The global food colorants market is experiencing steady growth, driven by increasing consumer demand for vibrant, visually appealing food and beverage products. According to Grand View Research, the market was valued at USD 3.7 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. A significant contributor to this expansion is the widespread use of synthetic dyes like Red 40, particularly in processed foods, confectionery, and sports nutrition products. Red 40 powder, known for its stability and intense hue, has become a staple in industrial applications across regions. As demand rises, manufacturers are scaling production and investing in compliant, high-purity formulations to meet stringent regulatory standards. With the Asia Pacific region emerging as a key growth hotspot due to expanding food processing industries, the global supply chain for Red 40 powder is becoming increasingly competitive. Here are the top 7 Red 40 powder manufacturers shaping the market today.

Top 7 Red 40 Powder Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 FD&C Red No. 40 Powder

Domain Est. 1996

Website: dystar.com

Key Highlights: DyStar is a leading producer of the highest quality regulated, certified food dyes. Our regulated FD&C dyes are manufactured with strict controls….

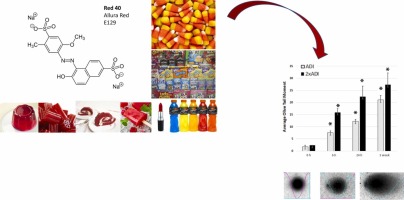

#2 The synthetic food dye, Red 40, causes DNA damage, causes …

Domain Est. 1997

Website: pmc.ncbi.nlm.nih.gov

Key Highlights: The synthetic food dye, Red 40, causes DNA damage, causes colonic inflammation, and impacts the microbiome in mice….

#3 Bulk Color Additives (Colorants)

Domain Est. 1999

Website: fromnaturewithlove.com

Key Highlights: Explore our premium quality bulk FD&C and D&C colors, oxides, micas, and herbal soap colorants for skin, hair, spa, beauty, and cosmetic formulations….

#4 Red No. 40 FD&C Lake 228

Domain Est. 1999

Website: makingcosmetics.com

Key Highlights: 3–7 day delivery 3-day returnsRed No. 40 FD&C Lake is a FDA-approved color additive and is subject to batch certification. It may be safely used in coloring cosmetics generally….

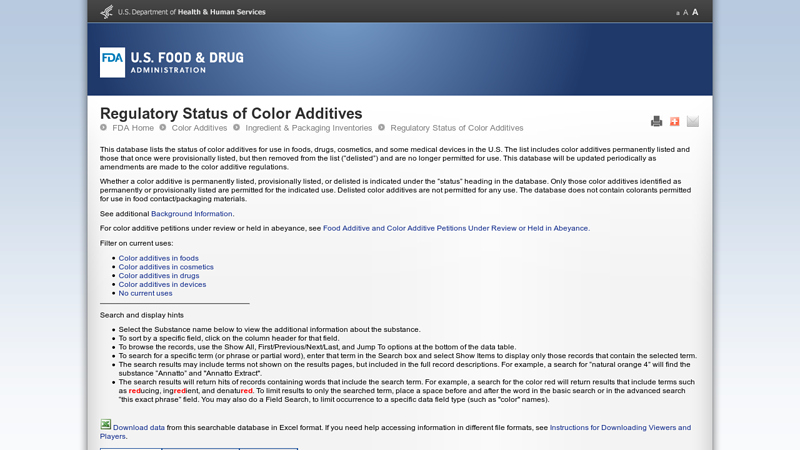

#5 Regulatory Status of Color Additives

Domain Est. 2000

Website: fda.gov

Key Highlights: All FD&C Red No. 40 lakes are permanently listed under 21 CFR 74.340 (food), 74.1340 (drugs), and 74.2340 (cosmetics). FD&C Blue No. 1 and ……

#6 Limited Ingredients

Domain Est. 2002

Website: ttb.gov

Key Highlights: FD&C Red No. 40 may be safely used for coloring foods (including dietary supplements) generally in amounts consistent with good manufacturing practice (GMP)….

#7 21 CFR Part 74

Domain Est. 2012

Website: ecfr.gov

Key Highlights: FD&C Red No. 40 may be safely used for coloring foods (including dietary supplements) generally in amounts consistent with good manufacturing practice except ……

Expert Sourcing Insights for Red 40 Powder

2026 Market Trends for Red 40 Powder

Red 40 Powder, also known as Allura Red AC, is one of the most widely used synthetic food colorants globally. As we approach 2026, several key market trends are shaping the demand, regulation, and application of this additive across industries. These trends reflect evolving consumer preferences, regulatory developments, technological advancements, and supply chain dynamics.

Rising Demand in Processed Foods and Beverages

Despite growing consumer skepticism toward artificial additives, Red 40 Powder continues to see strong demand in the processed food and beverage sector. Its stability, vibrant hue, and cost-effectiveness make it a preferred choice for manufacturers of snacks, candies, sodas, dairy alternatives, and baked goods. In emerging markets across Asia-Pacific and Latin America, urbanization and increasing disposable incomes are driving consumption of packaged foods—many of which rely on Red 40 for visual appeal. Market research projects a compound annual growth rate (CAGR) of approximately 3.5% for synthetic food dyes through 2026, with Red 40 remaining a dominant player.

Regulatory Scrutiny and Labeling Requirements

A significant trend influencing the Red 40 market is heightened regulatory scrutiny, particularly in North America and Europe. The U.S. Food and Drug Administration (FDA) continues to permit Red 40, but the European Union enforces stricter labeling requirements, mandating warnings such as “may have an adverse effect on activity and attention in children” on products containing the dye. This has prompted some multinational brands to reformulate products for different regions. As of 2026, advocacy groups and scientific studies on hyperactivity and allergic reactions may further pressure regulators, potentially leading to tighter controls or phased reductions in certain applications.

Shift Toward Natural Alternatives

Consumer demand for clean-label and natural ingredients is one of the most impactful trends challenging the dominance of Red 40. Natural colorants derived from sources like beetroot, anthocyanins, and carmine are gaining traction. However, Red 40 maintains an edge due to its superior heat and pH stability, longer shelf life, and lower production cost. While natural red dyes are improving through biotechnology and encapsulation techniques, they still struggle to match Red 40’s performance in many applications. As a result, the market in 2026 is characterized by a dual-track approach: premium and organic brands shifting to natural dyes, while mass-market producers continue to rely on Red 40.

Expansion in Non-Food Applications

Beyond food and beverages, Red 40 is experiencing growing use in non-food sectors such as cosmetics, pharmaceuticals, and pet food. In cosmetics, it is used in lipsticks, blushes, and soaps for its intense red shade. The pharmaceutical industry uses it to distinguish medications and improve patient compliance. These alternative applications are expected to account for an increasing share of Red 40 consumption by 2026, helping offset declining use in some food segments.

Supply Chain and Sustainability Concerns

Red 40 is derived from petroleum-based precursors, raising sustainability concerns among eco-conscious consumers and corporations. As environmental, social, and governance (ESG) criteria become more influential, manufacturers of Red 40 are exploring greener synthesis methods and sourcing transparency. Some chemical companies are investing in bio-based alternatives or closed-loop production systems to reduce environmental impact. However, as of 2026, the majority of Red 40 remains synthetically produced, with limited scalable sustainable substitutes.

Regional Market Dynamics

The North American and European markets are witnessing stagnation or slight decline in Red 40 usage due to health concerns and clean-label trends. In contrast, the Asia-Pacific region—especially India, China, and Southeast Asia—is a growth hotspot, driven by expanding food processing industries and less stringent regulations. Africa and the Middle East are also emerging as new markets, with rising urban populations adopting Western-style convenience foods.

Conclusion

In 2026, Red 40 Powder remains a crucial component of the global colorant industry, balancing ongoing demand with increasing regulatory and consumer challenges. While pressure to transition to natural alternatives intensifies, Red 40’s functional advantages and economic benefits ensure its continued relevance—particularly in cost-sensitive and technically demanding applications. Manufacturers that adapt to regional regulations, invest in sustainable practices, and diversify into non-food sectors are best positioned to thrive in the evolving landscape.

Common Pitfalls Sourcing Red 40 Powder: Quality and Intellectual Property Concerns

Sourcing Red 40 Powder (Allura Red AC) requires careful due diligence to avoid significant risks related to quality consistency, regulatory compliance, and intellectual property (IP) infringement. Overlooking these aspects can lead to product recalls, legal disputes, reputational damage, and financial losses.

Quality-Related Pitfalls

Inconsistent Purity and Impurity Profiles

Suppliers, particularly from regions with less stringent oversight, may provide batches with variable purity levels or high concentrations of harmful impurities (e.g., sulfonates, aromatic amines, heavy metals like lead and arsenic). These impurities can pose health risks and violate food safety standards such as those set by the FDA (U.S.) or EFSA (EU). Relying solely on supplier-provided Certificates of Analysis (CoA) without independent third-party testing increases the risk of accepting substandard material.

Mislabeling and Adulteration

Red 40 is sometimes adulterated with cheaper dyes or fillers to reduce costs. This can result in color inconsistency, reduced stability, and non-compliance with labeling regulations. Mislabeling—such as incorrect dye content or false claims of “food grade”—is common among unreliable suppliers, especially in online marketplaces or through intermediaries without direct manufacturing oversight.

Inadequate Regulatory Compliance

Not all Red 40 powder is suitable for food, pharmaceutical, or cosmetic use. Sourcing industrial-grade dye or material not compliant with regional regulations (e.g., FDA 21 CFR § 74.1705, EU Directive 94/36/EC) can result in regulatory rejection or legal penalties. Suppliers may claim compliance without verifiable documentation or audits, exposing buyers to compliance risks.

Poor Stability and Performance

Low-quality Red 40 may degrade prematurely due to improper drying, storage, or lack of stabilizers. This leads to color fading, batch inconsistency, and formulation failures in end products. Buyers may not detect these issues until after integration into production, causing costly rework.

Intellectual Property-Related Pitfalls

Infringement of Patented Production Processes

Although Red 40 itself is off-patent, specific manufacturing methods, purification techniques, or formulation enhancements may be protected by active patents. Sourcing from suppliers that use patented processes without licensing can expose the buyer to indirect infringement claims, especially in jurisdictions with strong IP enforcement (e.g., the U.S. or EU).

Counterfeit or Unlicensed Manufacturing

Some suppliers, particularly in regions with weak IP enforcement, may produce Red 40 using proprietary technology without authorization. Purchasing from such sources—even unknowingly—can entangle buyers in IP litigation if the original patent holder traces the unauthorized product through the supply chain.

Lack of IP Warranty and Indemnification

Many suppliers, especially smaller or offshore manufacturers, do not provide contractual assurances that their product does not infringe third-party IP. Without a clear indemnification clause in supply agreements, the buyer bears full liability in case of IP disputes, including legal costs and damages.

Insufficient Due Diligence on Supplier Legitimacy

Failing to verify a supplier’s manufacturing credentials, certifications (e.g., ISO, FSSC 22000), and legal standing increases exposure to both quality and IP risks. Suppliers operating without proper registrations or transparency may be using unlicensed technology or cutting corners in production.

Mitigation Strategies

To avoid these pitfalls:

– Conduct thorough supplier audits and request verifiable compliance documentation.

– Require independent third-party testing for purity, contaminants, and dye content.

– Include IP warranties and indemnification clauses in contracts.

– Source from reputable, certified manufacturers with transparent supply chains.

– Monitor regional regulatory updates and patent landscapes related to dye manufacturing.

By proactively addressing quality and IP risks, companies can ensure a reliable, compliant, and legally sound supply of Red 40 powder.

H2: Logistics & Compliance Guide for Red 40 Powder

Red 40 Powder (also known as Allura Red AC, E129, or FD&C Red No. 40) is a synthetic red dye widely used in food, cosmetics, and pharmaceuticals. Due to its widespread application and regulatory scrutiny, proper logistics and compliance handling are essential to ensure safety, legality, and product integrity throughout the supply chain.

Below is a comprehensive H2-level guide covering key aspects of logistics and compliance for Red 40 Powder.

1. Regulatory Classification and Approvals

-

FDA (U.S. Food and Drug Administration):

Red 40 is approved by the FDA for use in food, drugs, and cosmetics under 21 CFR § 74.1705. It must meet strict purity specifications and is listed as a certified color additive. -

EFSA (European Food Safety Authority):

Approved as E129 in the EU, but subject to usage limits in certain food categories. Requires labeling as “may have an adverse effect on activity and attention in children” in the EU. -

Other Regions:

- Canada: Permitted under the Food and Drug Regulations.

- Australia/New Zealand: Approved by Food Standards Australia New Zealand (FSANZ).

- Japan: Approved for use in specific food products.

- Some countries (e.g., Norway, Austria) have restrictions or require special labeling.

Compliance Tip: Always verify local regulatory requirements before export or formulation.

2. Handling and Storage Requirements

- Storage Conditions:

- Store in a cool, dry, well-ventilated area.

- Keep container tightly sealed to prevent moisture absorption and contamination.

- Avoid exposure to direct sunlight and extreme temperatures.

-

Ideal storage: 15–25°C (59–77°F), <60% relative humidity.

-

Shelf Life:

Typically 24–36 months when stored properly. Check manufacturer’s certificate of analysis (CoA) for exact expiration. -

Compatibility:

- Keep separate from strong oxidizing agents and incompatible chemicals.

- Use dedicated equipment to avoid cross-contamination.

3. Packaging and Labeling

- Primary Packaging:

- Use food-grade, sealed HDPE or multi-wall paper bags with moisture barrier liners.

-

Typical packaging: 1 kg, 5 kg, 25 kg units.

-

Labeling Requirements (GHS & Regulatory):

- Include: Product name, batch number, net weight, manufacturer details, hazard statements (if applicable).

- GHS Pictograms: Generally not classified as hazardous, but may require “Irritating to eyes” (H319) if in powder form.

-

Safety Data Sheet (SDS) must be provided (see Section 5).

-

Regulatory Labeling (End Products):

- In food: Must be declared as “Red 40,” “Allura Red,” or “E129” depending on region.

- In EU: Include warning statement if above threshold.

4. Transportation and Shipping

- Domestic (e.g., U.S., EU):

- Not classified as hazardous material under DOT (49 CFR) or ADR when in consumer packaging.

-

Transport in clean, dry vehicles. Avoid contamination with foodstuffs or sensitive materials.

-

International Shipping:

- IATA/IMDG: Generally exempt from hazardous shipping regulations (UN 3077, environmentally hazardous substance, may apply if contaminated).

- Provide commercial invoice, packing list, and CoA.

-

Include SDS for customs clearance.

-

Cold Chain Not Required:

Ambient transport acceptable, but avoid prolonged exposure to heat and humidity.

5. Safety Data Sheet (SDS) Compliance

Ensure up-to-date SDS is available (per OSHA HazCom 2012 / GHS standards):

- Hazard Identification:

- May cause eye or respiratory irritation (dust).

- Not classified as carcinogenic or mutagenic.

- H319: Causes serious eye irritation.

-

P305+P351+P338: IF IN EYES: Rinse cautiously with water for several minutes.

-

Handling: Use PPE (gloves, safety goggles, dust mask) when handling bulk powder.

- Disposal: Dispose in accordance with local regulations. May be incinerated or landfilled if permitted.

6. Quality Assurance & Documentation

- Required Documents:

- Certificate of Analysis (CoA) – includes assay, heavy metals, microbial limits, identification.

- Statement of Compliance (e.g., FDA 21 CFR, EU Directive 94/36/EC).

-

Non-GMO, allergen-free, or kosher/halal certifications (if applicable).

-

Testing:

- Supplier audits and lot testing recommended.

- Heavy metals (lead, arsenic, mercury), residual solvents, and microbial contamination must be within limits.

7. Import/Export Compliance

- HTS Codes (U.S. Example):

-

3204.17.0000 – Synthetic organic coloring matter, Red 40.

-

Customs Documentation:

- FDA Prior Notice required for U.S. imports.

- EU: Notification to RASFF if non-compliant.

- Verify tariff, import license, or inspection requirements per country.

8. Sustainability and Environmental Considerations

- Environmental Impact:

- Biodegradability: Low; potential aquatic toxicity.

-

Wastewater treatment required in manufacturing.

-

Sustainable Sourcing:

- Encourage suppliers to provide eco-friendly production data.

9. Risk Mitigation Strategies

- Recall Preparedness:

- Maintain full traceability (batch tracking from raw material to finished product).

-

Have a recall plan aligned with FDA/EU Rapid Alert systems.

-

Supplier Qualification:

- Audit suppliers for GMP (Good Manufacturing Practice) and ISO 22716 (cosmetics) compliance.

Conclusion

Proper logistics and compliance for Red 40 Powder require strict adherence to regulatory standards, safe handling practices, accurate documentation, and awareness of regional requirements. By implementing robust quality control, supply chain transparency, and regulatory monitoring, businesses can ensure safe and legal distribution of Red 40 Powder worldwide.

For further guidance, consult:

– FDA Color Additive Regulations

– EU Commission Directive 94/36/EC

– GHS SDS guidelines

– Local regulatory authorities

— End of H2: Logistics & Compliance Guide for Red 40 Powder —

In conclusion, sourcing Red 40 powder requires careful consideration of several key factors to ensure quality, safety, and regulatory compliance. It is essential to obtain the pigment from reputable suppliers who provide certified, food-grade or pharmaceutical-grade materials that meet relevant standards such as FDA, EFSA, or ISO certifications. Purity, solubility, and intended application—whether for food, cosmetics, or pharmaceuticals—should guide the selection process. Additionally, verifying proper labeling, conducting batch testing, and ensuring compliance with local and international regulations are crucial steps in responsible sourcing. By prioritizing transparency, quality assurance, and safety, businesses can reliably integrate Red 40 powder into their products while maintaining consumer trust and regulatory adherence.