The global ripper blade market is experiencing steady growth, driven by rising demand in construction, mining, and earthmoving operations. According to a report by Mordor Intelligence, the global excavator aftermarket parts market—of which ripper blades are a critical component—is projected to grow at a CAGR of over 4.5% from 2024 to 2029. This expansion is fueled by increased infrastructure development, fleet aging, and the need for cost-effective wear part replacements. Additionally, Grand View Research highlights that the global construction machinery market, a key end-user segment, is expected to grow at a CAGR of 5.8% from 2023 to 2030, further amplifying demand for high-performance ripper blades. With durability, efficiency, and machine compatibility becoming key selection criteria, manufacturers are investing in advanced materials and engineering to deliver superior wear resistance and operational longevity. In this competitive landscape, five manufacturers stand out for their innovation, global reach, and proven track record in delivering reliable ripping solutions.

Top 5 Ripper Blades Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

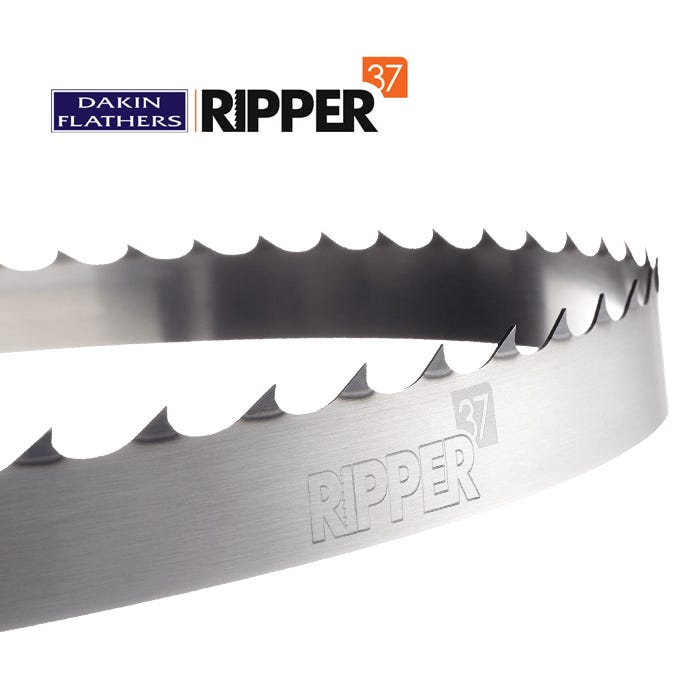

#1 Ripper37 Blades

Domain Est. 2002

Website: allblades.ca

Key Highlights: Sawmill Blades That Last 37% Longer. Ripper37 is known for its durability. The name comes from the manufacturer Dakin Flathers’ Generation37 project….

#2 Dakin

Domain Est. 2000

Website: dakin-flathers.com

Key Highlights: World-class manufacturer. Dakin-Flathers lead the way in performance and durability. Manufacturing specialised bandsaw and bandknife blades for over 125 years….

#3 Brandt

Domain Est. 2000

Website: brandt.ca

Key Highlights: The Brandt Group of Companies is a dynamic and diverse group of companies headquartered in Regina, Saskatchewan. Brandt employs over 6000 people and services ……

#4 Jerry’s Resharp Inc, Kentucky

Domain Est. 2010

Website: jerrysresharp.com

Key Highlights: Here at Jerry’s Resharp we can cater for all your band saw needs. We offer premium Ripper37 sawmill blades for most makes of mill……

#5 Ripper37 Saw Mill Blades

Website: jerryssawmillsupplies.com

Key Highlights: For sawyers who demand the best, Ripper37 Saw Mill Blades deliver exceptional performance, long-lasting durability, and accurate smooth cuts….

Expert Sourcing Insights for Ripper Blades

H2: Market Trends for Ripper Blades in 2026

As we approach 2026, the global market for ripper blades—essential components in earthmoving and construction machinery used to break up hard soil, rock, and pavement—is undergoing significant transformation driven by technological innovation, sustainability demands, and shifts in global infrastructure development. The following are key market trends shaping the ripper blade industry in 2026:

1. Increased Demand from Infrastructure Expansion

Governments worldwide, especially in emerging economies across Asia-Pacific, Africa, and Latin America, are investing heavily in infrastructure projects such as highways, railways, and urban development. This surge in construction and mining activities is directly fueling demand for heavy equipment, including ripper blades. In 2026, infrastructure-related demand remains a primary growth driver for the ripper blade market.

2. Technological Advancements in Blade Materials

Manufacturers are increasingly adopting advanced materials such as high-strength, wear-resistant steel alloys and composite coatings (e.g., tungsten carbide) to extend blade lifespan and improve performance under extreme conditions. These innovations reduce maintenance frequency and downtime, offering cost savings for operators. In 2026, smart materials and predictive wear technologies are being integrated into premium ripper blade designs.

3. Focus on Sustainability and Circular Economy

Environmental regulations and corporate sustainability goals are pushing manufacturers toward recyclable materials and remanufactured blades. In 2026, a growing number of OEMs and aftermarket providers offer reconditioned or refurbished ripper blades, reducing waste and raw material consumption. Additionally, energy-efficient manufacturing processes are becoming standard in leading production facilities.

4. Rise of Aftermarket and Customization

The aftermarket segment is expanding rapidly, with third-party suppliers offering cost-effective, customized ripper blades tailored to specific soil conditions and machine models. In 2026, digital configurators and 3D printing technologies enable rapid prototyping and on-demand production, allowing for greater customization and shorter lead times.

5. Integration with Smart Equipment and IoT

As construction equipment becomes more connected, ripper blades are being monitored through IoT-enabled sensors that track wear, temperature, and performance in real time. These data insights help fleet managers schedule maintenance proactively and optimize operational efficiency. By 2026, smart monitoring systems are increasingly bundled with high-end ripper blade packages.

6. Regional Market Shifts

While North America and Europe maintain strong demand due to equipment upgrades and stringent safety standards, the fastest growth is occurring in the Asia-Pacific region—particularly in India, Indonesia, and Vietnam—where rapid urbanization and mining activities are on the rise. China continues to be both a major consumer and producer, with increasing emphasis on domestic innovation.

7. Supply Chain Resilience and Localization

Post-pandemic supply chain disruptions have prompted companies to localize production and diversify sourcing. In 2026, many ripper blade manufacturers are establishing regional production hubs to reduce lead times and mitigate geopolitical risks, especially in response to trade fluctuations and tariffs.

Conclusion

The ripper blade market in 2026 is characterized by innovation, sustainability, and regional diversification. As demand grows in tandem with global infrastructure development, stakeholders who embrace advanced materials, digital integration, and circular economy principles are best positioned to lead the market. The H2 outlook remains positive, with steady growth projected across both developed and emerging markets.

Common Pitfalls Sourcing Ripper Blades: Quality and Intellectual Property Risks

Sourcing ripper blades—critical wear components used in heavy machinery like bulldozers and excavators—can be fraught with challenges, particularly concerning product quality and intellectual property (IP) concerns. Avoiding these pitfalls is essential to ensure operational efficiency, reduce downtime, and mitigate legal and reputational risks.

Poor Material Quality and Workmanship

One of the most prevalent issues when sourcing ripper blades is receiving products made from substandard materials or with inconsistent manufacturing processes. Low-quality steel alloys may lack the necessary hardness and toughness, leading to rapid wear, cracking, or catastrophic failure under stress. Blades that are improperly heat-treated or welded can deform or break prematurely, increasing maintenance costs and safety hazards.

Inaccurate Dimensional Tolerances

Ripper blades must fit precisely onto specific machine models. Sourcing from unreliable suppliers often results in blades with incorrect dimensions or mounting configurations. Poor tolerances can lead to improper fitment, increased vibration, accelerated wear on adjacent components, and reduced ripping efficiency. This not only affects performance but may also void equipment warranties.

Lack of Certification and Traceability

Reputable ripper blades should come with material certifications (e.g., mill test reports) and traceability documentation. Many low-cost suppliers, especially in unregulated markets, fail to provide these, making it difficult to verify the blade’s compliance with industry standards (e.g., ASTM, ISO). Without traceability, diagnosing premature failures becomes challenging, and liability in case of accidents is harder to assign.

Intellectual Property Infringement

A significant legal and ethical risk is purchasing ripper blades that infringe on original equipment manufacturer (OEM) patents or design rights. Some suppliers produce “compatible” or “aftermarket” blades that closely mimic OEM designs, potentially violating IP protections. Buyers may unknowingly contribute to or benefit from IP theft, exposing their organization to legal action, customs seizures, or reputational damage.

Misrepresentation of Branding and Compatibility

Suppliers may falsely claim that their blades are OEM-equivalent or authorized replacements when they are not. This misrepresentation can mislead buyers about performance expectations and warranty coverage. In some cases, counterfeit blades are sold with forged branding, further complicating procurement integrity and after-sales support.

Inadequate Testing and Performance Validation

Many third-party manufacturers do not conduct rigorous field or laboratory testing on their ripper blades. Without proper validation of wear resistance, impact strength, and fatigue life, buyers risk deploying unproven products in demanding environments. This can lead to unplanned downtime and higher total cost of ownership despite lower initial purchase prices.

Supply Chain Transparency Issues

Lack of transparency in the supply chain increases the risk of encountering unethical labor practices, environmental violations, or indirect IP infringement. Buyers may struggle to audit suppliers effectively, especially when sourcing through intermediaries or from regions with weak regulatory oversight.

Conclusion

To mitigate these risks, buyers should conduct due diligence on suppliers, demand material certifications, verify IP compliance, and prioritize long-term value over initial cost savings. Engaging with reputable manufacturers and legal counsel when evaluating aftermarket alternatives can help ensure quality, reliability, and compliance in ripper blade procurement.

Logistics & Compliance Guide for Ripper Blades

Product Classification and HS Code

Ripper blades, typically used in earthmoving and construction equipment such as bulldozers, are generally classified under Harmonized System (HS) codes related to machinery parts. A common classification is 8431.43 (Parts suitable for use solely or principally with the machinery of headings 8429 or 8430). However, exact classification may vary by country and blade specifications. Confirm the appropriate HS code with local customs authorities or a licensed customs broker to ensure accurate tariff application and compliance.

Import/Export Documentation Requirements

To facilitate international shipments of ripper blades, ensure the following documents are prepared and accurate:

– Commercial Invoice (detailing product description, value, quantity, and Harmonized System code)

– Packing List (including weight, dimensions, and packaging type)

– Bill of Lading or Air Waybill

– Certificate of Origin (may be required for preferential tariff treatment under trade agreements)

– Export Declaration (if required by the exporting country)

Maintain records of all documentation for a minimum of five years for audit and compliance purposes.

Packaging and Handling Instructions

Ripper blades are heavy, sharp, and prone to damage if improperly handled. Follow these guidelines:

– Secure blades in wooden crates or steel-reinforced containers to prevent movement during transit.

– Use edge protectors or padding on cutting edges to avoid damage and ensure safety.

– Clearly label packages with “Heavy,” “Sharp Edges,” “This Side Up,” and any applicable handling symbols.

– Ensure proper stacking and weight distribution on pallets or in containers to avoid structural damage.

Transportation and Freight Considerations

- Mode of Transport: Ripper blades are commonly shipped via ocean freight (FCL or LCL) due to size and weight. Air freight is viable only for urgent, smaller orders.

- Weight & Dimensions: Confirm dimensions and gross weight early in the logistics process to avoid carrier surcharges or handling issues.

- Freight Class: Classify under appropriate freight class (e.g., NMFC code for heavy machinery parts in North America) to ensure accurate freight quotes.

- Insurance: Obtain cargo insurance covering damage, loss, or theft during transit, especially for high-value shipments.

Regulatory Compliance and Safety Standards

- REACH & RoHS (EU): Confirm that blade materials (e.g., steel alloys) comply with EU regulations on restricted substances.

- OSHA & ANSI (USA): While not directly applicable to the product, handling and storage should follow OSHA safety standards to protect workers.

- Country-Specific Regulations: Some countries may require product certification or conformity assessment (e.g., CCC in China, INMETRO in Brazil). Verify requirements in the destination market.

Customs Clearance and Duties

- Provide accurate product descriptions to avoid delays or misclassification. Use terms such as “Wear Part for Bulldozer,” “Ripper Shank Tip,” or “Earthmoving Equipment Blade.”

- Be aware of anti-dumping or countervailing duties that may apply on steel products from certain countries.

- Leverage Free Trade Agreements (e.g., USMCA, RCEP) where applicable to reduce or eliminate import duties—ensure Certificate of Origin is correctly completed.

Environmental and Disposal Considerations

- Ripper blades are typically made from high-carbon or alloy steel and are recyclable at end-of-life.

- Provide customers with guidance on proper disposal or recycling in compliance with local environmental regulations.

- Avoid shipping blades coated with hazardous rust inhibitors unless compliant with transport regulations (e.g., IMDG for sea, ADR for road in Europe).

Recordkeeping and Audit Preparedness

- Maintain detailed logs of shipments, compliance documentation, and supplier certifications.

- Conduct periodic internal audits to verify adherence to export controls, sanctions lists (e.g., OFAC), and trade compliance policies.

- Train logistics and sales teams on key compliance responsibilities to reduce risk of violations.

By following this guide, businesses can ensure the safe, efficient, and compliant global movement of ripper blades while minimizing delays and regulatory exposure.

Conclusion for Sourcing Ripper Blades

In conclusion, sourcing high-quality ripper blades is a critical factor in maximizing operational efficiency, reducing downtime, and controlling maintenance costs in earthmoving and excavation projects. By carefully evaluating suppliers based on blade material, hardness, wear resistance, compatibility with equipment, and overall cost-effectiveness, organizations can ensure optimal performance and longevity of their ripping tools. Establishing relationships with reputable manufacturers or distributors, considering both OEM and aftermarket options, allows for a balanced approach between quality and cost. Additionally, proactive inventory management and timely replacement schedules contribute to sustained productivity. Ultimately, a strategic sourcing approach to ripper blades supports improved project outcomes, enhanced equipment reliability, and long-term cost savings in heavy-duty operations.