The global prototype manufacturing market is experiencing robust growth, driven by increasing demand for rapid product development across industries such as automotive, consumer electronics, and medical devices. According to Grand View Research, the global rapid prototyping market size was valued at USD 33.5 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 12.6% from 2023 to 2030. This surge is fueled by advancements in additive manufacturing, rising adoption of 3D printing technologies, and the need for faster time-to-market cycles. As innovation accelerates, selecting the right prototype manufacturer has become a critical factor in product success—making it essential to partner with firms that combine technical precision, scalable capacity, and industry-specific expertise. In this landscape, the following ten manufacturers stand out for their proven track record, technological capabilities, and data-backed performance across global supply chains.

Top 10 Prototype Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Prototype & Production Systems

Domain Est. 1997

Website: prototypesys.com

Key Highlights: Prototype & Production Systems Inc. (PPSI) offers custom industrial inkjet printers and digital printers. Enhance your printing capabilities with a custom ……

#2 FATHOM Advanced Manufacturing

Domain Est. 2019

Website: fathommfg.com

Key Highlights: Whether you need prototype or production parts, we have an industrial 3D printing solution for you. SLS Printing SLA Printing Polyjet Printing MJF Printing FDM ……

#3 Designcraft

Domain Est. 1993

Website: designcraft.com

Key Highlights: Partner with Designcraft to turn your concept into a real product with prototypes, low‑volume manufacturing and expert support. Start your project today….

#4 Prototyping & Low

Domain Est. 1995

Website: 3dimensional.com

Key Highlights: The 3-Dimensional Services Group specializes in manufacturing metal and plastic prototype and low-volume production parts and assemblies….

#5 RCO Engineering

Domain Est. 1996

Website: rcoeng.com

Key Highlights: Looking for a trusted manufacturing services provider? RCO Engineering offers contract manufacturing for a wide range of industries. Work with us today!…

#6 Quickparts

Domain Est. 1997

Website: quickparts.com

Key Highlights: Accelerate innovation. Seamlessly scale production. Prototypes and low quantities? Upload your file now. Get a QuickQuote® or High-volume production? Start ……

#7 Protolabs Network (formerly Hubs)

Domain Est. 1998

Website: hubs.com

Key Highlights: Hubs is now Protolabs Network. Manufacturing capabilities for complex custom parts–from prototypes to production. 3D printing | CNC machining | injection ……

#8 Protolabs

Domain Est. 2006

Website: protolabs.com

Key Highlights: Protolabs is the world’s fastest source for custom prototypes and low-volume production parts. Get an interactive online quote with free design analysis ……

#9 Fictiv

Domain Est. 2007

Website: fictiv.com

Key Highlights: Custom parts for prototypes to full scale production, for CNC machining, 3D printing, injection molding, and more. Get an instant quote….

#10 Star Rapid

Domain Est. 2015

Website: starrapid.com

Key Highlights: Submit. For any questions relating to STAR RAPID, please contact us by the following email address: [email protected]….

Expert Sourcing Insights for Prototype

H2: Market Trends Shaping Prototyping in 2026

By 2026, the prototyping landscape is undergoing a transformative shift, driven by technological convergence, evolving business demands, and a heightened focus on sustainability and speed. Key trends define this dynamic market:

1. Hyper-Automation & AI-Driven Design: Artificial Intelligence (AI) and Machine Learning (ML) are no longer futuristic concepts but core components of the 2026 prototyping workflow. AI algorithms will be deeply integrated into CAD software, enabling generative design at unprecedented speed and complexity. These systems will autonomously generate optimized prototype concepts based on functional requirements, material constraints, and manufacturing methods, drastically reducing initial design time. AI will also power predictive analysis, simulating performance, stress points, and failure modes with high accuracy before physical prototyping begins, minimizing costly late-stage iterations.

2. Convergence of Physical & Digital Prototyping (Digital Twins): The line between physical and virtual prototypes blurs. Digital twins – dynamic, real-time virtual replicas of physical prototypes and final products – become the central hub for development. In 2026, physical prototypes are created not just for form and fit, but specifically to validate and calibrate their digital twins. Data from embedded sensors in physical prototypes feeds back into the digital twin, creating a closed-loop system for continuous improvement. This convergence allows for extensive virtual testing, scenario simulation, and remote collaboration, significantly accelerating validation cycles.

3. Advanced Materials & Multi-Material 3D Printing Dominance: The prototyping market sees explosive growth in accessible, high-performance materials. Multi-material and multi-color 3D printing technologies mature, allowing the creation of functionally graded prototypes with varying material properties (rigidity, flexibility, conductivity) within a single build. This enables the production of highly realistic, near-final-product prototypes that accurately mimic complex assemblies, reducing the need for multiple prototype iterations. Bio-based, recyclable, and self-healing materials gain significant traction, driven by sustainability mandates.

4. Democratization & Cloud-Based Collaboration Platforms: Prototyping tools become increasingly accessible. Cloud-based simulation, design, and project management platforms dominate, enabling seamless collaboration across global teams, suppliers, and customers in real-time. User-friendly interfaces and subscription models lower the barrier to entry for startups and SMEs. This democratization fosters innovation but also intensifies competition.

5. Sustainability as a Core Design & Prototyping Imperative: Environmental impact is a primary driver. The “circular prototyping” model emerges, focusing on designing for disassembly, repair, and reuse from the outset. Sustainable material choices, minimizing waste through precise digital simulation, and utilizing remanufactured or recycled materials in prototypes become standard practice, driven by both regulation and consumer demand. Life Cycle Assessment (LCA) tools are integrated directly into prototyping software.

6. Speed-to-Market as the Ultimate KPI: The pressure to launch faster intensifies. This drives the adoption of Agile and Lean prototyping methodologies. Rapid iteration cycles, facilitated by the trends above, become the norm. “Fail fast, learn faster” is operationalized through quick, low-cost digital and physical proof-of-concept models, enabling faster validation of market fit and reducing the risk of large-scale development failures.

7. Rise of Service-Oriented Prototyping: The market sees a shift from selling prototyping machines to providing comprehensive prototyping services and solutions. Specialized providers offer on-demand access to cutting-edge technologies (like metal AM, micro-fabrication), expert engineering support, and full lifecycle management from concept to pre-production, allowing companies to scale prototyping capacity without heavy capital investment.

In summary, the 2026 prototyping market is characterized by intelligent automation, seamless digital-physical integration, sustainable practices, and unprecedented speed. Success will depend on leveraging AI, embracing digital twins, utilizing advanced materials, collaborating globally via the cloud, and embedding sustainability into every stage of the prototyping process.

Common Pitfalls in Sourcing Prototypes (Quality, IP)

Sourcing prototypes—especially from external suppliers or offshore manufacturers—can accelerate product development but introduces significant risks if not managed carefully. Two of the most critical areas prone to pitfalls are quality consistency and intellectual property (IP) protection. Overlooking these can lead to project delays, legal disputes, or compromised product integrity.

Quality Risks in Prototype Sourcing

- Inconsistent Manufacturing Standards: External vendors may lack the precise processes, materials, or testing procedures needed to meet design specifications, leading to non-functional or unreliable prototypes.

- Use of Substandard Materials: Suppliers might substitute lower-grade materials to cut costs, affecting performance and durability without immediate notice.

- Poor Documentation and Traceability: Inadequate records of design iterations, test results, or component sourcing make it difficult to diagnose failures or replicate successful prototypes.

- Limited Testing and Validation: Some suppliers deliver prototypes without rigorous functional or environmental testing, creating false confidence in the design.

Intellectual Property Risks in Prototype Sourcing

- Lack of Legal Agreements: Failing to establish clear non-disclosure agreements (NDAs), work-for-hire contracts, or IP ownership clauses leaves designs vulnerable to misuse or replication.

- Unsecured Design Files: Sharing CAD files, schematics, or firmware without encryption or access controls increases the risk of unauthorized duplication or leaks.

- Supplier Overreach: Some manufacturers may claim partial ownership of design improvements or use prototype designs for their own products, especially in regions with weak IP enforcement.

- Reverse Engineering by Third Parties: Once a prototype is in the hands of a supplier, there’s a risk they—or their subcontractors—could reverse engineer the product for competitive purposes.

Mitigation Strategies

To avoid these pitfalls:

– Vet suppliers thoroughly, including audits of quality systems and IP policies.

– Use legally binding contracts that explicitly assign IP rights to your organization.

– Limit the distribution of sensitive design data and use watermarked or obfuscated files when possible.

– Implement stage-gated prototyping with incremental disclosure of information.

– Conduct independent quality validation before accepting prototype deliveries.

Proactively addressing quality and IP concerns during the sourcing phase ensures that prototypes serve their intended purpose—validating design intent—without exposing your business to avoidable risks.

Logistics & Compliance Guide for Prototype Development

Developing a prototype involves more than just design and engineering—it also requires careful attention to logistics and regulatory compliance from the earliest stages. This guide outlines key considerations to ensure smooth progression from concept to functional prototype while minimizing legal, safety, and operational risks.

1. Regulatory Classification and Standards

Determine the regulatory category of your prototype based on its function, industry, and target market. Early classification helps guide design and testing requirements.

- Identify Applicable Standards: Research relevant standards (e.g., ISO, IEC, ASTM, FCC, CE, FDA) depending on product type (e.g., medical device, consumer electronics, automotive).

- Jurisdictional Requirements: Consider regional regulations if planning international testing or distribution (e.g., RoHS in the EU, UL in North America).

- Exemptions for Prototypes: Confirm whether regulatory bodies allow prototype exemptions from full certification (e.g., FCC’s prototype development exemption under Part 15).

2. Component Sourcing and Supply Chain Management

Secure reliable, compliant components while managing lead times and documentation.

- Preferred Suppliers: Use reputable distributors (e.g., Digi-Key, Mouser, RS Components) to ensure traceability and compliance documentation (e.g., RoHS, REACH, conflict minerals).

- Custom Parts: For fabricated components (e.g., PCBs, enclosures), vet manufacturers for quality control and IP protection.

- Lead Times & Inventory: Track component availability; maintain a bill of materials (BOM) with part numbers, sources, and compliance status.

3. Import/Export Compliance

Prototypes often cross borders for testing, collaboration, or manufacturing.

- Temporary Importation: Use ATA Carnets or temporary import regimes (e.g., U.S. Temporary Importation Under Bond) to avoid duties on prototypes.

- Export Controls: Review ITAR, EAR, or other export control regulations if your prototype contains sensitive technology (e.g., encryption, defense-related features).

- Documentation: Prepare accurate commercial invoices, packing lists, and product descriptions for customs.

4. Labeling and Marking Requirements

Even prototypes should reflect future compliance needs.

- Safety Labels: Include necessary warnings (e.g., electrical hazards, heat) based on intended use.

- FCC/CE Marking (if applicable): While prototypes may not require formal marks, design with future marking locations and requirements in mind.

- Internal Tracking: Label prototypes with version numbers, dates, and internal compliance status for traceability.

5. Testing and Safety Protocols

Ensure prototype testing follows safety and environmental standards.

- Electrical Safety: Follow standards like IEC 62368-1 for energy sources and user accessibility.

- EMC & RF Testing: Conduct pre-compliance testing for electromagnetic compatibility if applicable.

- Environmental Testing: Simulate real-world conditions (e.g., temperature, vibration) as needed, especially for rugged or outdoor use.

- Lab Safety: Use protective equipment and follow lab protocols when testing high-voltage, pressure, or moving parts.

6. Intellectual Property (IP) Protection

Safeguard your design during logistics and external handling.

- NDAs: Require non-disclosure agreements with suppliers, testers, and partners.

- Provisional Patents: File early if invention is novel and non-obvious.

- Marking: Label prototypes as “Confidential” or “Proprietary” to strengthen IP claims.

7. Packaging and Transportation

Protect the prototype and comply with shipping regulations.

- Secure Packaging: Use anti-static, shock-absorbent materials for sensitive electronics.

- Hazardous Materials: Declare batteries (especially lithium-ion) properly; follow IATA/IMDG regulations for air/sea transport.

- Shipping Carriers: Use services that offer tracking and insurance (e.g., FedEx, DHL) and declare contents accurately.

8. Data Privacy and Cybersecurity (if applicable)

For connected prototypes, ensure data handling aligns with compliance frameworks.

- Data Minimization: Collect only necessary data during testing.

- Encryption: Implement secure communication protocols (e.g., TLS).

- GDPR/CCPA Considerations: Anonymize user data and obtain consent if real users are involved in testing.

9. Documentation and Recordkeeping

Maintain detailed records to support future certification and audits.

- Design History File (DHF): Track design decisions, iterations, and test results.

- Compliance Matrix: Map prototype features to applicable standards.

- Test Reports: Archive safety, performance, and environmental test data.

10. Planning for Scale-Up Compliance

Design with future production compliance in mind.

- Design for Compliance (DfC): Integrate regulatory requirements during prototyping to avoid costly redesigns.

- Supplier Qualification: Begin qualifying production-grade suppliers early.

- Certification Roadmap: Outline steps and timelines for full product certification (e.g., UL listing, CE marking).

By proactively addressing logistics and compliance during the prototype phase, you reduce time-to-market, mitigate risk, and lay a strong foundation for commercialization.

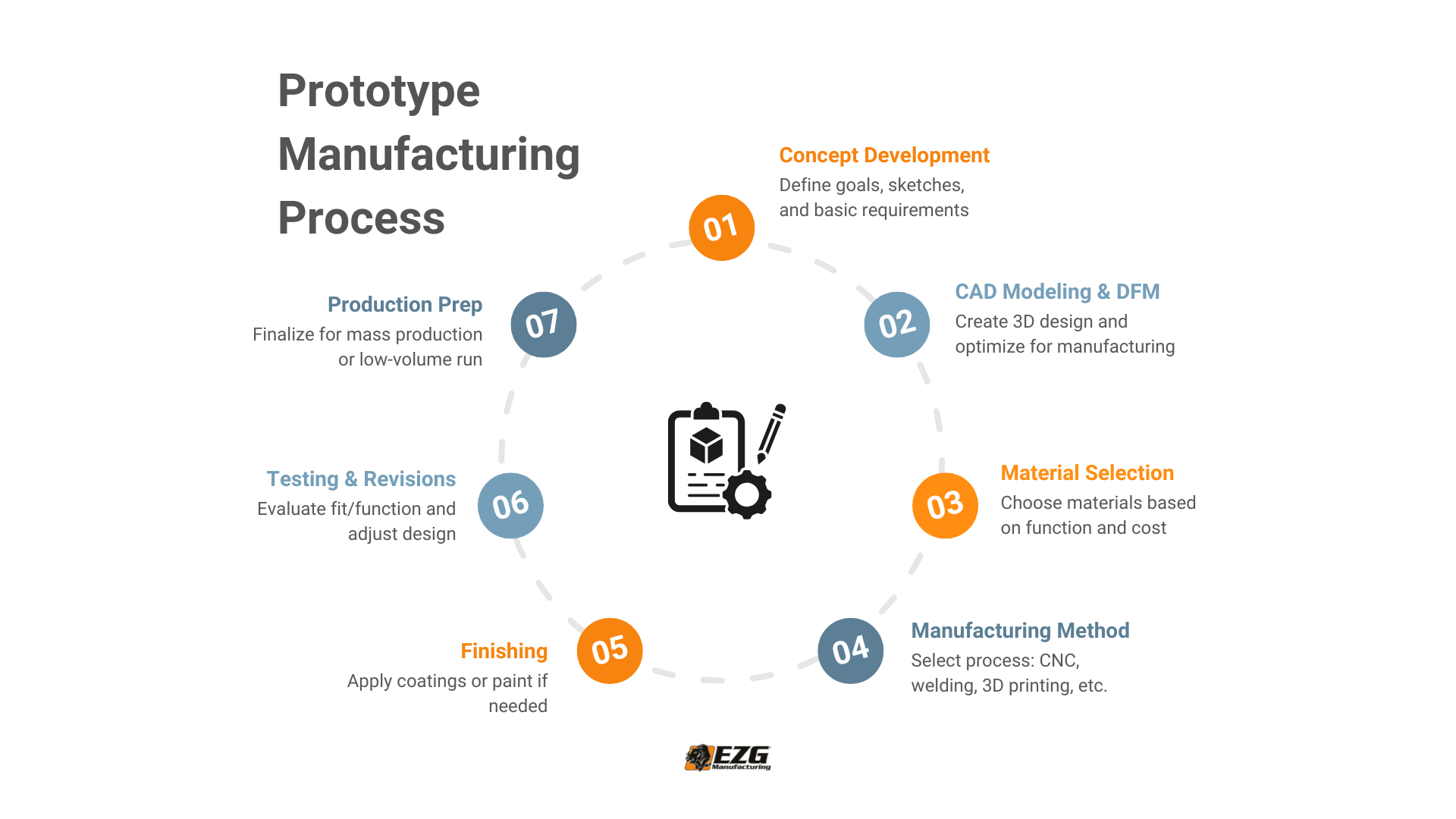

Conclusion for Sourcing a Prototype Manufacturer:

After a thorough evaluation of potential prototype manufacturers, selecting the right partner is critical to ensuring product development success, timely iterations, and a smooth transition to full-scale production. Key factors such as technical capabilities, material expertise, lead times, cost efficiency, communication responsiveness, and proven experience in your industry should guide the decision. Prototyping is not just about building a model—it’s about validating design, functionality, and manufacturability early on. Therefore, prioritizing collaboration, flexibility, and quality over the lowest initial cost will ultimately save time and resources.

Based on the assessment criteria, [Insert Chosen Manufacturer Name] emerges as the most suitable partner, demonstrating strong engineering support, rapid turnaround, and a track record of successful prototyping across similar projects. Moving forward, establishing clear milestones, maintaining open communication, and documenting design feedback will ensure an efficient prototyping phase, laying a solid foundation for future production.