The global rubber clothing market has experienced steady expansion in recent years, driven by increasing demand for protective wear in industrial, healthcare, and outdoor sectors. According to a 2023 report by Mordor Intelligence, the global rubber and plastic clothing market is projected to grow at a CAGR of approximately 5.8% from 2023 to 2028, fueled by rising safety regulations and growing infrastructure and chemical processing activities across Asia-Pacific and North America. Similarly, Grand View Research valued the global protective clothing market at USD 8.7 billion in 2022, with rubber-based garments representing a significant segment due to their impermeability, durability, and resistance to harsh chemicals. As industries prioritize worker safety and performance-driven apparel, sourcing from reliable, high-capacity manufacturers has become critical. Based on production volume, export data, and compliance with international quality standards such as ISO and EN, the following list highlights the top 10 rubber garment manufacturers shaping the global supply landscape.

Top 10 Rubber Garment Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Lavelle Industries

Domain Est. 1995

Website: lavelle.com

Key Highlights: Lavelle Industries is a Made in USA, USMCA-compliant OEM rubber manufacturer that designs and produces high-performance rubber and plastic components….

#2 Industrial Rubber Products Supplier

Domain Est. 1996

Website: midatlanticrubber.com

Key Highlights: Mid-Atlantic Rubber is a manufacturer and supplier of industrial rubber products. We carry a collection of rubber grommets, bushings, bumpers, extrusions ……

#3 Rubber & Buna

Domain Est. 1998

Website: minorrubber.com

Key Highlights: Minor Rubber is a rubber grommet manufacturer. We manufacture a wide assortment of high-quality rubber grommets to fit most industrial applications….

#4 Custom Rubber Products & Plastic Parts Manufacturer

Domain Est. 1996 | Founded: 1961

Website: viprubber.com

Key Highlights: Get high-quality, custom rubber and plastic products from VIP Rubber Co., a leading manufacturer since 1961. Contact us for a quote and see how we can meet ……

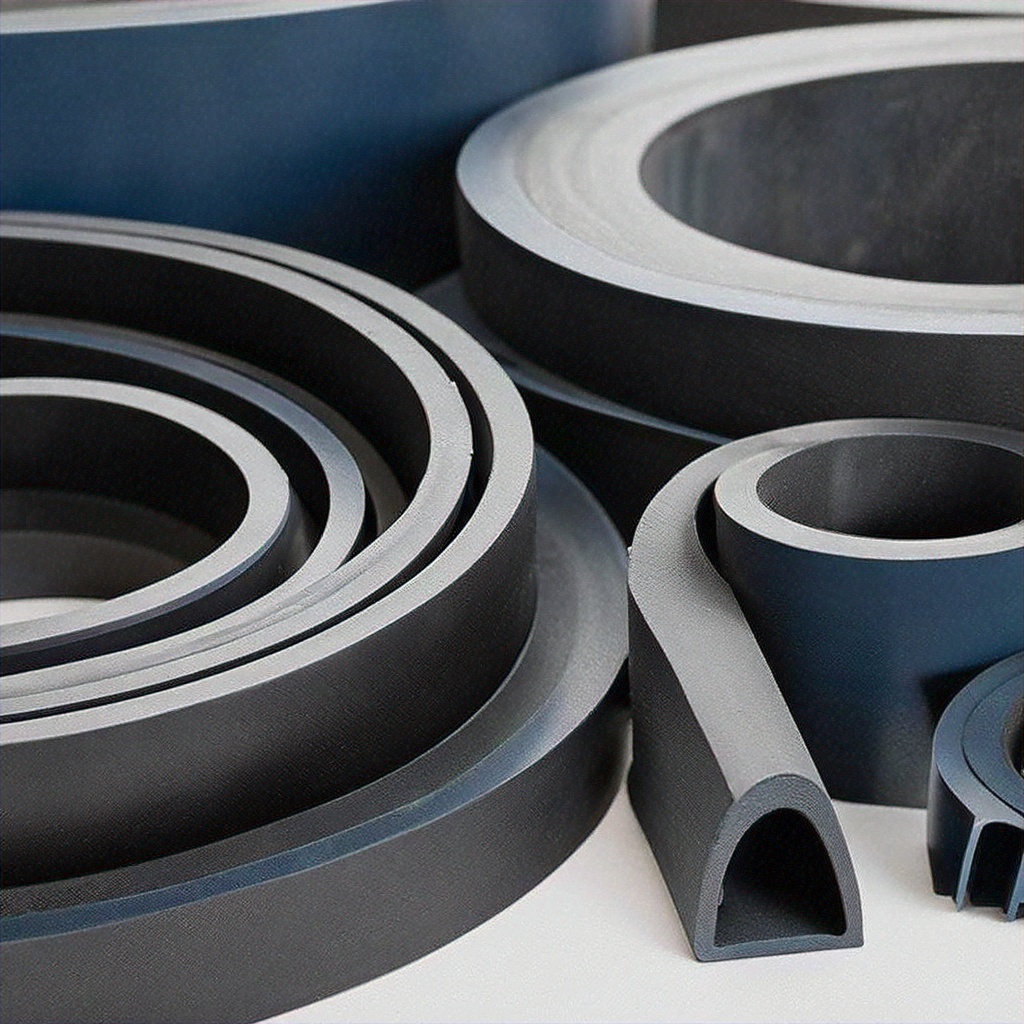

#5 National Rubber Corporation

Domain Est. 1998

Website: nationalrubber.com

Key Highlights: Leading manufacturer of custom rubber products, gaskets, seals, and molded components for aerospace, automotive, appliance, and chemical processing ……

#6 American Rubber Products

Domain Est. 2008

Website: americanrubberproducts.com

Key Highlights: American Rubber Products is an industry leading manufacturer of rubber coated fabric and quality engineered elastomer for nearly 40 years….

#7 Rubber Grommets

Domain Est. 2019

Website: rubber-grommet.com

Key Highlights: We are a professional rubber grommets manufacturer with over 20 years of experience, producing more than 18000 types of rubber products for our customers….

#8 Global Rubber Manufacturing Excellence by Fulflex

Domain Est. 1997

Website: fulflex.com

Key Highlights: #1 Global leader in manufacturing thin gauge calendered rubber sheeting. 100+ Years of collective experience….

#9 Bryant Rubber

Domain Est. 1998

Website: bryantrubber.com

Key Highlights: At Bryant Rubber, we pride ourselves on being the industry leader in providing high quality, tight tolerance precision molded components….

#10 Rubfila International

Domain Est. 2001

Website: rubfila.com

Key Highlights: Prime use of the Rubber Thread is to manufacture various types of elastic tapes mainly for foundation garments (briefs, trunks, panties, brassieres), shorts ……

Expert Sourcing Insights for Rubber Garment

2026 Market Trends for Rubber Garments

The global rubber garment market is poised for notable transformation by 2026, driven by evolving consumer preferences, technological advancements, sustainability imperatives, and shifts in industrial and fashion applications. This analysis explores key trends expected to shape the industry in the coming years, with a focus on innovation, market dynamics, regional developments, and environmental considerations.

Growing Demand in Protective and Industrial Applications

One of the primary drivers of the rubber garment market in 2026 will be the sustained demand from industrial and protective wear sectors. Rubber garments—such as gloves, aprons, boots, and full-body suits—are critical in industries including healthcare, chemical manufacturing, construction, and utilities due to their resistance to water, oils, acids, and electrical hazards.

By 2026, stricter occupational health and safety regulations across North America, Europe, and parts of Asia-Pacific are expected to increase procurement of high-performance rubber protective wear. The healthcare sector, still influenced by pandemic-era preparedness, will continue to prioritize disposable and reusable rubber-based PPE, especially nitrile and neoprene variants, which offer superior protection over traditional latex.

Innovation in Material Technology and Blends

Material innovation will be a defining trend in the rubber garment space. By 2026, manufacturers are expected to increasingly adopt advanced synthetic rubbers—including EPDM, silicone rubber, and hydrogenated nitrile (HNBR)—for enhanced durability, flexibility, and chemical resistance. These materials offer better performance in extreme temperatures and prolonged exposure scenarios.

Additionally, hybrid garments combining rubber with breathable textiles or smart fabrics are emerging. These composites aim to solve long-standing issues of heat retention and discomfort associated with traditional rubber wear. For instance, waterproof rubber-coated textiles with moisture-wicking linings are gaining traction in outdoor and emergency response apparel.

Sustainability and Eco-Friendly Alternatives

Environmental concerns are reshaping the rubber garment industry. By 2026, pressure from regulators and consumers will push companies to reduce reliance on petroleum-based synthetic rubbers and explore bio-based or recyclable alternatives. Natural rubber, sourced from sustainably managed plantations (e.g., FSC-certified), will see renewed interest, especially in eco-conscious fashion markets.

Moreover, closed-loop recycling programs and biodegradable rubber compounds are expected to emerge as competitive differentiators. Startups and established brands alike will focus on reducing the carbon footprint of rubber production and garment manufacturing processes, aligning with ESG goals and circular economy principles.

Fashion and Lifestyle Sector Revival

Beyond utility, rubber garments are experiencing a resurgence in the fashion industry. Designers are embracing rubber and latex materials for avant-garde collections, driven by bold aesthetics and waterproof functionality. By 2026, this trend is expected to expand beyond niche markets into mainstream streetwear and outerwear, particularly in urban centers like Tokyo, London, and New York.

Innovations in matte finishes, color stability, and soft-touch coatings will make rubber garments more wearable and less associated with fetish wear. Brands may also integrate rubber elements into hybrid designs—such as rubber-trimmed coats or rainwear with rubberized seams—enhancing both style and practicality.

Regional Market Dynamics

Asia-Pacific is projected to dominate the rubber garment market by 2026, supported by strong manufacturing bases in Malaysia, Thailand, and India—key producers of natural rubber. China and Vietnam will remain critical hubs for both industrial and fashion-oriented rubber garment production, benefiting from cost-effective labor and integrated supply chains.

In contrast, North America and Europe will lead in high-value, technologically advanced rubber wear, particularly in sectors like healthcare and emergency services. These regions will also set benchmarks in sustainable production, driving global standards.

Emerging markets in Latin America and Africa are expected to see gradual growth, fueled by improving healthcare infrastructure and rising industrial activity.

Supply Chain Resilience and Digital Integration

Post-pandemic supply chain lessons will culminate in more resilient and digitally integrated rubber garment supply chains by 2026. Companies will increasingly adopt AI-driven demand forecasting, blockchain for traceability (especially in sustainable rubber sourcing), and automation in manufacturing to improve efficiency and reduce lead times.

Nearshoring and regionalization strategies may also gain momentum, reducing dependency on single-source suppliers and mitigating geopolitical risks.

Conclusion

By 2026, the rubber garment market will be shaped by a convergence of safety requirements, material innovation, sustainability demands, and fashion-forward applications. Companies that invest in eco-conscious materials, digital supply chains, and product diversification will be best positioned to capture growth across industrial, healthcare, and consumer segments. As functionality meets fashion and responsibility, rubber garments will evolve from utilitarian wear to high-performance, sustainable apparel solutions.

Common Pitfalls in Sourcing Rubber Garments: Quality and Intellectual Property Risks

Sourcing rubber garments—such as raincoats, waders, industrial protective wear, or fashion pieces—can present unique challenges, particularly concerning material quality and intellectual property (IP) protection. Failing to address these issues can lead to product failures, customer dissatisfaction, legal disputes, and reputational damage. Below are key pitfalls to avoid.

Poor Material Quality and Inconsistent Manufacturing

One of the most frequent issues in rubber garment sourcing is inconsistent or substandard material quality. Natural and synthetic rubber can vary significantly in durability, elasticity, and resistance to environmental factors. Suppliers may use lower-grade rubber or improper vulcanization processes, resulting in garments that crack, degrade quickly, or fail under stress. Additionally, inconsistent thickness, poor seam sealing, or inadequate bonding between rubber and fabric layers can compromise performance, especially in protective or outdoor use cases.

Lack of Compliance with Safety and Environmental Standards

Rubber garments, especially those used in industrial or medical settings, must meet specific safety and environmental regulations (e.g., REACH, RoHS, OSHA, or EN standards). Sourcing from suppliers who do not adhere to these requirements exposes buyers to regulatory risks, product recalls, and potential liability. Some suppliers may falsify certifications or use restricted chemicals to cut costs, undermining both product safety and compliance.

Inadequate Testing and Quality Control Procedures

Many suppliers lack robust in-house testing capabilities or fail to implement consistent quality control protocols. Without proper batch testing for tensile strength, water resistance, chemical resistance, and aging performance, defects may go undetected until after shipment. Relying solely on supplier-provided certificates without third-party verification increases the risk of receiving non-conforming products.

Intellectual Property Infringement

Sourcing rubber garments—particularly fashion or branded protective wear—poses significant IP risks. Buyers may inadvertently source counterfeit designs, patented technologies, or trademarked patterns without authorization. This is especially common when working with manufacturers who replicate popular designs without licensing. Using such products can lead to cease-and-desist orders, customs seizures, or lawsuits, particularly in markets with strong IP enforcement like the EU or the US.

Unprotected Design and Innovation

On the flip side, buyers who develop custom rubber garment designs risk having their IP copied if proper safeguards are not in place. Without confidentiality agreements (NDAs), design patents, or clear contractual terms, suppliers may replicate and sell the designs to competitors. This is particularly prevalent in regions with weaker IP enforcement, where manufacturing partners may produce “ghost goods” or unauthorized duplicates.

Supply Chain Transparency and Traceability Gaps

Many rubber garment supply chains lack transparency, making it difficult to trace the origin of raw materials or verify ethical sourcing practices. This opacity can lead to reputational risks, especially if rubber is sourced from environmentally sensitive areas or involves unethical labor practices. Buyers may also struggle to ensure consistent quality when materials come from unverified sub-suppliers.

Overlooking Long-Term Performance and Durability

Rubber garments are often expected to perform under harsh conditions over extended periods. However, some suppliers prioritize upfront cost savings over long-term durability. Without accelerated aging tests or real-world performance validation, buyers may discover that garments deteriorate prematurely due to ozone exposure, UV radiation, or repeated flexing—leading to high return rates and customer complaints.

Failure to Secure IP Rights in Contracts

Even when working with legitimate manufacturers, buyers often neglect to include explicit IP ownership clauses in sourcing agreements. This can result in disputes over who owns tooling, molds, patterns, or custom formulations developed during production. Without clear terms, suppliers may retain rights to use or license these assets, limiting the buyer’s exclusivity and competitive advantage.

By proactively addressing these pitfalls—through rigorous supplier vetting, third-party testing, strong contractual protections, and IP due diligence—businesses can mitigate risks and ensure the successful sourcing of high-quality, legally compliant rubber garments.

Logistics & Compliance Guide for Rubber Garments

Product Classification & HS Code

Rubber garments, including items like raincoats, aprons, gloves, and protective wear made primarily of natural or synthetic rubber, are classified under the Harmonized System (HS) for international trade. The most common HS codes include:

– 4015: Articles of apparel and clothing accessories (other than gloves, mittens, and mitts) made of vulcanized rubber.

– 4016: Other articles of vulcanized rubber (non-hard rubber), which may include certain protective rubber garments.

– 6116.10 / 6216.00: For rubber gloves classified under apparel (knitted or woven).

Ensure correct classification based on material composition, function, and country-specific tariff schedules to avoid customs delays or penalties.

Import/Export Regulations

Compliance with import and export regulations is critical for rubber garments. Key considerations include:

– Country-Specific Restrictions: Some countries impose restrictions on rubber imports due to environmental or health concerns. Verify import policies in destination markets.

– Permits and Licenses: Certain rubber-based protective clothing (e.g., industrial safety wear) may require special import permits or conformity certifications.

– Quotas and Tariffs: Monitor tariff rates and quota limitations that may apply, especially under trade agreements or sanctions.

Safety & Chemical Compliance

Rubber garments may contain chemicals subject to global regulations:

– REACH (EU): Ensure compliance with Registration, Evaluation, Authorization, and Restriction of Chemicals. Restrict substances like phthalates, PAHs (polycyclic aromatic hydrocarbons), and certain accelerators (e.g., MBT).

– RoHS (EU): If the garment includes electronic components (e.g., heated rubber clothing), compliance with Restriction of Hazardous Substances is required.

– Proposition 65 (California, USA): Disclose the presence of listed chemicals such as latex or processing agents that may pose health risks.

– EN Standards (Europe): Protective rubber clothing must meet relevant EN standards (e.g., EN 340 for protective clothing general requirements, EN 14321 for chemical protection).

Labeling & Packaging Requirements

Accurate labeling and durable packaging are essential for global compliance:

– Fiber Content: Clearly label material composition (e.g., “100% Chloroprene Rubber” or “Natural Rubber Blend”).

– Care Instructions: Include washing, drying, and storage guidance to prevent degradation.

– Country of Origin: Mandatory in most markets (e.g., “Made in Vietnam”).

– Safety Warnings: Include allergy warnings (e.g., “Contains Natural Rubber Latex – May Cause Allergic Reactions”).

– Packaging: Use moisture-resistant, non-reactive packaging to prevent mold and maintain integrity during transit.

Transportation & Storage

Rubber is sensitive to environmental conditions; proper handling is essential:

– Temperature Control: Store and transport between 10–25°C (50–77°F); avoid extreme heat or cold to prevent hardening or softening.

– UV Protection: Shield from direct sunlight to reduce ozone cracking and degradation.

– Ventilation: Ensure breathable packaging or pallet spacing to avoid condensation and mold.

– Stacking & Weight Limits: Avoid excessive stacking pressure which can deform garments.

Customs Documentation

Prepare complete documentation to ensure smooth customs clearance:

– Commercial Invoice (with HS codes, value, and product description)

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Origin (to claim preferential tariffs under trade agreements)

– Test Reports or Certifications (e.g., REACH, EN, FDA for medical-grade rubber)

– Import/Export Licenses (if applicable)

Environmental & Disposal Compliance

- WEEE & Recycling (EU): If integrated with electronics, comply with waste electrical and electronic equipment directives.

- Waste Disposal: Rubber garments are not biodegradable; provide guidance on proper disposal or recycling options in accordance with local regulations.

- Sustainability Claims: Avoid unsubstantiated eco-labels; ensure any “recyclable” or “eco-friendly” claims are verified and compliant with FTC Green Guides or EU environmental labeling standards.

Recommended Best Practices

- Partner with certified suppliers adhering to ISO 9001 and ISO 14001 standards.

- Conduct regular third-party testing for chemical compliance.

- Maintain a compliance dossier for each product line.

- Train logistics teams on hazardous material handling (if applicable).

By following this guide, businesses can ensure the safe, legal, and efficient movement of rubber garments across international markets while minimizing risk and maximizing customer trust.

Conclusion for Sourcing Rubber Garments

Sourcing rubber garments requires a strategic approach that balances quality, cost, compliance, and sustainability. Given the specialized nature of rubber materials—such as natural latex, neoprene, or synthetic rubber—selecting reliable suppliers with proven expertise in textile and protective wear manufacturing is critical. Key considerations include material quality, durability, safety certifications (e.g., CE, ISO), and adherence to environmental and labor standards.

Establishing strong supplier relationships, conducting thorough due diligence, and performing regular quality audits help mitigate risks related to product consistency and supply chain disruptions. Additionally, with growing environmental concerns, exploring eco-friendly rubber alternatives and sustainable production methods can enhance brand reputation and meet evolving regulatory and consumer demands.

Ultimately, successful sourcing of rubber garments hinges on a comprehensive evaluation of technical specifications, supplier capabilities, and market requirements—ensuring that the final product meets both performance expectations and ethical standards.