Enclosure Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 ATTO Technology, Inc.

Domain Est. 1994

Website: atto.com

Key Highlights: ATTO Technology: Global leader in high-performance storage and network connectivity solutions. Optimize data transfer, storage, and productivity….

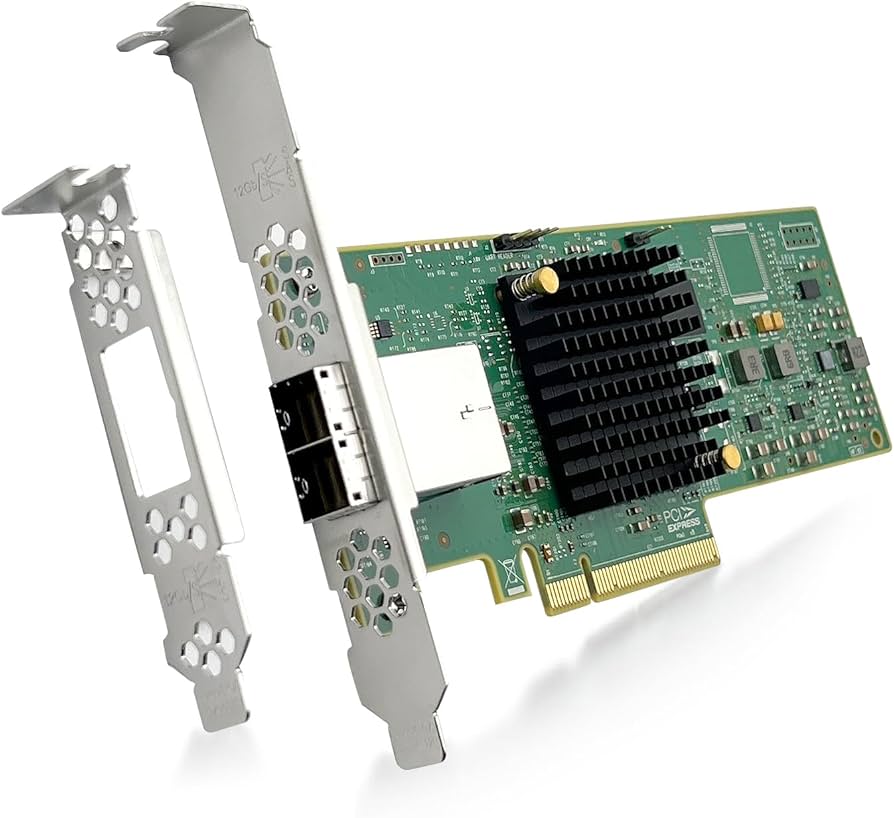

#2 RAID Controller Cards

Domain Est. 1994

Website: broadcom.com

Key Highlights: Our RAID controllers address virtually all direct-attached storage (DAS) environments – SATA or SAS, hard drives or solid state drives (SSDs)…

#3 RR2700 x8 Series

Domain Est. 1997

Website: highpoint-tech.com

Key Highlights: HighPoint RocketRAID 2700 HBA’s are cost-effective, high-performance PCI-Express 2.0 6Gb/s SAS RAID controllers, and are ideal for SMB server and workstation ……

#4 ICY DOCK

Domain Est. 2002

Website: global.icydock.com

Key Highlights: Supports 4 x U.2/U.3 PCIe 4.0 NVMe SSDs (up to 15mm height) in a single 5.25” drive bay • Ideal for building high-speed NVMe RAID arrays or expanding flash ……

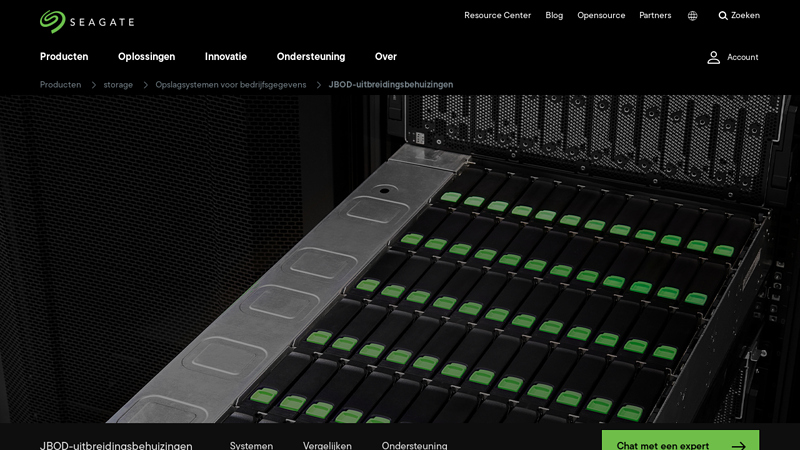

#5 JBOD Expansion Enclosures

Domain Est. 1992

Website: seagate.com

Key Highlights: The Seagate Exos E JBOD expansion enclosures enable you to build on initial storage investments and efficiently scale into exabyte-class storage infrastructure….

#6 DE75 SAS/SATA

Domain Est. 1998

Website: cdsg.com

Key Highlights: In stockThis removable enclosure receives any capacity 3.5-inch SAS or SATA 3 Gbps hard drives. … If you need to contact us for any reason, visit our website….

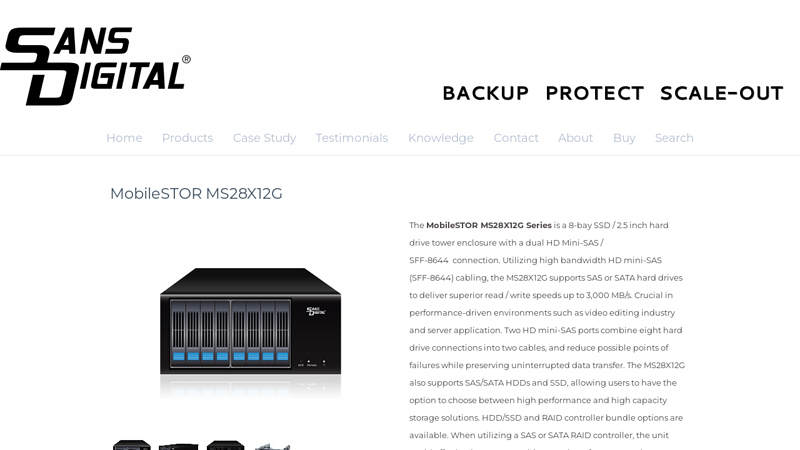

#7 MobileSTOR MS28X12G

Domain Est. 2005

Website: sansdigital.com

Key Highlights: The MobileSTOR MS28X12G Series is a 8-bay SSD / 2.5 inch hard drive tower enclosure with a dual HD Mini-SAS / SFF-8644 connection….

#8 HPE Best Storage Enclosures

Domain Est. 1995

Expert Sourcing Insights for Sas Disk Enclosure

H2: 2026 Market Trends for SAS Disk Enclosures

The market for SAS (Serial Attached SCSI) disk enclosures is poised for measured evolution by 2026, shaped by shifts in data storage demands, advancements in competing technologies, and the enduring need for high-performance, reliable storage in enterprise environments. While facing increasing competition from NVMe and cloud-based solutions, SAS disk enclosures are expected to maintain a strategic presence, particularly in specific verticals and hybrid IT infrastructures.

1. Sustained Demand in Enterprise and Mid-Range Storage

SAS disk enclosures will continue to serve as a backbone in enterprise data centers, especially in environments where a balance of performance, reliability, and cost-effectiveness is crucial. By 2026, industries such as finance, healthcare, and government—where data integrity and uptime are paramount—will sustain demand for SAS-based storage solutions. These enclosures are often integrated into SAN (Storage Area Network) and DAS (Direct-Attached Storage) configurations, providing scalable and high-throughput storage for mission-critical applications.

2. Coexistence with NVMe and Hybrid Configurations

Although NVMe-over-Fabrics (NVMe-oF) and all-flash arrays are gaining traction due to their superior speed and low latency, SAS disk enclosures are not being rendered obsolete. Instead, a hybrid model is emerging. By 2026, many organizations will deploy tiered storage architectures where NVMe drives handle high-speed workloads, while SAS enclosures store less frequently accessed or cold data. This coexistence allows enterprises to optimize performance and cost without overhauling existing infrastructure.

3. Focus on High-Capacity SAS Drives and Density Optimization

Advancements in drive technology will influence SAS enclosure design. The availability of high-capacity 20TB and 24TB SAS hard drives by 2026 will drive demand for enclosures that support greater storage density. Vendors will emphasize compact, high-bay configurations with improved power efficiency and thermal management to accommodate larger drive counts within constrained data center footprints.

4. Integration with Software-Defined Storage (SDS)

SAS disk enclosures are increasingly being leveraged as hardware platforms for software-defined storage solutions. By 2026, compatibility with SDS platforms such as Ceph, VMware vSAN (in hybrid mode), and Microsoft Storage Spaces Direct will be a key differentiator. This trend enables organizations to decouple storage hardware from software, enhancing flexibility, scalability, and reducing vendor lock-in.

5. Decline in New Deployments, Growth in Replacement and Expansion

While new greenfield deployments of SAS enclosures may plateau or decline due to flash adoption, the replacement and expansion market will remain robust. Enterprises with existing SAS infrastructure will continue to upgrade enclosures and drives to maintain performance and reliability. This replacement cycle will support steady market demand, particularly in regions with slower cloud adoption or strict data sovereignty regulations.

6. Regional Variations and Vertical-Specific Adoption

Geographically, North America and Western Europe will see moderate SAS enclosure growth, driven by legacy system maintenance and hybrid cloud integration. In contrast, emerging markets in Asia-Pacific and Latin America may experience stronger growth as enterprises build out on-premises data centers with proven, cost-effective technologies like SAS. Verticals such as manufacturing, education, and mid-sized businesses will favor SAS enclosures for their predictable performance and lower total cost of ownership compared to all-flash alternatives.

7. Vendor Consolidation and Ecosystem Integration

The SAS enclosure market will likely see continued consolidation among hardware vendors, with major players like Dell, HPE, and Lenovo focusing on integrated solutions that bundle enclosures with servers, storage management software, and support services. Interoperability with broader IT ecosystems—including backup software, monitoring tools, and cloud gateways—will be critical for maintaining competitiveness.

Conclusion

By 2026, the SAS disk enclosure market will transition from a growth phase to a maturity phase, characterized by steady demand in niche and enterprise applications rather than broad expansion. While flash and cloud alternatives dominate headlines, SAS enclosures will remain relevant through their reliability, cost-efficiency, and role in hybrid and tiered storage strategies. Vendors that innovate in density, compatibility, and integration with modern data architectures will best position themselves to capture value in this evolved landscape.

Common Pitfalls When Sourcing SAS Disk Enclosures (Quality, IP)

Sourcing SAS disk enclosures involves navigating technical, quality, and intellectual property (IP) challenges. Being aware of these pitfalls helps ensure reliable, compliant, and cost-effective procurement.

Poor Build Quality and Component Selection

Low-cost enclosures may use substandard materials, connectors, or power supplies, leading to signal integrity issues, overheating, or premature failure. Always verify build quality through certifications (e.g., UL, CE), manufacturer reputation, and user reviews. Avoid vendors who lack transparency about component sourcing or testing procedures.

Inadequate Thermal and Vibration Management

SAS enclosures generate heat and are sensitive to mechanical stress. Poorly designed airflow or insufficient shock absorption can degrade drive lifespan and performance. Ensure the enclosure includes proper fan control, thermal sensors, and robust mounting to mitigate these risks.

Non-Compliance with SAS Standards

Some enclosures fail to fully adhere to SAS-2, SAS-3, or SAS-4 specifications, resulting in compatibility issues with host bus adapters (HBAs) or expanders. Confirm compliance with relevant SCSI and SAS standards and request test reports or interoperability certifications.

Lack of Firmware Updates and Support

Enclosures with outdated or unsupported firmware can introduce security vulnerabilities or operational bugs. Choose vendors that provide regular firmware updates, detailed release notes, and responsive technical support to maintain system integrity.

Intellectual Property (IP) Infringement Risks

Cloned or reverse-engineered enclosures may violate patents or trademarks, especially in controller logic or management firmware. Sourcing from reputable manufacturers reduces legal exposure and ensures authenticity. Always verify licensing and avoid vendors offering “compatible” models at suspiciously low prices.

Insufficient Documentation and SDK Access

Poor documentation or restricted access to management APIs (e.g., for SNMP, SES-2) complicates integration and monitoring. Ensure full access to technical manuals, command-line tools, and software development kits (SDKs) to support deployment and troubleshooting.

Hidden Total Cost of Ownership (TCO)

The lowest upfront price may lead to higher long-term costs due to failures, downtime, or lack of scalability. Evaluate TCO by considering warranty length, service availability, and compatibility with future drive technologies.

Logistics & Compliance Guide for SAS Disk Enclosure

Product Overview

The SAS (Serial Attached SCSI) Disk Enclosure is a high-performance storage solution designed for enterprise environments. It supports SAS and SATA drives, enabling scalable storage capacity and fast data transfer rates. Proper logistics handling and regulatory compliance are essential to ensure product integrity, safety, and legal conformity during transportation, storage, and deployment.

Packaging & Handling

- Original Packaging: Always transport and store the SAS Disk Enclosure in its original anti-static packaging to prevent electrostatic discharge (ESD) damage.

- Handling Precautions: Use ESD-safe gloves and wrist straps when handling the enclosure. Avoid direct contact with internal connectors or circuitry.

- Orientation: Maintain upright orientation during transit; never lay the unit on its side or upside down unless specified by the manufacturer.

- Fragile Labeling: Clearly mark packages as “Fragile” and “This Side Up” to alert logistics personnel.

Transportation Requirements

- Temperature Range: Maintain ambient temperatures between 5°C and 35°C (41°F to 95°F) during transit. Avoid exposure to extreme cold or heat.

- Humidity: Relative humidity should not exceed 80% non-condensing.

- Shock & Vibration: Use shock-absorbing materials and comply with ISTA 3A or equivalent standards for shipping.

- Air Transport: Complies with IATA Dangerous Goods Regulations (no hazardous materials); lithium batteries (if present in cache modules) must meet IATA Section II requirements.

Storage Conditions

- Environment: Store in a clean, dry, temperature-controlled environment (10°C to 30°C / 50°F to 86°F), with humidity between 20% and 60% RH.

- Duration: Maximum recommended storage time is 6 months. Extended storage requires periodic power-up and inspection.

- Stacking: Do not stack enclosures unless designed for vertical stacking. Follow manufacturer stacking guidelines to avoid physical damage.

Regulatory Compliance

- RoHS (Restriction of Hazardous Substances): Compliant with EU Directive 2011/65/EU, restricting lead, mercury, cadmium, and other hazardous substances.

- REACH: Complies with EC 1907/2006, ensuring safe use of chemical substances.

- WEEE (Waste Electrical and Electronic Equipment): Labeled with the crossed-out wheeled bin symbol; must be recycled through approved e-waste channels.

- CE Marking: Certified for sale in the European Economic Area, meeting EMC, LVD, and RoHS directives.

- FCC Compliance: Meets FCC Part 15 Class A for electromagnetic emissions (suitable for commercial environments).

- UL/CSA Certification: Certified to UL 60950-1/CSA C22.2 No. 60950-1 for safety in North America.

Import & Export Documentation

- HS Code: 8471.80 (Data processing machines and units thereof). Confirm with local customs authority.

- Export Controls: Subject to EAR (Export Administration Regulations); check ECCN (Export Control Classification Number) – typically 5A992.c for commercial storage enclosures.

- Required Documents: Commercial invoice, packing list, bill of lading/air waybill, Certificate of Origin, and compliance declarations (RoHS, REACH, etc.).

Installation & Site Preparation

- Power Requirements: Verify voltage compatibility (e.g., 100–240 VAC, 50/60 Hz). Use dedicated circuits and surge protection.

- Ventilation: Ensure minimum clearance of 10 cm (4 inches) on all sides for airflow. Avoid enclosed spaces without adequate cooling.

- Rack Mounting: Use appropriate rails and hardware. Maximum load per rack unit must not exceed manufacturer specifications.

- Grounding: Properly ground the enclosure to prevent electrical hazards and EMI interference.

End-of-Life & Recycling

- Disposal: Do not dispose of in regular trash. Return to manufacturer or certified e-waste recycler.

- Data Security: Before recycling, securely erase or physically destroy drives using NIST 800-88 standards.

- Material Recovery: Enclosure materials (aluminum, steel, PCBs) are recyclable; follow local WEEE protocols.

Contact & Support

For compliance documentation, logistics inquiries, or technical support:

– Manufacturer Support: [Insert Manufacturer Contact]

– Regional Compliance Office: [Insert Regional Contact]

– Documentation Portal: [Insert URL for compliance certificates and manuals]

Note: Always refer to the latest manufacturer documentation and local regulations, as compliance requirements may vary by region and product revision.

Conclusion for Sourcing SAS Disk Enclosure:

Sourcing a SAS disk enclosure requires a careful evaluation of performance, scalability, compatibility, reliability, and total cost of ownership. Based on the assessment of available options, a SAS disk enclosure that aligns with current infrastructure needs while allowing for future expansion offers the best long-term value. Key considerations such as drive compatibility (e.g., support for 12 Gbps SAS/SATA drives), expandability via daisy-chaining or additional enclosures, redundancy features (dual controllers, hot-swap drives, and power supplies), and vendor support should guide the final decision.

After evaluating multiple vendors and models, selecting a reputable brand with proven reliability, strong technical support, and compatibility with existing storage controllers ensures seamless integration and minimal downtime. Additionally, factoring in energy efficiency and rack space optimization contributes to operational efficiency.

In conclusion, the optimal SAS disk enclosure balances performance, scalability, and reliability to support growing data demands, making it a strategic investment in a robust and future-ready storage infrastructure.