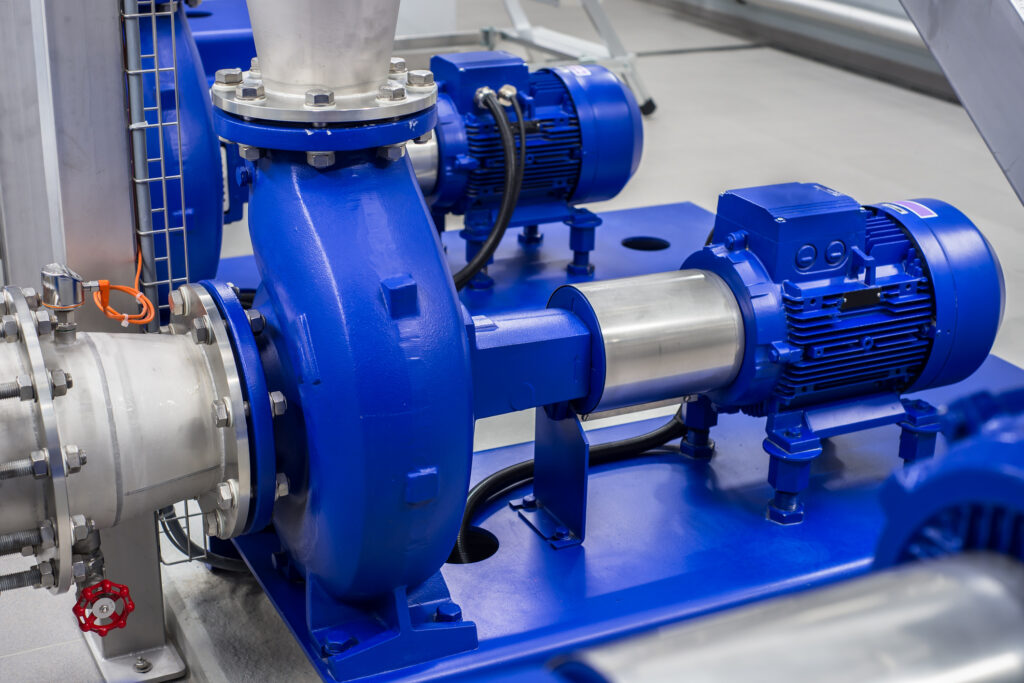

The global pump motor parts market is experiencing steady expansion, driven by rising demand across industrial, commercial, and residential applications. According to Mordor Intelligence, the global pump market was valued at USD 66.8 billion in 2023 and is projected to grow at a CAGR of over 5.2% from 2024 to 2029, fueled by infrastructure development, water management initiatives, and increasing industrial automation. This growth trajectory underscores the critical importance of high-performance pump motor components, which directly influence the efficiency, reliability, and longevity of pumping systems. As industries prioritize energy efficiency and operational uptime, the demand for precision-engineered motor parts—from rotors and stators to bearings and seals—has surged. In this competitive landscape, leading manufacturers are investing in R&D, advanced materials, and智能制造 (smart manufacturing) to meet stringent performance standards. Here, we spotlight the top 9 pump motor parts manufacturers shaping the industry with innovation, global reach, and robust product portfolios.

Top 9 Pump Motor Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Viking Pump

Domain Est. 1996

Website: vikingpump.com

Key Highlights: Viking Pump is the leading manufacturer of positive displacement pumps. Our industrial internal and external gear pumps, hygienic pumps, and energy pumps ……

#2 Industrial Pumps Manufacturer

Domain Est. 1997

Website: gouldspumps.com

Key Highlights: Industrial Pumps Manufacturer for a wide range of markets — including chemical, mining, oil & gas, power generation, pulp and paper, and general industry….

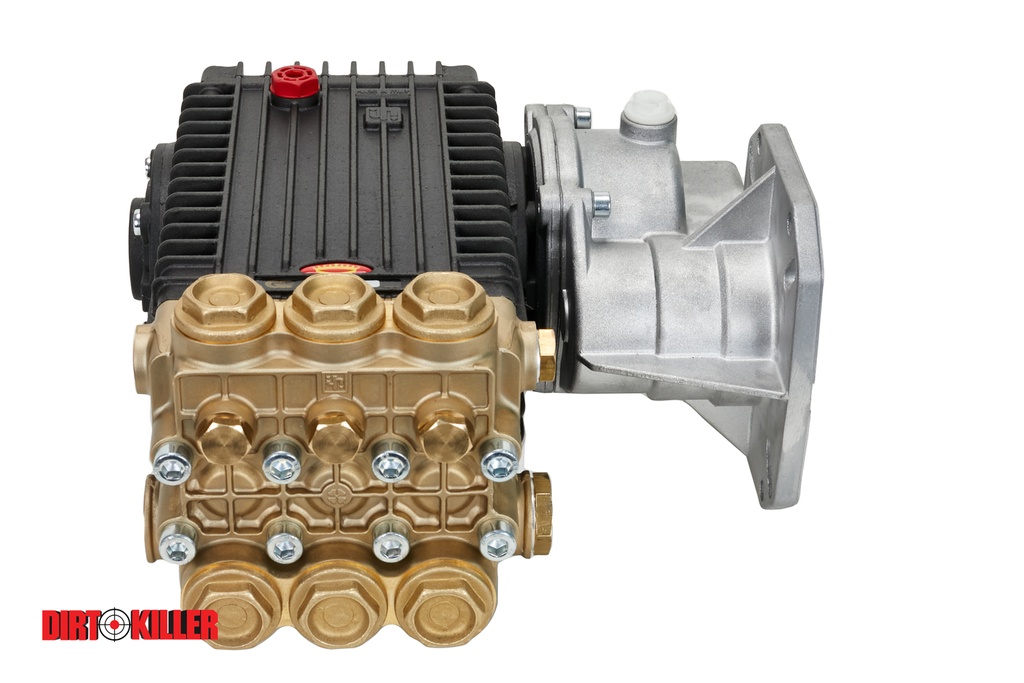

#3 General Pump

Domain Est. 1995

Website: generalpump.com

Key Highlights: General Pump is a world leader in plunger pumps, accessories & nozzles for fluid applications. From mining and misting to car washes and oil & gas uses….

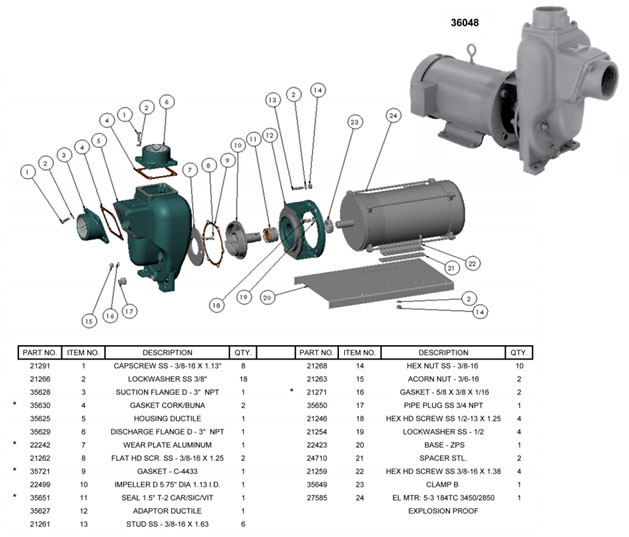

#4 MP Pumps

Domain Est. 1998 | Founded: 1942

Website: mppumps.com

Key Highlights: Discover MP Pumps’ durable centrifugal and self-priming pumps for agriculture, marine, petroleum, and industrial applications. Trusted since 1942….

#5 Pump Catalog Industrial Fluid Pumps

Domain Est. 2000

Website: pumpcatalog.com

Key Highlights: Online Shopping at Pump Catalog – Industrial Burks Pumps, LMI Pumps, Berkeley Pumps, Goulds Pumps, Yamada Pumps, Barnes Bumps, Grundfos, ARO, AMT & More!…

#6 AMT Pump Company

Domain Est. 2002

Website: amtpumps.com

Key Highlights: AMT Pump Company manufactures and sells Industrial/Commercial pumps & accessories through authorized distributors. Web Development: KDS FX Design. Go to Top….

#7

Domain Est. 2002

Website: weldonpumps.com

Key Highlights: With expertise stemming from over 80 years of pump/motor development and manufacturing, Weldon Pump has developed a line of robust brushed and brushless motors….

#8 Pumps & Pump Parts

Domain Est. 1999

Website: pecopage.com

Key Highlights: We support all pumps and parts marketed under the AC pump, with the largest supply of AC2000 series products in the US….

#9 US Motor Works

Domain Est. 1999

Website: usmotorworks.com

Key Highlights: PRODUCTS. FUEL PUMPS · UNIVERSAL FUEL PUMPS · WATER PUMPS · FAN CLUTCHES · MAX COOLING KITS · TIMING KITS · HEAVY DUTY · OSC AUTOMOTIVE · Derale Performance ……

Expert Sourcing Insights for Pump Motor Parts

H2: 2026 Market Trends for Pump Motor Parts

The global market for pump motor parts is poised for significant transformation by 2026, driven by technological innovation, sustainability mandates, and evolving industrial demands. Key trends shaping the sector include:

-

Increased Demand for Energy-Efficient Components

With growing emphasis on energy conservation and regulatory standards such as IE4 and IE5 efficiency classes, manufacturers are prioritizing high-efficiency motor parts like premium motors, variable frequency drives (VFDs), and optimized bearings. This shift is especially evident in water treatment, HVAC, and industrial manufacturing sectors, where operational cost reduction is critical. -

Adoption of Smart Pumping Systems

The integration of IoT-enabled sensors and predictive maintenance technologies into pump motor parts is accelerating. By 2026, smart monitoring systems—capable of tracking vibration, temperature, and power consumption—are expected to become standard in new installations, enhancing reliability and reducing downtime. -

Growth in Industrial Automation and Process Optimization

As industries embrace Industry 4.0, demand for intelligent pump motor components that support automation, remote control, and seamless integration with SCADA systems is rising. This trend is particularly strong in oil & gas, chemical processing, and food & beverage industries. -

Expansion in Water Infrastructure and Renewable Energy Projects

Global investments in water supply, wastewater management, and desalination—fueled by urbanization and climate change—are boosting demand for durable pump motor parts. Additionally, renewable energy projects such as solar-powered irrigation and geothermal systems are creating new market opportunities. -

Regional Market Shifts

Asia-Pacific is expected to lead market growth due to rapid industrialization in China, India, and Southeast Asia. Meanwhile, North America and Europe are focusing on retrofitting aging infrastructure with energy-efficient and digitally integrated pump systems. -

Supply Chain Resilience and Localization

Post-pandemic disruptions and geopolitical tensions have prompted manufacturers to diversify supply chains. By 2026, localized production of critical pump motor components—such as stators, rotors, and seals—is expected to increase, improving lead times and reducing dependency on single-source suppliers. -

Sustainability and Circular Economy Practices

Environmental regulations are pushing companies toward recyclable materials, longer product lifecycles, and remanufactured motor parts. Rebuilt motors and eco-design principles are gaining traction, aligning with ESG goals and reducing total cost of ownership.

In summary, the 2026 pump motor parts market will be defined by efficiency, digitalization, and sustainability. Companies that invest in R&D, embrace smart technologies, and adapt to regional regulatory landscapes will be best positioned for growth.

Common Pitfalls Sourcing Pump Motor Parts (Quality, IP)

Sourcing pump motor parts involves navigating complex supply chains, technical specifications, and intellectual property (IP) landscapes. Overlooking key pitfalls can lead to operational failures, safety risks, legal issues, and financial losses. Below are critical areas to watch:

Quality Inconsistencies and Substandard Components

One of the most frequent issues is receiving parts that fail to meet required quality standards. This often occurs when suppliers cut corners by using inferior materials (e.g., low-grade bearings, subpar insulation, or inadequate winding wire). Poor machining tolerances or inconsistent manufacturing processes can lead to premature motor failure, overheating, or vibration issues. Relying solely on price as a selection criterion increases the risk of encountering counterfeit or reconditioned parts misrepresented as new. Without third-party certifications (such as ISO, UL, or CE), verifying performance and durability becomes challenging.

Lack of IP Compliance and Unauthorized Replicas

Pump motor components—especially proprietary designs like rotors, stators, or control modules—are often protected by patents, trademarks, or design rights. Sourcing from unauthorized manufacturers or grey-market suppliers can result in the use of IP-infringing parts. This exposes the buyer to legal liability, product recalls, and reputational damage. Additionally, counterfeit parts may lack the engineering optimizations of genuine components, compromising efficiency and reliability. Always verify the supplier’s authorization to manufacture or distribute OEM (Original Equipment Manufacturer) parts and request documentation proving IP clearance.

Inadequate Documentation and Traceability

Missing or falsified documentation—such as material test reports, performance certifications, or traceability logs—hampers quality assurance processes. Without proper traceability, identifying the root cause of a failure becomes nearly impossible, and compliance with industry regulations (e.g., ATEX, FDA, or PED) may be compromised. Ensure suppliers provide complete technical dossiers, including conformity statements and batch-specific data.

Mismatched Specifications and Compatibility Issues

Even if parts appear physically identical, subtle differences in electrical ratings, insulation class, or dimensional tolerances can lead to incompatibility. Sourcing generic or “equivalent” replacements without thorough validation against OEM specifications risks inefficient operation or system damage. Always cross-reference part numbers, performance curves, and environmental ratings (e.g., IP55, IP68) to ensure compatibility.

Supply Chain Vulnerabilities and Counterfeit Risks

Global sourcing exposes buyers to supply chain disruptions and the increasing prevalence of counterfeit motor parts. Unverified distributors or online marketplaces may offer attractive pricing but deliver non-genuine or tampered components. Establishing relationships with reputable, audited suppliers and using anti-counterfeit verification tools (e.g., holograms, blockchain tracking) can mitigate these risks.

Avoiding these pitfalls requires due diligence, technical vetting, and a proactive approach to supplier management and IP compliance.

Logistics & Compliance Guide for Pump Motor Parts

This guide outlines key considerations for the efficient and compliant handling, transportation, and documentation of pump motor parts across the supply chain.

Product Classification & HS Codes

Accurate classification under the Harmonized System (HS) is critical for customs clearance, duty assessment, and regulatory compliance. Pump motor parts may fall under various HS codes depending on their function and composition. Common classifications include:

– 8501.31 – 8501.33: Electric motors of an output not exceeding 37.5 W

– 8501.40 – 8501.53: Other motors and generators (depending on power, AC/DC, etc.)

– 8413.91 – 8413.96: Spare parts for pumps (if the part is specifically a pump component)

– 8537.10: Control or switchgear for motors

Consult a licensed customs broker or use official tariff databases to determine the correct HS code based on technical specifications.

Packaging & Handling Requirements

Proper packaging ensures parts arrive undamaged and reduces the risk of delays or claims.

– Use moisture-resistant, shock-absorbent materials (e.g., foam inserts, desiccant packs).

– Clearly label packages with part numbers, serial numbers (if applicable), and handling instructions (e.g., “Fragile,” “Do Not Invert”).

– Secure small components in sealed bags or containers to prevent loss.

– Use ESD-safe packaging for electronic motor components (e.g., control boards, sensors).

Labeling & Documentation

Complete and accurate documentation is essential for global logistics compliance.

– Commercial Invoice: Must include detailed descriptions, unit prices, total value, currency, Incoterms®, country of origin, and buyer/seller details.

– Packing List: Itemize contents per package with weights, dimensions, and carton counts.

– Certificate of Origin: Required by some countries for tariff determination.

– Material Safety Data Sheets (MSDS/SDS): Required if parts contain hazardous materials (e.g., lubricants, batteries).

– Export Control Classification Number (ECCN): Required if parts are subject to export controls (e.g., dual-use items).

Export & Import Regulations

Compliance with international trade laws is mandatory.

– Export Controls: Check if parts are subject to ITAR, EAR, or other export regulations, especially for high-efficiency or specialized motors.

– Import Restrictions: Verify destination country requirements (e.g., CE marking in EU, UL/CSA in North America, CCC in China).

– Sanctions & Embargoes: Ensure shipments do not violate OFAC, EU, or UN restrictions.

Transport & Shipping Considerations

Choose the appropriate mode of transport based on urgency, cost, and part sensitivity.

– Air Freight: Preferred for high-value or time-sensitive parts; ensure compliance with IATA regulations for lithium batteries or magnetic materials.

– Ocean Freight: Cost-effective for bulk shipments; protect against humidity and salt exposure.

– Ground Transport: Ideal for regional distribution; ensure secure loading and climate control if needed.

Regulatory Compliance & Certifications

Verify all parts meet regional technical and safety standards.

– CE Marking (EU): Required for electric motors under the Low Voltage Directive (LVD) and Electromagnetic Compatibility (EMC) Directive.

– UL/CSA (USA/Canada): Certification for electrical safety.

– RoHS & REACH (EU): Restrictions on hazardous substances in electrical equipment.

– Energy Efficiency Standards: e.g., IE (International Efficiency) ratings per IEC 60034-30.

Returns & Reverse Logistics

Establish a clear process for handling defective or excess parts.

– Include return authorization (RMA) procedures.

– Ensure returned items are properly documented and inspected.

– Comply with local waste electrical and electronic equipment (WEEE) regulations for disposal or recycling.

Recordkeeping & Audit Readiness

Maintain records for at least 5–7 years (varies by jurisdiction).

– Retain copies of invoices, shipping documents, certificates, and compliance records.

– Prepare for customs audits by ensuring traceability from origin to delivery.

Adherence to this guide ensures timely delivery, minimizes compliance risks, and supports smooth global operations for pump motor parts.

Conclusion for Sourcing Pump Motor Parts

Sourcing pump motor parts requires a strategic approach that balances quality, cost, reliability, and lead time. A successful sourcing process involves identifying reputable suppliers, conducting thorough evaluations of part specifications and certifications, and establishing long-term partnerships to ensure consistent supply and support. It is crucial to prioritize genuine OEM components or high-quality aftermarket alternatives that meet industry standards to ensure optimal performance, safety, and longevity of the pump motor systems.

Additionally, leveraging global supply chain networks, maintaining inventory buffers for critical components, and staying informed about market trends and potential disruptions can enhance procurement efficiency. Ultimately, effective sourcing not only reduces downtime and maintenance costs but also contributes to the overall reliability and efficiency of operations. By implementing a well-structured sourcing strategy, organizations can achieve sustainable operational excellence in their pump motor maintenance and repair activities.