The pressure and temperature control equipment market, particularly for Pressure and Temperature With Hold (PWHT) manufacturers, has seen robust expansion, driven by increasing demand from oil & gas, power generation, and heavy industrial sectors. According to a 2023 report by Mordor Intelligence, the global industrial valves market—which includes critical components used in PWHT applications—is projected to grow at a CAGR of over 5.8% from 2023 to 2028. Similarly, Grand View Research estimates that the global industrial boiler market, a key end-use segment for PWHT technology, will expand at a CAGR of 4.6% during the same period, fueled by stricter safety regulations and the need for welded components to undergo post-weld heat treatment to ensure structural integrity. With rising infrastructure investments and expanding refinery operations, especially across Asia-Pacific and the Middle East, the demand for reliable and certified PWHT service providers and equipment manufacturers is poised for continued growth. As competition and technical standards intensify, identifying the top players becomes crucial for enterprises aiming to balance compliance, efficiency, and operational safety.

Top 10 Pwht Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Manufacturers and Suppliers of Post Weld Heat Treatment Machines …

Domain Est. 2012

Website: incertech.com

Key Highlights: Incertech is a Post Weld Heat Treatment (PWHT) Equipment Manufacturers and Suppliers. Our extensive experience in the industry, led us to design and erect ……

#2 Stress Relief/PWHT

Domain Est. 2017

Website: msmmfg.com

Key Highlights: Post Weld Heat Treatment (PWHT), or stress relief as it is sometimes known, is a method for reducing and redistributing the residual stresses in the ……

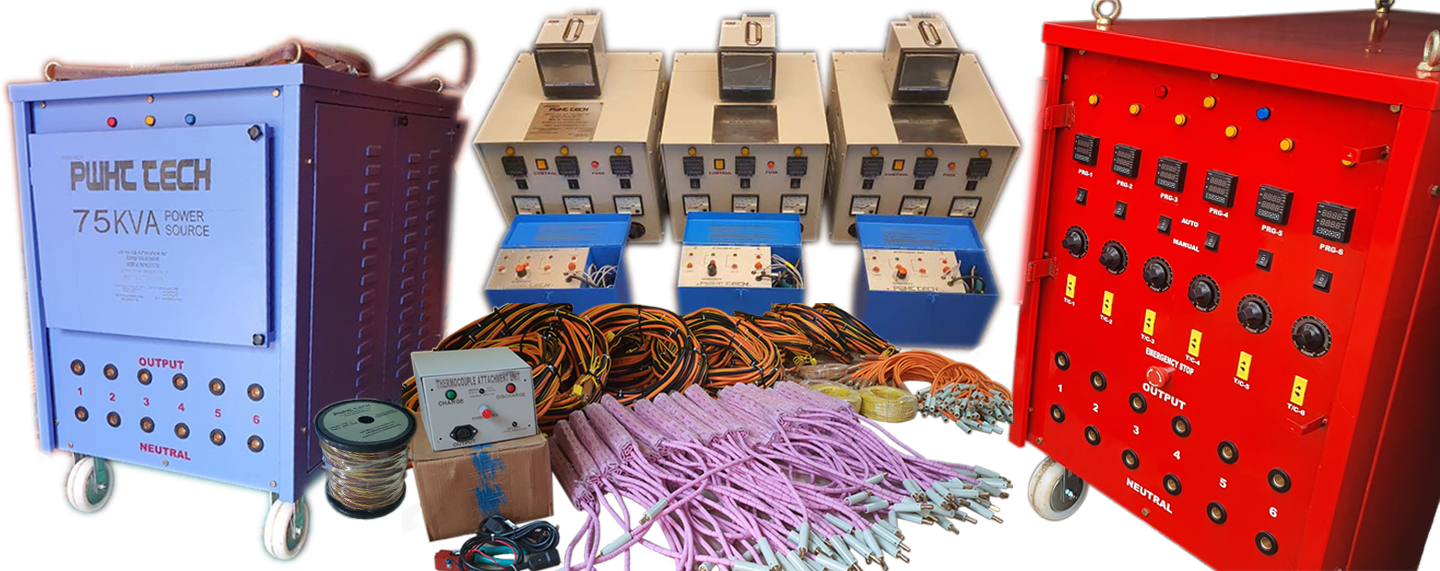

#3 pwhttech.com

Domain Est. 2019 | Founded: 2012

Website: pwhttech.com

Key Highlights: PWHT TECH established in 2012 has emerged as a leading Manufacturer and Service Provider of Post Weld Heat Treatment. We are renowned for our wide range of ……

#4 TEX

Domain Est. 1999

Website: tex-fin.com

Key Highlights: Post Weld Heat Treatment (PWHT) is a controlled process used to heat and cool metal components, typically pipes and tubes, after welding….

#5 Post Weld Heat Treatment (PWHT)

Domain Est. 2001

Website: intertek.com

Key Highlights: Intertek offers post weld heat treatment (PWHT) to improve weld microstructure and reduce residual stresses developed during welding….

#6 Post Weld Heat Treatment

Domain Est. 2002

Website: superheat.com

Key Highlights: Post Weld Heat Treatment (PWHT), also referred to as stress relieving, is an application of uniform heat applied after welding to a structure, or portion ……

#7 About us

Domain Est. 2014

Website: rem-teh.com

Key Highlights: We have receive the official state licence for teaching local post weld heat treatment (PWHT) operators in 2016. The teaching is performed by pur high quality ……

#8 –

Domain Est. 2015

Website: pwhtsolutions.com

Key Highlights: We offer a wide range of in-house and on site testing procedures for all of your standardized quality assurance programs / projects….

#9 Axiom HT: On

Domain Est. 2020

Website: axiomht.com

Key Highlights: PWHT is the relaxation of residual stress caused during the welding or in other processes such as high-pressure piping and is also effective for hydrogen ……

#10 NDT AND PWHT SOLUTIONS PVT LTD

Domain Est. 2022

Website: solutionss.org

Key Highlights: We are the solutions for all your drone inspections and surveys needs. Hard-to-reach areas have become easier than ever. Upgrade your operations with advanced ……

Expert Sourcing Insights for Pwht

H2: 2026 Market Trends for PWHT (Post Weld Heat Treatment)

As we approach 2026, the global Post Weld Heat Treatment (PWHT) market is poised for significant transformation, driven by evolving industrial standards, technological advancements, and increasing demand across key sectors such as oil & gas, power generation, heavy manufacturing, and renewable energy infrastructure. The following analysis outlines the key market trends expected to shape the PWHT landscape in 2026, with a focus on technological innovation, regulatory shifts, regional dynamics, and sustainability imperatives.

1. Technological Advancements and Automation

By 2026, digitalization and automation are expected to play a central role in PWHT operations. Advanced monitoring systems, including IoT-enabled temperature sensors and real-time data analytics, will become standard for ensuring precise control over heating and cooling cycles. Automated PWHT systems powered by AI algorithms will improve consistency, reduce human error, and enhance compliance with ASME, API, and ISO standards. These technologies will also support remote monitoring and predictive maintenance, especially in geographically dispersed operations.

2. Rising Demand from Renewable Energy Infrastructure

The global push toward decarbonization is accelerating investments in renewable energy projects such as offshore wind farms, hydrogen production facilities, and carbon capture and storage (CCS) systems. These applications often involve high-integrity welding of pressure vessels, pipelines, and structural components, necessitating rigorous PWHT protocols. By 2026, the renewable sector is expected to be a major growth driver for the PWHT market, particularly in Europe and North America.

3. Stricter Regulatory and Safety Standards

Regulatory bodies worldwide are tightening safety requirements for welded components in high-pressure and high-temperature environments. In 2026, compliance with updated codes such as ASME Section VIII Div. 1 and API 579-1/ASME FFS-1 will mandate more frequent and thorough PWHT procedures. Additionally, increased scrutiny following industrial incidents will push operators to adopt more conservative PWHT practices, even in cases where it is not strictly required, to mitigate risk.

4. Regional Growth Dynamics

Asia-Pacific will remain a key market for PWHT services, led by industrial expansion in India, China, and Southeast Asia. Infrastructure development, refinery upgrades, and nuclear power projects will drive demand. Meanwhile, the Middle East continues to invest heavily in oil & gas infrastructure modernization, creating sustained demand for PWHT in pipeline and pressure vessel fabrication. In contrast, North America and Europe will see growth driven by aging infrastructure replacement and energy transition initiatives.

5. Sustainability and Energy Efficiency

Environmental concerns are prompting PWHT service providers to adopt cleaner, more energy-efficient processes. By 2026, there will be a noticeable shift toward electric resistance heating and induction-based PWHT methods, which offer lower carbon emissions compared to traditional gas-fired furnaces. Additionally, companies will increasingly seek PWHT solutions that minimize fuel consumption and integrate with broader ESG (Environmental, Social, and Governance) reporting frameworks.

6. Growth in On-Site and Mobile PWHT Services

The complexity and size of modern industrial components often make transporting them to fixed facilities impractical. As a result, mobile and field-based PWHT services are expected to grow significantly by 2026. Portable heating systems with modular designs and cloud-connected controls will allow for greater flexibility and faster turnaround times, particularly in remote or offshore locations.

Conclusion

The 2026 PWHT market will be characterized by increased technological sophistication, regulatory rigor, and diversification of end-user industries. Companies that invest in digital capabilities, sustainability, and service innovation will be best positioned to capitalize on emerging opportunities. As global infrastructure evolves to meet energy transition goals, PWHT will remain a critical process ensuring the safety, reliability, and longevity of welded components across sectors.

Common Pitfalls in Sourcing PWHT (Post-Weld Heat Treatment) – Quality and Intellectual Property (IP) Concerns

When sourcing Post-Weld Heat Treatment (PWHT) services, companies often focus on cost and lead times, overlooking critical quality and intellectual property (IP) risks. Failing to address these can result in compromised structural integrity, regulatory non-compliance, and potential IP exposure. Below are key pitfalls to avoid:

1. Inadequate Qualification of Service Providers

One of the most common pitfalls is selecting a PWHT vendor without thoroughly verifying their certifications, equipment calibration records, and technician qualifications. Using an unqualified provider increases the risk of improper heat treatment, leading to residual stresses, reduced material toughness, and potential in-service failures.

Impact: Non-compliant PWHT can invalidate welding procedure qualifications (WPQs) and lead to rejection during third-party inspections or regulatory audits.

2. Lack of Traceability and Documentation Control

Poor documentation practices—such as missing or falsified heat treatment charts, thermocouple calibration logs, or procedure records—create significant quality risks. Without complete traceability, it becomes impossible to verify that PWHT was performed according to applicable codes (e.g., ASME, API, EN).

Impact: Regulatory bodies and clients may reject components, leading to costly rework, delays, or project shutdowns.

3. Insufficient Process Validation and Monitoring

Some vendors use outdated equipment or fail to monitor multiple thermocouple zones properly, leading to uneven heating or incorrect soak times. Relying solely on vendor-provided charts without independent verification increases the risk of undetected process deviations.

Impact: Inconsistent PWHT can result in premature cracking (e.g., stress corrosion cracking), especially in high-pressure or critical service applications.

4. Overlooking Intellectual Property Risks

When outsourcing PWHT, especially for proprietary components or patented manufacturing processes, companies may inadvertently expose sensitive design data, material specifications, or process parameters.

Impact: Unauthorized access to technical drawings, heat treatment procedures, or material test reports can lead to IP theft, reverse engineering, or loss of competitive advantage.

5. Inadequate Data Security and Confidentiality Agreements

Many PWHT providers lack robust cybersecurity measures or fail to sign comprehensive confidentiality agreements (NDAs). This is particularly concerning when sharing digital process records or integrating with client quality management systems.

Impact: Data breaches or unauthorized sharing of technical information can result in legal liabilities and damage to brand reputation.

6. Failure to Audit Subcontractors

Some primary vendors subcontract PWHT work without client knowledge. If the subcontractor is not vetted for quality systems or IP handling practices, it introduces uncontrolled risk into the supply chain.

Impact: Clients lose visibility and control over critical process steps, undermining quality assurance and compliance.

7. Non-Compliance with Industry-Specific Codes

Different industries (e.g., oil & gas, power generation, aerospace) have specific PWHT requirements. Sourcing from a vendor unfamiliar with these nuances—such as hold time calculations or cooling rate controls—can result in non-conformance.

Impact: Components may fail during hydrotesting or in-service operation, leading to safety hazards and costly litigation.

Best Practices to Mitigate Risks:

– Conduct on-site audits of PWHT providers, including equipment and records.

– Require full traceability and digital data logs with time-stamped charts.

– Implement strict NDAs and limit data access to essential personnel.

– Specify PWHT procedures in procurement contracts and verify compliance.

– Use only vendors certified to relevant standards (e.g., ISO 3834, ASME Section IX).

By proactively addressing these pitfalls, organizations can ensure both the quality integrity of their welded components and the protection of sensitive intellectual property.

Logistics & Compliance Guide for Post Weld Heat Treatment (PWHT)

Purpose

This guide outlines the logistical requirements and compliance standards for Post Weld Heat Treatment (PWHT) operations to ensure safety, quality, regulatory adherence, and consistency across fabrication and construction projects. It is intended for use by project managers, welding supervisors, quality control personnel, and third-party contractors engaged in PWHT processes.

Scope

Applies to all PWHT activities involving pressure vessels, piping systems, structural components, and other welded assemblies governed by recognized codes such as ASME, API, EN, and AWS. Covers on-site and shop-based operations.

H2: Regulatory and Code Compliance

Applicable Standards

PWHT procedures must comply with the following codes and standards:

– ASME BPVC Section VIII, Division 1 & 2: Mandatory for pressure vessels; defines PWHT requirements based on material type, thickness, and service conditions.

– ASME B31.3 Process Piping: Specifies PWHT requirements for process piping systems.

– API 510, 570, 653: Governs in-service inspection and repair of pressure vessels, piping, and tanks, often requiring PWHT after repairs.

– AWS D1.1/D1.8: Structural welding codes specifying PWHT for steel structures, especially seismic applications.

– EN 13445, EN 13480: European standards for unfired pressure vessels and metallic industrial piping.

– NBIC (National Board Inspection Code): Required for repairs and alterations subject to jurisdictional acceptance.

Jurisdictional Requirements

- Confirm local or national regulatory mandates (e.g., OSHA in the U.S., HSE in the UK, SEVESO in EU).

- Obtain permits and notify authorities where required (e.g., hot work permits, environmental notifications for furnace operations).

- Maintain documentation for third-party inspections and regulatory audits.

H2: Personnel Qualifications and Responsibilities

Qualified Personnel

- PWHT Supervisors: Must be certified in accordance with employer’s quality system (e.g., ASNT NDT Level II/III for monitoring).

- Welding Engineers: Responsible for specifying PWHT parameters per WPS and code requirements.

- Technicians: Trained in operating heating equipment, thermocouple placement, and data logging.

- Quality Inspectors: Verify compliance with procedures and record accuracy.

Roles and Duties

- Project Manager: Ensures resource allocation and schedule adherence.

- QA/QC Team: Validates procedure qualification, monitors execution, and approves reports.

- Safety Officer: Conducts risk assessments and ensures PPE and emergency protocols are in place.

H2: Equipment and Instrumentation

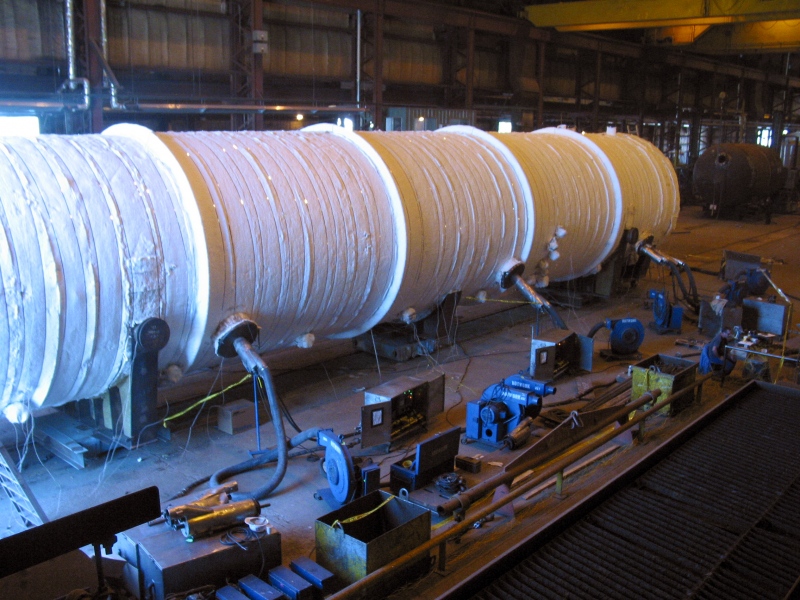

Heating Systems

- Furnace Heating: For shop-based treatment; ensure furnace calibration and temperature uniformity.

- Resistance (Ceramic Pad) Heating: Common for field applications; use certified pads and flexible heater mats.

- Induction Heating: Used for localized treatment; requires qualified induction systems and coils.

- Flame Heating: Limited use; requires strict control and monitoring to avoid localized overheating.

Temperature Monitoring

- Use calibrated thermocouples (Types K or N, per ASTM E230) attached per ASME PCC-2 or API 577.

- Minimum of two thermocouples per component: one on the thickest section, one on the thinnest.

- Data loggers must record temperature vs. time at intervals not exceeding 1 minute.

- Thermocouple attachment via arc spot welding or high-temperature ceramic adhesives; avoid mechanical clamps unless approved.

Calibration and Certification

- All instruments (thermocouples, controllers, recorders) calibrated every 6 months or per project requirements.

- Maintain calibration certificates traceable to NIST or equivalent standards.

H2: Procedure Qualification and Documentation

PWHT Procedure Specification (PWHTPS)

- Must be developed and qualified prior to production work.

- Includes:

- Base material and thickness range

- Heating and cooling rates (typically ≤ 300°F/hr for carbon steel)

- Soak temperature and duration (e.g., 1100°F–1200°F for 1 hour per inch of thickness)

- Maximum temperature variation across component (typically ±25°F)

- Cooling method (furnace cool vs. controlled air cool under insulation)

Required Documentation

- PWHT Request Form: Issued by welding/QC after weld completion and NDT approval.

- Heating Schedule: Approved by engineer and client.

- As-Run Chart: Temperature-time graph from data logger, signed by technician and inspector.

- PWHT Report: Includes equipment used, thermocouple locations, actual soak time/temp, and personnel involved.

- Non-Conformance Reports (NCRs): For deviations, with corrective actions and engineering approval.

H2: Safety and Environmental Considerations

Hazard Identification

- High temperatures (burns, fire risk)

- Electrical hazards (especially with resistance heating)

- Confined space entry (if treating internal components)

- Fumes and emissions (from coatings or contaminants)

Safety Protocols

- Implement lockout/tagout (LOTO) for electrical systems.

- Establish exclusion zones and use heat-resistant barriers.

- Provide PPE: heat-resistant gloves, face shields, flame-retardant clothing.

- Monitor for combustible gases when working near flammable materials.

Environmental Controls

- Capture and filter emissions if heating coated or contaminated surfaces.

- Prevent thermal damage to adjacent components or insulation.

- Follow local regulations for noise and atmospheric emissions (e.g., EPA, local air quality boards).

H2: Logistics and Scheduling

Planning and Coordination

- Schedule PWHT after welding and NDT (RT/UT/MT/PT) to avoid rework.

- Coordinate with site operations to minimize downtime.

- Ensure clear access and lifting arrangements for large components.

Resource Mobilization

- Deploy qualified crew and calibrated equipment in advance.

- Confirm power supply requirements (e.g., 480V 3-phase for large mats).

- Transport and store heating equipment safely; protect thermocouples from damage.

Contingency Planning

- Have backup equipment available for critical paths.

- Define weather limitations (e.g., wind > 15 mph affects open-air heating).

- Prepare for extended soak times due to unexpected delays.

H2: Quality Assurance and Non-Destructive Examination (NDE)

Pre-PWHT Checks

- Confirm welds are complete, cleaned, and passed dimensional and NDE inspections.

- Verify no temporary attachments remain (e.g., lifting lugs) unless post-PWHT removal is planned.

Post-PWHT Requirements

- Perform visual inspection for distortion, cracking, or damage.

- Conduct NDE as specified in WPS or code (e.g., MT/PT for critical joints after cooling to <120°F).

- Retest if PWHT parameters deviate beyond allowable limits (requires engineering review).

Records Retention

- Archive all PWHT documentation for minimum of 10 years or per project/client requirements.

- Digital records must be backed up and secure; include metadata (date, time, operator).

H2: Client and Third-Party Coordination

Notifications

- Inform client and third-party inspectors (TPI) 48–72 hours prior to PWHT.

- Provide access to procedures, qualifications, and real-time monitoring data upon request.

Witnessing and Approval

- Critical PWHT operations may require TPI witnessing.

- Obtain written approval before and after treatment.

- Submit final PWHT report as part of the Dossier or Final Inspection Dossier (FID).

H2: References and Revision History

Key References

- ASME BPVC Section VIII, Division 1 – UCS-56, UHT-56, etc.

- ASME B31.3 – Chapter V, Table 331.1.1

- API 577 – Welding Guidelines for the Refining and Petrochemical Industry

- AWS D1.1:2020 – Structural Welding Code – Steel

- PCC-2 – ASME Repair of Pressure Equipment and Piping

Revision History

| Version | Date | Author | Changes Made |

|———|————|————–|—————————-|

| 1.0 | 2024-04-01 | J. Engineer | Initial release |

| 1.1 | 2024-06-15 | Q. Manager | Added EU standards, EN refs|

This document is controlled. Unauthorized copying is prohibited.

Conclusion for Sourcing Post-Weld Heat Treatment (PWHT):

Sourcing Post-Weld Heat Treatment (PWHT) is a critical step in ensuring the structural integrity, durability, and safety of welded components, particularly in industries such as oil and gas, construction, power generation, and pressure vessel manufacturing. Proper PWHT relieves residual stresses, improves dimensional stability, and enhances resistance to brittle fracture and stress corrosion cracking.

When sourcing PWHT services, it is essential to select qualified and certified providers who adhere to recognized industry standards such as ASME, API, ASTM, or ISO. Key considerations include the provider’s technical capabilities, equipment suitability for the component size and material, quality assurance processes, and compliance with project specifications and regulatory requirements.

Additionally, logistical factors such as proximity of the service provider, lead times, and transportation of components should be evaluated to minimize project delays and costs. Building strong partnerships with reliable PWHT suppliers contributes to consistent quality, regulatory compliance, and overall project success.

In conclusion, effective sourcing of PWHT involves a strategic balance between technical competence, quality assurance, and operational efficiency. Investing time in due diligence during the supplier selection process ultimately ensures safer, more reliable welded fabrications and supports long-term performance and compliance.