The global robotic arm market is experiencing robust expansion, driven by increasing automation across manufacturing, healthcare, logistics, and electronics sectors. According to a 2023 report by Mordor Intelligence, the market was valued at USD 5.87 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.94% from 2024 to 2029, reaching an estimated USD 8.7 billion by the end of the forecast period. This growth is fueled by advancements in artificial intelligence, collaborative robot (cobot) adoption, and the push for Industry 4.0 integration worldwide. As demand for precision, efficiency, and scalability intensifies, leading manufacturers are innovating rapidly to deliver robotic arms that meet evolving industrial needs. In this rapidly advancing landscape, identifying the top players becomes critical for businesses seeking reliable automation solutions. Based on market share, technological innovation, global reach, and application diversity, here are the top 10 robotic arm manufacturers shaping the future of automation.

Top 10 Robotic Arm Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 DENSO Robotics

Domain Est. 1999

Website: densorobotics.com

Key Highlights: DENSO Robotics is the leading industrial robotics manufacturer. We build custom robotic automation solutions for our customers around the world….

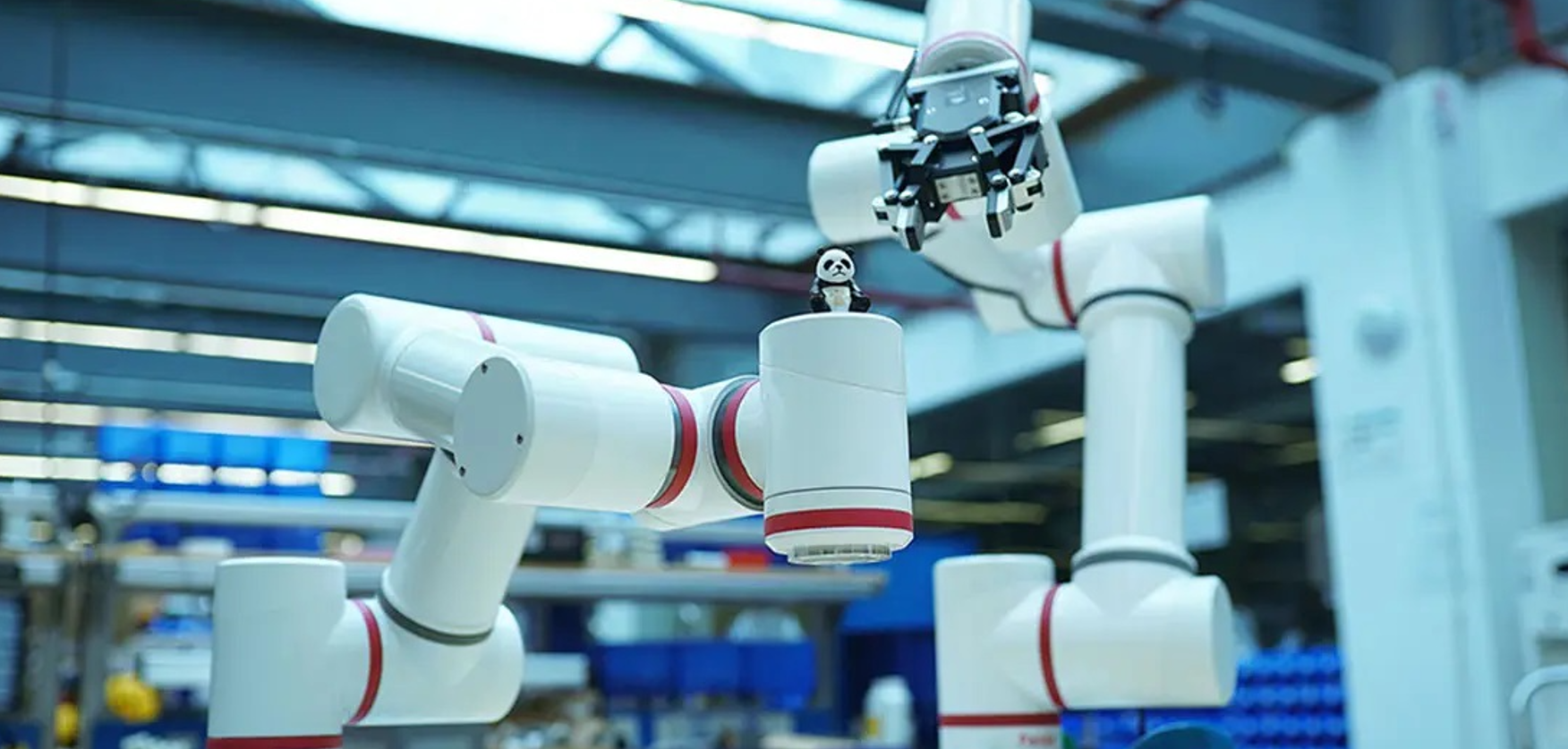

#2 Elephant Robotics

Domain Est. 2016

Website: elephantrobotics.com

Key Highlights: Elephant Robotics is a technology firm specializing in the design and development of Robotic Arms and Toys along with robot kits and robot parts….

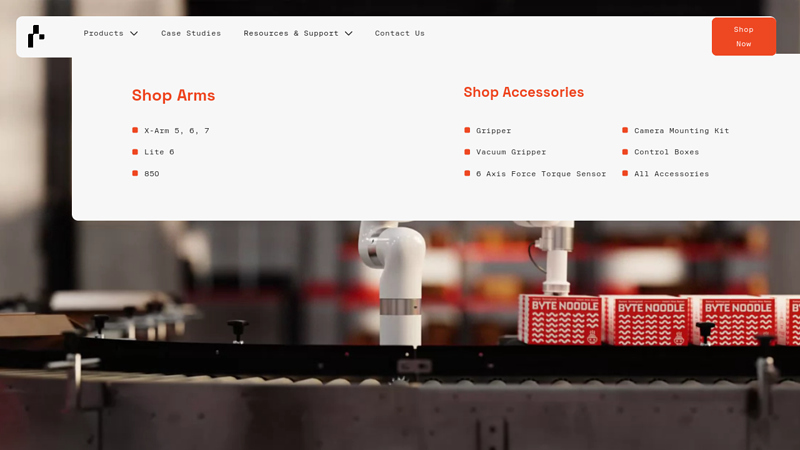

#3 UFACTORY US

Website: ufactory.us

Key Highlights: Free delivery 30-day returnsDiscover our affordable and reliable robotic arm designed for all levels. With open-source technology, you can customize and enhance your automation ……

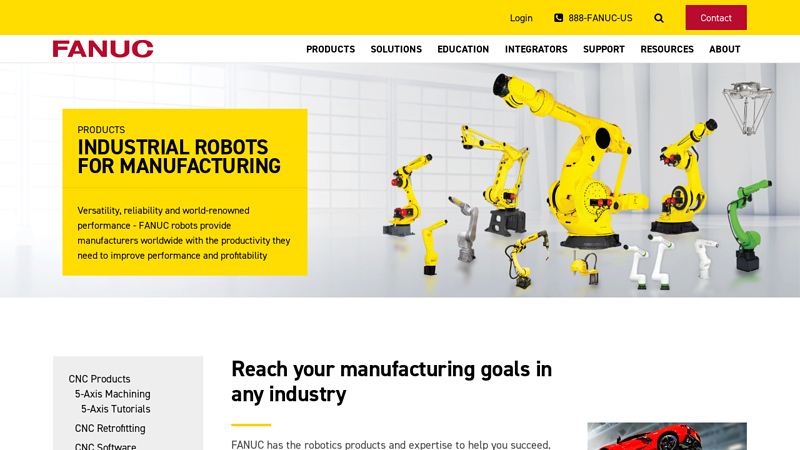

#4 Industrial Robots for Manufacturing

Domain Est. 1998

Website: fanucamerica.com

Key Highlights: FANUC has the expertise to help you succeed. With over 100 robot models and over 40 years of manufacturing experience, we’re ready for any challenge….

#5 Collaborative robotic automation

Domain Est. 2005

Website: universal-robots.com

Key Highlights: Universal Robots combines advanced robots design with industrial-grade performance – payloads up to 35 kg, reach up to 1750 mm, and deployment in minutes….

#6 Mecademic Industrial Robotics

Domain Est. 2012

Website: mecademic.com

Key Highlights: We develop and build the world’s smallest, most compact industrial robots. Our solutions are designed for maximum efficiency, even in extreme space limitations….

#7 ABB Robotics

Domain Est. 1990

Website: abb.com

Key Highlights: ABB Robotics leads in robotics and automation with integrated robots, AMRs, and software, helping industries boost resilience and efficiency….

#8 Kinova Robotics

Domain Est. 2011

Website: kinovarobotics.com

Key Highlights: DISCOVER OUR ROBOTS. Kinova designs innovative robotic solutions manufactured by experts in North America to empower people and businesses….

#9 GrayMatter Robotics

Domain Est. 2019

Website: graymatter-robotics.com

Key Highlights: We deliver easy-to-deploy, highly reliable smart robotic cells that empower workers with superhuman capabilities, allowing them to achieve unprecedented speeds….

#10 The Leader Of Ultra

Domain Est. 2020

Website: realman-robotics.com

Key Highlights: RealMan is a national high-tech enterprise specializing in the R&D, production, and sales of ultra-lightweight humanoid robotic arms….

Expert Sourcing Insights for Robotic Arm

H2 2026 Market Trends for Robotic Arms

The robotic arm market is poised for significant transformation in H2 2026, driven by technological convergence, evolving industrial needs, and broader economic shifts. Key trends shaping the landscape include:

1. Accelerated Adoption of AI and Machine Learning Integration

- Smarter Autonomy: Robotic arms will increasingly leverage advanced AI for real-time decision-making, adaptive path planning, and predictive maintenance, reducing reliance on pre-programmed paths and complex teaching.

- Enhanced Vision & Sensing: Integration of 3D vision, LiDAR, and force-torque sensors with AI will enable robust bin picking, complex assembly, and delicate handling of unstructured or variable objects (e.g., in e-commerce fulfillment, food processing).

- Generative AI for Programming: Tools using generative AI will simplify robot programming, allowing operators to define tasks through natural language or demonstrations (“programming by demonstration”), drastically reducing deployment time and skill barriers.

2. Proliferation of Collaborative Robots (Cobots) into New Sectors

- Beyond Automotive & Electronics: While established in these sectors, cobots will see explosive growth in healthcare (lab automation, rehabilitation assistance), agriculture (harvesting, sorting), retail (inventory management), and SMBs (small-batch manufacturing, packaging).

- Focus on Ease-of-Use & Flexibility: Manufacturers will prioritize intuitive interfaces, modular end-effectors, and seamless integration with existing workflows to appeal to non-expert users and dynamic production environments.

- Higher Payload & Reach Cobots: Development of cobots with increased payload capacity (beyond 10-20kg) and reach will expand their application scope into heavier-duty tasks.

3. Rise of Mobile Manipulation (MoMa)

- AMR + Robotic Arm Synergy: The integration of Autonomous Mobile Robots (AMRs) with robotic arms will become mainstream, creating versatile “MoMa” systems. These will enable true end-to-end automation in logistics (goods-to-person, case picking), warehousing, and flexible manufacturing cells.

- Demand for Seamless Navigation & Task Coordination: Key challenges will focus on robust navigation in dynamic environments, precise arm control while moving, and intelligent task planning software coordinating the mobile base and arm.

4. Sustainability and Energy Efficiency as Key Drivers

- “Green Robotics”: Manufacturers and end-users will prioritize energy-efficient robotic designs, recyclable materials, and longer lifespans. This aligns with corporate ESG goals and rising energy costs.

- Lightweight Materials: Increased use of carbon fiber and advanced composites will reduce robot mass, lowering energy consumption during operation and enabling faster, more dynamic movements.

5. Supply Chain Resilience Driving Onshoring/Nearshoring Automation

- Geopolitical & Cost Pressures: Ongoing supply chain disruptions and labor cost fluctuations will accelerate investments in automation to support onshoring or nearshoring of manufacturing (e.g., “reshoring” in the US/EU).

- Flexible Automation for Smaller Batches: Robotic arms, particularly cobots and reconfigurable systems, will be crucial for automating smaller-batch, high-mix production lines characteristic of reshored operations, replacing large, inflexible legacy automation.

6. Cloud Robotics and Digital Twins Maturation

- Centralized Monitoring & Optimization: Cloud platforms will enable remote monitoring, performance analytics, predictive maintenance, and centralized fleet management for robotic arms across multiple sites.

- Digital Twin Simulation: Widespread use of digital twins for virtual commissioning, process optimization, and operator training will reduce downtime and accelerate deployment of new robotic cells.

7. Tightening Labor Markets Sustain Automation Demand

- Persistent Skills Gap: Continued difficulty in finding skilled labor, especially for repetitive or dangerous tasks, will remain a primary driver for robotic arm adoption across manufacturing, logistics, and service sectors.

- Focus on Augmentation: Robots will increasingly be positioned as tools to augment human workers, taking over strenuous or monotonous tasks, improving worker safety, and allowing humans to focus on higher-value activities.

Conclusion:

H2 2026 will be characterized by robotic arms becoming significantly smarter, more flexible, and more integrated. The convergence of AI, mobility, and cloud connectivity will unlock new applications beyond traditional factories. Success for manufacturers will hinge on delivering solutions that are easy to deploy, highly adaptable, energy-efficient, and demonstrably improve operational resilience and productivity in a tight labor market. The focus will shift from pure automation to intelligent, collaborative, and sustainable augmentation of human capabilities.

Common Pitfalls Sourcing a Robotic Arm: Quality and Intellectual Property Issues

Sourcing a robotic arm, whether for integration into a larger system or as a standalone solution, involves navigating several critical challenges. Two of the most significant areas of risk are ensuring consistent product quality and managing intellectual property (IP) concerns. Failing to address these pitfalls can lead to project delays, increased costs, legal liabilities, and compromised product performance.

Quality-Related Pitfalls

Inconsistent Build Quality and Reliability

One of the most common issues when sourcing robotic arms—especially from lower-cost or less-established suppliers—is inconsistent build quality. Components such as gearboxes, motors, and encoders may vary in precision and durability between units. This inconsistency can result in unpredictable performance, higher failure rates, and increased maintenance costs. Without rigorous quality control processes in place, buyers may receive units that do not meet advertised specifications or fail prematurely under normal operating conditions.

Lack of Standardized Testing and Certification

Many suppliers, particularly in emerging markets, do not adhere to international standards such as ISO 9041 (robots and robotic devices) or IEC 61508 (functional safety). The absence of standardized testing protocols means that performance metrics like repeatability, payload capacity, and cycle life may be overstated or unverified. This lack of transparency makes it difficult to compare offerings across vendors and increases the risk of integration failures.

Insufficient Documentation and Support

Poorly documented robotic arms—lacking comprehensive manuals, API references, or troubleshooting guides—can severely hinder integration and maintenance. Inadequate technical support exacerbates these issues, especially when debugging communication errors, calibration problems, or firmware updates. Buyers may find themselves dependent on the supplier for basic operational tasks, creating bottlenecks and downtime.

Intellectual Property-Related Pitfalls

Unclear IP Ownership in Customizations

When modifying or integrating third-party robotic arms into proprietary systems, the ownership of resulting IP can become ambiguous. If the sourcing agreement does not explicitly state who owns the rights to software modifications, mechanical adaptations, or integrated control algorithms, disputes may arise. Suppliers may claim partial ownership or restrict the use of derivative works, limiting the buyer’s freedom to innovate or scale.

Use of Open-Source Components Without Compliance

Many robotic arms use open-source software (e.g., ROS – Robot Operating System) or hardware designs. While this can reduce costs, it also introduces IP compliance risks. Buyers must ensure that the supplier complies with relevant open-source licenses (e.g., GPL, LGPL), which may require disclosure of source code or restrict commercial use. Failure to verify compliance can expose the buyer to legal action or force costly redesigns.

Reverse Engineering and IP Infringement Risks

Some low-cost robotic arms, particularly those from certain regions, may incorporate designs or components that infringe on existing patents. Buyers who unknowingly source such products may become liable for contributory infringement. Conducting due diligence on the supplier’s design origins and patent landscape is essential to avoid legal exposure and reputational damage.

Mitigation Strategies

To avoid these pitfalls, organizations should conduct thorough supplier vetting, demand transparent quality assurance reports, require clear IP clauses in contracts, and perform independent testing before full-scale deployment. Engaging legal counsel to review IP terms and ensuring compliance with open-source licenses are also critical steps in de-risking the sourcing process.

Logistics & Compliance Guide for Robotic Arm

Product Classification and Documentation

Ensure the robotic arm is accurately classified under the appropriate Harmonized System (HS) code for international shipping, typically falling under HS 8479.50 (Robots, whether or not assembled or completed). Maintain comprehensive technical documentation, including user manuals, safety data sheets (SDS), electrical schematics, and CE/UL certification reports. Provide a detailed commercial invoice, packing list, and bill of lading or air waybill for customs clearance.

Export Controls and Regulatory Compliance

Verify compliance with export control regulations such as the Export Administration Regulations (EAR) in the U.S. or the EU Dual-Use Regulation. Determine if the robotic arm or its components (e.g., controllers, sensors) are subject to licensing requirements based on performance specifications (e.g., precision, speed, payload). Screen end-users and destinations against restricted party lists (e.g., OFAC, BIS Denied Persons List) to avoid violations.

Safety and Certification Standards

Confirm the robotic arm meets essential safety standards prior to shipment, including ISO 10218 (safety requirements for industrial robots) and ISO/TS 15066 (collaborative robots). In the European Union, ensure CE marking with compliance to the Machinery Directive (2006/42/EC), Electromagnetic Compatibility (EMC) Directive, and Low Voltage Directive. For North America, obtain UL/CSA certification according to ANSI/RIA R15.06. Maintain certification documentation for customs and customer inspection.

Packaging and Shipping Requirements

Package the robotic arm securely using custom crating with internal cushioning to prevent movement and damage during transit. Clearly label packages with handling instructions (e.g., “Fragile,” “This Side Up”), and include product identification, serial numbers, and compliance labels (e.g., CE, UL). Use anti-static materials if sensitive electronics are exposed. Select a freight forwarder experienced in handling industrial automation equipment and capable of managing temperature and humidity-sensitive shipments.

Import Regulations and Duties

Research import regulations, tariffs, and required documentation for the destination country. Some countries may require additional conformity assessments, local representative registration, or type approvals. Prepare for potential inspections by local authorities and ensure all compliance documents are translated if required. Account for applicable import duties, VAT, or GST in the total landed cost.

After-Sales Support and Warranty Compliance

Provide clear instructions for product registration and warranty activation. Ensure spare parts logistics are established to support maintenance and repairs. Comply with local consumer protection laws and product liability requirements. Maintain records of shipped units, software versions, and customer locations for recall readiness and regulatory reporting.

Environmental and End-of-Life Compliance

Adhere to environmental regulations such as the EU’s WEEE (Waste Electrical and Electronic Equipment) Directive and RoHS (Restriction of Hazardous Substances). Provide take-back or recycling information for end-of-life robotic arms. Include material declarations and substance restrictions documentation to ensure compliance across jurisdictions.

In conclusion, sourcing robotic arm manufacturers requires a comprehensive evaluation of several key factors, including technical capabilities, product quality, scalability, cost-efficiency, after-sales support, and compliance with industry standards. By identifying manufacturers that align with specific application requirements—such as precision, payload capacity, and integration capabilities—businesses can ensure long-term operational success and automation efficiency. Conducting thorough due diligence, visiting facilities when possible, and reviewing customer testimonials can further mitigate risks and strengthen supplier relationships. Ultimately, partnering with a reliable and innovative robotic arm manufacturer not only enhances productivity but also supports sustainable growth in an increasingly automated industrial landscape.