The global laser cleaning market is experiencing robust growth, driven by increasing demand for eco-friendly, precision surface treatment solutions across industries such as automotive, aerospace, and electronics. According to Grand View Research, the global laser cleaning market size was valued at USD 602.7 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 20.1% from 2023 to 2030. This surge is fueled by the shift away from traditional abrasive and chemical cleaning methods toward more sustainable, non-contact alternatives—where pulsed laser cleaners excel due to their high peak power and precision. As industrial digitization accelerates and regulations on environmental emissions tighten, manufacturers are investing heavily in advanced laser systems. In this competitive landscape, a core group of innovators has emerged as leaders in pulsed laser cleaning technology, combining performance, reliability, and R&D intensity to capture significant market share. Here are the top 7 pulsed laser cleaner manufacturers shaping the future of industrial cleaning.

Top 7 Pulsed Laser Cleaner Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 P-laser Industrial laser cleaning

Website: p-laser.com

Key Highlights: we engineer and manufacture the most advanced—and most powerful—pulsed industrial laser cleaning systems on the market, built for both manual and automated ……

#2 Laser Cleaning Machine

Website: pulsar-laser.com

Key Highlights: Explore PULSAR Laser P CL laser cleaning machines for industrial rust removal and paint stripping. Compare SHARK P CL, PANDA P CL and FOX P CL….

#3 SFX Laser

Website: sfxlaser.com

Key Highlights: SFX Laser is a 20+ years professional laser equipment manufacturer including laser cleaning machine, laser welding machine, fiber laser engraver, ……

#4 Pulse Wave Laser Machines

Website: nuwavelaser.com

Key Highlights: Explore our cutting-edge technology of pulse laser cleaning machines, delivering efficient removal of oil, weld seams, and gear rust….

#5 Fortune Laser pulse Laser cleaning Machine

Website: fortunelaser.com

Key Highlights: Fortune Laser portable handheld laser cleaning machine has many advantages such as portability, lightness, flexible parameter adjustment, etc….

#6 Pulse Laser Cleaning Machine

Website: triumphlaser.com

Key Highlights: A pulse laser cleaning machine is an advanced, highly efficient tool designed for precision cleaning and removal of contaminants such as rust, paint, oil, and ……

#7 Laser Cleaning and Laser Ablation Systems

Website: laserphotonics.com

Key Highlights: Pulsed Wave Laser Cleaning Machines. A pulsed laser can achieve a higher peak power per pulse than a CW laser. These laser systems come with a low output ……

Expert Sourcing Insights for Pulsed Laser Cleaner

H2: 2026 Market Trends for Pulsed Laser Cleaners

The pulsed laser cleaner market is poised for significant transformation by 2026, driven by technological advancements, expanding industrial applications, and growing environmental and efficiency demands. Here are the key trends shaping the market:

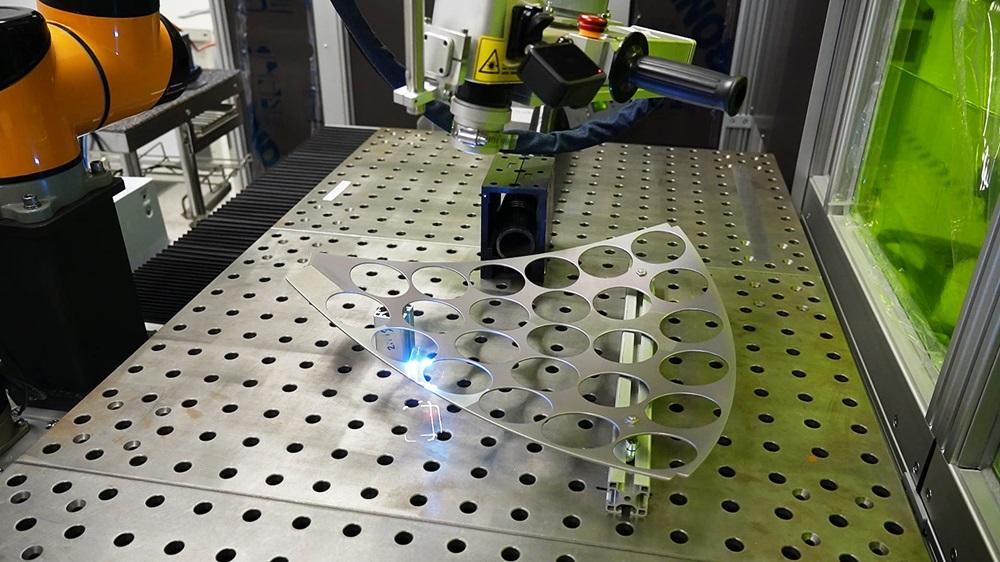

1. Accelerated Adoption in Advanced Manufacturing

By 2026, pulsed laser cleaning will see widespread integration in high-precision industries such as aerospace, automotive, and semiconductor manufacturing. The demand for non-contact, residue-free surface preparation and cleaning—especially for components sensitive to mechanical or chemical methods—will drive adoption. Original Equipment Manufacturers (OEMs) will increasingly embed laser cleaning into automated production lines to ensure consistent quality and reduce downtime.

2. Technological Innovation and Miniaturization

Advancements in fiber laser technology, including higher pulse energies, improved beam quality, and reduced system footprint, will lead to more compact, portable, and energy-efficient pulsed laser cleaners. Handheld systems will become more powerful and user-friendly, expanding their use in field maintenance, restoration, and smaller workshops. Integration with AI-driven process control and real-time monitoring will enhance precision and operational efficiency.

3. Sustainability and Regulatory Pressure as Key Drivers

Stringent environmental regulations targeting chemical solvents and abrasive blasting methods will accelerate the shift toward eco-friendly alternatives. Pulsed laser cleaning, which produces no secondary waste and requires no consumables, will be increasingly favored under ESG (Environmental, Social, Governance) compliance mandates. Industries seeking to reduce their carbon footprint and eliminate hazardous waste streams will prioritize laser solutions.

4. Expansion into New Application Verticals

Beyond traditional industrial cleaning, markets such as heritage conservation, medical device sterilization, and renewable energy (e.g., solar panel and wind turbine maintenance) will adopt pulsed laser systems. The non-destructive nature of pulsed lasers makes them ideal for delicate tasks like removing corrosion from historical artifacts or cleaning sensitive photovoltaic surfaces without damage.

5. Cost Reduction and Improved ROI

As production scales and component costs decline, the total cost of ownership for pulsed laser cleaners will become increasingly competitive with conventional methods. By 2026, shorter payback periods and demonstrable improvements in throughput and labor savings will make laser cleaning a financially attractive investment for mid-sized enterprises, not just large corporations.

6. Regional Market Growth and Supply Chain Localization

Asia-Pacific, particularly China and India, will lead market growth due to rapid industrialization and government support for green manufacturing technologies. North America and Europe will maintain strong demand, driven by automation trends and regulatory frameworks. Localized manufacturing and service networks will emerge to support faster deployment and after-sales support.

7. Integration with Smart Manufacturing (Industry 4.0)

Pulsed laser cleaners will increasingly feature IoT connectivity, enabling remote diagnostics, predictive maintenance, and data analytics for process optimization. Seamless integration with digital twins and factory-wide control systems will position laser cleaning as a critical component of smart, agile production ecosystems.

Conclusion:

By 2026, the pulsed laser cleaner market will transition from a niche technology to a mainstream industrial solution. Driven by sustainability, automation, and technological maturity, the market will experience robust growth across diverse sectors. Companies that invest in innovation, scalability, and application-specific solutions will be best positioned to capture value in this evolving landscape.

Common Pitfalls When Sourcing a Pulsed Laser Cleaner (Quality and Intellectual Property)

Sourcing a pulsed laser cleaner presents unique challenges, particularly concerning product quality and intellectual property (IP) protection. Overlooking these aspects can lead to financial loss, operational inefficiencies, and legal exposure. Below are the most common pitfalls to avoid:

Quality-Related Pitfalls

Inadequate Laser Source Verification

Many suppliers use generic or rebranded laser modules of unknown origin. Without verifying the laser’s brand, model, power stability, and pulse consistency, buyers risk receiving underperforming systems that degrade quickly or fail entirely. Always request third-party test reports and conduct on-site performance validation before finalizing procurement.

Overstated Performance Claims

Suppliers often exaggerate cleaning speed, material compatibility, or removal efficiency. Claims like “removes rust in one pass” may only apply under ideal lab conditions. Demand real-world test results on materials relevant to your application and insist on a trial unit under actual operating conditions.

Poor Beam Delivery and Optics Quality

Low-cost systems may use substandard scanning heads, mirrors, or lenses that degrade rapidly under high-intensity pulses. This results in inconsistent beam focus, reduced cleaning efficiency, and frequent maintenance. Inspect the quality of optical components and ensure they are rated for pulsed laser operation.

Insufficient Cooling and Thermal Management

Pulsed lasers generate significant heat. Inadequate cooling systems—especially in compact or portable units—lead to thermal drift, performance drop-offs, or catastrophic failure. Verify the cooling mechanism (air, water, or hybrid) and its duty cycle under continuous operation.

Lack of Safety Features and Compliance

Non-compliant systems may omit essential safety interlocks, laser shielding, or proper classification labeling (e.g., IEC 60825). This exposes users to radiation hazards and can result in regulatory fines. Confirm that the system meets regional safety standards and includes proper documentation.

Intellectual Property (IP)-Related Pitfalls

Unclear IP Ownership and Licensing

Some suppliers use proprietary laser control software or algorithms without proper licensing. Purchasing such systems may inadvertently involve your organization in IP infringement. Request documentation on software licensing, firmware origins, and any third-party patents involved.

Reverse-Engineered or Clone Systems

Especially prevalent with Chinese manufacturers, some pulsed laser cleaners are clones of established European or American designs. These systems may infringe on patents related to beam modulation, cooling architecture, or user interface. Conduct due diligence on the supplier’s R&D capabilities and patent portfolio.

Absence of IP Transfer Agreements

If customization is required, failing to secure IP rights to modifications can limit future scalability or resale. Always negotiate clear IP clauses in contracts, specifying ownership of custom designs, software updates, or process optimizations developed during integration.

Weak Warranty and Support Tied to IP Restrictions

Suppliers may restrict repairs or maintenance to authorized personnel only, citing IP protection. This can lead to costly downtime and vendor lock-in. Ensure service agreements include provisions for third-party maintenance or access to technical documentation within reasonable bounds.

By proactively addressing these quality and IP-related pitfalls, organizations can mitigate risks and ensure a reliable, legally sound investment in pulsed laser cleaning technology.

H2: Logistics & Compliance Guide for Pulsed Laser Cleaner

H2: Overview

Pulsed laser cleaners are Class 4 lasers, posing significant safety, regulatory, and logistical challenges. This guide outlines critical logistics and compliance considerations for the safe international transport, import, and operation of pulsed laser cleaning equipment.

H3: Regulatory Compliance

H4: Laser Safety (IEC 60825-1 & FDA 21 CFR 1040.10)

– Laser Classification: Pulsed laser cleaners are almost universally Class 4 lasers due to high peak power. Confirm classification with manufacturer test reports.

– Manufacturer Certification: Ensure equipment bears required labeling (Class 4 warning, aperture label, interlock warnings) and is certified under:

– IEC 60825-1 (International/CE Mark)

– FDA 21 CFR 1040.10 (U.S. market)

– Variance/Reporting (U.S.): U.S. importers must file a Laser Product Report with FDA (before shipment) and obtain a Variance if intended for non-exempt industrial use.

H4: Electromagnetic Compatibility (EMC)

– Equipment must comply with EMC directives (e.g., EU EMC Directive 2014/30/EU, FCC Part 15 in the U.S.) to prevent interference.

– Verify CE/FCC marks on power supplies and control units.

H4: Electrical Safety

– Comply with regional electrical standards (e.g., IEC 60335, UL 61010-1).

– Ensure voltage/frequency compatibility (e.g., 110V/60Hz vs. 230V/50Hz).

H4: RoHS & REACH (EU)

– Confirm compliance with RoHS (Restriction of Hazardous Substances) and REACH (chemical safety). Request Declarations of Conformity.

H4: Country-Specific Approvals

– China: CCC Mark may be required for power components.

– Canada: ICES-003 (EMC) and CSA C22.2 No. 61010-1.

– Japan: PSE Mark (METI).

– Always verify requirements with local authorities or customs brokers.

H3: International Shipping & Logistics

H4: Hazard Classification & Documentation

– UN Number: Class 4 lasers are NOT classified as dangerous goods for transport under IATA/IMDG/ADR.

– Exception: Batteries (if included) may require UN 3480 (lithium-ion) declaration and packaging.

– Key Documents:

– Commercial Invoice (declared value, HS code)

– Packing List

– Bill of Lading/Air Waybill

– Laser Safety Statement: Declare “Class 4 Laser Product – IEC 60825-1 Compliant” on all documents.

H4: Packaging & Handling

– Use shock-resistant, anti-static packaging with internal bracing.

– Include moisture barriers for humid climates.

– Label outer packaging:

▶ “FRAGILE”

▶ “CLASS 4 LASER – DO NOT OPERATE”

▶ “THIS SIDE UP”

H4: Customs Clearance (HS Codes)

– Primary HS Code: 8543.70 (Electrical Machines with Individual Functions)

– Alternative: 9013.20 (Laser Devices)

– Verify with destination country’s tariff database. Misclassification causes delays.

H4: Import Duties & Taxes

– Duties vary by country (e.g., 0–8% in EU, 2.5% in U.S. under HTS 8543.70.90).

– VAT/GST applies (e.g., 20% in UK, 10% in Japan).

– Use Incoterms® 2020 (e.g., DDP for importer control, EXW for exporter simplicity).

H3: On-Site Compliance & Safety

H4: Installation Requirements

– Laser-Controlled Area: Establish a Nominal Hazard Zone (NHZ) with barriers, warning signs, and interlocks.

– Ventilation: Required if cleaning generates fumes/particulates (use fume extractors).

– Electrical: Dedicated circuit with grounding; avoid shared lines with sensitive equipment.

H4: Operational Safety

– PPE: Mandatory laser safety goggles (OD 5+ at laser wavelength), flame-resistant clothing, and face shields.

– Training: Operators must complete laser safety training (ANSI Z136.1 or IEC 60825).

– Procedures: Implement lockout/tagout (LOTO), emergency shutdown protocols, and fire response plans.

H4: Regulatory Registration

– Germany: Notify local authorities under Ordinance on Protection against Non-Ionising Radiation (NNISV).

– U.S.: State-specific rules (e.g., California requires laser registration).

– UK: Comply with CDRH guidelines and HSE standards.

H3: Key Action Steps

- Obtain full compliance documentation (IEC, FDA, EMC, RoHS).

- File FDA Laser Report/Variance (for U.S. shipments).

- Use correct HS code (8543.70) and declare Class 4 laser status.

- Ship with robust packaging and clear hazard labels.

- Train operators and establish a laser safety program.

⚠️ Warning: Non-compliance risks shipment seizure, fines, or liability for injuries. Consult a laser safety officer (LSO) and customs expert before shipping.

This guide is advisory. Regulations vary by jurisdiction. Verify requirements with local authorities.

Conclusion on Sourcing a Pulsed Laser Cleaner

Sourcing a pulsed laser cleaner is a strategic investment that aligns with the growing demand for precise, environmentally friendly, and non-abrasive cleaning solutions across industries such as aerospace, automotive, heritage conservation, and precision manufacturing. Pulsed laser cleaning technology offers superior control, minimal substrate damage, and no secondary waste, making it a sustainable alternative to traditional cleaning methods.

When sourcing a pulsed laser cleaner, key considerations include pulse energy, frequency, wavelength, beam quality, reliability of the manufacturer, and after-sales support. It is essential to select a system tailored to specific application requirements—such as rust removal, oxide layer ablation, or delicate surface restoration—while ensuring compliance with safety and regulatory standards.

Additionally, evaluating total cost of ownership, including maintenance, training, and integration into existing workflows, is crucial for long-term success. Collaborating with reputable suppliers who offer technical expertise, service agreements, and scalability options will enhance operational efficiency and ensure a strong return on investment.

In conclusion, sourcing a high-quality pulsed laser cleaner not only improves cleaning performance and environmental sustainability but also positions organizations at the forefront of advanced industrial maintenance and restoration practices.