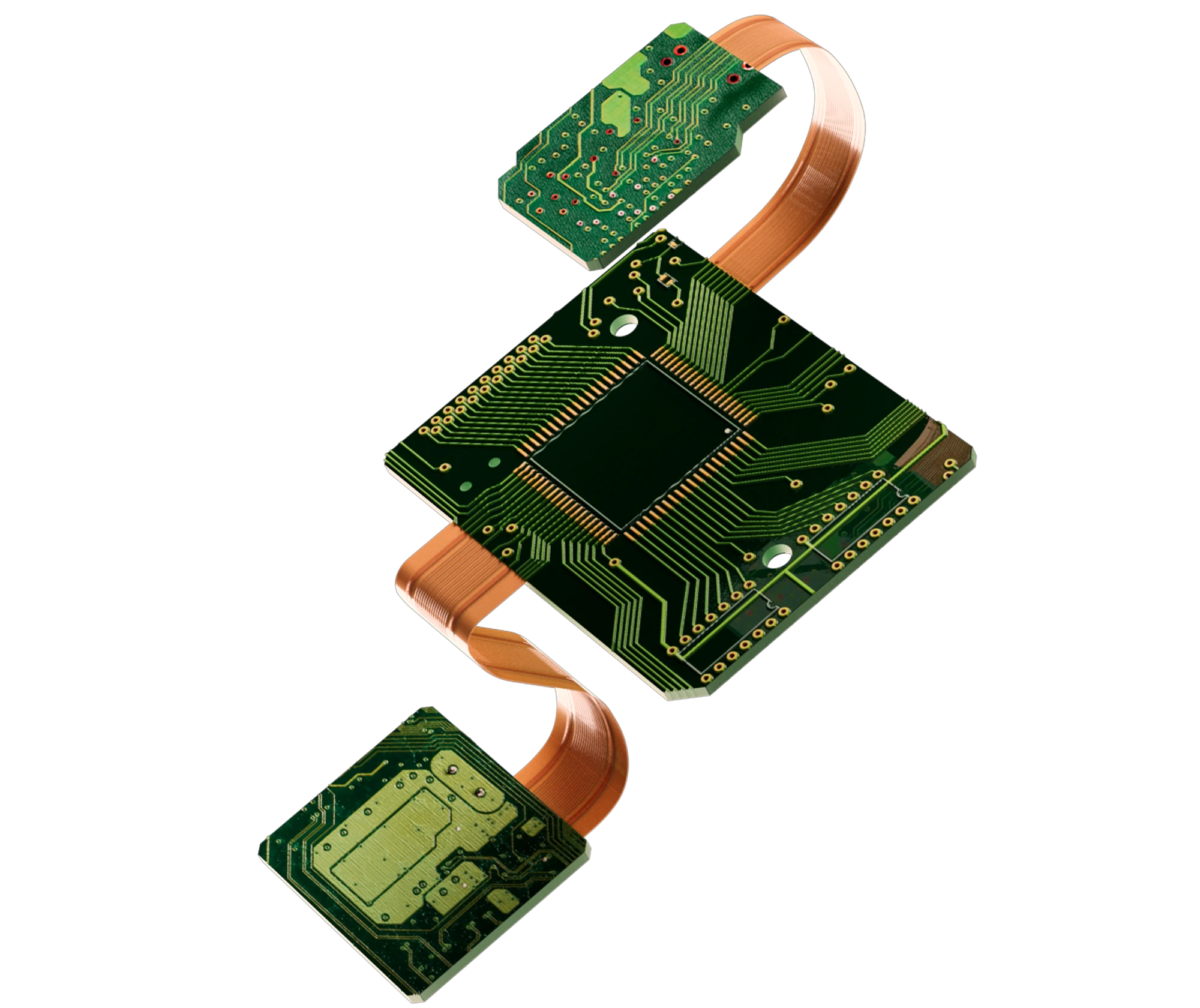

The global rigid flex printed circuit board (PCB) market is experiencing robust growth, driven by rising demand for compact, high-performance electronics across industries such as aerospace, medical devices, and consumer electronics. According to a 2023 report by Mordor Intelligence, the rigid flex PCB market was valued at USD 12.45 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2028. This expansion is fueled by the increasing adoption of wearable technology, the miniaturization of electronic components, and the need for reliable interconnections in harsh environments. As system designers prioritize space efficiency and signal integrity, rigid flex boards have become a preferred solution, blending the durability of rigid PCBs with the flexibility of flex circuits. With market dynamics favoring innovation and scalability, identifying leading manufacturers capable of delivering high-reliability, precision-engineered solutions has become critical. The following analysis highlights the top eight rigid flex board manufacturers shaping this evolving landscape through technological expertise, global reach, and strong quality certifications.

Top 8 Rigid Flex Board Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Rigid Flex Printed Circuit Board Manufacturer by Rigiflex Technology

Domain Est. 1997

Website: rigiflex.com

Key Highlights: Rigiflex is a trusted rigid-flex printed circuit board manufacturer, who is your partner in growth. Flex PCBs: Superior Results even in Demanding Conditions….

#2 Flex / Rigid

Domain Est. 1995

Website: ttm.com

Key Highlights: TTM is a Leading PCB Manufacturing Services Provider With Broad Flex and Rigid-Flex Expertise. Innovation to Support Emerging Technology Trends….

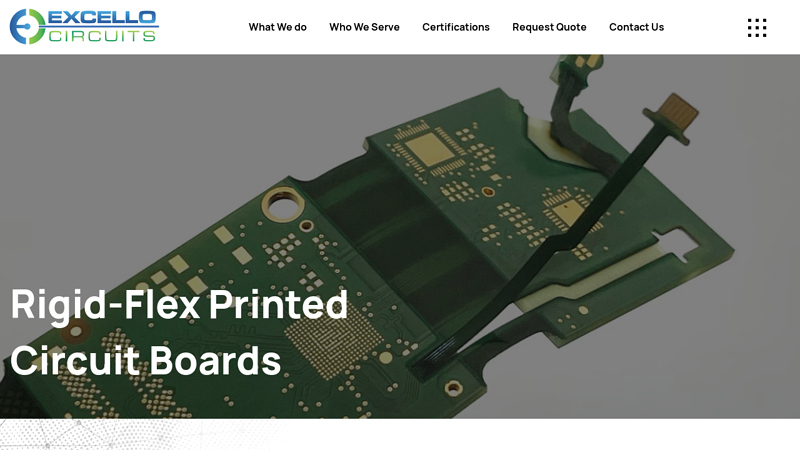

#3 Rigid

Domain Est. 2000

Website: excello.com

Key Highlights: Excello Circuits delivers advanced Rigid-Flex PCBs, combining flexibility with durability for challenging electronic designs….

#4 Flexible Circuits and Heaters, Rigid Flex Circuit Design

Domain Est. 2004

Website: flexiblecircuit.com

Key Highlights: Supplier of flexible circuits and heaters, rigid flex circuit design, product box builds and beyond. Serving a variety of markets with competitive prices….

#5 Flex & Rigid

Domain Est. 2009

Website: epectec.com

Key Highlights: Custom flex and rigid-flex PCBs built for aerospace, medical, and military use. Reduce cost, replace wiring, and ensure high reliability in every design….

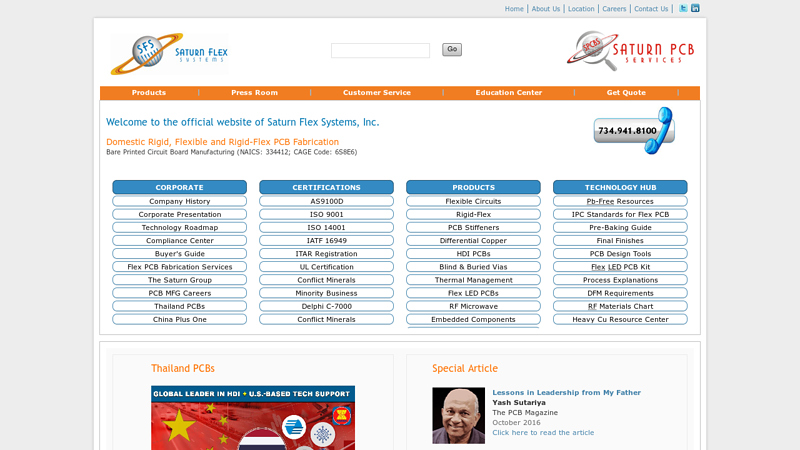

#6 Saturn Flex Systems

Domain Est. 2010

Website: saturnflex.com

Key Highlights: Saturn Flex Systems is a Rigid-Flex and Flexible PCB Fabricator providing advanced technologies such as HDI PCB, Blind and Buried Vias and Embedded ……

#7 Leader in Rigid

Domain Est. 2016

Website: summitinterconnect.com

Key Highlights: Rigid-flex PCBs combine the durability of rigid boards with the adaptability of flexible circuits, creating a single integrated design….

#8 Rigid

Website: multi-circuit-boards.eu

Key Highlights: Rating 4.7 (12,829) Rigid-Flex circuit boards are composed of a combination of rigid and flexible circuit boards that are permanently connected to one another….

Expert Sourcing Insights for Rigid Flex Board

H2: 2026 Market Trends for Rigid Flex Boards

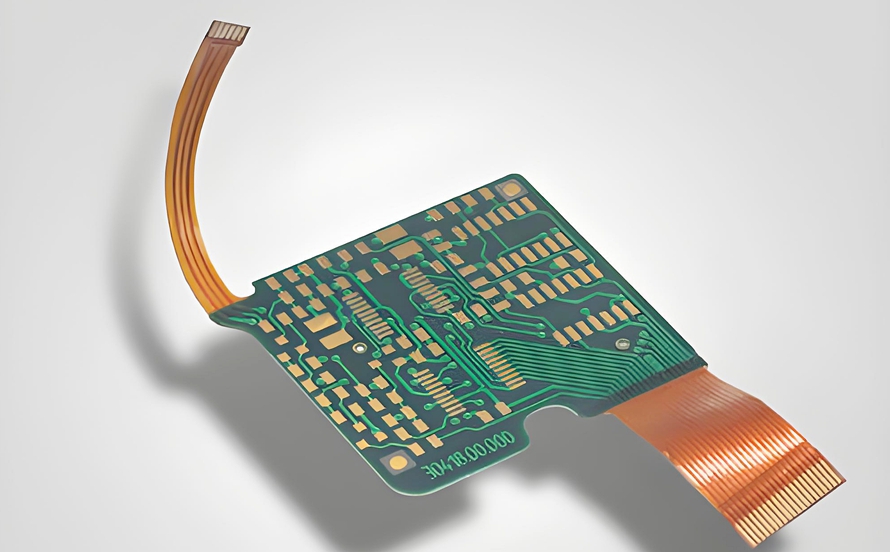

The rigid flex board market is poised for substantial growth and transformation by 2026, driven by rising demand for miniaturized, high-performance electronic systems across various industries. These hybrid circuit boards, which combine the durability of rigid boards with the flexibility of flexible circuits, are increasingly critical in applications requiring reliability in compact and dynamic form factors.

One of the primary drivers shaping the 2026 landscape is the continued expansion of the consumer electronics sector. Smartphones, wearables, and foldable devices increasingly utilize rigid flex technology to save space, reduce weight, and improve signal integrity. As manufacturers push the boundaries of device thinness and functionality, rigid flex boards offer an optimal solution for interconnecting components across multiple planes.

The aerospace and defense sector remains a cornerstone of demand. Rigid flex boards are favored in avionics, satellites, and military communication systems due to their resistance to vibration, thermal stress, and mechanical fatigue. With global defense modernization programs accelerating, especially in North America and Asia-Pacific, procurement of high-reliability rigid flex PCBs is expected to surge by 2026.

In the automotive industry, the shift toward electric vehicles (EVs) and advanced driver-assistance systems (ADAS) is creating new opportunities. Rigid flex boards are being integrated into battery management systems, infotainment units, and sensor networks where space constraints and reliability under extreme conditions are critical. The growing complexity of vehicle electronics supports sustained market growth.

Healthcare technology is another emerging application area. Portable medical devices, implantables, and diagnostic equipment benefit from the lightweight and space-efficient nature of rigid flex circuits. Regulatory approvals for more compact and reliable medical electronics will further boost adoption.

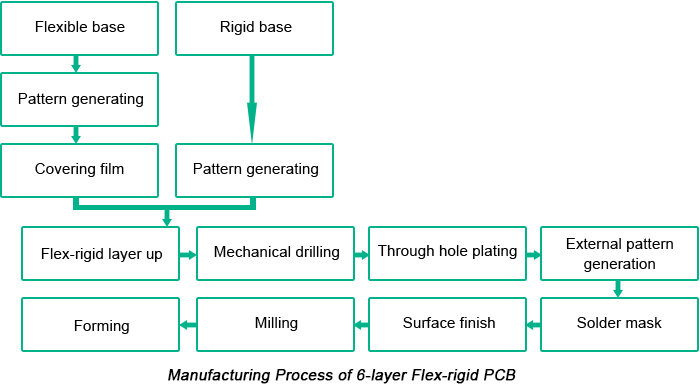

Technological advancements are also reshaping the market. Innovations in materials—such as improved polyimide films and low-Dk dielectrics—are enhancing signal performance and thermal management. Additionally, the integration of embedded components and higher layer counts is enabling more functionality in smaller footprints.

Regionally, Asia-Pacific is expected to dominate the rigid flex board market by 2026, supported by robust electronics manufacturing in China, Japan, and South Korea. However, increasing supply chain diversification and nearshoring trends may boost production capacity in North America and Europe, particularly for high-reliability applications.

In summary, the 2026 rigid flex board market will be defined by increasing demand from high-tech industries, ongoing miniaturization trends, and material and design innovations. As electronics continue to evolve toward greater integration and mobility, rigid flex technology will play a pivotal role in enabling next-generation devices.

Common Pitfalls When Sourcing Rigid Flex Boards: Quality and Intellectual Property Risks

Sourcing rigid flex boards—hybrid circuit boards combining rigid and flexible substrates—can offer significant advantages in compact, high-reliability electronic designs. However, the complexity of these boards introduces unique challenges, particularly in ensuring consistent quality and protecting intellectual property (IP). Overlooking these aspects can result in production delays, field failures, and exposure of sensitive design data.

Poor Material and Lamination Quality

One of the most critical quality pitfalls in rigid flex boards is inconsistent or substandard material selection and lamination processes. Low-quality polyimide films, improper adhesive application, or inadequate bonding between rigid and flexible layers can lead to delamination, especially under thermal cycling or mechanical stress. Vendors may cut corners by using inferior materials or skipping necessary process controls, resulting in boards that fail prematurely in the field.

Inadequate Layer Registration and Alignment

Rigid flex boards require precise alignment between multiple layers—both rigid and flexible—during lamination. Poor layer-to-layer registration can cause via misalignment, trace discontinuities, or impedance mismatches. This issue often stems from outdated equipment or insufficient process validation at the manufacturer. Without tight tolerances and robust imaging systems, even minor shifts can compromise electrical performance and long-term reliability.

Insufficient Testing and Inspection Capabilities

Many suppliers lack comprehensive testing procedures tailored to rigid flex boards. Standard electrical testing may not detect latent issues such as micro-cracks in flexible sections or interlayer voids. Without advanced inspection methods like automated optical inspection (AOI), X-ray, or cross-section analysis, defects may go unnoticed until final assembly or in-field use. Always verify that the supplier conducts rigorous testing specific to rigid flex construction.

Inconsistent Flex Circuit Durability

The flexible regions of the board are particularly vulnerable to mechanical fatigue. Sourcing from manufacturers without proven expertise in flex circuit design rules—such as minimum bend radii, proper coverlay placement, and strain relief—can result in cracked traces or broken vias during installation or operation. Ensure the supplier adheres to IPC-2223 and other relevant standards for flex reliability.

Lack of Design for Manufacturability (DFM) Support

Rigid flex boards require close collaboration between designer and manufacturer. A common pitfall is selecting a supplier that offers little or no DFM feedback. Without early-stage design review, issues like unsupported vias in flex zones, improper stiffener placement, or inadequate transition areas can lead to yield loss and costly redesigns. Choose a partner that provides proactive DFM analysis.

Weak Intellectual Property Protection

Rigid flex designs often contain proprietary routing, stack-up configurations, and miniaturized layouts that are highly sensitive. Sourcing from regions or suppliers with lax IP enforcement increases the risk of design theft or unauthorized replication. Some manufacturers may share Gerber files, stack-up details, or fabrication data with third parties without proper confidentiality agreements.

Inadequate NDAs and Legal Safeguards

Even with a non-disclosure agreement (NDA) in place, the scope and enforceability matter. Generic NDAs may not cover specific aspects like reverse engineering, subcontractor liabilities, or data usage. Ensure your NDA explicitly addresses rigid flex design data, includes audit rights, and specifies jurisdiction for dispute resolution. Avoid suppliers reluctant to sign comprehensive IP protection agreements.

Use of Unauthorized Subcontractors

Some contract manufacturers outsource parts of the fabrication process—especially lamination or plating—to third-party shops without informing the customer. These subcontractors may not adhere to the same quality or security standards, increasing the risk of IP exposure and inconsistent product quality. Demand transparency in the supply chain and require approval for any subcontracting.

Incomplete Traceability and Documentation

Traceability is essential for both quality control and IP management. Poor documentation—such as missing lot numbers, material certifications, or process logs—makes it difficult to investigate field failures or verify IP ownership. Ensure the supplier provides full fabrication records and maintains a secure, auditable data trail for each production batch.

Failure to Verify Certifications and Standards Compliance

Not all rigid flex manufacturers are created equal. Sourcing without verifying certifications like ISO 9001, IPC membership, or ITAR compliance can expose your project to unacceptable risk. These standards ensure adherence to quality management systems and, in some cases, safeguard against unauthorized data access—especially critical for defense or medical applications.

Conclusion

To avoid these pitfalls, conduct thorough due diligence on potential suppliers. Evaluate their technical capabilities, quality control processes, and IP protection policies. Engage in direct dialogue, request samples, and consider on-site audits when feasible. By prioritizing both quality and IP security, you can ensure a reliable and protected supply chain for your rigid flex board needs.

Logistics & Compliance Guide for Rigid Flex Boards

When shipping and handling rigid flex printed circuit boards (PCBs), adherence to logistical best practices and compliance standards is critical to ensure product integrity, regulatory compliance, and on-time delivery. This guide outlines key considerations for logistics and compliance specific to rigid flex boards.

Packaging and Handling

Rigid flex boards are fragile due to their combination of rigid and flexible substrates. Proper packaging prevents mechanical stress, electrostatic discharge (ESD), and environmental damage.

- ESD-Safe Packaging: Always use static-dissipative or conductive bags (e.g., metallized shielding bags) to protect against electrostatic discharge.

- Rigid Enclosures: Place boards in rigid containers or corrugated boxes with internal foam or molded pulp inserts to prevent bending or warping.

- Moisture Protection: Include desiccant packs and moisture barrier bags (MBBs) if storing or shipping in humid environments. Follow IPC/JEDEC J-STD-033 standards for moisture sensitivity levels (MSL).

- Labeling: Clearly mark packages with “Fragile,” “ESD Sensitive,” and orientation indicators to guide proper handling.

Transportation Requirements

Selecting the appropriate shipping method ensures boards arrive undamaged and meet delivery timelines.

- Climate-Controlled Transport: Use temperature- and humidity-controlled vehicles or containers to avoid thermal shock or moisture absorption, especially for vacuum-sealed packages.

- Avoid Excessive Vibration: Secure packages to minimize movement during transit. Use cushioning materials to absorb shocks.

- Air vs. Ground Shipping: For international or time-sensitive deliveries, air freight may be preferable—but ensure compliance with IATA regulations for electronic components.

- Tracking and Documentation: Use traceable shipping methods with real-time tracking. Maintain shipping logs for audit and compliance purposes.

Regulatory Compliance

Rigid flex boards may be subject to various international and industry-specific regulations.

- RoHS Compliance: Ensure materials and manufacturing processes comply with the Restriction of Hazardous Substances (RoHS) Directive (EU 2011/65/EU), restricting lead, cadmium, mercury, and other hazardous substances.

- REACH Regulation: Confirm that all substances used in the board meet REACH (EC 1907/2006) requirements for registration, evaluation, and restriction of chemicals.

- IPC Standards: Adhere to IPC-6013 (flex/rigid flex performance specifications) and IPC-2223 (sectional design standards for flex and rigid flex boards).

- Export Controls: Comply with export regulations such as ITAR (International Traffic in Arms Regulations) or EAR (Export Administration Regulations) if boards are used in defense, aerospace, or dual-use applications.

- Conflict Minerals: Follow SEC Rule 13p-1 and the Dodd-Frank Act by reporting the use of conflict minerals (tin, tantalum, tungsten, gold) sourced from conflict-affected regions.

Storage Conditions

Improper storage can compromise board quality before deployment.

- Environment: Store in a clean, dry environment with temperatures between 15°C and 30°C and relative humidity below 60%.

- Shelf Life: Respect MSL ratings. Boards removed from dry packaging must be used or re-baked according to J-STD-033 guidelines before assembly.

- Stacking: Avoid stacking heavy items on packages. Store vertically if possible to prevent flexing.

Documentation and Traceability

Maintain comprehensive records to support compliance and quality assurance.

- Certificates of Compliance (CoC): Include CoCs for RoHS, REACH, and IPC standards with each shipment.

- Lot Traceability: Implement batch/lot tracking for materials and finished boards to support recalls or audits.

- Customs Documentation: For international shipments, provide accurate HS codes, commercial invoices, and material declarations.

By following this logistics and compliance guide, manufacturers and distributors can ensure the reliable handling, shipping, and regulatory adherence of rigid flex boards throughout the supply chain.

Conclusion on Sourcing Rigid-Flex Boards:

Sourcing rigid-flex printed circuit boards (PCBs) requires careful consideration of design complexity, manufacturing capabilities, material quality, and supply chain reliability. Rigid-flex boards offer significant advantages in terms of space savings, improved signal integrity, and mechanical durability—making them ideal for high-performance applications in aerospace, medical devices, and advanced consumer electronics.

To ensure success, it is crucial to partner with experienced and certified manufacturers who possess specialized expertise in rigid-flex fabrication and can support the entire process—from design for manufacturability (DFM) review to prototyping and volume production. Key selection criteria include the supplier’s track record, quality certifications (such as ISO, IPC, and ITAR), testing capabilities, and ability to maintain consistent impedance control and layer alignment.

Additionally, early collaboration between design, procurement, and engineering teams helps mitigate risks related to lead times, cost overruns, and performance issues. Given the higher complexity and cost compared to standard PCBs, investing in rigorous supplier evaluation and prototyping is essential.

In conclusion, while sourcing rigid-flex boards presents unique challenges, selecting the right manufacturing partner and maintaining a proactive design-to-production workflow enables reliable, high-quality outcomes that meet both technical and commercial objectives.