The rotary die cutting machine market has experienced steady growth, driven by rising demand across packaging, corrugated board, automotive, and consumer goods industries. According to Grand View Research, the global die cutting machines market size was valued at USD 7.2 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.1% from 2023 to 2030. This growth is fueled by increasing automation in manufacturing, the need for precision in high-speed production environments, and the expansion of e-commerce, which has amplified packaging demands. Mordor Intelligence further notes a CAGR of approximately 4.8% over the forecast period (2023–2028), highlighting Asia-Pacific as a key growth region due to industrialization and rising investment in packaging infrastructure. As manufacturers seek advanced, reliable, and efficient cutting solutions, leading rotary die cutting machine providers are innovating to meet evolving industry standards. Below, we profile the top nine manufacturers shaping this competitive landscape through technology, scalability, and global service networks.

Top 9 Rotary Die Cutting Machine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Automatic Die Cutting Machine

Domain Est. 2003

Website: sblmachinery.com

Key Highlights: We’re a reputable manufacturer of rotary die cutter machines that can be customized based on different installation environments and production requirements….

#2 Schobertechnologies

Domain Est. 2010

Website: schobertechnologies.com

Key Highlights: Schobertechnologies is a manufacturer of rotary tools ✓ special-purpose machines ✓ die cutting machines ✓ cutting tools ✓ grooving tools….

#3 Rotary Die Cutting

Domain Est. 2022

Website: precollc.com

Key Highlights: With over 50 years in the die-cutting industry, Preco, LLC is the leading manufacturer of standard and custom automated rotary die-cutting machines….

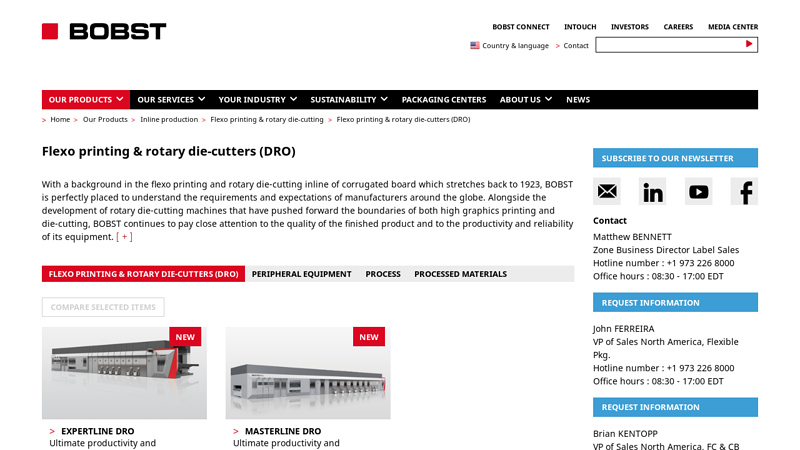

#4 Flexo printing & rotary die

Domain Est. 1996

Website: bobst.com

Key Highlights: Rotary die-cutters are used in two main industries, these being the manufacture of corrugated packaging that has high printing and die-cutting requirements ……

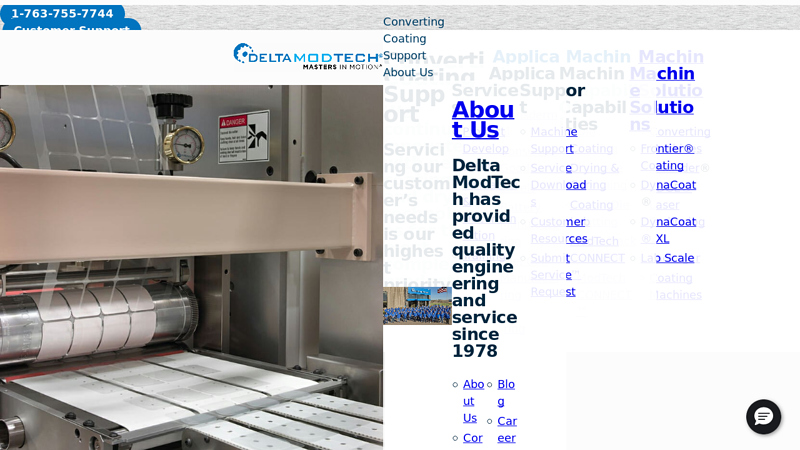

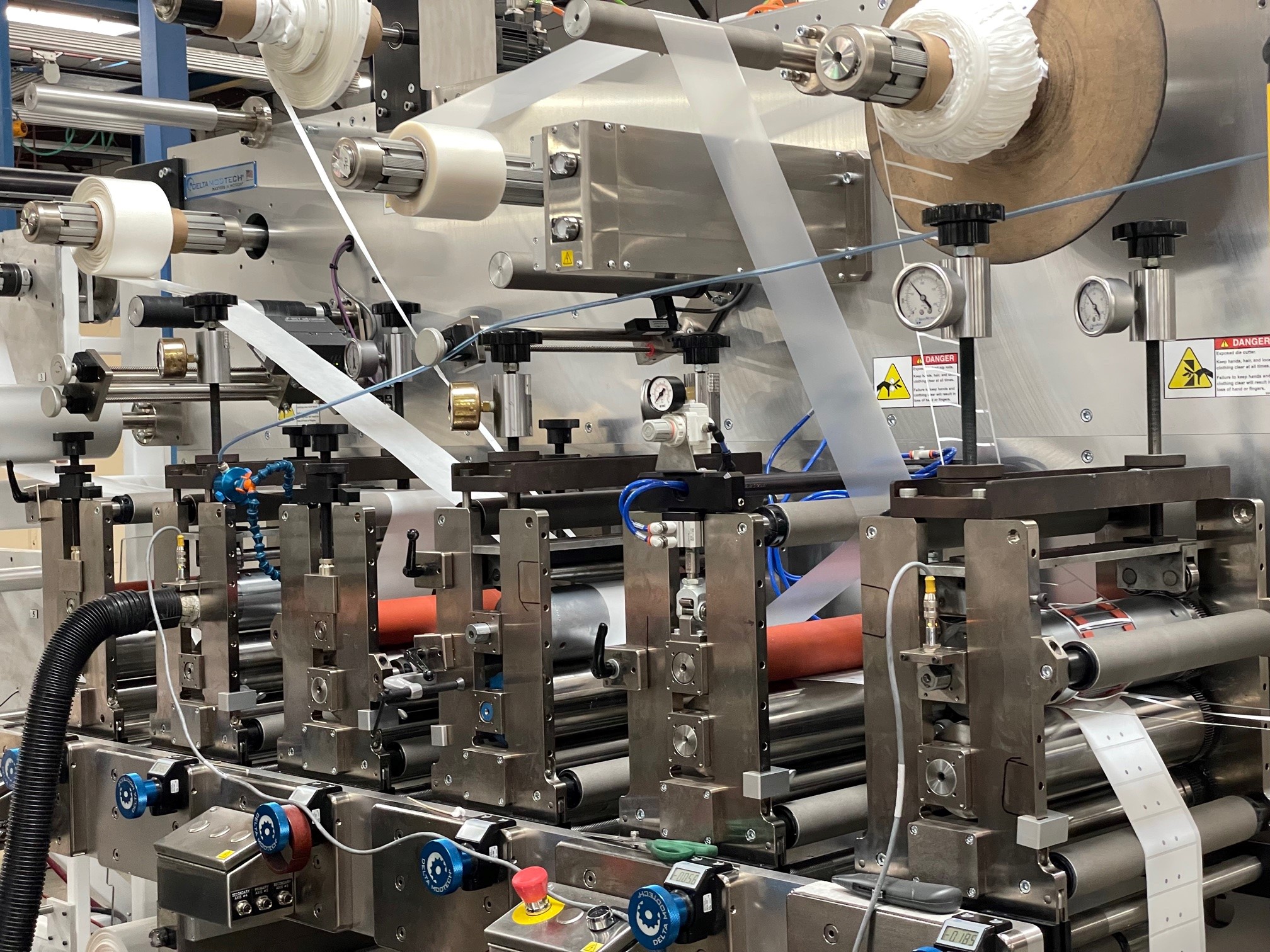

#5 Die Cutting Machines

Domain Est. 1996

Website: deltamodtech.com

Key Highlights: Our die cutting machines deliver tight tolerance and clean edges, run after run. Built to handle complexity with confidence….

#6 Rotary Die Cutters

Domain Est. 1997

Website: rollemusa.com

Key Highlights: A new class of sheet-fed rotary die cutter capable of die cutting, kiss cutting, embossing, perforating, creasing and cut-scoring a range of papers….

#7 RotoMetrics Rotary Dies

Domain Est. 1998

Website: maxcessintl.com

Key Highlights: RotoMetrics, a Maxcess brand, offers premium rotary dies designed for precision, high-performance die-cutting in packaging, labeling, and converting industries ……

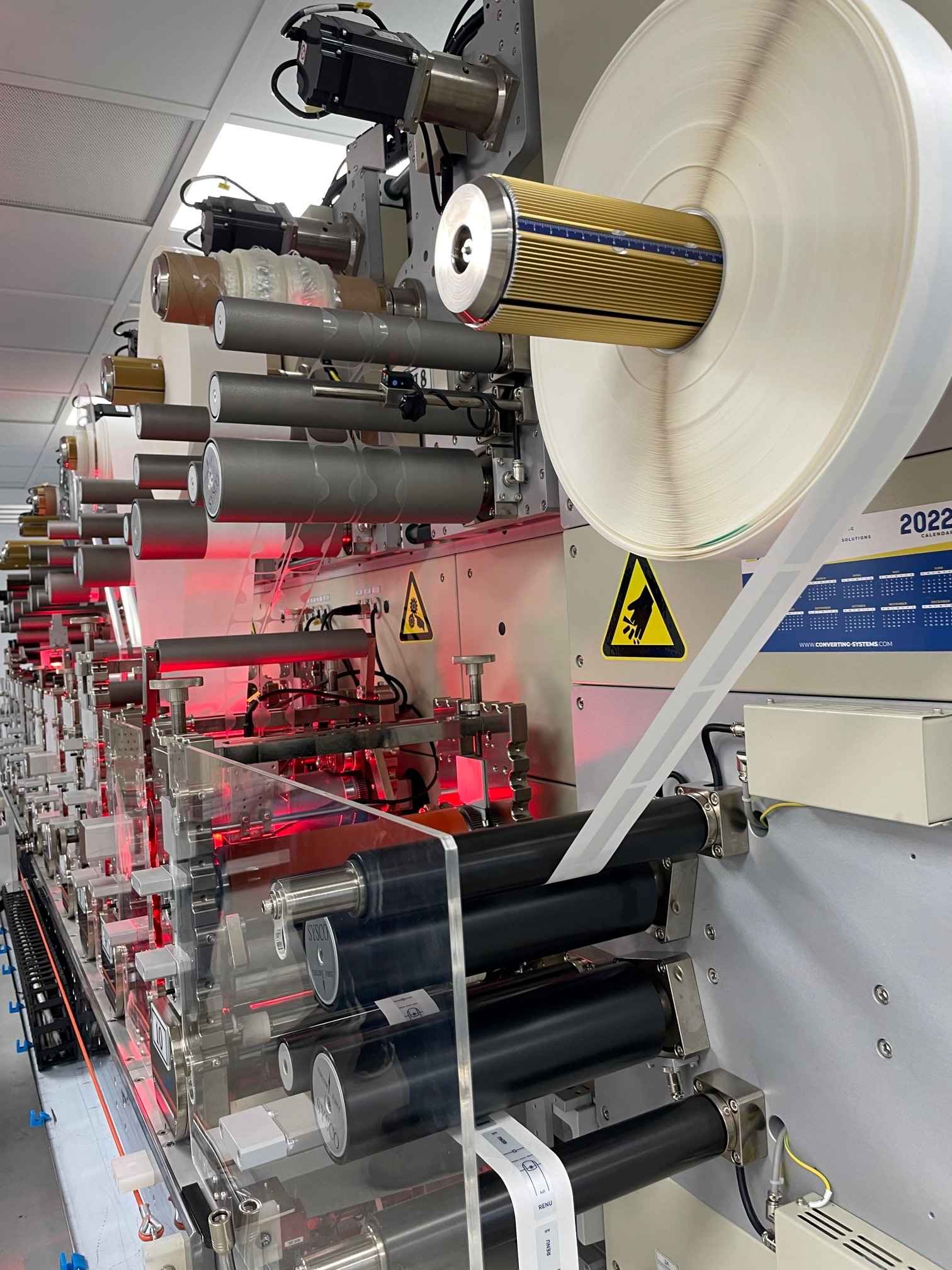

#8 Our Machine

Domain Est. 2012

Website: converting-systems.com

Key Highlights: The MACHINE SOLUTION supplied by Dorey Converting Systems is more than a machine, it’s a high-tech tool for all your converting and market expansion needs….

#9 Rotary Die Cutters

Domain Est. 2017

Website: hyperionmt.com

Key Highlights: Hyperion’s cemented carbide rotary die cutters for all of your cutting needs in the disposable hygiene, face mask, medical markets, and more….

Expert Sourcing Insights for Rotary Die Cutting Machine

H2: Projected 2026 Market Trends for Rotary Die Cutting Machines

The global rotary die cutting machine market is poised for significant evolution by 2026, driven by technological advancements, increasing demand from packaging and label industries, and the shift toward automation and smart manufacturing. This analysis outlines key trends expected to shape the market landscape in 2026 under the H2 (second half) projection framework.

-

Accelerated Adoption of Digital Integration and IoT

By H2 2026, rotary die cutting machines are expected to feature deeper integration with Industry 4.0 technologies. Manufacturers are increasingly embedding IoT-enabled sensors and real-time monitoring systems into machines. This shift allows for predictive maintenance, reduced downtime, and enhanced process transparency. Cloud-based platforms will facilitate remote diagnostics and performance tracking, particularly in large-scale packaging operations. -

Growth in Flexible Packaging Demand

The surge in e-commerce and consumer preference for sustainable and flexible packaging will continue to drive demand for high-speed, precision rotary die cutting solutions. By H2 2026, the food, beverage, pharmaceutical, and personal care sectors will rely heavily on rotary die cutters for producing labels, pouches, and folding cartons. This trend is especially prominent in emerging markets across Asia-Pacific and Latin America. -

Emphasis on Sustainability and Waste Reduction

Environmental regulations and corporate sustainability goals are pushing manufacturers to adopt rotary die cutting machines with reduced material waste and energy-efficient operations. Innovations such as closed-loop servo systems, optimized nesting software, and recyclable tooling materials will gain traction. By H2 2026, eco-design compliance will become a key differentiator among machine suppliers. -

Expansion of Hybrid and Servo-Driven Models

The market will see a shift from traditional mechanical systems to hybrid and fully servo-driven rotary die cutting machines. These models offer greater flexibility, faster changeovers, and improved precision—critical for short-run, high-mix production environments. Servo technology also supports seamless integration with digital printing lines, enabling end-to-end digital workflows. -

Regional Market Diversification

While North America and Europe remain mature markets with steady demand for high-end machines, H2 2026 will witness accelerated growth in Asia-Pacific—particularly in China, India, and Southeast Asia. This growth is fueled by rising industrialization, expanding FMCG sectors, and government initiatives supporting manufacturing modernization. -

Increased Competition and Innovation Among Suppliers

With growing demand, machine manufacturers such as Bobst, Heidelberg, and Matrix PMC are expected to intensify R&D investments. By H2 2026, competition will center on modular designs, AI-assisted setup optimization, and user-friendly interfaces. Partnerships with software developers will become common to enhance machine intelligence and data analytics capabilities.

In conclusion, the H2 2026 outlook for the rotary die cutting machine market reflects a transformation toward smarter, greener, and more adaptable solutions. Companies that embrace digitalization, sustainability, and regional customization are likely to gain a competitive edge in this evolving landscape.

Common Pitfalls When Sourcing a Rotary Die Cutting Machine: Quality and Intellectual Property Risks

Sourcing a rotary die cutting machine, especially from overseas suppliers, involves significant risks related to both machine quality and intellectual property (IP) protection. Failing to address these pitfalls can lead to production delays, substandard output, legal disputes, and financial losses.

Poor Build Quality and Substandard Components

One of the most frequent issues when sourcing rotary die cutting machines—particularly from low-cost manufacturers—is receiving equipment built with inferior materials and components. This includes using low-grade steel for the cutting cylinder, subpar bearings, or inadequate control systems. Such machines suffer from reduced precision, shorter lifespans, and frequent breakdowns, ultimately increasing downtime and maintenance costs.

Inconsistent Performance and Lack of Precision

Even if a machine appears well-constructed, inconsistent performance is a common problem. Poor calibration, inadequate engineering tolerances, or lack of quality control during assembly can result in imprecise cuts, registration errors, and material waste. This is especially critical in industries like packaging or medical device manufacturing, where tight tolerances are mandatory.

Inadequate or Misleading Technical Specifications

Suppliers may exaggerate machine capabilities, such as cutting speed, material thickness range, or tooling compatibility. Performance claims might be based on ideal lab conditions rather than real-world production environments. Without third-party verification or on-site testing, buyers risk investing in a machine that fails to meet operational requirements.

Limited After-Sales Support and Spare Parts Availability

Many suppliers, particularly smaller or offshore manufacturers, lack robust global service networks. This means delayed technical support, extended machine downtime, and difficulty sourcing genuine spare parts. Some may even discontinue support altogether, leaving buyers stranded with obsolete or malfunctioning equipment.

Intellectual Property Infringement Risks

Purchasing a rotary die cutting machine that incorporates patented technologies—such as specific feeding mechanisms, control software, or die mounting systems—without proper licensing can expose the buyer to IP litigation. Some manufacturers copy designs from established brands, offering “compatible” or “clone” machines that may infringe on existing patents, trademarks, or copyrights.

Lack of IP Due Diligence by Supplier

Suppliers may not provide documentation proving ownership or licensing of critical technologies. Without clear IP indemnification in the purchase agreement, the end user could be held liable for infringement, even if unintentional. This risk is heightened when sourcing from regions with weak IP enforcement.

Hidden Technology Dependencies and Proprietary Systems

Some machines use proprietary software or tooling systems that lock buyers into exclusive contracts for updates, support, or consumables. These dependencies can lead to inflated long-term costs and reduced flexibility. Additionally, reverse engineering or modifying such systems may violate IP agreements.

Failure to Verify Compliance and Certifications

Rotary die cutting machines often need to meet industry-specific standards (e.g., CE, UL, ISO) or safety regulations. Sourcing from unreliable suppliers may result in machines lacking proper certifications, posing safety hazards and risking non-compliance with local regulations.

Mitigation Strategies

To avoid these pitfalls, conduct thorough due diligence: inspect machines in person or via trusted third parties, request references, verify technical specs under real conditions, and review contracts for IP indemnification. Engage legal counsel to assess IP risks and ensure compliance with international trade and intellectual property laws.

Logistics & Compliance Guide for Rotary Die Cutting Machine

Transportation and Handling

Ensure the rotary die cutting machine is securely crated or palletized according to international shipping standards. Use lifting points specified by the manufacturer during loading/unloading. Avoid tilting or dropping the machine. For international transport, comply with ISPM 15 regulations for wooden packaging materials. Clearly label the shipment with “Fragile,” “This Side Up,” and handling instructions. Coordinate with freight forwarders experienced in industrial machinery logistics.

Import/Export Documentation

Prepare all necessary documentation prior to shipment, including commercial invoice, packing list, bill of lading/airway bill, and certificate of origin. Verify if an export license is required based on the destination country and machine specifications. Ensure Harmonized System (HS) code 8441.40 (for die-cutting machinery) is correctly applied. Maintain records for audit and customs clearance purposes.

Regulatory Compliance

Confirm the machine meets applicable safety and electromagnetic compatibility (EMC) standards for the destination market. In the EU, ensure CE marking per Machinery Directive 2006/42/EC and EMC Directive 2014/30/EU. In the U.S., comply with OSHA standards and relevant ANSI/B11 safety requirements. Provide required technical files, risk assessments, and user manuals in the local language.

Electrical and Operational Standards

Verify voltage, frequency, and plug compatibility with the destination’s power supply. Include transformers or adapters if needed. Machines must be equipped with emergency stop functions, guarding, and interlocks as per local safety codes. Conduct on-site safety inspections upon installation.

Environmental and Waste Compliance

Follow local regulations for disposal of packaging materials and industrial waste. Comply with RoHS (Restriction of Hazardous Substances) if operating in the EU. Ensure coolant or lubricant systems adhere to environmental protection standards, and provide proper containment measures to prevent spills.

After-Sales and Maintenance Support

Provide customers with machine documentation, including operation manuals, maintenance schedules, and spare parts lists. Offer remote or on-site technician support as per service agreements. Maintain compliance with warranty terms and update software/firmware per manufacturer recommendations.

Training and User Certification

Deliver training to operators and maintenance personnel on safe machine operation, emergency procedures, and compliance protocols. Document training completion and maintain records for regulatory or insurance purposes. Encourage adherence to lockout/tagout (LOTO) procedures during servicing.

Incident Reporting and Recalls

Establish a protocol for reporting equipment malfunctions, safety incidents, or non-compliance issues. Notify relevant authorities and the manufacturer promptly. Follow recall procedures if defects are identified, in accordance with regional regulatory bodies such as the EU’s RAPEX or the U.S. CPSC.

Conclusion:

After thorough evaluation of various options, sourcing a rotary die cutting machine represents a strategic investment that significantly enhances production efficiency, precision, and versatility in manufacturing processes—particularly in industries such as packaging, label production, and converting. The key advantages of rotary die cutting, including high-speed operation, consistent cutting accuracy, and minimal material waste, make it a superior choice over traditional flatbed systems for high-volume applications.

When sourcing the machine, critical factors such as production volume, material compatibility, automation integration, maintenance requirements, and total cost of ownership were considered. Selecting a reputable supplier with a proven track record, comprehensive after-sales support, and adaptable machine configurations ensures long-term reliability and scalability.

In conclusion, acquiring a rotary die cutting machine aligns with operational goals of improving throughput, reducing downtime, and maintaining high product quality. With the right machine and support in place, the organization is well-positioned to meet growing market demands and maintain a competitive edge in the industry.