The global ophthalmic anesthetics market, driven by rising incidences of eye disorders and increasing outpatient eye procedures, is projected to grow at a CAGR of 5.2% from 2023 to 2030, according to Grand View Research. Proparacaine hydrochloride, a widely used topical anesthetic in eye examinations and surgeries, plays a critical role in this expanding market. With demand bolstered by aging populations and greater access to ophthalmic care, the production of high-purity proparacaine HCl has become strategically important. As of 2024, North America and Asia-Pacific lead in both consumption and manufacturing capacity. Based on production scale, regulatory compliance, and global supply reach, the following four manufacturers have emerged as key suppliers of proparacaine hydrochloride, collectively accounting for a significant share of the active pharmaceutical ingredient (API) market.

Top 4 Proparacaine Hydrochloride Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

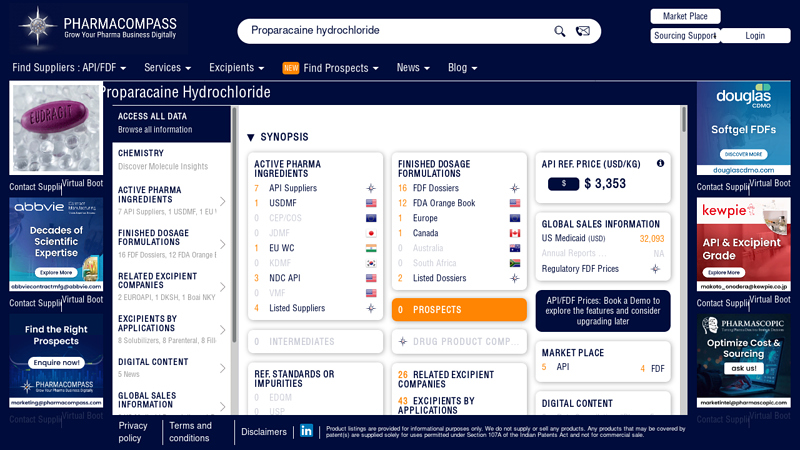

#1 Proparacaine hydrochloride

Domain Est. 2014

Website: pharmacompass.com

Key Highlights: PharmaCompass offers a list of Proparacaine hydrochloride API manufacturers, exporters & distributors, which can be sorted by GMP, USDMF, JDMF, KDMF, ……

#2 proparacaine hydrochloride solution/ drops

Domain Est. 1997

Website: dailymed.nlm.nih.gov

Key Highlights: Proparacaine hydrochloride ophthalmic solution is a rapidly-acting topical anesthetic, with induced anesthesia lasting approximately 10-20 minutes….

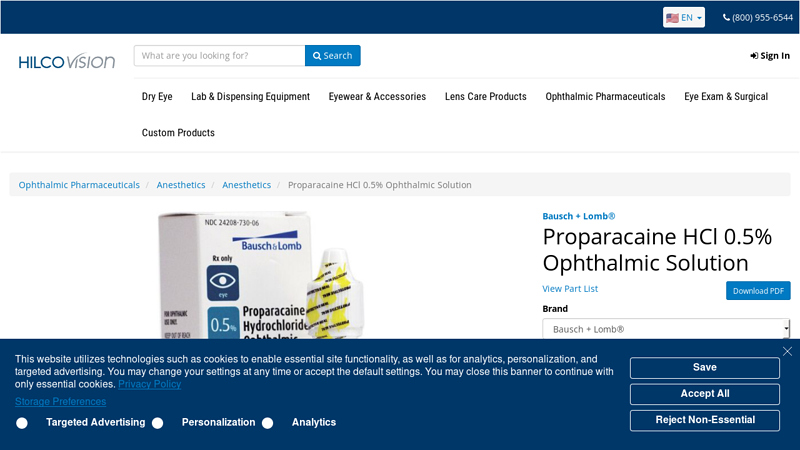

#3 Proparacaine HCl 0.5% Ophthalmic Solution

Domain Est. 2013

Website: hilcovision.com

Key Highlights: Proparacaine Hydrochloride 0.5% is a topical anesthetic solution used for numbing the eye during diagnostic procedures such as tonometry and corneal surgeries….

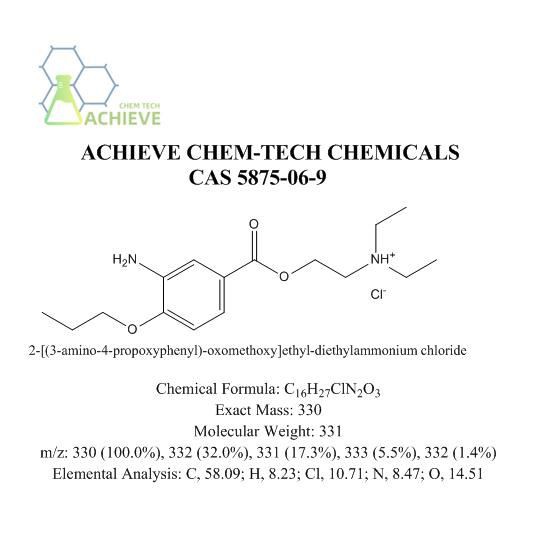

#4 Proparacaine HCl

Website: siegfried.ch

Key Highlights: Proparacaine is a local anesthetic medication used in ophthalmology to numb the eye before certain procedures or examinations….

Expert Sourcing Insights for Proparacaine Hydrochloride

H2: Market Trends for Proparacaine Hydrochloride in 2026

As the global ophthalmic pharmaceutical market evolves, Proparacaine Hydrochloride—a topical anesthetic widely used in eye care for procedures such as tonometry, foreign body removal, and minor ocular surgeries—is expected to experience notable demand shifts and strategic developments by 2026. Several key market trends are shaping its trajectory:

-

Growing Prevalence of Ocular Disorders

The rising global incidence of eye diseases—including cataracts, glaucoma, and dry eye syndrome—due to aging populations and increased screen time is driving higher volumes of diagnostic and surgical interventions. This, in turn, is increasing the reliance on fast-acting topical anesthetics like Proparacaine Hydrochloride, particularly in outpatient ophthalmology clinics and ambulatory surgical centers. -

Expansion of Minimally Invasive Ophthalmic Procedures

The shift toward same-day surgeries and non-invasive diagnostics is accelerating the need for rapid-onset, short-duration anesthetics. Proparacaine’s quick numbing effect (onset within 15–30 seconds) and short duration (10–15 minutes) make it ideal for such settings. This trend is particularly strong in emerging markets where healthcare systems are adopting cost-effective, high-throughput eye care models. -

Increased Generic Drug Utilization

Proparacaine Hydrochloride is available primarily as a generic medication, and its affordability continues to support widespread adoption, especially in price-sensitive regions such as Asia-Pacific and Latin America. By 2026, continued pressure to reduce healthcare costs will likely reinforce the preference for generic ophthalmic anesthetics, benefiting market penetration. -

Technological Advancements in Ophthalmic Formulations

Innovations in ophthalmic drug delivery—such as preservative-free single-dose units and improved stabilization techniques—are enhancing patient safety and comfort. Manufacturers are reformulating Proparacaine to reduce corneal toxicity and improve shelf life, aligning with regulatory standards in North America and Europe. These advancements are expected to support market growth and brand differentiation. -

Regulatory and Safety Scrutiny

Regulatory bodies, including the FDA and EMA, are placing greater emphasis on the safety profile of ophthalmic anesthetics due to risks of corneal damage with prolonged or repeated use. By 2026, compliance with stringent safety guidelines will be a market differentiator, encouraging manufacturers to invest in clinical data and risk mitigation strategies. -

Regional Market Dynamics

North America and Europe will remain dominant markets due to high healthcare spending and advanced ophthalmic infrastructure. However, the fastest growth is anticipated in Asia-Pacific, driven by expanding healthcare access, rising awareness, and increasing numbers of eye care specialists in countries like India and China. -

Strategic Collaborations and Supply Chain Optimization

Pharmaceutical companies are forming partnerships with ophthalmic device manufacturers and diagnostic firms to offer bundled solutions (e.g., anesthetic + tonometer kits). Additionally, supply chain resilience—especially post-pandemic—will drive regional production and inventory management improvements to ensure uninterrupted availability.

In conclusion, the Proparacaine Hydrochloride market in 2026 will be characterized by steady demand growth, innovation in delivery systems, and geographic expansion. While competition from newer anesthetics remains limited, the market will depend on adherence to safety standards and integration into modern eye care workflows to maintain relevance and profitability.

Common Pitfalls When Sourcing Proparacaine Hydrochloride (Quality, IP)

Sourcing high-quality Proparacaine Hydrochloride while ensuring intellectual property (IP) compliance presents several critical challenges. Being aware of these pitfalls is essential for pharmaceutical manufacturers, formulators, and procurement specialists to ensure product safety, efficacy, regulatory approval, and freedom to operate.

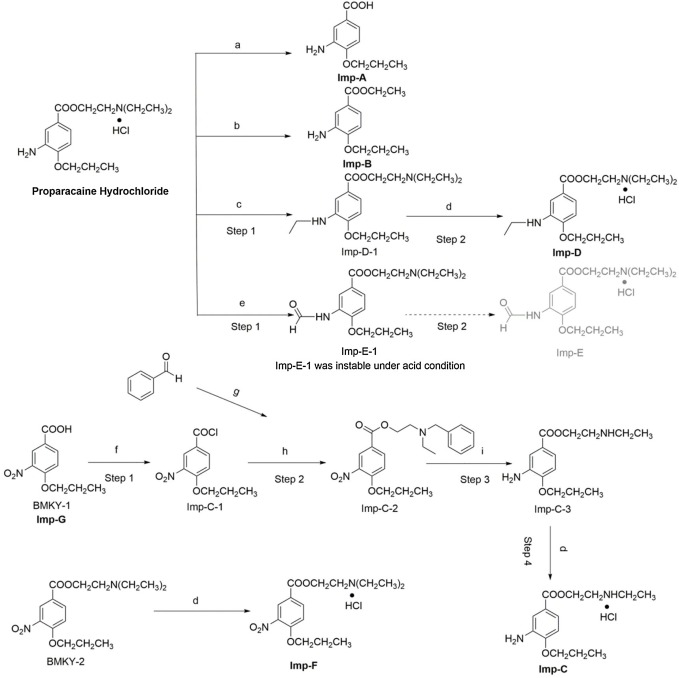

1. Compromised Chemical Purity and Impurity Profile

One of the most significant quality pitfalls is receiving material with substandard purity or an unacceptable impurity profile. Proparacaine HCl must meet stringent pharmacopeial standards (e.g., USP, Ph. Eur., BP).

* Impurity Concerns: The presence of genotoxic impurities (e.g., aromatic amines like 2-(dimethylamino)phenol), residual solvents, or process-related impurities above acceptable thresholds can render the API unsafe and lead to regulatory rejection.

* Inadequate Testing: Suppliers may provide Certificates of Analysis (CoA) based on limited testing (e.g., only assay and appearance), omitting critical tests for related substances, residual solvents, or heavy metals.

* Stability Issues: Poor storage or handling during transit can degrade the API, increasing impurity levels before it even reaches the manufacturer.

Mitigation: Demand comprehensive CoAs referencing current pharmacopeial monographs, conduct independent third-party testing upon receipt, and audit supplier manufacturing and quality control processes.

2. Inadequate Documentation and Lack of Regulatory Support

Sourcing from suppliers lacking robust regulatory documentation creates significant delays and risks.

* Missing DMF/ASMF: Reputable suppliers should have an active Drug Master File (DMF) filed with regulatory agencies (e.g., FDA, EMA) or be willing to file an Active Substance Master File (ASMF). Sourcing without access to a suitable DMF/ASMF complicates the buyer’s own regulatory submissions (IND, NDA, ANDA, MAA).

* Incomplete or Non-Compliant CoA: CoAs may lack essential information, use outdated test methods, or fail to specify acceptance criteria according to current standards.

* Poor Traceability: Inadequate batch traceability and lack of full documentation (e.g., synthesis pathway, starting materials, critical process parameters) hinder investigations during audits or deviations.

Mitigation: Only source from suppliers with a readily available, well-maintained DMF/ASMF suitable for your target markets. Require full compliance with ICH guidelines for analytical procedures and documentation.

3. Intellectual Property (IP) Infringement Risks

Ignoring IP landscape is a major strategic pitfall, potentially leading to costly litigation, injunctions, or blocked market entry.

* Patent Infringement: Proparacaine HCl itself is off-patent, but specific manufacturing processes, purification methods, crystalline forms (polymorphs), or novel formulations may be protected by active patents. Sourcing from a supplier using an infringing process can create liability for the buyer under “induced infringement” doctrines in some jurisdictions.

* Process Patents: A supplier’s efficient or novel synthesis route might be patented. Using API produced via this patented process without a license risks infringement.

* Formulation Patents: While sourcing the API, be aware that specific uses, delivery systems (e.g., specific ophthalmic formulations), or combinations might be patented, limiting how the sourced API can be used commercially.

Mitigation: Conduct thorough freedom-to-operate (FTO) analysis before finalizing sourcing. Investigate not just the compound, but also relevant process patents and formulation patents in your target markets. Require suppliers to warrant they do not infringe third-party IP and provide information on their manufacturing process.

4. Supplier Reliability and Supply Chain Vulnerability

Over-reliance on a single or unreliable supplier poses operational and quality risks.

* Supply Shortages: Geopolitical issues, regulatory non-compliance at the supplier’s facility (e.g., FDA warning letter), or production failures can lead to critical shortages, disrupting manufacturing.

* Quality Inconsistency: Switching between batches from different suppliers (or even the same supplier without rigorous controls) can lead to variability in API performance (e.g., solubility, stability in final formulation).

* Lack of Scalability: A supplier may not have the capacity to meet increased demand, forcing costly re-qualification of a new source.

Mitigation: Qualify multiple suppliers where feasible. Perform rigorous audits (onsite or virtual) of manufacturing and quality systems. Establish robust supply agreements with clear quality and delivery commitments. Monitor supplier performance continuously.

5. Poor Communication and Technical Support

Ineffective communication hinders problem resolution and process optimization.

* Unresponsive Suppliers: Difficulty in getting timely responses to technical queries, deviations, or stability data requests delays projects.

* Lack of Technical Expertise: Suppliers may lack the technical depth to understand specific customer requirements or troubleshoot issues related to the API’s performance in the final drug product.

* Inadequate Change Control: Suppliers may implement changes to their process, equipment, or source of starting materials without adequate notification or data to support the change, potentially impacting API quality.

Mitigation: Prioritize suppliers known for strong technical support. Establish clear communication protocols. Ensure the supply agreement includes robust change control notification requirements and qualification processes for changes.

By proactively addressing these common pitfalls related to quality and IP, organizations can secure a reliable, compliant, and legally sound supply of Proparacaine Hydrochloride, minimizing risks to patient safety, product approvals, and business operations.

Logistics & Compliance Guide for Proparacaine Hydrochloride

Regulatory Classification and Overview

Proparacaine Hydrochloride is a local anesthetic commonly used in ophthalmic procedures to temporarily numb the surface of the eye. While it is not classified as a controlled substance under the U.S. Controlled Substances Act (CSA) or international drug control conventions (e.g., UN Single Convention on Narcotic Drugs), its distribution, storage, and handling are subject to pharmaceutical and chemical regulations due to its medical use and potential for misuse.

Regulatory authorities, including the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and other national health agencies, regulate Proparacaine Hydrochloride as a prescription pharmaceutical product.

Import and Export Compliance

United States (FDA and DEA)

- FDA Regulation: Proparacaine Hydrochloride is regulated as a prescription drug under the Federal Food, Drug, and Cosmetic Act (FD&C Act). Importers and exporters must ensure the product is approved (e.g., via an NDA or ANDA) or qualifies for exemption (e.g., for investigational use).

- DEA Status: Not a controlled substance; no DEA licensing or quota requirements.

- Import Requirements:

- Prior Notice submission to FDA via the Automated Commercial Environment (ACE).

- Labeling must comply with 21 CFR Part 201, including adequate directions for use and warnings.

- Registered establishments must be listed with FDA.

- Export Requirements:

- For unapproved drugs, an Export Certificate may be needed under Section 802 of the FD&C Act.

- Recipient country must permit importation.

European Union (EMA and National Competent Authorities)

- Regulated under Directive 2001/83/EC as a medicinal product.

- Requires Marketing Authorization (MA) or a national exemption for supply.

- Active Pharmaceutical Ingredient (API) must comply with Good Manufacturing Practice (GMP) standards.

- Export to non-EU countries may require a Written Confirmation from EU authorities (per Commission Delegated Regulation (EU) 2016/161).

Other Jurisdictions

- Canada: Regulated by Health Canada under the Food and Drugs Act; requires a Drug Identification Number (DIN).

- Australia: Listed in the Therapeutic Goods Act 1989; requires inclusion in the Australian Register of Therapeutic Goods (ARTG).

- International: Check country-specific requirements; many nations require product registration, import licenses, and GMP certification.

Storage and Handling

- Storage Conditions: Store at controlled room temperature (typically 15–25°C / 59–77°F), protected from light and moisture. Follow manufacturer’s labeling.

- Packaging: Must comply with pharmaceutical packaging standards (e.g., child-resistant packaging if applicable) and maintain sterility for ophthalmic formulations.

- Hazard Information: Not classified as hazardous under OSHA or GHS for transport, but standard pharmaceutical hygiene practices should be followed. Avoid contact with eyes/skin; use appropriate PPE when handling bulk powder.

Transportation

- Domestic (e.g., U.S.):

- Not subject to DOT hazardous materials regulations (49 CFR) when in final medicinal form.

- Bulk API may require safety data sheet (SDS) compliance under OSHA Hazard Communication Standard.

- International (e.g., IATA, IMDG):

- Generally not classified as dangerous goods under IATA Dangerous Goods Regulations or IMDG Code when in medicinal dosage forms.

- Shipments of bulk powder should be evaluated per UN GHS criteria; may require proper shipping name, class, and packaging if hazardous properties are present.

- Always provide Safety Data Sheet (SDS) compliant with GHS.

Documentation Requirements

- Commercial Invoice

- Packing List

- Certificate of Analysis (CoA)

- Certificate of Pharmaceutical Product (CPP) or Statement of Pharmaceutical Product (SPP), if required by importing country

- Good Manufacturing Practice (GMP) Certificate

- Import/Export Licenses (as applicable)

- Drug Master File (DMF) reference, if available

- Material Safety Data Sheet (SDS)

Recordkeeping and Traceability

- Maintain records of batch numbers, expiration dates, distribution chain, and regulatory correspondence for a minimum of 5 years (or as required by jurisdiction).

- Implement track-and-trace systems where required (e.g., U.S. DSCSA for pharmaceutical distribution).

Quality Assurance and Regulatory Inspections

- Ensure compliance with cGMP (current Good Manufacturing Practices) for both API and finished dosage forms.

- Be prepared for audits by regulatory bodies (e.g., FDA, EMA, WHO).

- Validate storage and transportation conditions (e.g., temperature monitoring during transit).

Special Considerations

- Counterfeit Prevention: Use tamper-evident packaging and serialization where required.

- Recall Preparedness: Have a pharmaceutical recall plan in place per regulatory guidelines.

- Environmental and Disposal Compliance: Follow local regulations for pharmaceutical waste disposal; do not flush or pour down drains.

Conclusion

Proparacaine Hydrochloride, while not a controlled substance, is a regulated pharmaceutical requiring strict adherence to health authority guidelines throughout its logistics chain. Compliance with import/export regulations, proper storage and transport, accurate documentation, and quality assurance are essential for legal and safe distribution. Always consult the relevant regulatory authority in the country of import for up-to-date requirements.

Conclusion for Sourcing Proparacaine Hydrochloride:

Sourcing propacaine hydrochloride requires a strategic approach that balances quality, regulatory compliance, cost-efficiency, and supply chain reliability. As a widely used topical anesthetic in ophthalmic procedures, the active pharmaceutical ingredient (API) must meet stringent quality standards set by regulatory bodies such as the FDA, EMA, and other pharmacopoeias (e.g., USP, EP).

When evaluating potential suppliers, it is essential to conduct thorough due diligence, including audits of manufacturing facilities, verification of regulatory certifications (e.g., GMP, DMF filings), and assessment of raw material traceability. Geographic diversification of suppliers can mitigate risks associated with geopolitical instability, trade restrictions, or logistical disruptions.

Additionally, long-term partnerships with reliable suppliers, transparent communication, and ongoing quality monitoring are key to ensuring consistent supply and product safety. With growing demand in ophthalmic applications, investing in sustainable and compliant sourcing strategies will support both clinical efficacy and regulatory success in pharmaceutical manufacturing.

In summary, a well-structured sourcing strategy for proparacaine hydrochloride—prioritizing quality assurance, regulatory alignment, and supply chain resilience—is critical for maintaining product integrity and meeting market demands effectively.