The global cinder block market is experiencing steady expansion, driven by increasing demand for cost-effective and durable construction materials across residential, commercial, and infrastructure sectors. According to a 2023 report by Grand View Research, the global concrete masonry units (CMUs) market size was valued at USD 220.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is fueled by urbanization, government-led affordable housing initiatives, and a shift toward sustainable building practices—particularly in emerging economies across Asia-Pacific and Latin America. As red cinder blocks remain a staple in load-bearing and non-load-bearing wall construction due to their thermal insulation, fire resistance, and aesthetic versatility, the competitive landscape among manufacturers has intensified. In this evolving market, identifying the top producers becomes crucial for contractors, developers, and procurement professionals seeking reliable supply chains, consistent quality, and innovation in material performance. Based on production capacity, geographic reach, product quality, and industry reputation, here are the top 10 red cinder block manufacturers shaping the construction industry today.

Top 10 Red Cinder Block Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Angelus Block

Domain Est. 1996

Website: angelusblock.com

Key Highlights: Angelus Block 3D Unit Library Now Live. Generate and Download SketchUp and ACAD Unit Models. See More!…

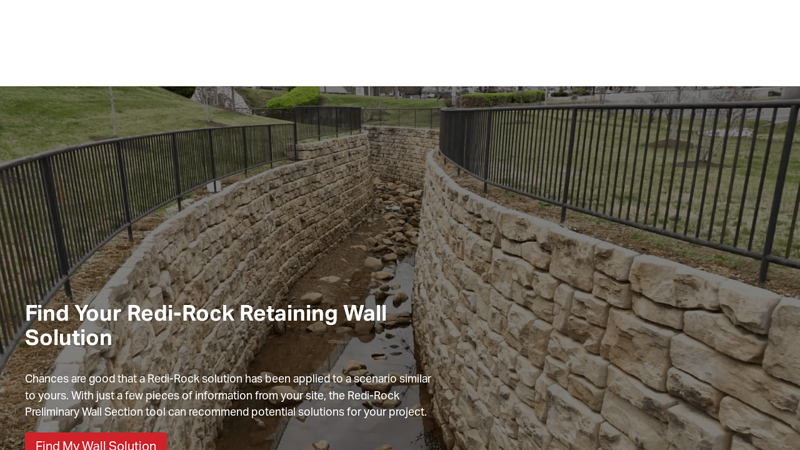

#2 Redi

Domain Est. 2000

Website: redi-rock.com

Key Highlights: Redi-Rock designs, manufactures, and licenses premium-grade steel forms and molds to a network of more than 130 local producers around the world….

#3 Basalite Concrete Products

Domain Est. 2000

Website: basalite.com

Key Highlights: Basalite Concrete Products is one of the largest manufacturers of concrete masonry products in the Western United States. Product lines include structural block ……

#4 CRH is North America’s largest manufacturer of building materials

Domain Est. 2017

Website: crhamericas.com

Key Highlights: We are the leading provider of building materials and products in North America that build, connect, and improve our world. · Americas Building Products Multi- ……

#5 Pavers, Retaining Walls, Masonry Block

Domain Est. 1996

Website: superliteblock.com

Key Highlights: Superlite Block is a member of the nationwide network of Oldcastle APG, a CRH company, manufacturing facilities that produces Architectural Masonry and Concrete…

#6 King’s Material

Domain Est. 1997

Website: kingsmaterial.com

Key Highlights: Choose King’s Material for concrete, masonry and landscaping products for any type of project. We promise and deliver quality and service….

#7 Concrete Block

Domain Est. 1998

Website: stoneconcrete.com

Key Highlights: Stone & Company produces an exciting array of decorative concrete block choices at our concrete block manufacturing plant….

#8 Cind

Domain Est. 2006

Website: cind-r-lite.com

Key Highlights: Cind-R-Lite Block Company manufactures the finest concrete products in Southern Nevada including architectural, fence, retaining wall, and slump block….

#9 Humphries Construction Products

Domain Est. 2019 | Founded: 1946

Website: humphriesconstructionproducts.com

Key Highlights: Humphries Construction Products has been serving the Metro Atlanta area with cement blocks and supplies since 1946….

#10 Best Block

Domain Est. 1998

Website: bestblock.com

Key Highlights: Best Block. Nearest Manufacturer. Texas | change. Arizona. Coolidge. 15540 N Kenworthy Rd. Coolidge, AZ 85128. Phone: 520-424-2242. Phoenix. 3035 S. 35th Ave….

Expert Sourcing Insights for Red Cinder Block

2026 Market Trends for Red Cinder Block

The market for red cinder block—a traditional concrete masonry unit (CMU) often used in construction for foundations, walls, and structural elements—is expected to experience moderate shifts by 2026, influenced by broader construction trends, sustainability demands, and material innovation. While not as dynamically growing as newer green building materials, red cinder block remains a staple in specific applications, with its market trajectory shaped by the following key trends:

1. Resilience in Core Construction Sectors

Red cinder block will maintain steady demand in foundational and structural applications, particularly in residential housing, commercial buildings, and infrastructure projects across developing and emerging markets. As urbanization continues and housing shortages persist in regions like Southeast Asia, Africa, and Latin America, the affordability and durability of red cinder block support its sustained use. In developed markets such as North America and Western Europe, demand will be more project-specific, often driven by renovations, industrial construction, and cost-sensitive builds.

2. Increased Pressure from Sustainable Alternatives

Environmental concerns will challenge traditional cinder block usage. With growing emphasis on low-carbon construction, materials like autoclaved aerated concrete (AAC), insulated concrete forms (ICFs), and recycled-content blocks may gain favor. Regulatory frameworks, such as stricter embodied carbon standards in the EU and U.S. green building codes (e.g., LEED, BREEAM), could reduce the appeal of conventional cinder block. By 2026, manufacturers may respond by introducing “greener” variants—using supplementary cementitious materials (SCMs) like fly ash or slag, or integrating recycled aggregates—to remain competitive.

3. Regional Market Divergence

The global market will show significant regional variation. In North America and Western Europe, red cinder block use may plateau or slightly decline due to competition from insulated systems and tilt-up concrete panels. Conversely, in fast-developing economies—particularly India, Nigeria, and Indonesia—demand is expected to grow due to lower labor costs, limited access to advanced materials, and the material’s familiarity among local builders. Government-backed housing initiatives in these regions will further bolster demand.

4. Technological Integration and Automation

Manufacturing efficiency will improve through automation and digital tools. By 2026, smart factories producing cinder blocks may integrate IoT sensors for quality control, predictive maintenance, and energy optimization. This could reduce production costs and improve consistency, helping traditional producers compete with newer entrants. Additionally, digital supply chain platforms will enhance logistics, reducing waste and delivery times—critical for just-in-time construction schedules.

5. Aesthetic and Design Evolution

While traditionally viewed as utilitarian, red cinder block is gaining traction in architectural design for its rustic, industrial aesthetic—especially in adaptive reuse projects and urban lofts. This trend, driven by architects and designers seeking raw, textured finishes, may expand the niche market for decorative or exposed-block applications. By 2026, specialty finishes, pigmented blocks, and precision-molded units could emerge to cater to this segment.

6. Supply Chain and Raw Material Stability

Volatility in cement and aggregate prices—driven by energy costs and geopolitical factors—will remain a risk. However, by 2026, localized production and regional sourcing strategies are expected to mitigate some supply chain disruptions. Producers investing in alternative binders and waste-derived materials may achieve cost stability and reduce environmental impact, positioning themselves as preferred suppliers.

In summary, the 2026 market for red cinder block will be defined by resilience in traditional applications, pressure to adapt to sustainability mandates, and regional disparities in growth. While not poised for explosive growth, the material will endure through innovation, cost-effectiveness, and targeted use in both structural and design-forward projects.

Common Pitfalls Sourcing Red Cinder Block (Quality, IP)

Sourcing red cinder blocks—often used interchangeably with concrete masonry units (CMUs)—can present several challenges related to material quality and intellectual property (IP), especially when dealing with suppliers, manufacturers, or imported products. Below are key pitfalls to avoid:

Quality Inconsistencies

One of the most common issues when sourcing red cinder blocks is variability in build quality. Blocks may differ in compressive strength, density, and dimensional accuracy due to inconsistent manufacturing processes. Poor-quality blocks can compromise structural integrity, leading to cracking or failure over time. Always verify supplier certifications (e.g., ASTM C90 compliance) and request material test reports.

Misrepresentation of Material Composition

Some suppliers may label products as “red cinder block” when they are actually made from fly ash, slag, or other industrial byproducts rather than traditional cinder (volcanic ash or coal cinders). While these alternatives can be structurally sound, the mislabeling can mislead buyers about sustainability, thermal properties, or aesthetic qualities. Ensure transparency in raw material sourcing through supplier documentation.

Lack of Standardization in Color and Finish

The distinctive red hue often comes from iron oxide in the raw materials. However, color variation between batches is common due to inconsistent pigment content or curing conditions. For architectural applications where appearance matters, this can lead to aesthetic mismatches. Request samples and define acceptable color tolerances in contracts.

Intellectual Property (IP) and Design Infringement

When sourcing decorative or specialty cinder blocks (e.g., unique textures, interlocking designs, or patented patterns), there is a risk of inadvertently using designs protected by intellectual property rights. Some manufacturers develop proprietary molds or block configurations covered by design patents. Sourcing from unauthorized suppliers may expose you to legal liability. Always verify the supplier’s right to produce and sell the design, and request IP indemnification clauses in procurement agreements.

Inadequate Testing and Certification

Suppliers—especially overseas or non-reputable ones—may not provide proper third-party testing data or certifications. Assuming blocks meet local building codes without verification can result in failed inspections or safety hazards. Require proof of compliance with regional standards (e.g., ASTM, BS, or ISO) before purchase.

Poor Supply Chain Transparency

Opaque sourcing chains make it difficult to trace material origins and verify claims about sustainability, labor practices, or environmental impact. This lack of transparency can pose reputational risks and complicate compliance with green building standards (e.g., LEED). Prioritize suppliers who offer full supply chain visibility and ethical sourcing documentation.

Conclusion

To mitigate these pitfalls, conduct due diligence on suppliers, demand technical specifications and test results, and include clear quality and IP protections in contracts. Proper vetting ensures you receive reliable, compliant, and legally sound red cinder blocks for your project.

Logistics & Compliance Guide for Red Cinder Block

This guide outlines the essential logistics and compliance considerations for the transportation, storage, handling, and regulatory adherence related to red cinder blocks. Proper management ensures safety, efficiency, and legal compliance throughout the supply chain.

Product Overview

Red cinder blocks, also known as concrete masonry units (CMUs) or ash blocks, are construction materials made from a mixture of Portland cement, water, and high-content cinder (volcanic ash or coal cinders). They are typically used in non-load-bearing or low-load-bearing walls due to their lighter weight and insulating properties compared to standard concrete blocks.

Transportation Logistics

- Packaging and Palletization: Red cinder blocks must be stacked securely on wooden or composite pallets and wrapped with stretch film to prevent shifting during transit. Use corner boards or edge protectors to avoid damage to block edges.

- Load Securing: Ensure loads are evenly distributed and secured with straps or nets to prevent movement during transport. Adhere to weight limits and axle load regulations.

- Vehicle Type: Utilize flatbed trucks or enclosed trailers based on weather conditions and distance. In wet climates, cover loads with waterproof tarps to prevent moisture absorption.

- Handling Equipment: Use forklifts or pallet jacks with appropriate load capacity for loading and unloading. Avoid dragging or dropping blocks to prevent chipping or cracking.

Storage Guidelines

- Location: Store blocks on a level, dry, and well-drained surface. Indoor storage is preferred; if outdoors, elevate pallets off the ground using dunnage and cover with breathable, waterproof covers.

- Stacking: Limit stack height to manufacturer recommendations (typically 8–10 courses) to prevent crushing or toppling. Stagger vertical seams between layers for stability.

- Moisture Control: Keep blocks dry prior to use. Excess moisture can affect adhesive performance and lead to efflorescence or freeze-thaw damage in cold climates.

- Inventory Rotation: Follow a first-in, first-out (FIFO) system to prevent prolonged storage and potential degradation.

Safety & Handling Procedures

- Personal Protective Equipment (PPE): Workers must wear safety gloves, steel-toed boots, and dust masks when handling blocks due to weight and potential silica dust.

- Manual Handling: Use mechanical aids whenever possible. If lifting manually, follow ergonomic practices to avoid strain or injury.

- Dust Management: Cut or drill blocks using wet methods or local exhaust ventilation to minimize airborne silica dust, complying with OSHA and other local regulations.

Regulatory Compliance

- OSHA Standards: Comply with OSHA 29 CFR 1926 for construction safety, particularly regarding material handling, fall protection, and respiratory protection.

- EPA & Environmental Regulations: If cinder contains fly ash or coal combustion residuals, confirm compliance with EPA guidelines (e.g., CCR rule) regarding material sourcing and environmental impact.

- Building Codes: Ensure blocks meet ASTM C90 – Standard Specification for Loadbearing Concrete Masonry Units. Verify regional building codes (e.g., IBC, IRC) for allowable use in structural applications.

- Transportation Regulations: Adhere to FMCSA regulations for commercial motor vehicles, including hours of service, vehicle maintenance, and load securement (49 CFR Part 393).

- Hazard Communication (HazCom): Provide Safety Data Sheets (SDS) for cinder block materials if they contain hazardous components. Train personnel on SDS interpretation and safe handling.

Documentation & Recordkeeping

- Maintain records of supplier certifications, material test reports, and compliance with ASTM standards.

- Keep logs of employee safety training, equipment inspections, and incident reports.

- Retain shipping manifests, bills of lading, and delivery confirmations for traceability and audit purposes.

Sustainability & Disposal

- Recycling: Crushed cinder blocks may be reused as aggregate in non-structural fill or sub-base applications where permitted.

- Disposal: Dispose of waste blocks at approved construction and demolition (C&D) landfills. Confirm local regulations for disposal of materials containing coal combustion byproducts.

- Carbon Footprint: Consider sourcing from suppliers with low-emission production methods and optimized transportation routes to reduce environmental impact.

Conclusion

Effective logistics and compliance practices for red cinder blocks ensure product integrity, worker safety, and adherence to legal and environmental standards. Regular audits, employee training, and supplier collaboration are key to maintaining a compliant and efficient supply chain.

In conclusion, sourcing red cinder blocks requires careful consideration of several factors including material quality, supplier reliability, cost-effectiveness, availability, and delivery timelines. Red cinder blocks offer durability, thermal mass, and an aesthetically pleasing rustic appearance, making them a popular choice for both structural and decorative applications. By evaluating local suppliers, comparing quotes, verifying product specifications, and ensuring compliance with regional building standards, you can secure high-quality materials that meet your project requirements. Additionally, prioritizing sustainable sourcing practices and building strong relationships with trusted vendors can lead to long-term benefits, including consistent supply and potential cost savings. With thorough research and strategic planning, sourcing red cinder blocks can be a seamless process that supports the success and integrity of your construction or landscaping project.