The Residual Current Circuit Breaker (RCCB) market has witnessed steady expansion over the past decade, driven by rising electrical safety standards, increased urbanization, and growing residential and commercial infrastructure development. According to a 2023 report by Mordor Intelligence, the global RCCB market was valued at USD 1.78 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2028, reaching an estimated USD 2.63 billion by the end of the forecast period. This growth is further supported by regulatory mandates across Europe and Asia-Pacific requiring the installation of protective devices in new electrical installations. Additionally, increasing awareness about electrocution prevention and surge protection in low-voltage applications continues to fuel demand. As the need for reliable and intelligent electrical safety solutions grows, manufacturers are focusing on innovation, durability, and compliance with international standards such as IEC 61008. In this evolving landscape, the following ten companies have emerged as leading RCCB manufacturers, recognized for their technological expertise, global reach, and consistent performance.

Top 10 Rccb Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 China Rccb Manufacturers and Factory, Suppliers OEM

Domain Est. 2020

Website: dada-ele.com

Key Highlights: Rccb – Factory, Suppliers, Manufacturers from China. Our goal is to satisfy our customers by offering golden service, good price and high quality….

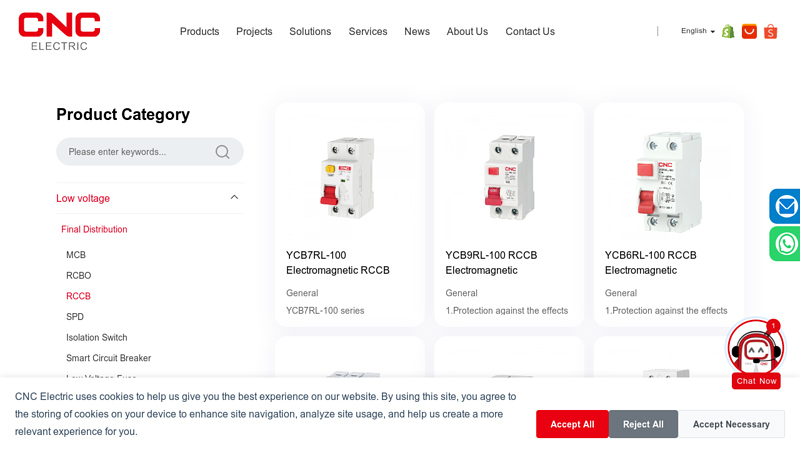

#2 China RCCB Factory & Suppliers

Domain Est. 2005

Website: cncele.com

Key Highlights: RCCB Manufacturers, Factory, Suppliers From China, Our company is dedicated to providing customers with high and stable quality products at competitive ……

#3 Residual Current Circuit Breaker (RCCB) Manufacturer

Domain Est. 1996

Website: viox.com

Key Highlights: VIOX Electric specializes in manufacturing Residual Current Circuit Breakers (RCCBs), essential for preventing electric shocks and fires by detecting leakage ……

#4 Residual Current Circuit Breaker (RCCB) Manufacturer

Domain Est. 2008

Website: geya.net

Key Highlights: GEYA is a leading manufacturer of residual current circuit breakers (RCCBs). We have been supplying customers from all over the world for more than 20 years….

#5 China Rccb And Elcb Factory

Domain Est. 2018

Website: people-electric.com

Key Highlights: Our Rccb (Residual Current Circuit Breaker) is designed to protect residential and commercial applications from electrical shocks due to ground faults. The Elcb ……

#6 RCCB Manufacturer

Website: tosunlux.eu

Key Highlights: From circuit breakers and isolating switches to contactors, distribution boards, and panel meters, we offer a full range of safe, reliable solutions….

#7 Residual Current Circuit Breakers

Domain Est. 1996

Website: eaton.com

Key Highlights: Eaton’s premium range of residual current circuit breakers (RCCB) provide ultimate protection from trips and electrical leakage currents of up to 100 amps….

#8 RCCB Working Principles & Benefits

Domain Est. 1997

Website: eshop.se.com

Key Highlights: RCCB is an electric current sensing device. It can automatically measure the amount of current and disconnect the circuit when there is a fault in the ……

#9 Reyes Coca

Domain Est. 2017

Website: reyescocacola.com

Key Highlights: Reyes Coca-Cola Bottling is a proud west coast and midwest bottler and distributor of Coca-Cola brands and is committed to adding value to the Coca-Cola ……

#10 Residual Current Circuit Breakers (RCCB)

Website: vekmar.com.tr

Key Highlights: VEKMAR supplies all these range of RCCBs in stock quantities as official distributor of Schneider Electric, Eaton and LS Electric. We can help ……

Expert Sourcing Insights for Rccb

H2 2026 Market Trends for RCCBs (Residual Current Circuit Breakers)

Based on current trajectories, technological advancements, and evolving regulatory landscapes, the RCCB market in the second half of 2026 (H2 2026) is expected to be characterized by several key trends, driven by safety imperatives, energy transition, digitalization, and regional growth disparities.

1. Accelerated Adoption of Smart & Connected RCCBs

- Dominant Trend: Integration with home/building automation and IoT platforms will move beyond premium segments into mainstream residential and commercial applications.

- Drivers: Demand for remote monitoring (fault detection, trip history, real-time status), predictive maintenance, and integration with smart energy management systems (solar, EV charging).

- H2 2026 Focus: Wider availability of affordable Wi-Fi/Bluetooth/Zigbee enabled RCCBs; enhanced cybersecurity features; standardized communication protocols (e.g., Matter) improving interoperability. Demand will be particularly strong in new smart home builds and retrofits in North America, Western Europe, and parts of Asia-Pacific.

2. Stringent Safety Regulations Driving Market Growth

- Dominant Trend: Global implementation and enforcement of stricter electrical safety codes mandating RCCB/RCBO protection in more circuits.

- Drivers: Rising awareness of electrical fire risks and electrocution incidents; alignment with international standards (IEC 60364, NEC, etc.).

- H2 2026 Focus: Mandatory RCCB/RCBO requirements for all final circuits (including lighting) becoming widespread outside Europe (e.g., accelerated adoption in parts of Asia, Latin America). Increased focus on Type A and Type F RCCBs for protection against pulsating DC faults (critical for PV systems and EVs). Regulatory push for higher sensitivity (30mA) in more applications.

3. Electrification of Transport and Renewable Energy as Key Growth Engines

- Dominant Trend: RCCB demand is intrinsically linked to the surge in Electric Vehicles (EVs) and Solar PV installations.

- Drivers: Rapid EV charging infrastructure rollout (residential, commercial, public); massive growth in rooftop and utility-scale solar; need for specialized DC or AC+DC RCCBs.

- H2 2026 Focus: High demand for Type B RCCBs (capable of detecting all fault currents, including pure DC) for DC fast chargers and complex PV systems with battery storage. Increased focus on RCCBs integrated into EV supply equipment (EVSE) and solar combiner boxes/inverters. Supply chain resilience for these specialized devices will be a key challenge.

4. Regional Divergence in Growth and Technology Adoption

- Dominant Trend: Significant variation in market maturity, regulatory drivers, and technology uptake across regions.

- Drivers: Differences in economic development, urbanization rates, regulatory frameworks, and energy transition policies.

- H2 2026 Focus:

- Asia-Pacific (APAC): Highest growth volume, driven by massive construction (India’s housing, Southeast Asian urbanization) and government electrification/safety programs. Mix of basic AC types and growing mid-tier (Type A). Smart RCCBs gaining traction in China and urban centers.

- Europe: Mature market focused on upgrades, retrofits, and high-end smart/specialized (Type B) solutions driven by strong regulations and energy transition (EVs, solar). Emphasis on reliability and digital integration.

- North America: Steady growth driven by NEC code updates (e.g., AFCI+GFCI combo devices), smart home adoption, and EV infrastructure build-out. Focus on UL-listed devices and integrated solutions.

- Rest of World (RoW – MEA, LATAM): Growth driven by improving safety standards and urbanization, often starting with basic AC types but seeing increasing influence from international codes.

5. Consolidation and Innovation in the Competitive Landscape

- Dominant Trend: Market consolidation among major players, coupled with innovation from specialized and regional manufacturers.

- Drivers: Need for R&D investment (especially in smart/DC tech), economies of scale, and global supply chain management.

- H2 2026 Focus: Continued M&A activity among Tier 1 players (e.g., Schneider, Siemens, ABB, Eaton). Increased competition from cost-effective Asian manufacturers (e.g., Legrand via acquisitions, local champions in India/China) capturing volume markets. Innovation focus on miniaturization, improved durability, advanced diagnostics, and cybersecurity for connected devices.

Summary for H2 2026:

The RCCB market in H2 2026 will be defined by smart connectivity, regulatory enforcement, and the energy transition. Growth will be robust, particularly in APAC and driven by EVs/solar. Smart RCCBs will become increasingly common, while specialized types (Type B) are essential for new energy applications. Regional differences will persist, but the global push for enhanced electrical safety and the integration of renewable energy and EVs will be the overarching forces shaping the market. Players will need to balance innovation in digital and DC technologies with cost-effective solutions for high-growth emerging markets.

Common Pitfalls When Sourcing RCCBs (Quality, IP)

Sourcing Residual Current Circuit Breakers (RCCBs) involves several critical considerations, particularly regarding product quality and intellectual property (IP). Overlooking these aspects can lead to safety hazards, compliance failures, and legal risks. Below are some common pitfalls to avoid:

Poor Quality Components and Manufacturing

One of the most frequent issues is selecting RCCBs from suppliers that use substandard materials or lack rigorous manufacturing controls. Low-quality RCCBs may fail to trip during fault conditions, posing serious electrical and fire risks. Look for products certified to international standards (e.g., IEC 61008/61009) and verify third-party testing reports.

Lack of Genuine Certifications

Counterfeit or falsified certifications are common in the electrical components market. Suppliers may claim compliance with safety standards without valid test reports from accredited laboratories. Always request and verify certification documents such as CB Scheme reports, CE marks, or UL listings directly from the issuing bodies.

Inadequate Ingress Protection (IP) Rating

RCCBs used in outdoor or industrial environments must have appropriate IP ratings (e.g., IP65 for dust-tight and water-resistant enclosures). Sourcing units with insufficient IP protection can lead to premature failure due to moisture or dust ingress. Ensure the specified IP rating matches the installation environment.

Non-Compliance with Regional Standards

Electrical regulations vary by country. A common mistake is sourcing RCCBs designed for one market (e.g., EU) and using them in another (e.g., India or Australia) without confirming local compliance. This can result in rejected installations or regulatory penalties.

Intellectual Property (IP) Infringement

Sourcing counterfeit or cloned RCCBs that mimic branded designs infringes on intellectual property rights. These knock-offs often lack performance reliability and legal traceability. Procure from authorized distributors or manufacturers with documented IP ownership and avoid suspiciously low-priced alternatives.

Insufficient Technical Support and Documentation

Low-cost suppliers may not provide comprehensive technical documentation, datasheets, or after-sales support. This can hinder proper installation, maintenance, and troubleshooting. Ensure access to detailed product specifications, installation guides, and responsive technical assistance.

Supply Chain Transparency Issues

Lack of visibility into the supply chain increases the risk of receiving reconditioned, expired, or gray-market products. Establish clear supplier vetting processes and request traceability information, including batch numbers and manufacturing dates.

Avoiding these pitfalls requires due diligence, supplier verification, and a focus on certified, IP-compliant products suitable for the intended application.

Logistics & Compliance Guide for RCCB

This guide provides essential information on the logistics and compliance considerations for Residual Current Circuit Breakers (RCCBs), ensuring safe handling, transportation, storage, and adherence to regulatory standards.

Definition and Purpose of RCCB

An RCCB (Residual Current Circuit Breaker) is an electrical safety device designed to protect against electric shock and fire hazards by detecting imbalances in the current flow between live and neutral conductors. When a leakage current exceeds a preset threshold, the RCCB disconnects the circuit to prevent injury or equipment damage.

Regulatory Standards and Certifications

RCCBs must comply with international and regional electrical safety standards to ensure performance and reliability:

- IEC 61008 and IEC 61009: International standards governing RCCB design, performance, and testing.

- EN 61008 / EN 61009: European equivalents adopted under the Low Voltage Directive.

- UL 943: Applicable in the United States for ground fault circuit interrupters (GFCIs), which serve a similar purpose.

- CE Marking: Required for RCCBs placed on the European market, indicating conformity with health, safety, and environmental protection standards.

- RoHS Compliance: Restriction of Hazardous Substances directive ensuring minimal use of lead, mercury, cadmium, and other harmful materials.

- REACH: Registration, Evaluation, Authorization, and Restriction of Chemicals, relevant for material disclosures.

Manufacturers and distributors must ensure RCCBs are certified by recognized bodies (e.g., TÜV, UL, CSA) and maintain documentation for audits.

Packaging and Labeling Requirements

Proper packaging and labeling are critical for compliance and logistics:

- Packaging: RCCBs should be packaged in anti-static, shock-resistant materials to prevent damage during transit. Bulk packaging must prevent internal movement and moisture exposure.

- Labeling: Each unit or package must include:

- Manufacturer name and address

- Model number and rating (e.g., 30mA, 40A)

- Compliance marks (CE, UL, etc.)

- Date of manufacture

- Warning symbols and safety instructions

- Multilingual Labels: Required for cross-border shipments within regions like the EU.

Transportation and Handling

Follow these best practices for safe and compliant transportation:

- Temperature Control: Store and transport RCCBs within 0°C to 40°C to avoid damage to internal components.

- Moisture Protection: Use desiccants and moisture-resistant packaging, especially for sea freight.

- ESD Precautions: Handle RCCBs in electrostatic discharge (ESD)-protected environments when unpacking.

- Stacking Limits: Observe manufacturer stacking guidelines to prevent crushing.

- Hazard Classification: RCCBs are typically non-hazardous, but verify with SDS (Safety Data Sheet) if required by carrier.

Storage Conditions

Proper storage ensures product integrity prior to installation:

- Environment: Store in a dry, clean, and well-ventilated area away from direct sunlight and corrosive substances.

- Shelving: Use non-conductive shelving; avoid contact with conductive materials.

- Shelf Life: While RCCBs have long operational lives, inspect stored units periodically for casing damage or expiration of performance guarantees.

Import and Export Compliance

International shipments require adherence to customs and trade regulations:

- HS Code Classification: Use appropriate Harmonized System (HS) code (e.g., 8536.30 for circuit breakers).

- Customs Documentation: Prepare commercial invoice, packing list, certificate of origin, and conformity certificates.

- Import Permits: Some countries require electrical product approval (e.g., KC Mark in South Korea, BIS in India).

- Incoterms: Clearly define responsibilities using standard trade terms (e.g., FOB, DDP).

Installation and Field Compliance

Ensure end-users follow compliance protocols:

- Qualified Personnel: RCCBs must be installed by licensed electricians.

- Local Codes: Installation must comply with national wiring rules (e.g., NEC in the US, IEC 60364 in Europe).

- Testing: Periodic testing (via test button) is required to verify functionality.

Environmental and Disposal Regulations

End-of-life handling must follow environmental standards:

- WEEE Directive (EU): Waste Electrical and Electronic Equipment rules mandate proper recycling.

- Recycling: Partner with certified e-waste recyclers to dispose of defective or obsolete units.

- Landfill Ban: RCCBs must not be disposed of in general waste due to electronic components and potential hazardous materials.

Documentation and Record Keeping

Maintain records for traceability and audit purposes:

- Product conformity certificates

- Test reports (type tests, routine tests)

- Shipping and customs documents

- Batch and serial number logs

- Customer delivery and installation records (where applicable)

Adhering to this logistics and compliance guide ensures RCCBs are handled safely, legally, and efficiently across the supply chain.

Conclusion for Sourcing RCCBs (Residual Current Circuit Breakers):

Sourcing RCCBs requires a balanced approach that considers product quality, compliance with international and local safety standards (such as IEC 61008/61009), reliability, cost-efficiency, and supplier credibility. It is essential to partner with reputable manufacturers or suppliers who offer certified, durable, and technologically advanced RCCBs to ensure electrical safety in residential, commercial, and industrial applications. Evaluating technical specifications—including rated current, trip sensitivity (e.g., 30mA, 100mA, 300mA), pole configuration, and breaking capacity—ensures the right product matches the intended application. Additionally, considering after-sales support, warranty, and availability of spare parts enhances long-term maintenance and system reliability. Ultimately, strategic sourcing of RCCBs not only improves electrical safety and system performance but also contributes to regulatory compliance and operational cost savings.