The global HVAC compressor market is experiencing robust growth, driven by rising demand for energy-efficient cooling solutions and expanding infrastructure in emerging economies. According to Grand View Research, the global air conditioning compressor market was valued at USD 28.7 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 6.4% from 2024 to 2030. A key contributor to this upward trend is the continued servicing and retrofitting of legacy systems that rely on R22 refrigerant, despite its phase-down under international environmental regulations like the Montreal Protocol. As older R22 compressors reach end-of-life, demand for reliable replacement units has surged among maintenance teams and OEMs seeking compatible, cost-effective alternatives. This has spurred a specialized segment within the compressor manufacturing industry, with select players emerging as leaders in producing drop-in or optimized replacements for R22 systems. Based on market presence, product availability, technical support, and compatibility performance, the following ten manufacturers represent the most prominent suppliers in the R22 compressor replacement space.

Top 10 R22 Compressor Replacement Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Copeland: Next

Domain Est. 1995

Website: copeland.com

Key Highlights: Copeland’s next-gen Copeland Compressors are trusted by HVACR professionals worldwide for efficient, reliable & regulation-ready performance….

#2 United Refrigeration Inc.

Domain Est. 1995

Website: uri.com

Key Highlights: United Refrigeration is one of the largest wholesale distributors of HVACR equipment, parts, & supplies. Trusted among contractors, supermarkets, mechanics, ……

#3 Compressors

Domain Est. 1995

Website: gea.com

Key Highlights: GEA offers the largest compressor program for industrial refrigeration, air-conditioning and heat pump applications….

#4 First Co.

Domain Est. 1996

Website: firstco.com

Key Highlights: First Co., an HVAC manufacturer in Dallas, specializes in innovative heating and cooling systems for residential, multi-occupant, and commercial ……

#5 Air Compressors

Domain Est. 2001

Website: ingersollrand.com

Key Highlights: Ingersoll Rand offers high-quality commercial air compressors, industrial air compressors & compressed air services for a wide range of industries….

#6 Compressors for refrigeration, A/C and heating

Domain Est. 1995

Website: danfoss.com

Key Highlights: Commercial reciprocating compressors, inverters, light compressors and scroll compressors for refrigeration and air conditioning and heating applications….

#7 Compressors

Domain Est. 1996

Website: tecumseh.com

Key Highlights: AE1345A-FZ1A · R-401A · 4.24 ; AE1360A-FZ1A · R-401A · 6.12 ; AE1370A-FZ1A · R-401A · 6.69 ; AE1380A-GS1B · R-401A · 7.56 ; AE1390A-FZ1B · R-401A · 8.02….

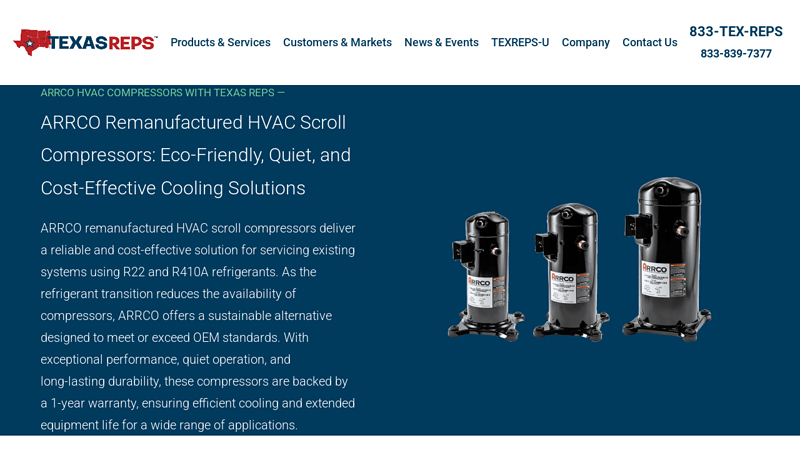

#8 ARRCO Remanufactured HVAC Compressors

Domain Est. 1998

Website: texasreps.com

Key Highlights: ARRCO remanufactured HVAC scroll compressors deliver a reliable and cost-effective solution for servicing existing systems using R22 and R410A refrigerants….

#9 r22 compressors

Domain Est. 2005

#10 Compressors

Domain Est. 2015

Website: m.lennoxpros.com

Key Highlights: Compressors · C0 ZR57KCE-PFV-950 R22 230V-1. Sale Clearance · C0 ZR81KCE-TFE-950 R22 575V-3. Sale Clearance · C0 ZR72KCE-TFE-950 R22 6.0T 575V-3. Sale Clearance ……

Expert Sourcing Insights for R22 Compressor Replacement

2026 Market Trends for R22 Compressor Replacement

The market for R22 compressor replacement is undergoing a significant transformation as the 2026 deadline for the complete phase-out of R22 refrigerant under the U.S. Environmental Protection Agency’s (EPA) Clean Air Act approaches. By 2026, the dynamics of this sector will be shaped by tightening regulations, shifting consumer behavior, technological innovation, and increasing economic pressures. Below is an analysis of the key trends expected to define the R22 compressor replacement landscape in 2026.

Regulatory Pressure and R22 Scarcity Will Peak

By 2026, the production and import of new R22 refrigerant in the United States will have been fully phased out for over a decade. This prolonged scarcity will drive R22 prices to historically high levels, making repair and recharging systems economically unviable for most consumers. As a result, demand for compressor-only replacements in existing R22 systems will decline sharply. Instead, HVAC service providers will increasingly steer customers toward complete system retrofits or full replacements using approved refrigerants such as R-410A, R-32, or emerging low-GWP alternatives like R-454B and R-466A.

Shift Toward System-Wide Retrofits and Full Replacements

Rather than replacing just the compressor—a temporary fix—property owners and facility managers will prioritize long-term solutions in 2026. The cost of sourcing compatible compressors for aging R22 units, combined with the risk of repeated failures, will make full system upgrades more attractive. HVAC contractors will focus on offering comprehensive replacement packages, including matched evaporator coils, condensing units, and smart thermostats, to improve efficiency, reliability, and compliance. This shift will reduce the standalone R22 compressor replacement market significantly.

Growth in Retrofit Solutions Using Alternative Refrigerants

While direct drop-in replacements for R22 are limited due to performance and safety concerns, 2026 will see expanded adoption of engineered retrofit refrigerants such as R-421A, R-422B, and R-438A, which are designed to work in existing R22 systems with minimal component changes. However, even these solutions will be transitional, as most manufacturers and contractors will recommend full system conversions to modern, energy-efficient platforms. Retrofit compressor kits compatible with newer refrigerants may gain niche use, especially in commercial applications where immediate full replacement is not feasible.

Emphasis on Energy Efficiency and Sustainability

By 2026, energy efficiency standards and environmental regulations will be more stringent. The U.S. Department of Energy (DOE) will have likely implemented updated minimum efficiency requirements, making older R22 systems non-compliant. Homeowners and businesses will prioritize replacements that reduce carbon footprints and energy costs. This trend will further erode demand for R22 compressor repairs, as investing in outdated technology will no longer align with sustainability goals or long-term savings.

Rise of Smart HVAC Systems and IoT Integration

The 2026 HVAC market will be increasingly dominated by smart, connected systems. New compressors and units will come equipped with IoT capabilities, remote monitoring, predictive maintenance, and integration with home automation platforms. These advanced features will make modern replacements far more appealing than repairing legacy R22 systems. Contractors will leverage this technology to offer value-added services, further incentivizing full system upgrades over piecemeal compressor replacements.

Labor and Supply Chain Challenges Persist

The shrinking pool of technicians trained to service R22 systems—due to declining demand and evolving certification requirements—will make compressor replacements harder to source and more expensive. Additionally, remaining R22 compressor inventory will be limited, often available only through secondary markets or refurbishers. These supply chain constraints will accelerate the transition away from R22-dependent technologies.

Conclusion

By 2026, the R22 compressor replacement market will be in steep decline, transitioning from a repair-oriented model to one dominated by full system replacements and retrofits using next-generation refrigerants. Regulatory, economic, and technological forces will converge to make continued use of R22 systems impractical. HVAC professionals and consumers alike will focus on long-term efficiency, compliance, and sustainability, rendering standalone compressor replacements a niche and increasingly obsolete solution.

Common Pitfalls When Sourcing R22 Compressor Replacements (Quality & IP Concerns)

Sourcing replacements for R22 compressors presents unique challenges due to the phase-out of R22 refrigerant and the resulting market dynamics. Buyers must navigate significant risks related to both product quality and intellectual property (IP) infringement. Failing to address these pitfalls can lead to system failures, safety hazards, warranty voidance, and legal exposure.

Poor Quality and Counterfeit Components

The declining availability of genuine R22 compressors has created a fertile ground for substandard and counterfeit products. Common quality-related pitfalls include:

- Non-OEM or Unverified Suppliers: Purchasing from unauthorized distributors or online marketplaces significantly increases the risk of receiving remanufactured, used, or outright counterfeit compressors that do not meet original specifications.

- Inferior Materials and Workmanship: Counterfeit or low-quality compressors often use cheaper materials (e.g., subpar windings, bearings, or lubricants) and lack rigorous quality control, leading to premature failure, overheating, or contamination of the refrigeration system.

- Incorrect Specifications: Some replacements may claim compatibility but have mismatched performance characteristics (e.g., BTU capacity, voltage, RPM, or refrigerant oil type), resulting in inefficient operation or damage to other system components.

Intellectual Property (IP) Infringement Risks

As R22 compressor production by major OEMs has ceased, many replacement units on the market infringe on the intellectual property of original manufacturers:

- Unauthorized Replicas and Clones: Numerous suppliers offer “compatible” compressors that are direct copies of patented designs from brands like Copeland, Danfoss, or Bristol. These clones often replicate trademarks, part numbers, and physical designs without licensing, constituting trademark and design patent infringement.

- Use of Original Part Numbers: Sellers may list products using genuine OEM part numbers (e.g., “Copeland ZR125”), misleading buyers into believing they are purchasing authentic equipment when they are not. This misrepresentation violates trademark laws.

- Legal and Warranty Implications: Using an IP-infringing compressor can void equipment warranties and expose contractors or end-users to potential legal liability, especially if the counterfeit product causes system damage or safety incidents.

To mitigate these risks, always source from authorized distributors, verify product authenticity through manufacturer databases, and avoid deals that seem too good to be true. Prioritizing genuine or properly licensed replacements ensures system reliability, safety, and compliance with IP regulations.

Logistics & Compliance Guide for R-22 Compressor Replacement

Scope and Purpose

This guide outlines the logistical planning and regulatory compliance requirements for replacing compressors in HVAC systems utilizing R-22 refrigerant. Due to R-22’s classification as an ozone-depleting substance under environmental regulations, special handling, recordkeeping, and disposal protocols must be followed.

Regulatory Compliance Overview

R-22 (Freon) is regulated under the U.S. Environmental Protection Agency (EPA) Section 608 of the Clean Air Act. As of January 1, 2020, the production and import of R-22 are banned in the United States, making recovery, recycling, and proper handling mandatory during compressor replacement.

Key compliance requirements include:

– Certification of technicians handling refrigerants (EPA Section 608 Type II or Universal Certification).

– Use of EPA-approved refrigerant recovery equipment.

– Complete recovery of R-22 prior to compressor removal.

– Accurate recordkeeping of refrigerant quantities recovered, recycled, or reclaimed.

– Prohibition on intentional venting of R-22 into the atmosphere.

Pre-Replacement Planning

-

System Evaluation:

Confirm the system uses R-22 and document current refrigerant charge. Assess compressor failure mode to prevent recurrence. -

Technician Certification Verification:

Ensure all personnel involved hold valid EPA 608 certification. Maintain copies of certification on file. -

Schedule Refrigerant Management:

Arrange for certified refrigerant reclaimer services if on-site recycling is not possible. Confirm logistics for cylinder transport and chain-of-custody documentation. -

Procurement of Replacement Components:

Verify compatibility of the new compressor with existing system components. Consider transitioning to an R-22 alternative refrigerant or upgrading to a newer system using approved refrigerants (e.g., R-410A, R-454B).

Refrigerant Recovery Procedure

-

System Isolation:

Shut down and lock out the HVAC system. Close service valves where applicable. -

Recovery Process:

Connect a certified recovery unit to high and low side service ports. Recover all R-22 into a DOT-approved recovery cylinder. Confirm recovery to a vacuum level per EPA standards (typically 0 psi gauge or 4 inches mercury vacuum). -

Documentation:

Record the weight of recovered refrigerant, date, technician name, EPA certification number, and cylinder ID. Retain logs for a minimum of three years.

Compressor Replacement Execution

-

Safe Removal:

Cut refrigerant lines using nitrogen-purged techniques to minimize oxidation. Cap all open ports immediately. -

Installation of New Compressor:

Follow manufacturer specifications for mounting, oil type/quantity, and electrical connections. Use proper brazing practices and nitrogen purge during welding. -

Evacuation and Charging:

Evacuate the system to a deep vacuum (typically 500 microns or less) and hold for stability. Charge with recovered/recycled R-22 only if legally permissible and system-compatible. Otherwise, use approved retrofit refrigerants with corresponding oil and component modifications.

Post-Replacement Compliance

-

Leak Testing:

Conduct thorough leak testing using electronic detectors or soap bubbles. Repair any leaks before system startup. -

System Performance Verification:

Monitor superheat, subcooling, pressures, and temperatures to ensure proper operation. -

Final Recordkeeping:

Update equipment service records to include: - Date of compressor replacement

- Quantity and type of refrigerant added

- Technician certification details

- Refrigerant recovery documentation

- Any retrofit modifications made

Disposal and Recycling

- Dispose of the failed compressor in accordance with local hazardous waste regulations. Compressors may contain residual refrigerant or oil.

- Recycle metal components through certified e-waste or scrap metal handlers.

- Return used refrigerant cylinders to reclaimers with proper manifests.

Environmental and Safety Considerations

- Always wear appropriate PPE: gloves, safety glasses, and ventilation in confined spaces.

- Never mix refrigerants. Cross-contamination renders refrigerants unreclaimable.

- Train all staff on spill response procedures and emergency shutdown protocols.

Conclusion

Compliance with environmental regulations is critical when replacing R-22 compressors. Proper logistics planning, certified technician involvement, accurate documentation, and responsible refrigerant handling ensure legal adherence and environmental protection. Consider long-term system upgrades to eliminate reliance on phased-out refrigerants.

Conclusion for Sourcing R-22 Compressor Replacement:

In conclusion, sourcing an R-22 compressor replacement presents significant challenges due to the global phaseout of R-22 refrigerant under the Montreal Protocol and increasingly stringent environmental regulations. As R-22 production has been largely discontinued in many countries, including the United States, availability of compatible compressors is limited and prices have risen substantially. While retrofit compressors using approved R-22 alternatives (such as R-404A, R-422D, or R-427A) are available, they require careful system evaluation and may not deliver identical performance.

For long-term reliability, cost-effectiveness, and environmental compliance, it is generally recommended to consider upgrading the entire system to a modern, R-22-free refrigeration platform rather than replacing just the compressor. This approach ensures improved energy efficiency, reduces future maintenance risks, and aligns with current and future regulatory requirements.

If replacement is necessary, thorough due diligence is required to ensure compatibility, proper retrofitting procedures, and adherence to local codes and refrigerant handling regulations. Ultimately, working with a licensed HVAC professional and evaluating the total cost of ownership will support the best decision—whether to retrofit, replace, or upgrade the system entirely.