The global sanding screens market is experiencing steady growth, driven by rising demand in woodworking, metal fabrication, and construction industries. According to Grand View Research, the global abrasives market—of which sanding screens are a key segment—was valued at USD 47.8 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030. Growth is further fueled by advancements in abrasive materials, increasing adoption of automated sanding systems, and expanding industrial activity in emerging economies. As manufacturers focus on efficiency, precision, and dust-free sanding solutions, the competition among leading sanding screen producers is intensifying. In this evolving landscape, seven key manufacturers have distinguished themselves through innovation, product quality, and global reach—shaping the future of surface preparation technology.

Top 7 Sanding Screens Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Mirka

Domain Est. 1997

Website: mirka.com

Key Highlights: Mirka Ltd is a world leader in surface finishing technology and offers a broad range of ground-breaking sanding solutions including abrasives, sandpaper,……

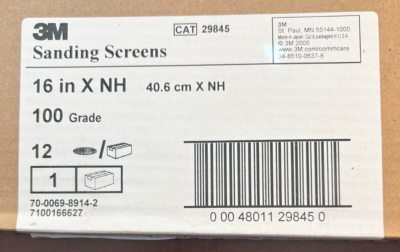

#2 3M Sanding Screen 29845, 100 Grit, 16 in. x NH

Domain Est. 2021

Website: oxshare.com

Key Highlights: In stock Rating 4.7 (150) 6 days ago · 3M Sanding Screen 29845, 100 Grit, 16 in. x NH ; New $78.99 ; California Residents. Proposition 65 Warning ; Certifications and Standards. …

#3 3M Sanding Screens

Domain Est. 1988

Website: 3m.com

Key Highlights: Sheets of abrasive material with mesh backing most commonly used in finishing applications….

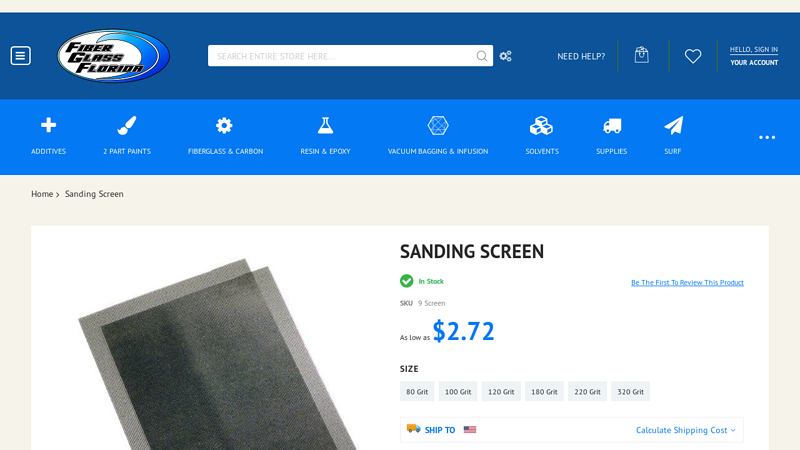

#4 Sanding Screen

Domain Est. 1999

Website: fiberglassflorida.com

Key Highlights: In stock 6-day deliveryThese abrasive mesh sanding screens are made of strong fibers with uniform open construction, providing superior durability and performance….

#5 Mesh Screens for Flooring

Domain Est. 2000

Website: virginiaabrasives.com

Key Highlights: Discover Virginia Abrasives’ selection of mesh sanding discs and sheets for use between coats to refine the finish of your project….

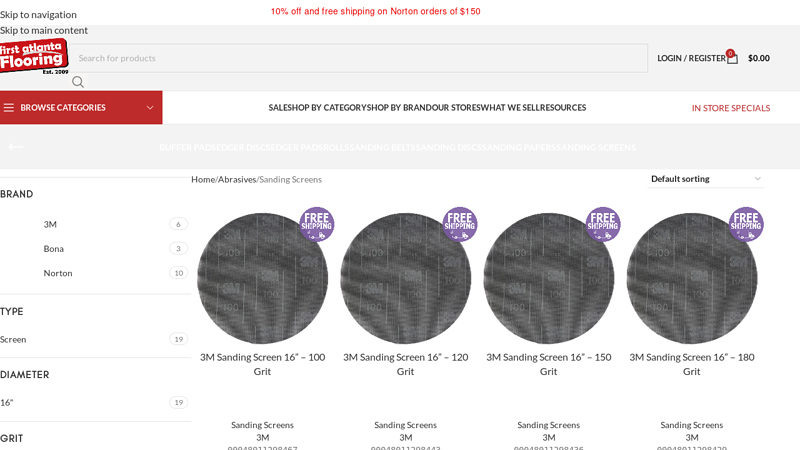

#6 Sanding Screens

Domain Est. 2009

#7 Drywall Sanding Screen

Domain Est. 1996

Expert Sourcing Insights for Sanding Screens

2026 Market Trends for Sanding Screens

The sanding screens market is poised for significant evolution by 2026, driven by technological innovation, sustainability demands, and shifting industrial needs. Here are the key trends expected to shape the landscape:

Advancements in Abrasive Technology and Material Science

By 2026, expect widespread adoption of next-generation abrasive grains such as ceramic alumina and hybrid composites engineered for longer life and cooler cutting. Innovations in coating technologies—like anti-loading treatments and precision electrostatic grain alignment—will enhance performance, reduce waste, and improve surface finishes. These advancements will be critical in high-precision industries such as aerospace, automotive refinishing, and hardwood flooring, where consistency and efficiency are paramount.

Rising Demand for Sustainable and Eco-Friendly Solutions

Environmental regulations and corporate sustainability goals will accelerate the shift toward recyclable and biodegradable sanding screens. Manufacturers will increasingly offer products with reduced volatile organic compound (VOC) binders and backing materials derived from renewable sources. Closed-loop recycling programs for used screens may become a competitive differentiator, especially in Europe and North America where green procurement policies are tightening.

Growth in Automation and Integration with Smart Tools

As industrial automation expands, sanding screens will be designed to integrate seamlessly with robotic sanding systems and IoT-enabled power tools. Sensors embedded in screens or tools will monitor wear rates and dust output in real time, enabling predictive maintenance and optimizing material usage. This trend will be particularly prominent in automotive manufacturing and large-scale woodworking operations seeking to improve productivity and reduce downtime.

Expansion in Emerging Markets and DIY Segments

Developing economies in Asia-Pacific, Latin America, and Africa will drive market growth due to rising construction activity and expanding middle-class demand for home improvement. Concurrently, the DIY (do-it-yourself) market will fuel demand for user-friendly, versatile sanding screens compatible with cordless and multi-tool systems. Retailers and manufacturers will focus on value packs, easy-dispense packaging, and educational content to capture this segment.

Consolidation and Strategic Partnerships Among Suppliers

The competitive landscape will likely see increased consolidation as larger abrasives companies acquire niche innovators to strengthen their sanding screen portfolios. Strategic partnerships between tool manufacturers and abrasive suppliers will emerge to co-develop optimized screen-tool ecosystems, offering consumers integrated performance solutions with improved durability and dust extraction.

These converging trends point to a more technologically advanced, environmentally conscious, and globally diversified sanding screens market by 2026, presenting both challenges and opportunities for industry stakeholders.

Common Pitfalls When Sourcing Sanding Screens: Quality and Intellectual Property Risks

When sourcing sanding screens—especially from overseas suppliers or lesser-known manufacturers—buyers often encounter critical pitfalls related to product quality and intellectual property (IP) protection. Being aware of these risks is essential to ensure performance, compliance, and long-term business integrity.

Poor Material and Construction Quality

One of the most frequent issues is inconsistent or substandard material quality. Low-cost sanding screens may use inferior abrasive grains (such as recycled or low-grade aluminum oxide) or weak bonding agents, leading to rapid wear, clogging, or uneven sanding. Additionally, mesh tension and screen backing may lack durability, resulting in warping or tearing during use—especially in high-speed or industrial applications.

Inaccurate Grit Size and Performance Claims

Suppliers may mislabel grit sizes or exaggerate performance metrics. A screen advertised as 120-grit might actually perform closer to 150-grit due to inconsistent grain distribution. This undermines precision sanding operations and can result in rework, customer dissatisfaction, or damage to sensitive materials like wood or composites.

Lack of Standardization and Certification

Many low-cost suppliers do not adhere to international standards such as ISO 9001 or FEPA (Federation of European Producers of Abrasives) guidelines. Without third-party testing or certifications, it’s difficult to verify claims about durability, heat resistance, or dust extraction efficiency—key factors in industrial applications.

Intellectual Property Infringement

Sourcing from manufacturers in regions with weak IP enforcement increases the risk of purchasing counterfeit or cloned products. Some suppliers replicate patented screen designs, patterns, or bonding technologies from leading brands without authorization. Buyers may unknowingly import infringing products, exposing their business to legal action, customs seizures, or reputational damage.

Insufficient IP Due Diligence by Suppliers

Even if a supplier claims their product is original, they may lack proper documentation or freedom-to-operate analysis. Without verified IP clearance, your company could be held liable for contributory infringement. Always require suppliers to provide proof of IP ownership or licensing for proprietary technologies.

Supply Chain Opacity and Traceability Gaps

Lack of transparency in the supply chain makes it difficult to trace materials and manufacturing processes. This not only affects quality control but also complicates compliance with regulations such as REACH or RoHS. It also hinders efforts to verify ethical sourcing and avoid counterfeit components.

Failure to Protect Your Own IP When Co-Developing

When working with suppliers to customize sanding screens (e.g., unique mesh patterns or coatings), companies often fail to secure proper IP agreements. Without clear contracts assigning ownership of new designs or processes, suppliers may replicate and sell your innovations to competitors.

Conclusion

To mitigate these pitfalls, conduct thorough supplier audits, request performance testing data, verify compliance with abrasives standards, and perform IP risk assessments before finalizing procurement. Legal agreements should clearly define IP ownership and include warranties for non-infringement. Investing in due diligence upfront protects both product quality and your company’s legal standing.

Logistics & Compliance Guide for Sanding Screens

Product Classification & HS Code

Sanding screens are typically classified under HS Code 6805.20, which covers abrasive powder or grain on a base of paper or cloth. Accurate classification is essential for international shipping, customs clearance, and determining applicable import duties. Confirm the specific HS code with local customs authorities, as classification may vary slightly based on composition (e.g., mesh material, abrasive type).

Packaging & Labeling Requirements

Ensure sanding screens are packaged to prevent damage during transit—use moisture-resistant, durable materials such as sealed plastic wrap or corrugated cardboard boxes. Label each package with:

– Product name and model/size

– Quantity per unit

– Manufacturer or supplier information

– Batch or lot number

– Safety warnings (if applicable)

– Barcodes for inventory tracking

Comply with country-specific labeling laws, including language requirements (e.g., bilingual labels in Canada).

Shipping & Transportation

Sanding screens are generally non-hazardous and can be shipped via standard freight (air, sea, or ground). However:

– Use palletized loads for bulk shipments to ensure stability.

– Follow carrier-specific packaging guidelines (e.g., UPS, FedEx, DHL).

– Maintain proper documentation, including commercial invoices, packing lists, and bills of lading.

– Consider temperature and humidity controls if stored in sensitive environments.

Import/Export Documentation

Essential documents for international trade include:

– Commercial Invoice

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Origin (if required for preferential tariffs)

Ensure all documents accurately reflect product details and value to avoid customs delays or penalties.

Regulatory Compliance

- REACH (EU): Confirm that any chemical components (e.g., adhesives, coatings) comply with REACH regulations. Registration may be required for substances of very high concern (SVHC).

- RoHS (EU): Not typically applicable unless electronic components are involved.

- OSHA & GHS (USA): If sanding screens generate hazardous dust during use, provide Safety Data Sheets (SDS) and ensure proper workplace labeling.

- EPA Regulations: Comply with air quality standards if manufacturing involves emissions.

Environmental & Disposal Considerations

Sanding screens may contain abrasive materials (e.g., aluminum oxide, silicon carbide) and plastic or paper substrates. Follow local waste disposal regulations:

– Do not dispose of in regular landfill if classified as hazardous waste.

– Recycle components where possible (e.g., cardboard packaging).

– Provide end-user guidance on proper disposal methods.

Quality Assurance & Standards

Adhere to relevant industry standards such as:

– ANSI B7.1 (for safety requirements of abrasive products)

– ISO 9001 (for quality management systems)

Maintain traceability through batch records and quality control testing to ensure consistency and compliance.

Recordkeeping & Audits

Retain shipping, compliance, and quality documentation for a minimum of 5–7 years, depending on jurisdiction. Conduct regular internal audits to verify adherence to logistics and regulatory requirements.

In conclusion, sourcing sanding screens requires careful consideration of quality, compatibility, cost, and supplier reliability. Selecting the right sanding screens—based on grit size, material composition, durability, and intended application—ensures optimal performance and efficiency in sanding operations, particularly in woodworking, flooring, and surface preparation. By evaluating suppliers for consistency, lead times, and technical support, businesses can maintain productivity while minimizing downtime and material waste. Establishing strong relationships with reputable suppliers and considering sustainable or reusable options can further enhance cost-effectiveness and environmental responsibility. Ultimately, a strategic sourcing approach to sanding screens contributes to improved finish quality, operational efficiency, and long-term cost savings.