The global injection molding market is experiencing robust growth, driven by rising demand for precision-molded components across industries such as automotive, healthcare, electronics, and consumer goods. According to a report by Mordor Intelligence, the injection molding market was valued at USD 345.5 billion in 2023 and is projected to grow at a CAGR of over 4.8% from 2024 to 2029. This expansion is further fueled by advancements in R&D, including the integration of Industry 4.0 technologies, the development of high-performance materials, and the increasing need for rapid prototyping and low-volume production. As innovation becomes a key differentiator, a select group of R&D-focused molding manufacturers are emerging as leaders—combining engineering expertise, cutting-edge technology, and deep industry knowledge to deliver next-generation solutions. Based on market presence, innovation capacity, and technological investment, here are the top 5 R&D-driven molding manufacturers shaping the future of the industry.

Top 5 R&D Molders Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 R&D Molders

Domain Est. 1997

Website: rdmolders.com

Key Highlights: At R&D Molders, we have successfully produced solutions for the Medical, Industrial, Consumer Goods, Sporting Goods, Electronics, GSA/DOD, Home & Garden and ……

#2 R&D Plastics

Domain Est. 1996

Website: rdplast.com

Key Highlights: R&D Plastics is a USA based, high quality, low-cost, market driven, plastic injection molder and engineering company. R&D Plastics is a medium-sized, high ……

#3 R&D Injection Molding

Domain Est. 1996

Website: rdproducts.com

Key Highlights: R&D Products, Inc was formed in 1976 to manufacture their own patented injection molded office products. R&D Molding division was originally created over 28 ……

#4 R&D Molders Canteens – Plastic Manufacturing – About Us

Domain Est. 1996

Website: lomont.com

Key Highlights: R&D Molders, a part of the Lomont family, manufactures reliable, high quality canteens for military, government and field-use applications….

#5 Plastic Injection Molding & Tooling Services

Domain Est. 2002

Website: rdplastics.net

Key Highlights: R&D Plastics has provided a wide range of plastic parts manufacturing methods as well as assembly, part decorating, and secondary operations….

Expert Sourcing Insights for R&D Molders

H2: Market Trends for R&D Molders in 2026

As the global manufacturing and product development landscape evolves, the role of R&D molders—specialized contractors focused on research, development, and prototyping of injection molds and molded components—is becoming increasingly strategic. By 2026, several key market trends are shaping the future of R&D molders, driven by technological innovation, shifting supply chain dynamics, and growing demand for high-performance, customized solutions across industries such as medical devices, automotive, consumer electronics, and clean energy.

1. Accelerated Adoption of Digital Twin and Simulation Technologies

By 2026, R&D molders are increasingly integrating digital twin technologies and advanced simulation software into their workflows. These tools enable real-time mold performance prediction, reducing prototyping cycles and accelerating time-to-market. Companies leveraging AI-powered simulation can optimize mold designs for material flow, cooling efficiency, and structural integrity before physical tooling is produced. This trend is particularly prominent in high-precision sectors like medical and aerospace, where failure costs are significant.

2. Growth in Micro-Molding and Precision Tooling

The demand for miniaturized components—especially in wearables, implantable medical devices, and microelectronics—is driving R&D molders to specialize in micro-molding capabilities. In 2026, leading molders are investing in ultra-precision CNC machining, laser micromachining, and cleanroom molding environments. These advancements allow for tolerances under 10 microns and support emerging applications such as lab-on-a-chip devices and micro-optics.

3. Sustainable Materials and Circular Design Integration

Sustainability is a core trend influencing R&D molders. By 2026, clients are requiring molders to support bio-based polymers, recyclable resins, and molds designed for disassembly and reuse. R&D molders are adapting by developing expertise in processing next-gen materials (e.g., PEF, PHA, and chemically recycled polyolefins) and collaborating with material suppliers to validate performance. Additionally, lifecycle assessment (LCA) tools are being embedded into the design phase to meet ESG goals.

4. Onshoring and Regionalization of R&D Molding Capacity

Geopolitical instability and supply chain resilience concerns have led to a strategic shift toward regionalization. In North America and Europe, 2026 sees growing investment in localized R&D molding hubs, particularly near innovation centers and OEM clusters. This trend reduces lead times, enhances IP security, and enables tighter collaboration between molders, designers, and engineers during the prototyping phase.

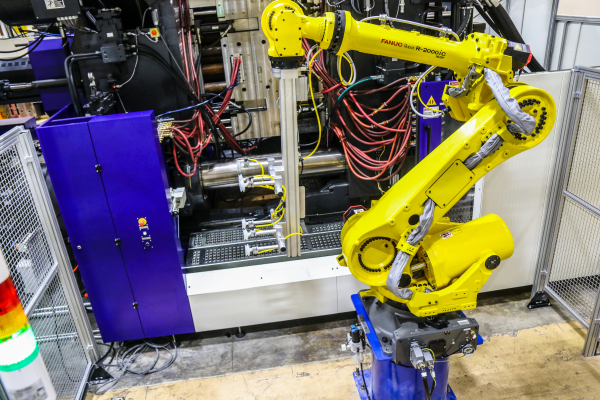

5. Integration of Additive Manufacturing for Rapid Tooling

Additive manufacturing (AM), especially metal 3D printing (e.g., DMLS, Binder Jet), is being adopted by R&D molders to produce conformal-cooled mold inserts and low-volume prototype tools. By 2026, hybrid molding approaches—combining AM with traditional machining—are standard for fast-turnaround projects. This enables faster design iterations, reduced waste, and greater geometric freedom in mold design.

6. Increased Demand for Multi-Material and Overmolding Expertise

As product functionality becomes more complex, R&D molders are seeing rising demand for multi-material molding (e.g., 2K, 3K, and co-injection). This trend is fueled by applications requiring soft-touch surfaces, embedded electronics, or biocompatible sealing layers. In 2026, top molders are investing in advanced multi-shot presses and developing proprietary material bonding databases to ensure reliability.

7. Strategic Partnerships with OEMs and Tech Startups

R&D molders are transitioning from service providers to innovation partners. By 2026, leading firms are engaging earlier in the product development cycle, offering co-design services, material selection guidance, and regulatory support (especially in FDA-regulated industries). Startups in medtech and cleantech are increasingly relying on molders with niche R&D capabilities to de-risk early-stage development.

Conclusion

By 2026, R&D molders are no longer just toolmakers—they are critical enablers of innovation. Success in this evolving market depends on technical agility, digital integration, sustainability leadership, and proximity to innovation ecosystems. Molders who invest in advanced capabilities and form strategic alliances will be well-positioned to capture growth in high-value, knowledge-intensive sectors.

Common Pitfalls When Sourcing R&D Molders (Quality, IP)

Sourcing R&D molders—especially for prototyping, low-volume production, or innovative product development—requires careful consideration beyond typical manufacturing criteria. Two critical areas where companies often encounter significant pitfalls are quality assurance and intellectual property (IP) protection. Overlooking these aspects can lead to delayed timelines, compromised product performance, and even legal or competitive risks.

Quality-Related Pitfalls

-

Inadequate Process Controls for Prototypes

R&D molders may prioritize speed over consistency, leading to inconsistent mold builds or part quality. Without robust process validation (e.g., Design of Experiments, process capability studies), early prototypes may not accurately reflect final production tolerances, resulting in design flaws discovered too late. -

Lack of Traceability and Documentation

Many R&D molders fail to maintain detailed records of materials, mold modifications, or process parameters. This absence of traceability complicates root-cause analysis when defects arise and hinders smooth technology transfer to high-volume production partners. -

Insufficient Testing and Validation Capabilities

Some molders lack in-house metrology, material testing, or environmental stress testing. Relying on external labs delays feedback loops, slowing innovation cycles. Without proper validation, design teams risk basing decisions on non-representative data. -

Overpromising on Capabilities

Smaller or newer molders may claim expertise in advanced materials or tight-tolerance molding but lack the equipment or experienced technicians. This mismatch becomes evident only after mold trials, causing delays and rework.

Intellectual Property-Related Pitfalls

-

Weak or Absent IP Agreements

A common and dangerous oversight is proceeding without a comprehensive IP agreement that clearly assigns ownership of tooling, design modifications, and process know-how. Verbal assurances are not enforceable—written contracts are essential. -

Inadequate Data Security Practices

R&D molders may use unsecured networks, lack access controls, or fail to restrict employee access to sensitive design files. This increases the risk of data leaks, especially if the molder works with competitors. -

Unclear Rights to Derived IP

When molders suggest design-for-manufacturability (DFM) improvements, disputes can arise over who owns the resulting IP. Without predefined terms, companies may lose rights to critical innovations or face licensing hurdles. -

Global Supply Chain Exposure

Offshore or third-party mold shops may be located in jurisdictions with weaker IP enforcement. Even with contracts, legal recourse can be limited, and monitoring compliance is challenging, increasing vulnerability to reverse engineering or unauthorized production.

Avoiding these pitfalls requires thorough due diligence, clear contractual terms, and ongoing collaboration focused on both technical excellence and IP security.

Logistics & Compliance Guide for R&D Molders

This guide outlines essential logistics and compliance considerations for R&D molders engaged in the development, testing, and small-batch production of molded components. Adherence to these principles ensures operational efficiency, regulatory compliance, and risk mitigation.

Regulatory Compliance Framework

R&D molders must comply with a range of local, national, and international regulations. Key areas include:

- Chemical Handling & Safety (e.g., OSHA, REACH, RoHS): Ensure safe handling, storage, and disposal of polymers, additives, release agents, and cleaning solvents. Maintain Safety Data Sheets (SDS) and conduct regular staff training.

- Environmental Regulations (e.g., EPA, local waste ordinances): Comply with waste management protocols for scrap material, contaminated tools, and process byproducts. Implement recycling programs where feasible.

- Product Safety & Standards (e.g., ISO 13485 for medical, UL for electrical): Align development processes with applicable end-product standards, especially when prototyping for regulated industries.

- Intellectual Property (IP) Protection: Establish confidentiality agreements (NDAs) with clients, partners, and employees to safeguard proprietary designs and formulations.

Material Sourcing & Inventory Management

Efficient material logistics are critical for R&D agility and cost control.

- Supplier Qualification: Vet suppliers for material traceability, batch consistency, and compliance documentation (e.g., Certificates of Conformance).

- Small-Volume Procurement: Leverage suppliers offering sample kits or low-MOQ (minimum order quantity) options to reduce upfront costs and storage needs.

- Inventory Tracking: Implement a digital system to track raw material lots, expiration dates, and usage history—especially important for experimental formulations.

- Storage Conditions: Maintain appropriate temperature, humidity, and light controls for sensitive materials (e.g., hygroscopic resins, UV-curable polymers).

Tooling & Equipment Compliance

R&D tooling often involves rapid iterations and diverse materials, requiring special attention.

- Tooling Design Documentation: Maintain detailed records of mold designs, revisions, and validation data for audit readiness.

- Equipment Maintenance & Calibration: Regularly service molding machines, temperature controllers, and measurement tools. Keep calibration logs compliant with ISO 9001 or internal QA standards.

- Safety Interlocks & Guards: Ensure all equipment meets OSHA or equivalent machinery safety standards, particularly during frequent setup changes.

Shipping & Handling of Prototypes

Prototypes and test samples may have unique shipping requirements.

- Packaging Standards: Use protective packaging to prevent damage during transit. Include desiccants or vapor barriers if moisture-sensitive.

- Labeling & Documentation: Clearly label shipments with project IDs, material type, date, and handling instructions. Include compliance labels (e.g., “Not for Commercial Use,” “Prototype”).

- Hazardous Material Shipping (if applicable): Follow IATA/IMDG regulations for any samples containing restricted substances or residual solvents.

Data Integrity & Recordkeeping

Maintain robust documentation to support compliance and traceability.

- Process Validation Records: Document molding parameters (temperature, pressure, cycle time), material batches, and tooling used for each run.

- Test & Inspection Reports: Archive results from dimensional checks, mechanical testing, and visual inspections.

- Audit Readiness: Organize records for internal reviews or client audits, ensuring data is accurate, complete, and securely stored.

Continuous Improvement & Training

Foster a culture of compliance and operational excellence.

- Regular Compliance Training: Conduct periodic training on safety procedures, regulatory updates, and quality protocols.

- Corrective Action Processes: Implement CAPA (Corrective and Preventive Action) systems to address non-conformances identified during R&D.

- Feedback Loops: Collaborate with clients and internal teams to refine processes based on test outcomes and logistical challenges.

By integrating these logistics and compliance practices, R&D molders can accelerate innovation while maintaining the highest standards of safety, quality, and regulatory adherence.

Conclusion for Sourcing R&D Molders

Sourcing R&D molders is a critical step in ensuring innovation, quality, and efficiency in product development and manufacturing. A strategic and thorough selection process enables companies to partner with molders who not only possess advanced technical capabilities and material expertise but also align with project timelines, regulatory standards, and long-term innovation goals. Key factors such as engineering support, prototyping speed, tooling precision, and collaboration throughout the development cycle significantly impact the success of R&D initiatives.

By prioritizing molders with a proven track record in R&D support, strong communication practices, and flexibility in handling iterative design changes, organizations can accelerate time-to-market, reduce development costs, and enhance product performance. Ultimately, establishing a reliable and innovative molding partnership lays the foundation for scalable production and sustained competitive advantage in dynamic markets.