The global resins and acrylics market is experiencing robust expansion, fueled by rising demand across industries such as automotive, construction, coatings, and consumer goods. According to a 2023 report by Mordor Intelligence, the global acrylic resins market was valued at USD 23.5 billion and is projected to grow at a CAGR of 5.8% from 2024 to 2029. Similarly, Grand View Research estimates that the global synthetic resins market reached USD 644.1 billion in 2022 and is anticipated to expand at a CAGR of 6.2% through 2030, driven by innovation in sustainable formulations and increasing applications in lightweight materials and protective coatings. As demand intensifies, a select group of manufacturers are leading the charge in production capacity, R&D investment, and global supply chain reach. Below, we spotlight the top 10 resin and acrylic manufacturers shaping the future of the industry—evaluated on revenue, market share, technological advancement, and sustainability initiatives.

Top 10 Resin And Acrylic Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Arkema Coating Resins corporate website

Domain Est. 2001

Website: coatingresins.arkema.com

Key Highlights: Arkema Coating Resins is a leading supplier of waterborne, solventborne and powder resins along with additives and opacifiers….

#2 Allnex

Domain Est. 2000

Website: allnex.com

Key Highlights: Allnex, the global leader in industrial coating resins. A market-leading manufacturer of adhesives, sealants and specialty coatings….

#3 Gellner Industrial Waterbased Acrylic Polymers

Domain Est. 2007

Website: gellnerindustrial.com

Key Highlights: Gellner Industrial, LLC is the premier manufacturer of water based acrylic resins, bringing over forty years of industry experience to our client base….

#4 Acrylic Resin Manufacturer

Domain Est. 1998

Website: andersondevelopment.com

Key Highlights: Anderson Development is an Acrylic Resin Manufacturer, including GMA acrylics, HFA, and CFA. Acrylic Resins are used in powder coating applications, ……

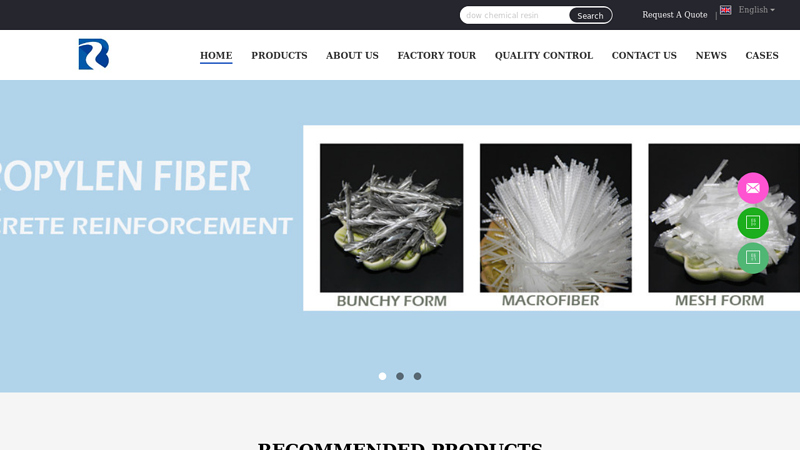

#5 China Solid Acrylic Resin & Water Based Acrylic Resin factories

Domain Est. 2022

Website: m.resin-acrylic.com

Key Highlights: Good quality Solid Acrylic Resin from China, Water Based Acrylic Resin factories of Briture Co., Ltd…..

#6 Acrylic Resin, Film and Sheet

Domain Est. 1992

Website: dow.com

Key Highlights: VERSALOID™ Acrylic Resins and ACRYLIGARD™ Capstock Resins offer innovative, high-performance options for film, sheet and other applications….

#7 Dispersions & Resins, North America

Domain Est. 1995

Website: dispersions-resins.basf.com

Key Highlights: Dispersions, Resins and Additives. BASF is a leading global supplier of high-quality polymer emulsions, acrylic binders, resins, additives and colorants….

#8 Dianal America, Acrylic Resin

Domain Est. 1998

Website: dianal.com

Key Highlights: As a member of the Mitsubishi Rayon MMA Business Complex, Dianal produces coating resins … plastics and paper. Dianal products are based on acrylic, methacrylic…

#9 Acrylic coating resin and PPMA manufacturing

Domain Est. 2017

Website: nouryon.com

Key Highlights: We offer a wide range of organic peroxide initiators that are used for (meth)acrylic resin and PMMA polymerization and production….

#10 Polymers / Resins / High Performance Chemicals

Website: m-chemical.co.jp

Key Highlights: Polymers / Resins / High Performance Chemicals · Biomass-based polycarbonatediol with superior characteristics · Acrylic Beads Resin · Acrylic Powder Resin….

Expert Sourcing Insights for Resin And Acrylic

H2: Projected Market Trends for Resin and Acrylic in 2026

By 2026, the global resin and acrylic market is expected to witness significant transformation driven by technological innovation, sustainability demands, and shifting industrial applications. Key trends shaping the market include:

-

Growth in Sustainable and Bio-Based Resins

Environmental regulations and consumer demand for eco-friendly materials are accelerating the adoption of bio-based and recyclable resins. Manufacturers are investing in bio-acrylics derived from renewable feedstocks such as sugarcane ethanol. This shift supports circular economy goals and is expected to capture a growing market share, particularly in Europe and North America. -

Expansion in Construction and Automotive Applications

Acrylic resins remain critical in architectural coatings, adhesives, and sealants due to their durability and weather resistance. The construction boom in Asia-Pacific and infrastructure development in emerging economies will fuel demand. In the automotive sector, lightweight acrylic components and high-performance resins for electric vehicles (EVs) will drive market growth. -

Advancements in 3D Printing and High-Performance Polymers

Resin-based 3D printing (especially stereolithography, or SLA) is expanding into industrial manufacturing, healthcare (dental and medical devices), and prototyping. High-clarity, heat-resistant, and flexible acrylic resins are being developed to meet specialized performance requirements, creating new revenue streams. -

Supply Chain Resilience and Regionalization

Geopolitical tensions and past supply chain disruptions have prompted companies to regionalize production. North America and Southeast Asia are emerging as key hubs for resin and acrylic manufacturing, reducing dependency on single-source suppliers and improving delivery times. -

Digitalization and Smart Manufacturing

Industry 4.0 technologies are being integrated into resin production processes. Real-time monitoring, AI-driven quality control, and predictive maintenance are enhancing efficiency and reducing waste, improving competitiveness in a cost-sensitive market. -

Regulatory Pressure and VOC Reduction

Stricter regulations on volatile organic compounds (VOCs) in coatings and adhesives are pushing formulators toward water-based and low-VOC acrylic dispersions. This trend is especially prominent in the EU and China, where environmental standards are tightening. -

Increased M&A and Strategic Partnerships

To consolidate R&D capabilities and expand market reach, major players like BASF, Dow, and Mitsubishi Chemical are engaging in mergers, acquisitions, and joint ventures—particularly in specialty resins and advanced acrylics.

In summary, the 2026 resin and acrylic market will be characterized by innovation, sustainability, and diversification across end-use industries. Companies that prioritize green chemistry, digital integration, and application-specific solutions are likely to lead the next phase of growth.

Common Pitfalls Sourcing Resin and Acrylic (Quality, IP)

Sourcing resin and acrylic materials presents unique challenges beyond simple price and availability. Key pitfalls often revolve around inconsistent quality and complex intellectual property (IP) considerations, which can significantly impact product performance, compliance, and legal risk.

Quality-Related Pitfalls

Inconsistent Material Properties: Resin and acrylic batches can vary in viscosity, molecular weight, color, clarity, curing time, and mechanical strength. Sourcing from unreliable suppliers may lead to off-spec materials, resulting in production defects, inconsistent end-product performance, or failure in critical applications (e.g., medical devices or aerospace components).

Contamination and Purity Issues: Impurities such as moisture, residual monomers, or foreign particles can compromise material integrity. For example, moisture in acrylic can cause bubbling during casting, while unreacted monomers in resins may lead to poor curing or outgassing. Suppliers without stringent quality control may not adequately test for these contaminants.

Lack of Certifications and Traceability: Many industries (e.g., food packaging, medical, electronics) require materials to meet specific standards (e.g., FDA, USP Class VI, REACH, RoHS). Sourcing without proper documentation or batch traceability increases compliance risk. Suppliers may provide generic data sheets that don’t reflect actual batch performance.

Inadequate Technical Support: Resin and acrylic processing often requires precise handling, mixing ratios, curing conditions, and storage. Suppliers who lack technical expertise or fail to provide detailed processing guidelines can lead to application failures and increased scrap rates.

Intellectual Property-Related Pitfalls

Unauthorized Use of Proprietary Formulations: Many high-performance resins and acrylics are protected by patents or trade secrets. Sourcing materials from unauthorized or gray-market suppliers may involve counterfeit or illegally reverse-engineered products, exposing the buyer to IP infringement lawsuits.

Unverified Supplier Claims: Suppliers may falsely claim compliance with patented technologies or certifications. Without due diligence—such as verifying material safety data sheets (MSDS), certificates of analysis (COA), or patent licensing agreements—companies risk using infringing materials unknowingly.

Lack of Licensing Agreements: For specialty resins (e.g., UV-curable, biocompatible, or flame-retardant formulations), proper use may require a license from the IP holder. Sourcing without confirming licensing status can result in legal exposure, especially when selling finished goods in regulated markets.

Reverse Engineering Risks: In an attempt to reduce costs, some buyers or suppliers may attempt to replicate branded resin or acrylic formulations. This poses significant IP risks and may result in litigation, reputational damage, and forced product recalls.

Mitigating these pitfalls requires thorough supplier vetting, clear contractual agreements, independent material testing, and legal review of IP rights—especially when sourcing for high-value or regulated applications.

Logistics & Compliance Guide for Resin and Acrylic Materials

Overview of Resin and Acrylic Materials

Resin and acrylic materials are widely used in manufacturing, construction, art, and industrial applications due to their versatility, clarity, and durability. However, these materials—especially in liquid, uncured, or chemical precursor forms—can pose specific handling, transportation, and regulatory challenges. This guide outlines key logistics and compliance considerations when shipping, storing, and using resin and acrylic products.

Classification and Regulatory Framework

Resin and acrylic materials may be classified under various regulatory categories depending on their chemical composition. Common classifications include:

– Hazardous Materials (HazMat): Many liquid resins (e.g., epoxy, polyester, polyurethane) and acrylic monomers (e.g., methyl methacrylate) are flammable, reactive, or toxic. They may fall under DOT (U.S. Department of Transportation), ADR (Europe), IATA (air), or IMDG (sea) hazardous goods regulations.

– GHS Compliance: Globally Harmonized System (GHS) labeling is required, including Safety Data Sheets (SDS), hazard pictograms, signal words, and precautionary statements.

– REACH & RoHS (EU): Ensure compliance with chemical registration (REACH) and restrictions on hazardous substances (RoHS) for products sold in the European Union.

– EPA & TSCA (USA): The U.S. Environmental Protection Agency (EPA) regulates certain resin chemicals under the Toxic Substances Control Act (TSCA).

Packaging and Labeling Requirements

Proper packaging is essential to ensure safety and regulatory compliance:

– Use UN-certified containers for hazardous resins (e.g., UN 1866 for polyester resin).

– Ensure containers are tightly sealed, leak-proof, and compatible with the chemical (e.g., HDPE for most resins).

– Label packages with:

– Proper shipping name and UN number

– Hazard class labels (e.g., Class 3 Flammable Liquid)

– GHS pictograms

– Handling instructions (e.g., “Keep Upright,” “Avoid Heat”)

– Acrylic sheets (solid, non-liquid form) are typically non-hazardous but require secure packaging to prevent scratching and breakage.

Transportation Guidelines

Transport regulations vary by mode:

– Ground (DOT/ADR): Follow 49 CFR (USA) or ADR (Europe) for hazardous resin shipments. Segregate incompatible materials (e.g., oxidizers).

– Air (IATA): Strict limits on quantity and packaging; many resins are forbidden or limited to small quantities in passenger aircraft. Check IATA Dangerous Goods Regulations annually.

– Sea (IMDG): Comply with maritime shipping codes; proper stowage and ventilation are critical for flammable liquids.

– Non-hazardous acrylic sheets can be shipped via standard freight but require protection from weather and physical damage.

Storage and Handling Best Practices

- Storage Conditions: Store liquid resins in a cool, dry, well-ventilated area away from direct sunlight, heat sources, and ignition hazards. Temperature control is critical—some resins degrade or react if stored above recommended ranges (typically below 25°C/77°F).

- Segregation: Keep resins separate from incompatible substances (e.g., strong acids, bases, oxidizers). Acrylic monomers should be stored in fire-rated cabinets if flammable.

- Ventilation: Use local exhaust ventilation when handling uncured resins to avoid inhalation of vapors.

- PPE Requirements: Personnel should wear nitrile gloves, safety goggles, and respiratory protection as specified in the SDS.

Safety Data Sheets (SDS) and Documentation

- Maintain up-to-date SDS for every resin and acrylic product (required by OSHA HazCom and similar global standards).

- SDS must include:

- Chemical identity and ingredients

- Hazard identification

- First aid and firefighting measures

- Spill response procedures

- Storage and disposal recommendations

- Shipments must include transport documents listing hazardous contents, emergency contact info, and emergency response codes (e.g., ERG guide numbers).

Environmental and Disposal Compliance

- Spill Management: Have spill kits (absorbents compatible with organic liquids) readily available. Neutralize or contain spills promptly per SDS instructions.

- Waste Disposal: Uncured resin waste, contaminated containers, and cleanup materials are often classified as hazardous waste. Dispose through licensed hazardous waste handlers in compliance with RCRA (USA), Waste Framework Directive (EU), or local regulations.

- Recycling: Acrylic sheets (PMMA) are recyclable—separate from general waste and process through certified recyclers. Avoid thermal decomposition (burning), which releases harmful fumes.

International Trade Considerations

- Customs Documentation: Provide accurate HS (Harmonized System) codes—e.g., 3906 for acrylic polymers, 3208 for synthetic resin paints.

- Import/Export Controls: Some resin precursors (e.g., MMA) may be controlled under dual-use or chemical weapons regulations (e.g., Australia Group). Verify licensing requirements.

- Country-Specific Regulations: Check local requirements in destination countries (e.g., China’s IECSC, Korea’s K-REACH).

Training and Compliance Audits

- Train all personnel involved in handling, shipping, or storing resins on:

- HazMat classification

- Emergency response

- SDS interpretation

- PPE use

- Conduct regular audits to ensure compliance with transportation, storage, and disposal regulations. Maintain records of training, SDS, and shipment logs.

Conclusion

Resin and acrylic materials require careful management throughout their lifecycle to ensure safety, regulatory compliance, and environmental protection. By adhering to transportation regulations, proper storage protocols, and documentation standards, businesses can mitigate risks and maintain smooth logistics operations. Always consult the latest regulatory publications and SDS for product-specific guidance.

In conclusion, sourcing resin and acrylic materials requires a careful evaluation of quality, cost, supplier reliability, and intended application. Resin, particularly epoxy and polyester varieties, is ideal for casting, coating, and artistic applications due to its clarity, durability, and versatility, while acrylic (PMMA) excels in applications demanding high transparency, weather resistance, and structural rigidity, such as signage, displays, and protective barriers. When selecting suppliers, prioritize those offering consistent material specifications, technical support, and compliance with industry standards. Additionally, consider factors such as lead times, minimum order quantities, and shipping logistics—especially given the weight and hazardous nature of liquid resins. By balancing performance needs with supply chain efficiency, businesses can secure high-quality resin and acrylic materials that support both product excellence and operational sustainability.