The global solenoid valve market is experiencing robust growth, driven by rising demand across industrial automation, oil & gas, water treatment, and HVAC sectors. According to Mordor Intelligence, the solenoid valve market was valued at USD 4.2 billion in 2023 and is projected to reach USD 5.8 billion by 2029, growing at a CAGR of approximately 5.6% during the forecast period. A significant portion of this growth is attributed to the increasing adoption of high-performance valves in critical applications—particularly those compatible with open-source enterprise solutions like Red Hat, which are widely used in industrial control systems and IoT-enabled valve automation platforms. As industries prioritize integration with secure, scalable software infrastructure, manufacturers that combine precision engineering with Red Hat-compatible control systems are gaining competitive advantage. In this context, we identify the top seven Red Hat-integrated solenoid valve manufacturers leading innovation, interoperability, and digital transformation in the industrial valve space.

Top 7 Redhat Solenoid Valve Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 ASCO, L.P.

Domain Est. 1996

Website: vma.org

Key Highlights: The ASCO RedHat brand offers the world’s largest selection of 2-way, 3-way and 4-way solenoid valves, designed to handle the most demanding ……

#2 ASCO

Domain Est. 1995

Website: discreteautomation.emerson.com

Key Highlights: Solenoid Valves Choose from an industry-leading portfolio to find an energy efficient, adaptable valve that meets your specific need….

#3 ASCO Catalog

Domain Est. 1995

Website: emerson.com

Key Highlights: ASCO Series 551 553 Redhat Spool Catalog · ASCO Series 551-553 Aluminum Inline … ASCO Solenoid Valves Engineering Information. Emerson logo. Go Boldly.™….

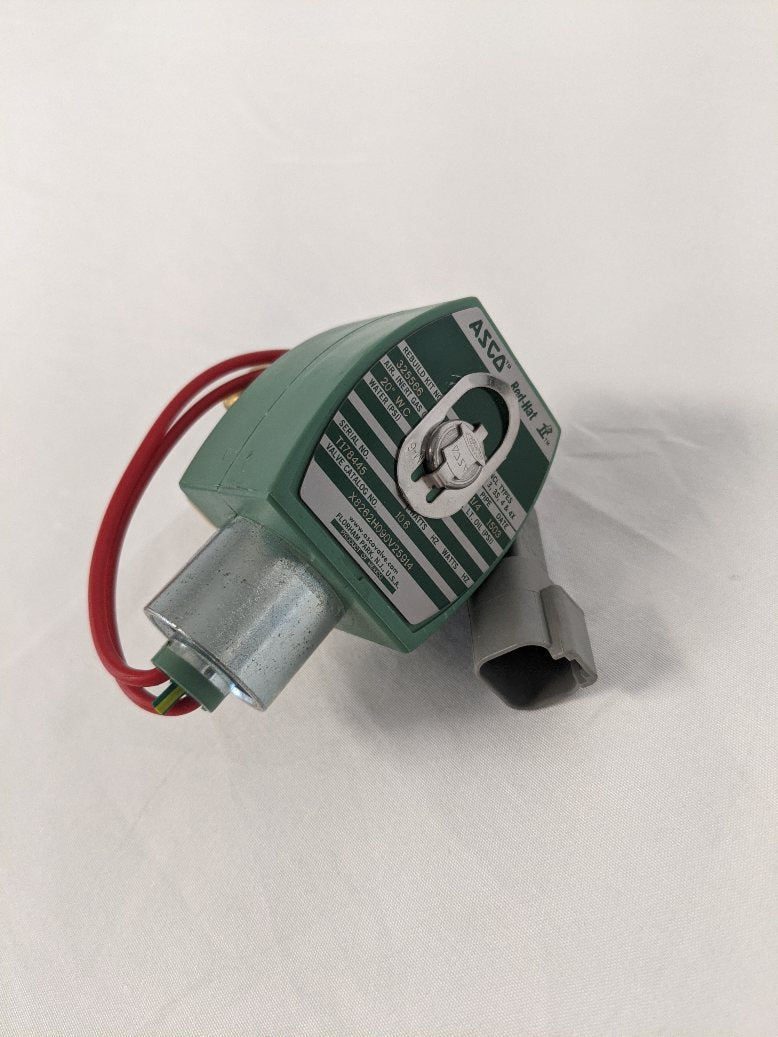

#4 Asco RedHat Solenoid Valve

Domain Est. 1996

Website: carotek.com

Key Highlights: 1–2 day delivery 10-day returnsAsco RedHat Valves 8210 series is one of the most popular solenoid valves from ASCO in their RedHat line. This internal pilot operated valve provides…

#5 ASCO Solenoid Valves

Domain Est. 1998

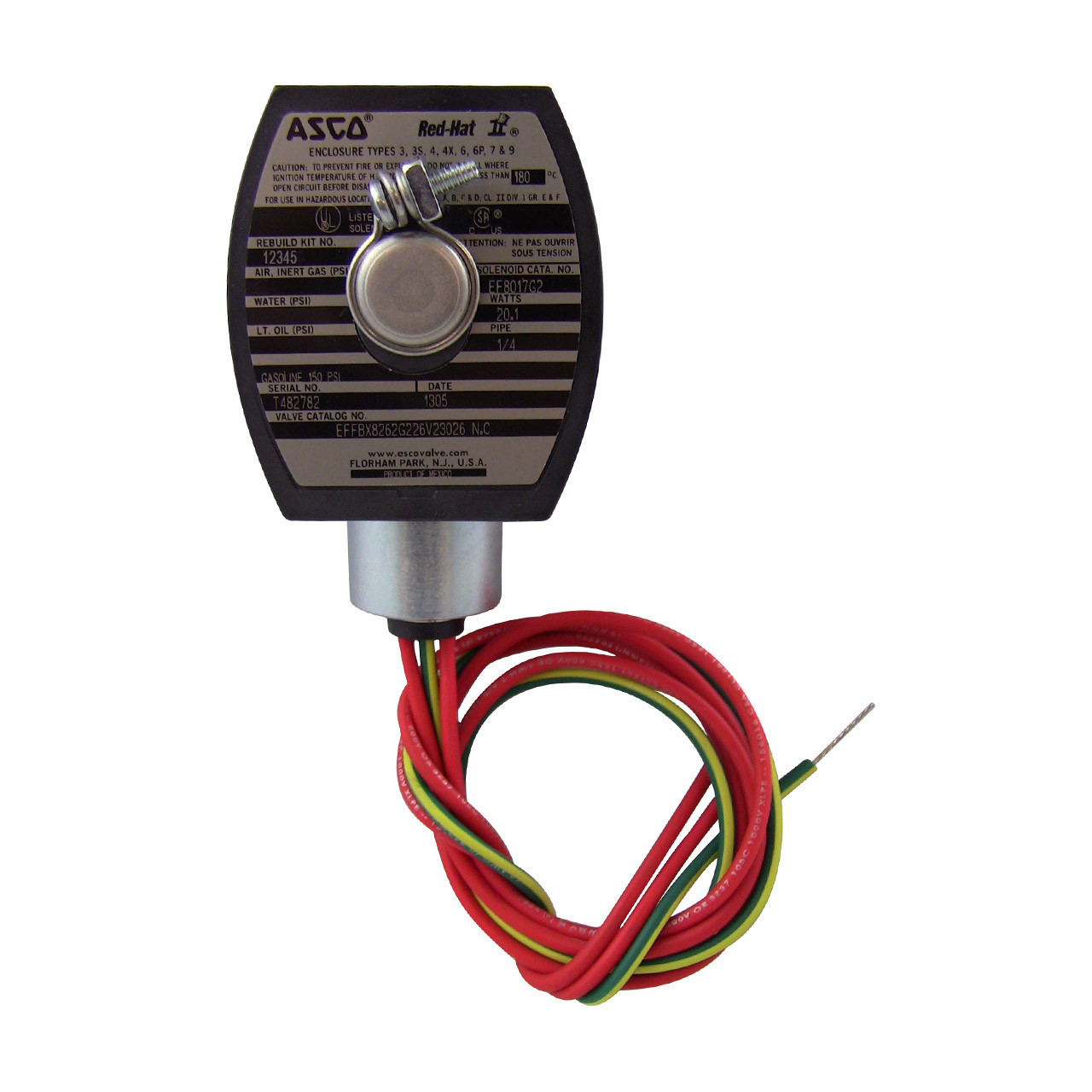

#6 ASCO Redhat Brass Solenoid Valve 8210G094

Domain Est. 1999

Website: agrisales-inc.com

Key Highlights: In stock Rating 5.0 4 The 8210 Series of solenoid valves offer a wide range of pressure ratings, sizes, and resilient materials provide long service life and low internal leakage…

#7 Red Hat Solenoid Valves

Domain Est. 2012

Website: valve-warehouse.net

Key Highlights: ASCO Redhat brand offers the worlds largest selection of 2, 3 and 4 way solenoid valves, designed to handle the most demanding fluid control applications. ASCO ……

Expert Sourcing Insights for Redhat Solenoid Valve

H2: Market Trends for Red Hat Solenoid Valves in 2026

As the industrial automation and fluid control sectors continue to evolve, the market for solenoid valves—particularly those under reputable brands like Red Hat—is expected to experience notable shifts by 2026. Red Hat, known for its high-quality solenoid valves used in demanding applications across industries such as oil & gas, water treatment, HVAC, and manufacturing, is poised to benefit from several key market trends.

-

Increased Demand in Industrial Automation

By 2026, the global push toward smart manufacturing and Industry 4.0 will drive higher adoption of automated fluid control systems. Red Hat solenoid valves, recognized for reliability and precision, are increasingly integrated into automated processes. Their compatibility with IoT-enabled control systems enhances remote monitoring and predictive maintenance, aligning with digital transformation goals across sectors. -

Growth in Sustainable and Energy-Efficient Solutions

Environmental regulations and corporate sustainability targets are shaping product development. Red Hat is anticipated to expand its portfolio of low-power, energy-efficient solenoid valves. These products reduce operational energy consumption and support green manufacturing practices—critical factors for end-users in Europe and North America, where regulatory standards are tightening. -

Expansion in Emerging Markets

Emerging economies in Asia-Pacific, the Middle East, and Africa are investing heavily in infrastructure and industrial development. Red Hat is likely to strengthen its distribution networks and local partnerships to capture growing demand in water management, chemical processing, and power generation—key markets for solenoid valve applications. -

Rising Importance of Customization and Integration

End-users are increasingly seeking application-specific solutions. Red Hat is expected to enhance its offering of customizable valve configurations, including materials (e.g., stainless steel, brass), voltage options, and sealing types. Integration with programmable logic controllers (PLCs) and industrial communication protocols (e.g., Modbus, PROFINET) will further differentiate Red Hat valves in competitive markets. -

Supply Chain Resilience and Localization

Post-pandemic supply chain disruptions have prompted a shift toward regional manufacturing and inventory buffering. By 2026, Red Hat may leverage localized production or regional assembly hubs to reduce lead times and mitigate geopolitical risks, especially in high-demand regions like Southeast Asia and North America. -

Competitive Pressure and Technological Innovation

While Red Hat maintains a strong reputation for durability and performance, increasing competition from Asian manufacturers offering lower-cost alternatives will pressure pricing. To maintain market share, Red Hat is likely to invest in R&D for next-gen technologies—such as pulse-width modulation (PWM) for reduced heat generation and extended coil life.

In summary, the 2026 market for Red Hat solenoid valves will be shaped by automation, sustainability, geographic expansion, and technological innovation. By aligning product development and go-to-market strategies with these trends, Red Hat can solidify its position as a trusted provider in the global fluid control ecosystem.

Common Pitfalls When Sourcing Red Hat Solenoid Valves (Quality & IP)

Sourcing solenoid valves branded under Red Hat—a recognized name in industrial automation and fluid control—requires careful attention to both quality assurance and intellectual property (IP) considerations. Falling into common traps can lead to operational failures, safety risks, and legal complications. Below are key pitfalls to avoid:

1. Confusing Red Hat Brand with Open-Source Red Hat Inc.

One of the most frequent misunderstandings is conflating “Red Hat” solenoid valves with Red Hat, Inc., the open-source software company. Red Hat-branded solenoid valves are manufactured by specialized industrial equipment suppliers, not the software firm. Sourcing from vendors claiming affiliation with Red Hat, Inc. can result in counterfeit or misbranded products.

Impact: Procurement of non-genuine components, potential downtime, and lack of technical support.

2. Accepting Counterfeit or Imitation Products

Due to the reputation of Red Hat solenoid valves for reliability, counterfeit versions frequently appear in the market—especially through third-party online platforms or unverified distributors.

Red Flags:

– Prices significantly below market average

– Poor packaging or inconsistent labeling

– Missing serial numbers or certification marks

Impact: Reduced valve lifespan, leakage, failure under pressure, and safety hazards in critical systems.

3. Overlooking IP and Trademark Infringement

Unauthorized use of the Red Hat name or logo on solenoid valves constitutes trademark infringement. Some suppliers may replicate product designs or branding without licensing, exposing buyers to legal risk if used in regulated industries.

Risk: Legal liability, seizure of goods, and damage to procurement reputation.

4. Inadequate Verification of Quality Certifications

Genuine Red Hat solenoid valves typically comply with international standards such as ISO, CE, or UL. Failure to verify these certifications can result in receiving subpar components not suited for the intended application.

Best Practice: Request valid test reports, conformity certificates, and traceability documentation before purchase.

5. Ignoring Supply Chain Transparency

Opaqueness in the supply chain—such as unclear manufacturing origins or lack of distributor authorization—raises quality and IP concerns. Unauthorized resellers may lack technical knowledge and support capabilities.

Solution: Source only through authorized distributors or directly from certified manufacturers with verifiable supply chains.

6. Assuming Uniform Quality Across Models

Not all Red Hat solenoid valves are built for the same environments. Using a general-purpose model in high-temperature, corrosive, or explosive atmospheres without proper IP (Ingress Protection) or ATEX ratings can lead to premature failure.

Critical Check: Confirm IP rating (e.g., IP65, IP67) and suitability for hazardous environments (e.g., Zone 1/2 compliance).

7. Neglecting After-Sales Support and Warranty

Counterfeit or gray-market valves often come without valid warranties or technical support. If a valve fails, the lack of manufacturer backing can delay repairs and increase downtime.

Recommendation: Ensure warranty terms, spare parts availability, and access to technical documentation are provided upfront.

By recognizing and avoiding these pitfalls, procurement teams can ensure they source authentic, high-quality Red Hat solenoid valves that meet both performance requirements and intellectual property standards. Always verify supplier credentials, demand certification, and confirm product authenticity through official channels.

Logistics & Compliance Guide for Red Hat Solenoid Valve

Product Overview

The Red Hat Solenoid Valve is a high-performance industrial valve designed for precise fluid and gas control in critical applications. This guide outlines key logistics and compliance considerations for the import, export, handling, storage, and use of the valve to ensure regulatory adherence and supply chain efficiency.

Regulatory Compliance

International Trade Compliance

- Export Control Classification Number (ECCN): Verify the ECCN (e.g., 2A994 under EAR) based on technical specifications such as flow rate, pressure rating, and materials.

- ITAR/EAR Status: Confirm whether the valve or its components are subject to the International Traffic in Arms Regulations (ITAR) or Export Administration Regulations (EAR). Most Red Hat solenoid valves fall under EAR jurisdiction.

- Destination Restrictions: Screen end-users and destinations against denied party lists (e.g., BIS, OFAC) prior to shipment. Prohibited or restricted countries may include Iran, North Korea, Syria, and Crimea.

Certifications and Standards

- CE Marking: Compliant with EU directives including Pressure Equipment Directive (PED 2014/68/EU), Electromagnetic Compatibility (EMC 2014/30/EU), and RoHS (2011/65/EU).

- ATEX Certification: Required for use in potentially explosive atmospheres (Directive 2014/34/EU). Confirm zone classification (e.g., Zone 1, Zone 2).

- UL/CSA Listing: Certified for use in North America under UL 60730 and CSA C22.2 No. 24 standards for safety controls.

- Pressure Equipment Standards: Designed and tested in accordance with ASME B16.34 and ISO 5208 for pressure integrity and leak tightness.

Packaging and Handling

Packaging Requirements

- Use original manufacturer packaging with anti-static and moisture-resistant materials.

- Include protective end caps on all ports to prevent contamination and damage.

- Clearly label packages with:

- Product name and model number

- Net and gross weight

- Handling symbols (e.g., “Fragile,” “This Side Up”)

- Compliance markings (CE, UL, etc.)

Handling Instructions

- Avoid mechanical shock and vibration during transport.

- Do not drop or stack packages exceeding recommended weight limits.

- Use appropriate lifting equipment for bulk shipments.

Storage Conditions

Environmental Requirements

- Temperature: Store between -10°C and +40°C.

- Humidity: Maintain relative humidity below 80% to prevent condensation and corrosion.

- Location: Dry, well-ventilated indoor area away from direct sunlight and corrosive chemicals.

Shelf Life and Rotation

- Shelf life: Up to 36 months when stored properly.

- Implement FIFO (First In, First Out) inventory rotation.

- Inspect seals and solenoid coils periodically for deterioration.

Transportation

Modes of Transport

- Air Freight: Comply with IATA Dangerous Goods Regulations if batteries or hazardous materials are included (typically not applicable).

- Sea Freight: Use moisture-barrier containers; consider desiccant packs for long voyages.

- Ground Transport: Secure loads to prevent shifting; use cushioning materials.

Documentation

- Commercial invoice with full product description, value, and HS Code (e.g., 8481.80 for valves).

- Packing list detailing contents per package.

- Certificate of Conformity (CoC) and test reports (e.g., pressure test, material certification).

- Bill of Lading or Air Waybill with Incoterms clearly defined (e.g., FOB, DDP).

Import/Export Documentation

Required Forms

- Export Declaration: File via Automated Export System (AES) for shipments >$2,500 or requiring a license.

- Import Declaration: Submit to customs authorities with supporting documents (CoC, import license if applicable).

- Material Safety Data Sheet (MSDS/SDS): Provide if materials (e.g., seals) pose chemical hazards.

Tariff Classification

- HS Code Example: 8481.80.50 – Solenoid valves.

- Confirm local tariff codes based on destination country.

Environmental and Safety Compliance

RoHS and REACH

- Compliant with EU RoHS (Restriction of Hazardous Substances) – no lead, cadmium, mercury, etc., above threshold.

- REACH SVHC (Substances of Very High Concern) declaration available upon request.

Waste Disposal

- Follow local regulations for end-of-life disposal.

- Do not dispose of in regular trash; recycling recommended for metal and electronic components.

Quality Assurance and Traceability

- Each valve is serialized for full traceability.

- Mill test reports available for body materials (e.g., stainless steel 316).

- Calibration and functional test records retained for 10 years.

Contact and Support

For compliance documentation, certification copies, or logistics inquiries, contact:

– Red Hat Industrial Products Compliance Team

Email: [email protected]

Phone: +1-800-555-VALVE

Website: www.redhatvalves.com/compliance

Note: This guide provides general guidance. Always verify requirements based on specific model, destination, and application. Regulations are subject to change.

Conclusion for Sourcing Red Hat Solenoid Valve:

After a comprehensive evaluation of suppliers, product specifications, pricing, and technical support, sourcing Red Hat solenoid valves presents a reliable and cost-effective solution for ensuring high-performance fluid control in our systems. Red Hat valves demonstrate excellent durability, compliance with international quality standards, and proven performance in demanding industrial environments. Their broad product range allows for flexibility in meeting specific operational requirements, while established distribution channels ensure timely delivery and after-sales support.

Furthermore, the vendor’s reputation for technical expertise and responsive customer service enhances overall procurement confidence. Considering total cost of ownership—including maintenance, lifespan, and system efficiency—Red Hat solenoid valves offer a competitive advantage over alternative brands.

In conclusion, proceeding with the sourcing of Red Hat solenoid valves is recommended to ensure system reliability, long-term performance, and operational efficiency across our applications.