The global rebar stakes market is experiencing steady growth, driven by rising infrastructure development and increased construction activities worldwide. According to a report by Mordor Intelligence, the construction reinforcement market—which includes rebar and related accessories like rebar stakes—is projected to grow at a CAGR of over 5.8% from 2023 to 2028. Factors such as urbanization, government investments in public infrastructure, and the expansion of commercial and residential construction are fueling demand for durable and cost-effective rebar support systems. Rebar stakes, essential for securing reinforcing steel in concrete forms, are becoming increasingly critical in ensuring structural integrity across large-scale projects. As demand surges, manufacturers are scaling production, enhancing product durability, and adopting automation to maintain quality and meet specifications. In this evolving landscape, the following nine companies have emerged as leading rebar stakes manufacturers, combining innovation, global reach, and strong production capabilities to support the growing needs of the construction industry.

Top 9 Rebar Stakes Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Rebar Stakes

Domain Est. 1996

Website: bometals.com

Key Highlights: BoMetals Rebar Stake is used to hold one end of a tie-bar or dowel bar while the dowel bar is going through a dowel hole in the keyway or timber ……

#2 Rebar Support Products

Domain Est. 2014

Website: rebarsupportproducts.com

Key Highlights: Rebar Support Products is a manufacturer and distributor of concrete accessories for precast, commercial and residential applications in the concrete industry….

#3 Rebar Stakes

Domain Est. 1996

Website: gemplers.com

Key Highlights: Rebar stakes are ideal for securing anything from trees to tarps. Each steel stake has a 1″-dia. loop that accommodates ropes or straps….

#4 Rebar Stakes

Domain Est. 1998

#5 Agtec Rebar Stake Cap

Domain Est. 2002

Website: agtec.com

Key Highlights: In stock Rating 4.5 (4) Agtec Rebar Stake Caps fit onto the end of rebar rods. The arms slide over Geocell walls to securely hold them in place and are installed more easily….

#6 NINA CONSTRUCTION SUPPLY

Domain Est. 2005

Website: ninaconstructionsupply.com

Key Highlights: Experienced Supplier of Rebar, Wood Stakes, Concrete & Masonry Accessories. We also offer Estimating, Detailing, & Fabrication Services for the Rebar Industry….

#7 1/2 X 18 Rebar Trap Stakes

Domain Est. 2011

Website: mntrapline.com

Key Highlights: 1/2″ rebar cut to 18″ in length. A nut welded to the top to increase surface area and ensure the swivel doesn’t slip over the rebar….

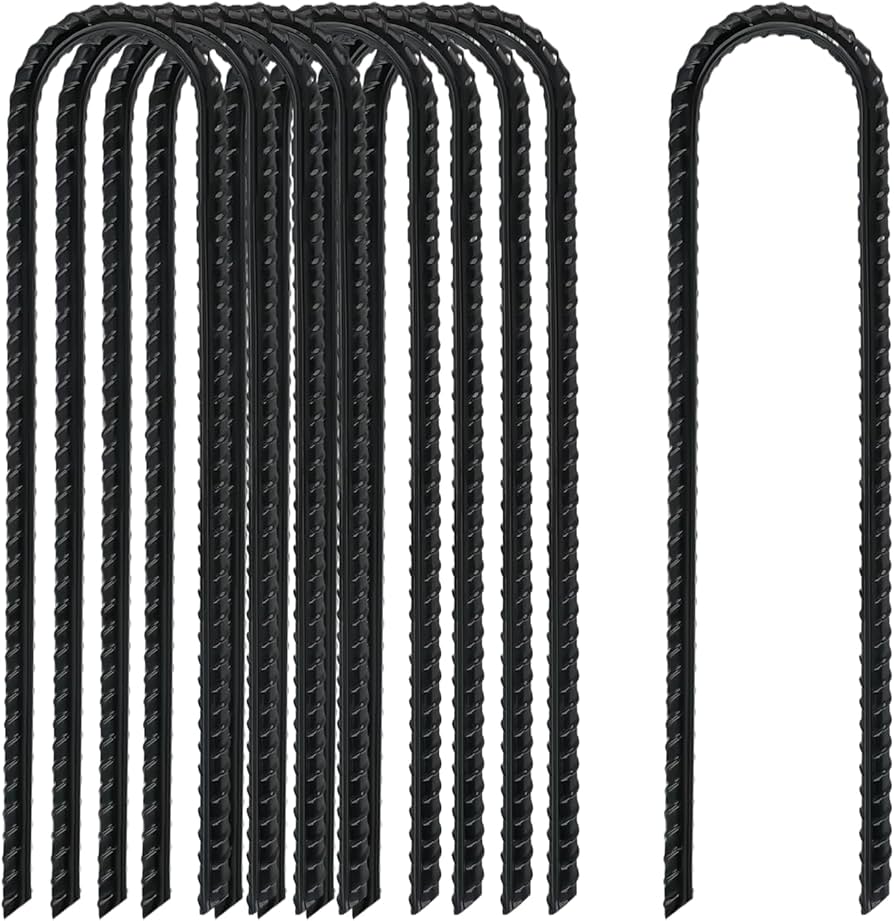

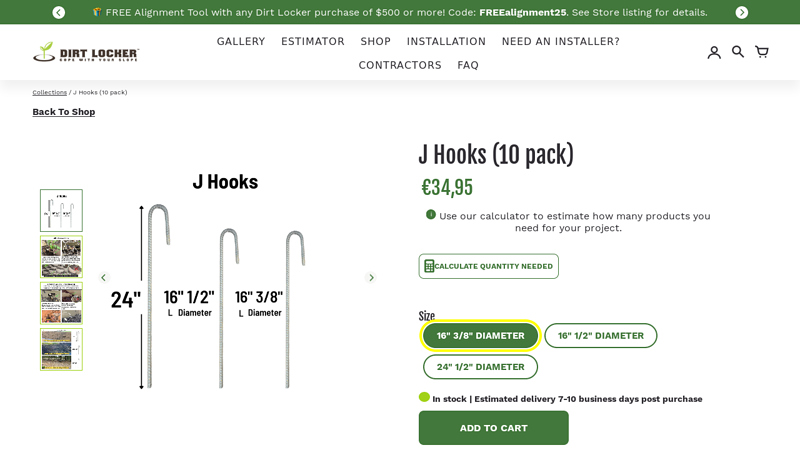

#8 J Hook Rebar Ground Stakes

Domain Est. 2017

Website: dirtlocker.com

Key Highlights: Free delivery over $500 14-day returns$39.50 · Metal rebar anchors (J Hooks) used to secure Dirt Lockers · Available separately in packs of 10 (not included automatically with Dirt…

#9 Southern Rebar

Domain Est. 2018

Website: southernrebar.com

Key Highlights: Southern Rebar & Supplies. A strong Foundation begins here. Form & Shoring rental. Helping your job take shape….

Expert Sourcing Insights for Rebar Stakes

H2 2026 Market Trends for Rebar Stakes

The rebar stakes market in the second half of 2026 is expected to reflect a combination of sustained infrastructure demand, evolving construction practices, and global economic dynamics. While the full-year 2026 picture will depend on earlier developments, H2 trends are likely to be shaped by the following key factors:

1. Infrastructure-Led Demand Continuity:

H2 2026 will likely see continued strong demand for rebar stakes driven by government-backed infrastructure projects, particularly in North America and parts of Asia. In the U.S., the full rollout of the Infrastructure Investment and Jobs Act (IIJA) funding is expected to peak during this period, supporting highway, bridge, and public transit construction—all heavy users of rebar stakes for formwork and reinforcement. Similarly, China’s targeted infrastructure spending to stimulate economic growth, especially in urban rail and regional connectivity, will sustain demand in Asia.

2. Steady Growth in Private Construction:

Residential and commercial construction activity is projected to stabilize in H2 2026 following earlier interest rate adjustments by central banks. As borrowing costs plateau or slightly decline, delayed housing and mixed-use developments are likely to resume, increasing the need for rebar stakes in foundation and structural applications. The industrial construction sector, particularly data centers and EV manufacturing plants, will also contribute to demand due to their reinforced concrete requirements.

3. Price Stabilization Amid Raw Material Volatility:

Steel prices, which influence rebar stake costs, are expected to stabilize in H2 2026 after fluctuations in early 2026 caused by energy costs and supply chain adjustments. Recycling rates for scrap steel may rise due to environmental regulations, providing a more consistent raw material supply. However, regional disparities will persist—North American producers may benefit from domestic scrap availability, while emerging markets could face input cost pressures.

4. Regional Market Divergence:

– North America: Robust demand driven by infrastructure and industrial construction; local production capacity may face strain, supporting prices.

– Europe: Moderate growth constrained by economic caution and energy transition costs; increased focus on sustainable construction may favor recycled-content rebar products.

– Asia-Pacific: China remains the largest market; India’s infrastructure push and urbanization will drive incremental growth. Southeast Asia may see rising demand from public-private partnerships.

– Latin America & Africa: Growth potential exists but remains vulnerable to political and currency instability, limiting large-scale procurement.

5. Technology and Efficiency Pressures:

Contractors in H2 2026 will increasingly prioritize efficiency and labor cost reduction. While rebar stakes remain essential, alternatives like plastic or composite stakes may gain niche adoption in non-structural applications. However, the durability and load-bearing capacity of steel rebar stakes will maintain dominance in major projects. Automation in rebar installation and inventory management may also influence procurement patterns, favoring suppliers offering bundled solutions.

6. Sustainability and Regulatory Influence:

Environmental regulations are expected to tighten, especially in the EU and developed markets. This could encourage the use of rebar stakes made from recycled steel and promote lifecycle assessments in construction. Carbon reporting requirements may push producers to adopt greener manufacturing processes, potentially impacting costs but also opening premium market segments.

Conclusion:

H2 2026 will likely be a period of steady, infrastructure-driven demand for rebar stakes, with regional variations and moderate pricing. While innovation and sustainability will shape long-term industry evolution, rebar stakes will remain a critical, low-tech but indispensable component in global construction. Suppliers who ensure reliable supply chains, embrace sustainable practices, and cater to large-scale public projects are best positioned to capitalize on H2 2026 trends.

Common Pitfalls Sourcing Rebar Stakes (Quality, IP)

When procuring rebar stakes—steel rods used in construction for alignment, support, or reinforcement—several critical pitfalls can compromise project integrity, safety, and compliance. These issues often stem from inadequate attention to quality standards and intellectual property (IP) considerations.

Poor Material Quality and Non-Compliance

One of the most frequent issues is sourcing rebar stakes made from substandard or non-compliant steel. Suppliers may offer products that appear cost-effective but fail to meet essential industry standards such as ASTM A615 (for deformed steel bars) or ASTM A36 (for structural steel). Using rebar that doesn’t meet tensile strength, yield strength, or chemical composition requirements can lead to structural failures, safety hazards, and costly rework. Buyers should verify mill test reports, conduct third-party inspections, and ensure traceability to certified steel mills.

Lack of Certification and Documentation

Many suppliers, especially in unregulated markets, provide rebar stakes without proper certification or documentation. This absence makes it difficult to confirm compliance with applicable building codes and engineering specifications. Without mill certificates or test reports, contractors and engineers assume significant liability, particularly in projects requiring third-party audits or regulatory approvals.

Counterfeit or Misrepresented Products

Counterfeiting is a growing concern in the construction materials supply chain. Some suppliers may mislabel lower-grade steel as high-strength rebar or falsify product markings. These deceptive practices are especially prevalent when sourcing from regions with weak enforcement of quality controls. Counterfeit rebar stakes can drastically underperform under load, leading to catastrophic structural issues over time.

Intellectual Property Infringement

Rebar stakes themselves are generally considered standard construction items not protected by patents. However, proprietary designs—such as specialized coatings, thread configurations, or anti-slip features—may be protected under IP laws. Sourcing stakes that replicate patented designs without authorization can expose buyers and contractors to legal risks, including infringement claims, project delays, and financial penalties. It is essential to verify that any non-standard or branded rebar stake design does not violate existing patents or trademarks.

Inconsistent Dimensions and Tolerances

Poorly manufactured rebar stakes often exhibit inconsistent lengths, diameters, or bend tolerances. These variations can lead to misalignment during installation, reduced load-bearing capacity, and compatibility issues with other structural components. Ensuring adherence to specified dimensional tolerances is critical for both performance and regulatory compliance.

Inadequate Corrosion Protection

For rebar stakes used in corrosive environments (e.g., coastal areas or chemical exposure), inadequate or counterfeit galvanization and epoxy coatings are common problems. Substandard coatings wear off quickly, exposing the steel to rust and degradation. Buyers should verify coating thickness and adherence to standards like ASTM A123 (for galvanizing) through documented testing.

Hidden Supply Chain Risks

Relying on suppliers with opaque supply chains increases the risk of receiving rebar stakes from unauthorized or uncertified sources. Lack of transparency makes it difficult to ensure ethical sourcing, material traceability, and compliance with environmental and labor regulations—factors increasingly important for large infrastructure and publicly funded projects.

Conclusion

To avoid these pitfalls, buyers should conduct thorough due diligence, source from reputable suppliers with verifiable certifications, request full material test reports, and consult legal counsel when using proprietary designs. Prioritizing quality and compliance over initial cost savings helps ensure structural integrity, project success, and legal protection.

Logistics & Compliance Guide for Rebar Stakes

Rebar stakes, commonly used in construction, landscaping, and surveying, are steel reinforcing bars cut to specific lengths and often sharpened at one end for easy ground penetration. Proper logistics and compliance management are essential to ensure safe handling, transportation, environmental protection, and adherence to regulatory standards.

Transportation & Handling

Proper transportation and handling of rebar stakes help prevent injury, material damage, and logistical delays.

- Packaging & Bundling: Rebar stakes should be bundled securely using steel or polymer banding to prevent shifting during transit. Bundles should be labeled with length, diameter, quantity, and material grade.

- Load Securing: When transported via flatbed truck or trailer, bundles must be secured with tiedowns or load bars to prevent movement. Overhang beyond the vehicle must comply with local transportation regulations (e.g., DOT in the U.S.).

- Handling Equipment: Use forklifts, cranes, or material handlers with appropriate attachments to move bundles. Manual handling should be avoided due to the weight and sharp ends of stakes.

- Worker Safety: Personnel should wear cut-resistant gloves, steel-toed boots, and eye protection when handling rebar stakes to prevent punctures and lacerations.

Storage Requirements

Proper storage maintains material integrity and reduces workplace hazards.

- Dry, Level Surface: Store bundles on elevated, level surfaces (e.g., wooden pallets or racks) to prevent moisture accumulation and corrosion.

- Covering: Use waterproof tarps or store indoors to protect against rain and humidity, especially in coastal or high-moisture environments.

- Segregation: Keep rebar stakes separated from chemicals or corrosive materials. Organize by size and grade to minimize handling errors.

- Safety Clearance: Maintain clear walkways and ensure sharp ends are oriented away from traffic paths to prevent tripping or impalement hazards.

Regulatory Compliance

Adherence to regional and international regulations is critical for legal and safe operations.

- OSHA Standards (U.S.): Comply with OSHA 29 CFR 1926 for construction safety, including requirements for material handling, fall protection, and impalement prevention. Exposed rebar ends must be fitted with protective caps when not in use.

- DOT Regulations: Follow Department of Transportation guidelines for highway transport, including load securement (49 CFR Part 393) and vehicle marking when loads extend beyond legal limits.

- Environmental Regulations: Manage rust and metal runoff during storage to comply with EPA regulations. Avoid storage near storm drains or waterways.

- REACH & RoHS (EU): If exporting to the EU, ensure steel composition complies with REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) directives, particularly regarding chromium and other alloying elements.

Import/Export Considerations

International movement of rebar stakes requires documentation and customs compliance.

- HS Code Classification: Use Harmonized System code 7214.20 (for hot-rolled steel bars and rods) for customs declarations.

- Country-Specific Standards: Confirm compliance with local building codes (e.g., ASTM A615 in the U.S., BS 4449 in the UK, or ISO 6935-2 internationally).

- Documentation: Provide commercial invoices, packing lists, certificates of origin, and mill test reports (MTRs) verifying steel grade and chemical composition.

- Tariffs & Duties: Be aware of anti-dumping duties or trade remedies that may apply to steel products from certain countries.

Quality Assurance & Traceability

Maintaining material integrity and accountability throughout the supply chain.

- Mill Test Reports (MTRs): Require MTRs for each batch to verify mechanical properties and chemical composition.

- Lot Tracking: Implement a system to track rebar stake batches from manufacturer to end use for quality control and recall readiness.

- Inspection Upon Delivery: Check for corrosion, deformation, or incorrect specifications before accepting shipments.

Disposal & Recycling

End-of-life management supports sustainability and regulatory compliance.

- Recycling: Rebar stakes are 100% recyclable. Dispose of through certified scrap metal recyclers to comply with environmental regulations.

- Hazardous Waste Classification: In most jurisdictions, untreated steel rebar is not classified as hazardous waste. Confirm local regulations before disposal.

- Site Cleanup: Remove all rebar stakes from project sites to prevent injury and environmental hazards.

By following this logistics and compliance guide, businesses can ensure the safe, efficient, and legal handling of rebar stakes across their operational lifecycle.

In conclusion, sourcing rebar stakes requires careful consideration of material quality, supplier reliability, cost-efficiency, and project-specific requirements. It is essential to partner with reputable suppliers who provide consistent product specifications, meet safety standards, and offer timely delivery. Evaluating factors such as rebar grade, length, finish, and quantity ensures suitability for intended applications, whether in construction, landscaping, or agricultural settings. Additionally, comparing pricing, lead times, and sustainability practices can lead to more informed and economical procurement decisions. By establishing a strategic sourcing approach, organizations can maintain project efficiency, reduce downtime, and ensure structural integrity and performance on-site.