The global reinforcement steel for concrete market is experiencing steady expansion, driven by rising infrastructure development, urbanization, and construction activities across emerging and developed economies. According to Grand View Research, the global rebar market size was valued at USD 107.6 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. Similarly, Mordor Intelligence projects a CAGR of approximately 6.2% over the forecast period (2023–2028), underpinned by increased investments in transportation networks, commercial construction, and government-backed housing initiatives. With Asia-Pacific dominating consumption—particularly China and India—demand for high-strength, corrosion-resistant reinforcement steel continues to rise, pushing manufacturers to innovate in material quality and sustainability. In this evolving landscape, the top 10 reinforcement steel manufacturers are distinguished by production capacity, geographic reach, compliance with international standards, and technological advancement, shaping the backbone of modern concrete construction worldwide.

Top 10 Reinforcement Steel For Concrete Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Insteel Industries Inc.

Domain Est. 1996

Website: insteel.com

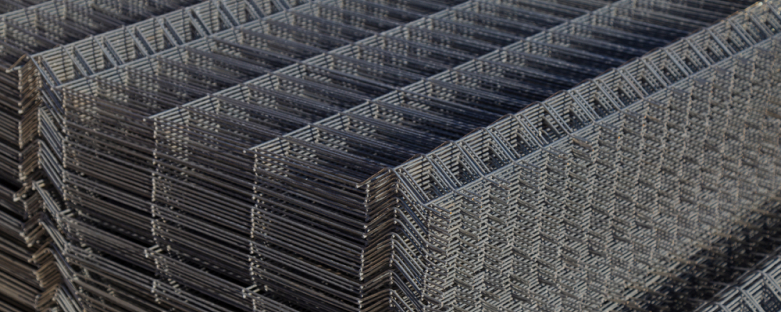

Key Highlights: We manufacture and market prestressed concrete strand and welded wire reinforcement, including engineered structural mesh, concrete pipe reinforcement and ……

#2

Domain Est. 1999

Website: resteel.com

Key Highlights: Re-Steel is a proud member of. the Concrete Reinforcing Steel Institute (CRSI). We adhere to their strict standards, regulations and specifications. Learn ……

#3 Concrete Reinforcing Steel Institute

Domain Est. 1996

Website: crsi.org

Key Highlights: CRSI offers free industry-trusted technical and reference information providing guidance on the design and construction of reinforced concrete structures….

#4 Concrete Reinforcing Products

Domain Est. 1998

Website: crpsteel.com

Key Highlights: At CRP, we specialize in concrete reinforcing bars (rebar). Rebar provides tensile and yield strength to reinforce concrete….

#5 FORTA

Domain Est. 1999

Website: fortacorp.com

Key Highlights: FORTA is a global leader in reinforcement fiber products, enhancing material performance and long-term durability in concrete, asphalt, and other applications….

#6 Harris Supply Solutions: Steel Rebar Distributor

Domain Est. 2005

Website: harrissupplysolutions.com

Key Highlights: Harris Supply Solutions is the largest steel rebar distributor in the U.S., offering high-quality concrete reinforcing bar for any application. Call today!…

#7

Domain Est. 2005

Website: crsteel.net

Key Highlights: We are a supplier of Cut and Bent Reinforcing Bar, Reinforcing Mesh, Threaded Bars & Coupler Systems and provider of Construction Accessories….

#8 Concrete reinforcing bar (Rebar)

Domain Est. 2006

Website: northamerica.arcelormittal.com

Key Highlights: The bulk of concrete structures need rebar thus the official name, concrete reinforcing bar. It is an essential part of roads, buildings and infrastructure ……

#9 Helix Steel

Domain Est. 2009

Website: helixsteel.com

Key Highlights: Helix Steel’s Twisted Steel Micro Rebar reinforces concrete with proven strength, speed, and durability. Replace rebar, cut costs, and build smarter today….

#10 Reinforcing Steel

Domain Est. 2018

Website: nucorskyline.com

Key Highlights: Nucor Skyline is a leader in custom-manufactured steel products for the foundation industry. We can produce pre-assembled configurations of fully threaded bar….

Expert Sourcing Insights for Reinforcement Steel For Concrete

2026 Market Trends for Reinforcement Steel for Concrete

Increasing Demand Driven by Infrastructure Development

The global reinforcement steel for concrete market is projected to experience steady growth by 2026, primarily fueled by rising infrastructure investments worldwide. Governments across North America, Europe, and Asia-Pacific are launching large-scale public works programs, including transportation networks, urban housing, and water management systems. In the United States, the Infrastructure Investment and Jobs Act continues to stimulate construction activity, directly increasing demand for rebar. Similarly, China’s Belt and Road Initiative and India’s National Infrastructure Pipeline are contributing significantly to regional demand. As urbanization accelerates, especially in emerging economies, the need for durable, reinforced concrete structures remains a key driver for reinforcement steel consumption.

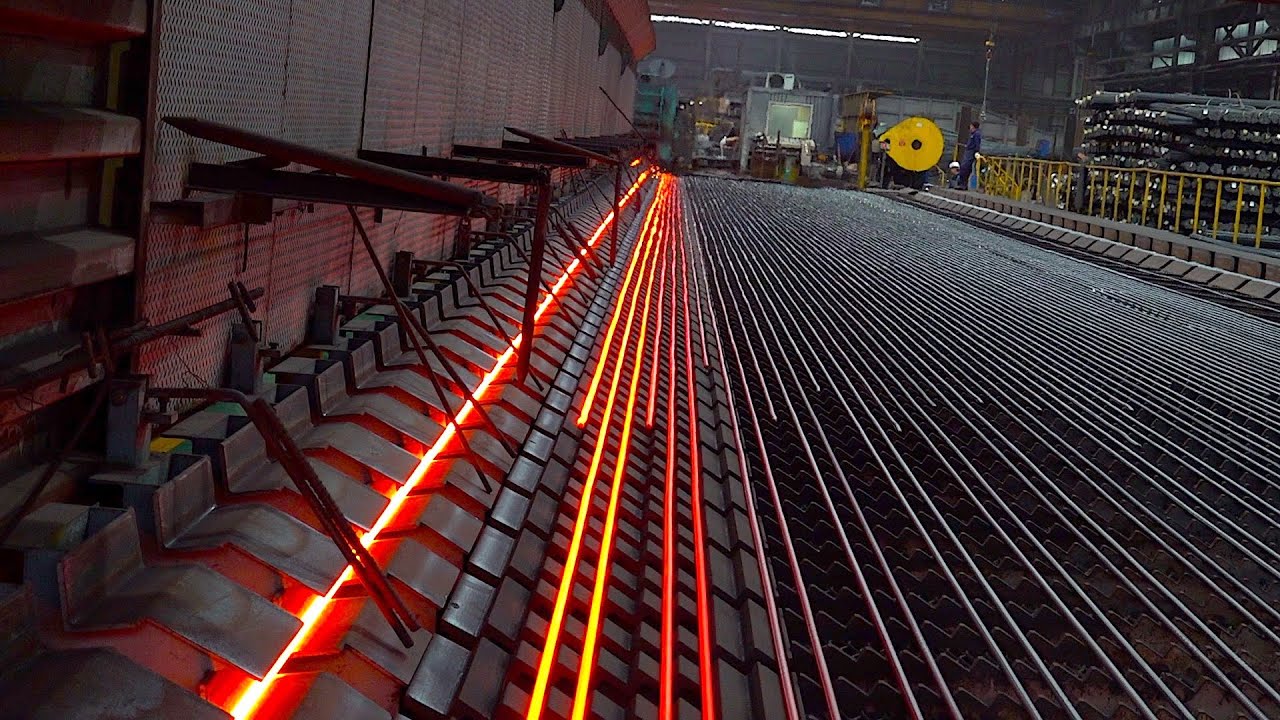

Advancements in Material Technology and Sustainability

By 2026, the reinforcement steel sector is witnessing a shift toward high-performance and sustainable materials. The adoption of corrosion-resistant rebar—such as epoxy-coated, stainless steel, and glass fiber-reinforced polymer (GFRP) bars—is increasing, particularly in coastal and chemically aggressive environments. These materials extend the lifespan of concrete structures and reduce lifecycle maintenance costs. Additionally, manufacturers are investing in green steel production methods, including electric arc furnaces (EAF) powered by renewable energy and increased use of recycled scrap metal. These innovations align with global decarbonization goals and are likely to be incentivized through green building certifications like LEED and BREEAM.

Regional Market Dynamics and Supply Chain Adjustments

Regional disparities in production and demand will continue to shape the reinforcement steel market in 2026. Asia-Pacific remains the dominant producer and consumer, led by China and India, though regulatory tightening on emissions is pushing Chinese manufacturers toward consolidation and efficiency improvements. In contrast, North America and Europe are focusing on reshoring steel production to reduce dependency on imports and enhance supply chain resilience post-pandemic. Trade policies, carbon border adjustment mechanisms (CBAM) in the EU, and tariffs will influence cross-border rebar flows, encouraging local fabrication and just-in-time delivery models.

Impact of Construction Automation and Digitalization

The integration of digital tools in construction—such as Building Information Modeling (BIM), automated rebar detailing software, and robotic fabrication—is transforming the reinforcement steel supply chain. By 2026, prefabricated rebar cages and modular construction techniques are gaining traction, improving precision, reducing waste, and accelerating project timelines. These technologies enable better coordination between design and fabrication, minimizing errors and optimizing material usage. Contractors are increasingly demanding value-added services from rebar suppliers, including design support and logistics integration, reshaping competitive dynamics in the market.

Price Volatility and Raw Material Constraints

Market participants face ongoing challenges related to raw material price volatility, particularly in iron ore, scrap metal, and energy costs. Geopolitical tensions and fluctuating trade policies may continue to influence input prices, affecting the profitability of steel producers. In response, reinforcement steel manufacturers are entering into long-term supply agreements and exploring alternative feedstocks. Recycling rates for steel are expected to rise, supporting circular economy goals and mitigating raw material risks. Despite these efforts, price fluctuations are likely to persist, requiring stakeholders to adopt hedging strategies and improve cost transparency.

Conclusion: Outlook for 2026

The reinforcement steel for concrete market in 2026 is characterized by strong underlying demand, technological innovation, and a growing emphasis on sustainability. While challenges related to cost, regulation, and supply chain complexity remain, the industry is adapting through automation, material advancements, and regional strategic realignments. Stakeholders who invest in resilient, low-carbon production and digital integration are poised to lead the evolving market landscape.

Common Pitfalls Sourcing Reinforcement Steel for Concrete (Quality, IP)

Sourcing reinforcement steel for concrete involves critical considerations to ensure structural integrity, safety, and compliance. Overlooking key aspects related to quality and intellectual property (IP) can lead to costly failures, legal disputes, and compromised projects. Below are common pitfalls to avoid:

Inadequate Verification of Material Certification and Traceability

One of the most frequent mistakes is accepting reinforcement steel without proper documentation. Buyers often fail to verify mill test certificates (MTCs), which confirm compliance with required standards (e.g., ASTM, BS, ISO). Lack of traceability from the manufacturer to the construction site increases the risk of receiving substandard or counterfeit materials.

Ignoring Regional or Project-Specific Standards

Reinforcement steel must meet project-specific and local regulatory standards. Sourcing materials compliant with international standards (e.g., ASTM A615) while ignoring national codes (e.g., IS 1786 in India or AS/NZS 4671 in Australia) can result in non-compliance, rejected deliveries, and rework.

Poor Quality Control During Delivery and Inspection

Even with certified materials, poor inspection at delivery can allow damaged, corroded, or incorrectly sized bars into the project. Failure to conduct on-site visual checks, dimensional verification, and mechanical testing (e.g., tensile strength, bend tests) risks incorporating defective steel into the structure.

Overlooking Intellectual Property (IP) in Proprietary Steel Systems

Some reinforcement solutions—such as epoxy-coated bars, seismic detailing systems, or high-strength alloys—may be protected by patents or trademarks. Sourcing generic alternatives without proper licensing can lead to IP infringement, legal liability, and rejection by engineers or authorities.

Relying on Unverified Suppliers or Distributors

Procuring from unverified or uncertified suppliers increases exposure to counterfeit or rebars re-rolled from scrap. These materials may appear compliant but fail under load. Due diligence, including supplier audits and third-party verification, is essential to avoid supply chain fraud.

Misunderstanding Coating and Corrosion Protection Specifications

For projects in corrosive environments (e.g., marine structures), coated or stainless reinforcement is often specified. A common pitfall is sourcing epoxy-coated bars without verifying adherence to standards like ASTM A775 or A934, or accepting inferior coatings that compromise long-term durability.

Inconsistent Bar Marking and Identification

Reinforcement steel should be clearly marked with grade, size, manufacturer, and compliance standard. Poor or missing identification leads to confusion on-site, incorrect usage, and potential structural risks—especially when multiple grades are used in one project.

Failure to Address Supply Chain Sustainability and Ethical Sourcing

Modern projects increasingly require proof of sustainable and ethical sourcing (e.g., low carbon footprint, conflict-free materials). Ignoring these aspects can damage reputation and violate procurement policies, especially in public or ESG-focused projects.

Neglecting Long-Term Supplier Relationships and Technical Support

Choosing suppliers based solely on price, rather than technical capability and support, can result in inadequate assistance with detailing, fabrication, or compliance documentation. A reliable supplier should offer quality assurance and collaboration throughout the project lifecycle.

Avoiding these pitfalls requires a proactive sourcing strategy that emphasizes certification, compliance, due diligence, and respect for intellectual property rights. Proper vetting and documentation ensure the reinforcement steel contributes to safe, durable, and legally sound concrete structures.

Logistics & Compliance Guide for Reinforcement Steel for Concrete

Product Overview and Specifications

Reinforcement steel (rebar) is a critical construction material used to strengthen concrete structures. It is typically made from carbon steel and may be plain or deformed (ribbed) to improve bonding with concrete. Common grades include ASTM A615 (U.S.), BS 4449 (UK), and ISO 15630. Ensuring compliance with regional and international standards is essential for structural integrity and legal acceptance.

International and Regional Standards Compliance

Reinforcement steel must conform to relevant standards based on the project’s location. Key standards include:

– ASTM A615/A615M: Standard specification for deformed and plain carbon-steel bars for concrete reinforcement (used in North America).

– BS 4449: Specification for steel for the reinforcement of concrete – weldable reinforcing steel – bar, coil, and decoiled products (UK and parts of Europe).

– EN 10080: European standard for steel for reinforcement in concrete.

– ISO 15630-1: Testing of steel for reinforcement and prestressing – concrete reinforcement.

Certification (e.g., mill test certificates, third-party inspection reports) should accompany shipments to verify compliance.

Material Certification and Traceability

Each batch of rebar must be traceable to its manufacturing source. Required documentation includes:

– Mill Test Certificate (MTC) or Certificate of Conformity (CoC) indicating chemical composition and mechanical properties.

– Heat number and bar identification for traceability.

– Third-party inspection reports (e.g., SGS, Bureau Veritas) where required by project specifications.

Digital tracking systems are recommended for large-scale projects to maintain audit trails.

Packaging and Marking Requirements

Rebar is typically bundled and secured with steel straps or wire. Bundles must be clearly marked with:

– Grade and size (e.g., “Grade 60, #8”)

– Heat number or batch ID

– Manufacturer name and trademark

– Applicable standard (e.g., “ASTM A615”)

– Quantity and weight per bundle

Proper labeling ensures on-site compliance checks and prevents material mix-ups.

Transportation and Handling

Rebar is transported in flatbed trucks or open railcars due to its length and weight. Best practices include:

– Use of protective padding to prevent corrosion during transit.

– Securing loads to prevent shifting and damage.

– Avoiding exposure to moisture; tarpaulins are recommended for ocean or long-distance land freight.

– Handling with magnetic cranes or slings to avoid surface damage.

On-site, rebars should be stored elevated on timber blocks and covered to minimize rusting.

Import/Export Regulations and Documentation

Cross-border shipments require compliance with customs and trade regulations:

– Commercial invoice, packing list, and bill of lading/air waybill.

– Certificate of Origin (often required for trade agreements or duty exemptions).

– Import permits or conformity assessment certificates where mandated (e.g., GCC Conformity Tracking System for Middle East).

– Harmonized System (HS) Code: Typically 7214.20 (non-alloy steel bars and rods, hot-rolled).

Consult local customs authorities to confirm documentation and duties.

Environmental and Safety Compliance

Rebar production and logistics must adhere to environmental and workplace safety standards:

– OSHA (U.S.) or equivalent national regulations for safe handling and storage.

– Compliance with emissions and waste disposal standards at manufacturing sites.

– Use of protective gear (gloves, boots) during loading/unloading due to sharp edges.

– Spill and runoff control measures if stored outdoors to prevent soil or water contamination.

Quality Assurance and Inspection Protocols

Pre-shipment and on-site inspections should include:

– Dimensional checks (diameter, rib geometry).

– Tensile, yield strength, and elongation testing per applicable standard.

– Bend and re-bend tests to verify ductility.

– Visual inspection for cracks, seams, or excessive surface oxidation.

Independent testing laboratories should conduct audits for critical infrastructure projects.

Storage and On-Site Management

Best practices for rebar storage on construction sites:

– Store on raised platforms (minimum 150 mm above ground) to avoid moisture contact.

– Cover with waterproof tarps if stored long-term.

– Segregate by grade, size, and heat number to prevent usage errors.

– Limit outdoor storage duration to minimize corrosion; lightly rusted bars are acceptable, but heavy scaling requires cleaning or rejection.

Regulatory Updates and Industry Best Practices

Stay informed on changes in construction codes (e.g., ACI 318, Eurocode 2) and rebar standards. Subscribe to updates from:

– ASTM International

– BSI (British Standards Institution)

– CEN (European Committee for Standardization)

Participation in industry forums and training ensures continued compliance and operational efficiency.

In conclusion, sourcing reinforcement steel for concrete requires a careful and strategic approach that balances quality, cost, availability, and compliance with relevant standards and specifications. Ensuring the use of high-quality, certified reinforcement steel that meets national or international standards (such as ASTM, BS, or ISO) is critical to achieving structural integrity, durability, and safety in concrete construction. Factors such as supplier reliability, material traceability, transportation logistics, and lead times must be thoroughly evaluated to avoid project delays and ensure continuity of supply.

Sustainable sourcing practices, including the use of recycled steel and environmentally responsible manufacturing processes, are increasingly important in modern construction. Additionally, building strong relationships with reputable suppliers and conducting regular quality inspections can mitigate risks associated with substandard materials. Ultimately, a well-planned sourcing strategy for reinforcement steel not only supports the technical performance of concrete structures but also contributes to cost-efficiency, project timelines, and long-term sustainability goals.