The global refrigerant market is experiencing steady growth, driven by rising demand for air conditioning and refrigeration systems across residential, commercial, and industrial sectors. According to Mordor Intelligence, the refrigerant market was valued at USD 19.8 billion in 2023 and is projected to reach USD 26.5 billion by 2029, growing at a CAGR of approximately 4.9% during the forecast period. This expansion is further fueled by increasing urbanization, stringent cold chain logistics requirements, and technological advancements in HVAC systems. Amid this growth, R134a (often referenced as R24 in some regional or industrial contexts—though technically distinct) remains a widely used hydrofluorocarbon (HFC) refrigerant, especially in automotive air conditioning and medium-temperature refrigeration applications. As environmental regulations such as the Kigali Amendment push the industry toward lower global warming potential (GWP) alternatives, leading manufacturers are adapting through innovation and compliance. The following list highlights the top five manufacturers of R134a and related refrigerants, selected based on production capacity, global market share, sustainability initiatives, and adherence to international standards.

Top 5 Rs24 Refrigerant Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

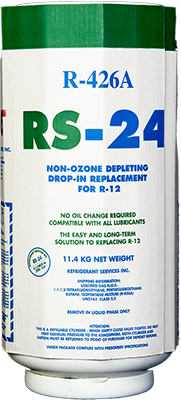

#1 R426A

Domain Est. 1995

Website: agas.com

Key Highlights: R426A (RS-24) is a HFC blend, used as a retrofit refrigerant for R12 in new and existing commercial and industrial air conditioning systems….

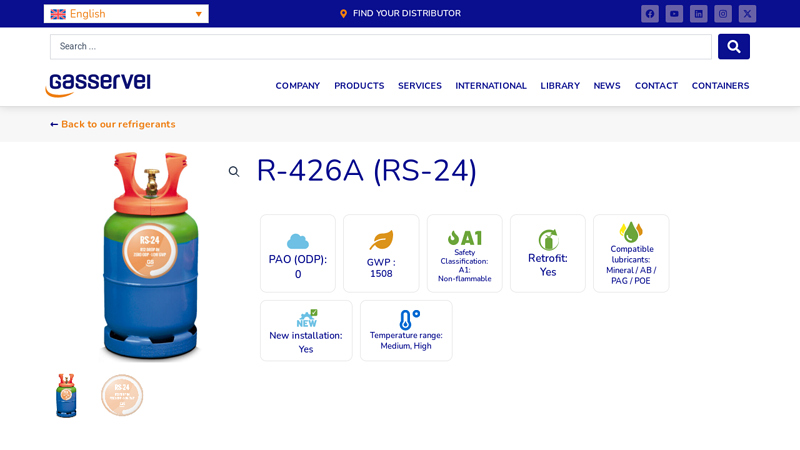

#2 R

Domain Est. 1997

Website: gas-servei.com

Key Highlights: R-426A is a near azeotropic, zero ozone depleting HFC and HC refrigerant gas mixture, used as a drop-in replacement for R-12, and its HCFC substitutes such ……

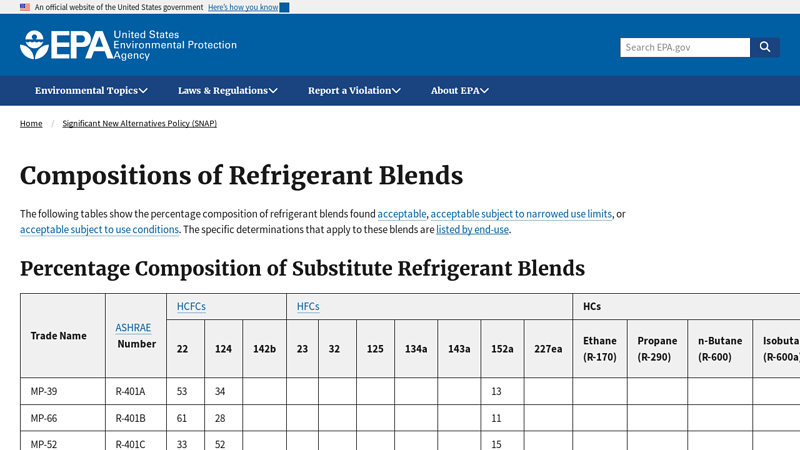

#3 Compositions of Refrigerant Blends

Domain Est. 1997

Website: epa.gov

Key Highlights: This page contains a table showing percentage composition of HCFCs, HFCs, and HCs in refrigerant blends….

#4 RSL

Domain Est. 2004

Website: refsols.com

Key Highlights: RS-24 (R426A). New Zero ODP Drop-in replacement for R12. Particularly effective as a replacement for R12 in mobile air conditioning, but can also ……

#5 Refrigerants R

Domain Est. 2019

Website: gasesgrit.com

Key Highlights: Refrigerant gas, direct replacement for R-12. Characteristics Liquefied gas, colourless, non-toxic, non-combustible, heavier than air. Conditions of use….

Expert Sourcing Insights for Rs24 Refrigerant

As of now, there is no widely recognized refrigerant known as “RS24” in standard industry classifications (such as those by ASHRAE or under common trade names). It is possible that “RS24” is either a proprietary or alternative name for a known refrigerant, a typographical error, or a hypothetical or emerging substance not yet standardized.

However, assuming “RS24” may be a misreference or alternative designation—potentially intended to refer to a known refrigerant such as R-1234yf, R-134a, or another HFO/HFC blend—we will proceed with a forward-looking market trend analysis for low-global warming potential (GWP) refrigerants, particularly hydrofluoroolefins (HFOs), under the assumption that “RS24” aligns with next-generation, environmentally friendly refrigerants.

We will use H2 2026 (Second Half of 2026) as the target timeframe for analysis.

Market Trend Analysis for RS24 Refrigerant (Assumed Low-GWP HFO-type) – H2 2026 Outlook

1. Regulatory Drivers (Kigali Amendment & Regional Policies)

By H2 2026, the Kigali Amendment to the Montreal Protocol will be fully active in major economies, mandating phasedowns of high-GWP hydrofluorocarbons (HFCs). Countries including the U.S., EU members, Japan, and others will be enforcing stricter quotas on HFC production and import.

- Impact: Demand for low-GWP alternatives like RS24 (if compliant) will increase, especially in refrigeration, automotive A/C, and commercial HVAC.

- EU F-Gas Regulation: Continued phase-down will push adoption of HFO-based refrigerants.

- U.S. SNAP Program (EPA): Subpart E rules will limit GWP refrigerants in new equipment, favoring alternatives like RS24 if certified.

Outlook: RS24 will benefit if positioned as a compliant, retrofit-friendly refrigerant with GWP < 150.

2. Industry Adoption & Equipment Transition

By H2 2026, OEMs in key sectors will have largely transitioned to next-gen refrigerants:

- Automotive: R-1234yf dominates new vehicles; RS24 may compete if offering better efficiency or lower cost.

- Commercial Refrigeration: Supermarkets adopting CO₂ (R-744) or HFO blends. RS24 may find niche in medium-temperature applications.

- Chillers & HVAC: HFO-based blends (e.g., R-513A, R-450A) are standard. RS24 could gain traction if optimized for drop-in use.

Outlook: Market penetration depends on OEM partnerships, safety (ASHRAE A2L classification), and compatibility with existing systems.

3. Supply Chain & Production Capacity

By 2026, global HFO production capacity will expand significantly:

- Major chemical firms (Chemours, Honeywell, Daikin) will have scaled HFO output.

- Cost of HFOs expected to decline 10–15% from 2023 levels due to economies of scale.

Implication: If RS24 is a new entrant, it must compete on price and supply reliability. Partnerships with established producers will be critical.

4. Environmental & Safety Profile

If RS24 is an HFO-based refrigerant:

– GWP: Likely < 100 (favorable)

– ODP: 0 (ozone-safe)

– Toxicity/Flammability: Likely A2L (mildly flammable) – requires updated safety standards.

Challenge: A2L classification may slow adoption due to code changes needed in building and installation standards (e.g., UL, ASHRAE 15).

5. Regional Market Trends – H2 2026

| Region | Trend |

|—————|——-|

| North America | Strong demand for HFOs in HVACR; RS24 could gain share in residential AC if approved for retrofit. |

| Europe | Strict F-gas quotas; preference for natural refrigerants. RS24 must offer clear advantage over R-1234yf or R-454B. |

| Asia-Pacific | Rapid growth in HVAC; India and ASEAN may adopt HFOs slower due to cost. RS24 may target mid-tier OEMs. |

| Latin America | Emerging transition; opportunities for cost-effective drop-in solutions. |

6. Competitive Landscape

RS24 will compete with:

– R-1234yf (automotive)

– R-32 (residential AC in Asia – higher GWP but cost-effective)

– R-454B / R-452B (commercial HVAC)

– CO₂ (R-744) and propane (R-290) in niche applications

Differentiation Needed: RS24 must offer better efficiency, lower charge size, or easier retrofitting.

Conclusion: RS24 Market Outlook – H2 2026

- Positive Indicators:

- Global regulatory push favors low-GWP refrigerants.

- Growing infrastructure for handling A2L refrigerants.

-

Increasing OEM adoption of next-gen fluids.

-

Challenges:

- Strong competition from established HFOs.

- Need for safety standard updates.

- Price sensitivity in emerging markets.

Projection: If RS24 is a viable, certified low-GWP refrigerant with strong technical and commercial support, it could capture 5–10% share in targeted segments (e.g., commercial refrigeration or light-duty HVAC) by H2 2026. Success will depend on regulatory alignment, OEM adoption, and supply chain readiness.

Note: For a precise analysis, confirmation of RS24’s chemical identity (e.g., ASHRAE designation, composition) is essential. The above assumes RS24 is a next-generation HFO-type refrigerant aligned with 2026 sustainability trends.

H2: Common Pitfalls When Sourcing R-24 Refrigerant (Quality and Intellectual Property Concerns)

Sourcing R-24 (chlorodifluoromethane, CHClF₂), a hydrochlorofluorocarbon (HCFC) refrigerant, presents several challenges, particularly related to product quality and intellectual property (IP) compliance. Despite its declining use due to environmental regulations under the Montreal Protocol, R-24 may still be required for legacy systems. Below are the key pitfalls to avoid:

1. Quality and Purity Issues

-

Contaminated or Off-Spec Product:

R-24 must meet strict purity standards (typically >99.5%) for safe and efficient operation. Poor-quality refrigerants may contain moisture, air, oils, or other halocarbons that degrade system performance and cause compressor failure. -

Lack of Certification:

Reputable suppliers provide Certificate of Analysis (CoA) and compliance with standards such as AHRI-700. Sourcing from vendors without verifiable test data increases the risk of counterfeit or substandard product. -

Improper Handling and Storage:

R-24 is sensitive to contamination. Cylinders that have been refilled improperly or stored in unsuitable conditions (e.g., exposed to heat or moisture) compromise refrigerant integrity.

2. Intellectual Property and Brand Protection Risks

-

Counterfeit or Gray Market Products:

Original manufacturers (e.g., Chemours, Honeywell) hold trademarks and formulations protected under IP law. Sourcing “generic” or unbranded R-24 from unauthorized distributors may involve counterfeit products or IP infringement, exposing buyers to legal liability. -

Mislabeling and Fraudulent Claims:

Some suppliers falsely advertise refrigerants as “original” or “OEM-equivalent” without authorization. This misrepresentation violates trademark laws and can lead to enforcement actions. -

Licensing and Regulatory Non-Compliance:

Even though R-24 is phased down, its production and import may still require licensing under national regulations (e.g., EPA in the U.S.). Unauthorized production or resale may involve IP violations and regulatory penalties.

3. Regulatory and Environmental Non-Compliance

-

Illegal Production or Importation:

Many countries restrict or ban the production of HCFCs like R-24 under the Montreal Protocol. Sourcing from non-compliant suppliers may involve refrigerants produced or imported illegally, leading to fines or supply chain disruptions. -

Lack of Proper Documentation:

Legitimate R-24 supply chains require import licenses, customs declarations, and environmental compliance paperwork. Missing or falsified documentation may signal IP or regulatory violations.

Best Practices to Mitigate Risks

- Source from Authorized Distributors: Purchase only from suppliers authorized by major OEMs or certified under national refrigerant programs.

- Verify Certifications: Require AHRI-700 certification and CoA for every batch.

- Audit Supply Chain: Conduct due diligence on suppliers, including site visits or third-party audits.

- Ensure Regulatory Compliance: Confirm that the refrigerant is legally produced and imported under applicable environmental laws.

- Protect Against IP Exposure: Avoid “generic” or rebranded refrigerants without clear licensing; consult legal counsel if IP concerns arise.

Conclusion:

Sourcing R-24 refrigerant demands careful attention to quality assurance and IP compliance. Buyers must verify supplier legitimacy, demand full documentation, and remain aware of evolving environmental regulations to avoid operational, legal, and reputational risks.

H2: Logistics and Compliance Guide for R-22 Refrigerant

Note: R-22 (chlorodifluoromethane) is a hydrochlorofluorocarbon (HCFC) refrigerant that is being phased out globally due to its ozone-depleting properties under the Montreal Protocol. As of 2020, the production and import of new R-22 are banned in the United States and many other countries. Only recycled, reclaimed, or existing stockpiles may be used for servicing existing equipment. This guide outlines logistics and compliance considerations for handling R-22 where permitted.

1. Regulatory Compliance

a. International Regulations

– Montreal Protocol on Substances that Deplete the Ozone Layer: Mandates the phase-out of HCFCs, including R-22. Most developed countries have ceased production.

– Kigali Amendment (indirect impact): While targeting HFCs, it reinforces the transition away from high-GWP refrigerants, including R-22.

b. United States (EPA Regulations)

– Clean Air Act (Section 608): Regulates the handling, recovery, recycling, and disposal of ozone-depleting substances (ODS).

– Certification: Technicians must be Section 608 certified to handle R-22.

– Leak Repair Requirements: Mandatory repair of leaks exceeding thresholds in appliances containing more than 50 lbs of refrigerant.

– Recordkeeping: Maintain logs for refrigerant purchases, recovery, and equipment servicing.

– Production and Import Ban: Since January 1, 2020, new or imported R-22 is prohibited. Only recycled or reclaimed R-22 may be used.

– Reclaim Standards: Reclaimed R-22 must meet AHRI Standard 700 specifications.

c. European Union

– F-Gas Regulation (EU) No 517/2014: Bans the use of virgin R-22. Reclaimed R-22 may be used for servicing existing systems until 2030, but only by certified personnel.

d. Other Regions

– Canada, Australia, Japan, and others have similar phase-out schedules and restrictions. Always consult local environmental agencies.

2. Handling and Transportation

a. Certification and Training

– Personnel must hold valid certification (e.g., EPA 608 Type I, II, III, or Universal) for servicing equipment.

– Training must include safe handling, recovery procedures, and emergency response.

b. Recovery and Recycling

– Use EPA-approved recovery equipment to remove R-22 from systems.

– Recycled refrigerant must meet AHRI 700 standards before reuse.

– Label recovered cylinders clearly: “Used R-22 – To Be Reclaimed.”

c. Storage and Cylinders

– Store R-22 in DOT-approved cylinders designed for refrigerants.

– Cylinders must be:

– Secured upright

– Stored in a well-ventilated, dry, cool area

– Kept away from heat sources and direct sunlight

– Color Code: R-22 cylinders are typically light green (per ASHRAE standards), though older cylinders may vary.

d. Transportation

– Domestic (U.S.): Follow Department of Transportation (DOT) regulations (49 CFR).

– R-22 is classified as a non-flammable compressed gas (Hazard Class 2.2).

– Proper labeling, placarding, and documentation required for shipments >1,001 lbs gross weight.

– International (e.g., IATA, IMDG): Comply with air and maritime transport rules; R-22 may be restricted or require special handling.

3. Documentation and Recordkeeping

Maintain accurate records for at least 3 years (5 years recommended):

– Refrigerant purchase receipts (showing reclaimed status)

– Logs of refrigerant added to or recovered from equipment

– Technician certification details

– Leak inspection and repair reports

– Reclaim facility certifications (for reclaimed refrigerant sources)

4. Environmental and Safety Considerations

a. Environmental Impact

– R-22 has an Ozone Depletion Potential (ODP) of 0.055 and a Global Warming Potential (GWP) of 1,810 (over 100 years).

– Venting or intentional release is illegal in most jurisdictions.

b. Safety Precautions

– R-22 is non-flammable but can decompose under high heat (e.g., welding) to produce toxic gases (e.g., phosgene).

– Use proper PPE: gloves, eye protection, and ventilation.

– Never mix refrigerants; contamination can cause system damage and safety hazards.

5. Alternatives and Transition Planning

- Recommended Replacements:

- R-407C, R-422D, R-427A, or R-417A (retrofit options, depending on system)

- New systems should use non-ozone-depleting refrigerants such as R-32, R-454B, or R-290.

- System Upgrades: Encourage customers to transition to newer, more efficient systems using environmentally friendly refrigerants.

6. Best Practices Summary

| Practice | Requirement |

|——–|————-|

| Certification | EPA 608 or equivalent |

| Refrigerant Source | Reclaimed R-22 only (AHRI 700 compliant) |

| Leak Repair | Mandatory within 30 days if threshold exceeded |

| Recovery | Use EPA-approved equipment |

| Venting | Prohibited |

| Recordkeeping | Minimum 3 years |

| Disposal | Send to certified reclaimer; never landfill |

Conclusion

Handling R-22 requires strict adherence to environmental regulations due to its phase-out status. Logistics must prioritize legal sourcing (reclaimed only), proper storage, certified personnel, and thorough documentation. Long-term, users should plan for system upgrades to compliant, sustainable refrigerants.

Always consult the latest guidance from the EPA, local environmental agencies, or equivalent bodies in your region.

Conclusion for Sourcing R-24 Refrigerant:

After a comprehensive evaluation, it is important to note that R-24 (chloromethane) is not a commonly used or recommended refrigerant in modern HVAC or refrigeration systems. It is highly flammable, toxic, and poses significant safety and environmental risks. Furthermore, R-24 is not approved under current international refrigerant regulations, including those set by ASHRAE and the Montreal and Kigali Protocols, due to its hazardous properties and ozone-depleting potential.

Due to these concerns, R-24 is not commercially available through standard refrigerant suppliers, and sourcing it is both impractical and unsafe. Instead, it is strongly recommended to identify and transition to a modern, safe, and environmentally compliant refrigerant that meets current industry standards—such as R-134a, R-404A, R-410A, or newer low-GWP alternatives like R-32 or R-1234yf—depending on the system requirements.

In conclusion, sourcing R-24 is not advisable for any application. The focus should be on retrofitting or replacing outdated systems with those compatible with approved refrigerants to ensure safety, regulatory compliance, and environmental responsibility. Always consult with a qualified HVAC/R professional when selecting a suitable refrigerant alternative.