The global prosthetic limbs market is experiencing robust growth, driven by rising incidences of amputations due to diabetes, vascular diseases, and trauma, alongside advancements in bionic and myoelectric technologies. According to a 2023 report by Mordor Intelligence, the market was valued at USD 1.87 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2028, reaching an estimated USD 2.76 billion. Similarly, Grand View Research notes increasing demand for technologically advanced prosthetics, particularly in developed regions, supported by growing healthcare expenditure and favorable reimbursement policies. This accelerating demand has fostered innovation and competition among leading manufacturers, reshaping rehabilitation outcomes for amputees worldwide. Below are the top 10 prosthetic limb companies leading this transformation through cutting-edge research, precision engineering, and patient-centric design.

Top 10 Prosthetic Limb Companies Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Limb Lab Prosthetic & Orthotic Care

Domain Est. 2013

Website: limblab.com

Key Highlights: Limb Lab delivers customized prosthetic and orthotic solutions to enhance mobility, comfort, and confidence with expert care and innovative technology….

#2 Steeper Prosthetics

Domain Est. 2015

Website: steepergroup.com

Key Highlights: Steeper is a leading international manufacturer of upper extremity prosthetic products, and a distributor of world class lower limb products….

#3 to Ottobock

Domain Est. 1996

Website: ottobock.com

Key Highlights: Ottobock offers innovative products in the areas of orthotics & prosthetics for patients who suffer from amputations, injuries, or neurological diseases….

#4 Prosthetics: Explore Össur’s Innovative Solutions

Domain Est. 1996

Website: ossur.com

Key Highlights: Össur prosthetics company designs exceptional prosthetic solutions that help amputees and people with limb difference improve their mobility….

#5 Proteor USA

Domain Est. 1997

Website: us.proteor.com

Key Highlights: PROTEOR is committed to helping people with lower limb loss achieve their goals. With focus on education, fitness and community, we strive to support your ……

#6 Fillauer Website

Domain Est. 1998

Website: fillauer.com

Key Highlights: At Fillauer, we are dedicated to creating innovative orthotic and prosthetic products that empower you to achieve your best functional outcomes….

#7 Arm Dynamics

Domain Est. 1998

Website: armdynamics.com

Key Highlights: Arm Dynamics provides exceptional prosthetic rehabilitation to upper limb amputees in the US and around the world….

#8 Hanger Clinic

Domain Est. 2010

Website: hangerclinic.com

Key Highlights: We create customized solutions for people of all ages, including state-of-the-art prostheses, braces, cranial helmets, and other devices….

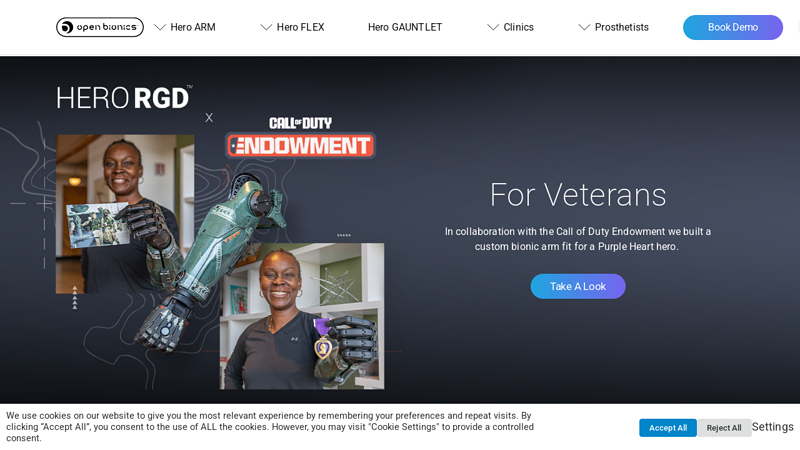

#9 Open Bionics

Domain Est. 2013

Website: openbionics.com

Key Highlights: At Open Bionics we develop medical devices that enhance the human body, starting with The Hero Arm. Your bionic journey starts here….

#10 The Most Advanced Lower Limb Prosthetics in the World

Domain Est. 2019

Website: blatchfordmobility.com

Key Highlights: We develop and manufacture products designed to offer individuals the best possible mobility, function, comfort and cosmesis after amputation or other pathology ……

Expert Sourcing Insights for Prosthetic Limb Companies

2026 Market Trends for Prosthetic Limb Companies

The global prosthetic limb market is poised for significant transformation by 2026, driven by technological innovation, demographic shifts, and evolving healthcare policies. Prosthetic limb companies must adapt to these emerging trends to maintain competitiveness and meet growing patient demands.

Technological Advancements in Prosthetics

By 2026, technological innovation will remain a core driver of market growth. Key developments include:

- AI and Machine Learning Integration: Prosthetic limbs are increasingly incorporating AI to improve motion prediction, gait adaptation, and user intent recognition, resulting in more intuitive and responsive devices.

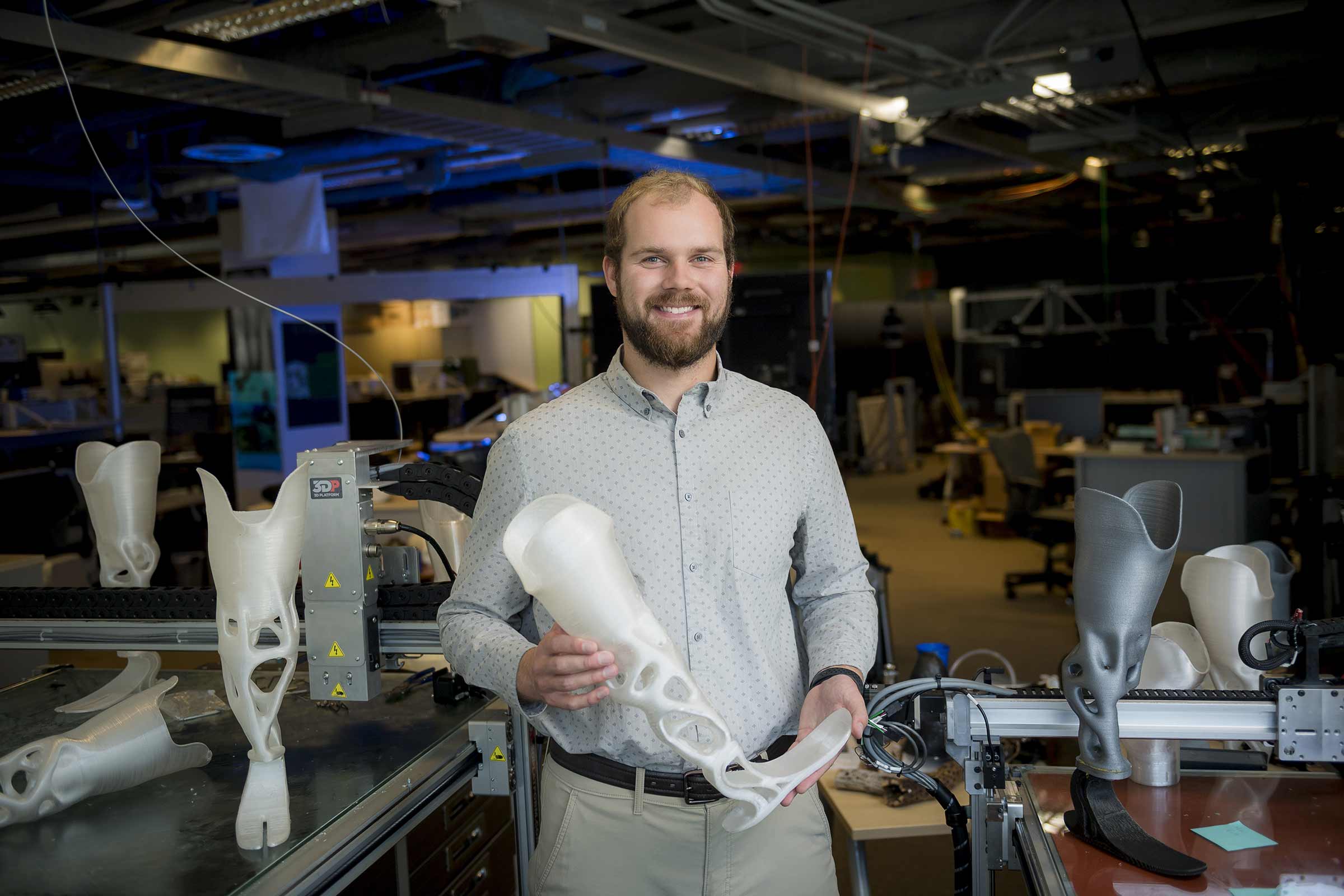

- Advanced Materials: Lightweight, durable materials such as carbon fiber composites and 3D-printed polymers are enabling more comfortable, customizable, and aesthetically pleasing prosthetics.

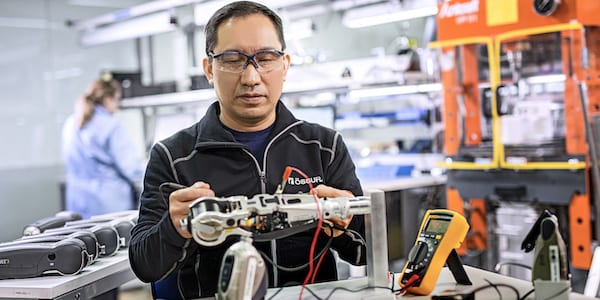

- Bionic and Myoelectric Limbs: Enhanced sensor technology and neural interface systems are allowing for greater dexterity and natural movement in upper and lower limb prosthetics.

- 3D Printing and Digital Scanning: These technologies are reducing production costs, shortening lead times, and enabling patient-specific customization at scale.

Rising Global Demand and Demographics

Demographic trends are significantly influencing market expansion:

- Aging Populations: In developed regions like North America and Europe, age-related conditions such as diabetes and vascular diseases are increasing amputation rates, driving demand for lower-limb prosthetics.

- Trauma and Conflict-Related Injuries: In certain regions, military conflicts and accidents contribute to a sustained need for advanced prosthetic solutions.

- Emerging Markets Growth: Countries in Asia-Pacific, Latin America, and Africa are witnessing rising healthcare access and insurance coverage, expanding the customer base for prosthetic devices.

Regulatory and Reimbursement Landscape

Regulatory clarity and reimbursement policies will shape market dynamics:

- FDA and EU MDR Compliance: Companies must navigate increasingly stringent regulatory frameworks, particularly for smart prosthetics classified as medical devices with software components.

- Insurance Coverage Expansion: In the U.S. and parts of Europe, improved insurance coverage for advanced prosthetics is making high-end devices more accessible, boosting market penetration.

- Public-Private Partnerships: Governments and NGOs are partnering with manufacturers to subsidize prosthetic care in underserved regions, creating new revenue opportunities.

Competitive Landscape and Strategic Moves

The market is becoming more competitive, prompting strategic shifts:

- Mergers and Acquisitions: Larger players are acquiring startups with niche technologies (e.g., neural interfaces or AI algorithms) to accelerate R&D and expand product portfolios.

- Focus on User-Centric Design: Companies are investing in ergonomic design, cosmetic realism, and modular components to enhance user satisfaction and adherence.

- Direct-to-Consumer Models: Some firms are leveraging telehealth and digital platforms to offer remote fittings and consultations, reducing costs and increasing reach.

Challenges and Opportunities

Despite growth potential, challenges remain:

- High Costs: Advanced prosthetics remain expensive, limiting accessibility in low-income regions.

- Training and Support Infrastructure: Effective use of smart prosthetics requires trained clinicians and ongoing support, which may be lacking in certain markets.

- Opportunities in Digital Health Integration: Connecting prosthetics with mobile apps and health monitoring platforms offers new value-added services and data-driven insights.

Conclusion

By 2026, prosthetic limb companies that embrace innovation, expand into emerging markets, and align with evolving regulatory and reimbursement frameworks will be best positioned for success. The convergence of AI, biometrics, and personalized medicine will redefine what is possible in prosthetic care, making this a pivotal period for industry growth and patient impact.

Common Pitfalls When Sourcing Prosthetic Limb Companies: Quality and Intellectual Property Concerns

Quality-Related Pitfalls

Inconsistent Manufacturing Standards

One of the most significant quality risks when sourcing from prosthetic limb companies—especially overseas or from emerging manufacturers—is inconsistent adherence to international quality standards. Many suppliers may not comply with ISO 13485 (medical device quality management) or FDA regulations, leading to variability in product safety, durability, and performance. This can result in higher failure rates, patient discomfort, or even safety hazards.

Lack of Clinical Validation

Some prosthetic limb manufacturers may offer innovative designs or advanced materials without sufficient clinical testing or peer-reviewed validation. Relying on untested technology can expose healthcare providers and patients to unreliable devices, increasing the risk of rejection, poor mobility outcomes, or long-term complications.

Poor Material Selection and Durability

Low-cost suppliers may use substandard materials to reduce production costs. Components made from inferior plastics, metals, or socket materials may degrade quickly under regular use, compromising both functionality and user safety. Durability issues can lead to frequent replacements, increasing long-term costs and reducing patient satisfaction.

Inadequate Customization and Fit

High-quality prosthetics require precise customization to match individual anatomical and biomechanical needs. Sourcing from companies with limited customization capabilities or outdated measurement techniques (e.g., manual casting instead of 3D scanning) can result in ill-fitting prostheses, discomfort, skin irritation, or gait abnormalities.

Intellectual Property (IP)-Related Pitfalls

Risk of IP Infringement

When sourcing from third-party manufacturers—particularly in regions with weak IP enforcement—there’s a heightened risk of inadvertently using prosthetic designs, software, or components that infringe on existing patents. This can lead to legal disputes, product recalls, or costly litigation, especially when entering regulated markets like the U.S. or EU.

Lack of IP Ownership Clarity

Many sourcing agreements fail to clearly define who owns the intellectual property developed during collaboration. If a prosthetic limb design is co-developed or customized, ambiguity in contracts can result in disputes over patent rights, licensing, or future product iterations. This is especially critical when incorporating proprietary control systems, microprocessors, or AI-driven mobility algorithms.

Reverse Engineering and Design Copying

Some manufacturers, particularly in regions with lax IP protections, may reverse-engineer advanced prosthetic technologies and replicate them without authorization. This not only undermines innovation but also floods the market with counterfeit or lower-quality versions, damaging brand reputation and eroding competitive advantage.

Insufficient Protection of Trade Secrets

Sharing sensitive design specifications, software code, or manufacturing processes with external suppliers without robust non-disclosure agreements (NDAs) or technical safeguards can expose core trade secrets. Once leaked, this information may be difficult or impossible to reclaim, jeopardizing long-term R&D investments.

Mitigation Strategies

To avoid these pitfalls, organizations should conduct thorough due diligence on potential suppliers, verify certifications, require clinical trial data, draft clear IP clauses in contracts, and consider working with legal experts in medical device regulations and international IP law. Regular audits and quality control checks can further ensure ongoing compliance and product integrity.

Logistics & Compliance Guide for Prosthetic Limb Companies

Navigating the logistics and compliance landscape is critical for prosthetic limb companies to ensure patient safety, regulatory adherence, and operational efficiency. This guide outlines key considerations across the product lifecycle—from manufacturing to delivery—emphasizing regulatory requirements, shipping protocols, and documentation standards.

Regulatory Compliance

Prosthetic limbs are classified as medical devices, subject to stringent regulations depending on the target market. Compliance is mandatory to legally market and distribute products.

United States (FDA)

- Classification: Most prosthetic limbs are Class I or Class II devices under the FDA’s classification system.

- Registration & Listing: Manufacturers must register their facility and list devices with the FDA.

- Quality System Regulation (QSR): Compliance with 21 CFR Part 820 is required, covering design controls, production, process controls, and corrective actions.

- Premarket Notification (510(k)): Class II devices typically require a 510(k) submission demonstrating substantial equivalence to a predicate device.

- Unique Device Identification (UDI): All prosthetic limbs must bear a UDI label compliant with FDA standards, enabling traceability.

European Union (EU MDR)

- Medical Device Regulation (MDR) 2017/745: Prosthetic limbs must meet EU MDR requirements for safety, performance, and quality.

- CE Marking: Achieved through conformity assessment, often involving a Notified Body for Class I (sterile or measuring) and higher classes.

- Technical Documentation: Includes design dossiers, risk management files, clinical evaluations, and UDI information.

- Post-Market Surveillance (PMS): Ongoing monitoring and reporting of device performance and adverse events are required.

Other Regions

- Canada (Health Canada): Requires Medical Device License (MDL) under the Medical Devices Regulations (SOR/98-282).

- Australia (TGA): Devices must be included in the Australian Register of Therapeutic Goods (ARTG).

- Japan (PMDA): Requires approval or certification under the Pharmaceutical and Medical Device Act (PMD Act).

Logistics & Supply Chain Management

Efficient and compliant logistics are essential for delivering prosthetic devices to patients, clinics, and distributors.

Inventory Management

- Maintain accurate records of device stock, including UDI, lot numbers, and expiration dates (if applicable).

- Implement a traceability system to support recalls and adverse event investigations.

Storage Conditions

- Store prosthetic components in clean, dry, temperature-controlled environments.

- Protect devices from contamination, physical damage, and UV exposure.

- Follow manufacturer-recommended storage guidelines for electronic or battery-powered components.

Shipping & Transportation

- Packaging: Use durable, tamper-evident packaging that protects against shock, moisture, and contamination.

- Labeling: Include UDI, handling instructions (e.g., “Fragile,” “This Side Up”), and appropriate hazard labels (e.g., for batteries).

- Cold Chain (if applicable): Some components (e.g., liners, sensors) may require temperature-controlled shipping.

- Courier Selection: Use carriers experienced in medical device logistics; ensure compliance with IATA, IMDG, or other relevant transport regulations for air, sea, or ground shipping.

International Shipping

- Customs Documentation: Prepare commercial invoices, packing lists, certificates of origin, and regulatory certificates (e.g., Certificate to Foreign Government, Certificate of Free Sale).

- Import Regulations: Verify destination country requirements for medical devices, including local registration, labeling in local language, and import licenses.

- Duties & Tariffs: Classify devices under correct HS codes; leverage trade agreements where applicable to reduce tariffs.

Documentation & Recordkeeping

Robust documentation supports compliance, traceability, and quality assurance.

Required Records

- Device master records (DMR) and device history records (DHR)

- UDI logs and serialization data

- Quality management system (QMS) documentation

- Adverse event reports and corrective and preventive actions (CAPA)

- Distribution records (shipments, recipients, dates)

Retention Policies

- Retain records for periods specified by regulations (e.g., FDA: device production period plus 2 years; EU MDR: up to 10 years post-device release).

Post-Market Responsibilities

Compliance continues after delivery through ongoing monitoring and reporting.

Adverse Event Reporting

- Establish procedures to receive, evaluate, and report adverse events to regulatory authorities (e.g., FDA MAUDE database, EUDAMED).

- Report incidents within required timeframes (e.g., 30 days for FDA, 15 days for serious incidents under EU MDR).

Field Safety Corrective Actions (FSCA)

- Implement processes to manage recalls, safety alerts, or field corrections.

- Notify regulatory bodies and customers promptly and maintain records of all actions taken.

Software & Digital Components

- If prosthetic limbs include software (e.g., myoelectric control systems), comply with cybersecurity and software lifecycle regulations.

- Ensure updates are validated and distributed securely.

Best Practices

- Conduct regular internal audits and management reviews of QMS.

- Train staff on regulatory requirements, handling procedures, and incident reporting.

- Partner with experienced regulatory consultants and logistics providers familiar with medical devices.

- Use integrated ERP or QMS platforms to streamline compliance and traceability.

By adhering to this logistics and compliance framework, prosthetic limb companies can ensure patient safety, minimize regulatory risk, and maintain trust in their products worldwide.

In conclusion, sourcing prosthetic limb companies requires a comprehensive evaluation of several critical factors including technological capabilities, product quality, customization options, regulatory compliance, cost-effectiveness, and after-sales support. Prioritizing companies that demonstrate innovation, patient-centered design, and adherence to medical standards ensures better outcomes for end users. Establishing partnerships with reputable manufacturers—whether global leaders or emerging regional players—can enhance access to advanced prosthetic solutions while balancing affordability and sustainability. Ultimately, a strategic sourcing approach that aligns clinical needs with reliable supply chain practices will support the delivery of life-changing prosthetic care to individuals in need.