The global sanitary pumps market is experiencing robust growth, driven by increasing demand from food & beverage, pharmaceuticals, and biotechnology industries, where hygiene and contamination control are paramount. According to Grand View Research, the market was valued at approximately USD 2.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 6.4% from 2023 to 2030. Similarly, Mordor Intelligence forecasts continued expansion, citing automation in processing plants, stricter regulatory standards, and rising investment in hygienic manufacturing infrastructure as key growth accelerators. As industries prioritize precision, cleanability, and energy efficiency, the role of leading sanitary pump manufacturers becomes increasingly critical. This list highlights the top nine manufacturers that stand out through innovation, product reliability, and a strong global footprint in meeting the evolving demands of sanitary fluid handling.

Top 9 Sanitary Pumps Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Sanitary Pumps, Valves & Replacement Parts

Domain Est. 2005

Website: flowtrend.com

Key Highlights: Flowtrend Inc. is the leading manufacturer of valves, pumps, tank equipment and parts for the sanitary industry. As an ISO 9001 company, we develop high ……

#2 Liberty Pumps

Domain Est. 1996

Website: libertypumps.com

Key Highlights: Liberty Pumps, is a leading pump manufacturer producing high-quality waste water pumps, sewage pumps and sump pumps – designed for commercial and residential…

#3 Q

Domain Est. 2001

Website: q-pumps.com

Key Highlights: We manufacture Centrifugal and Displacement Pumps for the food, pharmaceutical and cosmetic industries. 100% efficient production processes….

#4 Waukesha Cherry-Burrell

Domain Est. 2014

Website: spxflow.com

Key Highlights: We engineer and manufacture positive displacement and centrifugal pumps, sanitary valves, dispersion equipment, and the legendary Votator® scraped surface ……

#5 Hygienic Pumps

Domain Est. 1996

Website: vikingpump.com

Key Highlights: Viking Pump’s hygienic pumps offer the best efficiency and a wide range of porting, cleaning, and sealing options to meet your needs….

#6 Fristam Pumps

Domain Est. 1997

Website: fristam.com

Key Highlights: Fristam Pumps specializes in high quality sanitary stainless steel pumps & mixers. Engineered for lasting performance….

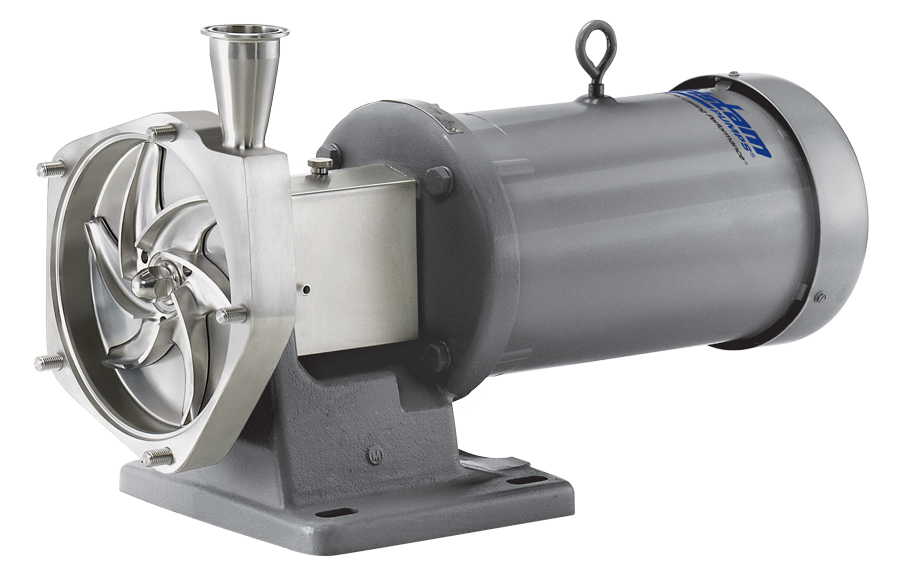

#7 Ampco Pumps

Domain Est. 1999

Website: ampcopumps.com

Key Highlights: Ampco Pumps Company has been providing quality centrifugal pumps and positive displacement pumps worldwide for more than 70 years….

#8 Sanitary Centrifugal Pumps

Domain Est. 2002

Website: steelobrien.com

Key Highlights: Steel & O’Brien is the leading supplier of stainless steel sanitary pumps and accessories to make sanitary simple. Click here to learn more….

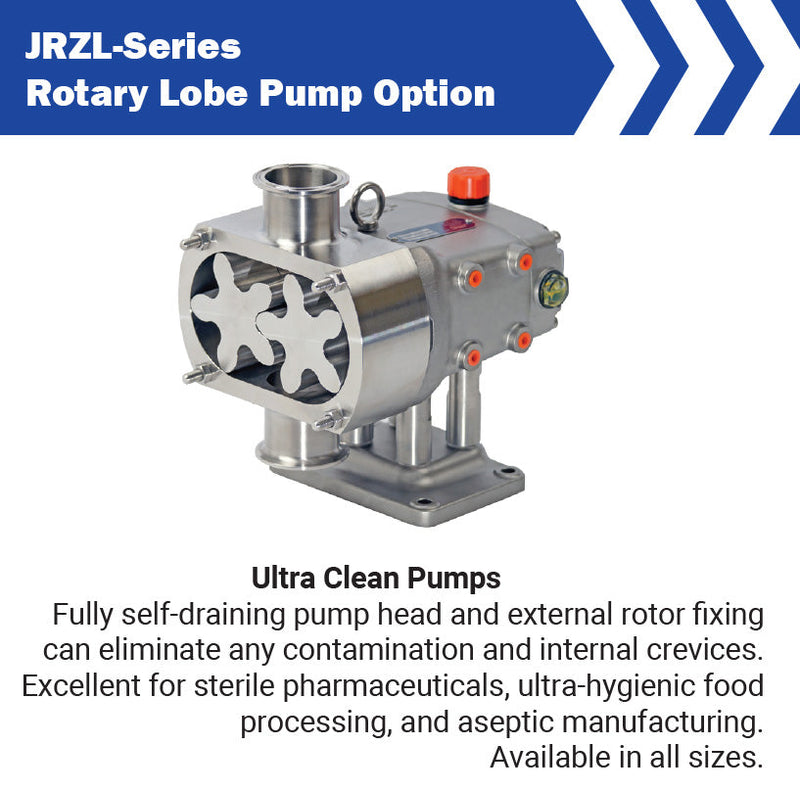

#9 Hygienic & Food

Domain Est. 2022

Website: unibloctech.com

Key Highlights: Our precision-engineered, hygienic, food grade positive displacement pumps take on the toughest sanitary jobs. We design simple, easy-to-clean pumps….

Expert Sourcing Insights for Sanitary Pumps

H2: 2026 Market Trends for Sanitary Pumps

The global sanitary pumps market is poised for significant transformation by 2026, driven by evolving industry standards, technological innovation, and heightened demand for hygiene-critical fluid handling across key sectors. Several strategic trends are shaping the market landscape:

-

Increased Demand from Food & Beverage and Pharmaceutical Industries

The food & beverage and pharmaceutical sectors remain primary drivers of sanitary pump adoption. With growing global emphasis on food safety and stringent regulatory requirements (e.g., FDA, EHEDG, 3A compliance), manufacturers are investing in high-purity pumping solutions. The expansion of clean-label products and personalized medicine is further accelerating the need for contamination-free transfer systems, boosting demand for hygienic centrifugal, rotary lobe, and diaphragm pumps. -

Adoption of Smart and Connected Pumping Systems

Industry 4.0 integration is transforming sanitary pump operations. By 2026, an increasing number of sanitary pumps are expected to feature IoT-enabled sensors, predictive maintenance capabilities, and remote monitoring. These smart systems enhance operational efficiency, reduce downtime, and ensure compliance through real-time data tracking of flow rates, pressure, and cleaning cycles (CIP/SIP). -

Focus on Energy Efficiency and Sustainability

Environmental regulations and corporate sustainability goals are pushing manufacturers to adopt energy-efficient pump designs. Variable frequency drives (VFDs), optimized hydraulic designs, and reduced water usage during cleaning processes are becoming standard. The market is witnessing a shift toward pumps with lower carbon footprints and recyclable materials, aligning with ESG (Environmental, Social, Governance) criteria. -

Rise in Customization and Modular Designs

End-users across biotechnology, cosmetics, and dairy processing are demanding tailored pump solutions that fit specific production layouts and hygiene protocols. Modular and scalable pump systems allow for easier integration into existing lines and faster changeovers, improving flexibility and reducing contamination risks. -

Growth in Emerging Markets

Expanding food processing infrastructure and pharmaceutical manufacturing in Asia-Pacific (especially India and China), Latin America, and parts of Africa are creating new growth avenues. Rising middle-class populations and increased healthcare access are fueling investment in sanitary equipment, including pumps compliant with international hygiene standards. -

Consolidation and Strategic Partnerships Among Suppliers

Market players are engaging in mergers, acquisitions, and joint ventures to strengthen their technological capabilities and geographic reach. Companies like Alfa Laval, SPX FLOW, and Gardner Denver are enhancing their portfolios with advanced sealing technologies, corrosion-resistant materials (e.g., 316L stainless steel, hygienic coatings), and digital service platforms. -

Stringent Regulatory Landscape Driving Innovation

Regulatory bodies are tightening hygiene and safety standards, especially in pharmaceutical and dairy applications. This is prompting manufacturers to innovate with fully drainable designs, crevice-free surfaces, and improved cleanability to meet evolving compliance benchmarks.

In conclusion, the 2026 sanitary pumps market reflects a convergence of hygiene excellence, digital intelligence, and sustainability. As industries prioritize safety, efficiency, and traceability, the demand for advanced, compliant, and intelligent sanitary pumping solutions is set to grow steadily, positioning innovation at the core of market competitiveness.

Common Pitfalls When Sourcing Sanitary Pumps: Quality and Intellectual Property Risks

Sourcing sanitary pumps for industries such as food, beverage, pharmaceuticals, and biotechnology requires careful attention due to stringent hygiene standards and regulatory compliance needs. Overlooking key quality and intellectual property (IP) aspects can lead to costly failures, production downtime, or legal disputes. Below are common pitfalls to avoid:

Compromised Quality from Unverified Suppliers

One of the most significant risks is selecting suppliers without rigorously assessing their manufacturing standards and quality control processes. Many low-cost suppliers, especially in emerging markets, may claim compliance with 3A, EHEDG, or FDA standards without proper certification. Buyers often discover post-purchase that pumps have substandard surface finishes, improper welds, or non-compliant materials—leading to contamination risks, frequent maintenance, or rejection during audits.

Tip: Always request third-party test reports, material certifications (e.g., 3.1 Mill Certs), and conduct factory audits or require video inspections of the production line.

Use of Counterfeit or Reverse-Engineered Designs

Some suppliers offer “compatible” or “OEM-equivalent” sanitary pumps at significantly reduced prices. While this may seem cost-effective, these pumps are often reverse-engineered copies of patented designs. Using such products exposes buyers to intellectual property infringement claims, especially in regulated markets where original equipment manufacturer (OEM) authenticity is required.

Tip: Verify that the supplier owns the design or has proper licensing agreements. Avoid vendors that cannot provide IP documentation or avoid discussing design origins.

Inadequate Documentation and Traceability

Sanitary applications demand full traceability of materials and components. A common pitfall is receiving pumps without proper documentation—such as material test reports, weld logs, or CIP/SIP validation data. Lack of documentation can result in failed regulatory inspections or inability to validate cleaning procedures.

Tip: Include documentation requirements in procurement contracts and verify that each pump has a unique serial number linked to its manufacturing history.

Hidden Costs from Poor After-Sales Support

Low initial pricing may conceal long-term costs related to poor technical support, unavailability of spare parts, or extended lead times. Some suppliers outsource IP and have no control over parts inventory, making maintenance difficult. This is particularly problematic when a pump fails and replacement components take weeks to arrive.

Tip: Evaluate the supplier’s service network, spare parts availability, and technical support responsiveness before finalizing a purchase.

Misrepresentation of Compliance and Certifications

Suppliers may falsely claim their pumps meet international sanitary standards. For example, a pump might claim “3A compliance” without undergoing official 3A certification. This misrepresentation can lead to product recalls or facility shutdowns during regulatory audits.

Tip: Request official certification numbers and verify them directly with the issuing body (e.g., 3-A Sanitary Standards, Inc.).

Lack of IP Protection in Custom Designs

When working with suppliers on custom pump configurations, companies risk losing control over proprietary designs if non-disclosure agreements (NDAs) and IP ownership clauses are not clearly defined. Suppliers may reuse or sell the design to competitors, undermining competitive advantage.

Tip: Draft clear contractual terms specifying that all custom designs, modifications, and related IP belong to the buyer.

By proactively addressing these quality and IP-related pitfalls, organizations can ensure reliable performance, regulatory compliance, and long-term supply chain security when sourcing sanitary pumps.

Logistics & Compliance Guide for Sanitary Pumps

This guide outlines key considerations for the logistics and regulatory compliance associated with the transportation, storage, installation, and operation of sanitary pumps, commonly used in food, beverage, pharmaceutical, and biotechnology industries.

Regulatory Standards and Certifications

Sanitary pumps must comply with stringent industry standards to ensure product safety and process integrity. Key certifications include:

- 3-A Sanitary Standards: Mandatory in the U.S. for dairy and food processing. Verify pumps carry current 3-A certification, including proper material finishes (typically Ra ≤ 0.8 µm), cleanability, and design to prevent bacterial growth.

- EHEDG (European Hygienic Engineering & Design Group): Required for operations in Europe. Ensures hygienic design and cleanability; look for EHEDG Type Approval.

- FDA Compliance: Confirm pump materials (e.g., stainless steel 316L, elastomers) are FDA-compliant for food contact (21 CFR §177.2600).

- USP Class VI & NSF/ANSI 51: Essential for pharmaceutical and food equipment; ensures biocompatibility and material safety.

- ATEX/IECEx (if applicable): Required when operating in explosive atmospheres; verify certification for hazardous locations.

Always obtain and retain certification documentation for audit and compliance purposes.

Material and Construction Requirements

Ensure pump components meet sanitary and corrosion-resistant standards:

- Wetted Materials: Use 316L stainless steel for all fluid-contact surfaces; confirm passivation and electropolishing per ASTM A967 or ASTM B912.

- Seals and Gaskets: Must be made from FDA-approved elastomers (e.g., EPDM, Silicone, FKM) and replaceable without tools where possible.

- Surface Finishes: Internal surfaces should have a minimum finish of 20 Ra (microinches) or better; electropolished finishes enhance cleanability and corrosion resistance.

Packaging and Transportation

Proper handling prevents contamination and damage:

- Cleanroom Packaging: Pumps should be factory-sealed in protective, non-shedding packaging (e.g., double polyethylene bags with desiccant) to prevent particulate and moisture ingress.

- Impact Protection: Use rigid crates with foam inserts to protect flanges, seals, and drive components during transit.

- Labeling: Clearly mark packages with handling instructions (e.g., “Fragile,” “This Side Up”), product ID, lot number, and certification tags.

- Cold Chain (if applicable): For pumps with sensitive elastomers or lubricants, ensure temperature-controlled shipping to avoid material degradation.

Storage Conditions

Improper storage can compromise performance and compliance:

- Environment: Store in a clean, dry, temperature-controlled area (10–25°C / 50–77°F) with low humidity (<60% RH).

- Positioning: Mount pumps vertically or as recommended by the manufacturer to prevent seal deformation or fluid pooling.

- Duration: Limit storage to manufacturer-recommended periods (typically <12 months). Extend only with documented preservation procedures.

- Preservation: If stored long-term, apply food-grade corrosion inhibitor to internal surfaces and seal openings with protective caps.

Documentation and Traceability

Maintain complete records for regulatory audits:

- Certificates of Conformance (CoC): Include material test reports (MTRs), 3-A, EHEDG, FDA, and any other relevant certifications.

- Batch/Lot Tracking: Record serial numbers, manufacturing dates, and installation locations.

- Shipping Logs: Document carrier, dates, handling conditions, and delivery verification.

Installation and Commissioning

Ensure compliance during setup:

- Pre-Installation Inspection: Check for shipping damage, verify seals and gaskets are intact, and confirm documentation matches the unit.

- Clean-in-Place (CIP) Compatibility: Validate that the pump design supports required CIP/SIP cycles (temperature, chemical resistance, flow rates).

- Alignment and Support: Follow manufacturer guidelines for piping alignment and support to prevent stress on pump housings.

- Leak Testing: Perform hydrostatic or pneumatic testing per ASME B31.3 or applicable standards before operation.

Maintenance and Validation

Ongoing compliance relies on proper upkeep:

- Scheduled Maintenance: Follow OEM-recommended intervals for seal replacement, lubrication (using food-grade lubricants), and inspection.

- Calibration Records: Maintain logs for variable frequency drives (VFDs) or flow meters integrated with the pump.

- Cleaning Validation: Document CIP effectiveness through swab testing or conductivity measurements.

- Spare Parts Management: Stock critical, certified spare components (e.g., seals, impellers) stored under the same conditions as the original pump.

Disposal and End-of-Life

Dispose of pumps and components responsibly:

- Material Recycling: Segregate stainless steel and approved elastomers for recycling per local regulations.

- Hazardous Waste: Treat lubricants or contaminated parts as hazardous waste if required.

- Documentation: Retain records of disposal for traceability and environmental compliance.

Adhering to this guide ensures sanitary pumps remain compliant, reliable, and safe throughout their lifecycle. Always consult manufacturer specifications and applicable regional regulations for project-specific requirements.

Conclusion on Sourcing Sanitary Pumps

Sourcing sanitary pumps requires a strategic approach that balances hygienic design, regulatory compliance, material quality, and operational efficiency. These pumps are critical in industries such as food and beverage, pharmaceuticals, and biotechnology, where product purity and safety are paramount. When selecting a supplier, it is essential to prioritize vendors offering pumps made from high-grade stainless steel (typically 316L), compliant with standards such as 3-A, EHEDG, and FDA, and designed for easy CIP (clean-in-place) and SIP (sterilize-in-place) procedures.

Total cost of ownership—factoring in durability, energy efficiency, maintenance requirements, and downtime—should guide procurement decisions rather than initial purchase price alone. Engaging with reputable manufacturers or distributors with proven industry experience, strong technical support, and customization capabilities ensures long-term reliability and performance.

In conclusion, a well-informed sourcing strategy for sanitary pumps not only enhances process hygiene and operational efficiency but also supports compliance with stringent industry regulations, ultimately safeguarding product quality and consumer safety.