The global laboratory glassware market is witnessing steady expansion, driven by increasing R&D investments in pharmaceuticals, biotechnology, and academic research. According to Mordor Intelligence, the laboratory glassware market was valued at USD 2.5 billion in 2023 and is projected to grow at a CAGR of over 5.2% through 2029. A key segment within this market is Pyrex chemistry glassware, prized for its thermal resistance, optical clarity, and chemical durability. As demand rises for high-performance, reliable lab equipment, the role of reputable manufacturers becomes increasingly critical. These leading producers not only set quality benchmarks but also drive innovation in borosilicate glass technology. Below are the top six Pyrex chemistry glassware manufacturers shaping the industry today.

Top 6 Pyrex Chemistry Glassware Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 A unique glass

Founded: 1915

Website: pyrex.eu

Key Highlights: 14-day returnsInnovation. From pie dishes to air fryer specific dishes, the Pyrex® brand has been at the forefront of trends since 1915.Missing: chemistry manufacturer…

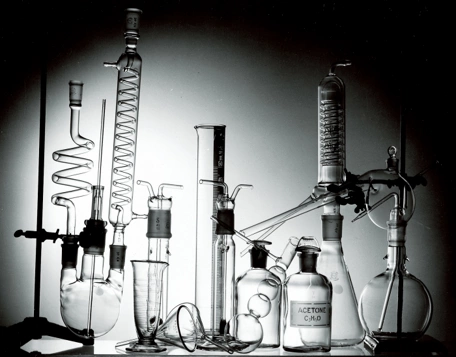

#2 Laboratory Glassware

Domain Est. 1991

Website: corning.com

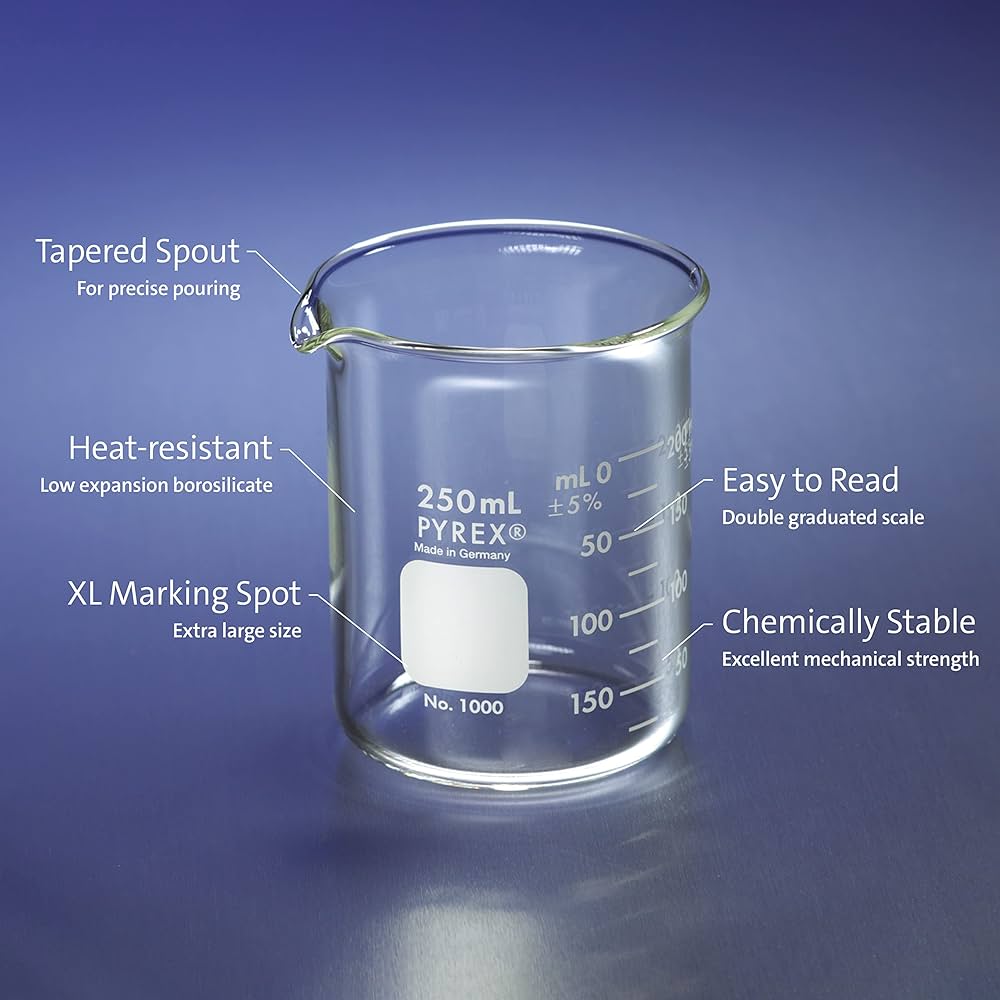

Key Highlights: Exceptional strength and stability. Brilliant transparency. Superior resistance to chemicals, contaminants, and drastic changes in temperature….

#3 PYREX® Test Tube with Beaded Rim

Domain Est. 1991

Website: ecatalog.corning.com

Key Highlights: These tubes are made from special tubing to give the optimum wall thickness. They are well annealed, resistant to heat, and chemically stable….

#4 PYREX®

Domain Est. 1996

Website: dwk.com

Key Highlights: PYREX® borosilicate glass was originally developed in 1908 by Corning Glass Works for use on the American railroads to overcome a problem with train lanterns….

#5 Pyrex

Domain Est. 1999

Website: pyrex.com

Key Highlights: Choose a Pyrex® brand and select your location. pyrex-glassware-white. Laboratory Glassware. glassware. Select your Location. North America · Europe · Japan ……

#6 Pyrex Glassware for Chemistry Labs

Domain Est. 2005

Expert Sourcing Insights for Pyrex Chemistry Glassware

H2: Projected 2026 Market Trends for Pyrex Chemistry Glassware

The global market for Pyrex chemistry glassware is anticipated to experience steady growth and notable shifts by 2026, driven by evolving scientific research demands, technological advancements, and increasing emphasis on laboratory safety and sustainability. Key trends shaping the Pyrex chemistry glassware market include:

-

Rising Demand in Academic and Research Laboratories

Investment in STEM (Science, Technology, Engineering, and Mathematics) education and government-funded research initiatives—particularly in biotechnology, pharmaceuticals, and environmental sciences—are expected to boost demand for high-quality laboratory glassware. Pyrex, known for its thermal and chemical resistance, remains a preferred brand in academic and industrial labs worldwide. -

Expansion in Emerging Markets

Developing regions such as Asia-Pacific (especially India, China, and Southeast Asia) and Latin America are witnessing rapid growth in pharmaceutical manufacturing and R&D infrastructure. This expansion is fueling demand for reliable and cost-effective chemistry glassware, positioning Pyrex as a competitive player due to its durability and brand reputation. -

Focus on Laboratory Safety and Regulatory Compliance

Increasing regulatory scrutiny on lab safety standards (e.g., OSHA, ISO/IEC 17025) is prompting institutions to upgrade to high-integrity glassware that can withstand extreme temperatures and corrosive substances. Pyrex’s borosilicate glass composition meets these stringent requirements, reinforcing its market position. -

Sustainability and Reusability Trends

Amid growing environmental concerns, reusable glassware like Pyrex is gaining favor over single-use plastic alternatives. Laboratories are prioritizing sustainable practices, and Pyrex products—being durable, recyclable, and long-lasting—align with green lab initiatives, further supporting market growth. -

Integration with Smart Laboratory Systems

While Pyrex glassware itself is not “smart,” the broader lab ecosystem is moving toward digitalization. Trends include barcode labeling of glassware for inventory tracking and integration with Laboratory Information Management Systems (LIMS). Pyrex manufacturers may increasingly partner with tech providers to offer traceable, compatible solutions. -

Product Innovation and Customization

To meet niche research applications, manufacturers are expected to offer more specialized Pyrex products—such as modular distillation setups, micro-scale reaction vessels, and custom-calibrated glassware. These innovations will cater to precision-focused industries like nanotechnology and analytical chemistry. -

Supply Chain Resilience and Localized Manufacturing

Post-pandemic supply chain disruptions have led companies to diversify sourcing and consider regional production. By 2026, Pyrex suppliers may expand localized manufacturing or distribution hubs to reduce lead times and mitigate geopolitical risks, particularly in North America and Europe. -

Competition and Market Consolidation

While Pyrex maintains strong brand recognition, it faces competition from other glassware manufacturers (e.g., Duran, Kimax) and private-label brands offering lower-cost alternatives. Strategic partnerships, product differentiation, and digital marketing will be critical for maintaining market share.

Conclusion

By 2026, the Pyrex chemistry glassware market is expected to grow at a moderate CAGR, supported by enduring trust in borosilicate glass performance, increasing R&D expenditures, and sustainability trends. Success will depend on innovation, geographic expansion, and alignment with evolving laboratory workflows and environmental standards.

Common Pitfalls When Sourcing Pyrex Chemistry Glassware: Quality and Intellectual Property Concerns

Sourcing genuine, high-quality Pyrex chemistry glassware is essential for laboratory safety, accuracy, and reproducibility. However, procurement professionals and researchers often encounter significant pitfalls related to product quality and intellectual property (IP) that can compromise experiments and institutional compliance.

Quality Concerns with Non-Genuine or Counterfeit Products

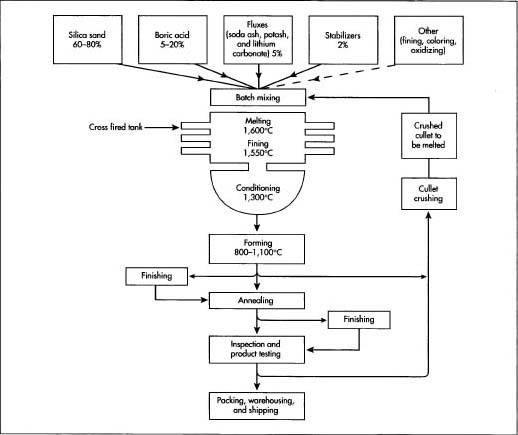

One of the most prevalent risks is the proliferation of substandard or counterfeit glassware marketed as “Pyrex.” Genuine Pyrex laboratory glassware, originally developed by Corning and now primarily manufactured under license by DWK Life Sciences (including the brand’s main production facilities), is made from high-quality borosilicate glass (typically Type 3.3 or 5.0). This material offers superior thermal shock resistance, chemical durability, and optical clarity. However, many third-party suppliers offer products labeled as “Pyrex-style” or “compatible with Pyrex,” which often:

- Use lower-grade soda-lime glass instead of borosilicate, increasing the risk of breakage under thermal stress.

- Exhibit inconsistent wall thickness or poor annealing, leading to weak spots and potential implosion or explosion during vacuum or heating applications.

- Lack precise calibration markings, compromising volumetric accuracy in titrations or measurements.

- Fail to meet international standards such as ISO 3819 (laboratory glassware) or ASTM E438 (chemical resistance).

These quality deficiencies not only jeopardize experimental integrity but also pose serious safety hazards, including chemical spills, fires, or personnel injury.

Intellectual Property and Trademark Infringement Risks

The term “Pyrex” is a registered trademark (owned by Corning Inc. and licensed to authorized manufacturers like DWK Life Sciences) protected under intellectual property laws globally. Sourcing glassware from unauthorized vendors that misuse the Pyrex name constitutes trademark infringement and exposes institutions to legal and reputational risks.

Common IP-related pitfalls include:

- Misleading Branding: Suppliers may use logos, fonts, or packaging that closely mimic genuine Pyrex products, creating confusion and potentially violating trademark law.

- Unauthorized Resale or Private Labeling: Some distributors repackage non-licensed glassware and sell it under the Pyrex name without proper authorization.

- Gray Market Imports: Glassware sourced through unofficial distribution channels may be counterfeit, expired, or diverted from other markets, bypassing quality control and IP protections.

Institutions purchasing such products may inadvertently support IP violations, void warranties, and face compliance issues during audits—particularly in regulated industries like pharmaceuticals or clinical research.

Mitigation Strategies

To avoid these pitfalls, organizations should:

- Source from Authorized Distributors: Purchase directly from DWK Life Sciences or their officially listed partners.

- Verify Product Authenticity: Check for official branding, batch numbers, and packaging consistency; use verification tools provided by the trademark holder.

- Request Certifications: Insist on material certifications (e.g., ISO, USP) and compliance documentation.

- Educate Procurement Teams: Train staff to recognize counterfeit products and understand IP implications in scientific supply chains.

By addressing both quality and IP concerns proactively, laboratories can ensure the reliability of their glassware, maintain regulatory compliance, and uphold scientific integrity.

H2: Logistics & Compliance Guide for Pyrex® Chemistry Glassware

Proper logistics handling and regulatory compliance are essential when transporting and storing Pyrex® chemistry glassware to ensure safety, maintain product integrity, and meet legal requirements. This guide outlines best practices and key compliance considerations for the logistics of laboratory-grade Pyrex glassware.

1. Packaging & Handling

1.1. Protective Packaging

– Use original manufacturer packaging or equivalent protective materials (e.g., bubble wrap, foam inserts, corrugated dividers) to prevent breakage.

– Ensure individual items are separated to avoid contact during transit.

– Use rigid outer shipping containers rated for fragile contents.

1.2. Labeling

– Clearly label packages with:

– “FRAGILE – HANDLE WITH CARE”

– “THIS SIDE UP” (for items with orientation sensitivity)

– Product name, catalog number, and quantity

– Include internal packing slips in waterproof pouches attached to the outside or inside of the box.

1.3. Handling Instructions

– Train personnel in proper manual handling techniques (e.g., two-handed lifting, no stacking on soft surfaces).

– Use dollies or hand trucks for heavy shipments.

– Avoid dropping, tipping, or sliding boxes.

2. Storage Conditions

2.1. Environmental Controls

– Store in a dry, temperature-controlled environment (15–25°C recommended).

– Avoid exposure to extreme temperatures, humidity, or direct sunlight, which may compromise packaging or labeling.

2.2. Shelf Storage

– Stack boxes no higher than manufacturer recommendations (typically 3–5 layers).

– Store on flat, level shelving with edge guards to prevent accidental tipping.

– Keep away from high-traffic areas or vibration sources.

2.3. Segregation

– Store glassware separately from chemicals, sharp objects, or heavy equipment to prevent contamination or damage.

3. Transportation

3.1. Domestic & International Shipping

– Use carriers experienced in handling scientific and fragile materials.

– For international shipments, ensure compliance with IATA, IMDG, or other applicable regulations if shipped alongside regulated substances (even if glassware itself is non-hazardous).

3.2. Temperature Considerations

– Avoid freezing conditions; thermal shock may weaken glass.

– Insulate packages if shipping through extreme climates.

3.3. Documentation

– Provide commercial invoice, packing list, and bill of lading.

– For exports, include Harmonized System (HS) code: 7017.20 (Laboratory glassware, of glass resistant to thermal shock, such as borosilicate glass).

4. Regulatory Compliance

4.1. Material Compliance

– Pyrex® chemistry glassware is typically made from borosilicate glass (e.g., Pyrex® 7740), compliant with:

– ASTM E438 (Standard Specification for Glass Volumetric Ware)

– ISO 385 and ISO 1042 (for burettes and volumetric flasks)

– USP <31> and EP 3.2 (pharmaceutical glass standards, where applicable)

4.2. REACH & RoHS

– Borosilicate glass is generally exempt from REACH SVHC (Substances of Very High Concern) requirements.

– Complies with RoHS directives as it contains no restricted heavy metals (e.g., lead, cadmium) in hazardous amounts.

4.3. Import/Export Regulations

– No CITES or ITAR restrictions apply.

– Verify destination country requirements—some may require certification of origin or product conformity (e.g., CE marking in EU).

5. Safety & Emergency Procedures

5.1. Breakage Response

– Equip storage and handling areas with:

– Spill kits including dustpan, brush, and puncture-resistant gloves

– Clearly labeled sharps/disposal containers for broken glass

– Follow OSHA 29 CFR 1910.1450 (Occupational Exposure to Hazardous Chemicals in Laboratories) if breakage occurs in chemical environments.

5.2. Training

– Provide staff with training on:

– Fragile material handling

– Emergency cleanup procedures

– Label interpretation and compliance documentation

6. Sustainability & Disposal

6.1. Reuse & Recycling

– Intact glassware should be cleaned and reused when possible.

– Broken borosilicate glass may be recycled through specialized glass recycling programs (not standard curbside).

– Label waste containers appropriately: “Non-Hazardous Glass Waste” (if uncontaminated).

Conclusion

Adhering to this logistics and compliance guide ensures safe, efficient handling of Pyrex® chemistry glassware across the supply chain. Proper packaging, storage, transportation, and regulatory awareness minimize risk and support laboratory safety and operational integrity.

For product-specific details, consult the manufacturer’s technical data sheets (TDS) and safety data sheets (SDS), available from Corning or authorized distributors.

Note: “Pyrex®” is a registered trademark of Corning Inc. or its affiliates. This guide is for informational purposes and does not constitute legal advice.

Conclusion: Sourcing Pyrex® Chemistry Glassware

Sourcing Pyrex® chemistry glassware requires careful consideration of quality, authenticity, supplier reliability, and compliance with laboratory standards. Due to its renowned thermal and chemical resistance, genuine Pyrex® glassware remains a preferred choice in academic, research, and industrial laboratories. However, the market is increasingly flooded with counterfeit or inferior products labeled as “Pyrex,” which do not meet the same performance standards as original borosilicate glass.

To ensure consistent results and laboratory safety, it is essential to source Pyrex® products through authorized distributors or reputable scientific supply companies. Verifying product specifications, such as material composition (e.g., borosilicate glass 3.3), certification markings, and compliance with international standards (e.g., ISO, ASTM), helps guarantee authenticity and performance.

In conclusion, while cost and availability are important factors, prioritizing verified suppliers and authentic Pyrex® products ensures long-term value, safety, and reliability in chemical applications. Investing in genuine, properly sourced glassware ultimately supports accurate experimentation, reduces the risk of breakage or contamination, and maintains the integrity of laboratory operations.