The global portable heater market is experiencing steady growth, driven by rising demand for energy-efficient heating solutions across residential and commercial sectors. According to Grand View Research, the global electric heater market was valued at USD 3.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This growth is fueled by colder climate patterns, increased urbanization, and advancements in heating technologies that prioritize safety, efficiency, and portability. As consumer preferences shift toward compact, reliable, and smart-enabled heating units, quart-sized heaters—known for their balance of heating power and space-saving design—have gained traction in North America, Europe, and parts of Asia-Pacific. With key players investing in innovation and sustainability, the competitive landscape among manufacturers is intensifying. Below, we spotlight the top 8 quart heater manufacturers leading the market through technological advancement, product reliability, and strong distribution networks.

Top 8 Quarts Heaters Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

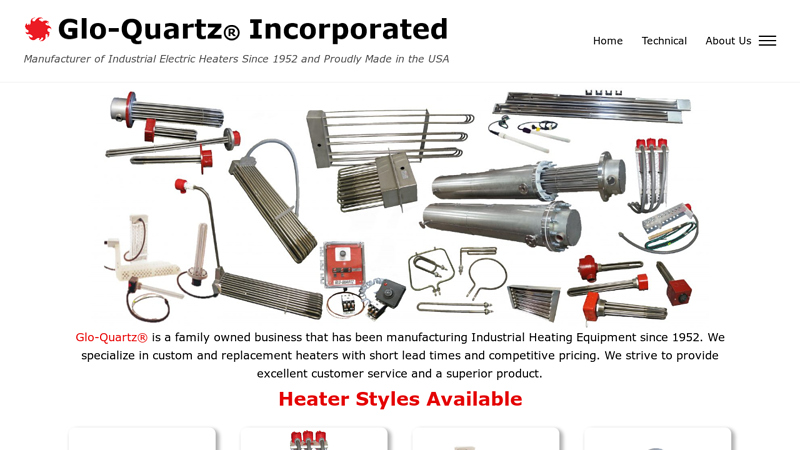

#1 Glo

Domain Est. 1997 | Founded: 1952

Website: gloquartz.com

Key Highlights: Glo-Quartz is a family owned business that has been manufacturing Industrial Heating Equipment since 1952. We specialize in custom and replacement heaters….

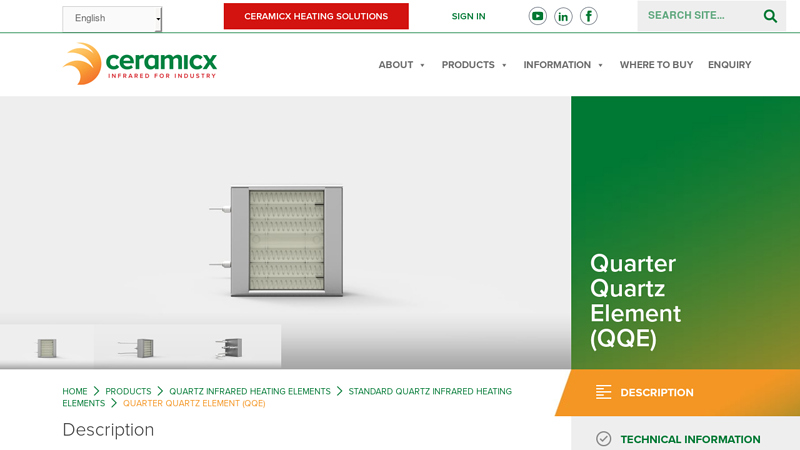

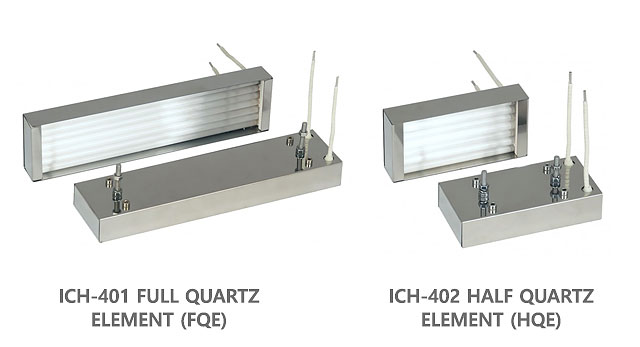

#2 Quarter Quartz Element (QQE)

Domain Est. 1998

Website: ceramicx.com

Key Highlights: A versatile infrared quartz heating element (125 – 250 W) providing an instant heat response for a variety of industrial process applications. These elements ……

#3 Quartz Infrared Electric Heating Elements

Domain Est. 2001

Website: quartzinfrared.com

Key Highlights: Manufacturer of custom and standard replacement Medium Wave Quartz Infrared Heating Elements….

#4 Technical – Infrared Quartz Heater Manufacturer

Domain Est. 2001

Website: tansun.com

Key Highlights: We cover the different types of infrared heating from shortwave (quartz) to long wave (far) infrared heating. IP ratings are fully explained….

#5 Quartz Infrared Heaters

Domain Est. 1998

Website: infraredheaters.com

Key Highlights: Nearly instantaneous heat-up and can provide heat for specific areas within a large area. 120V-480V 1500-3000W, two lengths; 46″ & 57″, Built-in Adjustable ……

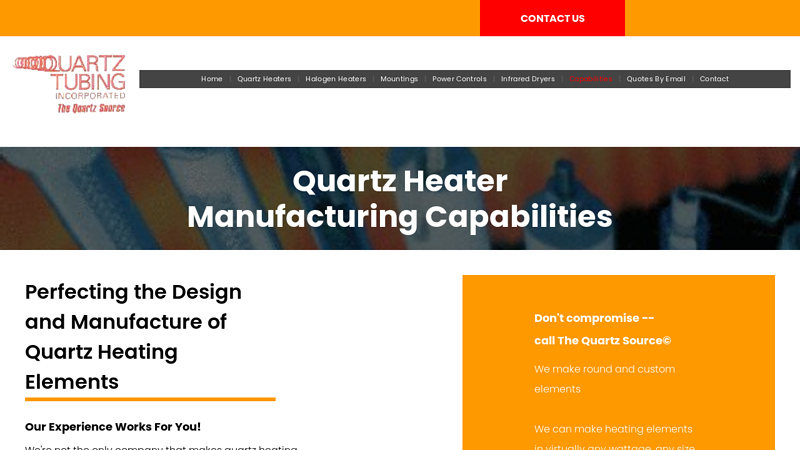

#6 Quartz Heater Manufacturing Capabilities

Domain Est. 1998

Website: quartztubing.com

Key Highlights: Thanks to our quartz heater manufacturing capabilities, the team at Quartz Tubing can create the perfect design for your quartz and halogen heater elements….

#7 Quartz Heater

Domain Est. 2009

Website: nexthermal.com

Key Highlights: Constructed from high-quality quartz, these heaters offer exceptional durability, rapid heat-up times, and precise temperature control….

#8 Quartz Infrared Heating Elements

Domain Est. 2016

Website: infra-heater.com

Key Highlights: EUROLINA high quality infrared quartz heating elements feature fast heating thus naturally delivering instant heat to the objects and warming up the space….

Expert Sourcing Insights for Quarts Heaters

H2: 2026 Market Trends for Quartz Heaters

As the global demand for energy-efficient and cost-effective heating solutions continues to rise, the quartz heater market is poised for significant transformation by 2026. Driven by technological advancements, environmental regulations, and evolving consumer preferences, several key trends are expected to shape the industry in the coming years.

-

Increased Demand for Energy Efficiency

By 2026, energy efficiency will remain a top priority for consumers and businesses alike. Quartz heaters, known for their rapid heat-up times and targeted heating capabilities, are well-positioned to benefit from this trend. Advances in heating element design and improved reflector technology will enhance thermal efficiency, reducing energy consumption by up to 20–30% compared to earlier models. Regulatory standards, such as updated energy labeling in the EU and ENERGY STAR certifications in North America, will further push manufacturers to innovate and meet higher efficiency benchmarks. -

Integration of Smart Technology

Smart home integration is becoming a standard feature across home appliances. By 2026, a growing number of quartz heaters are expected to include Wi-Fi connectivity, app-based controls, voice assistant compatibility (e.g., Alexa, Google Assistant), and AI-driven temperature optimization. These features allow users to schedule heating cycles, monitor energy usage, and control devices remotely—enhancing convenience and energy savings. -

Sustainability and Eco-Friendly Materials

Environmental concerns will continue to influence product development. Manufacturers are anticipated to adopt more sustainable practices, such as using recyclable materials in construction, minimizing packaging waste, and reducing carbon footprints in production. Additionally, as renewable energy becomes more widespread, quartz heaters—being compatible with solar-powered electricity—will be promoted as part of green home ecosystems. -

Growth in Commercial and Industrial Applications

While quartz heaters are traditionally used in residential settings, their application in commercial and industrial sectors is expanding. By 2026, demand is expected to rise in spaces such as warehouses, workshops, and outdoor hospitality areas due to their ability to provide instant, directional heat with minimal warm-up time. Infrared quartz models, in particular, are seeing increased adoption for spot heating in manufacturing and drying processes. -

Regional Market Expansion

The Asia-Pacific region, especially countries like India and Southeast Asian nations, is projected to experience robust growth due to urbanization, rising disposable incomes, and colder seasonal climates in certain areas. Europe will remain a strong market due to stringent energy regulations and consumer preference for efficient electric heating. North America will see steady growth, driven by renovations, cold weather events, and the popularity of supplemental heating solutions. -

Competition and Price Optimization

With increasing competition from other electric heating technologies (e.g., ceramic and oil-filled radiators), quartz heater manufacturers will focus on price-performance optimization. Economies of scale and advancements in manufacturing will likely lead to more affordable premium models, making smart and high-efficiency quartz heaters accessible to a broader consumer base. -

Focus on Health and Safety Features

Consumer awareness around indoor air quality and safety will drive innovations in quartz heater design. By 2026, expect widespread inclusion of overheat protection, tip-over switches, cool-touch exteriors, and low EMF (electromagnetic field) emissions. Additionally, quartz heaters do not rely on fans, reducing dust circulation—appealing to allergy-sensitive users.

In conclusion, the quartz heater market in 2026 will be characterized by smarter, greener, and more efficient products tailored to both residential and commercial needs. As innovation accelerates and global energy trends shift toward electrification and sustainability, quartz heaters are set to maintain a competitive edge in the portable and space heating sector.

Common Pitfalls Sourcing Quartz Heaters (Quality & IP)

Sourcing quartz heaters involves navigating several potential pitfalls related to both product quality and intellectual property (IP) risks. Failure to address these can lead to performance issues, safety hazards, supply chain disruptions, or legal liabilities.

Quality-Related Pitfalls

-

Inconsistent Heating Performance

Low-cost or poorly manufactured quartz heaters often suffer from uneven heat distribution, hotspots, or inconsistent wattage output. This can compromise process reliability in applications like industrial drying, curing, or semiconductor manufacturing. -

Poor Material Quality and Construction

Inferior quartz tubing (e.g., impure fused silica) or substandard heating elements (like low-grade tungsten or improper coil winding) reduce efficiency, lifespan, and thermal response. Cheap seals and end caps may degrade quickly under thermal cycling. -

Inadequate Thermal Shock Resistance

Genuine high-purity quartz withstands rapid temperature changes. Lower-quality alternatives may crack or shatter during operation, posing safety risks and increasing downtime. -

Lack of Proper Testing and Certification

Suppliers may not provide independent test reports for electrical safety (e.g., UL, CE), temperature uniformity, or lifespan. Unverified claims about watt density or maximum operating temperature can be misleading. -

Insufficient Customization and Documentation

Off-the-shelf units may not meet specific dimensional, spectral, or mounting requirements. Lack of detailed datasheets, performance curves, or installation guidelines complicates integration and troubleshooting.

Intellectual Property (IP)-Related Pitfalls

-

Design Infringement Risks

Some manufacturers replicate patented heater designs (e.g., reflector geometry, filament configuration, or terminal arrangements) without authorization. Sourcing from such suppliers exposes buyers to potential IP litigation, especially in regulated industries. -

Use of Counterfeit or Clone Products

Certain suppliers offer “compatible” or “generic” versions of branded heaters that mimic proprietary designs. These may infringe on patents or trademarks, and using them can lead to legal exposure and reputational damage. -

Ambiguous IP Ownership in Custom Designs

When co-developing custom heaters, failure to clearly define IP ownership in contracts may result in disputes. Suppliers might claim rights to design improvements or reuse custom designs for other clients. -

Lack of Transparency in Manufacturing Origins

Some suppliers outsource production to third parties without disclosing the actual manufacturer. This opacity increases the risk of unknowingly procuring IP-infringing products or components made using stolen designs. -

Inadequate Legal Protections in Contracts

Purchase agreements that omit IP indemnification clauses leave buyers vulnerable. Without clear terms, the buyer may be held liable for IP violations committed by the supplier.

Mitigation Strategies

- Conduct thorough supplier audits, including factory visits and quality certifications (ISO 9001, etc.).

- Request detailed technical documentation and test reports.

- Perform sample testing under real operating conditions.

- Verify patent databases for existing IP relevant to the heater design.

- Include robust IP indemnification and confidentiality clauses in procurement contracts.

- Work with reputable, transparent suppliers who respect IP and provide traceable manufacturing processes.

By proactively addressing these quality and IP pitfalls, organizations can ensure reliable performance, regulatory compliance, and legal safety in their quartz heater sourcing.

Logistics & Compliance Guide for Quartz Heaters

Product Classification & Documentation

Quartz heaters are typically classified under HS Code 8516.79 (Electrical space heating appliances) for international trade. Accurate classification ensures correct tariffs and compliance with customs regulations. Required documentation includes commercial invoices, packing lists, bill of lading or air waybills, and a Certificate of Conformity (if applicable). Ensure product labeling includes voltage, wattage, model number, and manufacturer details to meet customs and safety verification requirements.

Safety & Regulatory Compliance

Quartz heaters must comply with electrical safety standards in the destination market. In the United States, compliance with UL 1278 (Movable Electric Room Heaters) or UL 2021 is mandatory. In the European Union, the CE marking is required, demonstrating conformity with the Low Voltage Directive (2014/35/EU), Electromagnetic Compatibility Directive (2014/30/EU), and the RoHS Directive (2011/65/EU). Other regions may require certifications such as UKCA (UK), RCM (Australia/New Zealand), or PSE (Japan). Always verify local regulatory requirements before shipment.

Packaging & Handling Requirements

Use robust, double-walled corrugated cardboard boxes with internal foam or molded inserts to protect quartz tubes and controls during transit. Clearly label packages with “Fragile,” “This Side Up,” and “Do Not Stack” indicators. Ensure adequate ventilation in packaging to prevent moisture buildup. Palletize shipments securely using stretch wrap and corner boards; limit stack height to prevent crushing. Include user manuals and safety warnings in the local language of the destination country.

Import Restrictions & Duties

Check for import restrictions related to energy efficiency or hazardous materials. Some countries regulate heater wattage or require minimum energy performance standards (MEPS). Duties vary by country and trade agreements—consult local customs authorities or a licensed customs broker for accurate duty rates. Consider utilizing trade programs such as GSP (Generalized System of Preferences) where applicable to reduce tariffs.

Transportation & Shipping Modes

Quartz heaters can be shipped via ocean freight (FCL or LCL), air freight, or ground transport depending on urgency and volume. For ocean freight, ensure containers are dry and protected from temperature extremes. Air freight offers faster delivery but higher costs and stricter dimensional weight rules. Coordinate with carriers experienced in handling electrical appliances to minimize risk of damage and delays.

Environmental & Disposal Regulations

Quartz heaters may contain electronic components subject to WEEE (Waste Electrical and Electronic Equipment) regulations in the EU and similar e-waste laws elsewhere. Manufacturers or importers may be responsible for recycling fees or take-back programs. Avoid packaging materials containing restricted substances per environmental directives. Provide end-of-life disposal instructions in user documentation.

Post-Import Compliance & Monitoring

After importation, maintain records of compliance certifications, test reports, and customs filings for at least five years. Monitor regulatory updates in target markets, as standards for electrical heaters may change. Establish a process for handling product recalls or non-compliance issues, including customer notification and return logistics if required.

Conclusion for Sourcing Quartz Heaters

After a thorough evaluation of suppliers, technical specifications, cost structures, and market availability, sourcing quartz heaters presents a strategic opportunity to enhance heating efficiency, reduce energy consumption, and improve response times across various applications—be it industrial processes, commercial spaces, or specialty heating needs. Key suppliers have been assessed based on product quality, compliance with safety and energy standards, lead times, and after-sales support.

The most viable sourcing options combine reliability, scalability, and competitive pricing, with several manufacturers in Asia and Europe offering strong value propositions. Emphasis should be placed on partnering with suppliers who provide consistent product performance, customization capabilities, and certifications such as CE, RoHS, and ISO standards.

In conclusion, by establishing relationships with pre-qualified suppliers and implementing a structured procurement strategy, organizations can ensure a stable supply of high-performance quartz heaters that meet technical requirements while optimizing total cost of ownership. Future sourcing efforts should continue to monitor advancements in infrared and energy-efficient heating technologies to maintain a competitive edge.