The global demand for durable, sustainable, and cost-effective produce crates is rising in tandem with the expansion of the fresh produce supply chain and cold chain logistics. According to Grand View Research, the global plastic packaging market—of which produce crates are a vital component—is projected to grow at a compound annual growth rate (CAGR) of 4.5% from 2023 to 2030, driven by increasing agricultural output, urbanization, and the need for improved post-harvest handling. Additionally, Mordor Intelligence reports that the Asia-Pacific region is emerging as a key growth hub, fueled by modernization in agricultural infrastructure and rising investments in food distribution networks. As retailers and suppliers prioritize efficiency and sustainability, the role of high-quality produce crate manufacturers becomes increasingly critical. In this evolving landscape, nine manufacturers have distinguished themselves through innovation, scale, and reliability—shaping the future of agricultural logistics worldwide.

Top 9 Produce Crates Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Crates

Domain Est. 2000

Website: aristoplast.com

Key Highlights: Aristoplast as one of the leading manufacturer of Crates, Plastic Storage Crates, Industrial Crates, Textile Crates, Plastic Crates, PP Crates, HDPE Crates….

#2 20 x 12 Harvest Crate

Domain Est. 1997

Website: rehrigpacific.com

Key Highlights: Rehrig Pacific offers one-of-a-kind harvest crates for enhanced fruit transportation and storage. Rugged, durable, and fully automatable.Missing: produce manufacturer…

#3 Plastic Crates, Plastic Storage Crates, Cheap Stackable Plastic …

Domain Est. 2019

Website: plastic-crates.com

Key Highlights: In stock Rating 4.8 (74) we are a Plastic Crates manufacturer and wholesale a range of Plastic Storage Crates, including Stackable Plastic crates, plastic pallet containers, etc!…

#4 IFCO

Domain Est. 1995

Website: ifco.com

Key Highlights: IFCO is on a mission to make the fresh grocery supply chain sustainable. Good for business. Good for the planet. Learn more!…

#5 Fruit Growers Supply

Domain Est. 1997

Website: fruitgrowers.com

Key Highlights: OVER 100 YEARS AND GROWING … Fruit Growers Supply was created by the Sunkist Growers in 1907 to manufacture wood crates for their California grown oranges….

#6 Tosca Homepage

Domain Est. 1997

Website: toscaltd.com

Key Highlights: Our reusable crates, bins, and pallets transform your supply chain, enhance your bottom line, magnify sustainability impact, and ensure the delivery of top- ……

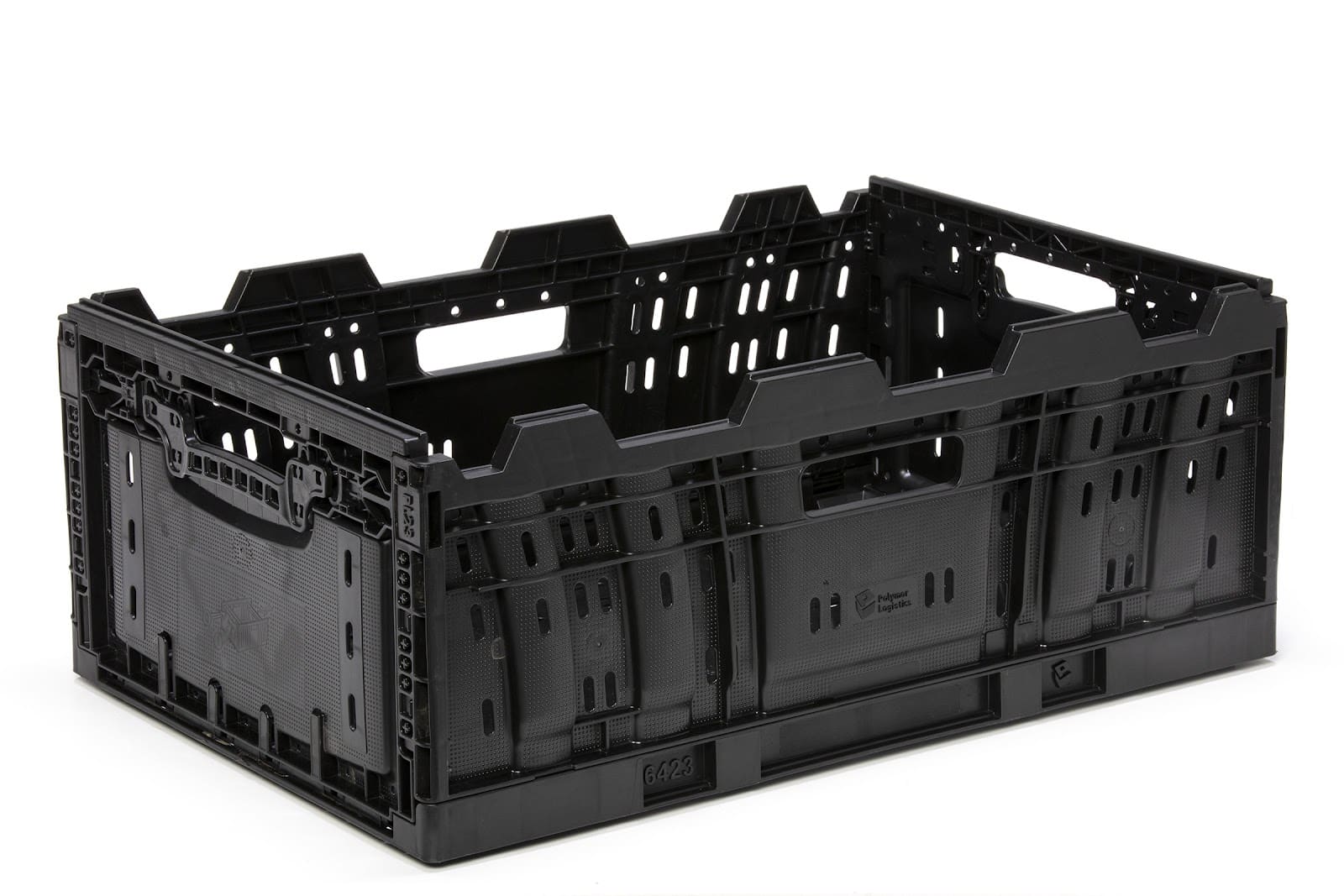

#7 Agricultural Crates

Domain Est. 1999

Website: tranpak.com

Key Highlights: Plastic agricultural crates don’t draw out moisture like wood & corrugated boxes so produce stays fresher. Smooth contours protects fruit, stacks easily….

#8 Fruits & Vegetable Crates

Domain Est. 2003

Website: supreme.co.in

Key Highlights: Supreme’s durable, food-grade perforated vegetable crates and fruit crates are ideal for Retail, FMCG & F&V industries. Customizable colors, easy to clean….

#9 Plastic Vegetable Crates supplier

Domain Est. 2017

Website: vegcrates.com

Key Highlights: Our plastic crates are used in food, fruit and vegetables, groceries in supermarket chains, bakeries, dairy, fisheries, household goods, nurseries, ……

Expert Sourcing Insights for Produce Crates

H2: 2026 Market Trends for Produce Crates

The global produce crates market is poised for substantial evolution by 2026, driven by sustainability mandates, technological advancements, and shifting supply chain dynamics. As retailers, farmers, and logistics providers prioritize efficiency and environmental responsibility, several key trends are expected to shape the industry over the next few years.

1. Surge in Demand for Reusable Plastic Crates (RPCs)

A major trend in 2026 will be the accelerated adoption of reusable plastic crates over single-use alternatives. With increasing pressure to reduce plastic waste and carbon footprints, stakeholders across the agricultural and retail sectors are transitioning to durable, washable RPCs. These crates offer long-term cost savings, reduce packaging waste, and support circular economy models—making them a preferred choice for major grocery chains and distributors.

2. Growth in Automation and Smart Packaging Integration

By 2026, produce crates are expected to integrate more closely with automated supply chain systems. Features such as embedded RFID tags, QR codes, and IoT sensors will become standard in high-end crates, enabling real-time tracking, temperature monitoring, and inventory management. This digital transformation will improve traceability, reduce spoilage, and enhance food safety—critical factors in a market increasingly focused on transparency.

3. Regional Shifts and Emerging Market Expansion

While North America and Europe continue to lead in RPC adoption due to strict environmental regulations and advanced cold chain infrastructure, emerging markets in Asia-Pacific, Latin America, and Africa will see significant growth. Rising urbanization, expansion of supermarket chains, and investments in agricultural logistics are driving demand for standardized, efficient produce packaging solutions in these regions.

4. Sustainability Regulations and Standardization

Regulatory frameworks aimed at reducing plastic pollution and promoting circularity will heavily influence the produce crate market by 2026. Governments and international bodies are expected to enforce stricter guidelines on packaging recyclability and reusability. This will encourage uniform crate designs and foster industry-wide pooling systems, where crates are shared among multiple users to optimize utilization and minimize environmental impact.

5. Material Innovation and Lightweighting

Manufacturers will increasingly focus on developing lightweight yet durable crate materials that reduce transportation emissions and improve handling efficiency. Advances in high-density polyethylene (HDPE) and polypropylene (PP) formulations, as well as exploration of bio-based plastics, will support this trend. Additionally, modular and stackable crate designs will gain traction to maximize space utilization in storage and transit.

6. Cost Pressures and Supply Chain Resilience

Ongoing supply chain volatility and fluctuating raw material prices will push companies to invest in long-term crate solutions that reduce operational costs. The total cost of ownership (TCO) model—factoring in durability, return logistics, and maintenance—will become a primary decision-making tool, favoring reusable systems despite higher initial investment.

In conclusion, the 2026 produce crates market will be defined by a convergence of sustainability, digitization, and global scalability. Companies that embrace innovation, collaborate on standardization, and align with ESG goals will be best positioned to capitalize on these evolving dynamics.

Common Pitfalls When Sourcing Produce Crates (Quality, IP)

Sourcing produce crates involves more than just finding the lowest price—overlooking key quality and intellectual property (IP) considerations can lead to significant operational, legal, and reputational risks. Below are common pitfalls to avoid.

Poor Material Quality and Durability

One of the most frequent issues is receiving crates made from substandard materials that degrade quickly under real-world conditions. Low-grade plastics or improperly treated wood can crack, warp, or break during transport, leading to damaged produce and increased replacement costs. Buyers may also face inconsistent crate dimensions or weak structural design, compromising stacking stability and cold chain integrity.

Lack of Food-Safe Certification

Produce crates must comply with food safety regulations. Sourcing crates without proper food-grade certifications (e.g., FDA compliance in the U.S. or EU 10/2011 in Europe) risks contamination. Non-compliant materials may leach harmful chemicals into fruits and vegetables, exposing suppliers and retailers to liability and regulatory penalties.

Inadequate Reusability and Sustainability Claims

Many suppliers market crates as “reusable” or “eco-friendly” without proof. Some crates fail after only a few uses due to poor construction, undermining sustainability goals. Additionally, misleading claims about recyclability or biodegradability can result in greenwashing accusations and damage brand reputation.

Non-Compliance with Phytosanitary Standards (Wooden Crates)

When sourcing wooden crates, failure to ensure compliance with International Standards for Phytosanitary Measures No. 15 (ISPM 15) is a major risk. Untreated or non-certified wood packaging can harbor pests, leading to shipment rejections, fumigation costs, or import bans—especially in international trade.

Intellectual Property Infringement

Using crate designs that mimic patented or trademarked models—such as those from major brands like IFCO or Rehrig Pacific—can result in IP violations. Even slight design similarities in stackable features, labeling, or structural elements may trigger legal action. Buyers may unknowingly purchase counterfeit or knock-off crates, leading to cease-and-desist orders, fines, or forced disposal.

Limited Traceability and Brand Protection

Generic crates lacking unique identification (e.g., RFID tags, barcodes, or proprietary markings) reduce supply chain visibility and increase the risk of theft or counterfeit infiltration. Moreover, without IP protection on custom-designed crates, competitors may replicate them, diluting brand value and investment.

Hidden Costs from Short-Term Savings

Focusing solely on upfront cost often leads to long-term expenses. Cheap crates may require frequent replacement, increase spoilage rates, or cause logistics inefficiencies. Additionally, resolving IP disputes or handling regulatory non-compliance can be far more costly than investing in compliant, high-quality, and legally sound solutions upfront.

Avoiding these pitfalls requires thorough due diligence, supplier audits, material testing, and legal review of design rights—ensuring that produce crates meet both operational needs and regulatory standards.

Logistics & Compliance Guide for Produce Crates

Proper handling, transportation, and regulatory compliance are essential when using produce crates to ensure food safety, product integrity, and adherence to legal standards. This guide outlines key logistics and compliance considerations for stakeholders involved in the agricultural supply chain, including growers, packers, distributors, and retailers.

Selection and Use of Produce Crates

Choose crates made from food-safe, durable materials such as high-density polyethylene (HDPE) or corrugated plastic. Wooden crates may be used but must meet ISPM 15 standards if intended for international shipping. Crates should be designed for stackability, proper ventilation, and ease of cleaning to prevent contamination and spoilage of produce.

Cleaning and Sanitation Protocols

Implement a regular cleaning and sanitation schedule for reusable crates. Wash crates with potable water and approved sanitizers between uses to prevent cross-contamination. Inspect for damage, mold, or biofilm buildup. Documentation of cleaning procedures should be maintained to meet food safety audits and regulatory requirements (e.g., FDA Food Safety Modernization Act – FSMA).

Temperature Control and Cold Chain Management

Maintain appropriate temperature throughout the supply chain. Use insulated crates or refrigerated transport when required to preserve freshness. Monitor and record temperature data during transit, especially for perishable goods. Ensure crates allow for adequate airflow to support uniform cooling and prevent condensation.

Stacking and Load Stability

Stack crates securely to prevent collapse during transport. Follow manufacturer guidelines for maximum stacking heights. Use dunnage or load stabilizers as needed. Overloading or improper stacking can lead to product damage, safety hazards, and non-compliance with transportation regulations.

Labeling and Traceability

Label crates clearly with essential information, including:

– Product type and variety

– Harvest/pack date

– Lot or batch number

– Farm or packing facility name and location

– Grade or quality designation (if applicable)

Labels support traceability under FSMA and Global Food Safety Initiative (GFSI) standards, enabling rapid response in case of recalls.

Regulatory Compliance

Adhere to relevant regulations, including:

– FDA FSMA: Requires preventive controls and traceability for produce.

– USDA AMS: May regulate grading, packaging, and labeling for certain commodities.

– DOT Regulations: Apply to transportation safety and load securement.

– International Standards (e.g., EU, Canada): Comply with import requirements, including phytosanitary certificates and crate treatment documentation.

Reuse and Sustainability

Promote sustainability by using reusable plastic crates (RPCs) over single-use alternatives. Establish return logistics for RPCs and partner with crate pooling services when possible. Ensure end-of-life crates are recycled responsibly through approved channels.

Training and Documentation

Train staff on proper crate handling, sanitation, and compliance procedures. Maintain records of cleaning logs, temperature monitoring, transportation manifests, and audit reports. Documentation is critical for regulatory inspections and third-party certifications (e.g., SQF, PrimusGFS).

By following this guide, supply chain partners can ensure the safe, efficient, and compliant transport of fresh produce using crates, minimizing waste and enhancing food safety.

Conclusion for Sourcing Produce Crates

In conclusion, sourcing produce crates is a critical component in ensuring the efficiency, sustainability, and cost-effectiveness of the agricultural supply chain. The right crates protect produce during transportation, reduce spoilage, and support safe handling practices from farm to market. When selecting suppliers and crate types—whether plastic, wood, or cardboard—factors such as durability, hygiene, stackability, environmental impact, and compliance with industry standards must be carefully evaluated.

Emphasizing sustainable materials and reusability not only reduces long-term costs but also aligns with growing consumer and regulatory demands for environmentally responsible practices. Building strong relationships with reliable suppliers and considering local sourcing options can further enhance supply chain resilience and reduce lead times.

Ultimately, a strategic and well-informed approach to sourcing produce crates contributes to improved product quality, operational efficiency, and overall profitability within the fresh produce industry.