The global HVAC market is experiencing steady expansion, driven by rising construction activities, urbanization, and increasing demand for energy-efficient cooling solutions. According to Grand View Research, the global air conditioning market was valued at USD 134.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.4% from 2023 to 2030. While the industry transitions toward environmentally friendly refrigerants, R22—though being phased out under regulatory mandates like the Montreal Protocol—remains relevant in legacy systems and certain regional markets. As demand persists for maintenance, replacements, and retrofitting of R22-compatible units, several manufacturers continue to support existing infrastructure while adapting to evolving standards. In this landscape, a select group of leading manufacturers have maintained strong market positions through technical expertise, service networks, and transitional product offerings. Here are the top 7 R22 AC manufacturers shaping the current and transitional phase of the cooling industry.

Top 7 R22 A C Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 What Is R

Domain Est. 1993

Website: trane.com

Key Highlights: R-22 refrigerant is one specific type of refrigerant, which is the main chemical your HVAC system uses to cool your home. It’s also known as R-22 Freon™ and ……

#2 Homeowners and Consumers: Frequently Asked Questions

Domain Est. 1997

Website: epa.gov

Key Highlights: Information to help homeowners make informed decisions when purchasing, servicing, or disposing of air conditioners or other equipment that ……

#3 hydrochlorofluorocarbon HCFC

Domain Est. 1998

Website: freon.com

Key Highlights: Learn how Freon™ 22 (R-22) refrigerant has been the refrigerant of choice for years in air conditioners and a variety of commercial refrigeration systems….

#4 Discover the Difference Between R22 and R401A

Domain Est. 1999

Website: ajdanboise.com

Key Highlights: At one time, R22, commonly known by its brand name Freon, was used as refrigerant in nearly every residential air conditioner throughout the ……

#5 R

Domain Est. 2000

Website: opteon.com

Key Highlights: An ideal retrofit refrigerant offers comparable performance to R-22, while minimizing or eliminating the need for component or oil changes….

#6 What Is R-22?

Domain Est. 2001

Website: americanstandardair.com

Key Highlights: R-22, also known as Freon®, is a common refrigerant used in older air conditioning systems. Find out why it’s being phased out and why that matters….

#7 R22

Domain Est. 2023

Website: mightyservhvac.com

Key Highlights: The Freon phaseout affects you if your air conditioner contains R-22 refrigerant, commonly referred to as Freon….

Expert Sourcing Insights for R22 A C

H2: 2026 Market Trends for R-22 in Air Conditioning

By 2026, the market for R-22 refrigerant in air conditioning systems will continue to reflect the long-term phaseout initiated under the U.S. Environmental Protection Agency’s (EPA) regulations and the Montreal Protocol. R-22, a hydrochlorofluorocarbon (HCFC), is being phased out due to its ozone-depleting properties and high global warming potential (GWP). As a result, the 2026 market landscape for R-22 is characterized by scarcity, rising costs, and a shift toward sustainable alternatives.

-

Limited Availability and Rising Prices

By 2026, the production and import of new R-22 in the United States will have been fully discontinued since the 2020 phaseout deadline. The only R-22 available will come from recycled, reclaimed, or existing stockpiles, leading to significantly constrained supply. This scarcity will keep prices elevated, making R-22 one of the most expensive refrigerants on the market. Technicians and HVAC service providers will face higher operational costs when maintaining older systems. -

Decline in Demand Due to System Obsolescence

As older R-22-based HVAC systems reach the end of their lifespan, demand for the refrigerant will continue to decline. Homeowners and businesses are increasingly opting to replace aging units with newer, energy-efficient models that use environmentally friendly refrigerants such as R-410A, R-32, or next-generation low-GWP options like R-454B. This transition reduces reliance on R-22 and accelerates its market irrelevance. -

Growth in Retrofit and Replacement Services

A key trend in 2026 will be the expansion of retrofitting services, where technicians convert R-22 systems to use approved alternative refrigerants. While not always recommended due to performance and warranty concerns, retrofits remain a cost-saving option for some users. More commonly, HVAC companies are promoting full system replacements, positioning them as long-term investments in efficiency and compliance. -

Regulatory and Environmental Compliance Focus

HVAC professionals must adhere to strict EPA Section 608 regulations, including proper handling, recovery, and recycling of R-22. In 2026, enforcement and awareness around these rules will remain high. Companies that manage refrigerant inventories and disposal responsibly will gain a competitive edge, especially as environmental sustainability becomes a greater priority for consumers and regulators. -

Increased Adoption of Eco-Friendly Refrigerants

The R-22 phaseout has accelerated innovation in refrigerant technology. By 2026, newer systems using A2L refrigerants (mildly flammable but low-GWP) will become more widespread. These alternatives align with global climate goals and future-proof HVAC installations against regulatory changes.

In conclusion, the 2026 market for R-22 in air conditioning is one of decline and transition. While residual demand persists for servicing legacy systems, the overall trajectory points toward obsolescence. Stakeholders in the HVAC industry must adapt by investing in training, embracing new technologies, and guiding customers toward sustainable, compliant cooling solutions.

Common Pitfalls When Sourcing R22 AC Units (Quality and Intellectual Property)

Sourcing R22 air conditioning units—especially given the phaseout of this refrigerant under the Montreal Protocol—presents significant challenges related to both product quality and intellectual property (IP) risks. Being aware of these pitfalls is crucial for avoiding legal, operational, and safety issues.

1. Poor Quality and Non-Compliant Equipment

One of the most prevalent issues when sourcing R22 AC units is encountering substandard equipment that fails to meet safety, performance, or regulatory standards.

- Use of Counterfeit or Reconditioned Parts: Many suppliers, particularly in unregulated markets, offer units that appear new but contain recycled, refurbished, or counterfeit components. These parts often degrade quickly, leading to frequent breakdowns and higher maintenance costs.

- Lack of Certification and Testing: Genuine R22 systems should meet international standards (e.g., ASHRAE, ISO, CE). Sourcing from unreliable vendors may result in units lacking proper certification, increasing the risk of inefficiency, refrigerant leaks, or even fire hazards.

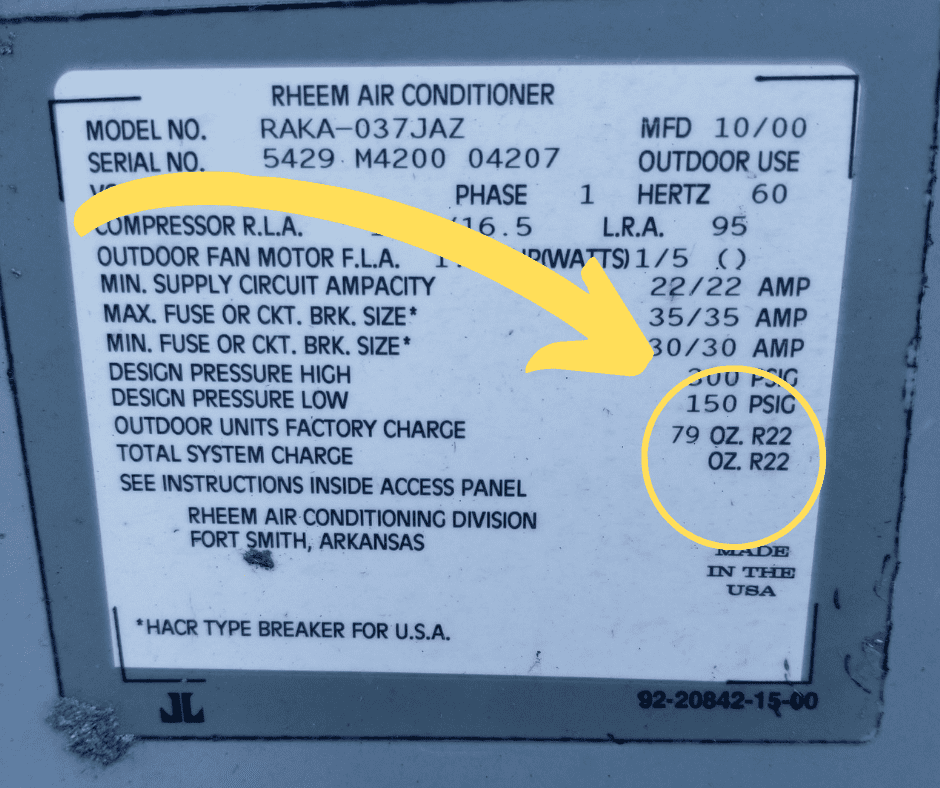

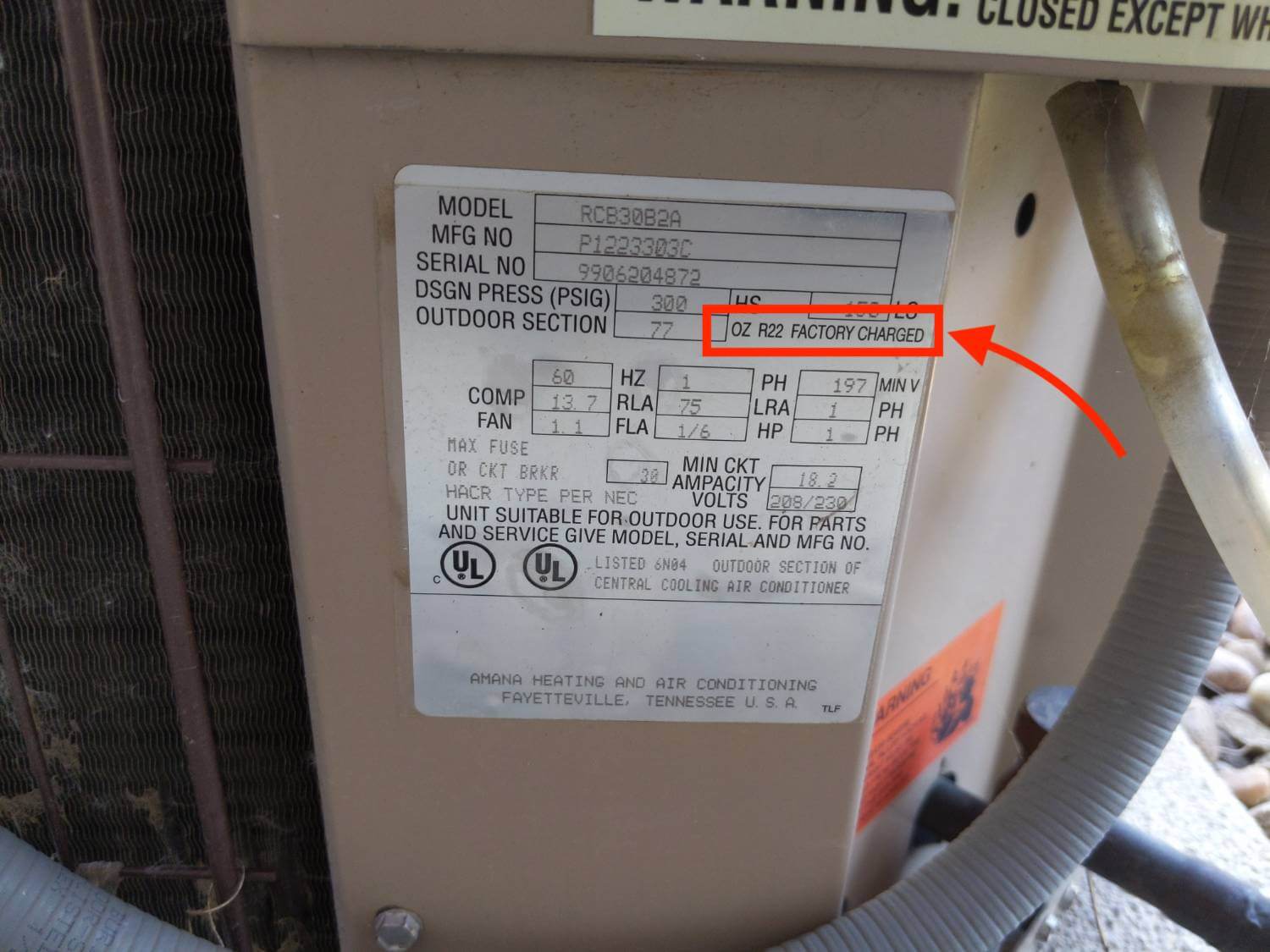

- Inaccurate Refrigerant Charging: Improperly charged R22 systems—either overcharged or undercharged—reduce cooling efficiency, increase energy consumption, and can damage compressors. This is common with poorly assembled or refilled units.

- Non-Original Refrigerant: Some suppliers may claim to use R22 but substitute it with cheaper, illegal, or incompatible refrigerants (e.g., R400-series blends). This compromises system performance and may void warranties or violate environmental regulations.

2. Intellectual Property (IP) Infringement

Sourcing R22 AC units, especially from overseas manufacturers or gray market suppliers, exposes businesses to serious IP risks.

- Counterfeit Branded Units: Unauthorized manufacturers often replicate the logos, labels, and designs of well-known HVAC brands (e.g., Carrier, Trane, Daikin). These counterfeit units infringe on trademarks and can lead to legal liability for both importers and end users.

- Patented Technology Violations: Many components in R22 systems—such as compressors, heat exchangers, and control systems—are protected by patents. Sourcing units that incorporate these technologies without licensing exposes buyers to IP litigation.

- Gray Market Imports: Units originally intended for markets with less stringent regulations may be diverted to regions where R22 use is restricted or banned. These imports often bypass customs checks and can involve IP violations or non-compliance with local safety laws.

- Lack of Traceability and Documentation: Reputable suppliers provide detailed documentation, including proof of origin, compliance certificates, and warranty information. Lack of transparency often indicates IP-infringing or illegally sourced products.

3. Regulatory and Environmental Risks

Even if quality and IP appear acceptable, sourcing R22 units can lead to compliance issues due to global phaseout regulations.

- Violation of EPA or Local Regulations: In many countries (e.g., the U.S., EU), the production and import of new R22 equipment are banned. Sourcing new R22 units may violate these laws, resulting in fines or equipment seizure.

- Difficulty in Servicing and Refrigerant Supply: Since virgin R22 is no longer produced in many regions, obtaining legal refrigerant for top-ups or repairs is costly and limited to reclaimed sources. This increases long-term operational risk.

Best Practices to Avoid Pitfalls

- Source from Authorized Distributors: Purchase only from certified dealers of reputable HVAC brands to ensure authenticity and compliance.

- Verify Certifications: Request and validate product certifications (e.g., UL, CE, ISO) and refrigerant documentation.

- Conduct Supplier Audits: Evaluate suppliers’ manufacturing practices, IP compliance, and supply chain transparency.

- Consider Retrofitting or Replacement: Instead of sourcing R22 units, explore retrofitting existing systems with approved refrigerants (e.g., R407C, R422D) or upgrading to modern, higher-efficiency systems using eco-friendly refrigerants.

By understanding these common pitfalls, businesses can make informed decisions that protect their operations, legal standing, and environmental responsibility when dealing with legacy R22 AC systems.

Logistics & Compliance Guide for R-22 A/C Equipment

Handling and Transportation of R-22 Systems

Transportation of air conditioning units containing R-22 refrigerant must adhere to strict environmental and safety regulations due to the ozone-depleting nature of R-22 (chlorodifluoromethane). All units must be securely fastened to prevent damage during transit. Ensure that refrigerant lines are capped or sealed to minimize the risk of leaks. Use appropriate lifting equipment when moving heavy units, and avoid tilting or inverting systems unless specified by the manufacturer. Transport vehicles should be well-ventilated, and drivers must be trained in handling hazardous materials if applicable.

Regulatory Compliance and Environmental Requirements

R-22 is regulated under the U.S. Environmental Protection Agency (EPA) Clean Air Act, specifically Section 608, which prohibits the intentional venting of ozone-depleting substances. As of January 1, 2020, the production and import of R-22 are banned in the United States, allowing only recycled, reclaimed, or existing stock for servicing. Technicians must be Section 608 certified to handle R-22. Additionally, all maintenance, repair, and decommissioning activities must include proper refrigerant recovery using EPA-approved equipment. Documentation of refrigerant recovery and disposal must be maintained for a minimum of three years.

End-of-Life Disposal and Recycling

When an R-22-based air conditioning system reaches end-of-life, it must be decommissioned in compliance with EPA regulations. A certified technician must recover all remaining refrigerant using a recovery machine, which must meet EPA standards. The recovered R-22 can be recycled or reclaimed for reuse, but only by certified reprocessors. The unit’s components, including copper tubing and compressors, should be recycled through authorized facilities. Disposal of the system without proper refrigerant recovery is a violation of federal law and may result in significant fines.

Recordkeeping and Reporting Obligations

Facilities managing R-22 equipment must maintain detailed logs of all refrigerant transactions, including additions, recoveries, and servicing. Each entry should include the date, quantity of refrigerant handled, technician certification number, and method of recovery. These records are subject to inspection by regulatory authorities. For commercial systems containing more than 50 pounds of refrigerant, periodic leak inspections are required, and if a system exceeds the applicable leak rate threshold, repair and follow-up verification are mandatory within strict timeframes.

Conclusion for Sourcing R-22 for Air Conditioning Systems:

Sourcing R-22 refrigerant has become increasingly challenging and costly due to its phase-out under the Montreal Protocol and strict EPA regulations aimed at protecting the ozone layer. As of 2020, the production and import of new R-22 have been banned in the United States, and globally, its use is being rapidly phased out. Currently, the only available R-22 comes from recycled, reclaimed, or existing stockpiles, making it expensive and limited in supply.

For owners of older HVAC systems that rely on R-22, the long-term solution is not continued reliance on this dwindling refrigerant but rather proactive system upgrades. Transitioning to newer, more energy-efficient air conditioning units that use environmentally friendly refrigerants such as R-410A or R-32 is the most sustainable and cost-effective approach. Retrofitting existing systems is possible in some cases but often comes with compatibility and efficiency drawbacks.

In conclusion, while it may still be possible to source R-22 for maintenance or repairs in the short term, doing so is neither economically nor environmentally sustainable. Businesses and homeowners are strongly encouraged to plan for the eventual replacement of R-22-dependent systems to ensure reliability, reduce environmental impact, and avoid escalating maintenance costs.