The pressure-treated wood market has experienced steady growth, driven by rising demand in residential construction, landscaping, and outdoor infrastructure. According to Grand View Research, the global treated wood market size was valued at USD 6.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. This growth is fueled by increasing awareness of wood preservation benefits, stringent building codes, and the material’s cost-effectiveness compared to alternatives like composites and metals. As sustainability and durability become key considerations in construction materials, leading manufacturers are investing in advanced treatment technologies and environmentally friendly preservatives. In this evolving landscape, seven key companies have emerged as top suppliers, consistently delivering high-grade pressure-treated wood products that meet rigorous industry standards.

Top 7 Pressure Treated Wood Grades Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Grademarks

Domain Est. 1997

Website: spib.org

Key Highlights: The SPIB grade-mark is recognized as a sign of integrity within the industry. Application of these grade-marks represents assurance by the manufacturer….

#2 Industry Resources

Domain Est. 1997

Website: treatedwood.com

Key Highlights: Western Wood Products Association – Supported by Western lumber manufacturers, WWPA delivers lumber grading, quality control, technical, business information ……

#3 Grade Descriptions

Domain Est. 1995

Website: southernpine.com

Key Highlights: SFPA provides guidance on nearly 95 Southern Pine lumber grade descriptions to show characteristics and typical uses….

#4 [PDF] Preservative

Domain Est. 1996

Website: roseburg.com

Key Highlights: Applicable standards for preservative treatment of plywood include American Wood Protection Association (AWPA). Standards U1(1) (and all other standards ……

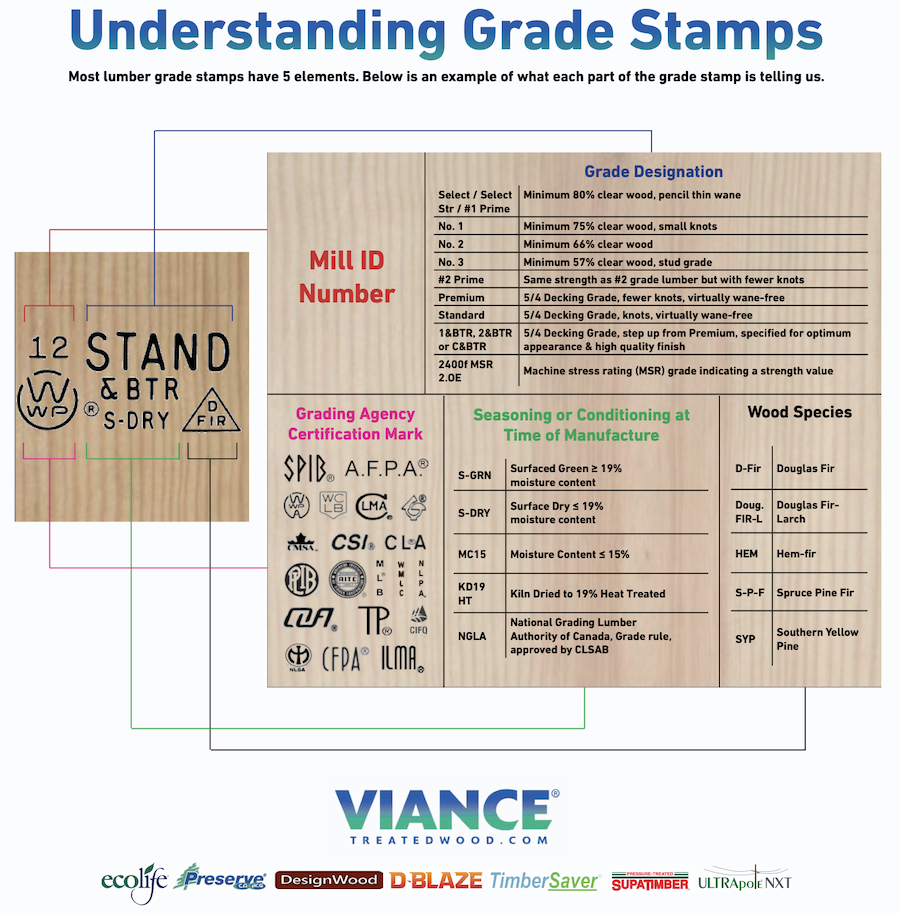

#5 Lumber Grade Stamps

Domain Est. 1999

Website: nachi.org

Key Highlights: Lumber that has been treated with flame-resistant chemicals may bear a “D-BLAZE” notation on its grade stamp. In summary, information about the wood’s quality ……

#6 ProWood Pressure

Domain Est. 2000

Website: prowood.com

Key Highlights: ProWood pressure-treated lumber offers exceptional protection and performance, guaranteed to withstand harsh weather conditions and the everyday wear and tear ……

#7 PWT Treated™ LVL

Domain Est. 2022

Website: pwtewp.com

Key Highlights: PWT Treated™ LVL, the first on the market treated during manufacturing, is perfect for demanding outdoor and structural applications….

Expert Sourcing Insights for Pressure Treated Wood Grades

2026 Market Trends for Pressure Treated Wood Grades

The pressure treated wood market is poised for significant evolution by 2026, driven by increasing demand for sustainable building materials, regulatory changes, and advancements in treatment technologies. This analysis examines key trends shaping the market for various pressure treated wood grades, including residential, industrial, and specialty applications.

Rising Demand for Environmentally Compliant Grades

One of the most influential trends shaping the 2026 market is the growing preference for environmentally compliant pressure treated wood grades. Consumers and regulatory bodies are increasingly favoring treatments that use non-arsenical preservatives such as alkaline copper quaternary (ACQ), copper azole (CA-B), and micronized copper. These alternatives to traditional chromated copper arsenate (CCA) are expected to dominate the market, particularly in residential and consumer-facing applications.

Regulations in North America and Europe continue to restrict hazardous chemicals in building materials, pushing manufacturers to innovate and adopt greener formulations. By 2026, pressure treated wood labeled as “low-environmental-impact” or “eco-treated” is expected to capture a larger market share, especially in decking, landscaping, and playground structures.

Growth in Premium and Enhanced Performance Grades

The market is seeing a shift toward higher-grade pressure treated lumber with enhanced durability, dimensional stability, and resistance to warping and splitting. These premium grades—typically rated for ground contact or heavy-duty outdoor use—are gaining traction due to their longer service life and reduced maintenance costs.

In residential construction, particularly in decking and outdoor living spaces, demand for high-performance grades is bolstered by the trend toward luxury outdoor amenities. Additionally, commercial and industrial sectors are adopting higher retention levels and improved treatment penetration to meet stringent building codes and reduce replacement frequency.

By 2026, manufacturers are expected to expand product lines that offer performance warranties of 25 years or more, contributing to consumer confidence and market growth.

Regional Market Divergence in Grade Preferences

Market trends for pressure treated wood grades vary significantly by region. In North America, ACQ and CA-B treated lumber dominate due to regulatory standards and consumer awareness. The U.S. continues to lead in volume consumption, with a strong emphasis on #2 and better grades for structural applications.

In Europe, the market leans more toward thermally modified wood and preservative systems compliant with the European Union Biocidal Products Regulation (BPR). However, pressure treated grades meeting EN 351-1 standards are still widely used, particularly in utility and infrastructure projects.

Emerging markets in Asia-Pacific and Latin America are witnessing increased adoption of pressure treated wood, especially in infrastructure and agricultural construction. However, grade consistency and treatment quality remain challenges, creating opportunities for international suppliers to introduce standardized, certified grades by 2026.

Technological Advancements in Treatment and Grading

Innovations in treatment processes are enhancing the performance and consistency of pressure treated wood grades. Vacuum-pressure impregnation techniques are becoming more precise, allowing for uniform preservative retention and reduced waste. Additionally, real-time monitoring systems and digital grading tools are improving quality control, enabling manufacturers to offer certified, traceable lumber batches.

Micronized copper systems, which use nano-sized copper particles for deeper penetration and reduced leaching, are gaining market share. By 2026, these advanced treatments are expected to become standard in higher-grade products, especially in moisture-prone and coastal environments.

Supply Chain and Raw Material Pressures

The availability and cost of southern yellow pine—a primary species used in pressure treated lumber—will continue to influence grade pricing and availability in 2026. Ongoing supply chain resilience efforts, including vertical integration and sustainable forestry practices, are helping stabilize raw material inputs.

However, rising transportation costs and labor shortages may impact the affordability of premium grades. As a result, manufacturers are focusing on optimizing yield and offering bundled product solutions (e.g., treated lumber with compatible fasteners and sealants) to maintain value for end-users.

Conclusion

By 2026, the pressure treated wood market will be defined by sustainability, performance, and regional regulatory compliance. Premium and eco-friendly grades are expected to lead growth, supported by technological innovation and changing consumer preferences. Stakeholders across the supply chain—from producers to contractors—will need to adapt to these evolving grade standards to remain competitive in a dynamic global market.

Common Pitfalls When Sourcing Pressure Treated Wood Grades (Quality, IP)

Sourcing pressure treated wood requires careful attention to grading standards, quality control, and Intellectual Property (IP) considerations—especially when procuring for construction, landscaping, or industrial applications. Overlooking key factors can lead to structural failures, compliance issues, or legal risks. Below are the most common pitfalls to avoid:

Inadequate Understanding of Treatment Grades and Standards

One of the most frequent errors is failing to distinguish between different pressure treated wood grades (e.g., Above Ground, Ground Contact, or Heavy Duty) as defined by standards such as AWPA (American Wood Protection Association) or equivalent international benchmarks. Sourcing wood with an insufficient treatment level for the intended use—such as using Above Ground grade in direct soil contact—can result in premature decay, fungal growth, or termite infestation, compromising structural integrity and safety.

Confusing Visual Grade with Treatment Level

Buyers often assume that a higher visual grade (appearance, knot count, straightness) correlates with superior treatment quality. However, visual grading (e.g., Select, #1, #2) pertains only to appearance and structural strength, not preservative retention. A high-visual-grade board may have inadequate chemical penetration if not properly treated. This misalignment can lead to poor performance in harsh environments despite a premium price.

Overlooking Certification and Compliance Documentation

Many suppliers provide wood without proper certification tags (e.g., ICC-ES reports, use category labels per EN 351-1 in Europe), missing treatment details like retention levels, preservative type (e.g., ACQ, CA, CCA), and compliance with regional building codes. Procuring uncertified material risks non-compliance with local regulations, delays in inspections, or liability in case of failure.

Ignoring Moisture Content and Dimensional Stability

Freshly treated wood often has high moisture content, which leads to shrinkage, warping, or splitting as it dries. Sourcing without confirming kiln-dried after treatment (KDAT) status can result in installation issues, joint failures, or aesthetic problems in decking and framing applications.

Relying on Unverified or Non-Standard IP Claims

Some suppliers market proprietary treatment processes or “enhanced” formulations with claims of longer lifespan or better environmental performance. However, these may lack independent verification or standardized testing. Using such products without validating Intellectual Property rights and performance data can expose buyers to greenwashing risks, patent infringement, or underperforming materials.

Failure to Verify Supply Chain Traceability

Pressure treated wood sourced from unverified or offshore suppliers may not adhere to the same quality and environmental standards as domestic producers. Lack of traceability increases the risk of receiving substandard or illegally harvested timber, undermining sustainability goals and potentially violating import regulations like the Lacey Act.

Inconsistent Quality Control in Batch Sourcing

Even when specifications are correct, inconsistent quality across production batches can occur due to variations in treatment processes or raw material sourcing. Without a robust incoming inspection process, buyers may unknowingly accept under-treated or over-treated wood, both of which compromise performance and safety.

Avoiding these pitfalls requires due diligence: verify treatment grades against intended use, demand certification, validate IP claims through third-party testing, and work with reputable suppliers who provide full transparency in sourcing and manufacturing.

Logistics & Compliance Guide for Pressure Treated Wood Grades

Overview of Pressure Treated Wood Grades

Pressure treated wood is categorized into specific grades based on its intended use, level of preservative retention, and exposure conditions. The most common grading standards in North America are established by the American Wood Protection Association (AWPA) and enforced through compliance with building codes such as the International Building Code (IBC). These grades determine where and how treated wood can be safely used—ranging from above-ground applications to ground contact and heavy-duty marine environments.

Common pressure treated wood grades include:

– UC1: Interior Dry – For indoor, dry conditions with no risk of moisture.

– UC2: Interior Damp – Suitable for damp indoor locations but not ground contact.

– UC3A: Above Ground – For exterior applications not in contact with the ground (e.g., decks, railings).

– UC3B: Ground Contact – Light Duty – For wood directly in contact with soil or fresh water (e.g., fence posts, landscaping).

– UC4A: Ground Contact – Heavy Duty – For structural applications in ground contact with high decay/insect exposure.

– UC4B: Ground Contact – Extreme Duty – For critical structural components in harsh environments.

– UC5: Marine Use – For saltwater exposure (e.g., docks, piers), typically using specialized preservatives like ACQ or CBA.

Each grade corresponds to a minimum preservative retention level (measured in pounds per cubic foot) and must be clearly marked on the lumber per ASTM and AWPA standards.

Regulatory Compliance Requirements

Compliance with federal, state, and local regulations is essential when sourcing, transporting, and installing pressure treated wood. Key regulatory bodies and standards include:

– Environmental Protection Agency (EPA) – Regulates wood preservatives under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA). All treated wood must be produced using EPA-registered preservatives.

– American Wood Protection Association (AWPA) – Sets treatment standards (e.g., AWPA U1) that specify preservative types, retention levels, and quality control procedures.

– ASTM International – Provides standards for marking, sampling, and quality assurance (e.g., ASTM D2488 for identification, ASTM D1194 for load classification).

– International Building Code (IBC) – Dictates acceptable uses of treated wood in construction projects based on grade and location.

Compliance best practices:

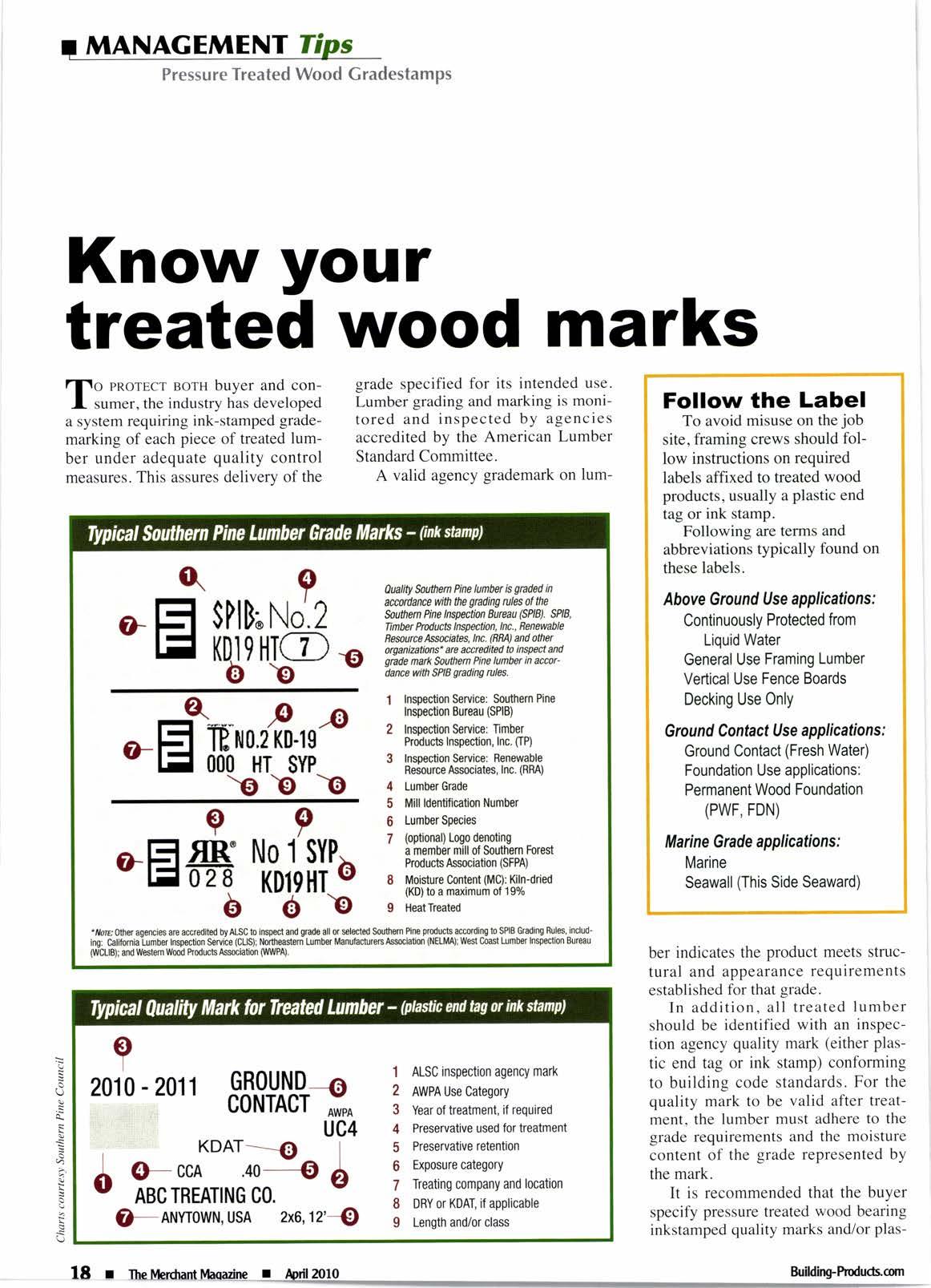

– Ensure all treated lumber bears an approved grade stamp indicating the treating company, preservative type (e.g., ACQ, CA-B, MCQ), retention level, and AWPA use category.

– Maintain documentation (e.g., mill certificates, treatment reports) for audit and inspection purposes.

– Verify that treated wood used in residential projects (especially children’s playsets, decks, and picnic tables) meets current safety standards, particularly regarding older CCA-treated wood restrictions.

Transportation and Handling Logistics

Proper logistics planning is crucial to maintain the integrity and compliance of pressure treated wood during transportation and storage:

– Moisture Management – Treated wood is often shipped wet (“green”). Allow for proper drying and acclimatization before installation to prevent warping or shrinkage.

– Segregation by Grade – Store different UC grades separately to prevent misapplication. Clearly label bundles with grade, treatment type, and intended use.

– Protective Covering – Use breathable tarps during transit to prevent water accumulation while allowing moisture to escape. Avoid plastic sheeting that traps moisture and promotes mold.

– Load Securing – Secure bundles on trucks to prevent shifting. Use dunnage to avoid direct ground contact and reduce risk of contamination or reabsorption of moisture.

– Material Safety Data Sheets (MSDS/SDS) – Carry Safety Data Sheets for all preservative types used, especially when crossing state or international borders. Some preservatives may be subject to additional reporting under OSHA or DOT regulations.

Environmental and Safety Considerations

Pressure treated wood contains chemical preservatives that require careful handling to protect workers and the environment:

– Worker Protection – Use personal protective equipment (PPE) including gloves, masks, and eye protection when cutting or sanding treated wood. Follow OSHA guidelines for exposure control.

– Waste Disposal – Do not burn treated wood, as combustion releases toxic fumes. Dispose of offcuts and waste at designated facilities compliant with local environmental regulations.

– Runoff Control – During storage, prevent leaching into soil or waterways by using impervious pads and containment systems, especially in wet climates.

– Site Compliance – On construction sites, avoid using treated wood in vegetable gardens or areas with direct food contact unless approved for such use (e.g., certain UC3B products with food-safe barriers).

Inspection and Documentation

To ensure full compliance throughout the supply chain:

– Conduct visual and documentation checks upon delivery to verify correct grade, stamping, and moisture content.

– Keep records of supplier certifications, treatment reports, and delivery receipts for traceability.

– Schedule third-party inspections if required by project specifications or local authorities, particularly for public infrastructure or high-risk environments.

Adhering to this logistics and compliance guide ensures safe, legal, and durable use of pressure treated wood across construction and landscaping applications.

Conclusion: Sourcing Pressure-Treated Wood Grades

When sourcing pressure-treated wood, selecting the appropriate grade is essential to ensure durability, safety, performance, and cost-effectiveness for the intended application. Different treatment levels and wood grades—such as Above Ground, Ground Contact, and Heavy Duty (or Foundation Grade)—are designed to meet specific environmental exposures and structural demands.

It is crucial to match the wood grade to the project requirements: Above Ground grades are suitable for structures not in direct contact with the ground or constant moisture, while Ground Contact and Heavy Duty grades are necessary for decks, fences, landscaping, or foundation applications where moisture and soil contact increase the risk of decay and insect damage.

Additionally, sourcing from reputable suppliers who adhere to industry standards (such as those set by the American Wood Protection Association or AWPA) ensures that the wood is properly treated and labeled. Environmental considerations, local building codes, and long-term maintenance should also influence sourcing decisions.

In conclusion, a well-informed selection of pressure-treated wood grades—based on use case, compliance, and quality—leads to longer-lasting, safer, and more sustainable construction projects. Careful sourcing not only enhances performance but also reduces the need for premature replacements, ultimately saving time and resources.

![[PDF] Preservative](https://www.sohoinchina.com/wp-content/uploads/2026/01/pdf-preservative-341.png)