The global molding industry continues to expand rapidly, driven by rising demand across construction, automotive, and furniture sectors. According to Mordor Intelligence, the global plastic molding market was valued at USD 321.5 billion in 2023 and is projected to grow at a CAGR of 4.8% through 2029. This growth is mirrored in the architectural and decorative molding segment, where increasing focus on interior aesthetics and infrastructure development—particularly in emerging economies—is fueling demand for high-quality, precision-engineered products. As one of the most widely used profiles in cabinetry, furniture, and wall treatments, round molding has seen a notable uptick in both residential and commercial applications. With manufacturers investing in advanced tooling, sustainable materials, and automated production lines, the competitive landscape is evolving to meet tighter tolerances and custom design requirements. This data-driven shift underscores the importance of partnering with reliable, innovative manufacturers—especially as supply chain dynamics and material costs continue to influence procurement strategies. In this context, identifying the top-performing round molding manufacturers provides critical insight for sourcing professionals and project managers aiming to balance quality, scalability, and cost-efficiency.

Top 10 Round Molding Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 RSP, Inc.

Domain Est. 2003

Website: rspinc.com

Key Highlights: A full service global contract manufacturer, specializing in plastic molding and leveraging innovation to turn ideas into reality for over 50 years….

#2 DME

Domain Est. 1999

Website: dme.net

Key Highlights: The premier global supplier of Mold Bases, Mold Components, Molding Supplies, Hot Runner & Controllers and Mold Technology with locations, operations, ……

#3 PCS Company

Domain Est. 1997

Website: pcs-company.com

Key Highlights: PCS Company is a team of industry experts providing solutions and innovative products for the plastic injection molding, mold making, and die casting ……

#4 Hoffer Plastics

Domain Est. 1998 | Founded: 1953

Website: hofferplastics.com

Key Highlights: Since 1953, Hoffer Plastics has led in custom plastic injection molding, delivering precision parts with innovation and reliability….

#5 Thermoset & Thermoplastic Compression & Injection Molding

Domain Est. 2002

Website: coremt.com

Key Highlights: At CORE Molding Technologies, we are experts in molding large surface and structural components in thermoplastic and thermoset materials….

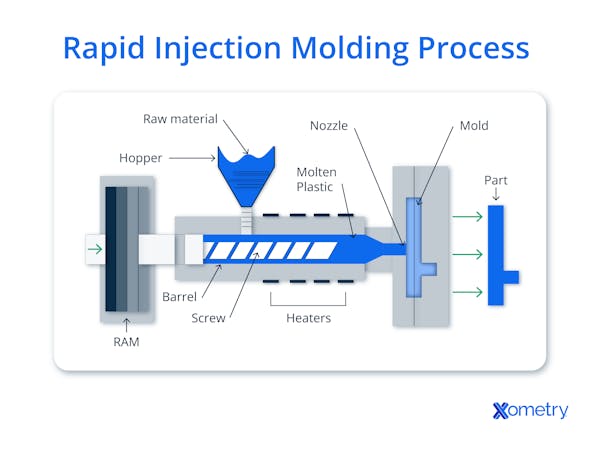

#6 Rapid Molding: Rapid Injection Molding

Domain Est. 2004

Website: rapidmolding.com

Key Highlights: On-demand manufacturing of real injection molded prototypes and high volume production. Custom injection molded parts starting at $899!…

#7 Innovative Plastic Molders

Domain Est. 2008

Website: ipmolders.com

Key Highlights: We provide cutting-edge solutions for the efficient and economical production of high quality injection molded components and assemblies….

#8 Husky Technologies

Domain Est. 2010

Website: husky.co

Key Highlights: Husky delivers industry-leading injection molding machines and systems engineered for maximum productivity and superior part quality….

#9 Springboard Manufacturing

Domain Est. 2019

Website: springboardmfg.com

Key Highlights: We offer state-of-the-art medical injection molding and assembly services for numerous types of medical device applications in a wide range of sizes….

#10 Barnes Molding Solutions

Domain Est. 2021

Website: barnesmoldingsolutions.com

Key Highlights: United Expertise in Plastic Injection Molding: Barnes Molding Solutions brings together leading companies in tooling, hot runner, and control systems. Under ……

Expert Sourcing Insights for Round Molding

H2: 2026 Market Trends for Round Molding

The global round molding market in 2026 is poised for steady growth, driven by evolving construction, automotive, and industrial demands, with sustainability and material innovation emerging as key differentiators. Here’s a detailed analysis of the key trends shaping the market in the second half of the year and beyond:

1. Sustainable Materials and Circular Economy Adoption

By 2026, environmental regulations and consumer demand are accelerating the shift toward eco-friendly round molding solutions. Manufacturers are increasingly incorporating:

– Recycled Content: Use of post-consumer recycled (PCR) plastics and reclaimed wood composites in PVC and composite round moldings.

– Bio-based Polymers: Growth in bioplastics (e.g., PLA, bio-PVC) derived from renewable resources, particularly in European and North American markets.

– End-of-Life Management: Improved recyclability and take-back programs, supported by extended producer responsibility (EPR) legislation.

Impact: Brands emphasizing sustainability are gaining market share, especially in green building projects certified under LEED or BREEAM.

2. Growth in Construction and Renovation Sectors

Residential and commercial construction remains a primary driver, with particular momentum in:

– Retrofit and Renovation Projects: Aging infrastructure in North America and Europe is fueling demand for durable, easy-to-install trim solutions.

– Multifamily Housing Development: Urbanization trends support demand for cost-effective, low-maintenance round moldings in apartments and condos.

– Customization Demand: Growing preference for architectural detailing in high-end homes is increasing demand for custom-diameter and decorative round moldings.

Regional Insight: Asia-Pacific, especially India and Southeast Asia, is emerging as a high-growth region due to rapid urbanization and rising disposable incomes.

3. Material Innovation and Performance Enhancement

Advancements in material science are redefining product performance:

– Composite Moldings: Wood-plastic composites (WPC) and mineral-filled PVC are gaining traction due to superior moisture resistance, dimensional stability, and durability.

– Co-Extrusion Technologies: Dual-layer extrusion enhances surface finish and UV resistance, reducing fading and maintenance.

– Fire-Retardant Formulations: Increased demand in commercial and multifamily applications is pushing development of flame-retardant round moldings compliant with stricter fire codes.

Innovation Impact: These improvements extend product lifespan and reduce lifecycle costs, appealing to both contractors and property managers.

4. Digitalization and Supply Chain Optimization

Manufacturers are leveraging digital tools to improve efficiency and meet just-in-time delivery expectations:

– BIM Integration: Round molding suppliers are providing BIM-compatible product data to streamline architectural design and procurement.

– Predictive Analytics: Use of data analytics for inventory management and demand forecasting, reducing lead times and waste.

– E-commerce Expansion: Online procurement platforms are growing, especially among small contractors and DIY consumers.

Benefit: Enhanced supply chain resilience and faster project turnaround times.

5. Automotive and Industrial Niche Applications

Beyond construction, round moldings are finding increased use in:

– Automotive Interiors: Sealing and trim applications in EVs and luxury vehicles, where noise dampening and aesthetic finishes are critical.

– Industrial Equipment: Protective edge trims in machinery and control panels, driven by safety and durability requirements.

Opportunity: These niche segments offer higher margins and lower competition compared to the saturated building sector.

6. Price Volatility and Raw Material Challenges

Despite growth, the market faces headwinds:

– PVC and Additive Costs: Geopolitical instability and energy prices continue to impact resin costs, affecting profit margins.

– Logistics Inflation: Though easing compared to 2022–2023, freight and labor costs remain elevated in key regions.

Response: Companies are hedging through long-term supplier contracts and regional production shifts to mitigate risks.

Conclusion:

In H2 2026, the round molding market is characterized by innovation, sustainability, and digital transformation. Leaders in the space are those investing in eco-conscious materials, expanding into high-growth regions, and leveraging technology for efficiency. While macroeconomic pressures persist, the long-term outlook remains positive, with a projected CAGR of 4.5–5.2% through 2026, underpinned by resilient construction activity and evolving product applications.

Common Pitfalls in Sourcing Round Molding (Quality, IP)

Sourcing round molding components—whether for trim, furniture, automotive, or construction applications—can present several challenges, particularly concerning quality consistency and intellectual property (IP) risks. Overlooking these pitfalls can lead to production delays, increased costs, legal disputes, and reputational damage.

Quality Inconsistencies

One of the most frequent issues when sourcing round molding is inconsistent product quality. Suppliers, especially those in low-cost regions, may use variable raw materials, outdated tooling, or lack rigorous quality control processes. This can result in dimensional inaccuracies, surface defects (e.g., warping, blemishes, or uneven finishes), or poor color matching. Without strict quality audits and clear specifications (e.g., tolerance levels, material grades, and finish requirements), buyers risk receiving substandard parts that fail to meet design or functional requirements.

Lack of Process Standardization

Round molding often requires precise extrusion or machining techniques. Suppliers may lack standardized manufacturing processes, leading to batch-to-batch variation. Without documented process controls or certifications (such as ISO 9001), it’s difficult to ensure repeatability. This is particularly problematic in long-term sourcing relationships where consistency across multiple production runs is essential.

Intellectual Property Infringement Risks

Sourcing from third-party manufacturers increases the risk of IP violations, especially if the design of the round molding is proprietary. Unscrupulous suppliers may replicate patented profiles, trademarks, or copyrighted designs and sell them to multiple clients. Buyers can inadvertently become liable for using counterfeit or unauthorized components. This is compounded when sourcing through intermediaries or in regions with weak IP enforcement.

Inadequate IP Protection Agreements

Many sourcing agreements fail to include robust IP clauses, such as ownership of tooling, design rights, and restrictions on duplication. Without non-disclosure agreements (NDAs) and clear contractual language stating that the supplier cannot reproduce or resell the design, companies expose themselves to reverse engineering and unauthorized competition.

Tooling Ownership and Control

Tooling used to produce custom round molding is often financed by the buyer but left in the supplier’s possession. If ownership isn’t explicitly transferred or controlled, suppliers may use the tooling to produce parts for competitors. This not only undermines competitive advantage but may also dilute brand exclusivity.

Supply Chain Opacity

Complex supply chains can obscure the origin of materials and manufacturing processes, making it difficult to verify compliance with quality standards or IP regulations. Sub-tier suppliers may introduce unapproved materials or replicate designs without the buyer’s knowledge, increasing exposure to compliance and legal risks.

To mitigate these pitfalls, companies should conduct thorough supplier vetting, enforce strong contractual protections, perform regular quality audits, and maintain clear ownership of designs and tooling. Engaging legal counsel to review IP provisions and ensuring supply chain transparency are also critical steps in responsible sourcing.

Logistics & Compliance Guide for Round Molding

This guide outlines essential logistics and compliance considerations specific to the transportation, handling, storage, and regulatory requirements for round molding products—commonly used in construction, furniture, and decorative applications. Adhering to these guidelines ensures product integrity, regulatory compliance, and efficient supply chain operations.

Product Handling and Packaging

Round moldings—typically made from wood, MDF, PVC, or composite materials—are prone to warping, chipping, and surface damage if not properly packaged and handled. Use the following best practices:

- Secure Bundling: Group moldings by size and profile. Use banding or shrink-wrapping to maintain alignment and prevent shifting.

- End Protection: Apply corner guards or edge protectors to prevent damage during transit.

- Moisture Barriers: For wood and MDF products, include moisture-resistant wrapping (e.g., plastic film) to prevent warping due to humidity.

- Palletization: Stack bundles on standard pallets (e.g., 48” x 40”) and secure with stretch wrap. Load vertically when possible to minimize flexing.

Transportation and Shipping

Ensure safe and compliant transportation of round molding products across various modes:

- Load Securing: Use straps, dunnage, and edge protectors to prevent movement in trucks or containers. Avoid overhang beyond legal limits (typically ≤ 3 feet beyond rear of vehicle in the U.S.).

- Climate Considerations: Protect temperature- and humidity-sensitive materials (e.g., wood) during extreme weather. Use climate-controlled containers if necessary.

- Stacking Limits: Adhere to maximum stacking heights to prevent bottom-layer crushing—typically no more than 5–6 feet for wood-based moldings.

- Labeling: Clearly mark packages with product type, dimensions, weight, handling instructions (e.g., “Fragile,” “Do Not Stack”), and orientation arrows.

Storage Guidelines

Proper warehousing practices preserve product quality:

- Indoor Storage: Store in dry, well-ventilated areas away from direct sunlight and moisture.

- Flat or Vertical Racking: Keep moldings flat on level surfaces or store vertically in racks to prevent sagging.

- Rotation: Implement FIFO (First-In, First-Out) inventory management to minimize aging and moisture exposure.

- Pest Control: Especially for wood products, ensure facilities are treated for termites and wood-boring insects.

Regulatory Compliance

Round moldings may be subject to various regional and international regulations:

- Material Sourcing (Legal Timber): For wood products, comply with laws such as the U.S. Lacey Act or EU Timber Regulation (EUTR) by maintaining documentation on legal harvest and chain of custody.

- Emissions Standards: MDF and composite moldings may need to meet formaldehyde emission standards (e.g., CARB Phase 2 in the U.S., EPA TSCA Title VI).

- Labeling Requirements: Ensure product labels include material content, safety warnings (if applicable), country of origin, and compliance marks (e.g., CE marking in Europe).

- Hazardous Materials: If coatings or treatments contain regulated substances (e.g., lead-based paints), comply with local restrictions (e.g., U.S. CPSIA, EU REACH).

- Import/Export Documentation: Provide accurate HS codes (e.g., 4409.29 for molded wood trim), commercial invoices, packing lists, and certificates of origin when shipping internationally.

Sustainability and Environmental Compliance

- Recyclability: Promote recyclable packaging materials and design moldings for end-of-life recyclability where possible.

- Environmental Certifications: Leverage certifications such as FSC®, PEFC™, or SCS Recycled Content to meet customer and regulatory demands.

- Waste Management: Follow local disposal regulations for off-cuts and defective products, especially for composites or treated materials.

Quality Assurance and Documentation

- Inspection Protocols: Conduct pre-shipment inspections to verify dimensions, finish quality, and packaging integrity.

- Compliance Records: Maintain records of material test reports, safety data sheets (SDS), and regulatory certifications for audit readiness.

- Traceability: Implement batch/lot tracking to support recalls or compliance investigations.

By following this logistics and compliance guide, manufacturers, distributors, and logistics providers can ensure round molding products are delivered safely, legally, and to the highest quality standards. Regular review and updates to align with evolving regulations are strongly recommended.

Conclusion for Sourcing Round Molding:

In conclusion, sourcing round molding requires a strategic approach that balances quality, cost, availability, and supplier reliability. After evaluating various suppliers, materials, and manufacturing processes, it is evident that selecting the right source involves considering factors such as material durability (e.g., wood, PVC, metal), precision in diameter and profile consistency, lead times, and compliance with project specifications or industry standards. Establishing long-term relationships with reputable suppliers can ensure consistent product quality and better pricing over time. Additionally, incorporating sustainable sourcing practices and exploring local or eco-friendly options can further enhance the value and responsibility of the procurement process. Ultimately, a well-researched and thoughtful sourcing strategy for round molding contributes to the overall success, efficiency, and aesthetic integrity of the intended application—whether in construction, furniture, or decorative finishes.