The global automotive relay and starter motor market is experiencing steady expansion, driven by rising vehicle production, increased demand for fuel-efficient engines, and the growing complexity of electronic systems in modern automobiles. According to a report by Mordor Intelligence, the global automotive relays market was valued at USD 4.2 billion in 2023 and is projected to grow at a CAGR of over 5.8% through 2029. Similarly, Grand View Research estimates that the global starter motor market reached USD 9.3 billion in 2022 and is expected to expand at a CAGR of 5.6% from 2023 to 2030, fueled by advancements in start-stop technologies and the proliferation of hybrid electric vehicles. As automotive electrification and system reliability become critical differentiators, a select group of manufacturers has emerged as leaders in innovation, scale, and global reach. The following analysis highlights the top 9 relay and starter motor manufacturers shaping the future of automotive propulsion and control systems.

Top 9 Relay Starter Motor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Starter Relay 278003012 – OEM Parts

Domain Est. 1995

Website: ski-doo-shop.brp.com

Key Highlights: In stock 3–7 day deliveryShop Starter Relay – (sku: 278003012) at Ski-Doo® Official Store. Free Shipping available….

#2 Starter Relay Manufacturer

Domain Est. 2017

Website: startersolenoid.net

Key Highlights: T&X relay starter are long lasting, being made from tough corrosion-resistant materials. A highly efficient design allows for improved operation….

#3 Relay Starter Motor

Domain Est. 2017

Website: shopbmwmotorcycles.com

Key Highlights: Out of stockRelay Starter Motor – BMW-Motorrad (61311357104) ; Manufacturer Warranty Minimum of 12 Months ; Manufacturer Warranty 24-month unlimited miles ; Guaranteed Fitment ……

#4 LS ELECTRIC Co., Ltd.

Domain Est. 2020

Website: ls-electric.com

Key Highlights: We offer power devices, systems, and solutions required for transmitting and supplying electricity produced from generators. to our customers….

#5 RELAY, starter

Domain Est. 1996

#6 Starting Relays and Combos

Domain Est. 2001

Website: sensata.com

Key Highlights: Bimetal enabled Relay and PTC used for motor starting and to protect against AC motor overheating, caused by a locked rotor or running overload conditions….

#7 DENSO Auto Parts

Domain Est. 2006

Website: densoautoparts.com

Key Highlights: DENSO is a global choice for top automakers, with multiple vehicle models rolling off the assembly line with DENSO auto parts under the hood….

#8 RELAY – STARTER

Domain Est. 2022

Website: excelerator.com.mx

Key Highlights: RELAY – 12 VOLTS, WHT RGR, STRAIGHT BRACKET, CON. Compare. 06-26989-000 · RELAY – STARTER,39MT. Compare. DR 10511414 · INTEGRATED MAGNETIC SWITCH – PACKAGE,24V….

#9 Starter Relay

Expert Sourcing Insights for Relay Starter Motor

2026 Market Trends for Relay Starter Motor

The global relay starter motor market is poised for significant evolution by 2026, driven by technological advancements, regulatory shifts, and changing vehicle dynamics. Key trends shaping the landscape include the rise of electrification, integration of smart technologies, increased demand for reliability and efficiency, and regional market variations.

Electrification and Hybridization Drive Innovation

The accelerating shift toward electric and hybrid vehicles (EVs/HEVs) is fundamentally altering the demand for traditional relay starter motors. While pure battery electric vehicles (BEVs) eliminate the need for starter motors altogether, hybrid architectures—especially 48V mild hybrids—continue to rely on advanced starter systems. By 2026, the market will see growing demand for high-efficiency, compact, and intelligent relay starter motors integrated into start-stop systems and belt-driven starter generators (BSG). These components are critical for improving fuel economy and reducing emissions in internal combustion engine (ICE) and hybrid platforms, particularly in regions with stringent CO₂ regulations such as Europe and China.

Smart and Integrated Relay Technologies

Future relay starter motors are increasingly incorporating smart features, leveraging embedded electronics and sensor integration. By 2026, expect wider adoption of relays with built-in diagnostics, remote monitoring, and communication capabilities via CAN or LIN protocols. This enables predictive maintenance, improved system reliability, and seamless integration with vehicle control units (VCUs). OEMs are prioritizing components that support vehicle connectivity and over-the-air (OTA) updates, pushing suppliers to develop smarter, software-upgradable relay systems.

Emphasis on Durability and Miniaturization

As vehicles become more complex, reliability and space optimization are paramount. The 2026 market will favor relay starter motors designed for extended lifecycles, enhanced thermal management, and resistance to harsh environments (vibration, moisture, temperature extremes). Concurrently, miniaturization trends will drive demand for compact, lightweight designs without sacrificing performance. This is particularly relevant in urban EVs and compact vehicles where packaging space is limited.

Regional Market Divergence

Regional dynamics will influence demand patterns. In emerging markets such as India, Southeast Asia, and Africa, continued reliance on ICE vehicles will sustain demand for cost-effective, durable relay starter motors. In contrast, mature markets like North America and Western Europe will see slower growth in traditional starter motor volumes due to EV adoption, but increased demand for high-performance relays in luxury and hybrid models. China will remain a key manufacturing and consumption hub, with strong government support for new energy vehicles (NEVs) shaping component innovation.

Supply Chain Resilience and Localization

Post-pandemic supply chain disruptions have prompted automakers to prioritize localization and dual sourcing. By 2026, there will be a notable shift toward regional manufacturing of relay starter motors, particularly near major EV production centers. This trend enhances supply chain resilience and reduces logistics costs, encouraging partnerships between global suppliers and local tier-2/3 vendors.

In summary, the 2026 relay starter motor market will be characterized by a transition phase—declining in traditional ICE applications but evolving through hybrid integration, smart functionality, and regional adaptation. Suppliers that innovate in efficiency, intelligence, and sustainability will be best positioned to capture value in this changing ecosystem.

Common Pitfalls Sourcing Relay Starter Motor (Quality, IP)

When sourcing relay starter motors—especially for industrial or automotive applications—several critical pitfalls related to quality and intellectual property (IP) can lead to operational failures, legal risks, and increased costs. Being aware of these issues helps ensure reliable performance and compliance.

Poor Quality Components and Manufacturing

One of the most frequent issues in sourcing relay starter motors is compromising on quality to reduce costs. Low-quality relays or motors may use substandard materials (e.g., inferior copper windings, weak contact alloys, or low-grade plastics), leading to premature failure, overheating, or inconsistent performance. Poor manufacturing processes—such as inadequate soldering, misalignment of components, or lack of environmental sealing—can significantly reduce product lifespan and reliability, especially in harsh conditions.

Inaccurate or Misrepresented IP Ratings

Many suppliers claim high Ingress Protection (IP) ratings (e.g., IP67 or IP68) without proper certification or testing. This misrepresentation can be particularly dangerous in environments exposed to dust, moisture, or water. A relay starter motor with an overstated IP rating may fail when deployed outdoors or in industrial settings, resulting in costly downtime or safety hazards. Always verify IP ratings through independent test reports or certifications (e.g., IEC 60529 compliance).

Lack of Traceability and Certifications

Sourcing from suppliers without proper quality management certifications (such as ISO 9001) or product-specific standards (like UL, CE, or RoHS) increases the risk of receiving non-compliant or unsafe components. Without traceability in the supply chain, it becomes difficult to address defects, initiate recalls, or ensure consistent quality across batches.

Intellectual Property Infringement Risks

Using or sourcing relay starter motors that mimic patented designs or incorporate proprietary technology without authorization exposes buyers to legal liability. Some manufacturers, particularly in less-regulated markets, produce “clone” versions of well-known branded components. While these may appear identical and function similarly, they can infringe on patents, trademarks, or design rights—potentially leading to seizures, lawsuits, or reputational damage.

Inadequate Testing and Validation

Relay starter motors often operate under high electrical loads and mechanical stress. Suppliers who skip rigorous testing—such as endurance cycling, thermal stress, vibration, and insulation resistance tests—may deliver products that fail prematurely in real-world applications. Always request test data or conduct third-party validation before large-scale procurement.

Supply Chain Transparency Issues

Opaqueness in the supply chain—such as unclear component origins, subcontracting without oversight, or inconsistent quality control—makes it difficult to ensure product integrity. This lack of transparency increases vulnerability to counterfeit parts, quality drift, and IP violations, particularly when dealing with intermediaries or offshore suppliers.

By addressing these pitfalls proactively—through supplier audits, independent testing, legal due diligence, and clear contractual terms—buyers can mitigate risks and ensure they source reliable, compliant, and legally sound relay starter motor solutions.

Logistics & Compliance Guide for Relay Starter Motor

Overview

This guide outlines the essential logistics and compliance considerations for the shipment, handling, and regulatory adherence of Relay Starter Motors. Proper procedures must be followed to ensure safe transportation, customs clearance, and conformity with international and regional regulations.

Packaging & Handling Requirements

Relay Starter Motors must be packaged in sturdy, shock-resistant materials to prevent damage during transit. Use anti-static bags for electronic components and secure units with foam inserts or cushioning to minimize vibration. Label packages with “Fragile,” “This Side Up,” and “Do Not Stack” as appropriate. Ensure terminals are insulated to prevent short-circuiting.

Transportation Modes & Restrictions

Relay Starter Motors may be shipped via air, sea, or ground freight. When shipping by air, verify compliance with IATA regulations—lithium batteries (if integrated) require special handling under PI 965 or PI 966. For sea freight, follow IMDG Code guidelines if batteries are present. Ground transport must comply with ADR (Europe), 49 CFR (USA), or equivalent local regulations.

Import/Export Documentation

Prepare accurate documentation including commercial invoice, packing list, bill of lading/air waybill, and certificate of origin. For exports from regulated regions (e.g., U.S.), determine if the product requires an Export Control Classification Number (ECCN). Most Relay Starter Motors fall under EAR99, but verify based on technical specifications.

Regulatory Compliance

Ensure products meet regional safety and electromagnetic compatibility (EMC) standards:

– CE Marking (EU): Comply with Low Voltage Directive (LVD) 2014/35/EU and EMC Directive 2014/30/EU.

– UKCA Marking (UK): Required for sales in Great Britain; similar to CE requirements.

– FCC Certification (USA): Required if the motor includes electronic control components emitting radio frequencies.

– RoHS & REACH (EU): Confirm absence of restricted hazardous substances in materials.

Product Classification & Tariff Codes

Classify the Relay Starter Motor under the appropriate Harmonized System (HS) code for customs purposes. A typical classification may be 8511.40 (Ignition or starting equipment for internal combustion engines), but verify based on design and function. Accurate classification ensures correct duty rates and avoids clearance delays.

Environmental & Disposal Compliance

Relay Starter Motors may contain recyclable metals and electronic parts. Comply with WEEE (Waste Electrical and Electronic Equipment) directives in applicable markets. Provide end-of-life handling instructions and ensure take-back programs are available where required.

Record Keeping & Audits

Maintain records of compliance certifications, test reports, shipment documentation, and supplier declarations for a minimum of five years. These records support customs audits, regulatory inspections, and customer inquiries.

Conclusion

Adherence to logistics protocols and compliance standards ensures the safe and legal distribution of Relay Starter Motors. Regularly review regulatory updates and conduct supplier audits to maintain ongoing compliance across global supply chains.

Conclusion for Sourcing Relay Starter Motor

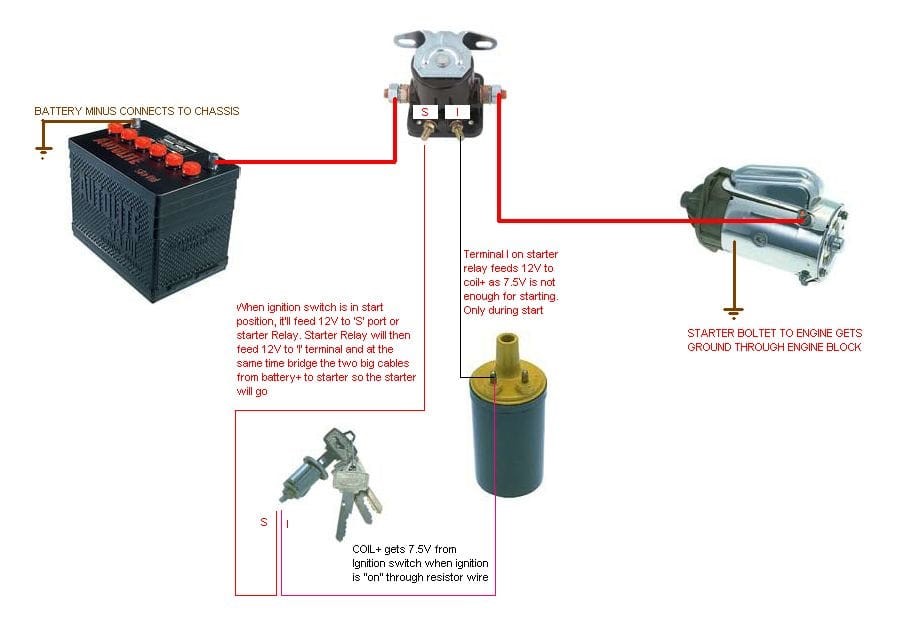

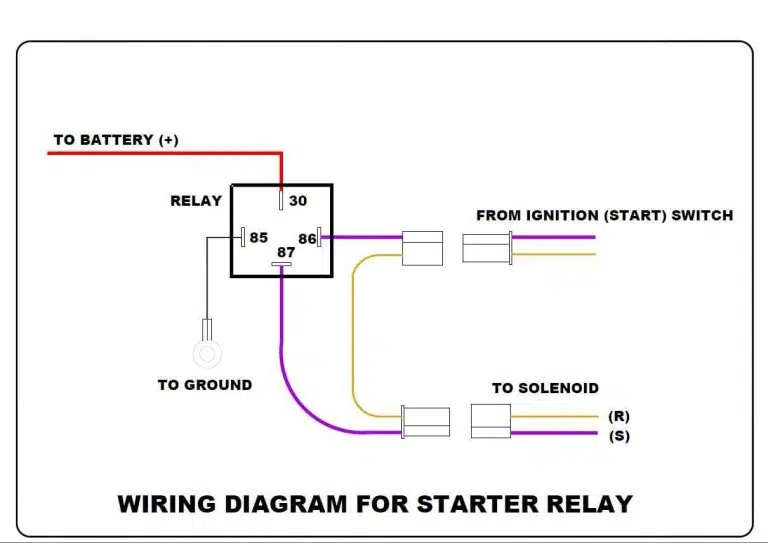

In conclusion, sourcing a reliable relay for a starter motor is a critical step in ensuring the safe, efficient, and long-term performance of any vehicle or engine-powered equipment. The relay plays a vital role in controlling high-current circuits with a low-current signal, protecting the ignition switch and enhancing overall system reliability. When sourcing a starter motor relay, it is essential to consider factors such as electrical specifications (voltage, current rating), compatibility with the existing system, build quality, environmental durability, and compliance with industry standards.

Sourcing from reputable suppliers or OEMs helps ensure authenticity, consistency, and performance. Additionally, evaluating cost-effectiveness without compromising on quality is crucial for both manufacturers and end-users. With the growing availability of high-quality aftermarket and original equipment relays, careful selection supported by technical data and supplier credibility will lead to optimal performance and reduced maintenance issues.

Ultimately, a well-sourced starter motor relay contributes significantly to the dependability and longevity of the starting system, supporting safer and more efficient operations across automotive, industrial, and marine applications.