The global rail brake systems market is undergoing significant transformation, driven by increasing urbanization, rising investments in public transportation, and the modernization of aging rail infrastructure. According to a report by Mordor Intelligence, the rail brake market was valued at USD 3.8 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 4.7% from 2024 to 2029. This growth is further supported by Grand View Research, which highlights expanding metro and high-speed rail networks—particularly in Asia-Pacific and Europe—as key demand drivers. As rail operators prioritize safety, efficiency, and compliance with stringent regulatory standards, innovation in braking technologies such as electro-pneumatic, frictionless, and regenerative systems has become critical. In this competitive landscape, a select group of manufacturers are leading the charge through advanced R&D, strategic partnerships, and global supply capabilities. The following list highlights the top 10 rail brake manufacturers shaping the industry’s future, based on market presence, technological innovation, and financial performance.

Top 10 Rail Brake Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Engine Braking and Valvetrain Technologies

Domain Est. 1990

Website: cummins.com

Key Highlights: We lead the way in designing, testing, and manufacturing high-performing engine brakes for engine OEMs around the world….

#2 New York Air Brake

Domain Est. 1996 | Founded: 1991

Website: nyab.com

Key Highlights: Since 1991, New York Air Brake has been a member company of Knorr-Bremse – the world’s leading manufacturer of braking systems for rail and commercial vehicles….

#3

Domain Est. 1997

Website: knorr-bremse.com

Key Highlights: Knorr-Bremse is the world’s leading manufacturer of braking systems and a leading supplier of safety-critical sub-systems for rail and commercial….

#4 Wabtec Corporation

Domain Est. 2018

Website: wabteccorp.com

Key Highlights: Wabtec is a leading global provider of equipment, systems, digital solutions, and value-added services. Whether it’s freight rail, transit, mining, industrial ……

#5 DAKO

Website: dako-cz.eu

Key Highlights: DAKO-CZ, a.s. … The company DAKO-CZ is a leading manufacturer of pneumatic, electromechanical and hydraulic brake systems and components for rail vehicles with ……

#6 Rail

Domain Est. 1986

Website: mobility.siemens.com

Key Highlights: Rail Solutions for trams, light rail and metro services, commuter, regional and long distance trains: Discover the comprehensive portfolio from Siemens!…

#7 Start page

Domain Est. 1997

Website: rail.knorr-bremse.com

Key Highlights: Systems supplier for rail transport: Knorr-Bremse is a leading provider of innovative solutions and systems for the rail industry….

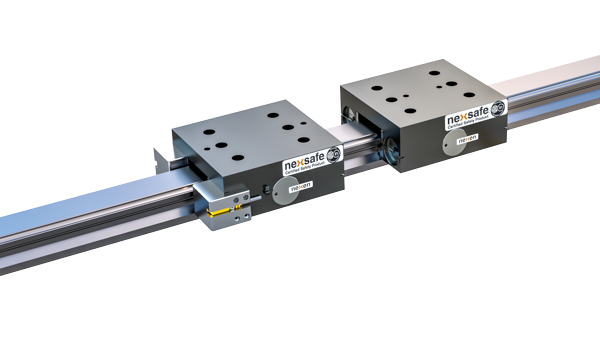

#8 Safety Certified Rail Brakes

Domain Est. 1999

Website: nexengroup.com

Key Highlights: Nexen’s Safety Certified linear profile guide rail brakes use spring force to secure the load in holding applications like e-stop and power-off situations….

#9 EBC Brakes

Domain Est. 2000

Website: ebcbrakes.com

Key Highlights: EBC Brakes are a leading brake company offering brakes, pads, calipers, brake lines, discs & rotors for Automotive, Motorcycle, Mountain Bike & Racing….

#10 Amsted Rail: Performance

Domain Est. 2002

Website: amstedrail.com

Key Highlights: Amsted Rail builds virtually everything under the railcar, from wheels, axles and bearings to brake systems, end-of-car energy management systems and more….

Expert Sourcing Insights for Rail Brake

H2: 2026 Market Trends for Rail Braking Systems

The global rail brake market is poised for significant transformation by 2026, driven by technological innovation, regulatory mandates, and increasing demand for safe, efficient, and sustainable rail transportation. Below is an analysis of key market trends shaping the rail braking industry in the lead-up to 2026.

1. Shift Toward Electrification and E-Friction Braking Technologies

Rail operators are increasingly adopting electrified braking systems, including electro-pneumatic (EP) and fully electric friction brakes. These systems offer faster response times, improved energy efficiency, and better integration with train control systems. By 2026, e-friction brakes are expected to gain traction in high-speed and urban transit applications, particularly in Europe and East Asia.

2. Growth in Regenerative Braking Adoption

Regenerative braking systems, which feed kinetic energy back into the power grid or onboard storage, are becoming standard in modern electric trains. With pressure to reduce carbon emissions and operational costs, rail operators are investing heavily in regenerative solutions. This trend is especially prominent in metro systems and high-speed rail networks, where frequent stops maximize energy recovery potential.

3. Integration with Digitalization and Predictive Maintenance

Rail brake manufacturers are embedding sensors and IoT connectivity into braking systems to enable real-time monitoring and predictive maintenance. By 2026, smart braking systems will be a key component of digital train platforms, reducing downtime, improving safety, and lowering lifecycle costs. AI-driven diagnostics will allow for condition-based maintenance, replacing scheduled servicing.

4. Demand Driven by Urbanization and Public Transit Expansion

Rapid urbanization, particularly in Asia-Pacific, the Middle East, and parts of Africa, is fueling investment in metro and light rail systems. This infrastructure growth directly increases demand for reliable and high-performance braking solutions. China, India, and Saudi Arabia are expected to lead procurement of new rail vehicles equipped with advanced braking systems.

5. Stringent Safety Regulations and Standardization

Regulatory bodies such as the European Union Agency for Railways (ERA) and the International Union of Railways (UIC) are enforcing stricter safety standards, including requirements for fail-safe braking, redundancy, and fire-resistant materials. Compliance with standards like EN 13452 and ISO 24228 is accelerating innovation in brake design and materials.

6. Lightweight and Composite Materials

To improve energy efficiency and reduce wear, manufacturers are adopting lightweight composites and advanced alloys in brake components. Carbon-ceramic and sintered metal brakes are gaining popularity in high-speed applications due to their durability and thermal performance.

7. Regional Market Dynamics

– Europe: Leading in innovation with strong support from EU green mobility initiatives. Adoption of ETCS (European Train Control System) is influencing brake system integration.

– Asia-Pacific: Fastest-growing market due to large-scale rail projects in China, India, and Southeast Asia.

– North America: Focused on freight rail modernization, driving demand for electronically controlled pneumatic (ECP) brakes.

– Middle East & Africa: Emerging opportunities in new metro and commuter rail systems.

8. Sustainability and Circular Economy Considerations

By 2026, environmental concerns will push manufacturers to design brakes with recyclable materials and reduced particulate emissions. Brake dust, particularly from friction brakes, is under scrutiny for its environmental and health impacts, prompting R&D into low-emission and dust-free braking technologies.

Conclusion

The rail brake market in 2026 will be characterized by a convergence of digital, environmental, and safety-driven trends. Companies that invest in smart, sustainable, and integrated braking solutions will be best positioned to capture market share. As rail remains a cornerstone of low-carbon transportation, braking systems will play a critical role in ensuring performance, reliability, and passenger safety in next-generation rail networks.

Common Pitfalls Sourcing Rail Brakes: Quality and Intellectual Property Risks

Sourcing rail brakes involves critical considerations beyond cost and delivery timelines. Two of the most significant challenges are ensuring consistent quality and safeguarding intellectual property (IP), both of which can have serious safety, legal, and financial consequences if not properly managed.

Quality-Related Pitfalls

Rail brakes are safety-critical components whose failure can lead to catastrophic accidents. Poor quality control during sourcing can result in non-compliance, operational disruptions, or liability issues.

-

Inadequate Supplier Qualification

Selecting suppliers without rigorous assessment of their manufacturing capabilities, quality management systems (e.g., ISO 9001, IRIS), and experience in rail-specific applications increases the risk of substandard components. Suppliers lacking domain expertise may not fully understand the operational stresses rail brakes endure. -

Non-Compliance with Industry Standards

Rail brakes must meet stringent international and regional standards such as UIC 540, EN 14198, or AAR S-420. Sourcing from suppliers unfamiliar with these requirements—or failing to verify compliance through proper certification and testing—can result in rejected deliveries or field failures. -

Inconsistent Manufacturing Processes

Without robust oversight, suppliers may vary materials or processes between batches, leading to inconsistent performance. This is particularly dangerous in braking systems where reliability under repeated stress is essential. -

Insufficient Testing and Validation

Relying solely on supplier-provided test reports without independent validation or third-party certification (e.g., by notified bodies) exposes buyers to undetected defects. Dynamic and endurance testing under real-world conditions is often overlooked during procurement. -

Counterfeit or Substandard Materials

Low-cost suppliers may use inferior friction materials or metallurgy to cut costs. These materials can degrade prematurely or fail under high-temperature conditions, compromising braking efficiency and safety.

Intellectual Property-Related Pitfalls

Rail brake technology often incorporates proprietary designs, materials, and control systems. Mishandling IP during sourcing can lead to infringement claims, loss of competitive advantage, or legal disputes.

-

Unlicensed Use of Patented Technology

Sourcing brake systems that incorporate patented features (e.g., specific caliper designs, electronic control algorithms) without proper licensing exposes the buyer to infringement lawsuits, even if unintentional. This is especially common when sourcing from third-party manufacturers in regions with lax IP enforcement. -

Lack of IP Clarity in Contracts

Failure to define IP ownership, usage rights, and restrictions in supplier agreements can lead to ambiguity. For example, custom-designed components may inadvertently transfer IP to the supplier unless explicitly addressed in the contract. -

Reverse Engineering and Design Theft

Sharing detailed technical specifications with untrusted suppliers increases the risk of design theft or unauthorized replication. This is a particular concern when sourcing from regions known for IP violations. -

Dependency on Proprietary Components

Sourcing brakes with embedded proprietary software or firmware without proper documentation or access rights can create long-term maintenance and upgrade challenges. Suppliers may withhold updates or charge excessive licensing fees. -

Inadequate Protection of Buyer-Specific Innovations

When co-developing brake systems, companies may contribute unique engineering solutions. Without clear NDAs and IP clauses, these innovations can be used by the supplier for other clients, eroding competitive differentiation.

To mitigate these risks, organizations should implement thorough supplier vetting, insist on full compliance documentation, conduct independent audits and testing, and include robust IP protections in all sourcing agreements. Engaging legal and technical experts during the procurement process is essential to ensure both safety and legal integrity.

Logistics & Compliance Guide for Rail Brake Systems

This guide outlines the essential logistics and compliance considerations for the handling, transportation, storage, and regulatory adherence of rail brake systems. Proper management ensures safety, regulatory compliance, and operational reliability across the supply chain.

Scope and Applicability

This guide applies to all rail brake components, including brake blocks, pads, calipers, cylinders, control valves, electronic brake control units (EBCUs), and associated hardware. It covers manufacturers, suppliers, maintenance depots, rail operators, and logistics providers involved in the movement and management of brake systems.

Regulatory Compliance Framework

Rail brake systems are subject to stringent international, regional, and national regulations. Key compliance standards include:

- AAR (Association of American Railroads) Standards – For freight and passenger rail in North America, including M-901 (brake shoes) and S-488 (air brake system components).

- EN (European Norm) Standards – For European rail applications, such as EN 14198 (brake pads), EN 15485 (brake discs), and EN 13384 (brake systems).

- TSI (Technical Specifications for Interoperability) – Under EU Directive 2016/797/EU, covering braking subsystems for interoperable rolling stock.

- UIC (International Union of Railways) Codes – Including UIC 540 (brake blocks) and UIC 541-4 (brake equipment).

- FMVSS & FRA (Federal Motor Vehicle Safety Standards & Federal Railroad Administration) – In the U.S., compliance with 49 CFR parts related to brake performance and safety.

All rail brake components must be certified, marked with traceability data (e.g., serial numbers, manufacturing dates), and accompanied by a Declaration of Conformity (DoC) where applicable.

Packaging and Handling Requirements

Proper packaging ensures components arrive undamaged and contamination-free:

- Use anti-corrosive packaging (VCI wraps or desiccants) for metal components.

- Employ protective casing for electronic control units to prevent ESD (electrostatic discharge) and moisture damage.

- Clearly label packages with “Fragile,” “This Side Up,” and “Do Not Stack” as appropriate.

- Secure internal components to prevent movement during transit.

- Handle brake discs and pads with clean gloves to avoid oil contamination.

Storage Conditions

Storage environments must preserve component integrity:

- Store in dry, climate-controlled facilities (10°C–25°C, RH <60%).

- Elevate packages off the floor to prevent moisture absorption.

- Rotate stock using FIFO (First In, First Out) to prevent obsolescence.

- Protect from direct sunlight and chemical exposure.

- For rubber and elastomeric parts (e.g., seals, hoses), limit storage to 24 months from manufacture.

Transportation Logistics

Transporting rail brake systems requires adherence to mode-specific regulations:

- Road: Use shock-absorbing transport with secure lashing. For oversized components (e.g., brake beams), obtain special permits and follow dimensional regulations.

- Rail: Secure loads inside freight wagons; avoid coupling shocks. Use dedicated containerized transport when possible.

- Sea: Comply with IMDG Code if hazardous materials (e.g., lubricants) are included. Use moisture-resistant containers with silica gel.

- Air: Follow IATA Dangerous Goods Regulations if applicable. Prioritize time-sensitive electronic units via air freight.

Temperature-controlled transport is recommended for sensitive components.

Documentation and Traceability

Complete and accurate documentation is critical for compliance and safety:

- Packing lists with itemized contents and quantities.

- Certificates of Conformity and Material Test Reports (MTRs).

- Batch/lot numbers and serial traceability for recall readiness.

- Customs documentation (e.g., HS codes, COO – Certificate of Origin).

- Maintenance and inspection records for refurbished or overhauled units.

Digital tracking via barcodes or RFID is encouraged for end-to-end visibility.

Maintenance and Reconditioning Compliance

Reconditioned brake components must meet original equipment specifications:

- Perform inspections per OEM and regulatory guidelines (e.g., AAR M-901 for reconditioned brake shoes).

- Document all rework, testing, and certification.

- Clearly mark reconditioned units with “Reconditioned” and include date and facility ID.

- Discard components beyond permissible wear limits or damage thresholds.

Environmental and Safety Considerations

- Dispose of worn brake pads and linings as hazardous waste if containing asbestos or heavy metals (e.g., copper).

- Follow local regulations (e.g., EPA, REACH, RoHS) for material content and end-of-life handling.

- Provide Safety Data Sheets (SDS) for any chemicals used in brake manufacturing or maintenance.

Audit and Quality Assurance

- Conduct regular internal audits of logistics and storage practices.

- Maintain ISO 9001 and, where applicable, ISO/TS 22163 (Rail Quality Management System) certification.

- Support third-party inspections and regulatory audits with full documentation access.

Conclusion

Effective logistics and strict compliance are vital for the safety and performance of rail brake systems. Adhering to this guide ensures regulatory alignment, preserves component integrity, and supports the reliability of rail operations worldwide. Always consult OEM specifications and local regulatory authorities for updates and region-specific requirements.

Conclusion for Sourcing Rail Brakes

In conclusion, the sourcing of rail brakes is a critical aspect of ensuring the safety, reliability, and efficiency of railway operations. A successful sourcing strategy requires a thorough evaluation of technical specifications, compliance with industry standards (such as UIC, AAR, or EN), and rigorous supplier qualification processes. Factors such as performance under varying load and weather conditions, maintenance requirements, lifecycle costs, and compatibility with existing rolling stock must be carefully assessed.

Engaging with reputable suppliers that demonstrate proven experience, robust quality management systems, and a commitment to innovation enhances supply chain resilience and long-term operational performance. Additionally, adopting a strategic sourcing approach—leveraging volume contracts, fostering supplier collaboration, and considering total cost of ownership—can lead to significant cost savings and service improvements.

Ultimately, effective sourcing of rail brakes not only supports operational safety and regulatory compliance but also contributes to the overall reliability and sustainability of rail transport systems. Continuous monitoring, performance evaluation, and adaptation to emerging technologies (such as regenerative or electro-pneumatic braking systems) will be key to maintaining a competitive and future-ready rail network.