The global salt tiles market is experiencing steady growth, driven by rising consumer interest in natural wellness products and air purification solutions. According to Grand View Research, the global Himalayan salt market was valued at USD 1.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This surge is fueled by increasing demand for salt-based home decor, therapeutic lighting, and health-focused applications across residential and commercial spaces. As consumer awareness grows and e-commerce channels expand, manufacturers of salt tiles are scaling production and improving product quality to meet international standards. Against this backdrop, identifying the top players in the industry becomes essential for retailers, distributors, and wellness brands seeking reliable and high-performing suppliers. Based on market presence, production capacity, certifications, and customer feedback, we examine the top 10 salt tiles manufacturers shaping this evolving landscape.

Top 10 Salt Tiles Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

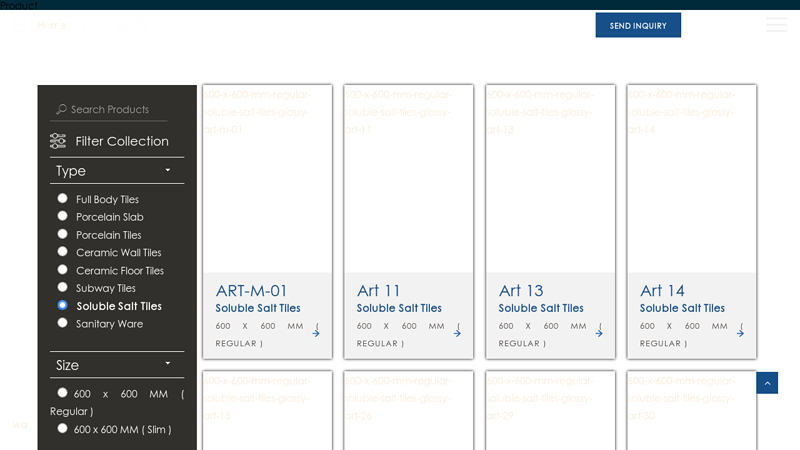

#1 Soluble Salt Tiles Manufacturer & Supplier

Domain Est. 2018

Website: bluecerallp.com

Key Highlights: Rating 4.1 (34) Bluecera is a leading manufacturer and supplier of soluble salt tiles. We offer soluble salt tiles for the bedroom, drawing room, living room, and kitchen….

#2 Soluble Salt Tiles Manufacturer & Supplier

Domain Est. 2019

Website: marazentiles.com

Key Highlights: Marazen Tiles offers soluble salt tiles for the bedroom, drawing room, living room, kitchen….

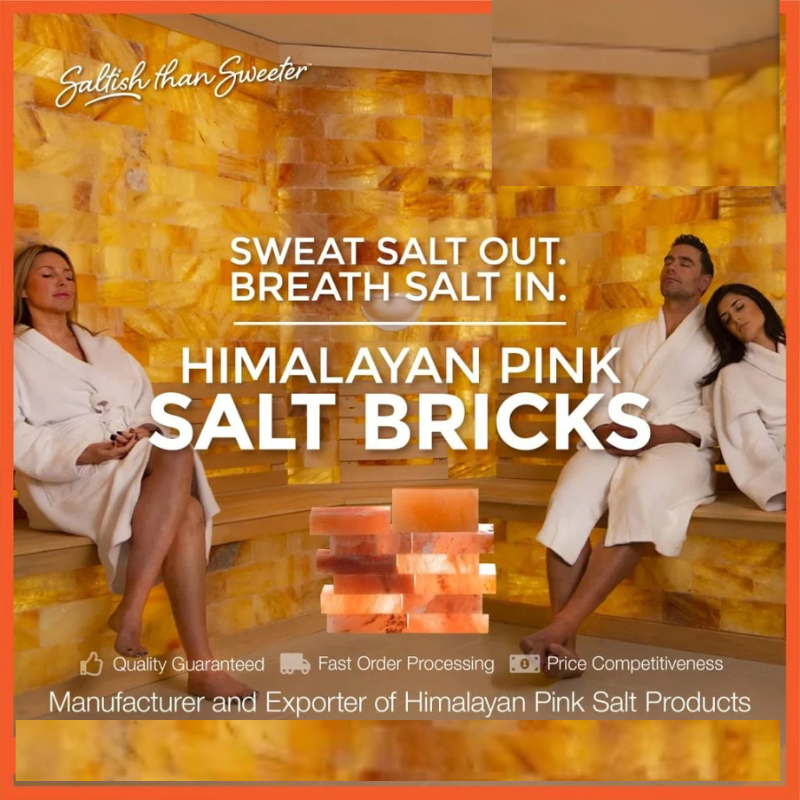

#3 Salt bricks and tiles are used by butchers and sauna manufacturers

Domain Est. 2021

Website: naturessaltglobal.com

Key Highlights: Our bricks and tiles are made from 100% Himalayan Salt. The bricks and tiles can be heated to high temperatures and chilled at a very low temperature….

#4 Wholesale salt tiles Manufacturer & Supplier in China

Domain Est. 2023

Website: sjzhuabangkc.com

Key Highlights: Wholesale Salt Tiles – Bringing Good Health to Your Home. Looking for a completely means new bring a healthy body to your home or workplace?…

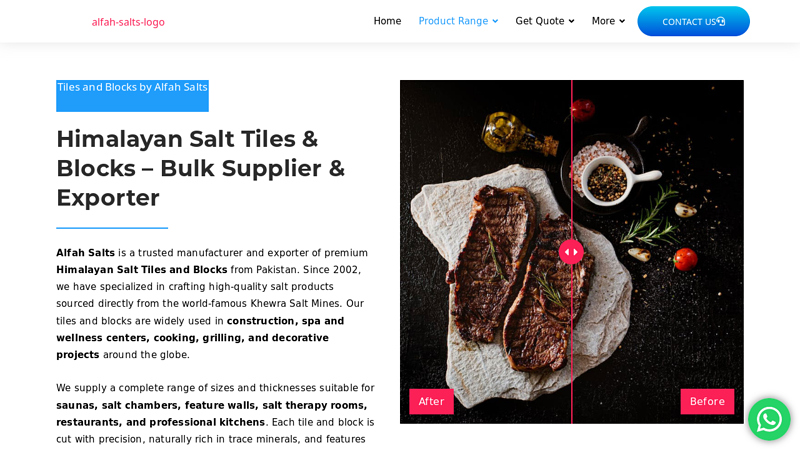

#5 Salt Tiles And Blocks Exporter

Founded: 2002

Website: alfahsalts.com

Key Highlights: Alfah Salts is a trusted manufacturer and exporter of premium Himalayan Salt Tiles and Blocks from Pakistan. Since 2002, we have specialized in crafting ……

#6 Salt Stone by Provenza: Elegant Stone

Domain Est. 2013

Website: emilgroup.com

Key Highlights: Explore the Salt Stone collection by Provenza, featuring versatile porcelain stoneware in elegant shades like Black Iron and Pink Halite for elegant areas….

#7 Salt Tiles

Domain Est. 2018

Website: saltpak.com

Key Highlights: Salt Tiles by Salt Pak are premium Himalayan salt slabs, crafted for versatile use in wellness centers, spas, saunas, and interiors….

#8 Salt Tiles Largest Exporter

Domain Est. 2024

Website: saltigoexports.com

Key Highlights: Salt Export specializes in providing premium-quality salt products that can be branded under your own label. We handle everything — from sourcing and ……

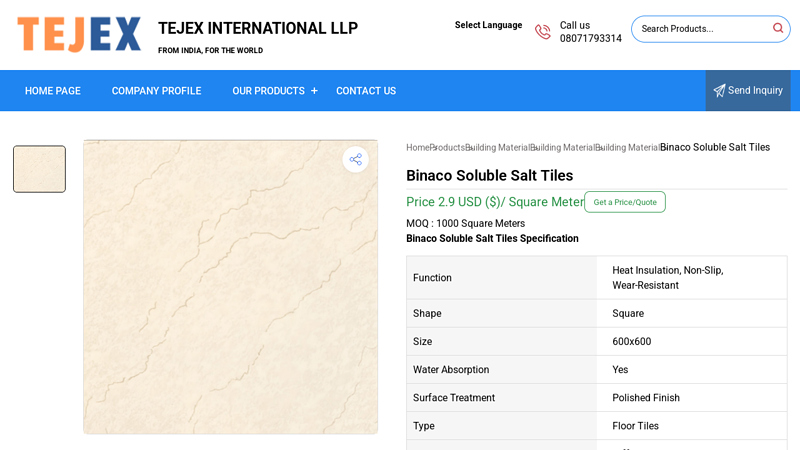

#9 Binaco Soluble Salt Tiles

Website: tejexinternational.com

Key Highlights: In stockBinaco Soluble Salt Tiles ; Material: Ceramic ; Shape: Square ; Size: 600×600 ; Surface Treatment: Polished Finish ; Technique: Vitrified Tiles….

#10 Naveen Tile – India’s Top Tile Company

Domain Est. 2006

Website: naveentile.com

Key Highlights: Soluble Salt Tiles. Add a rustic touch with Soluble Salt Tiles. Handcrafted designs make them ideal for feature walls, bathrooms, and kitchens. Explore more….

Expert Sourcing Insights for Salt Tiles

2026 Market Trends for Salt Tiles

Salt tiles—decorative blocks primarily made from Himalayan pink salt—are expected to experience evolving market dynamics by 2026, shaped by shifting consumer preferences, sustainability concerns, and increased competition. Here are the key trends poised to influence the salt tile industry:

Rising Demand for Natural and Holistic Wellness Products

By 2026, consumers are increasingly prioritizing wellness-focused home environments. Salt tiles are often marketed for their purported air-purifying and mood-enhancing benefits, such as negative ion emission and allergen reduction. As interest in holistic health and biophilic design grows, salt tiles are likely to gain traction in residential wellness spaces, spas, and meditation rooms. This trend will be amplified by social media and influencer marketing emphasizing natural, non-toxic materials.

Expansion into Commercial and Hospitality Sectors

Beyond residential use, the commercial application of salt tiles is projected to expand. Hotels, wellness centers, and high-end restaurants are expected to integrate salt walls and lighting features to create unique, calming atmospheres. By 2026, designers may increasingly specify salt tiles in boutique hospitality projects, leveraging their aesthetic appeal and perceived health benefits to differentiate spaces in a competitive market.

Sustainability and Ethical Sourcing Concerns

As environmental awareness intensifies, scrutiny over the sourcing and environmental impact of salt mining will grow. Consumers and regulators may demand greater transparency regarding mining practices, labor conditions, and carbon footprints. Brands that adopt ethical sourcing certifications and promote responsible extraction methods will likely gain a competitive edge. Conversely, those unable to substantiate sustainability claims may face reputational risks.

Product Innovation and Hybrid Materials

To overcome limitations such as moisture sensitivity and fragility, manufacturers are expected to introduce composite salt tiles or protective coatings that enhance durability without compromising aesthetics. By 2026, hybrid materials combining salt with resin or recycled components may gain popularity, broadening application possibilities in humid environments like bathrooms and kitchens.

Market Saturation and Price Competition

As entry barriers remain relatively low, the salt tile market may become increasingly saturated by 2026. This could lead to intensified price competition, especially among online retailers and mass-market suppliers. Differentiation through design, quality assurance, and wellness certifications will become essential for premium brands aiming to maintain profitability.

Regulatory and Health Claim Scrutiny

While salt tiles are often promoted with health-related claims, regulatory bodies may increase oversight on unsubstantiated assertions. By 2026, companies may need to provide scientific evidence or reframe marketing language to comply with advertising standards, particularly in regions like the EU and North America. This could shift positioning from “therapeutic” to “ambient wellness” or “aesthetic wellness” products.

In summary, the 2026 salt tile market will be defined by a balance between wellness appeal and practical innovation, with sustainability and authenticity playing pivotal roles in consumer decision-making. Brands that adapt to these trends through transparency, product development, and targeted marketing will be best positioned for growth.

Common Pitfalls Sourcing Salt Tiles (Quality, IP)

Sourcing salt tiles—decorative blocks made from natural Himalayan or rock salt—for construction, wellness, or decorative applications can present several challenges, particularly concerning quality and intellectual property (IP). Being aware of these pitfalls helps ensure you receive authentic, durable products and avoid legal complications.

Quality-Related Pitfalls

Inconsistent Material Composition

Salt tiles vary significantly in mineral content, color, and density depending on their origin. Lower-quality tiles may contain excessive impurities or moisture, making them prone to cracking, crumbling, or “sweating” in humid environments. Buyers often receive tiles that don’t meet advertised standards due to lack of grading or standardized sourcing.

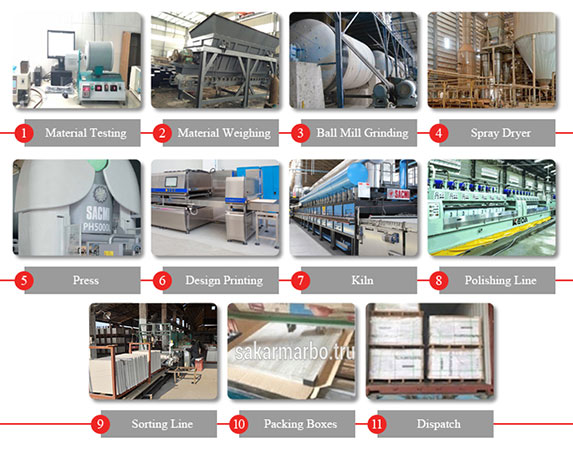

Poor Manufacturing Standards

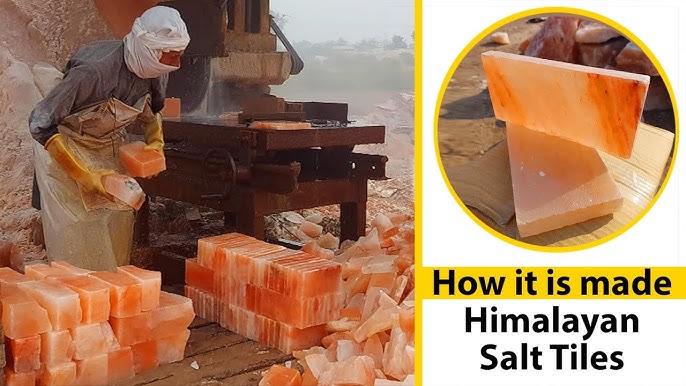

Tiles cut with improper techniques or inadequate drying processes degrade faster. Some suppliers use adhesives or chemical treatments to enhance appearance or durability, which can compromise the natural integrity of the salt and pose health risks in wellness applications like salt rooms.

Misrepresentation of Origin

Many products are falsely marketed as “Himalayan” salt when sourced from less reputable mines. This mislabeling affects not only the aesthetic appeal but also the perceived therapeutic benefits, which are culturally and commercially tied to authentic origins.

Lack of Certification or Testing

Reputable salt tiles should come with mineral analysis, structural integrity reports, or ISO certifications. Without these, buyers have no objective way to verify quality, increasing the risk of receiving substandard materials.

Intellectual Property (IP) Risks

Design Copying and Brand Infringement

Unique tile patterns, engravings, or proprietary installation systems may be protected by design patents or trademarks. Sourcing from unauthorized manufacturers can lead to purchasing counterfeit products that infringe on IP rights, exposing buyers to legal liability—especially in commercial projects.

Unauthorized Use of Trademarked Names

Suppliers may use terms like “Himalayan Glow” or “Therapeutic Salt Panels” that are registered trademarks. Importing or reselling such products without authorization can result in customs seizures or litigation, even if the buyer was unaware of the infringement.

Lack of IP Due Diligence in Supply Chain

Many intermediaries and overseas suppliers do not verify the IP status of the products they distribute. Buyers who fail to conduct due diligence may inadvertently finance or distribute pirated designs or patented technologies, risking reputational damage and legal action.

Mitigation Strategies

To avoid these pitfalls, conduct thorough supplier vetting, request material test reports, verify geographic origin through documentation, and consult legal experts when importing branded or uniquely designed salt tiles. Use contracts that specify quality standards and IP compliance to protect your investment and ensure long-term project success.

Logistics & Compliance Guide for Salt Tiles

Product Overview

Salt tiles, typically made from natural Himalayan pink salt, are used for decorative lighting, wellness products, and culinary purposes. Proper logistics and compliance are essential to ensure product integrity, safety, and legal adherence during transportation, storage, and sale.

Regulatory Classification

Salt tiles may fall under different regulatory categories depending on their intended use:

– Decorative/Wellness Use: Generally classified as home décor or wellness products; subject to general consumer product safety standards.

– Culinary Use: Regulated as a food product by agencies such as the FDA (U.S.) or EFSA (EU), requiring compliance with food-grade handling and labeling.

– Electrical Use (e.g., salt lamps): Must meet electrical safety standards (e.g., UL, CE, RoHS) if they include wiring, bulbs, or plugs.

Packaging Requirements

- Use moisture-resistant packaging (e.g., vacuum-sealed plastic or moisture-barrier wrap) to prevent salt degradation.

- Include shock-absorbing materials (e.g., foam, bubble wrap) to protect tiles during transit.

- Clearly label packaging with “Fragile,” “Keep Dry,” and “Do Not Expose to Moisture.”

- If intended for food use, ensure packaging is food-grade compliant and sealed to avoid contamination.

Storage Conditions

- Store in a cool, dry environment with low humidity (ideally below 40% RH) to prevent deliquescence (moisture absorption and dissolving).

- Elevate pallets off the floor and away from exterior walls to minimize moisture exposure.

- Avoid storage in basements or areas prone to dampness.

- Rotate stock using a first-in, first-out (FIFO) system to maintain product quality.

Transportation Guidelines

- Use enclosed, climate-controlled vehicles for long-distance or international shipments to reduce humidity exposure.

- Avoid shipping during high-humidity seasons or in tropical climates without proper protection.

- Secure loads to prevent shifting and damage during transit.

- For international shipments, comply with Incoterms and document cargo appropriately (e.g., commercial invoice, packing list).

Import/Export Compliance

- HS Codes: Use appropriate Harmonized System (HS) codes (e.g., 2501.00 for unrefined salt, 9405.40 for salt lamps) for customs clearance.

- Country-Specific Regulations: Research import requirements for destination countries, including labeling, safety certifications, and restricted substances.

- Documentation: Provide certificates of origin, conformity (CE, FCC, etc.), and food safety compliance (if applicable).

- Tariffs and Duties: Account for potential tariffs based on product classification and trade agreements.

Labeling & Consumer Information

- Include product name, net weight, country of origin, and intended use.

- For food-grade salt tiles: Add ingredient declaration, nutritional info (if required), and food safety handling instructions.

- For electrical salt lamps: Affix required safety marks (e.g., UL, CE, ETL) and include user manuals with safety warnings.

- Add care instructions: “Wipe with dry cloth only,” “Avoid humid areas,” “Unplug before cleaning.”

Safety & Environmental Compliance

- Comply with REACH (EU), CPSIA (U.S.), and other chemical safety regulations.

- Ensure electrical components meet RoHS (Restriction of Hazardous Substances) and WEEE (waste electrical equipment) directives where applicable.

- Provide proper disposal instructions, especially for lamps with electronic parts.

Quality Control & Testing

- Conduct regular quality checks for moisture absorption, structural integrity, and color consistency.

- Test electrical components for safety and performance (if applicable).

- Maintain records of third-party lab testing for compliance audits.

Handling & Training

- Train warehouse and logistics staff on the hygroscopic nature of salt and proper handling procedures.

- Avoid bare-hand contact to prevent oil and moisture transfer.

- Use gloves and dry tools when handling tiles.

Risk Mitigation

- Insure shipments against moisture damage, breakage, and transit loss.

- Include disclaimers on packaging and websites about salt’s sensitivity to humidity.

- Monitor customer feedback for recurring quality or compliance issues.

By following this guide, businesses can ensure that salt tiles are transported, stored, and sold in compliance with global standards while preserving product quality and consumer safety.

In conclusion, sourcing salt tiles requires careful consideration of several key factors including quality, authenticity, supplier reliability, and ethical sourcing practices. It is essential to partner with reputable suppliers who provide transparent information about the origin of the salt, mining methods, and environmental impact. Himalayan salt tiles, in particular, should be verified for their natural pink hue and mineral composition to ensure authenticity. Additionally, evaluating cost-effectiveness, shipping logistics, and compliance with safety and import regulations will contribute to a successful sourcing strategy. By prioritizing sustainability, quality assurance, and long-term supplier relationships, businesses can secure premium salt tiles that meet both consumer expectations and market demands.