The global round belt market is experiencing steady growth, driven by increasing demand across industries such as automotive, packaging, textiles, and food processing. According to Grand View Research, the global timing belt market—of which round belts are a key segment—was valued at USD 2.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030. This growth is fueled by the need for efficient power transmission solutions and the rising adoption of automation in manufacturing. Additionally, Mordor Intelligence projects a CAGR of over 5.5% for the global timing belt market through 2028, citing advancements in belt materials and expanding industrial applications as key drivers. With such momentum, identifying the leading round belt manufacturers has become critical for businesses seeking reliable, high-performance components. Here, we present the top 10 round belt manufacturers leading innovation, quality, and market share in this evolving landscape.

Top 10 Round Belt Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

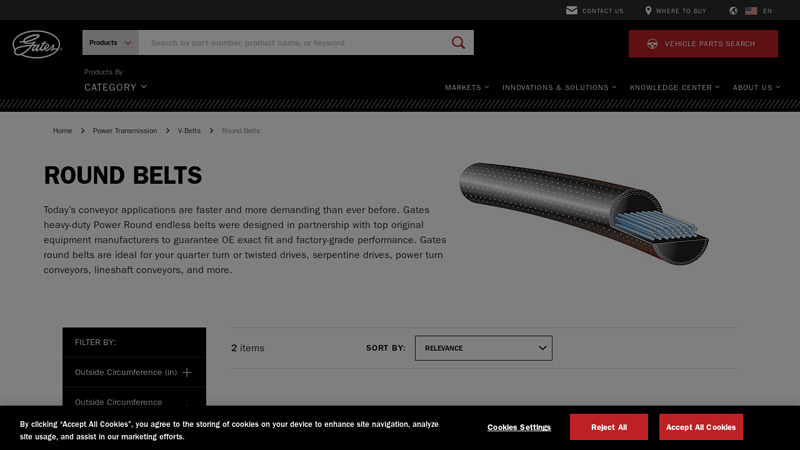

#1 Round Belts

Domain Est. 1994

Website: gates.com

Key Highlights: Gates round belts are ideal for your quarter turn or twisted drives, serpentine drives, power turn conveyors, lineshaft conveyors, and more. Round Endless Belts….

#2 Conveyor Belting

Domain Est. 1998

Website: beltpower.com

Key Highlights: Investing in high-quality conveyor belting is essential for maximizing operational efficiency and minimizing downtime….

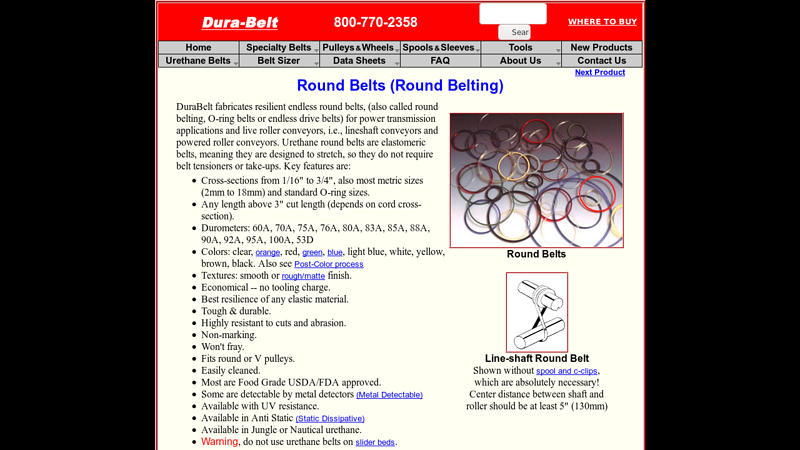

#3 DuraBelt ROUND BELTS, round belting

Domain Est. 1998

Website: durabelt.com

Key Highlights: DuraBelt fabricates resilient endless round belts, (also called round belting, O-ring belts or endless drive belts) for power transmission applications and ……

#4 optibelt ROUND POLYURETHANE BELTS RR / HRR

Domain Est. 1999

Website: optibelt.com

Key Highlights: Optibelt round polyurethane belts consist of high quality materials which are produced as open-ended rolls in different diameters from 2 to 20 mm….

#5 Volta Belting

Domain Est. 1999

Website: voltabelting.com

Key Highlights: Elevate your poultry processing operations with Volta Belting’s innovative conveyor belt solutions, designed for superior hygiene and efficiency….

#6 Extruded Belts

Domain Est. 1999

Website: habasit.com

Key Highlights: Habasit’s extruded belts include round belts from 2 mm to 20 mm in diameter, as well as V-and T-shapes in various designs and sizes….

#7 Round belts

Domain Est. 2001

Website: mafdel-belts.com

Key Highlights: Mafdel manufactures endless round belts upon request. These include small, medium and large series: SOUPLEX; POLY/FLEX; DEL/FLEX; DEL/ROC types….

#8 Round belts made of PU and TPE

Domain Est. 2004

Website: behabelt.com

Key Highlights: BEHAbelt uses high-quality PU (polyurethane) and TPE (polyester) materials for the production of round belts, which guarantee an optimal performance and long ……

#9 Round Belts

Domain Est. 2005

Website: c-rproducts.com

Key Highlights: Browse our range of Round Belts for lasting performance on conveyors, quarter-turn, twisted, and serpentine drives. Browse Round Belts Now!…

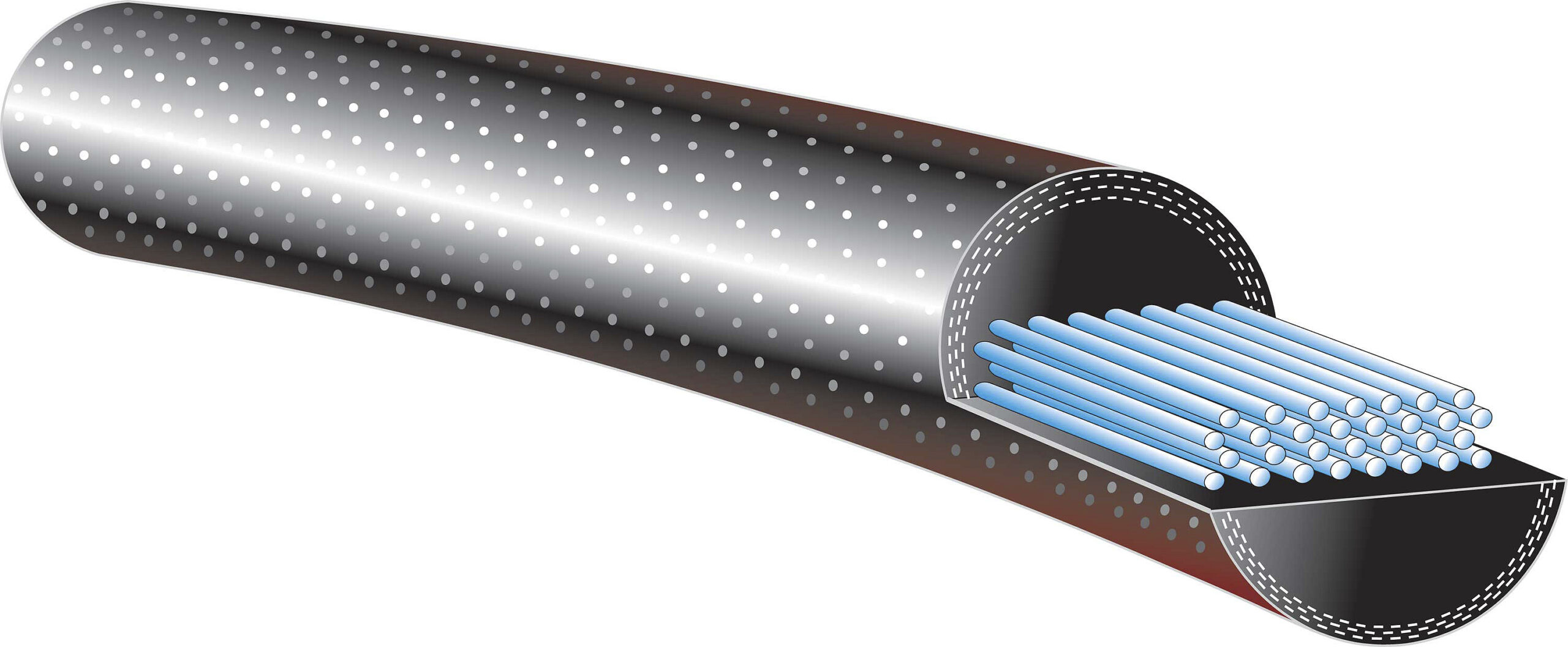

#10 Round Belt

Domain Est. 2015

Website: timkenbelts.com

Key Highlights: Our round belts feature a no-splice construction for added durability with minimal stretch for minimum take-up requirements. Round Belt cutaway….

Expert Sourcing Insights for Round Belt

H2: 2026 Market Trends for Round Belts

The global round belt market is poised for steady growth and transformation through 2026, driven by evolving industrial automation, material innovations, and increasing demand across key end-use sectors. As industries prioritize efficiency, durability, and cost-effectiveness in power transmission components, round belts—known for their flexibility, compact design, and simple installation—are gaining renewed attention. The second half of the decade (H2: 2023–2026) is expected to bring several defining trends that will shape the trajectory of the round belt market.

1. Rising Demand in Automation and Robotics

With the acceleration of Industry 4.0 initiatives, automated assembly lines, robotic systems, and precision machinery are increasingly adopting round belts for motion control. Their ability to transmit power in tight spaces with minimal maintenance makes them ideal for use in pick-and-place robots, packaging machines, and medical devices. By 2026, the integration of smart sensors and IoT-enabled monitoring systems may further drive demand for high-performance round belts capable of reliable, continuous operation.

2. Shift Toward High-Performance Materials

Material innovation is a key trend shaping the round belt landscape. Traditional rubber and polyurethane belts are being enhanced or replaced with advanced thermoplastic polyurethanes (TPU), silicone, and composite polymers offering superior resistance to heat, oils, UV radiation, and abrasion. These materials extend service life and reduce downtime, particularly in harsh environments such as food processing, pharmaceuticals, and outdoor applications. By 2026, eco-friendly and recyclable materials are also expected to gain traction, aligning with global sustainability mandates.

3. Growth in the Packaging and Food & Beverage Sector

The packaging industry remains a major consumer of round belts, especially in conveyor systems and labeling machines. With e-commerce driving demand for faster, more efficient packaging solutions, the need for reliable and hygienic belt systems is intensifying. Round belts made from FDA-compliant, non-toxic materials are increasingly specified in food and beverage processing lines. This sector is expected to remain a primary growth engine through 2026.

4. Regional Market Expansion in Asia-Pacific

Asia-Pacific, particularly China, India, and Southeast Asia, is anticipated to lead global market growth. Rapid industrialization, rising investments in manufacturing infrastructure, and the expansion of automotive and electronics industries are fueling demand for power transmission components. Local production of round belts is also increasing, reducing dependency on imports and lowering costs, which supports wider adoption.

5. Competitive Landscape and Strategic Collaborations

The round belt market is witnessing consolidation and strategic partnerships among key players such as Gates, Habasit, Mitsuboshi, and Zhejiang Kehua. Companies are focusing on R&D to differentiate their product offerings and expand into niche applications. Customization, rapid prototyping, and just-in-time delivery models are becoming critical competitive advantages.

6. Impact of Digitalization and Predictive Maintenance

By 2026, digital tools such as AI-driven predictive maintenance platforms are expected to influence belt selection and lifecycle management. Integration with digital twins and condition monitoring systems will allow operators to anticipate belt wear and replacement needs, minimizing unplanned downtime and optimizing performance.

Conclusion

The 2026 outlook for the round belt market is positive, with H2 trends emphasizing technological advancement, sustainability, and sector-specific customization. As industries continue to modernize, round belts will maintain relevance by adapting to new operational demands, ensuring their place in the future of mechanical power transmission. Companies that invest in innovation, regional expansion, and digital integration will be best positioned to capitalize on emerging opportunities.

Common Pitfalls Sourcing Round Belts (Quality, IP)

Sourcing round belts—commonly used in light-duty power transmission, automation, and timing applications—can be deceptively complex. While they appear simple, overlooking key quality and intellectual property (IP) considerations can lead to performance failures, safety risks, and legal exposure. Below are common pitfalls to avoid.

Poor Material Quality and Inconsistent Specifications

One of the most frequent issues is sourcing belts made from substandard materials. Low-quality rubber, silicone, or polyurethane can degrade rapidly under heat, UV exposure, or mechanical stress. Buyers often encounter inconsistencies in diameter, tensile strength, or elongation due to poor manufacturing controls, leading to premature failure, slippage, or misalignment in machinery.

Lack of Traceability and Certification

Many suppliers, especially from unverified sources, fail to provide material certifications or compliance documentation (e.g., RoHS, REACH, FDA). This lack of traceability makes it difficult to ensure the belts meet industry standards or operational requirements, particularly in regulated environments such as food processing or medical devices.

Misrepresentation of Performance Ratings

Some suppliers exaggerate performance claims, such as temperature resistance, load capacity, or chemical compatibility. Without independent testing or verifiable data, buyers may select belts unsuitable for their operating conditions, resulting in downtime or safety hazards.

Counterfeit or IP-Infringing Products

Infringement of intellectual property is a serious risk when sourcing generic or off-brand round belts. Some manufacturers copy patented designs, logos, or proprietary formulations from established brands (e.g., Gates, Bosch Rexroth). Purchasing such products—even unknowingly—can expose the buyer to legal liability, especially in markets with strict IP enforcement.

Inadequate Testing and Quality Control

Suppliers without robust quality management systems (e.g., ISO 9001) may skip essential testing procedures such as tensile strength analysis, dimensional inspection, or longevity trials. This increases the risk of batch-to-batch variability and undetected defects.

Overlooking Environmental and Regulatory Compliance

Round belts used in sensitive applications must comply with environmental and safety regulations. Sourcing belts containing restricted substances or non-compliant materials can lead to product recalls, fines, or reputational damage—particularly in EU or North American markets.

Failure to Verify Supplier Credentials

Engaging with suppliers lacking transparency about manufacturing processes, facility audits, or ownership can result in unreliable supply chains. This is especially critical when IP protection and consistent quality are required.

Conclusion

To mitigate these pitfalls, buyers should conduct thorough due diligence: request material certifications, verify IP legitimacy, audit suppliers, and prioritize vendors with proven quality systems. Investing time upfront ensures reliable performance, regulatory compliance, and protection against IP risks.

Logistics & Compliance Guide for Round Belts

Overview of Round Belts

Round belts are flexible power transmission components typically made from rubber, polyurethane, or silicone. They are commonly used in light-duty applications such as printers, small conveyors, food processing equipment, and household appliances. Due to their simple design and ease of installation, they are widely distributed across global supply chains. This guide outlines key logistics and compliance considerations for the international shipment and use of round belts.

Material Composition and Regulatory Compliance

Round belts must comply with material regulations depending on their application and destination. Common compliance standards include:

– REACH (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals. Ensure that substances like phthalates or polycyclic aromatic hydrocarbons (PAHs) are within permissible limits.

– RoHS (EU): Restriction of Hazardous Substances. Applies if belts are used in electrical or electronic equipment.

– FDA Compliance (USA): Required for belts used in food, beverage, or pharmaceutical applications. Materials must be food-grade and non-toxic.

– REACH SVHC (Substances of Very High Concern): Monitor for substances listed on the Candidate List.

– Proposition 65 (California, USA): Warn consumers if belts contain chemicals known to cause cancer or reproductive harm.

Manufacturers and distributors must provide documentation such as Declarations of Conformity (DoC), Material Safety Data Sheets (MSDS), or Substance Declarations.

Packaging and Labeling Requirements

Proper packaging and labeling ensure product integrity and regulatory compliance:

– Packaging: Use moisture-resistant and anti-static materials if applicable. Individual or bulk packaging should prevent deformation and contamination.

– Labeling: Include:

– Product name and model/size (e.g., “Round Belt, Ø6mm x 10m, Polyurethane”)

– Manufacturer name and address

– Batch or lot number

– Compliance markings (e.g., CE, FDA, RoHS)

– Country of origin

– Handling symbols (e.g., “Do Not Freeze,” “Protect from Sunlight”)

Labels must be durable and legible throughout the supply chain.

Transportation and Handling

Round belts are generally non-hazardous but require careful handling to maintain performance:

– Temperature Control: Avoid exposure to extreme heat (>60°C) or cold (<-20°C), which can degrade elastomeric materials.

– Humidity: Store and transport in dry environments (ideally 40–60% RH) to prevent mold or hydrolysis in polyurethane belts.

– UV Protection: Shield from direct sunlight to prevent material cracking.

– Stacking and Storage: Do not stack heavy items on top of packaged belts. Store horizontally in a clean, ventilated area.

– Shelf Life: Most elastomer-based belts have a shelf life of 5–10 years. Rotate stock using FIFO (First In, First Out) principles.

Import and Export Documentation

International shipments require accurate documentation:

– Commercial Invoice: Includes product description, value, quantity, Harmonized System (HS) code, and Incoterms.

– Packing List: Details box contents, weight, dimensions, and packaging type.

– Certificate of Origin: May be required for tariff preferences under trade agreements.

– Bill of Lading / Air Waybill: Essential for freight tracking and customs clearance.

HS Code Example: 4010.31 (Belts and bandings, of vulcanized rubber, without textile reinforcement) – verify based on material and design.

Customs Clearance and Duties

Customs authorities assess duties based on:

– Product classification (HS code)

– Country of origin

– Free Trade Agreement (FTA) eligibility

– Declared value (FOB, CIF, etc.)

Ensure accurate classification to avoid delays or penalties. Some countries may require conformity assessment or product testing prior to import.

Special Considerations by Industry

- Food & Beverage: Use FDA-compliant or EU 1935/2004-compliant materials. Belts must be cleanable and resistant to oils, water, and cleaning agents.

- Pharmaceuticals: Require high purity and traceability. Documentation must support GMP (Good Manufacturing Practice) standards.

- Automotive/Appliances: May need ISO/TS 16949 or IATF 16949 compliance for supply chain traceability.

Environmental and Sustainability Compliance

- WEEE (EU): Apply if belts are part of electronic equipment subject to recycling.

- End-of-Life Management: Provide guidance for proper disposal or recycling. Some polyurethane belts can be recycled; others may require incineration with energy recovery.

- Carbon Footprint: Consider sustainable sourcing and low-emission transport options to meet corporate ESG goals.

Summary and Best Practices

To ensure smooth logistics and compliance for round belts:

– Verify material compliance with destination regulations.

– Use appropriate packaging and labeling.

– Control environmental conditions during transport and storage.

– Prepare complete and accurate customs documentation.

– Maintain traceability with batch records and compliance certificates.

– Stay updated on regulatory changes in target markets.

By following this guide, suppliers and distributors can minimize risks, avoid customs delays, and ensure safe, compliant delivery of round belts worldwide.

Conclusion for Sourcing Round Belts:

In conclusion, the sourcing of round belts requires a comprehensive evaluation of material quality, dimensional specifications, supplier reliability, and cost-effectiveness. Round belts, commonly used in power transmission and automation applications, must meet specific performance criteria such as tensile strength, wear resistance, and flexibility to ensure operational efficiency and longevity. By identifying reputable suppliers, verifying compliance with industry standards, and considering factors like material (e.g., rubber, polyurethane, silicone), diameter tolerance, and environmental resistance, organizations can secure high-quality belts that enhance system performance. Additionally, establishing long-term supplier relationships and implementing consistent quality control measures will contribute to reliable supply chain operations. Effective sourcing not only optimizes cost but also minimizes downtime and maintenance, ultimately supporting improved productivity and equipment reliability.