The global refrigerant market is undergoing a significant transformation as environmental regulations drive demand for low-global warming potential (GWP) alternatives to traditional hydrofluorocarbons (HFCs). Among these, R32 refrigerant has emerged as a leading solution due to its balance of energy efficiency, lower environmental impact, and compatibility with existing systems. According to Grand View Research, the global R32 refrigerant market size was valued at USD 1.97 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 10.8% from 2023 to 2030, fueled by stringent regulatory frameworks such as the Kigali Amendment and increasing demand for energy-efficient air conditioning systems in Asia-Pacific and North America. Mordor Intelligence also projects robust growth, citing rising HVAC installations in emerging economies and the phase-down of high-GWP refrigerants as key market drivers. As demand surges, a select group of manufacturers have positioned themselves at the forefront of R32 production, leveraging scale, innovation, and regulatory compliance to capture market share. Below are the top six R32 refrigerant manufacturers shaping the future of sustainable cooling.

Top 6 R32 Refrigerant Details Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 R-32

Domain Est. 1995

Website: carrier.com

Key Highlights: Carrier has selected R-32 refrigerant to replace R-410A refrigerant, in commercial chillers and heat pumps using scroll technology….

#2 R-32, The Most Balanced Refrigerant

Domain Est. 1996

Website: daikin.com

Key Highlights: Find out R-32, The Most Balanced Refrigerant of Daikin Industries, Ltd. Daikin is a world’s leading air conditioning company….

#3 R32

Domain Est. 1995

Website: agas.com

Key Highlights: R32 is a HFC refrigerant, used as a replacement for R410A in low temperature refrigeration and air conditioning applications….

#4 R32

Domain Est. 1998

Website: nationalref.com

Key Highlights: R32 is a single component lower GWP (Global Warming Potential) alternative to R410A most commonly used in new air conditioning split & portable systems….

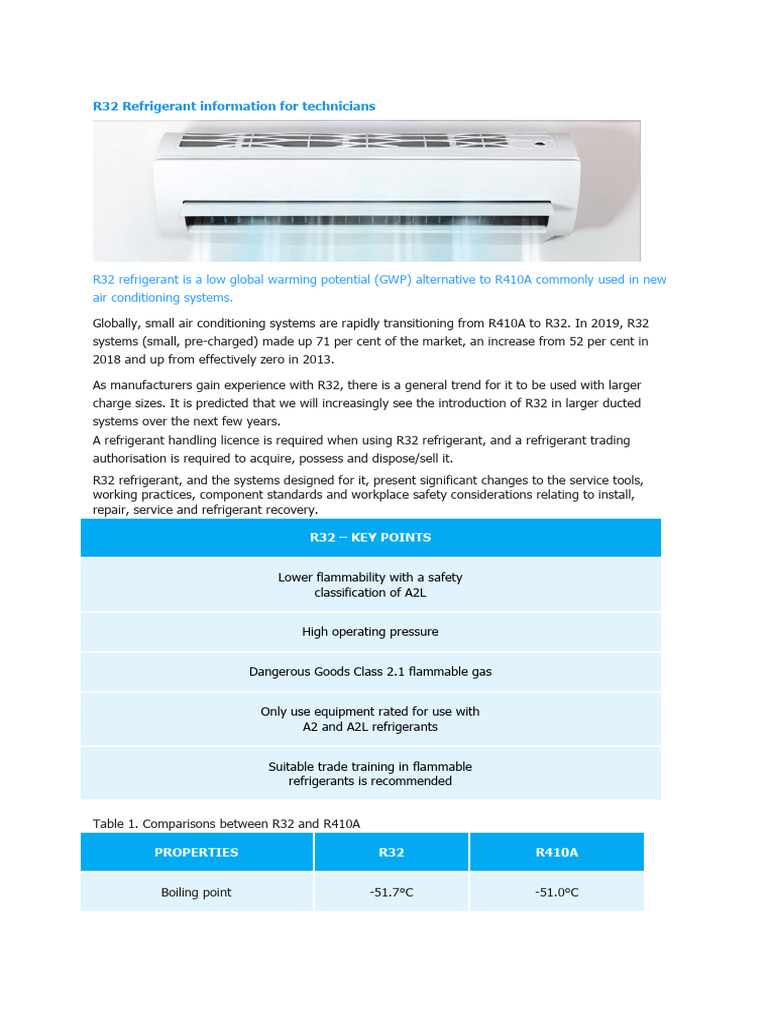

#5 R32 Refrigerant information for technicians

Domain Est. 2002

Website: arctick.org

Key Highlights: R32 refrigerant is a low global warming potential (GWP) alternative to R410A commonly used in new air conditioning systems….

#6 Why R32?

Domain Est. 2007

Website: lghvac.com

Key Highlights: R-32 refrigerant is a chlorine-free, fluorocarbon with zero Ozone Depletion Potential (ODP) and lower Global Warming Potential (GWP) than alternative ……

Expert Sourcing Insights for R32 Refrigerant Details

2026 Market Trends for R32 Refrigerant

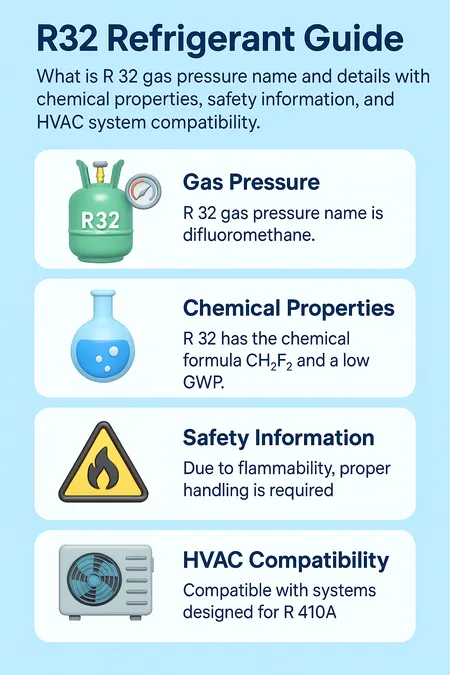

The global refrigerant market is undergoing a significant transformation as environmental regulations, technological advancements, and shifting consumer preferences drive the transition from high-global warming potential (GWP) refrigerants to more sustainable alternatives. Among these, R32 (difluoromethane), a low-GWP hydrofluorocarbon (HFC), has emerged as a leading solution—particularly in air conditioning applications. As the world approaches 2026, several key trends are expected to shape the R32 refrigerant market.

Rising Demand Driven by Energy Efficiency and Environmental Regulations

One of the primary drivers of R32 adoption is its favorable environmental profile compared to legacy refrigerants such as R410A. With a GWP of approximately 675—about two-thirds lower than R410A’s GWP of 2,088—R32 aligns well with global initiatives like the Kigali Amendment to the Montreal Protocol, which mandates phasedowns of HFCs. Countries in Asia-Pacific, Europe, and North America are tightening regulations on high-GWP refrigerants, accelerating the shift toward R32, especially in residential and commercial split-system air conditioners.

By 2026, government policies in key markets such as Japan, India, South Korea, and the European Union are expected to further restrict high-GWP refrigerants, creating a favorable regulatory environment for R32. Additionally, energy efficiency standards such as MEPS (Minimum Energy Performance Standards) are being upgraded, and R32’s superior thermodynamic properties—higher coefficient of performance (COP) and improved heat transfer—make it an ideal choice for meeting these benchmarks.

Dominance in the Asia-Pacific Region

The Asia-Pacific region is projected to remain the largest market for R32 refrigerant through 2026. Countries like Japan, China, and India are at the forefront of R32 adoption. Japanese manufacturers such as Daikin, Mitsubishi, and Panasonic pioneered R32-based air conditioning systems and have driven widespread consumer acceptance. In China, the government’s Green Development Plan and revised refrigerant management policies are incentivizing HVAC manufacturers to transition to R32.

India’s rapidly growing cooling demand, fueled by rising urbanization and increasing temperatures due to climate change, is expected to boost R32 consumption. As local production capabilities expand and OEMs adopt R32 in new AC models, India’s R32 market is projected to grow at a CAGR of over 12% from 2023 to 2026.

Technological Advancements and Safety Considerations

While R32 is mildly flammable (classified as A2L by ASHRAE), its flammability risk is significantly lower than that of other low-GWP alternatives like hydrocarbons (e.g., R290). Ongoing technological improvements in compressor design, leak detection systems, and charge size limitations are mitigating safety concerns. By 2026, smart HVAC systems with integrated sensors and IoT connectivity are expected to enhance the safe operation of R32-based equipment.

Manufacturers are also investing in training technicians for safe handling and servicing of A2L refrigerants. Industry-wide certification programs and updated installation guidelines are being rolled out globally, which will further support R32 adoption in both new installations and retrofits.

Competitive Landscape and Supply Chain Dynamics

The global R32 market is dominated by key chemical producers such as Chemours, Honeywell, Daikin Industries, and Zhejiang Juhua Co., Ltd. These companies are expanding production capacities to meet rising demand, particularly in Asia. By 2026, increased competition is likely to drive efficiency improvements and moderate price volatility.

However, supply chain challenges—such as raw material (e.g., hydrogen fluoride) availability and geopolitical factors—could impact production costs. Companies are responding by vertically integrating and investing in sustainable manufacturing practices, including recycling and recovery of used refrigerants.

Transition Pathway Toward Lower-GWP Alternatives

While R32 is a transitional solution, it is expected to serve as a bridge toward next-generation refrigerants such as R454B and natural refrigerants (e.g., CO₂, ammonia, hydrocarbons). However, due to its balance of performance, safety, cost, and environmental impact, R32 is projected to maintain a dominant position in the HVAC sector through 2026—especially in regions where infrastructure for handling more flammable refrigerants is still under development.

Conclusion

By 2026, the R32 refrigerant market will be shaped by stringent environmental regulations, energy efficiency mandates, technological innovation, and regional demand dynamics—particularly in Asia-Pacific. While long-term trends point toward ultra-low-GWP solutions, R32 will remain a cornerstone of the global refrigerant transition due to its technical maturity, cost-effectiveness, and regulatory compliance. Stakeholders across the HVAC value chain—from manufacturers to policymakers and service providers—will need to adapt to evolving standards and ensure safe, sustainable deployment of R32-based systems.

Common Pitfalls When Sourcing R32 Refrigerant: Quality and Intellectual Property (IP) Concerns

Sourcing R32 (difluoromethane) refrigerant, while increasingly common due to its lower global warming potential (GWP) compared to older refrigerants like R410A, carries significant risks related to product quality and intellectual property (IP). Failing to address these pitfalls can lead to system failures, safety hazards, legal disputes, and reputational damage.

1. Quality and Purity Issues

The performance, safety, and longevity of HVAC&R systems depend critically on refrigerant purity. Sourcing R32 from unreliable suppliers often leads to compromised quality.

-

Contamination with Air and Moisture:

Low-cost or uncertified R32 is frequently contaminated with non-condensable gases (like air, nitrogen) and moisture. Moisture can react with refrigerant and lubricants to form corrosive acids (e.g., hydrofluoric acid), leading to compressor burnout, valve failure, and system corrosion. Air increases discharge pressure, reducing efficiency and potentially causing mechanical stress or safety valve activation. -

Presence of Wrong Refrigerants or Isomers:

Some suppliers may blend R32 with cheaper, non-compliant refrigerants (e.g., R22, R23, or hydrocarbons) to cut costs. Others may supply incorrect isomers or chemical variants that behave differently under pressure and temperature. This adulteration can result in unpredictable system performance, inefficient operation, and severe safety risks, including flammability increases beyond R32’s A2L classification. -

Inadequate Certification and Testing:

Genuine R32 must meet strict international standards such as AHRI 700 (USA) or ISO 817 (global). Unscrupulous suppliers may falsify certificates of analysis (CoA) or provide inadequate testing data. Buyers must verify third-party laboratory testing from accredited institutions and demand batch-specific CoAs. -

Poor Cylinder Handling and Traceability:

Used or improperly refilled cylinders can introduce contaminants. Reputable suppliers use dedicated, properly cleaned cylinders with tamper-evident seals and clear batch traceability. Sourcing from grey-market suppliers often involves recycled or untraceable cylinders, increasing contamination risk.

2. Intellectual Property (IP) and Legal Risks

R32 is subject to extensive patent protections, particularly concerning its use in specific applications and blends. Ignoring IP rights can lead to costly legal action and market exclusion.

-

Patented Applications and Formulations:

Major chemical manufacturers (e.g., Daikin, Chemours, Honeywell) hold patents covering the use of R32 in specific refrigerant blends, compressor technologies, and HVAC system designs. Using R32 in a patented application without a license—even if the refrigerant itself is legally produced—can constitute patent infringement. For example, many inverter-driven air conditioner designs optimized for R32 are protected by system-level patents. -

Sourcing from Unauthorized or Infringing Suppliers:

Some suppliers may produce or distribute R32 in violation of process patents or licensing agreements. Purchasing from such suppliers does not shield the buyer from secondary liability or supply chain disruption if the supplier is shut down. Due diligence on supplier legitimacy and licensing is essential. -

Trademark and Brand Confusion:

Illegitimate suppliers may mislabel generic R32 as branded products (e.g., falsely claiming “Daikin R32” or “Honeywell Solstice®”). This not only violates trademark laws but also misleads buyers about quality and origin. Always verify authenticity through authorized distribution channels. -

Lack of Licensing Agreements:

In some regions and applications, using R32 requires adherence to licensing agreements that include technical support, safety training, and compliance monitoring. Operating outside these agreements may void equipment warranties and expose users to liability in case of accidents.

Mitigation Strategies

To avoid these pitfalls:

* Source R32 only from reputable, authorized suppliers with verifiable certifications (ISO, AHRI, etc.).

* Demand and independently verify batch-specific CoAs from accredited labs.

* Conduct regular quality audits and on-site testing if sourcing in large volumes.

* Consult legal and technical experts to assess IP risks related to your specific application.

* Ensure your equipment manufacturer permits the use of the sourced R32 and confirm licensing requirements.

* Maintain full supply chain traceability and documentation.

By proactively addressing quality and IP concerns, businesses can safely and legally leverage the benefits of R32 while minimizing operational and legal risks.

Logistics & Compliance Guide for R32 Refrigerant

Overview of R32 Refrigerant

R32 (Difluoromethane) is a single-component hydrofluoroolefin (HFO) refrigerant increasingly used in air conditioning and heat pump systems as a lower-global warming potential (GWP) alternative to R410A. With a GWP of 675 (over 100 years), R32 is considered more environmentally friendly, though it is classified as mildly flammable (A2L safety classification per ASHRAE Standard 34). This classification necessitates strict handling, transportation, and storage protocols to ensure safety and regulatory compliance.

Regulatory Framework and Standards

R32 is subject to international, regional, and national regulations governing the handling, transport, and use of hazardous substances. Key regulatory frameworks include:

- ASHRAE Standard 34: Assigns R32 the safety classification A2L (low toxicity, mild flammability), influencing equipment design and installation practices.

- ISO 817 & ISO 5149: International standards specifying classification, labeling, and safety requirements for refrigerants and refrigeration systems.

- EU F-Gas Regulation (EU) No 517/2014: Controls the use and emissions of fluorinated greenhouse gases, including R32, with phasedown targets and leak-checking requirements.

- U.S. EPA SNAP Program: Under Section 608 of the Clean Air Act, R32 is approved for specific applications but subject to refrigerant management and technician certification requirements.

- REACH & CLP Regulations (EU): Require proper classification, labeling, and safety data sheet (SDS) provision for R32.

Compliance with these standards is mandatory for importers, distributors, and end users.

Transportation Requirements

Transporting R32 requires adherence to hazardous materials regulations due to its A2L classification and pressurized state.

- UN Classification: R32 is classified under UN 3259, “Refrigerant gas, flammable, n.o.s.”, Class 2.1 (Flammable Gas).

- Packaging: Must be shipped in UN-approved cylinders or containers designed for pressurized gases, with protective valve caps and secure closures.

- Labeling & Marking: Cylinders must display:

- Proper shipping name: “Refrigerant gas, flammable, n.o.s. (Difluoromethane)”

- UN number: 3259

- Class 2.1 hazard label

- GHS pictograms for flammability and gas under pressure

- Documentation: Shipments require a Safety Data Sheet (SDS), transport documents noting hazardous classification, and, where applicable, emergency response information.

- Modes of Transport:

- Road (ADR): Comply with European Agreement concerning the International Carriage of Dangerous Goods by Road; includes vehicle placarding and driver training.

- Air (IATA): Subject to IATA Dangerous Goods Regulations; generally restricted or limited in quantity due to flammability.

- Sea (IMDG): Must comply with the International Maritime Dangerous Goods Code, including stowage and segregation requirements.

Storage Guidelines

Safe storage of R32 is critical to prevent leaks, fire hazards, and environmental release.

- Location: Store in a well-ventilated, dry, cool area away from direct sunlight and heat sources (>50°C maximum ambient temperature).

- Flammability Precautions:

- Keep away from ignition sources (sparks, open flames, electrical equipment not rated for hazardous areas).

- Prohibit smoking in storage areas.

- Use explosion-proof lighting and ventilation systems if stored indoors.

- Segregation: Store separately from oxidizers and incompatible materials (e.g., ammonia, strong bases).

- Cylinder Handling:

- Secure upright with chains or racks to prevent tipping.

- Use only approved lifting equipment; never drag, roll, or drop cylinders.

- Keep valve protection caps in place when not in use.

- Inventory Management: Implement a first-in, first-out (FIFO) system and conduct regular leak checks.

Handling and Use Safety Procedures

Personnel must be trained and equipped to handle R32 safely.

- Personal Protective Equipment (PPE): Include chemical-resistant gloves, safety goggles, flame-resistant clothing, and respiratory protection if ventilation is inadequate.

- Ventilation: Ensure adequate ventilation during charging, recovery, or maintenance to prevent accumulation of flammable concentrations.

- Leak Detection: Use electronic refrigerant leak detectors calibrated for HFCs/HFOs. Never use halide torches.

- System Design & Installation: Use only equipment and components certified for A2L refrigerants. Follow manufacturer guidelines for charge limits, piping, and safety clearances.

- Recovery & Recycling: Use recovery equipment rated for flammable refrigerants. Recover R32 before servicing or disposal. Do not vent to atmosphere.

Environmental and Disposal Compliance

Environmental protection is a core component of R32 compliance.

- Leak Prevention: Regularly monitor systems for leaks per local regulations (e.g., EU F-Gas mandates leak checks based on CO₂ equivalent charge).

- Reporting: Facilities may need to report R32 usage, emissions, or inventory changes to environmental agencies.

- End-of-Life Disposal:

- R32 must be recovered and sent to certified reprocessing or destruction facilities.

- Destruction methods include high-temperature incineration with scrubbing to prevent harmful byproducts.

- Never dispose of in landfills or release into the atmosphere.

- Record Keeping: Maintain logs of refrigerant purchases, usage, recovery, recycling, and disposal for audit purposes (typically 5+ years).

Training and Certification Requirements

Only trained and certified personnel should handle R32.

- Technician Certification: Required in many regions (e.g., Section 608 certification in the U.S., F-Gas certification in the EU).

- A2L-Specific Training: Covers flammability risks, safe handling, emergency procedures, and use of A2L-compatible tools and equipment.

- Employer Responsibility: Employers must provide training, PPE, and ensure compliance with local safety regulations.

Emergency Response Plan

Facilities handling R32 must have an emergency response plan.

- Spill or Leak Response:

- Evacuate area and eliminate ignition sources.

- Ventilate the space thoroughly.

- Do not attempt to stop a leak from a cylinder unless trained and equipped.

- Contact emergency services if large release occurs.

- Fire Involving R32:

- Use dry chemical, CO₂, or foam extinguishers.

- Cool exposed cylinders with water from a safe distance.

- Toxic gases (e.g., hydrogen fluoride) may form—evacuate and use self-contained breathing apparatus (SCBA).

- First Aid:

- Inhalation: Move to fresh air; seek medical attention if symptoms persist.

- Skin contact: Wash with soap and water; treat frostbite if cold exposure occurs.

- Eye contact: Flush with water for at least 15 minutes; consult a physician.

Recordkeeping and Audits

Maintain comprehensive documentation to demonstrate compliance:

- Refrigerant purchase records

- Cylinder tracking logs

- Leak inspection reports

- Recovery and disposal certificates

- Technician training certifications

- SDS and risk assessments

Regular internal audits help identify gaps and ensure ongoing compliance with logistics and safety standards.

Conclusion

R32 offers environmental advantages over higher-GWP refrigerants but requires robust logistical and compliance measures due to its mild flammability. Adhering to international standards, proper transport and storage practices, certified handling, and emergency preparedness ensures safe and lawful use across the supply chain. Continued training and regulatory vigilance are essential for all stakeholders involved in the R32 lifecycle.

Conclusion on Sourcing R32 Refrigerant:

Sourcing R32 refrigerant requires careful consideration of regulatory compliance, environmental impact, technical compatibility, and supply chain reliability. As a lower-global warming potential (GWP) refrigerant compared to traditional options like R410A, R32 is increasingly favored in modern air conditioning and heat pump systems, particularly in regions promoting environmentally sustainable technologies. However, its mild flammability (classified as A2L) necessitates adherence to safety standards during handling, installation, and storage.

When sourcing R32, it is essential to procure from certified and reputable suppliers who comply with international standards such as ISO, ASHRAE, and local environmental regulations. Ensuring product purity and proper cylinder labeling is critical for system performance and user safety. Additionally, technicians must be adequately trained in handling A2L refrigerants to mitigate risks.

The growing global shift toward energy-efficient and eco-friendly cooling solutions is driving increased availability of R32. Nevertheless, market access may vary by region due to regulatory frameworks and infrastructure readiness. Therefore, a strategic sourcing approach—considering supplier credentials, logistical feasibility, cost-effectiveness, and future regulatory trends—is vital for successful implementation and long-term sustainability.