The global salt market is experiencing steady growth, driven by rising demand across food and beverage, chemical, pharmaceutical, and industrial applications. According to Grand View Research, the global salt market was valued at USD 18.5 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2030. This growth is fueled by increasing packaged food consumption, water treatment needs, and de-icing activities in colder climates. Additionally, Mordor Intelligence reports that Asia-Pacific dominates both production and consumption, with countries like China and India leading in solar salt production due to favorable geography and low operational costs. As demand continues to rise, a select group of salt distributors and manufacturers are scaling operations, investing in sustainable extraction methods, and expanding distribution networks to meet global supply chain demands. The following list highlights the top 10 salt distributors and manufacturers shaping the industry through innovation, volume, and market reach.

Top 10 Salt Distributors Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Morton Salt

Domain Est. 1998

Website: mortonsalt.com

Key Highlights: United States producer of salt for grocery, water softening, ice control, agricultural and industrial uses….

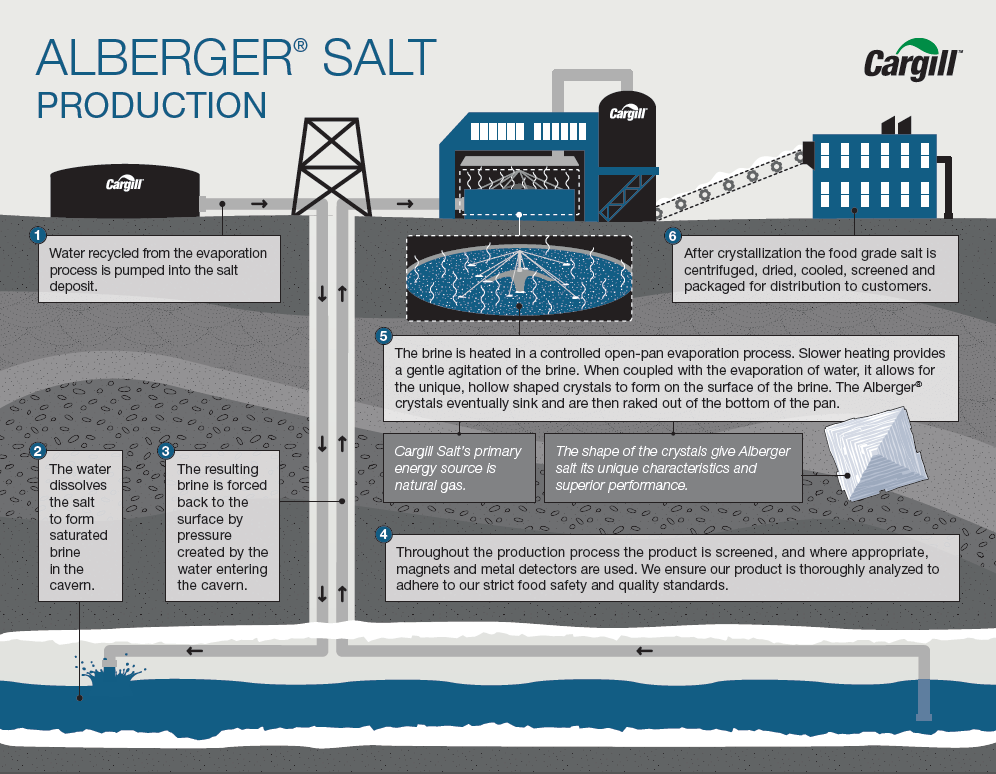

#2 Bulk Salt Ingredient Supplier in US

Domain Est. 1994

Website: cargill.com

Key Highlights: Cargill is a trusted salt and sodium supplier to the food manufacturing and foodservice industries. Full range of salt ingredients to meet your needs….

#3 America’s Sea Salt Company

Domain Est. 1995

Website: seasalt.com

Key Highlights: SaltWorks is America’s Sea Salt Company®. Offering the largest selection of all-natural sea salt in the world, SaltWorks is the most trusted name in artisan ……

#4 National Salt Distributors

Domain Est. 1996

Website: nationalsalt.com

Key Highlights: Whether it’s wholesale or home delivery, National Salt Distributors values your business and we look forward to meeting your Salt and Firewood needs….

#5 Windsor Salt

Domain Est. 1998

Website: windsorsalt.com

Key Highlights: We bring you all the salts for whatever your recipe needs. Whether it’s pickling or seasoning, Windsor® has a salt for your every need….

#6 North American Salt Company is Now Compass Minerals

Domain Est. 2001

Website: compassminerals.com

Key Highlights: As one of the world’s largest salt companies, Compass Minerals produces millions of tons of salt and other minerals annually for snow and ice melting….

#7 Salt Distributors Inc

Domain Est. 2014

Website: saltdistributorsinc.com

Key Highlights: Salt Distributors Inc provides bulk road salt delivery, Icekicker Corrosion Inhibited salt, kiln dried salt for brine and other highway deicing products….

#8 Big Sur Salts

Domain Est. 2015

Website: bigsursalts.com

Key Highlights: 6-day delivery Free 30-day returnsCraft salts by Big Sur Salts. Hand-harvested California sea salts blended with local ingredients. Experience Big Sur via our salts!…

#9 True Salt Co.

Domain Est. 2018

Website: truesaltco.com

Key Highlights: True Salt is a better salt. Our all natural sea salt is rich in minerals for your healthy lifestyle. Elevate your dishes as well as your mind, body, ……

#10 Clarity Salt

Domain Est. 2022

Website: claritysalt.com

Key Highlights: Clarity Salt is the nation’s largest wholesaler of water softener salt, ice melt and rock salt, food grade salt, agricultural salt, pool salt, and reverse ……

Expert Sourcing Insights for Salt Distributors

2026 Market Trends for Salt Distributors: H2 Analysis

The salt distribution landscape in H2 2026 is being reshaped by converging consumer, regulatory, technological, and geopolitical forces. Distributors must adapt strategically to maintain margins and market share. Here’s a breakdown of the key trends:

1. Intensifying Focus on Health & Wellness (Driven by Consumer Demand)

* Low-Sodium & Mineral-Enriched Dominance: Demand for low-sodium alternatives (potassium chloride blends, sea salt flakes with lower NaCl) and salts fortified with minerals (iodine, magnesium, iron) continues to surge. Distributors must expand portfolios beyond basic iodized salt.

* “Clean Label” & Transparency: Consumers demand minimal processing and clear origin labeling. Distributors benefit from sourcing and promoting sea salts, Himalayan pink salt, and artisanal salts with verifiable provenance and simple ingredient lists. Traceability systems are becoming a competitive advantage.

* Functional Benefits: Growth in salts marketed for specific benefits (e.g., electrolyte balance, digestion support) creates niche opportunities for distributors to partner with specialized brands.

2. Sustainability & Ethical Sourcing as Non-Negotiables

* Supply Chain Scrutiny: Retailers and foodservice operators demand proof of sustainable harvesting practices (e.g., solar evaporation vs. energy-intensive methods), minimal environmental impact (wetland protection), and ethical labor certifications (Fair Trade, B Corp). Distributors face pressure to audit and report on their suppliers.

* Packaging Revolution: Significant shift towards recyclable (glass, paper-based composites) and compostable packaging. Distributors are incentivized to consolidate shipments, optimize logistics, and offer bulk/refill options to reduce plastic waste. “Plastic-free” salt lines are gaining traction.

* Water Stewardship: Increased focus on the water footprint of salt production, especially in water-scarce regions. Distributors favor suppliers with closed-loop water systems.

3. Geopolitical & Supply Chain Volatility (Persistent Challenge)

* Trade Fluctuations & Tariffs: Ongoing geopolitical tensions and potential shifts in trade agreements (e.g., related to major producers like China, India) continue to impact import costs and availability. Distributors need diversified sourcing strategies and robust risk management.

* Climate Change Impacts: Extreme weather events (droughts affecting evaporation ponds, floods disrupting logistics) pose tangible risks to production and transportation. Distributors are investing in more resilient supply chains and exploring regional sourcing where feasible.

* Energy Cost Sensitivity: Energy-intensive production methods (rock salt mining, vacuum evaporation) make salt prices sensitive to energy market swings. Distributors must manage cost pass-through mechanisms carefully.

4. Technological Integration & Operational Efficiency

* Digital Platforms & E-commerce Growth: B2B e-commerce platforms for salt distribution (especially industrial/foodservice) are maturing, offering streamlined ordering, tracking, and inventory management. Direct-to-consumer (DTC) channels for premium salts require distributors to support brands with fulfillment expertise.

* Supply Chain Visibility: Adoption of IoT sensors and blockchain for tracking salt from mine/pond to end-customer enhances traceability, quality control, and meets compliance demands. Distributors leveraging this tech gain trust.

* Data-Driven Inventory Management: Advanced analytics optimize stock levels, reduce waste (especially for hygroscopic salts), and improve forecasting accuracy amidst volatile demand.

5. Industrial & Food Manufacturing Evolution

* Alternative Salts in Processed Foods: Food manufacturers increasingly reformulate to reduce sodium, driving demand for potassium-based salt substitutes and flavor enhancers that allow lower NaCl usage. Distributors need technical knowledge to support these applications.

* Water Treatment & De-icing Demand: Stable demand in municipal water softening and winter de-icing remains crucial. However, environmental regulations on chloride runoff are tightening, pushing distributors towards more eco-friendly de-icing alternatives or promoting responsible usage practices.

* Specialty Applications: Growth in niche industrial uses (e.g., batteries, chemical processes) creates opportunities for distributors with technical sales expertise.

Strategic Implications for Salt Distributors (H2 2026):

- Diversify & Differentiate: Move beyond commoditized rock salt. Build portfolios around health-focused, sustainable, and specialty salts.

- Invest in Transparency: Implement robust traceability systems and secure credible sustainability certifications for key product lines.

- Embrace Technology: Leverage digital platforms for sales, logistics, and customer service. Utilize data analytics for efficiency.

- Strengthen Supply Chain Resilience: Diversify suppliers, build strategic inventory buffers for critical products, and develop contingency plans for disruptions.

- Become a Solutions Partner: Offer technical support, sustainability reporting data, and innovative packaging/logistics solutions to retain and attract high-value clients (retailers, foodservice, manufacturers).

- Navigate Regulations Proactively: Stay ahead of evolving food safety, labeling, and environmental regulations globally.

Conclusion:

H2 2026 presents a complex but navigable environment for salt distributors. Success will favor those who proactively transform from passive commodity movers into value-added partners focused on sustainability, health, transparency, and technological efficiency. The core commodity remains essential, but the way it is sourced, distributed, and marketed is undergoing fundamental change. Distributors who adapt will capture growth; those who don’t risk commoditization and margin erosion.

Common Pitfalls When Sourcing Salt Distributors (Quality, IP)

Sourcing salt distributors involves more than just finding a supplier with competitive pricing. Two critical areas prone to pitfalls are product quality consistency and intellectual property (IP) considerations, especially when dealing with private-label or specialty salt products.

Quality-Related Pitfalls

Inconsistent Product Specifications

Salt can vary significantly in grain size, moisture content, purity, and trace mineral composition. A common pitfall is working with distributors who cannot consistently meet defined specifications across batches. This variability can disrupt manufacturing processes and compromise end-product quality, particularly in food production or industrial applications.

Lack of Traceability and Certification

Sourcing from distributors without proper certifications (e.g., ISO, HACCP, FDA compliance, or organic certifications) increases the risk of contamination or non-compliance. Distributors without transparent supply chains may obscure the origin of salt, making it difficult to verify ethical sourcing or regulatory adherence.

Poor Packaging and Storage Practices

Salt is hygroscopic and prone to clumping or contamination if not stored and transported properly. Distributors using substandard packaging or inadequate warehousing may deliver degraded product, affecting usability and shelf life.

Insufficient Testing and Quality Control

Some distributors may lack in-house quality control labs or third-party testing protocols. Relying solely on supplier declarations without verifiable test reports opens the door to receiving salt with impurities (e.g., heavy metals, unwanted minerals) or incorrect iodine levels in iodized salt.

Intellectual Property (IP)-Related Pitfalls

Unauthorized Use of Branding or Formulations

When private-labeling salt products, companies risk IP infringement if the distributor replicates or resells the same formulation or packaging to competitors. Failure to secure proper contractual agreements can result in loss of market exclusivity.

Lack of IP Clauses in Contracts

Many sourcing agreements overlook IP ownership, especially concerning custom blends, packaging designs, or proprietary processing methods. Without clear terms, the distributor may claim partial rights or use similar IP in other client offerings.

Counterfeit or Misrepresented Products

Some distributors may misrepresent the origin or type of salt (e.g., labeling standard sea salt as “Himalayan pink salt”)—constituting both quality fraud and potential trademark or geographical indication (GI) violations. This exposes the buyer to legal risk and reputational damage.

Inadequate Protection of Trade Secrets

Sharing proprietary blending techniques or packaging innovations with a distributor without non-disclosure agreements (NDAs) or confidentiality clauses can lead to IP leakage or industrial espionage.

To mitigate these risks, conduct thorough due diligence, audit supplier facilities, require comprehensive certifications, and establish legally binding contracts that explicitly address quality standards and IP ownership.

Logistics & Compliance Guide for Salt Distributors

This guide outlines essential logistics and compliance considerations for salt distributors to ensure efficient operations and adherence to regulatory standards.

Supply Chain Management

Establish reliable relationships with salt suppliers, ensuring consistent quality and volume. Implement inventory management systems to track stock levels, prevent shortages, and minimize overstocking. Utilize demand forecasting to optimize procurement and distribution schedules.

Transportation and Storage

Use appropriate transportation methods based on salt type (e.g., bulk trucks for industrial salt, climate-controlled vehicles for food-grade salt). Store salt in dry, well-ventilated facilities to prevent clumping and contamination. Segregate food-grade salt from industrial or de-icing salt to avoid cross-contamination.

Regulatory Compliance

Adhere to all local, national, and international regulations. For food-grade salt, comply with FDA (U.S.), EFSA (EU), or equivalent food safety standards. Ensure packaging and labeling meet requirements, including ingredient lists, sodium content, allergen information, and country of origin. Industrial salts must meet relevant safety and environmental regulations.

Product Labeling and Traceability

Clearly label all salt products with batch numbers, production dates, expiration (if applicable), and usage instructions. Maintain a traceability system to track salt from source to end customer in case of recalls or audits.

Safety and Handling

Train staff in safe handling procedures, especially when dealing with bulk salt or iodized variants. Provide appropriate personal protective equipment (PPE) where necessary. Follow OSHA (or equivalent) guidelines for workplace safety in storage and distribution centers.

Environmental and Sustainability Practices

Minimize packaging waste and explore recyclable or reusable materials. Adhere to environmental regulations for salt storage near sensitive ecosystems, particularly for de-icing salt to prevent soil and water contamination. Document and report any environmental incidents promptly.

Documentation and Recordkeeping

Maintain accurate records of supplier certifications, inspection reports, shipping manifests, and compliance audits. Retain documentation for a minimum of five years, or as required by local regulations.

Quality Assurance

Implement a quality control program including periodic testing for purity, moisture content, and iodine levels (where applicable). Conduct regular facility and equipment inspections to ensure hygiene and operational efficiency.

By following this guide, salt distributors can ensure regulatory compliance, maintain product integrity, and support safe, efficient delivery across the supply chain.

In conclusion, sourcing salt distributors requires a strategic approach that balances quality, reliability, cost-efficiency, and logistical feasibility. It is essential to evaluate potential suppliers based on their production standards, regulatory compliance, distribution capabilities, and track record for timely delivery. Building strong relationships with reputable distributors ensures consistent supply, especially important given salt’s critical role in industries ranging from food processing to de-icing and chemical manufacturing. Conducting thorough due diligence, comparing multiple suppliers, and considering both local and international options will help secure a resilient and scalable supply chain. Ultimately, selecting the right salt distributor supports operational efficiency, cost management, and long-term business sustainability.