The global PVC channel market is experiencing robust growth, driven by increasing demand for durable, cost-effective infrastructure solutions in electrical and construction sectors. According to Grand View Research, the global PVC conduit market—of which PVC channels are a critical component—was valued at USD 36.8 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 6.4% from 2024 to 2030. This upward trajectory is fueled by rising urbanization, infrastructure development, and the shift toward corrosion-resistant and lightweight materials in electrical installations. With Asia Pacific dominating demand due to rapid industrialization and large-scale building projects, manufacturers are scaling production and innovation to meet evolving technical and environmental standards. As competition intensifies, a select group of leading companies has emerged at the forefront of quality, scalability, and global reach—setting the benchmark in PVC channel manufacturing.

Top 9 Pvc Channel Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Palram Americas

Domain Est. 1999

Website: palram.com

Key Highlights: Palram is the leading polycarbonate manufacturer and PVC supplier. Explore our wide range of thermoplastic technology solutions….

#2 Leading PVC Channel Manufacturers

Domain Est. 2000

Website: extrudedplastics.com

Key Highlights: Discover the top pvc channel suppliers committed to producing in the USA. Many of the suppliers listed on our site also have large part capabilities….

#3 Canalplast

Domain Est. 2013

Website: canalplast.com

Key Highlights: In Canalplast we are specialized in the production of trunking systems for industrial and residential electrical installations….

#4 PVC Wiring Channel Manufacturer,PVC Cable Trunking Supplier …

Domain Est. 2014

Website: marutipvcchannel.com

Key Highlights: MARUTI FLEXOPLAST INDUSTRIES is one of the leading manufacturer and supplier of pvc channel, pvc wiring channel, pvc wiring ducts, pvc cable channels and ……

#5 Bina Industries

Domain Est. 2024

Website: binaindustries.com

Key Highlights: We “Bina Industries” have been a leading Manufacturer and Supplier of a premium quality assortment of PVC Wiring Channels, PVC Conduit Pipes & Fittings….

#6 PVC Wiring Channels and PVC Trunking Manufacturer In India

Domain Est. 2024

Website: marutiprofile.com

Key Highlights: Maruti Profile Industries is known in the market as a reliable PVC Wiring Channels and PVC Trunking Manufacturer In India. We also offer HDPE Conduit Pipe, ……

#7 PVC Channel

Domain Est. 1996

#8 Advanced Drainage Systems

Domain Est. 2000

Website: adspipe.com

Key Highlights: Advanced Drainage Systems provides high-performing, durable pipe and innovative stormwater management solutions. Discover our industry-leading products ……

#9 PVC Channel

Domain Est. 2008

Website: rolliflex.in

Key Highlights: Rolliflex cables, a four decade old company, established in the year 1979. We have our state-of-art manufacturing units in Daman….

Expert Sourcing Insights for Pvc Channel

H2: PVC Channel Market Trends in 2026

The global PVC channel market is poised for significant transformation by 2026, driven by evolving construction practices, sustainability demands, and technological advancements. As urbanization accelerates and infrastructure investment increases—particularly in emerging economies—the demand for durable, cost-effective, and low-maintenance drainage and cable management solutions continues to rise. Below is an analysis of key market trends shaping the PVC channel industry in 2026 under the H2 economic and industrial outlook.

1. Steady Market Growth Amid Infrastructure Expansion

Under the H2 2026 economic scenario—characterized by moderate global growth, inflation stabilization, and continued public spending on infrastructure—PVC channel systems are expected to see increased adoption. Governments across Asia-Pacific, Latin America, and Africa are prioritizing smart city projects, road expansions, and flood mitigation systems, all of which rely heavily on efficient linear drainage solutions. PVC channels, known for their corrosion resistance and lightweight properties, are favored in these applications over traditional concrete or metal alternatives.

2. Shift Toward Sustainable and Recyclable Materials

Environmental regulations and green building certifications (such as LEED and BREEAM) are influencing material selection in construction. In H2 2026, there is a growing preference for PVC channels made from recycled content or designed for recyclability at end-of-life. Manufacturers are responding by introducing eco-friendly formulations and promoting closed-loop recycling programs. This trend is particularly strong in Europe and North America, where regulatory pressure and consumer demand for sustainability are highest.

3. Technological Innovations and Smart Integration

The integration of smart infrastructure is gaining momentum. By H2 2026, advanced PVC channel systems are increasingly being designed to accommodate sensors for water level monitoring, flow rate measurement, and pollution detection. These “smart drainage” systems are being deployed in urban areas to improve stormwater management and reduce flooding risks. Coupled with IoT platforms, PVC channels are evolving from passive components to active elements in intelligent city ecosystems.

4. Competitive Pricing and Regional Manufacturing Growth

PVC remains cost-competitive compared to alternatives like stainless steel or HDPE, especially in price-sensitive markets. With supply chain normalization post-pandemic and regional manufacturing hubs expanding in Southeast Asia and the Middle East, production costs for PVC channels are stabilizing. This enables broader market penetration in residential, commercial, and industrial sectors, supporting sustained volume growth in H2 2026.

5. Challenges from Regulatory and Material Substitution Pressures

Despite the positive outlook, the market faces headwinds. Concerns over the environmental impact of virgin PVC production and end-of-life disposal are prompting some regions to explore alternatives like polymer concrete or composite materials. Additionally, fluctuating raw material prices (especially ethylene and chlorine) could impact profit margins if not mitigated through long-term supply contracts or material efficiency improvements.

Conclusion

By H2 2026, the PVC channel market is expected to grow steadily, supported by infrastructure development, sustainability initiatives, and technological innovation. While challenges remain, particularly around environmental perception and material competition, strategic adaptations by manufacturers—such as embracing circular economy principles and enhancing product functionality—are likely to sustain market relevance and expansion. The H2 economic environment, with its emphasis on resilient and cost-effective infrastructure, positions PVC channels as a key component in modern drainage and utility management systems worldwide.

Common Pitfalls When Sourcing PVC Channels (Quality and IP)

Sourcing PVC channels for construction, electrical, or cable management applications requires careful attention to both material quality and intellectual property (IP) considerations. Overlooking these aspects can lead to performance failures, safety hazards, legal risks, and reputational damage. Below are key pitfalls to avoid:

Poor Material Quality and Non-Compliance

One of the most frequent issues when sourcing PVC channels is receiving substandard products that fail to meet technical or safety standards. Low-quality PVC may degrade quickly under UV exposure, become brittle in cold temperatures, or deform under heat or load.

Key risks include:

– Use of recycled or mixed-grade PVC: Some suppliers blend post-consumer or industrial waste into virgin PVC, reducing strength and longevity.

– Inconsistent wall thickness: Poor manufacturing control leads to weak spots prone to cracking.

– Failure to meet fire safety standards: Non-compliant PVC channels may emit toxic fumes when exposed to fire, violating building codes (e.g., RoHS, REACH, or local fire safety regulations).

Always verify compliance with relevant standards (e.g., IEC, ASTM, UL) and request test reports or certifications from suppliers.

Counterfeit or IP-Infringing Products

Sourcing from unreliable suppliers—especially in low-cost regions—increases the risk of receiving counterfeit or IP-infringing PVC channel systems. Many branded channel designs (e.g., snap-fit mechanisms, profile geometry) are protected by patents, design rights, or trademarks.

Common IP-related pitfalls:

– Unauthorized replication of patented profiles: Some suppliers copy the design of well-known systems (e.g., cable trunking from Legrand or ABB), violating utility or design patents.

– Use of misleading branding or logos: Counterfeit products may feature fake logos or packaging that mimics reputable brands.

– Lack of design freedom to use accessories: IP-protected channels often require proprietary accessories; using knock-offs may result in incompatibility or legal action.

To mitigate IP risks, conduct due diligence on suppliers, verify their manufacturing licenses, and avoid suppliers offering “compatible” versions of branded systems at suspiciously low prices.

Inadequate Supplier Vetting and Traceability

Many sourcing failures stem from insufficient supplier evaluation. Buyers may focus solely on price without assessing manufacturing capabilities, quality control processes, or supply chain transparency.

Red flags include:

– No clear documentation of raw material sourcing

– Inability to provide batch traceability or material certificates

– Refusal to allow factory audits or third-party inspections

Establish a supplier qualification process that includes on-site audits, sample testing, and contractual quality clauses.

Lack of Long-Term Performance Data

PVC channels are expected to last 10–25 years in building installations. However, many low-cost suppliers cannot provide aging or environmental resistance data (e.g., UV stability, thermal cycling).

Relying on short-term cost savings without assessing long-term durability can result in premature failures, costly replacements, and liability issues.

Conclusion

To avoid these pitfalls, prioritize suppliers with proven quality management systems (e.g., ISO 9001), demand full compliance documentation, and engage legal expertise when sourcing designs that may be IP-protected. Investing time in due diligence upfront ensures reliable performance and reduces legal and operational risks.

Logistics & Compliance Guide for PVC Channel

This guide outlines key logistics and compliance considerations for the transportation, handling, and regulatory adherence of Polyvinyl Chloride (PVC) channel products, commonly used in construction, electrical, and industrial applications.

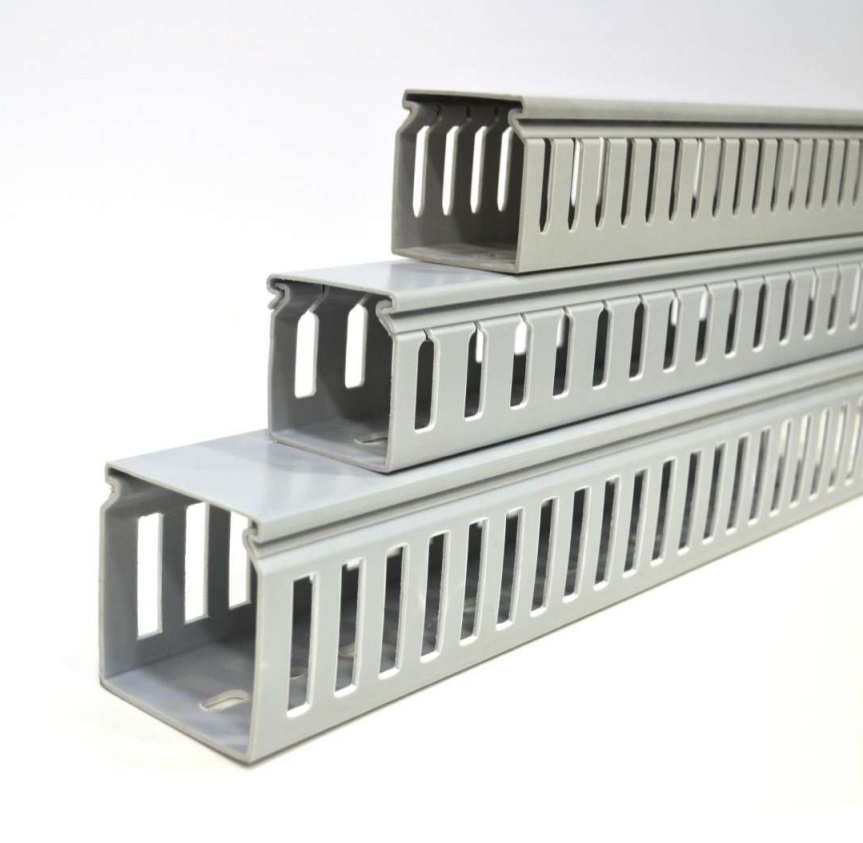

Product Overview

PVC channels are extruded profiles made from rigid polyvinyl chloride, designed to house and protect cables, wires, or support structural elements. They are lightweight, durable, and resistant to moisture and corrosion but require careful handling to avoid damage during transit.

Packaging Requirements

- Use robust, weather-resistant packaging such as corrugated cardboard bundles or shrink-wrapped units on wooden pallets.

- Secure channels to prevent shifting during transport; use edge protectors for long or fragile profiles.

- Label each package with product identification, batch number, length, and handling instructions (e.g., “Fragile,” “This Side Up”).

Storage Conditions

- Store in a dry, well-ventilated area away from direct sunlight to prevent UV degradation.

- Avoid stacking beyond recommended height limits to prevent deformation.

- Keep away from heat sources and incompatible materials (e.g., strong oxidizers).

Transportation Guidelines

- Use covered vehicles or containers to protect from rain, snow, and prolonged sun exposure.

- Ensure proper load securing to prevent movement during transit.

- For international shipments, comply with IMDG Code (if applicable) and national road/rail transport regulations.

Regulatory Compliance

- REACH (EU): Confirm that PVC formulations comply with REACH regulations, particularly regarding restricted substances like phthalates.

- RoHS (EU & others): Ensure compliance if used in electrical applications; verify absence of lead, cadmium, and other hazardous substances.

- TSCA (USA): Adhere to Toxic Substances Control Act requirements for chemical substances, including PVC resin and additives.

- Proposition 65 (California): Provide warnings if products contain chemicals known to cause cancer or reproductive harm (e.g., certain vinyl chloride monomers).

Environmental & Safety Considerations

- PVC is non-toxic under normal use but may release hydrogen chloride gas if burned. Provide Material Safety Data Sheets (MSDS/SDS) to customers.

- Promote recycling where local facilities support PVC reprocessing; label recyclability per local standards (e.g., Resin Identification Code 3).

- Follow OSHA or local workplace safety guidelines during handling and installation.

Import/Export Documentation

- Provide commercial invoices, packing lists, and certificates of origin for cross-border shipments.

- Include test reports or compliance certificates (e.g., ISO 9001, UL, CE marking) when required by destination country.

- Verify tariff classifications (HS Code: typically 3916.20 or 3925.90) and applicable duties.

Quality Assurance

- Conduct regular inspections for dimensional accuracy, surface defects, and color consistency.

- Maintain traceability through batch coding and production records.

- Align with ISO 9001 or other relevant quality management systems.

Disposal & End-of-Life

- Advise customers on proper disposal methods; do not incinerate without proper emission controls.

- Support take-back programs or recycling initiatives where available.

By adhering to this guide, businesses can ensure safe, compliant, and efficient logistics for PVC channel products across the supply chain.

Conclusion for Sourcing PVC Channel

In conclusion, sourcing PVC channels requires a strategic approach that balances cost, quality, availability, and reliability of suppliers. After evaluating various suppliers and market options, it is evident that selecting the right source involves considering factors such as material specifications, compliance with industry standards, lead times, and logistical support.

Opting for reputable manufacturers or distributors—whether local or international—ensures consistent product quality and reduces the risk of supply chain disruptions. Additionally, establishing long-term relationships with suppliers can lead to better pricing, improved service, and greater flexibility in meeting project demands.

Ultimately, a well-structured sourcing strategy for PVC channels not only supports operational efficiency but also contributes to the durability and performance of the end application, whether in construction, electrical installations, or industrial projects. Continuous market monitoring and periodic supplier assessments will further enhance sourcing effectiveness and support sustainable procurement goals.