The global medical imaging market is experiencing robust growth, driven by rising demand for diagnostic accuracy, advancements in imaging technologies, and the increasing prevalence of chronic diseases. According to a report by Mordor Intelligence, the global radiology equipment market was valued at USD 13.9 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.5% from 2024 to 2029. A critical component of this ecosystem is the radiology computer monitor—a specialized display designed to meet the stringent requirements of diagnostic imaging, including high resolution, grayscale accuracy, and DICOM compliance. As healthcare providers shift toward digitized workflows and Picture Archiving and Communication Systems (PACS), the demand for high-performance radiology monitors continues to rise. This growth is further corroborated by Grand View Research, which highlights the expanding adoption of teleradiology and 3D/4D imaging as key drivers increasing reliance on advanced visualization tools. With major players innovating to deliver superior luminance, calibration precision, and ergonomic design, the competitive landscape among radiology monitor manufacturers is rapidly evolving. Below, we profile the top 10 manufacturers shaping this essential segment of modern medical imaging.

Top 10 Radiology Computer Monitor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Radiology

Domain Est. 1994

Website: barco.com

Key Highlights: Our radiology display systems help you see the smallest details and make swift, well-informed decisions. Both in the office and at home.Missing: computer manufacturer…

#2 Varex Imaging

Domain Est. 2016

Website: vareximaging.com

Key Highlights: Varex Imaging Corporation is the world’s largest independent supplier and manufacturer of X-ray imaging components and image processing solutions….

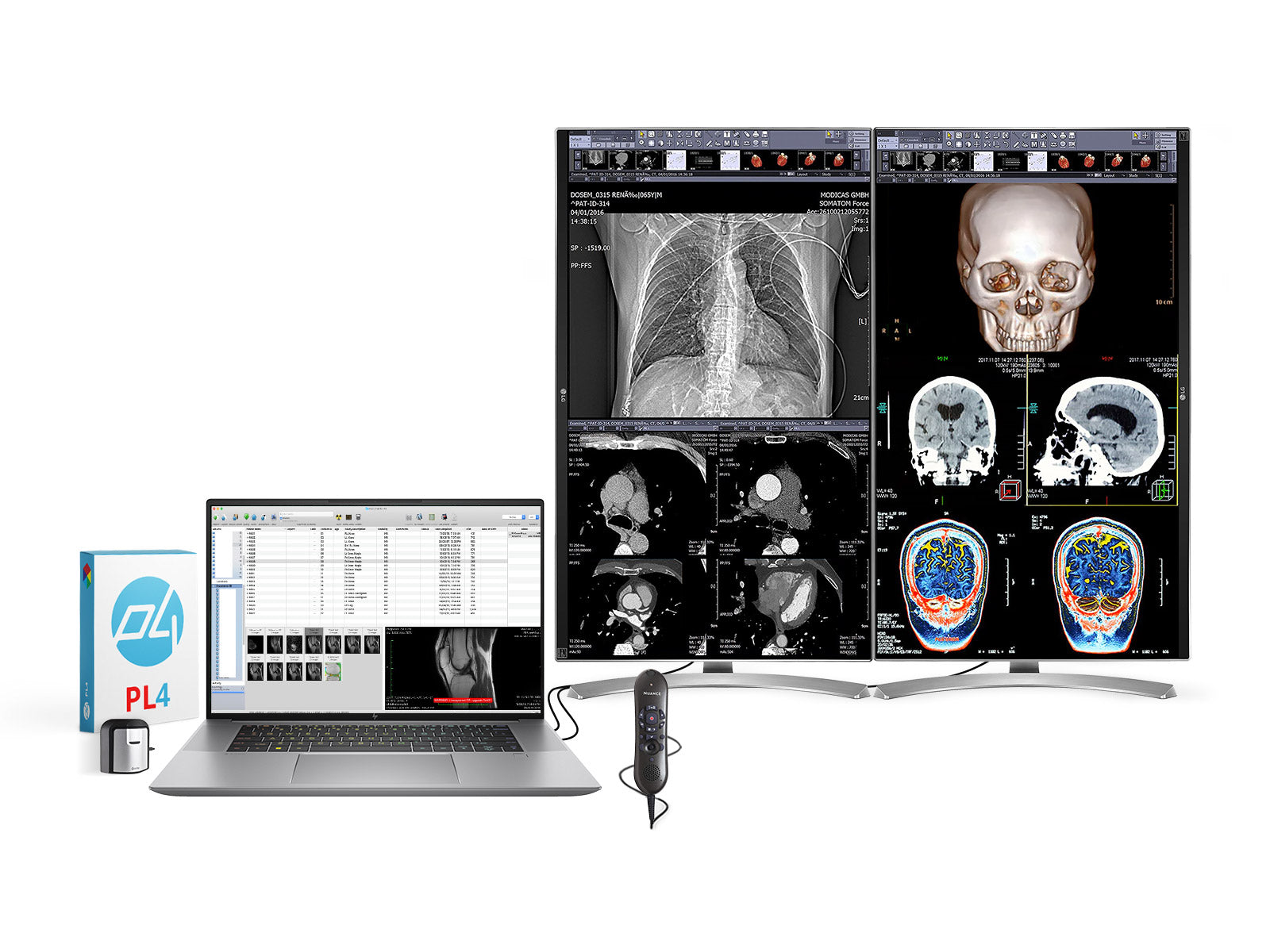

#3 Medical Diagnostics & Medical Imaging Solutions

Domain Est. 1997

Website: eizo.com

Key Highlights: EIZO has been developing and manufacturing innovative display monitors for mission critical applications for over 50 years. Incorporating the latest ……

#4 Radiology Monitor

Domain Est. 1997

Website: cybernetman.com

Key Highlights: Cybernet’s series of 4k medical monitors are ideal for use as radiology monitors and general imaging monitors. These are great monitors for PACS use….

#5 Ampronix

Domain Est. 1997

Website: ampronix.com

Key Highlights: Ampronix is the official Master Distributor for Sony Medical Surgical Display Monitors in the United States , offering hospitals and medical facilities ……

#6 Mindray North America

Domain Est. 1998

Website: mindray.com

Key Highlights: Mindray is a focused, innovative, and accessible provider of technologies and solutions for patient monitoring, anesthesia, and ultrasound….

#7 Medical Displays & Monitors

Domain Est. 2002

Website: doubleblackimaging.com

Key Highlights: We offer top-tier medical displays and calibration software for fully developed and integrated systems. Discover how we can enhance your imaging solutions!…

#8 NDS Surgical Imaging

Domain Est. 2007

Website: ndssi.com

Key Highlights: As an industry pioneer over the last 20 years, NDS has been first to market with LCD surgical displays, 60 GHz wireless imaging, cordless secondary monitors, ……

#9 Synaptive

Domain Est. 2012

Website: synaptivemedical.com

Key Highlights: Next-Gen Precision Imaging, Navigation, & Robotics · Our mission is to help clinicians see with greater precision and clarity, improving patient care everywhere….

#10 Medical Imaging Solutions

Domain Est. 2024

Website: eizovisualsolutions.com

Key Highlights: EIZO’s innovative medical image reproduction solutions stand out thanks to their outstanding image quality and powerful functionalities for precise diagnoses….

Expert Sourcing Insights for Radiology Computer Monitor

H2: Radiology Computer Monitor Market Trends in 2026

By 2026, the radiology computer monitor market is poised for significant transformation, driven by technological advancements, evolving clinical needs, and shifting healthcare dynamics. Here are the key trends expected to shape the landscape:

Advancements in Display Technology

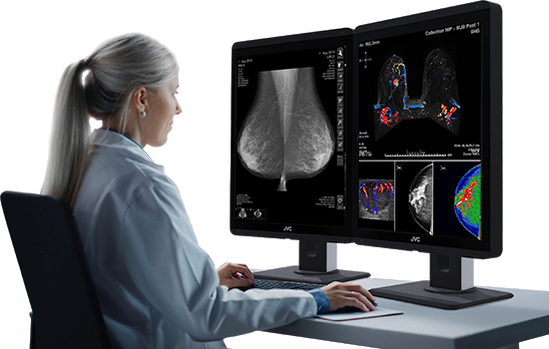

High-resolution, high-luminance displays will become the standard, with 8-megapixel (MP) and even 12-MP monitors increasingly adopted for complex imaging modalities like mammography and digital pathology. Mini-LED backlighting and improved LCD panels will enhance contrast ratios and reduce power consumption, while OLED technology may make inroads in specialized applications due to superior black levels and viewing angles, despite cost and longevity concerns.

Integration with AI and Workflow Optimization

Radiology monitors will increasingly serve as interfaces for AI-powered diagnostic tools. Real-time AI overlays—highlighting potential anomalies or quantifying tissue characteristics—will be displayed directly on the monitor, necessitating seamless integration with PACS and AI platforms. This trend will push demand for monitors with high color fidelity and low latency to ensure accurate rendering of AI-generated visualizations.

Rise of Teleradiology and Remote Diagnostics

The expansion of teleradiology will drive demand for secure, high-performance remote viewing solutions. Monitors optimized for remote access—supporting encrypted connections, consistent color calibration across locations, and compatibility with zero-client or virtual desktop infrastructure (VDI)—will gain traction. Portable diagnostic-grade displays may also see increased use among radiologists working off-site.

Emphasis on Ergonomics and User Experience

As radiologist burnout remains a concern, ergonomic design will be a key differentiator. Adjustable arm systems, ambient light sensors, flicker-free displays, and blue light reduction features will be standard. Unified workstation setups combining primary and secondary diagnostic monitors with intuitive control interfaces will improve workflow efficiency and diagnostic accuracy.

Consolidation and Interoperability

Healthcare systems will favor vendors offering comprehensive imaging ecosystems. Monitors that seamlessly integrate with existing PACS, voice recognition, reporting systems, and enterprise imaging platforms will have a competitive edge. Open standards like DICOM grayscale standard display function (GSDF) compliance will remain critical for image consistency and diagnostic confidence.

Sustainability and Total Cost of Ownership

Environmental concerns and budget constraints will push providers toward energy-efficient monitors with longer lifespans and recyclable components. Vendors offering comprehensive service agreements, calibration services, and modular designs for easier upgrades will appeal to cost-conscious institutions aiming to reduce long-term operational expenses.

In summary, the 2026 radiology monitor market will be defined by smarter, more integrated, and user-centric solutions that support the growing demands of precision diagnostics, AI integration, and distributed healthcare delivery.

Common Pitfalls Sourcing Radiology Computer Monitors (Quality, IP)

Sourcing radiology computer monitors—critical tools for diagnostic imaging—requires careful consideration of both technical quality and intellectual property (IP) compliance. Overlooking key factors can lead to substandard performance, regulatory issues, or legal exposure. Below are common pitfalls to avoid:

Inadequate Image Quality and Calibration

One of the most frequent mistakes is selecting monitors that fail to meet medical imaging standards. Using consumer-grade or non-certified displays can result in inaccurate diagnosis due to poor grayscale resolution, low contrast ratios, or inconsistent brightness. Radiology monitors must comply with DICOM Part 14 calibration standards to ensure consistent image representation across devices. Failure to verify calibration capabilities and ongoing maintenance support can compromise diagnostic accuracy.

Lack of Regulatory Certification

Purchasing monitors without proper regulatory approvals—such as FDA 510(k) clearance, CE marking, or compliance with IEC 60601 safety standards—poses significant risks. Non-certified monitors may not be legally deployable in clinical environments and could jeopardize accreditation. Always confirm that the supplier provides up-to-date regulatory documentation specific to medical use.

Insufficient Support for Teleradiology and Network Integration

Modern radiology workflows often involve remote diagnostics and integration with PACS (Picture Archiving and Communication Systems) and RIS (Radiology Information Systems). Sourcing monitors without adequate network security, low-latency performance, or compatibility with existing infrastructure can hinder efficiency and expose patient data to vulnerabilities. Ensure monitors support secure DICOM communication and are compatible with your IT ecosystem.

Overlooking Intellectual Property (IP) Risks

Using monitors bundled with unlicensed or proprietary imaging software can create IP infringement risks. Some vendors integrate third-party calibration or display management software without proper licensing, exposing healthcare providers to legal challenges. Always request documentation verifying software licensing and ensure that firmware and calibration tools are legally distributed for medical use.

Choosing Vendors Without Medical-Grade Service and Warranty

Radiology monitors require specialized service and predictable uptime. General IT suppliers may offer lower prices but lack the expertise or service level agreements (SLAs) required for medical equipment. Avoid vendors that do not provide on-site support, loaner units during repairs, or guaranteed calibration traceability. Long-term service costs and downtime can outweigh initial savings.

Ignoring Future-Proofing and Scalability

Purchasing monitors based solely on current needs without considering future imaging modalities (e.g., 3D/4D imaging, AI integration) can lead to premature obsolescence. Ensure monitors support high-resolution formats (e.g., 5MP, 8MP), have adequate processing power, and allow for software updates to adapt to evolving clinical demands.

By addressing these pitfalls proactively, healthcare organizations can ensure they source radiology monitors that deliver diagnostic accuracy, regulatory compliance, and long-term value while minimizing IP and operational risks.

Logistics & Compliance Guide for Radiology Computer Monitors

Overview

Radiology computer monitors, also known as diagnostic imaging displays, are critical components in medical imaging workflows. Due to their specialized use in interpreting diagnostic images (e.g., X-rays, CT, MRI), they are subject to stringent logistics, regulatory, and compliance requirements. This guide outlines key considerations for the procurement, shipping, handling, installation, and ongoing compliance of radiology monitors in healthcare environments.

Regulatory Classifications

Radiology computer monitors used for diagnostic interpretation are typically classified as medical devices under regulatory frameworks such as:

– FDA (U.S.): Class II medical device under 21 CFR 892.2050 (Image Display Devices)

– EU MDR (European Union): Class IIa or IIb, depending on intended use and software integration

– Health Canada: Class II under the Medical Devices Regulations

– Other Jurisdictions: Compliance with local medical device regulations (e.g., TGA in Australia, PMDA in Japan)

Ensure devices carry appropriate certifications (e.g., FDA 510(k) clearance, CE Marking, Health Canada license) prior to deployment.

Procurement & Vendor Qualification

- Source monitors only from ISO 13485-certified manufacturers or authorized distributors

- Verify that the monitor model is FDA-cleared or CE-marked for diagnostic use

- Confirm inclusion of necessary accessories (e.g., calibration sensors,遮光罩, mounting arms)

- Require compliance documentation (IFU, Declaration of Conformity, labeling)

- Ensure software provided (e.g., QA tools, calibration software) is validated and compliant

Shipping & Handling

- Packaging: Use original manufacturer packaging with shock-absorbing materials; avoid third-party or reused boxes

- Labeling: Mark packages as “Fragile,” “This Side Up,” and “Medical Equipment”

- Environmental Controls: Protect from extreme temperatures (typically -10°C to 60°C during transport), humidity, and condensation

- Shipping Method: Use reliable, trackable carriers with experience in medical equipment logistics

- Insurance: Ensure full-value insurance coverage for high-cost diagnostic displays (often $5,000–$15,000 per unit)

Import & Customs Compliance

- Provide accurate HS codes (e.g., 8528.59.00 for medical display monitors in the U.S.)

- Submit required documentation: Commercial invoice, packing list, certificate of origin, FDA registration (if applicable), CE Certificate

- Be aware of duty exemptions for medical devices under certain trade agreements (e.g., U.S.-Korea FTA, GSP)

- Engage a customs broker familiar with medical device imports

Installation & Commissioning

- Perform installation in a controlled clinical environment with stable power and appropriate lighting

- Mount on vibration-resistant, height-adjustable arms meeting VESA standards

- Connect to medical-grade power outlets with surge protection

- Calibrate using manufacturer-recommended procedures and tools (e.g., photometer)

- Validate performance per AAPM Task Group 18 (TG18) or IEC 62563-1 standards

- Document calibration and initial QA results in asset management system

Quality Assurance & Maintenance

- Perform regular QA testing per ACR or local protocols (e.g., monthly/biannual)

- Maintain luminance levels (typically 400–700 cd/m² for primary diagnostic displays)

- Track calibration history and maintain logs for audits

- Use only manufacturer-approved service technicians for repairs

- Replace monitors according to manufacturer’s recommended lifespan (typically 5–7 years)

Compliance & Documentation

- Maintain records of:

- Device registration and UDI (Unique Device Identification)

- Installation and calibration reports

- Service and repair history

- Software updates and validation

- Staff training on proper use

- Retain documentation for minimum of 10 years or per local regulatory requirements

- Ensure compliance with HIPAA (U.S.) or GDPR (EU) if monitors are connected to systems with patient data

Disposal & End-of-Life

- Decommission monitors in accordance with medical device recall and disposal guidelines

- Securely wipe or destroy internal storage (if applicable)

- Recycle through certified e-waste handlers compliant with WEEE (EU), R2, or local standards

- Document disposal in asset tracking system

Training & User Compliance

- Train radiologists and technologists on:

- Proper monitor use and ambient lighting requirements

- Reporting image quality issues

- Calibration schedules and QA participation

- Enforce policies prohibiting non-diagnostic use (e.g., web browsing) on diagnostic displays

Summary

Radiology computer monitors require careful attention throughout their lifecycle—from procurement to disposal. Adhering to regulatory, logistical, and quality standards ensures patient safety, diagnostic accuracy, and compliance with healthcare regulations globally. Always consult local regulatory authorities and institutional policies when implementing or managing diagnostic display systems.

In conclusion, sourcing radiology computer monitors requires a careful and strategic approach that balances clinical requirements, regulatory standards, and cost-effectiveness. Given the critical role these monitors play in accurate diagnosis and patient care, it is essential to prioritize high-resolution displays, consistent brightness and contrast, DICOM compliance, and calibration capabilities. Partnering with reputable vendors who offer robust technical support, warranty coverage, and scalability options ensures long-term reliability and system integration. Additionally, considering total cost of ownership—beyond the initial purchase price—helps optimize budget allocation and performance sustainability. By conducting thorough evaluations and aligning procurement decisions with both current needs and future technological advancements, healthcare organizations can secure radiology monitors that enhance diagnostic accuracy, improve workflow efficiency, and ultimately support superior patient outcomes.