The global automotive suspension market is experiencing steady growth, driven by increasing demand for enhanced vehicle ride comfort, safety, and performance. According to Grand View Research, the market was valued at USD 38.5 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030. A significant segment of this market is dominated by premium suspension systems, especially those derived from or inspired by the engineering legacy of Erich Paulander and the Sachs brand—renowned for pioneering hydraulic damper technology. With the ongoing trend toward advanced driver assistance systems (ADAS), electric vehicles (EVs), and adaptive suspension adoption, manufacturers building on the Sachs heritage continue to lead in innovation and market share. Here are the top 5 Sachs-affiliated or Sachs-influenced suspension manufacturers shaping the future of ride dynamics.

Top 5 Sachs Suspension Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Sachs Shocks & Auto Parts

Domain Est. 2010

Website: fcpeuro.com

Key Highlights: Free delivery over $49.02Sachs specializes in shock absorbers and clutches including as an OEM (original equipment manufacturer) and aftermarket supplier for most European car bran…

#2 Sachs Shocks

Domain Est. 2000

Website: bimmerforums.com

Key Highlights: OEM sachs will work just fine. When new, they are most definitely not spongy, nor do they make the car wallow around. They’re fine. I dunno how ……

#3 Sachs Parts

Domain Est. 2001

Website: buyautoparts.com

Key Highlights: The state-of-the-art line of Sachs’ products includes clutches, dampers, shock absorbers, clutch actuation systems and dual-mass flywheels. The brand’s parts ……

#4 SACHS

Domain Est. 1996

Website: aftermarket.zf.com

Key Highlights: SACHS products are manufactured from high-quality materials and reflect the state of the art. They stand for high performance and reliability….

#5 ZF SACHS Performance

Domain Est. 2007

Website: sachsperformance.com

Key Highlights: Performance Clutch Kits from ZF SACHS deliver more transmittable torque and more stability, longer life and superior thermal resistance….

Expert Sourcing Insights for Sachs Suspension

H2 2026 Market Trends Analysis for Sachs Suspension

Based on current industry trajectories, technological advancements, and macroeconomic factors, the second half of 2026 presents a dynamic and potentially transformative market environment for Sachs Suspension (ZF Aftermarket Division). Key trends shaping the landscape include:

1. Accelerated Electrification & Vehicle Platform Evolution

- Trend: By H2 2026, BEV (Battery Electric Vehicle) and PHEV (Plug-in Hybrid) adoption will be significantly higher, with a growing number of dedicated EV platforms dominating new sales. These platforms feature unique weight distributions, unsprung mass challenges, and integration requirements for suspension systems.

- Impact on Sachs: Demand will shift towards Sachs solutions optimized for EVs. This includes:

- Enhanced Durability: Components designed for higher curb weights and different load cycles.

- Integrated Systems: Growth in demand for Sachs CDC (Continuous Damping Control) and other semi-active/active systems that compensate for EV ride height and handling quirks.

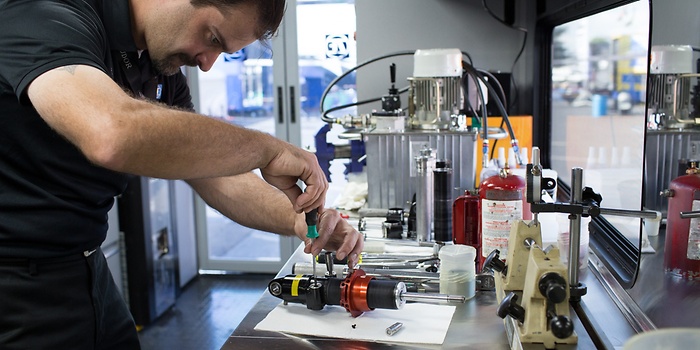

- Aftermarket Complexity: Increased need for specialized diagnostic tools and training for technicians servicing integrated electronic suspension on EVs.

2. Dominance of Advanced Driver Assistance Systems (ADAS) & Connectivity

- Trend: ADAS features (adaptive cruise, lane keeping, automated emergency braking) are standard, relying heavily on precise vehicle dynamics data. Vehicle-to-Everything (V2X) connectivity begins wider rollout.

- Impact on Sachs: Suspension systems are critical ADAS enablers. Sachs will see:

- Sensor Integration: Higher demand for Sachs dampers and struts with integrated sensors (position, acceleration) feeding data to ADAS/AD (Autonomous Driving) control units. Sachs CDC systems are inherently data-rich.

- Predictive Maintenance: Leveraging real-time suspension data (via Sachs systems) for predictive maintenance alerts (e.g., impending damper wear) becomes a key aftermarket service offering.

- Calibration Dependency: Suspension repairs (especially alignment and replacement) require sophisticated ADAS recalibration, increasing the value of Sachs’ technical support and training programs.

3. Sustainability & Circular Economy Pressure

- Trend: Regulatory pressure (EU Green Deal, extended producer responsibility) and consumer demand for sustainability intensify. Focus shifts to lifecycle management, remanufacturing, and material choices.

- Impact on Sachs:

- Remanufactured/Refurbished Growth: Strong market for high-quality Sachs remanufactured shock absorbers and struts, offering cost and environmental benefits. Sachs’ established reman capabilities are a major asset.

- Material Innovation: Increased R&D focus on recyclable materials, reduced friction coatings, and designs facilitating disassembly.

- Battery for ADAS: Marketing emphasis on the longevity and repairability of Sachs systems (especially CDC) vs. full replacement, aligning with circular economy goals.

4. Consolidation in the Aftermarket & Digitalization

- Trend: Further consolidation among distributors, retailers, and workshops. E-commerce for parts (including complex assemblies) matures. AI-driven inventory management and digital repair workflows become standard.

- Impact on Sachs:

- Direct & Strategic Partnerships: Need for closer relationships with large distributor networks and major e-commerce platforms (OEM parts portals, large online retailers).

- Digital Product Integration: Seamless integration of Sachs part numbers, technical data, installation guides, and ADAS calibration specs into workshop management software and online catalogs.

- Data-Driven Services: Offering value-added digital services (e.g., remote diagnostic support for CDC systems, digital warranty management) to differentiate from commoditized parts.

5. Supply Chain Resilience & Geopolitical Factors

- Trend: Ongoing focus on supply chain diversification and nearshoring/reshoring, driven by past disruptions and geopolitical tensions. Energy costs remain a consideration.

- Impact on Sachs: ZF’s global footprint provides resilience, but Sachs must:

- Optimize Logistics: Ensure efficient distribution networks, particularly for time-sensitive remanufactured parts.

- Local Production/Reman: Leverage local remanufacturing facilities (e.g., in NA, EU) to reduce lead times and carbon footprint.

- Cost Management: Navigate potential fluctuations in energy and raw material costs, potentially influencing pricing strategies.

Conclusion for H2 2026:

Sachs Suspension is well-positioned to capitalize on key H2 2026 trends, leveraging its technological leadership (especially in CDC), strong remanufacturing infrastructure, and ZF’s systems integration expertise. Success will depend on:

- Agile EV Focus: Rapidly expanding and marketing the EV-optimized product portfolio.

- Data & Service Monetization: Effectively leveraging suspension system data for predictive services and enhancing digital support.

- Sustainability Leadership: Promoting remanufactured parts and transparent sustainability initiatives.

- Digital Ecosystem Integration: Ensuring seamless digital presence across the entire value chain.

- Strategic Channel Management: Adapting to a consolidated aftermarket landscape.

The H2 2026 market favors Sachs’ strengths in technology, systems, and sustainability, but requires continued innovation and adaptation to the evolving digital and EV-dominated landscape.

Common Pitfalls When Sourcing Sachs Suspension Components

Quality Inconsistencies with Non-OEM Suppliers

One of the most significant risks when sourcing Sachs suspension parts is encountering inconsistent quality from third-party or aftermarket suppliers. While genuine Sachs components are engineered to meet strict OEM (Original Equipment Manufacturer) standards, many alternative suppliers offer lower-cost replicas or rebranded units that may use inferior materials, substandard manufacturing processes, or lack proper calibration. These components often wear out faster, deliver poor ride performance, or fail prematurely under stress, leading to safety concerns and increased long-term costs due to frequent replacements.

Intellectual Property (IP) and Counterfeit Risk

Sachs is a well-known brand under ZF Aftermarket, and its suspension products—including shocks, struts, and complete assemblies—are protected by trademarks and technical patents. When sourcing from unverified suppliers, especially in gray markets or through online marketplaces, there’s a high risk of receiving counterfeit parts that infringe on Sachs’ intellectual property. These fake components not only violate IP laws but also bypass critical safety and performance testing. Buyers may inadvertently support illegal operations and expose themselves to liability, particularly in commercial or fleet applications where component traceability and compliance are essential. Always verify supplier authenticity and demand proper documentation to ensure genuine Sachs parts.

Logistics & Compliance Guide for Sachs Suspension

This guide outlines the essential logistics and compliance procedures for handling Sachs Suspension products throughout the supply chain. Adherence to these guidelines ensures efficient operations, regulatory compliance, and product integrity.

Supply Chain Overview

Sachs Suspension products move through a structured supply chain involving manufacturing plants, distribution centers, regional warehouses, and end customers (OEMs and aftermarket distributors). Understanding each stage is critical for maintaining consistency and meeting delivery expectations.

Packaging & Labeling Requirements

All Sachs Suspension components must be packed according to standardized protocols:

– Use only approved packaging materials to prevent damage during transit.

– Label each unit with a unique barcode, product identification number (P/N), batch/lot number, and country of origin.

– Include hazard symbols if applicable (e.g., for shock absorbers containing pressurized gas).

– Ensure multilingual labeling for international shipments as required by destination country regulations.

Transportation & Handling

- Use vehicles equipped with load-securing mechanisms to prevent shifting during transit.

- Avoid exposure to extreme temperatures, moisture, and corrosive environments.

- Handle products with care; do not drop or stack beyond recommended weight limits.

- Implement FIFO (First In, First Out) inventory practices at all storage points.

Import/Export Compliance

Shipments crossing international borders must comply with the following:

– Accurate completion of commercial invoices, packing lists, and certificates of origin.

– Adherence to Incoterms® 2020 (typically EXW, FCA, or DAP based on customer agreement).

– Compliance with export control regulations, including EAR (Export Administration Regulations) when applicable.

– Classification under correct HS (Harmonized System) codes for customs clearance.

Regulatory & Safety Standards

Sachs Suspension products must meet global and regional regulatory standards:

– ISO 9001 and IATF 16949 for quality management.

– Compliance with regional automotive safety standards (e.g., ECE R9, FMVSS 127).

– RoHS and REACH compliance for material substances.

– Documentation of conformity (DoC) available upon request.

Documentation & Traceability

Maintain complete and accurate records for traceability:

– Batch and serial number tracking from production to delivery.

– Retain shipping documents, customs filings, and quality inspection reports for a minimum of 7 years.

– Utilize SAP or designated ERP system for real-time inventory and shipment tracking.

Returns & Reverse Logistics

- Return requests must be pre-authorized via the Sachs Returns Portal.

- Returned goods must be in original packaging with all components and labels intact.

- Inspect returned items for damage or tampering; document findings and disposition (repair, recycle, scrap).

- Update inventory and compliance records accordingly.

Sustainability & Environmental Responsibility

- Optimize transport routes to reduce carbon emissions.

- Recycle packaging materials and encourage suppliers and partners to do the same.

- Comply with WEEE (Waste Electrical and Electronic Equipment) directives where applicable.

- Report environmental performance metrics annually.

Training & Audits

- Conduct regular training for logistics and warehouse staff on compliance procedures.

- Perform internal audits quarterly to verify adherence to logistics and regulatory standards.

- Address non-conformities promptly and implement corrective actions.

For questions or support, contact the Sachs Global Logistics Team at [email protected].

Conclusion for Sourcing Sachs Suspension Components:

In conclusion, sourcing Sachs suspension components presents a strategic advantage for ensuring high-quality, reliable, and performance-driven vehicle handling. As a reputable brand under the ZF Group, Sachs is globally recognized for its innovation, rigorous engineering standards, and extensive OEM experience. Sourcing genuine Sachs products ensures access to advanced damping technology, durability, and compatibility across a wide range of vehicle makes and models.

However, it is essential to establish partnerships with authorized distributors or direct suppliers to avoid counterfeit products and ensure authenticity. While Sachs parts may come at a premium compared to aftermarket alternatives, the long-term benefits—such as enhanced ride comfort, improved safety, extended service life, and reduced maintenance costs—justify the investment.

Additionally, aligning with Sachs supports compliance with industry standards and contributes to customer satisfaction, particularly in markets that prioritize original equipment quality. Therefore, for automotive service providers, OEMs, or fleet operators, sourcing Sachs suspension systems is a sound decision that balances performance, reliability, and brand trust.