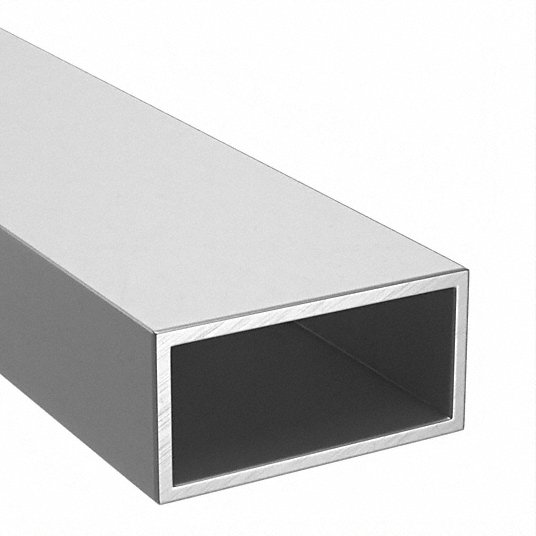

The global aluminum tubing market is experiencing robust growth, driven by rising demand across automotive, construction, aerospace, and renewable energy sectors. According to a 2023 report by Mordor Intelligence, the aluminum tubing market was valued at USD 32.1 billion in 2022 and is projected to grow at a CAGR of 6.8% from 2023 to 2028. This expansion is fueled by aluminum’s lightweight properties, corrosion resistance, and recyclability—key factors in sustainability-focused manufacturing. Rectangular aluminum tubing, in particular, has gained traction due to its structural efficiency and versatility in applications such as structural framing, solar panel mounting systems, and transportation infrastructure. With North America and Asia Pacific leading in both production and consumption, the competitive landscape is marked by technological advancements and strategic capacity expansions. As demand intensifies, reliability, precision engineering, and material consistency have become critical differentiators among manufacturers. Below, we present the top 10 rectangular aluminum tubing manufacturers shaping this evolving market.

Top 10 Rectangular Aluminum Tubing Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 80/20 Aluminum Extrusions

Domain Est. 1997

Website: 8020.net

Key Highlights: T-Slots, aluminum extrusions, and parts. Architectural solutions and frames for industrial machine guards, workstations, data center enclosures, and more….

#2 6061 and 6063 Aluminum Rectangular Tube

Domain Est. 1999

Website: industrialmetalsupply.com

Key Highlights: 30-day returnsAluminum rectangular tubing in 6061 and 6063 grades is lightweight, corrosion resistant, and features good weldability and machinability ……

#3 6061 T6 Aluminum Rectangular Tubing

Domain Est. 2017

Website: southwest-aluminum.com

Key Highlights: SOUTHWEST is one of the leading 6061 t6 aluminum rectangular tubing manufacturers and suppliers … Official web:www.southwest-aluminum.com. Hot Tags: 6061 t6 ……

#4 Aluminum Rectangular Tubing

Domain Est. 1991

Website: hydro.com

Key Highlights: Rectangular tubing ranges in size from 1/2 inch to 8 inches per side, and has square defined corners on both the inside radius and outside radius. Architectural ……

#5 Aluminum Rectangular Tube

Domain Est. 1996

Website: easternmetal.com

Key Highlights: We stock a large selection of aluminum rectangular tubing, including hard to find large press sizes. We uniquely carry sizes up to 6″ x 12″ x 1/4″ for ……

#6 Aluminum Tubing Supplier

Domain Est. 1997

Website: twmetals.com

Key Highlights: See all features of our tubing products below: Shapes include rounds, squares, rectangular, and streamline tubing; Metals include nickel, stainless, aluminum ……

#7 Aluminum Rectangular Tubing

Domain Est. 1998

Website: continentalsteel.com

Key Highlights: Aluminum Rectangular Tubing ; Size · 3 x 5 x 0.125 inches ; Working Decimal Equivalent · 3.000 x 5.000 x 0.125 inches76.2 x 127 x 3.175 mm ; Estimated Weight · 2.2553 ……

#8 Rectangular Tube

Domain Est. 1998

Website: piercealuminum.com

Key Highlights: Pierce Aluminum supplies a full inventory of aluminum rectangular tube, as well as complete processing and fabrication services, at its 10 U.S. locations….

#9 Rectangular Tube

Domain Est. 2003

Website: liebovichsteel.com

Key Highlights: Rectangular tube is an extruded product that is widely used for all types of fabrication projects where lightweight and corrosion resistance is a primary ……

#10 Extruded Aluminum Rectangular Tubing & Piping for Sale

Domain Est. 2010

Website: eagle-aluminum.com

Key Highlights: $25 delivery 30-day returnsEagle Aluminum offers extruded aluminum rectangular tubing in a variety of dimensions and finishes. Browse our selection of piping to find what you need….

Expert Sourcing Insights for Rectangular Aluminum Tubing

2026 Market Trends for Rectangular Aluminum Tubing

The rectangular aluminum tubing market is poised for significant transformation by 2026, driven by evolving industrial demands, technological advancements, and global sustainability imperatives. Key trends shaping the landscape include:

Increased Demand from Lightweighting in Transportation

The automotive and aerospace sectors will continue prioritizing fuel efficiency and emissions reduction, accelerating the adoption of aluminum over steel. Electric vehicles (EVs), in particular, rely heavily on lightweight materials to extend battery range, making rectangular aluminum tubing a preferred choice for structural frames, battery enclosures, and chassis components. This trend is expected to dominate market growth through 2026.

Growth in Renewable Energy Infrastructure

Solar panel mounting systems and energy-efficient building frameworks are increasingly utilizing rectangular aluminum tubing due to its corrosion resistance, durability, and ease of assembly. With global investments in solar and wind energy expanding, demand for aluminum structural components is projected to rise steadily, especially in emerging markets.

Advancements in Manufacturing and Fabrication

Innovations in extrusion technology, automation, and precision cutting are enhancing the cost-efficiency and design flexibility of rectangular aluminum tubing. Custom profiles tailored to specific applications—such as modular construction and robotics—will become more accessible, broadening the material’s applicability across industries.

Sustainability and Recycling Initiatives

Aluminum’s high recyclability aligns with corporate sustainability goals and regulatory pressures. By 2026, manufacturers are expected to emphasize closed-loop recycling and low-carbon production methods, driven by both consumer demand and environmental regulations. This shift will enhance the material’s appeal in green building and eco-conscious manufacturing.

Supply Chain Resilience and Regionalization

Geopolitical uncertainties and past disruptions have prompted a reevaluation of supply chains. Companies are increasingly investing in regional production and nearshoring to reduce dependency on single-source suppliers. This trend will likely lead to localized aluminum extrusion hubs, improving delivery times and reducing logistics costs.

Rising Use in Construction and Architecture

The construction industry is embracing aluminum for modern façades, curtain walls, and modular buildings due to its strength-to-weight ratio and aesthetic versatility. Rectangular tubing offers clean lines and structural integrity, making it ideal for sustainable and prefabricated building solutions gaining traction worldwide.

In summary, the 2026 rectangular aluminum tubing market will be shaped by innovation, environmental responsibility, and cross-sector demand for lightweight, durable materials. Companies that adapt to these trends through technological investment and sustainable practices will be best positioned for growth.

Common Pitfalls Sourcing Rectangular Aluminum Tubing: Quality and Intellectual Property

Sourcing rectangular aluminum tubing involves more than just finding a supplier with the right dimensions and price. Overlooking critical quality and intellectual property (IP) factors can lead to production delays, safety issues, legal disputes, and reputational damage. Below are the most common pitfalls in these two key areas.

Quality-Related Pitfalls

Failing to Specify Material Grade and Temper Accurately

One of the most frequent mistakes is not clearly defining the required aluminum alloy (e.g., 6061-T6, 6063-T5) and temper condition. Different alloys offer varying strength, corrosion resistance, and weldability. Sourcing tubing with an incorrect grade can compromise structural integrity, especially in load-bearing or outdoor applications.

Neglecting Dimensional Tolerances and Straightness

Rectangular tubing used in precision assemblies—such as frames or enclosures—requires tight tolerances. Overlooking specifications for wall thickness, outside dimensions, or straightness can result in poor fit-up during fabrication, leading to increased labor costs or rework.

Overlooking Surface Finish and Cosmetic Defects

For applications where appearance matters (e.g., architectural or consumer products), surface quality is critical. Suppliers may deliver tubing with scratches, dents, or inconsistent anodizing if finish requirements aren’t explicitly stated in the purchase order.

Inadequate Quality Assurance and Testing Documentation

Relying on supplier claims without requiring mill test reports (MTRs) or third-party certifications (e.g., ISO 9001) increases risk. Without proper documentation, verifying compliance with industry standards (like ASTM B221) becomes difficult, especially in regulated industries.

Choosing Low-Cost Suppliers Without Auditing

While cost is important, selecting suppliers solely on price often leads to substandard materials. Unverified suppliers may use recycled aluminum with inconsistent properties or skip proper heat treatment, compromising performance and safety.

Intellectual Property-Related Pitfalls

Unintentional Use of Proprietary Profiles

Some rectangular tubing profiles are patented or protected under design rights. Sourcing a profile that mimics a proprietary cross-section—especially for custom extrusions—can expose your company to IP infringement claims, even if the tubing is purchased from a third-party supplier.

Lack of IP Clarity in Custom Tooling Agreements

When commissioning custom extrusion dies, many buyers assume they own the tooling and associated design rights. However, without a clear contract, the extruder may retain ownership or reuse the die for other clients, undermining competitive advantage and potentially leaking design information.

Failure to Protect Design Specifications

Sharing detailed drawings or performance specs with multiple suppliers without non-disclosure agreements (NDAs) risks exposing sensitive design information. Competitors or unscrupulous suppliers could replicate or reverse-engineer proprietary designs.

Assuming “Standard” Profiles Are Free from IP Restrictions

Even seemingly generic rectangular tubing shapes may be covered by design patents in certain regions or industries. Assuming standard dimensions are always safe to use can lead to legal exposure, particularly when entering new markets.

Ignoring Export and Compliance Risks

Some aluminum products may be subject to trade regulations or technology controls, especially if used in defense, aerospace, or high-tech applications. Sourcing without considering export compliance (e.g., ITAR, EAR) can result in shipment delays or penalties.

Logistics & Compliance Guide for Rectangular Aluminum Tubing

This guide provides essential information for the safe, efficient, and compliant handling, transportation, and regulatory management of rectangular aluminum tubing across the supply chain.

Packaging and Handling Requirements

Proper packaging and handling are critical to prevent damage and ensure product integrity during transit.

- Bundling: Rectangular aluminum tubing is typically bundled using steel or plastic strapping. Bundles should be secured tightly to prevent shifting.

- End Protection: Plastic or rubber caps should be used on tube ends to prevent dents, scratches, and worker injury.

- Palletization: Bundles must be stacked on wooden or composite pallets suitable for forklift handling. Load stability is essential—use edge protectors and stretch wrap to minimize movement.

- Lifting: Use appropriate slings or spreader bars when lifting with cranes or forklifts. Never lift by the strapping alone.

- Storage: Store indoors in a dry, well-ventilated area. If outdoors, cover with waterproof tarpaulins and elevate off the ground to prevent water contact and corrosion.

Transportation and Shipping

Ensure safe and efficient transport from manufacturer to end user.

- Mode Selection: Choose between truck, rail, or ocean freight based on volume, distance, and delivery timeline. For international shipments, ocean freight is commonly used for bulk orders.

- Load Securing: Use dunnage, load bars, and straps to secure bundles and prevent movement during transit. Comply with FMCSA (U.S.) or ADR (Europe) load securement regulations.

- Containerization: For ocean shipping, use standard 20’ or 40’ dry containers. Maximize space utilization while avoiding overloading. Protect against condensation with desiccants if needed.

- Weight and Dimensions: Confirm that tubing dimensions and total shipment weight comply with vehicle and carrier limits. Over-dimensional loads may require permits.

Regulatory Compliance

Adherence to international, national, and industry-specific regulations is mandatory.

- Customs Documentation: Provide accurate commercial invoices, packing lists, and bills of lading. Include HS Code 7604.21 (Aluminum tubes, pipes, and hollow profiles, rectangular, unwrought aluminum).

- Import/Export Controls: Comply with export regulations such as the U.S. EAR (Export Administration Regulations). Verify if destination country has import restrictions or tariffs on aluminum products.

- REACH & RoHS: While aluminum itself is generally exempt, confirm that any surface treatments (e.g., anodizing, coatings) comply with EU REACH and RoHS directives regarding restricted substances.

- TSCA (U.S.): Ensure compliance with the Toxic Substances Control Act, particularly concerning chemical treatments applied during manufacturing.

Safety and Environmental Considerations

Prioritize worker safety and environmental responsibility throughout the logistics process.

- Workplace Safety: Train personnel in safe handling practices. Use PPE (gloves, safety glasses) to prevent injury from sharp edges or moving loads.

- Material Safety Data Sheets (MSDS/SDS): Maintain updated SDS for aluminum tubing and any applied treatments. Although aluminum is non-toxic, dust from cutting or grinding may require respiratory protection.

- Recycling and Waste: Aluminum is highly recyclable. Coordinate with certified recyclers for scrap or damaged material. Follow local regulations for disposal of packaging materials (e.g., plastic strapping, wood pallets).

Quality Assurance and Traceability

Maintain product quality and regulatory traceability.

- Mill Certifications: Provide material test reports (MTRs) or mill certificates (e.g., EN 10204 3.1) verifying alloy, temper, dimensions, and mechanical properties.

- Batch Traceability: Label bundles with batch/heat numbers, alloy type (e.g., 6061-T6), dimensions, and manufacturing date to ensure full traceability.

- Inspection Points: Conduct pre-shipment inspections to verify compliance with customer specifications and detect transit-related damage.

Incoterms and Contractual Obligations

Clearly define responsibilities between buyer and seller.

- Select Appropriate Incoterms: Common choices include FOB (Free On Board), CIF (Cost, Insurance, Freight), or EXW (Ex Works). Clearly specify in contracts to avoid disputes.

- Insurance: Ensure shipments are adequately insured against loss or damage during transit, especially for high-value or long-distance deliveries.

By following this guide, stakeholders can ensure that rectangular aluminum tubing is transported efficiently, handled safely, and complies with all relevant legal and industry standards. Regular audits and updates to logistics practices are recommended to adapt to regulatory changes and operational improvements.

Conclusion for Sourcing Rectangular Aluminum Tubing

After evaluating various suppliers, material specifications, cost structures, and logistical considerations, it is clear that sourcing rectangular aluminum tubing requires a balanced approach focused on quality, value, and reliability. The optimal supplier should offer aluminum tubing that meets required industry standards (such as ASTM B221 or AMS), provides consistent dimensional accuracy, and supports the intended application—whether for structural, architectural, or industrial use.

Key factors in the decision include material grade (commonly 6061-T6 or 6063-T5), finish options (mill finish, anodized, or powder-coated), lead times, and pricing competitiveness. Local suppliers may offer faster delivery and reduced shipping costs, while larger national or international manufacturers may provide volume discounts and broader product availability.

Ultimately, establishing a long-term relationship with a reputable supplier ensures supply chain stability, consistent quality, and the ability to scale as project demands evolve. By prioritizing these criteria, organizations can secure high-performance rectangular aluminum tubing that supports efficiency, durability, and cost-effectiveness across their operations.