The global remote-controlled (RC) airplane components market is experiencing robust growth, driven by rising hobbyist engagement, advancements in drone technology, and increasing adoption in education and aerial photography. According to Grand View Research, the global hobby and toy market—of which RC aircraft components are a key segment—is projected to grow at a CAGR of 4.8% from 2023 to 2030, fueled by technological innovation and expanding distribution channels. Complementing this, Mordor Intelligence reports that the growing integration of lightweight materials, brushless motors, and advanced flight control systems is accelerating demand among both amateur and professional users. As the ecosystem for RC aviation evolves, manufacturers specializing in high-performance components such as motors, electronic speed controllers (ESCs), servos, and flight controllers are playing a pivotal role in shaping industry standards. This list highlights the top 10 RC airplane components manufacturers leading innovation, reliability, and market influence in this expanding niche.

Top 10 Rc Airplane Components Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Phoenixmodel.com

Domain Est. 2008

Website: phoenixmodel.com

Key Highlights: We are the largest and most experienced R/C model airplane manufacturer in Vietnam. Phoenix Model provides clients with the best resources and services ……

#2 OMPHOBBY

Domain Est. 2018

Website: omphobby.com

Key Highlights: 7–45 day deliveryOMPHOBBY-manufacturer of RC Airplane Model,Helicopters, rcemote Control Model. We carry the huge selection of RC airplane models OMPHOBBY recommend ompbobby ……

#3 RC Airplane Parts, Electronics & Accessories

Domain Est. 1995

Website: towerhobbies.com

Key Highlights: Free delivery over $99 · 30-day returnsOur collection of high-quality Airplane Parts, Electronics & Accessories is designed for optimal durability and performance. Shop RC ……

#4 RC Airplanes

Domain Est. 1996

Website: horizonhobby.com

Key Highlights: Free delivery over $100 · 30-day returnsSHOP PARTS AND ACCESSORIES FOR RC AIRPLANES. Compliment your passion for RC flight with our full line of replacement parts, batteries, char…

#5 DU-BRO RC Airplane Parts

Domain Est. 1996

Website: dubro.com

Key Highlights: 5-day delivery 30-day returnsShop DU-BRO RC Airplane parts for durable, high-precision hardware. Wheels, linkages, mounts & more for RC aircraft. Trusted by pilots worldwide….

#6 THUNDER TIGER GROUP

Domain Est. 2000

Website: thundertiger.com

Key Highlights: Its TTSOLUTIONS division is dedicated fully to designing and manufacturing RC cars and vehicles in Taiwan. facebook · youtube · [email protected]. Business ……

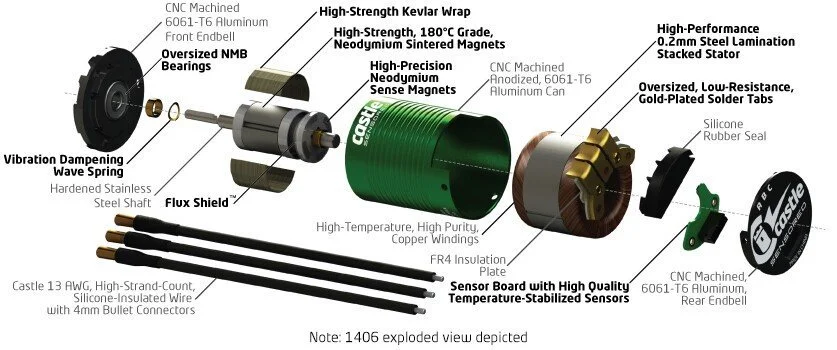

#7 Castle Homepage

Domain Est. 2000

Website: home.castlecreations.com

Key Highlights: Castle Creations-powered drone, RC jet, and off-road buggy showcasing high-performance brushless motors and ESCs for air, land, and multi-rotor applications….

#8 Airplanes & Parts

Domain Est. 2002

Website: rcsuperstore.com

Key Highlights: Free delivery over $99 · 30-day returns…

#9 to Pilot

Domain Est. 2008

Website: pilot-rc.com

Key Highlights: Welcome to Pilot-RC. New Pilot-RC Elster Jet SU-30 110″. New 3D Foam plane : EDGE 540 39″. New 3D Aerobatic 120cc plane : Sbach 342 V2 103″. Tap to unmute….

#10 RC Planes

Domain Est. 2010

Expert Sourcing Insights for Rc Airplane Components

H2: 2026 Market Trends for RC Airplane Components

The global market for remote-controlled (RC) airplane components is poised for significant transformation by 2026, driven by technological innovation, rising hobbyist engagement, and expanding commercial applications. Several key trends are expected to shape the industry landscape over the next few years.

-

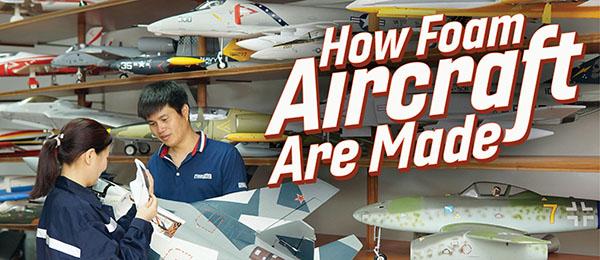

Increased Adoption of Advanced Materials

By 2026, lightweight composite materials such as carbon fiber, Kevlar, and advanced polymers will dominate component manufacturing. These materials enhance flight performance by reducing weight while increasing structural durability. Demand is growing not only among hobbyists seeking higher speed and agility but also in professional drone sectors where reliability under stress is critical. -

Growth in Brushless Motor and ESC Integration

Brushless motors and electronic speed controllers (ESCs) will continue to replace brushed systems due to their efficiency, longer lifespan, and superior power-to-weight ratios. The trend toward integrated motor-ESC units, offering plug-and-play convenience and optimized performance, is expected to accelerate, especially in mid-to-high-end RC aircraft. -

Expansion of Smart Components and IoT Connectivity

Smart components equipped with sensors and wireless communication capabilities (e.g., real-time telemetry, GPS stabilization, and battery health monitoring) are becoming standard. By 2026, IoT-enabled components will allow pilots to receive live data feeds on flight performance, enhancing safety and user experience. This trend is fueled by advancements in miniaturization and low-power wireless protocols like Bluetooth LE and LoRa. -

Rise in 3D-Printed and Customizable Parts

The accessibility of affordable 3D printing technology enables hobbyists and small manufacturers to produce custom or replacement parts on-demand. By 2026, the market will see a surge in open-source designs and online marketplaces for 3D-printable RC components, fostering innovation and personalization. -

Growth in FPV (First-Person View) Ecosystems

FPV flying continues to gain popularity, driving demand for high-resolution cameras, compact video transmitters, and lightweight antennas. The FPV market segment is expected to expand rapidly, with component manufacturers focusing on reducing latency and improving signal reliability, especially in urban or obstructed environments. -

Sustainability and Reusability Focus

Environmental concerns are pushing manufacturers to develop eco-friendly components, including recyclable packaging, biodegradable materials, and energy-efficient production methods. Additionally, modular designs that allow for easy repair and part replacement will gain traction, reducing electronic waste. -

Commercial and Educational Applications Driving Demand

Beyond recreational use, RC airplane components are increasingly utilized in aerial photography, precision agriculture, and STEM education. Schools and training institutions are adopting RC aircraft for teaching principles of aerodynamics and engineering, creating a steady demand for durable, entry-level components. -

Supply Chain Localization and Resilience

Geopolitical factors and past supply chain disruptions have prompted a shift toward regional manufacturing hubs. By 2026, North America and Europe are expected to increase local production of critical components to reduce dependency on single-source suppliers, especially from Asia. -

AI and Autonomous Flight Integration

While still emerging, AI-assisted flight controllers capable of autonomous navigation, obstacle avoidance, and automated maneuvers will begin influencing the RC component market. These intelligent systems require specialized sensors, processors, and software, creating new niches for component developers. -

E-commerce and Direct-to-Consumer Sales Growth

Online platforms will remain the dominant channel for RC component sales. Brands are investing in direct-to-consumer models, offering bundled kits, firmware updates, and community support, enhancing customer loyalty and driving repeat purchases.

In conclusion, the 2026 RC airplane components market will be defined by innovation, connectivity, and customization. Manufacturers who prioritize performance, sustainability, and user-centric design will be best positioned to capture growing demand across hobby, educational, and commercial sectors.

Common Pitfalls Sourcing RC Airplane Components (Quality, IP)

Sourcing components for RC airplanes—especially for custom builds or commercial production—can be fraught with challenges. Two of the most significant pitfalls involve component quality inconsistencies and intellectual property (IP) risks. Recognizing these issues early can save time, money, and potential legal complications.

Quality Inconsistencies and Counterfeit Parts

One of the biggest challenges when sourcing RC airplane components—particularly from online marketplaces or third-party suppliers—is the variability in quality. Components such as motors, electronic speed controllers (ESCs), servos, and propellers must meet precise specifications to ensure flight safety and performance. However, many suppliers, especially overseas, offer counterfeit or substandard parts misrepresented as genuine. These may fail under stress, leading to in-flight malfunctions or crashes. Additionally, inconsistent manufacturing tolerances in structural components like carbon fiber arms or landing gear can compromise airframe integrity. Buyers often discover too late that advertised specifications (e.g., motor KV rating or battery discharge rate) do not match real-world performance, resulting in poor flight dynamics or component damage.

Intellectual Property Infringement Risks

Another critical pitfall is the unintentional sourcing of components that violate intellectual property rights. Many popular RC parts—such as proprietary flight controllers, branded motor designs, or patented airframe geometries—are protected by trademarks, copyrights, or utility patents. Sourcing knock-off versions of branded electronics (e.g., clones of popular flight controller boards) may expose buyers or integrators to legal liability, especially in commercial applications. Even if the components function adequately, using them could lead to cease-and-desist orders, product recalls, or trademark infringement lawsuits. Furthermore, open-source hardware designs often come with specific licensing terms (e.g., GPL or Creative Commons), and failure to comply—such as not crediting original designers or redistributing modifications improperly—can also result in IP disputes. Due diligence in verifying the legitimacy and licensing of sourced components is essential to avoid these legal entanglements.

Logistics & Compliance Guide for RC Airplane Components

Overview

This guide outlines the key logistical and compliance considerations when shipping and receiving remote control (RC) airplane components. Whether you’re a manufacturer, distributor, or hobbyist importing or exporting parts, understanding these regulations ensures timely delivery, avoids penalties, and promotes safety.

Classification of RC Airplane Components

Proper classification helps determine shipping requirements and compliance obligations. Common components include:

– Electronic Components: Flight controllers, receivers, ESCs (Electronic Speed Controllers)

– Power Systems: LiPo (Lithium Polymer) batteries, motors, servos

– Structural Parts: Frames, wings, landing gear (often made of carbon fiber, plastic, or lightweight metals)

– Radio Equipment: Transmitters, receivers, antennas

– Propulsion: Propellers, fuel tanks (for nitro/gas engines)

– Sensors & Accessories: GPS modules, cameras, telemetry systems

Shipping Regulations and Restrictions

Lithium Batteries (LiPo)

LiPo batteries are classified as dangerous goods (UN 3480) due to fire risk. Key requirements:

– Must be shipped at ≤30% state of charge for air transport.

– Each battery must be individually protected from short circuits (e.g., placed in insulated bags).

– Package must be rigid and non-conductive with clear “Lithium Battery” labeling.

– Air shipments require UN-certified packaging and a Shipper’s Declaration for Dangerous Goods (for larger quantities).

– Ground shipments (e.g., domestic via parcel) may have less stringent rules but still require proper labeling.

Radio Frequency Devices

Components like transmitters and receivers may be subject to telecommunications regulations:

– In the U.S., the FCC (Federal Communications Commission) regulates RF devices. Ensure components comply with Part 15 or other relevant rules.

– In the EU, RED (Radio Equipment Directive) compliance is required (CE marking).

– Importers must verify devices operate within permitted frequency bands (e.g., 2.4 GHz ISM band).

Customs and Import Compliance

Harmonized System (HS) Codes

Use accurate HS codes to determine tariffs and import rules:

– Electronics/Controllers: 8543.70 (Electronic Integrated Circuits)

– Electric Motors: 8501.10 or 8501.31

– Lithium Batteries: 8507.60

– Plastic/Carbon Fiber Parts: 3926.30 or 8803.30 (if classified as aircraft parts)

Note: Classification may vary by country; consult a customs broker when unsure.

Documentation Requirements

Essential documents for international shipments:

– Commercial Invoice: Includes item descriptions, values, weights, and country of origin.

– Packing List: Details contents per package.

– Certificate of Origin: May be required for preferential tariff treatment.

– Safety Data Sheets (SDS): Required for LiPo batteries.

– FCC/CE Compliance Certificates: For electronic/radio components.

Packaging and Handling Best Practices

General Packaging

- Use double-boxing with cushioning (e.g., foam or bubble wrap) to protect fragile components.

- Clearly label contents and include handling instructions (e.g., “Fragile,” “This Side Up”).

- Seal packages securely to prevent moisture or dust ingress.

Battery-Specific Packaging

- Use fire-resistant LiPo safety bags for individual batteries.

- Do not pack batteries with conductive materials.

- Avoid over-packing to prevent pressure damage.

Air, Ground, and Sea Transport Considerations

Air Freight

- Most restrictive due to battery regulations.

- Only IATA-certified shippers can handle dangerous goods.

- Small quantities (e.g., one or two batteries under 100 Wh) may qualify for Exception 188 (PI 965–970), allowing limited consumer shipments.

Ground Transport

- Less regulated than air, but still subject to local hazardous material rules (e.g., DOT in the U.S.).

- Suitable for domestic or regional shipping of non-battery components.

Sea Freight

- Cost-effective for large shipments.

- Requires full IMDG Code compliance for batteries.

- Longer transit times; suitable for non-urgent bulk orders.

Country-Specific Compliance Notes

United States

- Batteries: DOT & FAA regulations apply.

- Electronics: FCC ID required for intentional radiators.

- No special permit for RC aircraft under 55 lbs (FAA Part 107 does not apply to hobby use).

European Union

- Batteries: Must comply with EU Battery Directive and proper labeling.

- Electronics: CE marking under RED and RoHS directives.

- Importers must register in national databases (e.g., EAR in Germany).

Canada

- ISED certification required for radio equipment.

- Transport Canada regulates lithium battery shipments (aligned with IATA).

Australia

- ACMA oversees radio compliance.

- Batteries must meet ADG Code standards.

Record Keeping and Liability

- Maintain shipping records (invoices, declarations, compliance certificates) for at least 5 years.

- Use liability insurance, especially for high-value or hazardous shipments.

- Verify carrier insurance covers damage or loss of sensitive electronics.

Conclusion

Shipping RC airplane components requires careful attention to classification, packaging, and international regulations—especially for lithium batteries and radio equipment. By following this guide, businesses and individuals can ensure safe, compliant, and efficient logistics operations across borders. Always consult a customs expert or freight forwarder when dealing with complex or large-scale shipments.

In conclusion, sourcing RC airplane components requires a careful balance between quality, cost, compatibility, and reliability. Whether purchasing from online retailers, specialty hobby shops, or manufacturing parts independently through 3D printing or custom fabrication, it is essential to assess the specific needs of your aircraft design and performance goals. Prioritizing reputable suppliers, reading user reviews, and verifying component specifications can significantly enhance build success and flight performance. Additionally, considering factors such as availability, lead times, and after-sales support ensures a smoother development process. With the growing accessibility of high-quality parts and advancements in materials and electronics, enthusiasts and professionals alike have more options than ever—enabling innovation, customization, and improved overall RC aircraft performance. Ultimately, informed and strategic sourcing is key to building a durable, efficient, and high-performing RC airplane.