The global rice harvester market is experiencing steady growth, driven by increasing demand for mechanized agricultural solutions, labor shortages, and the need for higher harvesting efficiency. According to a report by Mordor Intelligence, the agricultural machinery market—including rice harvesters—is projected to grow at a CAGR of over 5.2% from 2023 to 2028. Similarly, Grand View Research estimates that the agricultural machinery sector will expand at a CAGR of 5.4% during the same period, fueled by rising adoption of precision farming and government support for farm mechanization across Asia-Pacific and Africa. With rice being a staple crop for more than half the world’s population, the demand for advanced, efficient harvesting equipment has never been greater. In response, manufacturers are innovating to offer robust, high-capacity rice harvesters tailored to diverse field conditions and farm sizes. This list highlights the top nine rice harvester manufacturers leading the charge in technology, global reach, and market impact.

Top 9 Rice Harvester Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Harvesting Equipment

Domain Est. 1990

Website: deere.com

Key Highlights: CH570 Sugar Cane Harvester. John Deere exclusive floating crop divider and contour basecutter height-control technology reduces soil content and cane loss….

#2 ENGLISH

Website: iseki.co.jp

Key Highlights: ISEKI & CO.,LTD. Products. Tractor · Mower · Tiller · Rice Transplanter · Combine Harvester · Diesel Engine · About ISEKI · Sustainability · Investor Relations….

#3 Combine Harvesters|Agriculture

Domain Est. 1996

Website: yanmar.com

Key Highlights: Yanmar has head-feeding combine harvesters for good rice selection and conventional combine harvesters good for versatile use….

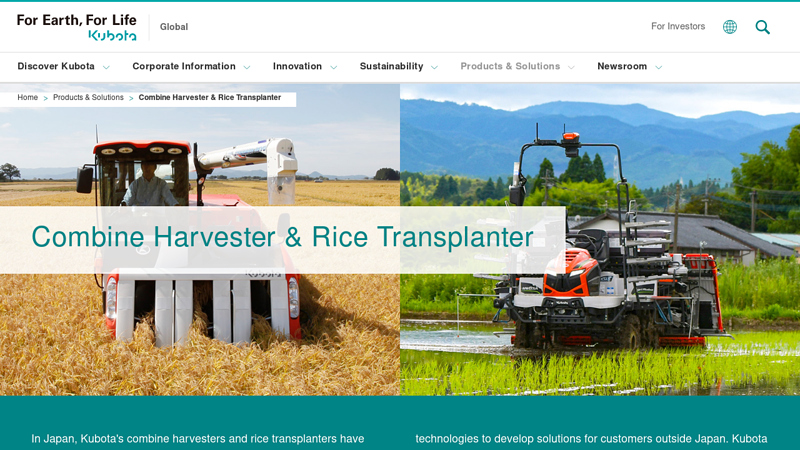

#4 Combine Harvester & Rice Transplanter

Domain Est. 1997

Website: kubota.com

Key Highlights: Kubota has been manufacturing combine harvesters and rice transplanters for over 50 years. As a specialist in this field, Kubota offers reliable technologies to ……

#5 Changfa Agricultural Equipment

Domain Est. 2010

Website: en.changfanz.com

Key Highlights: Tractor · Corn Harvester · Rice and Wheat Harvester · Rice Transplanter · Self-propelled Rotary Tiller · Diesel Engine · Generator Set….

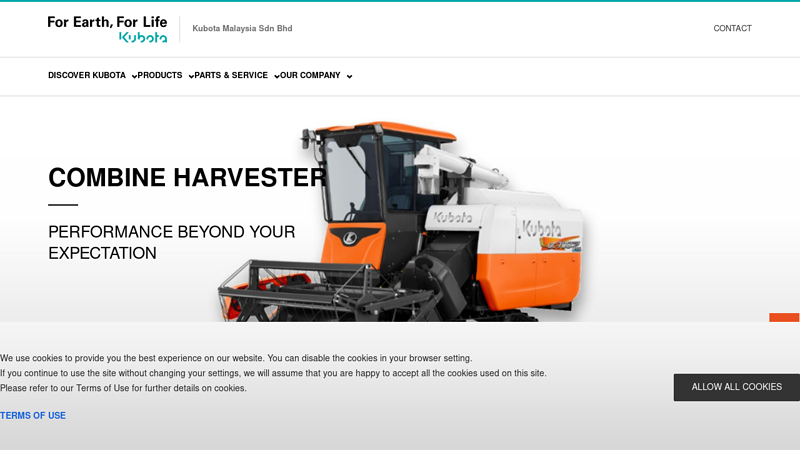

#6 Combine Harvester

Domain Est. 2019

Website: kubotamalaysia.com

Key Highlights: Kubota’s combine has helped mechanization of harvesting for over 50 years. Harvesting is one of the most labor-intensive work in rice farming. As Kubota has ……

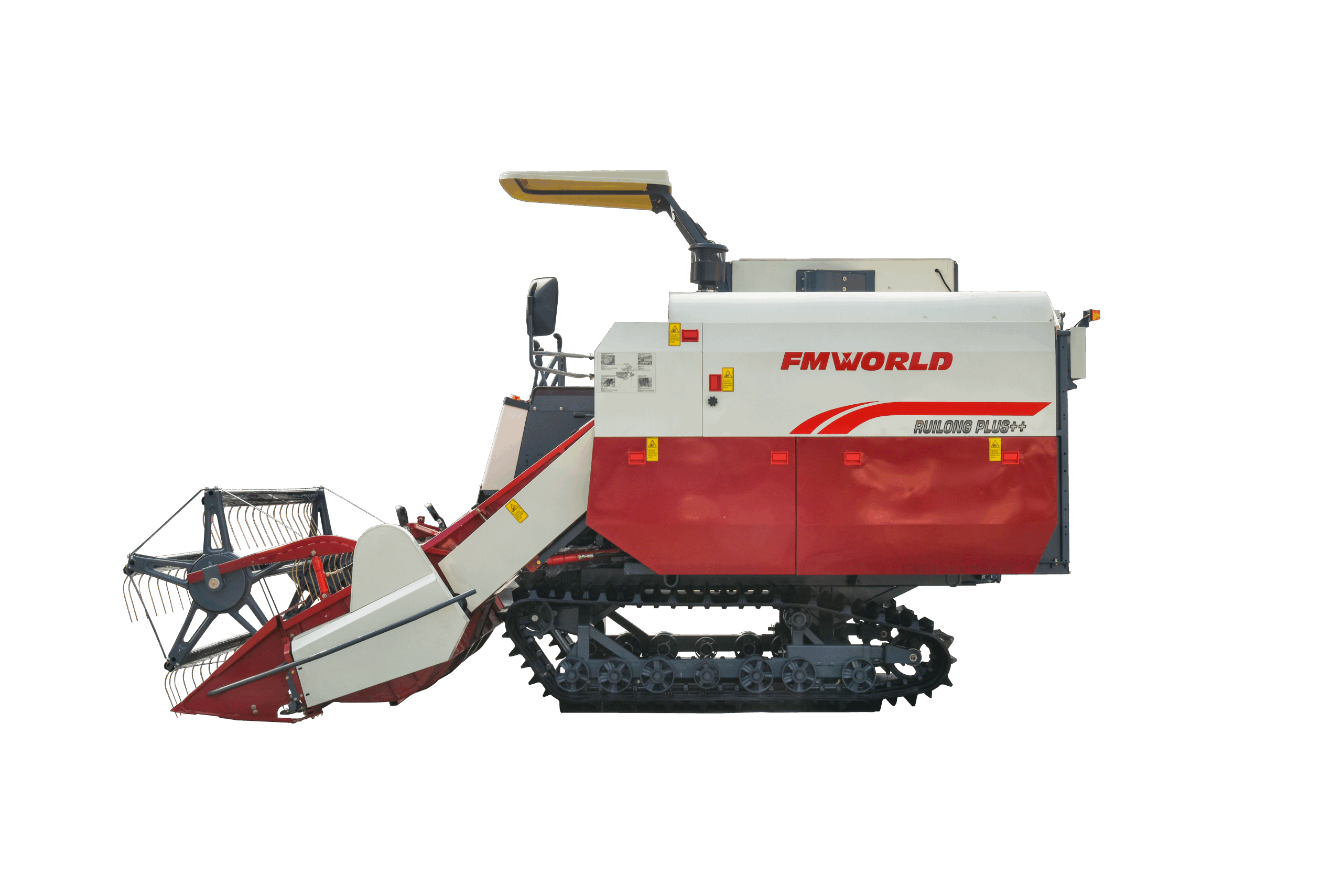

#7 FMWorld Agricultural Machinery

Domain Est. 2021

Website: fmworldagri.com

Key Highlights: Achieve precision and efficiency in planting with our state-of-the-art rice transplanters,showcased in the Planting module. Designed for uniform seedling ……

#8 Hunan Nongyou Machinery Group

Domain Est. 2022

Website: nongyoumachinery.com

Key Highlights: Our 100,000 sqm workshop produces top-tier grain dryers, rotary tillers, combine harvesters, and rice milling machines, with strong market positions in China….

#9 MITSUBISHI AGRICULTURAL MACHINERY

Website: mam.co.jp

Key Highlights: We provide ongoing support for farming, manufacturing of farming tools and benefit consumers to create enjoyable life….

Expert Sourcing Insights for Rice Harvester

2026 Market Trends for Rice Harvesters: Key Drivers and Outlook

The global rice harvester market is poised for significant transformation by 2026, driven by a confluence of technological advancements, economic pressures, labor dynamics, and sustainability demands. This analysis explores the key trends shaping the sector.

H2: Technological Innovation and Automation Accelerate

Technology remains the primary engine of change. By 2026, we expect:

* Wider Adoption of Smart & Autonomous Features: While fully autonomous rice harvesters are still emerging, semi-autonomous functions (auto-guidance, auto-threshing adjustment, yield mapping) will become increasingly standard, even in mid-tier models. Integration with GPS and IoT enables precise field data collection for optimizing future planting and harvesting.

* Enhanced Sensor Integration: Advanced sensors for grain loss monitoring, moisture content measurement in real-time, and crop condition assessment will be crucial for maximizing yield efficiency and minimizing waste, appealing to large-scale commercial farms.

* Telematics and Fleet Management: Cloud-based platforms for remote monitoring, predictive maintenance alerts, and fleet optimization will gain traction, reducing downtime and operational costs, particularly for agricultural service providers.

* Focus on AI and Machine Learning: AI algorithms will be used to analyze harvest data, optimize machine settings dynamically based on crop conditions, and provide actionable insights for yield improvement.

H2: Labor Shortages and Rising Costs Fuel Mechanization Demand

Persistent challenges in agricultural labor are a major market driver:

* Urban Migration: Continued migration from rural areas to cities in key rice-producing regions (Asia, parts of Latin America) exacerbates labor scarcity, especially during peak harvest seasons.

* Increasing Wages: Rising labor costs make manual harvesting economically unviable for larger farms, accelerating the shift towards mechanized solutions.

* Need for Speed and Efficiency: Mechanization, particularly with efficient rice harvesters, allows farmers to harvest vast areas quickly, reducing the risk of crop loss due to adverse weather and enabling timely planting of subsequent crops.

H2: Sustainability and Environmental Regulations Gain Prominence

Environmental concerns are increasingly influencing machinery design and purchasing decisions:

* Emission Standards: Stricter emission regulations (e.g., Tier 4 Final/Stage V equivalents in various regions) will push manufacturers towards cleaner engine technologies, including potential exploration of alternative fuels (biodiesel blends, electrification for smaller models).

* Fuel Efficiency: Demand for fuel-efficient harvesters will remain high as fuel costs are a major operational expense. Improved engine design, transmission efficiency, and weight reduction will be key selling points.

* Reduced Soil Compaction: Manufacturers will focus on designs with lower ground pressure (e.g., wider tracks, optimized weight distribution) to minimize soil damage, promoting long-term field health.

* Minimizing Grain Loss and Straw Management: Features that reduce grain loss during harvesting and facilitate efficient straw management (e.g., better choppers, spreaders) will be valued for economic and environmental reasons (reducing stubble burning).

H2: Market Expansion and Regional Differentiation

Growth patterns will vary significantly by region:

* Asia-Pacific Dominance (Especially China & India): This region will remain the largest market. Growth will be driven by government subsidies promoting mechanization, rising farm sizes (particularly in India), and replacement demand for aging machinery in countries like Japan and South Korea. Compact and mid-size harvesters suited for smallholder farms will see strong demand.

* Southeast Asia Growth: Countries like Vietnam, Thailand, and Indonesia will see steady growth as farmers seek to improve efficiency and compete globally, supported by government modernization programs.

* Latin America (Brazil Leading): Brazil’s large-scale rice farms will drive demand for high-capacity, advanced combine harvesters. Mechanization rates are expected to continue rising.

* Africa’s Potential: Sub-Saharan Africa presents significant long-term potential due to very low current mechanization rates, but growth by 2026 will likely be gradual, focused on entry-level or small-scale mechanization solutions, often supported by development initiatives.

H2: Business Model Evolution and Service Focus

The way harvesters are acquired and supported is changing:

* Rise of Custom Hiring Services (CHS): In regions with fragmented landholdings (e.g., India, Southeast Asia), CHS will grow substantially, making advanced machinery accessible to small farmers without large capital investment. This creates opportunities for service providers and OEMs offering fleet packages.

* Increased Importance of After-Sales Service: Reliability and access to spare parts and skilled technicians will be critical differentiators. OEMs will invest heavily in expanding service networks and offering comprehensive maintenance contracts.

* Financing Solutions: Access to affordable financing and leasing options will be crucial for driving adoption, especially among small and medium-sized farmers.

Conclusion: By 2026, the rice harvester market will be characterized by smarter, cleaner, and more efficient machines. Demand will be fueled by the urgent need to overcome labor constraints and boost productivity, particularly in Asia. Success for manufacturers will depend on innovation in automation and sustainability, offering regionally tailored solutions (from compact models to large combines), and adapting to evolving business models like custom hiring and robust service networks. The focus will shift beyond just the machine to integrated solutions that maximize yield, minimize waste, and ensure long-term farm profitability.

Common Pitfalls When Sourcing a Rice Harvester: Quality and Intellectual Property Concerns

Sourcing a rice harvester, especially from international suppliers, involves navigating several critical challenges related to both quality assurance and intellectual property (IP) protection. Overlooking these pitfalls can lead to operational inefficiencies, financial losses, and legal complications.

Quality-Related Pitfalls

Inconsistent Manufacturing Standards

Suppliers, particularly from regions with less stringent regulatory oversight, may not adhere to international quality standards such as ISO or CE certifications. This can result in poorly constructed machines with subpar performance, increased downtime, and safety hazards.

Use of Inferior Materials and Components

To cut costs, some manufacturers use low-grade steel, unreliable engines, or worn-out spare parts. These compromises reduce the harvester’s durability, fuel efficiency, and suitability for varying field conditions, ultimately increasing total cost of ownership.

Lack of Rigorous Testing and Quality Control

Many sourced harvesters are shipped without comprehensive field testing. Without proper quality control protocols, defects in critical components like the cutting mechanism, threshing system, or grain handling may go undetected until after deployment.

Inadequate After-Sales Support and Spare Parts Availability

Poorly sourced machines often come with limited access to technical support, service manuals, or replacement parts. This can lead to extended downtime during harvest season, significantly impacting productivity.

Misrepresentation of Specifications and Performance

Some suppliers exaggerate machine capabilities—such as harvesting capacity, grain loss rates, or fuel efficiency—without third-party verification. Buyers may receive equipment that underperforms compared to advertised metrics.

Intellectual Property (IP) Pitfalls

Counterfeit or Clone Machinery

A significant risk in global sourcing is receiving machines that replicate branded models without authorization. These “knock-off” harvesters infringe on original designs and patents, exposing the buyer to legal liability and reputational damage.

Unlicensed Use of Technology

Some suppliers integrate patented technologies—such as advanced threshing systems or GPS-guided automation—without proper licensing. Purchasing such equipment may inadvertently involve the buyer in IP infringement disputes.

Lack of Transparency in Design Ownership

Suppliers may be evasive about the origin of their designs or fail to provide proof of IP ownership. This opacity increases the risk of sourcing machines that violate intellectual property rights, especially when importing into countries with strict IP enforcement.

Difficulty in Enforcing IP Rights Across Borders

If IP infringement is discovered post-purchase, enforcing rights across jurisdictions can be costly and complex. Legal recourse may be limited, especially when contracts lack clear IP clauses or dispute resolution mechanisms.

Absence of Licensing Agreements or Documentation

Reputable manufacturers provide documentation confirming licensing for proprietary components. Sourcing without these records makes it difficult to verify legality and can complicate resale or regulatory compliance.

By recognizing and addressing these quality and IP-related pitfalls, buyers can make more informed sourcing decisions, ensuring reliable performance and legal compliance when acquiring rice harvesters.

Logistics & Compliance Guide for Rice Harvester

Overview

This guide outlines the essential logistics and compliance considerations for transporting and operating a rice harvester, whether domestically or internationally. It covers regulatory requirements, shipping procedures, documentation, import/export rules, and best practices to ensure smooth movement and legal compliance.

Regulatory Compliance

National and International Standards

Rice harvesters must comply with safety, emissions, and operational standards set by relevant authorities. In the U.S., this includes adherence to OSHA and EPA regulations. For international shipments, compliance with ISO standards (e.g., ISO 4254 for agricultural machinery) and regional regulations such as CE marking (EU) or ARN (Australia) is required.

Emissions and Environmental Regulations

Diesel-powered harvesters are subject to emissions standards such as Tier 4 Final (U.S.) or Stage V (EU). Ensure the machine meets the host country’s environmental regulations before import. Non-compliant machinery may be denied entry or require costly modifications.

Import and Export Requirements

Export Documentation

When exporting a rice harvester, the following documents are typically required:

– Commercial Invoice

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Origin

– Export License (if applicable)

– Technical Specifications and User Manual

Import Regulations by Region

Different countries impose unique import duties, taxes, and certification requirements:

– United States: USDA and CBP regulations; potential agricultural inspection

– European Union: CE certification, customs declaration, VAT payment

– Southeast Asia: Local certification (e.g., SNI in Indonesia), phytosanitary inspection

– Africa: Pre-shipment inspection (PSI), customs valuation compliance

Transportation and Logistics

Domestic Transport

For movement within a country:

– Use lowboy trailers or specialized agricultural transporters

– Obtain oversized load permits if required

– Secure the harvester properly to prevent damage

– Comply with road weight and dimension regulations

International Shipping

Choose the appropriate shipping method based on destination and urgency:

– FCL (Full Container Load): Suitable for smaller harvesters or disassembled units

– Breakbulk/Ro-Ro (Roll-on/Roll-off): Ideal for large, operational machines

– Air Freight: Rare due to cost; only for urgent spare parts

Ensure the harvester is cleaned of soil, plant material, and pests to meet biosecurity requirements.

Customs Clearance

Pre-Shipment Inspection (PSI)

Many countries require a pre-shipment inspection to verify value, quantity, and compliance. Hire an approved inspection agency to avoid delays.

Duties and Taxes

Calculate applicable import duties, VAT, and excise taxes in advance. Some countries offer reduced rates for agricultural equipment under trade agreements.

Biosecurity and Sanitation

Cleaning and Decontamination

Before shipment, thoroughly clean the harvester to remove soil, seeds, and organic debris. This helps prevent the spread of invasive species and meets biosecurity laws (e.g., APHIS in the U.S., DAFF in Australia).

Phytosanitary Certificate

Required in many countries, this document certifies that the machine is free from plant pests. Issued by the national agricultural authority of the exporting country.

Operational Compliance

Operator Certification

Ensure operators are trained and certified according to local regulations. Some regions require licenses for operating large agricultural machinery.

Maintenance and Safety Inspections

Regular maintenance and safety checks are mandatory in many jurisdictions. Keep logs of service records to demonstrate compliance during audits.

Conclusion

Successfully transporting and deploying a rice harvester requires careful planning and adherence to a complex web of logistics and compliance rules. By understanding and preparing for regulatory, customs, and biosecurity requirements, stakeholders can avoid delays, penalties, and operational disruptions. Always consult with customs brokers, freight forwarders, and regulatory experts when moving agricultural machinery across borders.

In conclusion, sourcing a rice harvester is a strategic investment that can significantly enhance agricultural productivity, reduce labor dependency, and improve harvesting efficiency. A thorough evaluation of machinery specifications, farm requirements, budget constraints, and long-term operational needs is essential to select the most suitable harvester. Factors such as machine type (combine harvester vs. reaper), power capacity, terrain adaptability, after-sales service, and spare parts availability should be carefully considered. Additionally, engaging with reputable suppliers, comparing multiple quotes, and reviewing warranty and support options will ensure a reliable and cost-effective purchase. Ultimately, the right rice harvester not only boosts yield and timeliness of harvest but also contributes to sustainable and profitable farming practices.