The global outboard engines market is experiencing steady growth, driven by rising recreational boating activities and increased demand for fuel-efficient, sustainable marine propulsion systems. According to Grand View Research, the global outboard motors market size was valued at USD 4.37 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth trajectory has spurred interest in cost-effective and environmentally conscious alternatives—such as reconditioned outboard engines—particularly among commercial operators and budget-conscious recreational users. With original equipment costs on the rise and supply chain constraints affecting new engine availability, reconditioned units offer a reliable, performance-tested option without the premium price tag. As the secondary marine engine market gains momentum, a select group of manufacturers have emerged as leaders in quality remanufacturing, rigorous testing standards, and customer trust. Based on market presence, customer reviews, and operational scale, the following nine companies represent the top reconditioned outboard engine manufacturers currently shaping the industry.

Top 9 Reconditioned Outboard Engines Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Factory Refurbished Outboards & Inboards

Domain Est. 1995

Website: mercurymarine.com

Key Highlights: Mercury remanufactured engines are factory refurbished with new components featuring the latest specifications and the newest technology….

#2 ReCon™ Marine

Domain Est. 1990

Website: cummins.com

Key Highlights: ReCon engines offer a combination of reliability, performance, service network, warranty and price that is simply unmatched….

#3 JASPER remanufactured engines, transmissions & differentials

Domain Est. 1996

Website: jasperengines.com

Key Highlights: We are the nation’s largest remanufacturer of gas and diesel engines, transmissions, differentials, air and fuel components, marine engines, sterndrives….

#4 Suzuki Marine

Domain Est. 1997

#5

Domain Est. 1998

Website: mercuryracing.com

Key Highlights: Mercury Racing builds the best marine & automotive propulsion systems, accessories, and parts on the market. Learn the value of raw performance and power….

#6 Yamaha Outboards

Domain Est. 2002

Website: yamahaoutboards.com

Key Highlights: Yamaha Outboards provides industry-leading innovation, outstanding performance, incredible power, unequalled customer satisfaction and legendary ……

#7 Almars Outboards

Domain Est. 2007

Website: almarsoutboards.net

Key Highlights: We stock the largest inventory of new Mercury Outboard engines in the country! Over $5M in stock! Call 302-328-8541 or come by today!…

#8 Buy an Outboard Motor

Domain Est. 2013

Website: outboard-occasions.com

Key Highlights: Find your new or used outboard motor in one of Europe’s largest selections ✓ Official dealer of Yamaha, Suzuki and others ✓ Guarantee on all engines….

#9 Outboard Global Store

Domain Est. 2023

Website: outboardglobalstore.com

Key Highlights: We are large distributor for outboard engine,inboard engine,marine accessories , diesel engine,marine electronic Etc. We sell the latest and used products….

Expert Sourcing Insights for Reconditioned Outboard Engines

H2: Market Trends for Reconditioned Outboard Engines in 2026

The global market for reconditioned outboard engines is poised for significant transformation by 2026, driven by shifting consumer preferences, environmental regulations, technological advancements, and economic factors. This analysis explores key trends shaping the industry under the H2 framework—highlighting Hybridization, Holistic Sustainability, and High-Tech Reconditioning as dominant forces.

Hybridization of Propulsion Systems

One of the most prominent trends in 2026 is the growing integration of hybrid and electric technologies into reconditioned outboard engines. While fully electric outboards are still emerging, many reconditioning firms are retrofitting older gasoline-powered models with hybrid components to improve fuel efficiency and reduce emissions. This hybridization trend is supported by increasing government incentives for low-emission marine propulsion and rising demand from eco-conscious recreational boaters.

Manufacturers and reconditioners are partnering with tech firms to offer upgrade kits that allow legacy engines to interface with electric auxiliary systems. As a result, reconditioned hybrid outboards are becoming a cost-effective bridge between traditional combustion engines and next-generation electric models, particularly in mid-sized and entry-level marine markets.

Holistic Sustainability and Circular Economy Adoption

By 2026, environmental sustainability is no longer a niche concern but a core driver in the reconditioned outboard engine market. Regulatory pressures—especially in Europe and North America—are pushing marine industries toward circular economy models. Reconditioned engines are increasingly positioned as a sustainable alternative to new manufacturing, reducing raw material consumption and carbon footprint.

Reconditioners are adopting transparent, traceable remanufacturing processes, often certified under ISO 14001 or similar environmental standards. Consumers now expect detailed lifecycle reports, including carbon savings and component reuse rates. This holistic approach to sustainability is enhancing brand trust and expanding the market to environmentally aware buyers, including marinas, rental fleets, and eco-tourism operators.

Additionally, end-of-life engine take-back programs are becoming standard, further closing the loop and reinforcing the sustainability proposition of reconditioned units.

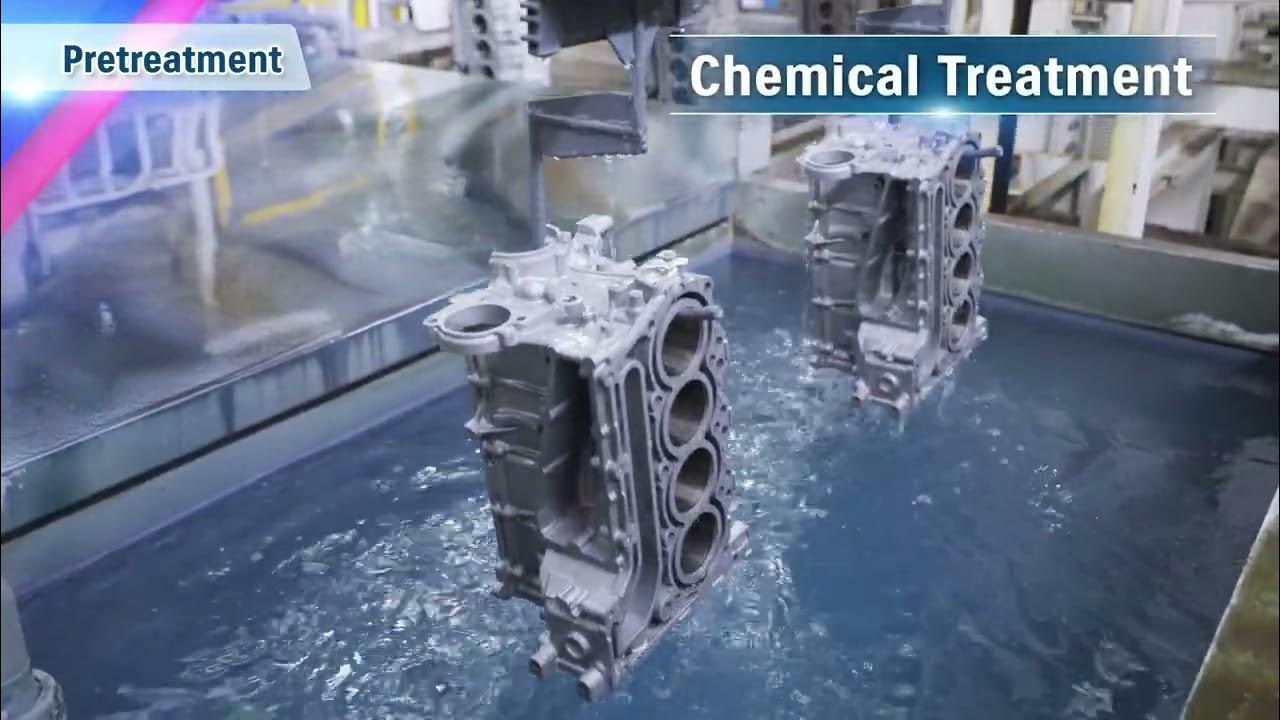

High-Tech Reconditioning and Digital Integration

Advancements in diagnostics, automation, and digital twin technologies are revolutionizing how outboard engines are reconditioned. In 2026, high-tech reconditioning centers use AI-powered inspection systems to assess engine wear, predict remaining lifespan, and optimize part replacement. This precision leads to more reliable, longer-lasting reconditioned engines that rival new units in performance.

Moreover, many reconditioned engines now come embedded with IoT sensors and connectivity features, allowing real-time monitoring of engine health, fuel consumption, and maintenance alerts via smartphone apps. This digital integration improves user experience and supports predictive maintenance—a key selling point for commercial operators and serious recreational users.

Blockchain-based certification is also emerging, providing tamper-proof records of an engine’s service history, parts used, and reconditioning standards met. This enhances transparency and builds consumer confidence in the quality and authenticity of reconditioned products.

Conclusion

By 2026, the reconditioned outboard engine market is being reshaped by the convergence of Hybridization, Holistic Sustainability, and High-Tech Reconditioning. These H2 trends reflect a maturing industry that balances economic accessibility with environmental responsibility and technological innovation. As demand for cost-effective, sustainable marine propulsion grows, reconditioned outboards are transitioning from a budget alternative to a strategic choice in the evolving marine ecosystem.

Common Pitfalls When Sourcing Reconditioned Outboard Engines

Purchasing a reconditioned outboard engine can offer significant cost savings, but it also comes with risks if not approached carefully. Avoiding these common pitfalls is essential to ensure reliability, performance, and protection of your investment.

Quality Inconsistencies and Hidden Defects

One of the most significant risks when sourcing reconditioned outboard engines is inconsistent rebuild quality. Not all reconditioning processes follow the same standards—some rebuilders may cut corners by replacing only the most visibly worn parts while ignoring internal wear or corrosion. Engines might appear clean and functional on the surface but suffer from compromised seals, worn bearings, or outdated components. Additionally, improper break-in procedures or the use of substandard replacement parts can lead to premature failure. Without a thorough inspection or a trusted warranty, buyers may inherit problems that only surface after installation and use.

Intellectual Property and Counterfeit Components

Another often-overlooked pitfall involves intellectual property (IP) concerns and the use of counterfeit or non-OEM parts. Reputable manufacturers invest heavily in research, design, and certification of their marine engines. When third-party rebuilders use imitation or unlicensed components—especially in critical systems like fuel injection, ignition, or gearcases—they may infringe on patents or trademarks. These counterfeit parts often lack the durability, precision, and safety certifications of genuine OEM components, increasing the risk of mechanical failure, voiding insurance, or even regulatory non-compliance. Buyers may unknowingly support IP violations and compromise the engine’s performance and longevity. Always verify that replacement parts are genuine or certified equivalents, and source from rebuilders with transparent supply chains and IP-compliant practices.

Logistics & Compliance Guide for Reconditioned Outboard Engines

Overview

Reconditioned outboard engines involve complex logistics and regulatory compliance due to their nature as remanufactured marine propulsion units. This guide outlines key considerations for the safe, legal, and efficient handling, transportation, import/export, and sale of reconditioned outboard engines across domestic and international markets.

Classification and Documentation

Reconditioned outboard engines must be accurately classified for customs and regulatory purposes. Typically categorized under Harmonized System (HS) codes related to marine propulsion engines (e.g., 8407.21 or 8407.29 depending on specifications). Proper documentation includes:

– Bill of Lading (BOL)

– Commercial Invoice detailing “Reconditioned” or “Remanufactured” status

– Packing List

– Certificate of Conformity (if applicable)

– Proof of origin and reconditioning certification

– EPA or CARB compliance documentation (for U.S. markets)

Environmental and Emissions Compliance

Reconditioned engines must meet emissions standards of the destination country:

– United States: Engines sold or operated in the U.S. must comply with Environmental Protection Agency (EPA) marine engine standards. Reconditioned engines may require recertification or compliance with applicable remanufacturing guidelines.

– California: Additional compliance with California Air Resources Board (CARB) regulations, including potential smog-check equivalence or executive order (EO) number for legal sale.

– European Union: Must comply with EU Stage IIIB or equivalent emission standards; CE marking may be required for new installations.

– Exporting countries may impose restrictions on used engines; verify local environmental laws before shipment.

Safety and Recertification Standards

Reconditioned engines should meet industry safety and performance benchmarks:

– Rebuilt following manufacturer or ISO 9001-compliant processes

– Pressure testing of fuel and cooling systems

– Functional testing of ignition, electrical, and control systems

– Certification from recognized marine engineering bodies (e.g., ABYC standards in the U.S.)

– Include updated operation manuals and warranty documentation

Import and Export Regulations

- Export Controls: Verify if reconditioned engines are subject to export restrictions (e.g., dual-use technology concerns under EAR).

- Import Duties: Duties may differ for reconditioned vs. new engines; some countries impose higher tariffs on used machinery.

- Waste Shipment Regulations: Avoid classification as electronic or hazardous waste under Basel Convention rules. Proper declaration as functional reconditioned goods is essential.

- Country-Specific Requirements: Some nations (e.g., Australia, Brazil) require pre-shipment inspection (PSI) or import permits.

Packaging and Handling

- Engines must be securely crated with moisture barriers and corrosion inhibitors.

- Include protective caps on intake/exhaust ports and fuel lines.

- Clearly label units as “Reconditioned – Handle with Care” with lifting instructions.

- Use weatherproof, ventilated packaging suitable for marine environments.

Transportation and Carrier Requirements

- Use freight carriers experienced in handling marine equipment.

- Declare accurate weight, dimensions, and hazardous material status (e.g., residual oil or coolant).

- Comply with IMDG Code if transporting by sea with flammable liquids or batteries.

- For air freight, ensure compliance with IATA Dangerous Goods Regulations (e.g., for fuel systems with traces of gasoline).

Warranty and Liability Considerations

- Clearly define warranty terms (e.g., 6–12 months limited warranty).

- Disclose service history and components replaced.

- Include disclaimers if selling “as-is” (where legally permitted).

- Maintain records of reconditioning processes to support liability defense if needed.

Recordkeeping and Traceability

- Maintain logs of engine serial numbers, original manufacture date, reconditioning date, and technician details.

- Track parts used (OEM vs. aftermarket) and certifications.

- Store documentation for a minimum of 5–7 years for audit or compliance purposes.

Best Practices Summary

- Always declare engines as reconditioned or remanufactured in all transactions.

- Work with customs brokers familiar with marine equipment.

- Stay updated on evolving emissions and trade regulations.

- Prioritize transparency with end buyers regarding engine history and compliance status.

Adhering to this guide ensures legal compliance, reduces shipment delays, and supports customer confidence in reconditioned outboard engine operations.

In conclusion, sourcing reconditioned outboard engines offers a cost-effective, sustainable, and reliable solution for boat owners seeking performance without the premium price tag of new units. These engines, when sourced from reputable suppliers with transparent refurbishment processes, undergo thorough inspection, repairs, and testing to restore them to optimal working condition. This not only ensures dependable performance but also extends the lifecycle of marine equipment, reducing environmental impact through reuse and recycling. However, success in procurement hinges on due diligence—verifying warranty terms, service history, and compatibility with your vessel. With careful selection and proper maintenance, reconditioned outboard engines can deliver excellent value, making them a smart and practical choice for both recreational and commercial marine applications.